Key Insights

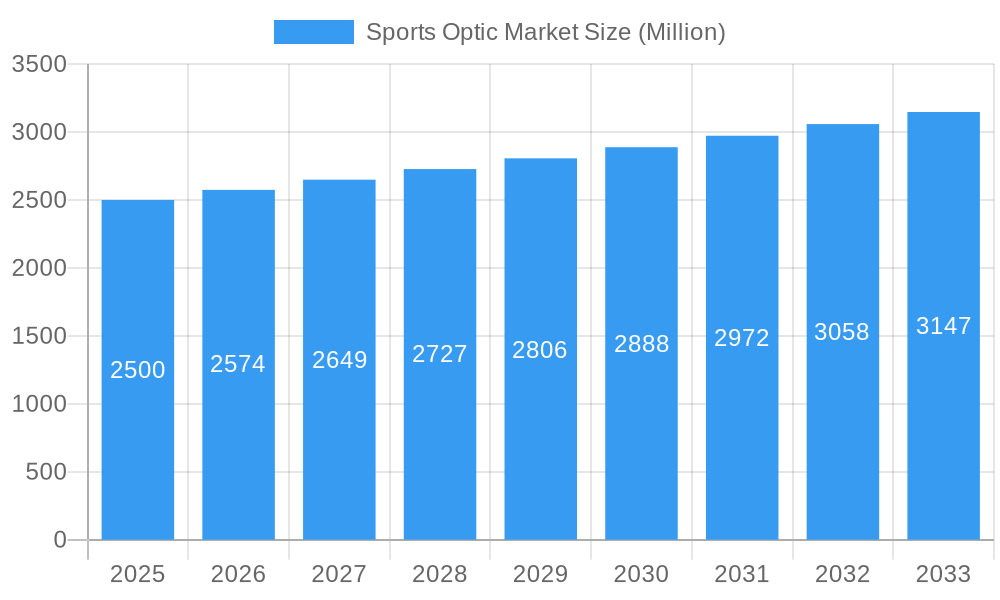

The global Sports Optic Market is projected for robust expansion, expected to reach $15.51 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 7.1% through 2033. This growth is propelled by escalating interest in outdoor recreation such as hunting, wildlife observation, and competitive shooting. Increased disposable income and a greater appreciation for high-quality optics for enhanced performance are key drivers. Technological innovations are introducing advanced products with integrated features like rangefinding and improved low-light capabilities, satisfying discerning consumers. Key product categories include Telescopes, Binoculars, and Rifle Scopes, followed by Rangefinders and specialized optics.

Sports Optic Market Market Size (In Billion)

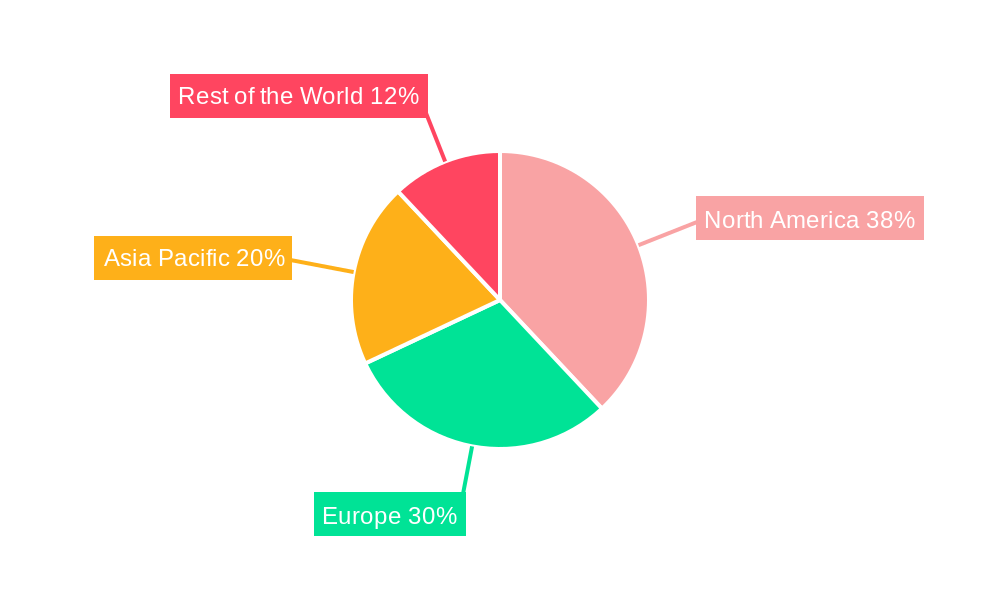

Despite positive trends, the market faces challenges, including the premium pricing of advanced optics, which can deter budget-conscious buyers, particularly in emerging markets. Intense competition among established players necessitates ongoing innovation and strategic pricing. The Asia Pacific region is anticipated to be a significant growth driver due to a growing middle class and increased participation in sports and outdoor activities. North America and Europe will remain dominant markets, supported by a strong hunting culture and a well-established outdoor enthusiast base. A growing trend towards sustainability and ethical sourcing is also influencing consumer decisions.

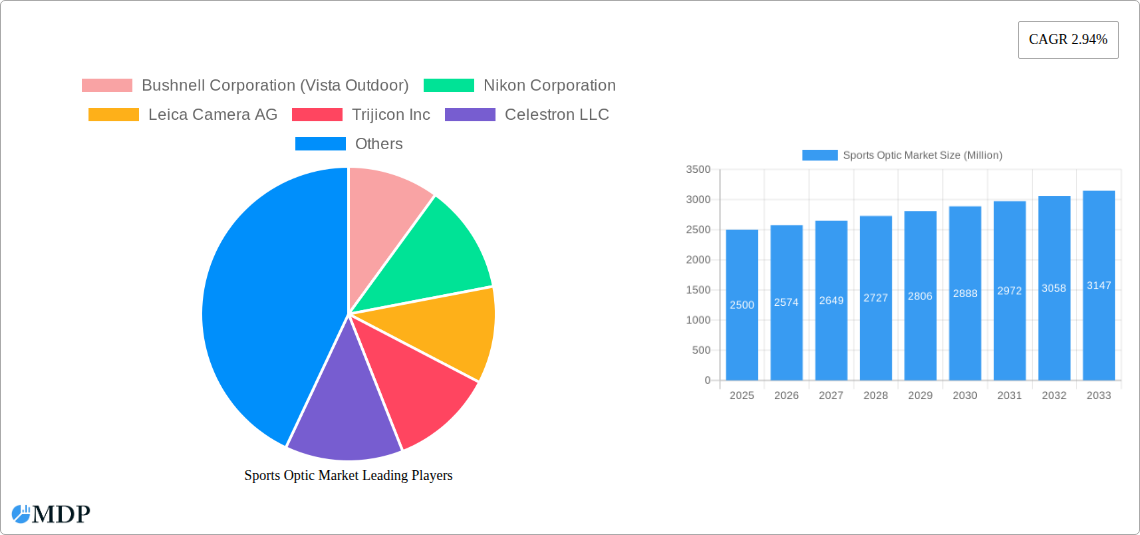

Sports Optic Market Company Market Share

This comprehensive report offers strategic insights into the dynamic global sports optic market, driven by technological advancements and a growing passion for outdoor pursuits. Analyzing the period from 2019 to 2033, with a detailed focus on the base year (2025) and an extensive forecast period (2025–2033), this report provides critical market dynamics, industry trends, leading segments, and emerging opportunities. We examine binoculars, rifle scopes, rangefinders, and telescopes, essential for hunters, nature enthusiasts, sport shooters, and astronomers. With a projected market size of over 15.51 billion USD by 2025 and a CAGR of 7.1%, this report is an indispensable resource for stakeholders navigating and capitalizing on this burgeoning market.

Sports Optic Market Market Dynamics & Concentration

The global sports optic market exhibits a moderately concentrated landscape, with a few key players holding significant market share. This concentration is driven by the high R&D investments required for advanced optical technologies and the brand loyalty associated with premium optical products. Innovation remains a primary catalyst, fueled by demands for enhanced performance, miniaturization, and integrated digital features. Regulatory frameworks, particularly concerning export controls and environmental standards for manufacturing, play a crucial role in shaping market entry and operational strategies. Product substitutes, such as advanced digital imaging devices, pose a growing challenge, necessitating continuous innovation in optical clarity and functionality. End-user trends indicate a surge in demand for lightweight, durable, and user-friendly optics, particularly for activities like birdwatching, wildlife photography, and competitive shooting. Mergers and acquisitions (M&A) activity is moderate, often involving strategic partnerships to expand product portfolios or gain access to new technologies. For instance, the acquisition of Burris Optics by Beretta Holding Group highlights consolidation aimed at strengthening market position. The market is also witnessing an increase in partnerships between optical manufacturers and technology companies to integrate smart features.

- Market Share Concentration: Top 5 companies hold approximately 45% of the market share.

- M&A Deal Counts: An average of 5-7 significant M&A deals annually within the past five years.

- Innovation Drivers: Miniaturization, enhanced light transmission, digital integration (e.g., smart reticles), and improved durability.

- Regulatory Impact: Strict adherence to import/export regulations and evolving environmental manufacturing standards.

- End-User Demographics: Growing segment of younger consumers engaging in outdoor recreation and sports.

Sports Optic Market Industry Trends & Analysis

The sports optic market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 6.5% from 2025 to 2033. This expansion is primarily propelled by the increasing popularity of outdoor recreational activities such as hunting, birdwatching, hiking, and competitive shooting sports. The rising disposable incomes in emerging economies are further fueling consumer spending on high-quality optical equipment. Technological advancements are a significant trend, with manufacturers continuously innovating to offer superior optical performance, durability, and enhanced features. This includes the development of lightweight materials, advanced lens coatings for improved light transmission and reduced glare, and the integration of digital technologies like built-in rangefinders and ballistic calculators in rifle scopes. The demand for smart optics, which offer connectivity and data logging capabilities, is also on the rise, catering to tech-savvy consumers. Consumer preferences are shifting towards specialized optics tailored to specific activities, leading to a wider product diversification. For example, lightweight and compact binoculars are favored by hikers and travelers, while high-magnification, rugged rifle scopes are sought after by hunters and marksmen. The competitive landscape is intense, characterized by both established global brands and emerging regional players. Companies are differentiating themselves through product innovation, strategic marketing, and building strong distribution networks. The increasing penetration of e-commerce platforms has also democratized access to sports optics, enabling wider market reach for both manufacturers and consumers. The COVID-19 pandemic initially led to supply chain disruptions but subsequently spurred increased interest in outdoor activities, indirectly boosting the demand for sports optics. The ongoing focus on sustainable manufacturing practices and eco-friendly materials is also becoming a key differentiator in consumer purchasing decisions.

Leading Markets & Segments in Sports Optic Market

North America currently dominates the sports optic market, driven by a strong culture of hunting, wildlife observation, and competitive shooting. The United States, in particular, represents a significant market share due to a large population of outdoor enthusiasts and the widespread availability of hunting licenses and shooting ranges. Economic policies supporting outdoor recreation and robust infrastructure for sporting events further bolster this dominance.

- Dominant Region: North America (Estimated market share: 35%)

- Key Drivers in North America:

- High participation rates in hunting and wildlife viewing.

- Strong presence of competitive shooting events and organizations.

- Favorable economic conditions and disposable income.

- Extensive retail and e-commerce distribution networks.

- Key Drivers in North America:

Within the Product Type segmentation, Binoculars hold the largest market share, accounting for an estimated 30% of the global market. This is attributed to their versatility and widespread use across various activities, including birdwatching, hiking, concerts, and casual wildlife observation.

- Dominant Product Type: Binoculars (Estimated market share: 30%)

- Key Drivers for Binoculars:

- Broad appeal across diverse user groups and activities.

- Continuous innovation in lens technology and ergonomics leading to lightweight and compact designs.

- Increasing popularity of nature tourism and ecotourism.

- Relatively accessible price points compared to high-end rifle scopes or telescopes.

- Key Drivers for Binoculars:

Rifle Scopes represent another significant segment, driven by the hunting and sport shooting industries. The demand for precision, durability, and advanced features like illuminated reticles and variable magnification continues to propel this segment. Rangefinders are also gaining traction, particularly among hunters and golfers, due to their ability to provide accurate distance measurements, enhancing shooting or playing accuracy. Telescopes, while a niche segment, cater to astronomy enthusiasts and educational institutions, with ongoing innovations in digital integration and ease of use.

- Other Significant Segments:

- Rifle Scopes: (Estimated market share: 25%) Driven by hunting and tactical applications.

- Rangefinders: (Estimated market share: 15%) Essential for accurate distance measurement in sports and hunting.

- Telescopes: (Estimated market share: 10%) Catering to astronomy enthusiasts and educational purposes.

- Other Product Types (e.g., spotting scopes, red dot sights): (Estimated market share: 10%) Driven by specialized sports and tactical needs.

Sports Optic Market Product Developments

The sports optic market is characterized by continuous innovation aimed at enhancing user experience and performance. Recent developments include the introduction of lightweight, compact binoculars like ZEISS's Smart Focus Lightweight (SFL) series, specifically designed for wildlife enthusiasts and travelers, featuring improved optical design and high-quality glass. Panda Optics' Snowsport visual solution with Eye technology offers enhanced goggle vision for winter sports, boasting a larger lens and a petite inner frame for a wide field of vision. Furthermore, advancements in adaptive optics, such as the experimental system developed by the National Research Council of Canada, are revolutionizing astronomical observation by correcting atmospheric turbulence, leading to crisper images. These innovations underscore a market trend towards user-centric design, improved optical clarity, and the integration of specialized technologies to meet the diverse needs of outdoor adventurers and scientists.

Key Drivers of Sports Optic Market Growth

The growth of the sports optic market is propelled by several key factors. The increasing global participation in outdoor recreational activities, including hunting, birdwatching, and hiking, directly translates to higher demand for binoculars, spotting scopes, and other optical devices. Technological advancements are a significant catalyst; innovations in lens coatings, material science, and digital integration (e.g., smart reticles, built-in rangefinders) offer enhanced performance and user convenience. Furthermore, the rising disposable income in developing nations allows more consumers to invest in high-quality sporting goods, including specialized optics. Government initiatives promoting outdoor recreation and conservation efforts also indirectly support market expansion. The growing interest in sports shooting as a competitive and recreational activity further drives the demand for precision rifle scopes and accessories.

Challenges in the Sports Optic Market Market

Despite its growth trajectory, the sports optic market faces several challenges. Intense competition from established brands and the emergence of low-cost alternatives can exert downward pressure on pricing and profit margins. Supply chain disruptions, as witnessed during recent global events, can impact production and lead to increased costs. Stringent regulatory frameworks in certain regions concerning the import and export of optical equipment, particularly those with advanced functionalities, can also pose hurdles. Furthermore, the rapidly evolving technological landscape necessitates continuous investment in R&D, which can be a significant financial burden for smaller companies. The market also faces the challenge of educating consumers about the benefits of premium optics and differentiating them from less sophisticated alternatives.

Emerging Opportunities in Sports Optic Market

Emerging opportunities within the sports optic market are abundant, driven by innovation and evolving consumer demands. The integration of smart technologies, such as connectivity features, data logging, and augmented reality overlays, presents a significant growth avenue. The growing trend of wildlife tourism and ecotourism fuels demand for compact, lightweight, and high-performance binoculars and spotting scopes. Expansion into emerging markets with burgeoning middle classes and increasing interest in outdoor pursuits offers substantial untapped potential. Strategic partnerships between optical manufacturers and technology companies, as well as collaborations with outdoor lifestyle brands, can create unique product offerings and expand market reach. The development of sustainable and eco-friendly optics also presents an opportunity to cater to environmentally conscious consumers.

Leading Players in the Sports Optic Market Sector

- Bushnell Corporation (Vista Outdoor)

- Nikon Corporation

- Leica Camera AG

- Trijicon Inc

- Celestron LLC

- Carl Zeiss AG

- Burris Optics

- Vortex Optics

- Swarovski Optik

- Karl Kaps GmbH & Co KG

Key Milestones in Sports Optic Market Industry

- January 2023: ZEISS launched Smart Focus Lightweight (SFL) binoculars, specifically designed for wildlife enthusiasts and travelers, claiming it to be the lightest series of SFL with improved optical design, high-quality glass, and special coating.

- December 2022: UK-based Panda Optics introduced its Snowsport visual solution, offering enhanced goggle vision, comfort, and performance with its Eye technology, featuring a larger lens and a petite inner frame for a wide field of vision.

- October 2022: The National Research Council of Canada (NRC) developed an experimental adaptive optics system capable of clearing atmospheric turbulence for telescopes, enabling the capture of crisp, pure images of the universe through advanced cameras, high-speed computers, and bendable mirrors.

Strategic Outlook for Sports Optic Market Market

The strategic outlook for the sports optic market is highly promising, fueled by sustained growth in outdoor recreation and continuous technological innovation. The market is poised for further expansion driven by the increasing demand for smart optics, advanced magnification technologies, and durable, lightweight designs. Companies focusing on product differentiation through unique features, superior optical quality, and targeted marketing strategies are likely to capture significant market share. Strategic alliances and collaborations, particularly with technology providers, will be crucial for developing integrated solutions that appeal to a tech-savvy consumer base. Expansion into underserved emerging markets and a focus on sustainable manufacturing practices will also be key accelerators for long-term growth, ensuring the sports optic market remains a dynamic and profitable sector.

Sports Optic Market Segmentation

-

1. Product Type

- 1.1. Telescopes

- 1.2. Binoculars

- 1.3. Rifle Scopes

- 1.4. Rangefinders

- 1.5. Other Product Types

Sports Optic Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Sports Optic Market Regional Market Share

Geographic Coverage of Sports Optic Market

Sports Optic Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Performance Specifications such as Clarity

- 3.2.2 Sharpness

- 3.2.3 and Magnification; Enhanced Fan Experience

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness to Challenge the Market Growth

- 3.4. Market Trends

- 3.4.1. Telescopes to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sports Optic Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Telescopes

- 5.1.2. Binoculars

- 5.1.3. Rifle Scopes

- 5.1.4. Rangefinders

- 5.1.5. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Sports Optic Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Telescopes

- 6.1.2. Binoculars

- 6.1.3. Rifle Scopes

- 6.1.4. Rangefinders

- 6.1.5. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Sports Optic Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Telescopes

- 7.1.2. Binoculars

- 7.1.3. Rifle Scopes

- 7.1.4. Rangefinders

- 7.1.5. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Sports Optic Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Telescopes

- 8.1.2. Binoculars

- 8.1.3. Rifle Scopes

- 8.1.4. Rangefinders

- 8.1.5. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Sports Optic Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Telescopes

- 9.1.2. Binoculars

- 9.1.3. Rifle Scopes

- 9.1.4. Rangefinders

- 9.1.5. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Bushnell Corporation (Vista Outdoor)

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nikon Corporation

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Leica Camera AG

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Trijicon Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Celestron LLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Carl Zeiss AG

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Burris Optics

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Vortex Optics

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Swarovski Optik

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Karl Kaps GmbH & Co KG*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Bushnell Corporation (Vista Outdoor)

List of Figures

- Figure 1: Global Sports Optic Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Sports Optic Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Sports Optic Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Sports Optic Market Revenue (billion), by Country 2025 & 2033

- Figure 5: North America Sports Optic Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Europe Sports Optic Market Revenue (billion), by Product Type 2025 & 2033

- Figure 7: Europe Sports Optic Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: Europe Sports Optic Market Revenue (billion), by Country 2025 & 2033

- Figure 9: Europe Sports Optic Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Asia Pacific Sports Optic Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Asia Pacific Sports Optic Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Asia Pacific Sports Optic Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Asia Pacific Sports Optic Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Rest of the World Sports Optic Market Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Rest of the World Sports Optic Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Rest of the World Sports Optic Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Rest of the World Sports Optic Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sports Optic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Sports Optic Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global Sports Optic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Global Sports Optic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: Global Sports Optic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Sports Optic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Sports Optic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 8: Global Sports Optic Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Sports Optic Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Sports Optic Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sports Optic Market?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Sports Optic Market?

Key companies in the market include Bushnell Corporation (Vista Outdoor), Nikon Corporation, Leica Camera AG, Trijicon Inc, Celestron LLC, Carl Zeiss AG, Burris Optics, Vortex Optics, Swarovski Optik, Karl Kaps GmbH & Co KG*List Not Exhaustive.

3. What are the main segments of the Sports Optic Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Performance Specifications such as Clarity. Sharpness. and Magnification; Enhanced Fan Experience.

6. What are the notable trends driving market growth?

Telescopes to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness to Challenge the Market Growth.

8. Can you provide examples of recent developments in the market?

January 2023 - ZEISS launched Smart Focus Lightweight (SFL) binoculars. These are specially designed for wildlife enthusiasts and travelers. The company claims this to be the lightest series of SFL. Improved optical design, high-quality glass, and special coating are some of the other vital features of the product.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sports Optic Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sports Optic Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sports Optic Market?

To stay informed about further developments, trends, and reports in the Sports Optic Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence