Key Insights

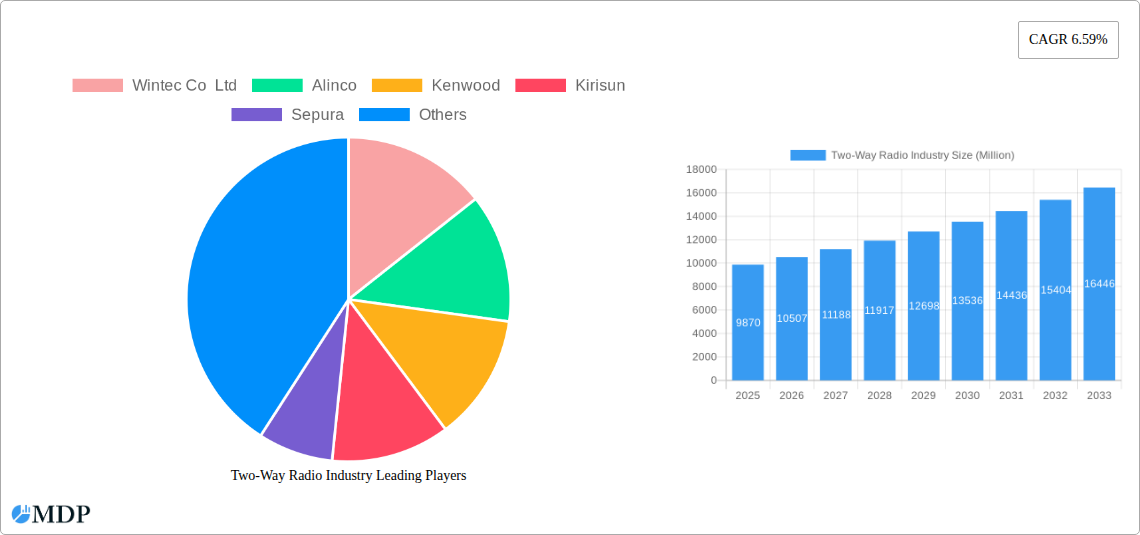

The global two-way radio market is poised for significant expansion, projected to reach approximately $9.87 billion in value. This growth will be fueled by a robust Compound Annual Growth Rate (CAGR) of 6.59% over the forecast period of 2025-2033. Key drivers behind this upward trajectory include the increasing demand for reliable and immediate communication solutions across various industries, particularly in sectors like public safety, utilities, and industrial operations where instant connectivity is paramount. The evolution of digital radio technologies, offering enhanced voice quality, data transmission capabilities, and improved security features, is further stimulating market adoption. Furthermore, the ongoing need for interoperability and the integration of two-way radio systems with other communication platforms are creating new avenues for market growth. Emerging economies, with their expanding infrastructure development and increasing adoption of advanced communication tools, are also expected to contribute substantially to the market's overall expansion.

Two-Way Radio Industry Market Size (In Billion)

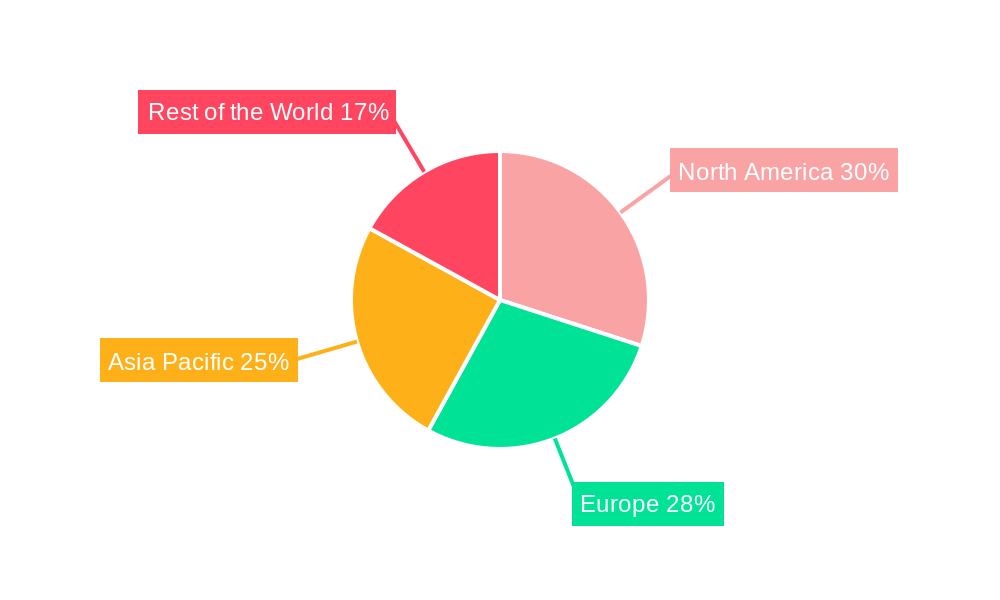

The market is segmented into Analog and Digital types, with Digital radios increasingly gaining traction due to their superior performance and functionalities. End-user industries are broadly categorized into Business Use, encompassing government and public safety, utilities, and industry and commerce, alongside Private Use applications. While the business sector is expected to remain the dominant consumer, private use, including recreational activities and personal safety, is also witnessing steady growth. Major players such as Motorola, Kenwood, and Icom America are actively innovating and expanding their product portfolios to cater to diverse industry needs. Geographically, North America and Europe currently hold significant market shares, driven by established industries and advanced technological adoption. However, the Asia Pacific region is anticipated to exhibit the fastest growth, propelled by rapid industrialization and increasing government investments in communication infrastructure. Challenges, such as the higher initial cost of digital systems and the increasing prevalence of mobile communication devices, are being addressed through technological advancements and the development of more cost-effective solutions, ensuring the continued vitality of the two-way radio market.

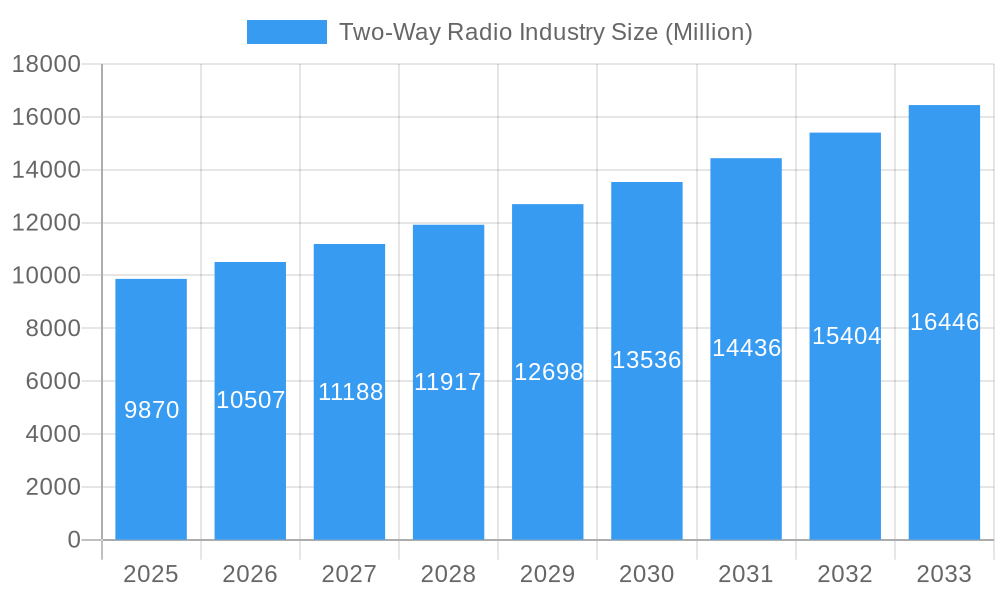

Two-Way Radio Industry Company Market Share

Gain an in-depth understanding of the dynamic two-way radio industry with this comprehensive market report. Covering the period from 2019 to 2033, with a base year of 2025, this report delves into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, and emerging opportunities. Essential for industry stakeholders, including manufacturers, distributors, end-users in government, public safety, utilities, industry, commerce, and private sectors, as well as investors and analysts, this report provides actionable insights and a strategic outlook for the future. We analyze key players like Motorola Solutions, Kenwood, Hytera, and Sepura, and explore the evolution from analog to advanced digital two-way radio technologies.

Two-Way Radio Industry Market Dynamics & Concentration

The two-way radio industry exhibits moderate to high market concentration, with major players like Motorola Solutions, Kenwood, and Hytera holding significant market shares estimated in the range of 15% to 25% each. Innovation drivers are primarily technological advancements, particularly the shift towards digital radio standards such as DMR and TETRA, enhancing voice clarity, data capabilities, and security features. Regulatory frameworks, including spectrum allocation and public safety mandates, play a crucial role in shaping market entry and product development. Product substitutes, such as cellular-based push-to-talk (PTT) solutions, pose a growing challenge, especially in less critical communication scenarios. End-user trends are driven by increasing demand for robust and reliable communication in harsh environments and for mission-critical operations, leading to a preference for specialized digital solutions. Merger and acquisition (M&A) activities have been moderate, with an estimated 15-20 significant deals within the historical period (2019-2024), primarily focused on consolidating market share, acquiring new technologies, or expanding geographical reach. The number of M&A deals is projected to increase by 10-15% in the forecast period (2025-2033) as companies seek to strengthen their competitive positions.

Two-Way Radio Industry Industry Trends & Analysis

The global two-way radio market is experiencing robust growth, projected at a Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period (2025–2033). This expansion is fueled by several key trends and technological disruptions. The increasing adoption of digital two-way radio systems, such as those based on the DMR (Digital Mobile Radio) and TETRA (Terrestrial Trunked Radio) standards, is a significant growth driver. These digital technologies offer superior audio quality, enhanced security features like encryption, and the ability to transmit data alongside voice, making them indispensable for critical communications in sectors like public safety, government, and utilities. The growing demand for rugged, reliable, and intrinsically safe radios capable of operating in extreme environments continues to shape product development. Furthermore, the integration of IoT (Internet of Things) capabilities with two-way radios is an emerging trend, enabling real-time data collection and asset tracking. Consumer preferences are shifting towards solutions that offer seamless communication across different platforms and devices, including push-to-talk over cellular (PoC) applications, which, while a substitute in some cases, also spurs innovation in dedicated radio systems to maintain their competitive edge. Competitive dynamics are intensifying, with established players investing heavily in R&D to introduce next-generation products and solutions. Market penetration for digital two-way radios is estimated to reach approximately 70% by 2025, up from around 55% in 2019, indicating a strong market shift. The market size is projected to reach over $12 Billion by 2025 and is expected to cross the $18 Billion mark by 2033.

Leading Markets & Segments in Two-Way Radio Industry

The Business Use segment, encompassing Government and Public Safety, Utilities, and Industry and Commerce, represents the largest and most dominant segment in the two-way radio industry, accounting for an estimated 65% of the total market share in 2025. Within this segment, Government and Public Safety is particularly dominant, driven by the critical need for reliable and secure communication networks for law enforcement, emergency services, and defense organizations.

- Key Drivers for Government and Public Safety Dominance:

- Mission-Critical Operations: The absolute requirement for uninterrupted communication during emergencies, natural disasters, and public safety incidents.

- Regulatory Mandates: Government initiatives and regulations often mandate the use of specific radio standards for interoperability and enhanced security.

- Technological Advancements: The adoption of advanced digital technologies like P25 (Project 25) and TETRA ensures enhanced features such as encryption, GPS tracking, and data transmission.

- Infrastructure Investment: Significant government investment in robust communication infrastructure to support national security and public services.

The Digital segment, in terms of technology type, is rapidly outpacing the Analog segment and is projected to command over 75% of the market share by 2025. This dominance is driven by the superior capabilities of digital radios, including clearer audio, longer battery life, and the ability to support data services and advanced features.

- Dominance Analysis of Digital vs. Analog:

- Superior Performance: Digital radios offer significant improvements in audio quality, even in noisy environments, due to advanced noise-canceling technologies.

- Enhanced Functionality: Digital systems enable features like text messaging, GPS location tracking, remote device management, and integration with other IT systems.

- Spectrum Efficiency: Digital modulation techniques allow for more efficient use of radio spectrum, enabling more users and data on the same frequencies.

- Future-Proofing: The industry is increasingly focused on digital standards, making them the de facto choice for new deployments and upgrades.

The North America region is a leading market, driven by substantial investments in public safety infrastructure and a strong presence of major industry players. In 2025, North America is expected to contribute approximately 30% to the global two-way radio market revenue.

Two-Way Radio Industry Product Developments

Recent product developments highlight a strong emphasis on enhanced audio capabilities, ruggedness, and seamless connectivity. Motorola Solutions' launch of the MOTOTRBO R7 exemplifies this trend, featuring advanced noise cancellation, automatic feedback suppression, and adaptive volume adjustment for superior intelligibility in loud and dynamic environments, utilizing the DMR standard. This focus on crystal-clear voice communication ensures operational efficiency and safety for users in demanding sectors. Furthermore, the integration of digital technologies across product lines, as seen with Hytera's TF series radios available in both analog and digital versions, caters to a broader market spectrum, including small businesses seeking improved customer service through reliable two-way communication. These innovations underscore the industry's commitment to delivering robust, feature-rich, and user-friendly solutions that meet evolving market demands.

Key Drivers of Two-Way Radio Industry Growth

The growth of the two-way radio industry is propelled by several interconnected factors.

- Technological Advancements: The continuous evolution towards digital radio standards like DMR and TETRA, offering superior audio quality, data capabilities, and encryption, is a primary driver.

- Increasing Demand for Reliable Communication: Sectors like public safety, government, utilities, and heavy industry rely on the consistent and robust communication that two-way radios provide, especially in environments where cellular networks may be unreliable or unavailable.

- Safety and Security Regulations: Stricter regulations and mandates, particularly in public safety and hazardous industries, are driving the adoption of compliant and advanced radio systems.

- Digital Transformation Initiatives: The integration of IoT and data services with two-way radios is enabling new applications and efficiencies, further stimulating demand.

Challenges in the Two-Way Radio Industry Market

Despite strong growth, the two-way radio industry faces several challenges.

- Competition from Cellular PTT: Push-to-talk over cellular (PoC) applications offer a lower-cost alternative for less critical communication needs, posing a competitive threat to traditional two-way radio systems.

- High Initial Investment Costs: Implementing advanced digital radio systems can involve significant upfront capital expenditure, which can be a barrier for smaller businesses or organizations with budget constraints.

- Interoperability Issues: While improving, ensuring seamless interoperability between different radio systems and across different agencies or organizations can still be complex.

- Spectrum Availability and Licensing: Access to suitable radio spectrum and navigating complex licensing procedures can be a bottleneck for new deployments and network expansions in certain regions.

Emerging Opportunities in Two-Way Radio Industry

Emerging opportunities are set to catalyze long-term growth within the two-way radio sector. The burgeoning adoption of IoT integration with two-way radios presents a significant avenue for expansion, enabling real-time data collection for asset tracking, environmental monitoring, and enhanced operational insights. Strategic partnerships and collaborations between radio manufacturers and software providers are creating integrated communication and management platforms, catering to a more holistic solution demand. Furthermore, the expansion into emerging markets and the increasing demand for specialized radios in niche sectors like construction, hospitality, and event management offer substantial growth potential. The ongoing need for enhanced security features and encryption in response to evolving cybersecurity threats will continue to drive innovation and demand for advanced digital solutions.

Leading Players in the Two-Way Radio Industry Sector

- Wintec Co Ltd

- Alinco

- Kenwood

- Kirisun

- Sepura

- Motorola

- Binatone

- Tait Communications

- Wanhua

- JVCKENWOOD Corporation

- Icom America

- BFDX

- Yaesu

- Uniden America Corporation

- Midland

Key Milestones in Two-Way Radio Industry Industry

- January 2022: Motorola Solutions announced the launch of the MOTOTRBO R7, a two-way digital radio with advanced audio features and a slim, rugged design to connect teams in loud, rough, and dynamic environments. The MOTOTRBO R7 voice communications system uses the DMR standard to produce sharp, clear speech with industrial-level noise cancellation, automatic feedback suppression, and automatic volume adjustment based on background noise for greater intelligibility.

- December 2021: Hytera, a provider of professional communications technologies and solutions, announced that its long-term business partner Global Beam Telecom has secured a contract with Virgin Megastore to sell Hytera TF series radios (two-way radios) in all Virgin Megastore outlets across the United Arab Emirates, including Dubai Mall, Mall of the Emirates, Abu Dhabi Yas Mall, and others. It's available in analog and digital versions, and it helps small businesses provide better customer service through greater two-way communication.

Strategic Outlook for Two-Way Radio Industry Market

The strategic outlook for the two-way radio industry is characterized by sustained growth and innovation. The market will continue to be shaped by the ongoing transition from analog to advanced digital solutions, with a strong focus on enhancing audio clarity, data integration, and cybersecurity. Key growth accelerators include the increasing adoption of integrated IoT capabilities, the development of specialized solutions for niche markets, and the expansion of push-to-talk over cellular (PoC) technologies as complementary offerings. Strategic opportunities lie in forming robust partnerships for software and hardware integration, focusing on reliable and secure communication for mission-critical applications, and capitalizing on government initiatives for public safety modernization. Companies that prioritize innovation, customer-centric solutions, and adaptability to evolving technological landscapes will be well-positioned for success in the coming years.

Two-Way Radio Industry Segmentation

-

1. Type

- 1.1. Analog

- 1.2. Digital

-

2. End User Industry

-

2.1. Business Use

- 2.1.1. Government and Public Safety

- 2.1.2. Utilites

- 2.1.3. Industry and Commerce

- 2.2. Private Use

-

2.1. Business Use

Two-Way Radio Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Two-Way Radio Industry Regional Market Share

Geographic Coverage of Two-Way Radio Industry

Two-Way Radio Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.59% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Array of advantages over a cellular phone; Simple Interface to establish connection

- 3.3. Market Restrains

- 3.3.1. ; Declining Rate of Shipment of PCs and Tablets

- 3.4. Market Trends

- 3.4.1. Industry and Commerce is One of the Factor Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Two-Way Radio Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Analog

- 5.1.2. Digital

- 5.2. Market Analysis, Insights and Forecast - by End User Industry

- 5.2.1. Business Use

- 5.2.1.1. Government and Public Safety

- 5.2.1.2. Utilites

- 5.2.1.3. Industry and Commerce

- 5.2.2. Private Use

- 5.2.1. Business Use

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Two-Way Radio Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Analog

- 6.1.2. Digital

- 6.2. Market Analysis, Insights and Forecast - by End User Industry

- 6.2.1. Business Use

- 6.2.1.1. Government and Public Safety

- 6.2.1.2. Utilites

- 6.2.1.3. Industry and Commerce

- 6.2.2. Private Use

- 6.2.1. Business Use

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Two-Way Radio Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Analog

- 7.1.2. Digital

- 7.2. Market Analysis, Insights and Forecast - by End User Industry

- 7.2.1. Business Use

- 7.2.1.1. Government and Public Safety

- 7.2.1.2. Utilites

- 7.2.1.3. Industry and Commerce

- 7.2.2. Private Use

- 7.2.1. Business Use

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Two-Way Radio Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Analog

- 8.1.2. Digital

- 8.2. Market Analysis, Insights and Forecast - by End User Industry

- 8.2.1. Business Use

- 8.2.1.1. Government and Public Safety

- 8.2.1.2. Utilites

- 8.2.1.3. Industry and Commerce

- 8.2.2. Private Use

- 8.2.1. Business Use

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Two-Way Radio Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Analog

- 9.1.2. Digital

- 9.2. Market Analysis, Insights and Forecast - by End User Industry

- 9.2.1. Business Use

- 9.2.1.1. Government and Public Safety

- 9.2.1.2. Utilites

- 9.2.1.3. Industry and Commerce

- 9.2.2. Private Use

- 9.2.1. Business Use

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Wintec Co Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Alinco

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Kenwood

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Kirisun

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Sepura

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Motorola

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Binatone

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Tait Communications

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Wanhua

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 JVCKENWOOD Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Icom America

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 BFDX

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.13 Yaesu

- 10.2.13.1. Overview

- 10.2.13.2. Products

- 10.2.13.3. SWOT Analysis

- 10.2.13.4. Recent Developments

- 10.2.13.5. Financials (Based on Availability)

- 10.2.14 Uniden America Corporation

- 10.2.14.1. Overview

- 10.2.14.2. Products

- 10.2.14.3. SWOT Analysis

- 10.2.14.4. Recent Developments

- 10.2.14.5. Financials (Based on Availability)

- 10.2.15 Midland*List Not Exhaustive

- 10.2.15.1. Overview

- 10.2.15.2. Products

- 10.2.15.3. SWOT Analysis

- 10.2.15.4. Recent Developments

- 10.2.15.5. Financials (Based on Availability)

- 10.2.1 Wintec Co Ltd

List of Figures

- Figure 1: Global Two-Way Radio Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Two-Way Radio Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Two-Way Radio Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Two-Way Radio Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 5: North America Two-Way Radio Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 6: North America Two-Way Radio Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Two-Way Radio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Two-Way Radio Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Two-Way Radio Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Two-Way Radio Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 11: Europe Two-Way Radio Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 12: Europe Two-Way Radio Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Two-Way Radio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Two-Way Radio Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Two-Way Radio Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Two-Way Radio Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 17: Asia Pacific Two-Way Radio Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 18: Asia Pacific Two-Way Radio Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Two-Way Radio Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Two-Way Radio Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Rest of the World Two-Way Radio Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Two-Way Radio Industry Revenue (Million), by End User Industry 2025 & 2033

- Figure 23: Rest of the World Two-Way Radio Industry Revenue Share (%), by End User Industry 2025 & 2033

- Figure 24: Rest of the World Two-Way Radio Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Two-Way Radio Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Two-Way Radio Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Two-Way Radio Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 3: Global Two-Way Radio Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Two-Way Radio Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Two-Way Radio Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 6: Global Two-Way Radio Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Two-Way Radio Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Two-Way Radio Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 9: Global Two-Way Radio Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Two-Way Radio Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Two-Way Radio Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 12: Global Two-Way Radio Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Two-Way Radio Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Two-Way Radio Industry Revenue Million Forecast, by End User Industry 2020 & 2033

- Table 15: Global Two-Way Radio Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Two-Way Radio Industry?

The projected CAGR is approximately 6.59%.

2. Which companies are prominent players in the Two-Way Radio Industry?

Key companies in the market include Wintec Co Ltd, Alinco, Kenwood, Kirisun, Sepura, Motorola, Binatone, Tait Communications, Wanhua, JVCKENWOOD Corporation, Icom America, BFDX, Yaesu, Uniden America Corporation, Midland*List Not Exhaustive.

3. What are the main segments of the Two-Way Radio Industry?

The market segments include Type, End User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Array of advantages over a cellular phone; Simple Interface to establish connection.

6. What are the notable trends driving market growth?

Industry and Commerce is One of the Factor Driving the Market.

7. Are there any restraints impacting market growth?

; Declining Rate of Shipment of PCs and Tablets.

8. Can you provide examples of recent developments in the market?

January 2022 - Motorola Solutions announced the launch of the MOTOTRBO R7, two-way digital radio with advanced audio features and a slim, rugged design to connect teams in loud, rough, and dynamic environments. The MOTOTRBO R7 voice communications system uses the DMR standard to produce sharp, clear speech with industrial-level noise cancellation, automatic feedback suppression, and automatic volume adjustment based on background noise for greater intelligibility.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Two-Way Radio Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Two-Way Radio Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Two-Way Radio Industry?

To stay informed about further developments, trends, and reports in the Two-Way Radio Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence