Key Insights

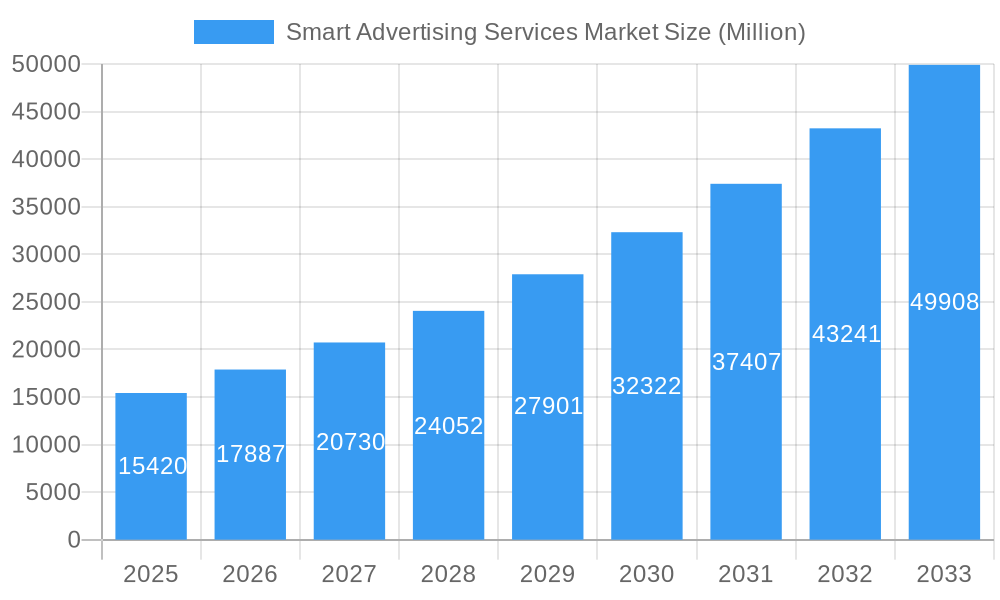

The global Smart Advertising Services market is poised for significant expansion, projected to reach an estimated USD 15,420 Million by 2025, demonstrating a robust Compound Annual Growth Rate (CAGR) of 16.00% from 2019 to 2033. This dynamic growth is primarily fueled by the increasing adoption of data-driven strategies and advanced technologies across diverse industries. Key drivers include the burgeoning demand for personalized advertising experiences, enhanced audience targeting capabilities, and the measurable ROI that smart advertising solutions offer. The pervasive integration of Artificial Intelligence (AI) and Machine Learning (ML) into advertising platforms is enabling sophisticated audience segmentation and campaign optimization, leading to more effective and efficient marketing efforts. Furthermore, the exponential growth of digital channels and the increasing reliance on online consumer behavior data are creating fertile ground for smart advertising innovation and adoption.

Smart Advertising Services Market Market Size (In Billion)

The market's evolution is characterized by several key trends. The shift towards programmatic advertising and the rise of AI-powered ad creative generation are transforming how campaigns are designed and executed. Moreover, the growing emphasis on cross-channel attribution and the demand for real-time analytics are pushing service providers to offer more integrated and responsive solutions. While the market presents immense opportunities, certain restraints, such as data privacy concerns and the complexity of integrating new technologies with legacy systems, need to be addressed. However, the inherent benefits of smart advertising, including improved customer engagement and higher conversion rates, are expected to outweigh these challenges. The market is segmented across various platforms (Online, Offline), channels of service (Social Media Publishing, Radio Commercials, TV Ads, Direct Mail, Print Media), and end-user industries (Retail, Ecommerce, Travel & Tourism, Media & Entertainment), indicating a broad and diverse application landscape. Major industry players like WPP Plc, Omnicom Group Inc., and Publicis Groupe SA are actively investing in research and development to stay ahead in this competitive and rapidly evolving market.

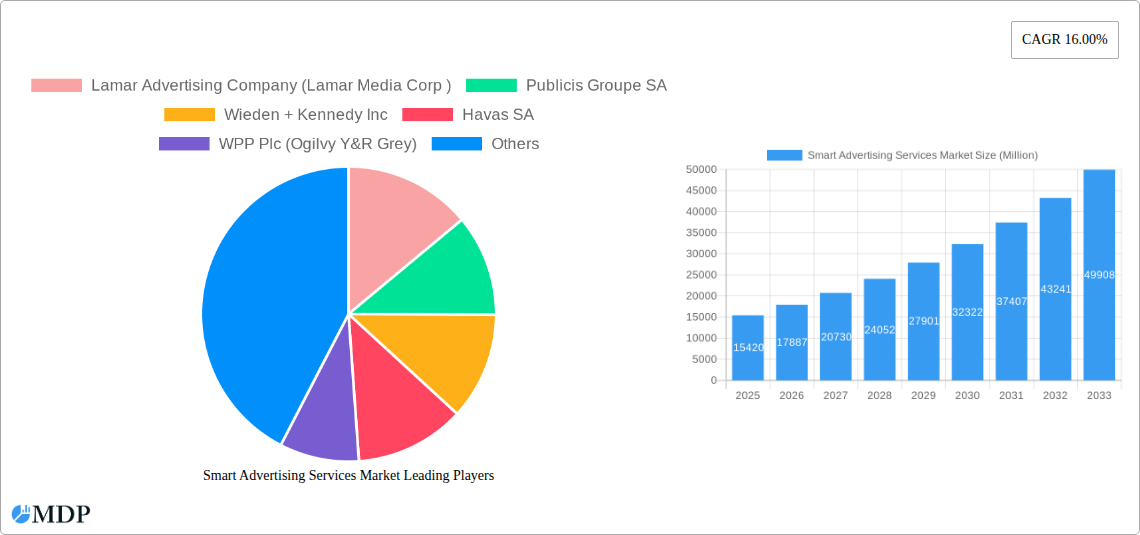

Smart Advertising Services Market Company Market Share

Here's the SEO-optimized, engaging report description for the Smart Advertising Services Market:

Gain a comprehensive understanding of the rapidly evolving Smart Advertising Services Market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, this analysis delves into market dynamics, industry trends, leading segments, and strategic outlooks. Leveraging high-traffic keywords such as "smart advertising solutions," "digital advertising platforms," "programmatic advertising," "AI in advertising," and "marketing technology," this report is essential for industry stakeholders seeking to navigate and capitalize on market opportunities. We provide actionable insights for businesses in Retail, Ecommerce, Travel & Tourism, Media & Entertainment, and beyond.

Smart Advertising Services Market Market Dynamics & Concentration

The Smart Advertising Services Market is characterized by a dynamic interplay of innovation, regulatory shifts, and evolving consumer behaviors. Market concentration is moderately high, with key players investing heavily in research and development to drive innovation. The global smart advertising services market is projected to reach $XXX Billion by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of XX.XX% during the forecast period.

- Innovation Drivers: Artificial intelligence (AI), machine learning (ML), and big data analytics are the primary catalysts for innovation, enabling hyper-personalized ad campaigns and real-time optimization. The increasing adoption of programmatic advertising platforms is also a significant driver.

- Regulatory Frameworks: Evolving data privacy regulations like GDPR and CCPA are shaping advertising practices, pushing for greater transparency and consumer control. This necessitates adaptive strategies from service providers.

- Product Substitutes: While traditional advertising channels persist, smart advertising services offer superior targeting and ROI, gradually displacing less efficient methods. However, the market for influencer marketing and content-driven advertising also presents a form of competition.

- End-User Trends: The demand for personalized customer experiences, seamless omnichannel engagement, and measurable campaign performance is driving the adoption of smart advertising solutions across all end-user industries.

- M&A Activities: The market has witnessed strategic mergers and acquisitions, with approximately XX significant deals recorded in the historical period, aimed at consolidating market share, acquiring new technologies, and expanding service portfolios. For instance, WPP Plc's acquisition of xx agencies in the past two years highlights this trend.

Smart Advertising Services Market Industry Trends & Analysis

The Smart Advertising Services Market is on an accelerated growth trajectory, fueled by technological advancements and shifting consumer interaction paradigms. The market is expected to be valued at $XXX Billion in 2025, with an anticipated growth to $XXX Billion by 2033, demonstrating a compelling CAGR of XX.XX% during the 2025-2033 forecast period. This expansion is intricately linked to the digital transformation initiatives undertaken by businesses worldwide, seeking more efficient and effective ways to reach and engage their target audiences.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is revolutionizing the landscape, enabling predictive analytics, automated campaign optimization, and hyper-personalized ad delivery. This shift towards intelligent automation allows advertisers to move beyond broad targeting to nuanced, data-driven strategies that resonate with individual consumer preferences. The rise of programmatic advertising continues to dominate, with an increasing percentage of ad spend being allocated to automated media buying, facilitated by sophisticated algorithms and real-time bidding (RTB) systems. This efficiency not only reduces operational costs but also enhances campaign performance by ensuring ads are served to the most relevant audiences at optimal times.

Consumer preferences are increasingly leaning towards personalized and non-intrusive advertising experiences. Smart advertising services excel in delivering content that is contextually relevant and aligned with user interests, thereby improving engagement rates and brand recall. The proliferation of connected devices, from smartphones to smart TVs and wearables, has created a rich ecosystem of touchpoints for advertisers to leverage, further driving the demand for integrated smart advertising solutions. Furthermore, the growing importance of data privacy and ethical advertising practices is prompting the development of more transparent and consent-driven advertising technologies, which are becoming a key differentiator for service providers. The competitive dynamics within the market are intense, with established advertising giants and nimble technology startups vying for market share through continuous innovation, strategic partnerships, and the development of proprietary platforms.

Leading Markets & Segments in Smart Advertising Services Market

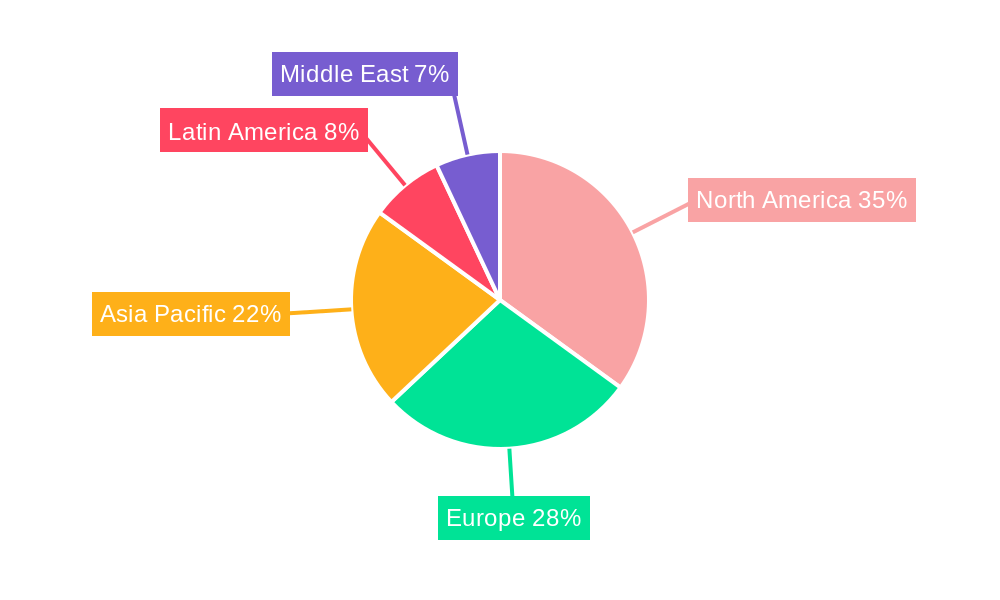

The Smart Advertising Services Market exhibits significant regional and segmental dominance, driven by economic policies, technological adoption rates, and consumer behavior.

Dominant Region: North America currently leads the smart advertising services market, propelled by high digital penetration, advanced technological infrastructure, and a significant concentration of major advertising agencies and technology providers. The United States, in particular, accounts for a substantial share of the global market, driven by its mature ecommerce sector and early adoption of programmatic advertising. The region’s strong economic policies that foster innovation and investment in AI and data analytics further bolster its leadership.

Platform Dominance:

- Online Platform: This segment holds the largest market share, driven by the pervasive use of the internet, mobile devices, and the growth of digital channels for advertising. The ability to track, measure, and optimize online campaigns in real-time provides unparalleled advantages. Key drivers include the growth of search engine marketing (SEM), social media advertising, and display advertising.

- Offline Platform: While digital channels dominate, offline platforms like TV, radio, and out-of-home (OOH) advertising are increasingly being integrated with smart technologies, offering data-driven insights and enhanced targeting capabilities.

Channel of Service Dominance:

- Social Media Publishing: This channel commands a significant share due to the massive user base of social media platforms and their sophisticated advertising tools that allow for precise audience segmentation and engagement.

- TV Ads: With the advent of connected TVs (CTV) and programmatic TV, traditional TV advertising is undergoing a smart transformation, offering better targeting and measurement.

- Radio Commercials: Smart radio advertising leverages data and analytics for more targeted ad placements and audience insights.

- Other Channels: Direct Mail and Print Media, while traditional, are also seeing smart integrations through personalized campaigns and data-driven targeting, albeit with a smaller market share compared to digital channels.

End-User Industry Dominance:

- Ecommerce: This sector is a primary driver of smart advertising, owing to the direct link between advertising spend and sales conversion. The need for personalized product recommendations and targeted promotions makes smart advertising indispensable.

- Retail: Brick-and-mortar and online retailers are increasingly using smart advertising to drive foot traffic, promote loyalty programs, and offer personalized in-store experiences.

- Media & Entertainment: This industry heavily relies on smart advertising for content promotion, audience engagement, and revenue generation through advertising.

- Travel & Tourism: Smart advertising enables personalized travel deals, destination promotions, and retargeting based on user search history and preferences.

Smart Advertising Services Market Product Developments

The Smart Advertising Services Market is characterized by continuous product innovation focused on enhancing personalization, automation, and measurability. Key developments include AI-powered predictive analytics for audience segmentation, real-time ad optimization engines, and advanced shoppable video technologies. Companies are developing integrated platforms that seamlessly combine online and offline advertising efforts, providing a unified view of customer journeys. These advancements offer competitive advantages by improving campaign ROI, reducing ad waste, and delivering more engaging and relevant advertising experiences to consumers. The market is seeing a rise in creative AI tools that generate ad copy and visuals, further streamlining the advertising production process.

Key Drivers of Smart Advertising Services Market Growth

The Smart Advertising Services Market is propelled by several key factors. Technologically, the pervasive adoption of AI, ML, and big data analytics is central, enabling hyper-personalization and automated campaign management. Economically, the growing demand for measurable marketing ROI and the increasing shift of advertising budgets towards digital channels are significant drivers. Regulatory shifts, while presenting challenges, also encourage the development of more compliant and transparent advertising solutions. The expansion of the internet and mobile penetration globally provides a vast audience for smart advertising efforts.

Challenges in the Smart Advertising Services Market Market

Despite its growth, the Smart Advertising Services Market faces several challenges. Regulatory hurdles, particularly concerning data privacy and consumer consent (e.g., GDPR, CCPA), necessitate continuous adaptation and compliance efforts, potentially increasing operational costs. The increasing complexity of the advertising technology (ad-tech) ecosystem and the fragmentation of data sources can lead to integration issues and measurement difficulties. Intense competition and the constant need for technological innovation require significant investment, posing a barrier for smaller players. Furthermore, the potential for ad fraud and the need for robust cybersecurity measures add to the operational challenges.

Emerging Opportunities in Smart Advertising Services Market

Emerging opportunities in the Smart Advertising Services Market are vast and driven by technological breakthroughs and evolving consumer behaviors. The expansion of connected TV (CTV) advertising offers a significant avenue for growth, enabling programmatic buying and personalized ad experiences on a larger screen. The metaverse and augmented reality (AR) present nascent but promising frontiers for immersive and interactive advertising. Strategic partnerships between technology providers, media agencies, and brands are crucial for developing innovative solutions and expanding market reach. Furthermore, the growing emphasis on sustainability and ethical advertising presents opportunities for companies that can offer transparent and socially responsible advertising services.

Leading Players in the Smart Advertising Services Market Sector

- Lamar Advertising Company (Lamar Media Corp)

- Publicis Groupe SA

- Wieden + Kennedy Inc

- Havas SA

- WPP Plc (Ogilvy Y&R Grey)

- MDC Partners Inc

- Droga5 LLC

- Dentsu Aegis Network Ltd (Dentsu Inc)

- The Interpublic Group of Companies Inc (McCann Worldgroup MullenLowe U S)

- Omnicom Group Inc (BBDO DDB Worldwide)

Key Milestones in Smart Advertising Services Market Industry

- July 2022: Havas Group announced the start of a new chapter in its history by simplifying its organization and deeper integration of its Global Creative and Health Networks to meet companies' ever-changing needs better. Following the launch of its Together strategy, which has significantly contributed to the Group's transformation and transformation into the most integrated company in the communications industry, Havas Group has led the market by putting meaningfulness at the heart of its ambition, a priority that advertisers now share, partners and also by peers.

- April 2022: Omnicom Group Inc. has partnered with Firework, the world's largest provider of Livestream commerce and shoppable video platforms. Clients across all Omnicom agencies will access Firework's enterprise suite of proprietary short-form video and live streaming technologies, offering shoppable live streaming video directly to brand websites.

Strategic Outlook for Smart Advertising Services Market Market

The Smart Advertising Services Market is poised for continued robust growth, driven by the relentless pursuit of personalized customer engagement and measurable campaign effectiveness. The future of advertising lies in the seamless integration of AI, data analytics, and emerging technologies like AR and VR to create immersive and impactful brand experiences. Strategic opportunities will emerge from the development of privacy-centric advertising solutions, the expansion into new markets, and the formation of synergistic partnerships. Companies that prioritize data-driven insights, ethical practices, and agile adaptation to technological advancements will be best positioned to capitalize on the evolving market dynamics and secure long-term success.

Smart Advertising Services Market Segmentation

-

1. Platform

- 1.1. Online

- 1.2. Offline

-

2. Channel of Service

- 2.1. Social Media Publishing

- 2.2. Radio Commercials

- 2.3. TV Ads

- 2.4. Direct Mail

- 2.5. Print Media

- 2.6. Other Types

-

3. End-user Industry

- 3.1. Retail

- 3.2. Ecommerce

- 3.3. Travel & Tourism

- 3.4. Media & Entertainment

- 3.5. Other End-user Industry

Smart Advertising Services Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East

Smart Advertising Services Market Regional Market Share

Geographic Coverage of Smart Advertising Services Market

Smart Advertising Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 16.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand of the Social Media Engagement; Shifting Demand from Traditional to Digital Channels

- 3.3. Market Restrains

- 3.3.1. Operational Compatibility Due to Growing Brand Value

- 3.4. Market Trends

- 3.4.1. Retail Segment is Expected to Have Significant Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Advertising Services Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 5.1.1. Online

- 5.1.2. Offline

- 5.2. Market Analysis, Insights and Forecast - by Channel of Service

- 5.2.1. Social Media Publishing

- 5.2.2. Radio Commercials

- 5.2.3. TV Ads

- 5.2.4. Direct Mail

- 5.2.5. Print Media

- 5.2.6. Other Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Retail

- 5.3.2. Ecommerce

- 5.3.3. Travel & Tourism

- 5.3.4. Media & Entertainment

- 5.3.5. Other End-user Industry

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Platform

- 6. North America Smart Advertising Services Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 6.1.1. Online

- 6.1.2. Offline

- 6.2. Market Analysis, Insights and Forecast - by Channel of Service

- 6.2.1. Social Media Publishing

- 6.2.2. Radio Commercials

- 6.2.3. TV Ads

- 6.2.4. Direct Mail

- 6.2.5. Print Media

- 6.2.6. Other Types

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Retail

- 6.3.2. Ecommerce

- 6.3.3. Travel & Tourism

- 6.3.4. Media & Entertainment

- 6.3.5. Other End-user Industry

- 6.1. Market Analysis, Insights and Forecast - by Platform

- 7. Europe Smart Advertising Services Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 7.1.1. Online

- 7.1.2. Offline

- 7.2. Market Analysis, Insights and Forecast - by Channel of Service

- 7.2.1. Social Media Publishing

- 7.2.2. Radio Commercials

- 7.2.3. TV Ads

- 7.2.4. Direct Mail

- 7.2.5. Print Media

- 7.2.6. Other Types

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Retail

- 7.3.2. Ecommerce

- 7.3.3. Travel & Tourism

- 7.3.4. Media & Entertainment

- 7.3.5. Other End-user Industry

- 7.1. Market Analysis, Insights and Forecast - by Platform

- 8. Asia Pacific Smart Advertising Services Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 8.1.1. Online

- 8.1.2. Offline

- 8.2. Market Analysis, Insights and Forecast - by Channel of Service

- 8.2.1. Social Media Publishing

- 8.2.2. Radio Commercials

- 8.2.3. TV Ads

- 8.2.4. Direct Mail

- 8.2.5. Print Media

- 8.2.6. Other Types

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Retail

- 8.3.2. Ecommerce

- 8.3.3. Travel & Tourism

- 8.3.4. Media & Entertainment

- 8.3.5. Other End-user Industry

- 8.1. Market Analysis, Insights and Forecast - by Platform

- 9. Latin America Smart Advertising Services Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 9.1.1. Online

- 9.1.2. Offline

- 9.2. Market Analysis, Insights and Forecast - by Channel of Service

- 9.2.1. Social Media Publishing

- 9.2.2. Radio Commercials

- 9.2.3. TV Ads

- 9.2.4. Direct Mail

- 9.2.5. Print Media

- 9.2.6. Other Types

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Retail

- 9.3.2. Ecommerce

- 9.3.3. Travel & Tourism

- 9.3.4. Media & Entertainment

- 9.3.5. Other End-user Industry

- 9.1. Market Analysis, Insights and Forecast - by Platform

- 10. Middle East Smart Advertising Services Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 10.1.1. Online

- 10.1.2. Offline

- 10.2. Market Analysis, Insights and Forecast - by Channel of Service

- 10.2.1. Social Media Publishing

- 10.2.2. Radio Commercials

- 10.2.3. TV Ads

- 10.2.4. Direct Mail

- 10.2.5. Print Media

- 10.2.6. Other Types

- 10.3. Market Analysis, Insights and Forecast - by End-user Industry

- 10.3.1. Retail

- 10.3.2. Ecommerce

- 10.3.3. Travel & Tourism

- 10.3.4. Media & Entertainment

- 10.3.5. Other End-user Industry

- 10.1. Market Analysis, Insights and Forecast - by Platform

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Lamar Advertising Company (Lamar Media Corp )

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Publicis Groupe SA

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Wieden + Kennedy Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Havas SA

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 WPP Plc (Ogilvy Y&R Grey)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 MDC Partners Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Droga5 LLC*List Not Exhaustive

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Dentsu Aegis Network Ltd (Dentsu Inc )

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Interpublic Group of Companies Inc (McCann Worldgroup MullenLowe U S )

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Omnicom Group Inc (BBDO DDB Worldwide)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Lamar Advertising Company (Lamar Media Corp )

List of Figures

- Figure 1: Global Smart Advertising Services Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Smart Advertising Services Market Revenue (Million), by Platform 2025 & 2033

- Figure 3: North America Smart Advertising Services Market Revenue Share (%), by Platform 2025 & 2033

- Figure 4: North America Smart Advertising Services Market Revenue (Million), by Channel of Service 2025 & 2033

- Figure 5: North America Smart Advertising Services Market Revenue Share (%), by Channel of Service 2025 & 2033

- Figure 6: North America Smart Advertising Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 7: North America Smart Advertising Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Smart Advertising Services Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Smart Advertising Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Smart Advertising Services Market Revenue (Million), by Platform 2025 & 2033

- Figure 11: Europe Smart Advertising Services Market Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Europe Smart Advertising Services Market Revenue (Million), by Channel of Service 2025 & 2033

- Figure 13: Europe Smart Advertising Services Market Revenue Share (%), by Channel of Service 2025 & 2033

- Figure 14: Europe Smart Advertising Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 15: Europe Smart Advertising Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Smart Advertising Services Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Europe Smart Advertising Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Smart Advertising Services Market Revenue (Million), by Platform 2025 & 2033

- Figure 19: Asia Pacific Smart Advertising Services Market Revenue Share (%), by Platform 2025 & 2033

- Figure 20: Asia Pacific Smart Advertising Services Market Revenue (Million), by Channel of Service 2025 & 2033

- Figure 21: Asia Pacific Smart Advertising Services Market Revenue Share (%), by Channel of Service 2025 & 2033

- Figure 22: Asia Pacific Smart Advertising Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Smart Advertising Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Smart Advertising Services Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific Smart Advertising Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Smart Advertising Services Market Revenue (Million), by Platform 2025 & 2033

- Figure 27: Latin America Smart Advertising Services Market Revenue Share (%), by Platform 2025 & 2033

- Figure 28: Latin America Smart Advertising Services Market Revenue (Million), by Channel of Service 2025 & 2033

- Figure 29: Latin America Smart Advertising Services Market Revenue Share (%), by Channel of Service 2025 & 2033

- Figure 30: Latin America Smart Advertising Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 31: Latin America Smart Advertising Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Latin America Smart Advertising Services Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Latin America Smart Advertising Services Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East Smart Advertising Services Market Revenue (Million), by Platform 2025 & 2033

- Figure 35: Middle East Smart Advertising Services Market Revenue Share (%), by Platform 2025 & 2033

- Figure 36: Middle East Smart Advertising Services Market Revenue (Million), by Channel of Service 2025 & 2033

- Figure 37: Middle East Smart Advertising Services Market Revenue Share (%), by Channel of Service 2025 & 2033

- Figure 38: Middle East Smart Advertising Services Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 39: Middle East Smart Advertising Services Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 40: Middle East Smart Advertising Services Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Middle East Smart Advertising Services Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Smart Advertising Services Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 2: Global Smart Advertising Services Market Revenue Million Forecast, by Channel of Service 2020 & 2033

- Table 3: Global Smart Advertising Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Smart Advertising Services Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Smart Advertising Services Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 6: Global Smart Advertising Services Market Revenue Million Forecast, by Channel of Service 2020 & 2033

- Table 7: Global Smart Advertising Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Smart Advertising Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: Global Smart Advertising Services Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 10: Global Smart Advertising Services Market Revenue Million Forecast, by Channel of Service 2020 & 2033

- Table 11: Global Smart Advertising Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Smart Advertising Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Smart Advertising Services Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 14: Global Smart Advertising Services Market Revenue Million Forecast, by Channel of Service 2020 & 2033

- Table 15: Global Smart Advertising Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Smart Advertising Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 17: Global Smart Advertising Services Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 18: Global Smart Advertising Services Market Revenue Million Forecast, by Channel of Service 2020 & 2033

- Table 19: Global Smart Advertising Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Smart Advertising Services Market Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Global Smart Advertising Services Market Revenue Million Forecast, by Platform 2020 & 2033

- Table 22: Global Smart Advertising Services Market Revenue Million Forecast, by Channel of Service 2020 & 2033

- Table 23: Global Smart Advertising Services Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 24: Global Smart Advertising Services Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Advertising Services Market?

The projected CAGR is approximately 16.00%.

2. Which companies are prominent players in the Smart Advertising Services Market?

Key companies in the market include Lamar Advertising Company (Lamar Media Corp ), Publicis Groupe SA, Wieden + Kennedy Inc, Havas SA, WPP Plc (Ogilvy Y&R Grey), MDC Partners Inc, Droga5 LLC*List Not Exhaustive, Dentsu Aegis Network Ltd (Dentsu Inc ), The Interpublic Group of Companies Inc (McCann Worldgroup MullenLowe U S ), Omnicom Group Inc (BBDO DDB Worldwide).

3. What are the main segments of the Smart Advertising Services Market?

The market segments include Platform, Channel of Service, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand of the Social Media Engagement; Shifting Demand from Traditional to Digital Channels.

6. What are the notable trends driving market growth?

Retail Segment is Expected to Have Significant Share in the Market.

7. Are there any restraints impacting market growth?

Operational Compatibility Due to Growing Brand Value.

8. Can you provide examples of recent developments in the market?

July 2022 - Havas Group announced the start of a new chapter in its history by simplifying its organization and deeper integration of its Global Creative and Health Networks to meet companies' ever-changing needs better. Following the launch of its Together strategy, which has significantly contributed to the Group's transformation and transformation into the most integrated company in the communications industry, Havas Group has led the market by putting meaningfulness at the heart of its ambition, a priority that advertisers now share, partners and also by peers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Advertising Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Advertising Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Advertising Services Market?

To stay informed about further developments, trends, and reports in the Smart Advertising Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence