Key Insights

The online video platforms (OVP) market is experiencing robust growth, driven by the increasing consumption of video content across various sectors. The market's Compound Annual Growth Rate (CAGR) of 13.23% from 2019 to 2024 indicates a significant upward trajectory. This expansion is fueled by several key factors: the rising adoption of live streaming for events, education, and entertainment; the increasing demand for sophisticated video content management systems (VCMS) to streamline workflow and enhance user experience; and the growing utilization of video analytics for better content optimization and audience engagement. The e-learning sector, in particular, is a major driver, with educational institutions and corporations increasingly leveraging OVPs for online courses and training programs. Other significant end-user segments include media and entertainment, BFSI (Banking, Financial Services, and Insurance), retail, and IT and communications, each contributing to the market's overall expansion. The competitive landscape is dynamic, with established players like YouTube and Vimeo coexisting with specialized providers offering niche functionalities. This competition fosters innovation and drives down costs, further accelerating market growth.

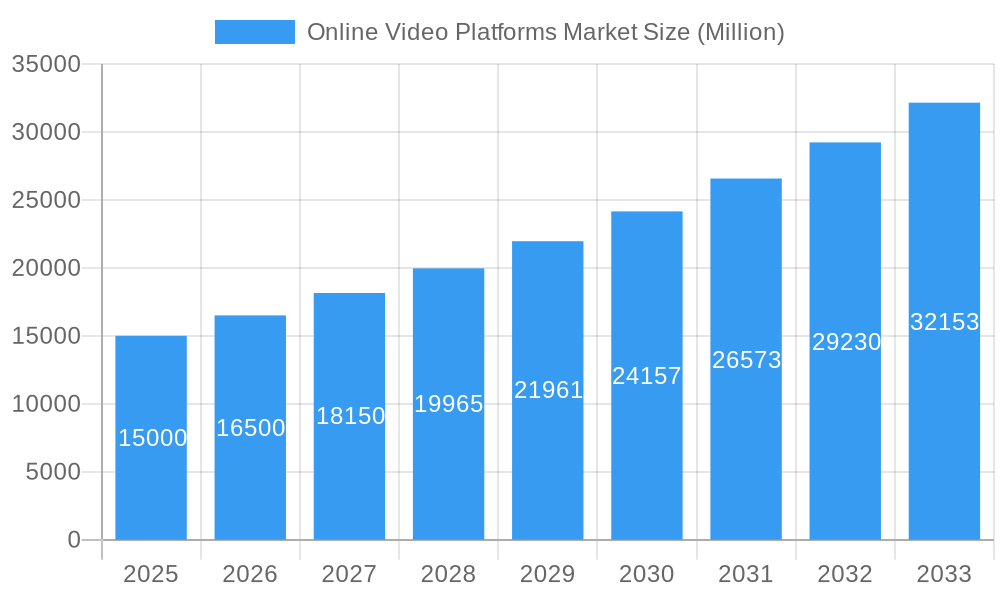

Online Video Platforms Market Market Size (In Billion)

Looking ahead, several trends will shape the future of the OVP market. The integration of artificial intelligence (AI) and machine learning (ML) for personalized content recommendations and automated content moderation is gaining traction. The rise of short-form video content and the increasing demand for high-quality, immersive video experiences, including virtual reality (VR) and augmented reality (AR), are also influencing market dynamics. Despite these positive trends, challenges remain. The need for robust cybersecurity measures to protect against data breaches and content piracy poses a significant restraint. Additionally, ensuring seamless scalability and accessibility across various devices and platforms continues to be a crucial consideration for OVP providers. Given the ongoing digital transformation and the pervasive nature of video content, the OVP market is poised for sustained growth throughout the forecast period (2025-2033), with significant opportunities for both established players and new entrants. Considering the 2019-2024 CAGR of 13.23%, and assuming a slight moderation due to market saturation effects, a conservative estimate for the CAGR from 2025-2033 would be around 10%.

Online Video Platforms Market Company Market Share

Online Video Platforms Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Online Video Platforms Market, offering invaluable insights for stakeholders, investors, and industry professionals. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report analyzes market dynamics, industry trends, leading players, and emerging opportunities, providing a clear picture of this rapidly evolving sector. The market is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period. This report is crucial for understanding the competitive landscape and making informed strategic decisions.

Online Video Platforms Market Dynamics & Concentration

The Online Video Platforms Market is characterized by a dynamic interplay of factors influencing its growth and concentration. Market concentration is moderate, with several key players holding significant market share, but a large number of smaller niche players also contributing. Innovation is a key driver, with continuous improvements in video quality, streaming technologies, and analytics capabilities shaping market trends. Regulatory frameworks concerning data privacy, content moderation, and intellectual property rights significantly impact market operations. The market witnesses continuous product substitution as new technologies emerge, with software-based solutions gaining prominence over hardware-based systems.

End-user trends are pivotal, with increasing adoption of video across diverse sectors like e-learning, media & entertainment, and BFSI driving market expansion. Mergers and acquisitions (M&A) activities are frequent, with larger players acquiring smaller companies to expand their capabilities and market reach. For example, the number of M&A deals in the market averaged xx per year between 2019 and 2024, leading to a consolidation of market share among major players. While precise market share figures for individual companies are proprietary data and not fully accessible here, the leading companies control a significant portion of the overall market.

- Market Concentration: Moderate, with several key players and numerous smaller participants.

- Innovation Drivers: Improved video quality, streaming technologies, analytics capabilities.

- Regulatory Framework: Data privacy, content moderation, intellectual property rights.

- Product Substitution: Shift towards software-based solutions.

- End-user trends: Increasing video adoption across various sectors.

- M&A Activity: Significant M&A activity driving market consolidation.

Online Video Platforms Market Industry Trends & Analysis

The Online Video Platforms Market is experiencing robust growth, fueled by several key trends. The increasing penetration of high-speed internet and mobile devices is expanding the accessibility of online video content. Technological advancements, such as the widespread adoption of 5G and improved video compression technologies, are further enhancing the user experience and enabling higher quality streaming. Consumer preferences are shifting towards personalized and on-demand video content, driving the growth of subscription-based video-on-demand (SVOD) platforms. Competitive dynamics remain intense, with ongoing innovation and strategic partnerships shaping the market landscape. The market experienced a growth of xx Million between 2019 and 2024, reflecting the strong demand for online video services. The estimated market size for 2025 is xx Million.

Leading Markets & Segments in Online Video Platforms Market

The North American region currently holds a dominant position in the Online Video Platforms Market, driven by factors such as high internet penetration, robust technological infrastructure, and strong consumer demand for online video content. Strong economic conditions and favorable regulatory policies also contribute to its leading position.

By Type:

- Video Content Management Systems (VCMS): This segment is the largest, driven by the need for efficient video storage, management, and delivery.

- Live Streaming: This segment exhibits high growth, fueled by the rising popularity of live events and interactive content.

- Video Analytics: This segment is rapidly expanding, driven by the increasing demand for data-driven insights into video content performance.

By End User:

- Media and Entertainment: This is a major segment, accounting for a significant portion of market revenue.

- E-learning: This segment shows strong growth, fueled by the rising popularity of online education.

- BFSI (Banking, Financial Services, and Insurance): This sector is experiencing increasing adoption of video for customer service and training.

The other end-user segments, including retail, IT & communications and others, are also experiencing growth, reflecting the increasing use of video across various industries.

Online Video Platforms Market Product Developments

Recent product innovations have focused on enhancing video quality, improving streaming performance, and integrating advanced analytics capabilities. New features such as AI-powered video editing tools, personalized content recommendations, and interactive video experiences are gaining popularity. These innovations address the growing demand for more engaging and efficient video solutions, making them better suited for various applications. The focus on cloud-based platforms and improved scalability is enhancing market fit and making online video platforms more accessible to businesses of all sizes.

Key Drivers of Online Video Platforms Market Growth

Several key factors are driving the growth of the Online Video Platforms Market. Technological advancements such as improved video compression techniques and high-speed internet access are expanding market reach. The increasing affordability of mobile devices is making video consumption more accessible. Government initiatives promoting digital literacy and digital infrastructure development are further fueling market expansion. Finally, the rising popularity of online video content across various applications is boosting market demand.

Challenges in the Online Video Platforms Market

The Online Video Platforms Market faces several challenges. Maintaining high video quality while managing bandwidth costs is a significant hurdle. Competition is intense, with several established players and new entrants vying for market share. Data security and privacy concerns are also significant, requiring stringent measures to protect user data. Furthermore, evolving regulatory frameworks concerning content moderation and intellectual property rights pose a challenge for platform operators. These challenges impact profitability and market stability.

Emerging Opportunities in Online Video Platforms Market

The future of the Online Video Platforms Market looks bright, with several emerging opportunities poised to drive further growth. The adoption of advanced technologies such as AI and VR/AR in video production and delivery presents significant growth potential. Strategic partnerships between technology providers and content creators can unlock new market segments and create innovative video solutions. Expanding into new geographical markets and underserved segments offers substantial untapped potential.

Leading Players in the Online Video Platforms Market Sector

Key Milestones in Online Video Platforms Market Industry

- April 2022: Vimeo launches its enterprise video providers on the Google Cloud Marketplace, expanding accessibility for businesses.

- March 2022: K16 Solutions partners with Panopto, streamlining the transition process for customers switching from legacy providers.

Strategic Outlook for Online Video Platforms Market

The Online Video Platforms Market is expected to experience sustained growth driven by technological advancements, increasing internet penetration, and rising consumer demand for video content. Strategic opportunities exist in developing innovative video solutions, expanding into new markets, and forging strategic partnerships to leverage the collective strengths of different industry players. Companies focused on personalized video experiences, enhanced security features, and robust analytics capabilities are best positioned to capture a larger share of the growing market.

Online Video Platforms Market Segmentation

-

1. Type

- 1.1. Live Streaming

- 1.2. Video Content Management Systems

- 1.3. Video Analytics

-

2. End User

- 2.1. E-learning

- 2.2. Media and Entertainment

- 2.3. BFSI

- 2.4. Retail

- 2.5. IT and Communications

- 2.6. Other End Users

Online Video Platforms Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Online Video Platforms Market Regional Market Share

Geographic Coverage of Online Video Platforms Market

Online Video Platforms Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Trends in Online Advertisements; Increase in Popularity of Online Viewers

- 3.3. Market Restrains

- 3.3.1. Too Much Competition Due to the Open Source; Network Congestion Due to Slow Network

- 3.4. Market Trends

- 3.4.1. Increase in Trends in Online Advertisements is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Video Platforms Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Live Streaming

- 5.1.2. Video Content Management Systems

- 5.1.3. Video Analytics

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. E-learning

- 5.2.2. Media and Entertainment

- 5.2.3. BFSI

- 5.2.4. Retail

- 5.2.5. IT and Communications

- 5.2.6. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Online Video Platforms Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Live Streaming

- 6.1.2. Video Content Management Systems

- 6.1.3. Video Analytics

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. E-learning

- 6.2.2. Media and Entertainment

- 6.2.3. BFSI

- 6.2.4. Retail

- 6.2.5. IT and Communications

- 6.2.6. Other End Users

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Online Video Platforms Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Live Streaming

- 7.1.2. Video Content Management Systems

- 7.1.3. Video Analytics

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. E-learning

- 7.2.2. Media and Entertainment

- 7.2.3. BFSI

- 7.2.4. Retail

- 7.2.5. IT and Communications

- 7.2.6. Other End Users

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Online Video Platforms Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Live Streaming

- 8.1.2. Video Content Management Systems

- 8.1.3. Video Analytics

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. E-learning

- 8.2.2. Media and Entertainment

- 8.2.3. BFSI

- 8.2.4. Retail

- 8.2.5. IT and Communications

- 8.2.6. Other End Users

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Online Video Platforms Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Live Streaming

- 9.1.2. Video Content Management Systems

- 9.1.3. Video Analytics

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. E-learning

- 9.2.2. Media and Entertainment

- 9.2.3. BFSI

- 9.2.4. Retail

- 9.2.5. IT and Communications

- 9.2.6. Other End Users

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Online Video Platforms Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Live Streaming

- 10.1.2. Video Content Management Systems

- 10.1.3. Video Analytics

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. E-learning

- 10.2.2. Media and Entertainment

- 10.2.3. BFSI

- 10.2.4. Retail

- 10.2.5. IT and Communications

- 10.2.6. Other End Users

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Online Video Platforms Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Live Streaming

- 11.1.2. Video Content Management Systems

- 11.1.3. Video Analytics

- 11.2. Market Analysis, Insights and Forecast - by End User

- 11.2.1. E-learning

- 11.2.2. Media and Entertainment

- 11.2.3. BFSI

- 11.2.4. Retail

- 11.2.5. IT and Communications

- 11.2.6. Other End Users

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Kollective Technology Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 JW Player (Longtail Ad Solutions Inc )

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IBM Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Dacast Inc*List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Wistia Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Vidyard (BuildScale Inc )

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 YouTube LLC

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Kaltura Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Vimeo Inc (Inter Active Corp )

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Brightcove Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Panopto Inc

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Kollective Technology Inc

List of Figures

- Figure 1: Global Online Video Platforms Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Online Video Platforms Market Revenue (undefined), by Type 2025 & 2033

- Figure 3: North America Online Video Platforms Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Online Video Platforms Market Revenue (undefined), by End User 2025 & 2033

- Figure 5: North America Online Video Platforms Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Online Video Platforms Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Online Video Platforms Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Online Video Platforms Market Revenue (undefined), by Type 2025 & 2033

- Figure 9: Europe Online Video Platforms Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Online Video Platforms Market Revenue (undefined), by End User 2025 & 2033

- Figure 11: Europe Online Video Platforms Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Online Video Platforms Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Online Video Platforms Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Online Video Platforms Market Revenue (undefined), by Type 2025 & 2033

- Figure 15: Asia Online Video Platforms Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Online Video Platforms Market Revenue (undefined), by End User 2025 & 2033

- Figure 17: Asia Online Video Platforms Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Online Video Platforms Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Online Video Platforms Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Online Video Platforms Market Revenue (undefined), by Type 2025 & 2033

- Figure 21: Australia and New Zealand Online Video Platforms Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Australia and New Zealand Online Video Platforms Market Revenue (undefined), by End User 2025 & 2033

- Figure 23: Australia and New Zealand Online Video Platforms Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Australia and New Zealand Online Video Platforms Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Online Video Platforms Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Online Video Platforms Market Revenue (undefined), by Type 2025 & 2033

- Figure 27: Latin America Online Video Platforms Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Online Video Platforms Market Revenue (undefined), by End User 2025 & 2033

- Figure 29: Latin America Online Video Platforms Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Latin America Online Video Platforms Market Revenue (undefined), by Country 2025 & 2033

- Figure 31: Latin America Online Video Platforms Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Online Video Platforms Market Revenue (undefined), by Type 2025 & 2033

- Figure 33: Middle East and Africa Online Video Platforms Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East and Africa Online Video Platforms Market Revenue (undefined), by End User 2025 & 2033

- Figure 35: Middle East and Africa Online Video Platforms Market Revenue Share (%), by End User 2025 & 2033

- Figure 36: Middle East and Africa Online Video Platforms Market Revenue (undefined), by Country 2025 & 2033

- Figure 37: Middle East and Africa Online Video Platforms Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Online Video Platforms Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Global Online Video Platforms Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 3: Global Online Video Platforms Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Online Video Platforms Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Global Online Video Platforms Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 6: Global Online Video Platforms Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: Global Online Video Platforms Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 8: Global Online Video Platforms Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 9: Global Online Video Platforms Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 10: Global Online Video Platforms Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 11: Global Online Video Platforms Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 12: Global Online Video Platforms Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Global Online Video Platforms Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 14: Global Online Video Platforms Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 15: Global Online Video Platforms Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Online Video Platforms Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 17: Global Online Video Platforms Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 18: Global Online Video Platforms Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: Global Online Video Platforms Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 20: Global Online Video Platforms Market Revenue undefined Forecast, by End User 2020 & 2033

- Table 21: Global Online Video Platforms Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Video Platforms Market?

The projected CAGR is approximately 12.4%.

2. Which companies are prominent players in the Online Video Platforms Market?

Key companies in the market include Kollective Technology Inc, JW Player (Longtail Ad Solutions Inc ), IBM Corporation, Dacast Inc*List Not Exhaustive, Wistia Inc, Vidyard (BuildScale Inc ), YouTube LLC, Kaltura Inc, Vimeo Inc (Inter Active Corp ), Brightcove Inc, Panopto Inc.

3. What are the main segments of the Online Video Platforms Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increase in Trends in Online Advertisements; Increase in Popularity of Online Viewers.

6. What are the notable trends driving market growth?

Increase in Trends in Online Advertisements is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Too Much Competition Due to the Open Source; Network Congestion Due to Slow Network.

8. Can you provide examples of recent developments in the market?

April 2022 - Vimeo, one of the world's leading all-in-one video software solutions, has announced the availability of its enterprise video providers to developers directly on the Google Cloud Marketplace. Users can easily access businesses of all kinds to integrate video across their operations. Moreover, Vimeo provides enterprise-level video software for businesses to create, manage, deliver, and monetize video securely and efficiently.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Video Platforms Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Video Platforms Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Video Platforms Market?

To stay informed about further developments, trends, and reports in the Online Video Platforms Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence