Key Insights

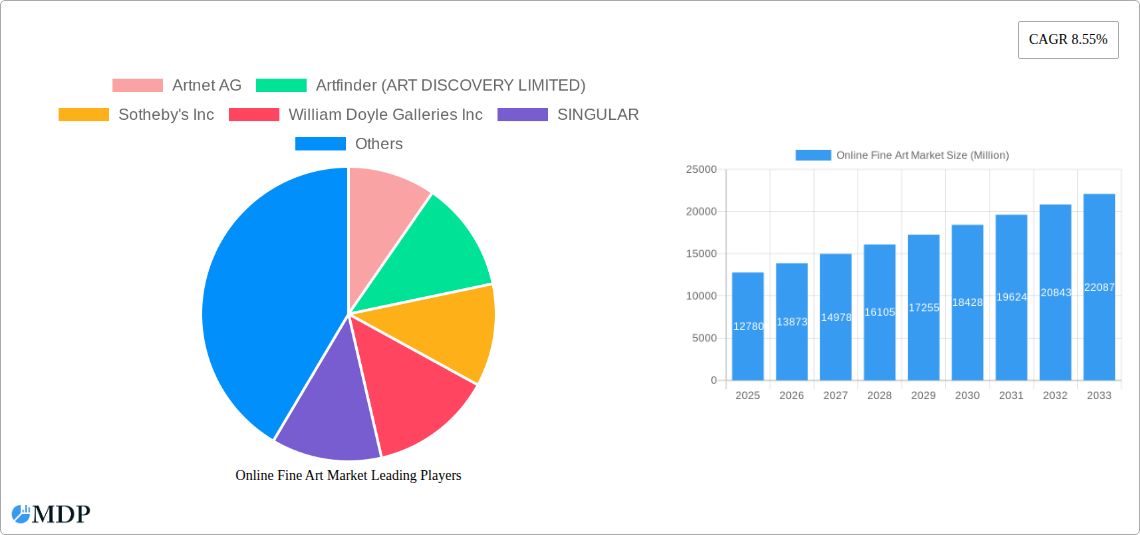

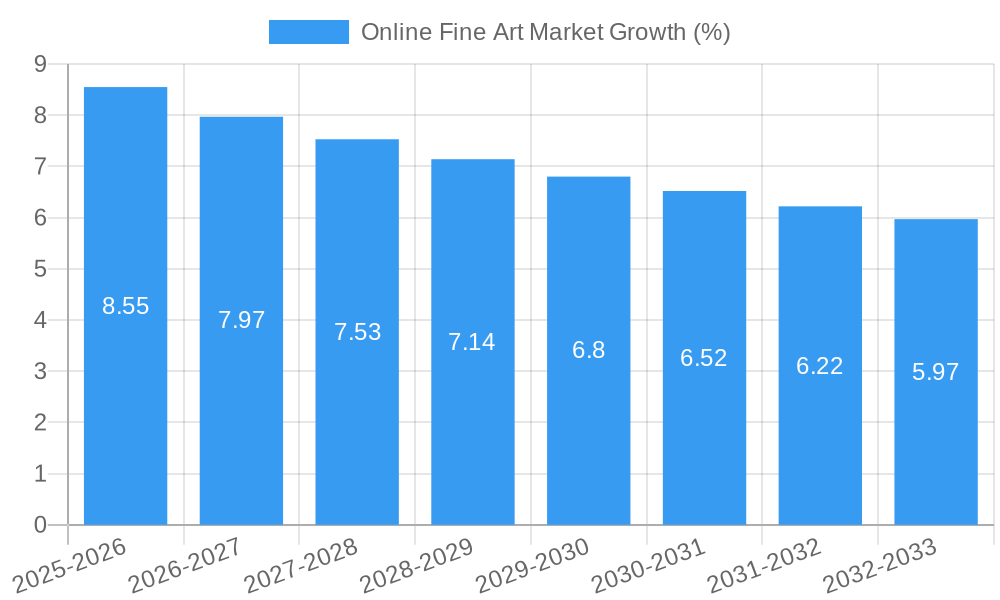

The global online fine art market is poised for substantial growth, projected to reach a valuation of $12.78 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 8.55% anticipated from 2025 to 2033. This upward trajectory is propelled by a confluence of powerful drivers, including the increasing accessibility and convenience offered by digital platforms, the growing collector base driven by a desire for unique and investment-worthy assets, and the expanding reach of online auctions and galleries to a global audience. The market's dynamic nature is further fueled by evolving collector preferences, a growing appreciation for post-war and contemporary art, and innovative online selling strategies. These factors are collectively shaping a more inclusive and expansive fine art marketplace.

Despite the robust growth potential, the online fine art market faces certain restraints that require strategic navigation. These include persistent concerns around authentication and provenance in a digital environment, the challenges of replicating the tactile experience of viewing art in person, and the ongoing need for robust cybersecurity measures to protect valuable transactions. However, these challenges are being met with innovative solutions, such as advanced blockchain technology for provenance tracking and immersive virtual gallery experiences. The market is segmented across various channels, with dealers and auctions being dominant, and a strong focus on mediums like paintings and sculptures. The dominant sectors, Post-War and Contemporary, Modern, and Impressionist and Post-Impressionist art, are experiencing significant online demand, reflecting a mature and evolving collector base eager to engage with art across diverse artistic periods and styles.

Unlocking Value in the Digital Canvas: An In-Depth Report on the Online Fine Art Market

This comprehensive report, "Online Fine Art Market: Dynamics, Trends, and Future Outlook," provides an authoritative analysis of the global digital art ecosystem. Spanning the Study Period 2019–2033, with a Base Year of 2025, it offers critical insights into market concentration, innovation drivers, regulatory landscapes, emerging trends, and strategic opportunities. Leveraging high-traffic keywords such as "online art sales," "digital art market," "fine art e-commerce," "art auctions online," and "contemporary art market," this report is an indispensable resource for collectors, investors, galleries, auction houses, and industry stakeholders seeking to navigate and capitalize on the burgeoning online fine art sector.

The report delves deep into the multifaceted landscape of online fine art, exploring its rapid evolution and forecasting its trajectory through 2033. With a detailed breakdown of market segments, leading players, and key developmental milestones, this analysis empowers strategic decision-making in an increasingly digitized art world. This report is designed for immediate use without further modification.

Online Fine Art Market Market Dynamics & Concentration

The online fine art market exhibits a dynamic and evolving concentration, driven by technological advancements and shifting collector behaviors. The historical period of 2019–2024 has witnessed a significant influx of both established and emerging players, leading to a competitive yet collaborative environment. Innovation drivers such as blockchain technology for provenance and authentication, augmented reality (AR) for virtual gallery experiences, and sophisticated data analytics for price prediction are reshaping the market. Regulatory frameworks, while still developing, are increasingly focused on transparency, anti-money laundering (AML) compliance, and intellectual property rights in the digital realm. Product substitutes, though limited in the realm of unique physical artworks, include fractional ownership platforms and digital art marketplaces. End-user trends show a growing comfort with online purchases, particularly among younger demographics and new collectors. Mergers and acquisitions (M&A) activities have been strategic, aimed at consolidating market share, expanding digital capabilities, and integrating diverse art offerings. For instance, the acquisition of smaller online galleries or technology providers by larger platforms signals a move towards market consolidation.

- Market Concentration: The market is characterized by a mix of large, established auction houses with significant online presences and a plethora of specialized online galleries and platforms.

- Innovation Drivers: Blockchain for provenance, AR for visualization, AI for curation and pricing, and user-friendly e-commerce platforms.

- Regulatory Frameworks: Increasing focus on consumer protection, anti-fraud measures, and digital asset regulations.

- Product Substitutes: Fractional art ownership, digital art platforms, and curated art advisory services.

- End-User Trends: Growing online purchasing confidence, demand for transparency, interest in emerging artists, and the influence of social media.

- M&A Activities: Strategic acquisitions to gain market share, acquire technology, and expand geographical reach. Deal counts are estimated to be in the dozens annually during the historical period.

Online Fine Art Market Industry Trends & Analysis

The online fine art market is experiencing robust growth, driven by a confluence of technological advancements, evolving consumer preferences, and increased accessibility. The projected Compound Annual Growth Rate (CAGR) for the forecast period 2025–2033 is estimated at XX%, signaling a sustained expansion. This growth is fueled by the increasing digitization of the global art economy, making fine art more accessible to a wider audience beyond traditional brick-and-mortar galleries and auction rooms. Technological disruptions, including the adoption of high-resolution imagery, virtual reality (VR) gallery tours, and AI-powered curation tools, are enhancing the online buying experience and fostering trust. Consumer preferences are shifting towards convenience, personalization, and a desire for unique investment opportunities, which the online space readily provides. The competitive dynamics are intensifying, with established art market leaders like Christie's and Sotheby's Inc enhancing their online offerings, while digital-native platforms such as Artnet AG, Artsy, and Artfinder (ART DISCOVERY LIMITED) continue to innovate and capture market share. The introduction of features like live online auctions, secure payment gateways, and enhanced shipping logistics are critical in overcoming past hesitations regarding online art transactions. Furthermore, the increasing acceptance of art as an alternative asset class, particularly in the post-pandemic era, has spurred demand for online platforms that offer curated selections and expert insights. The market penetration of online sales within the broader fine art ecosystem is expected to continue its upward trajectory, significantly impacting traditional sales channels. The integration of financial services, as seen in the Artnet and Luxury Asset Capital collaboration announced in May 2023, further solidifies the market's evolution by addressing liquidity needs for art collectors. The continuous innovation in user experience and the increasing trust built through transparent transaction histories are key factors underpinning this market's strong performance and future potential. The overall market size is projected to reach several tens of millions of USD by the end of the forecast period.

Leading Markets & Segments in Online Fine Art Market

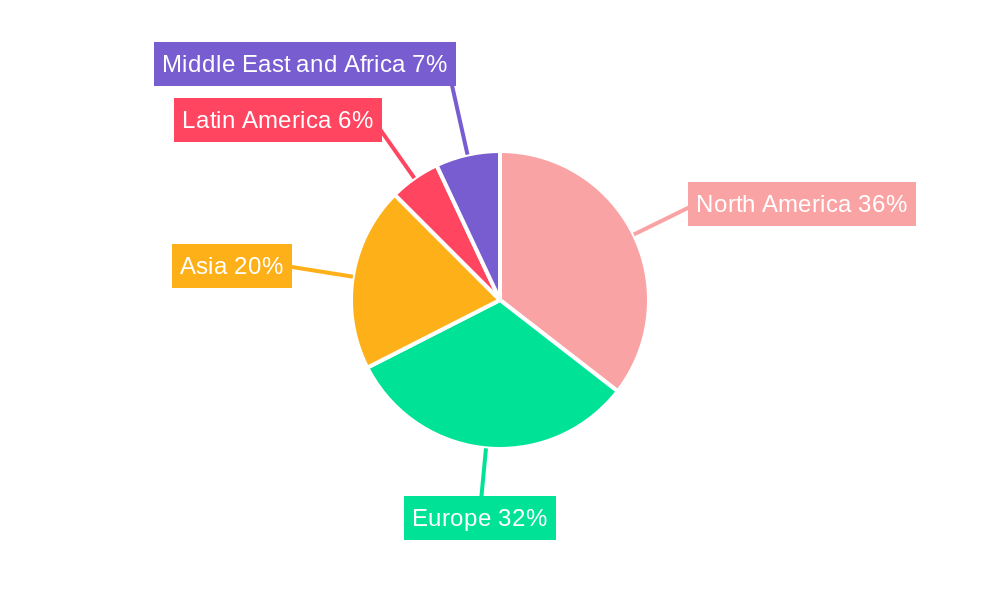

The online fine art market is a diverse landscape with distinct leading segments across channels, mediums, and sectors. Geographically, North America and Europe currently dominate, driven by established art markets, high disposable incomes, and a robust digital infrastructure. However, Asia Pacific is emerging as a significant growth region.

Channel Dominance:

- Dealers: Online galleries and dealer platforms represent a substantial segment, offering curated selections and personalized service. Key players like The Artling Pte Ltd and Kooness excel in this area by providing a direct connection between collectors and art professionals. Their dominance is fueled by their ability to foster relationships and offer expert guidance, mirroring the traditional gallery experience online.

- Auctions: Online auctions, facilitated by platforms like Auction Technology Group PLC (thesaleroom com) and integrated offerings from Sotheby's Inc and Christie's, command significant transaction volumes. The convenience of bidding from anywhere in the world and the access to a wider range of artworks contribute to their strong performance. The August 2023 announcement of Phillips entering the eCommerce space with its Dropshop platform highlights the growing importance of this channel, particularly for accessible price points.

Medium Dominance:

- Painting: Paintings remain the most sought-after medium, comprising a significant portion of online fine art sales. Their visual appeal and established market value make them a primary focus for collectors venturing into online purchases.

- Sculptures: Sculptures are gaining traction online, with advancements in shipping and display technologies making them more accessible. Platforms are increasingly showcasing three-dimensional artworks with detailed multi-angle views and AR previews.

- Others: This segment includes prints, drawings, photography, mixed media, and digital art, each with its growing niche within the online market. The rise of digital art and NFTs has particularly boosted this "Others" category.

Sector Dominance:

- Post-War and Contemporary: This sector is a powerhouse in the online fine art market, driven by its popularity among younger collectors and its dynamic market trends. The accessibility and often more approachable price points compared to older art movements contribute to its strong online performance. Platforms like Saatchi Online Inc have built their reputation around this segment.

- Modern: The Modern art sector continues to attract significant interest online, with collectors seeking established artists and iconic works. The increasing availability of high-quality imagery and detailed provenance information online aids in the acquisition of these valuable pieces.

- Impressionist and Post Impressionist: While often commanding higher price points, these sectors are also well-represented online, particularly by major auction houses and specialized dealers. Their historical significance and established collector base ensure continued demand.

Online Fine Art Market Product Developments

- Painting: Paintings remain the most sought-after medium, comprising a significant portion of online fine art sales. Their visual appeal and established market value make them a primary focus for collectors venturing into online purchases.

- Sculptures: Sculptures are gaining traction online, with advancements in shipping and display technologies making them more accessible. Platforms are increasingly showcasing three-dimensional artworks with detailed multi-angle views and AR previews.

- Others: This segment includes prints, drawings, photography, mixed media, and digital art, each with its growing niche within the online market. The rise of digital art and NFTs has particularly boosted this "Others" category.

Sector Dominance:

- Post-War and Contemporary: This sector is a powerhouse in the online fine art market, driven by its popularity among younger collectors and its dynamic market trends. The accessibility and often more approachable price points compared to older art movements contribute to its strong online performance. Platforms like Saatchi Online Inc have built their reputation around this segment.

- Modern: The Modern art sector continues to attract significant interest online, with collectors seeking established artists and iconic works. The increasing availability of high-quality imagery and detailed provenance information online aids in the acquisition of these valuable pieces.

- Impressionist and Post Impressionist: While often commanding higher price points, these sectors are also well-represented online, particularly by major auction houses and specialized dealers. Their historical significance and established collector base ensure continued demand.

Online Fine Art Market Product Developments

The online fine art market is witnessing rapid product development focused on enhancing collector experience and streamlining transactions. Innovations include sophisticated AI-driven recommendation engines, personalized virtual viewing rooms, and advanced AR tools for in-situ artwork visualization. Blockchain technology is increasingly integrated for provenance tracking and authentication, building buyer confidence. The development of secure, integrated payment systems and specialized logistics for art shipping further enhances the market's appeal. These developments aim to bridge the gap between the physical and digital art worlds, offering competitive advantages through improved accessibility, transparency, and user engagement, ultimately driving market fit and sales conversion.

Key Drivers of Online Fine Art Market Growth

The online fine art market's growth is propelled by several key factors. The increasing adoption of digital technologies and e-commerce platforms by consumers worldwide provides a foundational element. Technological innovations such as augmented reality for art visualization and blockchain for provenance verification are building trust and reducing transaction friction. Economic factors, including rising disposable incomes in key demographics and art's recognition as an alternative asset class, are driving investment. Furthermore, the COVID-19 pandemic accelerated the shift towards online channels, demonstrating their resilience and scalability. The growing global accessibility of art, allowing collectors to discover and acquire works from anywhere in the world, is a significant catalyst.

Challenges in the Online Fine Art Market Market

Despite its robust growth, the online fine art market faces several challenges. Regulatory hurdles, particularly concerning international shipping, customs, and differing legal frameworks across jurisdictions, can complicate transactions. The inherent risk of fraud and the need for robust authentication processes remain concerns for buyers, requiring continuous investment in verification technologies. Supply chain issues related to the secure and insured transportation of valuable artworks can lead to increased costs and logistical complexities. Furthermore, intense competitive pressures from a growing number of platforms and the need to continually innovate to attract and retain collectors pose ongoing challenges. Quantifiable impacts include increased operational costs associated with specialized logistics and insurance premiums, estimated to add 5-15% to transaction values for high-value items.

Emerging Opportunities in Online Fine Art Market

Emerging opportunities in the online fine art market are abundant, driven by technological breakthroughs and strategic market expansion. The burgeoning digital art and NFT market presents a significant growth avenue, attracting new collectors and artists. Continued advancements in AR and VR technologies offer immersive experiences that can further enhance online art discovery and appreciation, potentially reaching a market size of tens of millions of USD. Strategic partnerships between art platforms, financial institutions (as exemplified by the May 2023 Artnet collaboration), and technology providers can unlock new revenue streams and customer segments. The expansion into emerging markets with growing middle classes and increasing interest in art investment offers substantial untapped potential. Furthermore, the development of more accessible fractional ownership models can democratize art investment, opening the market to a broader investor base.

Leading Players in the Online Fine Art Market Sector

- Artnet AG

- Artfinder (ART DISCOVERY LIMITED)

- Sotheby's Inc

- William Doyle Galleries Inc

- SINGULAR

- Kooness

- Saatchi Online Inc

- Artellite Limited

- Artsy

- Christie's

- Catawiki B V

- The Artling Pte Ltd

- Invaluable LLC

- Auction Technology Group PLC (thesaleroom com)

Key Milestones in Online Fine Art Market Industry

- August 2023 - Phillips' eCommerce Entry: Phillips, an auction house known for handling the work of up-and-coming artists, is reportedly entering the world of eCommerce. The house will begin selling fine art directly to collectors through its new online platform, Dropshop. The launch is part of Phillips' commitment to diversifying its portfolio and helping artists get their work to a wider audience. Phillips will collect a fee for every sale and will offer a 3% commission back to artists if a piece purchased from the platform is resold through Phillips in the future. Prices on the Dropshop platform will range from USD 5,000 to USD 50,000 but may increase in some instances. As for art galleries or curators wishing to use Phillips' service, Lo Iacono hinted that may be a possibility in the future. This marks a significant move by a major auction house to embrace direct-to-collector online sales, impacting pricing strategies and artist relations.

- May 2023 - Artnet's Financial Services Collaboration: Artnet, the platform for art market data and media, the global online fine art player, and Luxury Asset Capital, and in the alternative financing market, announced a specialty financial services collaboration that enables Artnet's clients to quickly access capital without having to deal fine art or other luxury purchases by using them as loan collateral held by Luxury Asset Capital. This collaboration addresses liquidity needs for collectors and signals an integration of financial services within the art market ecosystem, potentially boosting sales by facilitating capital access.

Strategic Outlook for Online Fine Art Market Market

The strategic outlook for the online fine art market is exceptionally positive, driven by continued digital transformation and evolving collector demographics. Key growth accelerators include the ongoing integration of advanced technologies like AI for personalized recommendations and VR for enhanced viewing experiences, which will further democratize art acquisition. Strategic partnerships between online platforms, financial institutions, and logistics providers will streamline transactions and expand market reach. The increasing demand for authenticated and transparently sourced artworks, facilitated by blockchain, will solidify buyer trust. Furthermore, targeted expansion into emerging markets and the cultivation of younger collector bases through social media engagement and educational content will be crucial for sustained growth. The market is poised to witness a significant increase in transaction volume and value, solidifying its position as a dominant force in the global art economy.

Online Fine Art Market Segmentation

-

1. Channel

- 1.1. Dealers

- 1.2. Auctions

-

2. Medium

- 2.1. Painting

- 2.2. Sculptures

- 2.3. Others

-

3. Sector

- 3.1. Post-War and Contemporary

- 3.2. Modern

- 3.3. Impressionist and Post Impressionist

- 3.4. Others

Online Fine Art Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

Online Fine Art Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.55% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ease of Convenience of Shoppers Elevated Through No Traveling and Simpler Access Across Global Borders; Higher Return on Investment

- 3.3. Market Restrains

- 3.3.1 Incidents of Fraudulent Transactions and Cyber Crime; Opening of Physical Spaces

- 3.3.2 Galleries

- 3.3.3 and Auctions Impacting Online Sales

- 3.4. Market Trends

- 3.4.1. Dealers to Hold Major Share in the Channel Segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Online Fine Art Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 5.1.1. Dealers

- 5.1.2. Auctions

- 5.2. Market Analysis, Insights and Forecast - by Medium

- 5.2.1. Painting

- 5.2.2. Sculptures

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Sector

- 5.3.1. Post-War and Contemporary

- 5.3.2. Modern

- 5.3.3. Impressionist and Post Impressionist

- 5.3.4. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Channel

- 6. North America Online Fine Art Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 6.1.1. Dealers

- 6.1.2. Auctions

- 6.2. Market Analysis, Insights and Forecast - by Medium

- 6.2.1. Painting

- 6.2.2. Sculptures

- 6.2.3. Others

- 6.3. Market Analysis, Insights and Forecast - by Sector

- 6.3.1. Post-War and Contemporary

- 6.3.2. Modern

- 6.3.3. Impressionist and Post Impressionist

- 6.3.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Channel

- 7. Europe Online Fine Art Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 7.1.1. Dealers

- 7.1.2. Auctions

- 7.2. Market Analysis, Insights and Forecast - by Medium

- 7.2.1. Painting

- 7.2.2. Sculptures

- 7.2.3. Others

- 7.3. Market Analysis, Insights and Forecast - by Sector

- 7.3.1. Post-War and Contemporary

- 7.3.2. Modern

- 7.3.3. Impressionist and Post Impressionist

- 7.3.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Channel

- 8. Asia Online Fine Art Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Channel

- 8.1.1. Dealers

- 8.1.2. Auctions

- 8.2. Market Analysis, Insights and Forecast - by Medium

- 8.2.1. Painting

- 8.2.2. Sculptures

- 8.2.3. Others

- 8.3. Market Analysis, Insights and Forecast - by Sector

- 8.3.1. Post-War and Contemporary

- 8.3.2. Modern

- 8.3.3. Impressionist and Post Impressionist

- 8.3.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Channel

- 9. Latin America Online Fine Art Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Channel

- 9.1.1. Dealers

- 9.1.2. Auctions

- 9.2. Market Analysis, Insights and Forecast - by Medium

- 9.2.1. Painting

- 9.2.2. Sculptures

- 9.2.3. Others

- 9.3. Market Analysis, Insights and Forecast - by Sector

- 9.3.1. Post-War and Contemporary

- 9.3.2. Modern

- 9.3.3. Impressionist and Post Impressionist

- 9.3.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Channel

- 10. Middle East and Africa Online Fine Art Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Channel

- 10.1.1. Dealers

- 10.1.2. Auctions

- 10.2. Market Analysis, Insights and Forecast - by Medium

- 10.2.1. Painting

- 10.2.2. Sculptures

- 10.2.3. Others

- 10.3. Market Analysis, Insights and Forecast - by Sector

- 10.3.1. Post-War and Contemporary

- 10.3.2. Modern

- 10.3.3. Impressionist and Post Impressionist

- 10.3.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Channel

- 11. North America Online Fine Art Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Online Fine Art Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Online Fine Art Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Online Fine Art Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Online Fine Art Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Online Fine Art Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Artnet AG

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Artfinder (ART DISCOVERY LIMITED)

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 Sotheby's Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 William Doyle Galleries Inc

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 SINGULAR

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Kooness

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Saatchi Online Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Artellite Limited

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Artsy

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Christie's

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Catawiki B V

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 The Artling Pte Ltd

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Invaluable LLC

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 Auction Technology Group PLC (thesaleroom com)

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.1 Artnet AG

List of Figures

- Figure 1: Global Online Fine Art Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Online Fine Art Market Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Online Fine Art Market Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Online Fine Art Market Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Online Fine Art Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Online Fine Art Market Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Online Fine Art Market Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Online Fine Art Market Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Online Fine Art Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Online Fine Art Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Online Fine Art Market Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Online Fine Art Market Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Online Fine Art Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Online Fine Art Market Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Online Fine Art Market Revenue (Million), by Country 2024 & 2032

- Figure 16: South America Online Fine Art Market Volume (K Unit), by Country 2024 & 2032

- Figure 17: South America Online Fine Art Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Online Fine Art Market Volume Share (%), by Country 2024 & 2032

- Figure 19: North America Online Fine Art Market Revenue (Million), by Country 2024 & 2032

- Figure 20: North America Online Fine Art Market Volume (K Unit), by Country 2024 & 2032

- Figure 21: North America Online Fine Art Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: North America Online Fine Art Market Volume Share (%), by Country 2024 & 2032

- Figure 23: MEA Online Fine Art Market Revenue (Million), by Country 2024 & 2032

- Figure 24: MEA Online Fine Art Market Volume (K Unit), by Country 2024 & 2032

- Figure 25: MEA Online Fine Art Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: MEA Online Fine Art Market Volume Share (%), by Country 2024 & 2032

- Figure 27: North America Online Fine Art Market Revenue (Million), by Channel 2024 & 2032

- Figure 28: North America Online Fine Art Market Volume (K Unit), by Channel 2024 & 2032

- Figure 29: North America Online Fine Art Market Revenue Share (%), by Channel 2024 & 2032

- Figure 30: North America Online Fine Art Market Volume Share (%), by Channel 2024 & 2032

- Figure 31: North America Online Fine Art Market Revenue (Million), by Medium 2024 & 2032

- Figure 32: North America Online Fine Art Market Volume (K Unit), by Medium 2024 & 2032

- Figure 33: North America Online Fine Art Market Revenue Share (%), by Medium 2024 & 2032

- Figure 34: North America Online Fine Art Market Volume Share (%), by Medium 2024 & 2032

- Figure 35: North America Online Fine Art Market Revenue (Million), by Sector 2024 & 2032

- Figure 36: North America Online Fine Art Market Volume (K Unit), by Sector 2024 & 2032

- Figure 37: North America Online Fine Art Market Revenue Share (%), by Sector 2024 & 2032

- Figure 38: North America Online Fine Art Market Volume Share (%), by Sector 2024 & 2032

- Figure 39: North America Online Fine Art Market Revenue (Million), by Country 2024 & 2032

- Figure 40: North America Online Fine Art Market Volume (K Unit), by Country 2024 & 2032

- Figure 41: North America Online Fine Art Market Revenue Share (%), by Country 2024 & 2032

- Figure 42: North America Online Fine Art Market Volume Share (%), by Country 2024 & 2032

- Figure 43: Europe Online Fine Art Market Revenue (Million), by Channel 2024 & 2032

- Figure 44: Europe Online Fine Art Market Volume (K Unit), by Channel 2024 & 2032

- Figure 45: Europe Online Fine Art Market Revenue Share (%), by Channel 2024 & 2032

- Figure 46: Europe Online Fine Art Market Volume Share (%), by Channel 2024 & 2032

- Figure 47: Europe Online Fine Art Market Revenue (Million), by Medium 2024 & 2032

- Figure 48: Europe Online Fine Art Market Volume (K Unit), by Medium 2024 & 2032

- Figure 49: Europe Online Fine Art Market Revenue Share (%), by Medium 2024 & 2032

- Figure 50: Europe Online Fine Art Market Volume Share (%), by Medium 2024 & 2032

- Figure 51: Europe Online Fine Art Market Revenue (Million), by Sector 2024 & 2032

- Figure 52: Europe Online Fine Art Market Volume (K Unit), by Sector 2024 & 2032

- Figure 53: Europe Online Fine Art Market Revenue Share (%), by Sector 2024 & 2032

- Figure 54: Europe Online Fine Art Market Volume Share (%), by Sector 2024 & 2032

- Figure 55: Europe Online Fine Art Market Revenue (Million), by Country 2024 & 2032

- Figure 56: Europe Online Fine Art Market Volume (K Unit), by Country 2024 & 2032

- Figure 57: Europe Online Fine Art Market Revenue Share (%), by Country 2024 & 2032

- Figure 58: Europe Online Fine Art Market Volume Share (%), by Country 2024 & 2032

- Figure 59: Asia Online Fine Art Market Revenue (Million), by Channel 2024 & 2032

- Figure 60: Asia Online Fine Art Market Volume (K Unit), by Channel 2024 & 2032

- Figure 61: Asia Online Fine Art Market Revenue Share (%), by Channel 2024 & 2032

- Figure 62: Asia Online Fine Art Market Volume Share (%), by Channel 2024 & 2032

- Figure 63: Asia Online Fine Art Market Revenue (Million), by Medium 2024 & 2032

- Figure 64: Asia Online Fine Art Market Volume (K Unit), by Medium 2024 & 2032

- Figure 65: Asia Online Fine Art Market Revenue Share (%), by Medium 2024 & 2032

- Figure 66: Asia Online Fine Art Market Volume Share (%), by Medium 2024 & 2032

- Figure 67: Asia Online Fine Art Market Revenue (Million), by Sector 2024 & 2032

- Figure 68: Asia Online Fine Art Market Volume (K Unit), by Sector 2024 & 2032

- Figure 69: Asia Online Fine Art Market Revenue Share (%), by Sector 2024 & 2032

- Figure 70: Asia Online Fine Art Market Volume Share (%), by Sector 2024 & 2032

- Figure 71: Asia Online Fine Art Market Revenue (Million), by Country 2024 & 2032

- Figure 72: Asia Online Fine Art Market Volume (K Unit), by Country 2024 & 2032

- Figure 73: Asia Online Fine Art Market Revenue Share (%), by Country 2024 & 2032

- Figure 74: Asia Online Fine Art Market Volume Share (%), by Country 2024 & 2032

- Figure 75: Latin America Online Fine Art Market Revenue (Million), by Channel 2024 & 2032

- Figure 76: Latin America Online Fine Art Market Volume (K Unit), by Channel 2024 & 2032

- Figure 77: Latin America Online Fine Art Market Revenue Share (%), by Channel 2024 & 2032

- Figure 78: Latin America Online Fine Art Market Volume Share (%), by Channel 2024 & 2032

- Figure 79: Latin America Online Fine Art Market Revenue (Million), by Medium 2024 & 2032

- Figure 80: Latin America Online Fine Art Market Volume (K Unit), by Medium 2024 & 2032

- Figure 81: Latin America Online Fine Art Market Revenue Share (%), by Medium 2024 & 2032

- Figure 82: Latin America Online Fine Art Market Volume Share (%), by Medium 2024 & 2032

- Figure 83: Latin America Online Fine Art Market Revenue (Million), by Sector 2024 & 2032

- Figure 84: Latin America Online Fine Art Market Volume (K Unit), by Sector 2024 & 2032

- Figure 85: Latin America Online Fine Art Market Revenue Share (%), by Sector 2024 & 2032

- Figure 86: Latin America Online Fine Art Market Volume Share (%), by Sector 2024 & 2032

- Figure 87: Latin America Online Fine Art Market Revenue (Million), by Country 2024 & 2032

- Figure 88: Latin America Online Fine Art Market Volume (K Unit), by Country 2024 & 2032

- Figure 89: Latin America Online Fine Art Market Revenue Share (%), by Country 2024 & 2032

- Figure 90: Latin America Online Fine Art Market Volume Share (%), by Country 2024 & 2032

- Figure 91: Middle East and Africa Online Fine Art Market Revenue (Million), by Channel 2024 & 2032

- Figure 92: Middle East and Africa Online Fine Art Market Volume (K Unit), by Channel 2024 & 2032

- Figure 93: Middle East and Africa Online Fine Art Market Revenue Share (%), by Channel 2024 & 2032

- Figure 94: Middle East and Africa Online Fine Art Market Volume Share (%), by Channel 2024 & 2032

- Figure 95: Middle East and Africa Online Fine Art Market Revenue (Million), by Medium 2024 & 2032

- Figure 96: Middle East and Africa Online Fine Art Market Volume (K Unit), by Medium 2024 & 2032

- Figure 97: Middle East and Africa Online Fine Art Market Revenue Share (%), by Medium 2024 & 2032

- Figure 98: Middle East and Africa Online Fine Art Market Volume Share (%), by Medium 2024 & 2032

- Figure 99: Middle East and Africa Online Fine Art Market Revenue (Million), by Sector 2024 & 2032

- Figure 100: Middle East and Africa Online Fine Art Market Volume (K Unit), by Sector 2024 & 2032

- Figure 101: Middle East and Africa Online Fine Art Market Revenue Share (%), by Sector 2024 & 2032

- Figure 102: Middle East and Africa Online Fine Art Market Volume Share (%), by Sector 2024 & 2032

- Figure 103: Middle East and Africa Online Fine Art Market Revenue (Million), by Country 2024 & 2032

- Figure 104: Middle East and Africa Online Fine Art Market Volume (K Unit), by Country 2024 & 2032

- Figure 105: Middle East and Africa Online Fine Art Market Revenue Share (%), by Country 2024 & 2032

- Figure 106: Middle East and Africa Online Fine Art Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Online Fine Art Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Online Fine Art Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Online Fine Art Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 4: Global Online Fine Art Market Volume K Unit Forecast, by Channel 2019 & 2032

- Table 5: Global Online Fine Art Market Revenue Million Forecast, by Medium 2019 & 2032

- Table 6: Global Online Fine Art Market Volume K Unit Forecast, by Medium 2019 & 2032

- Table 7: Global Online Fine Art Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 8: Global Online Fine Art Market Volume K Unit Forecast, by Sector 2019 & 2032

- Table 9: Global Online Fine Art Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Online Fine Art Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Global Online Fine Art Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Online Fine Art Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Global Online Fine Art Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Online Fine Art Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Germany Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Germany Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: United Kingdom Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: United Kingdom Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: France Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Spain Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Spain Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Italy Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Italy Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Spain Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Spain Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Belgium Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Belgium Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Netherland Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Netherland Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Nordics Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Nordics Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Rest of Europe Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of Europe Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Global Online Fine Art Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Online Fine Art Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: China Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: China Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Japan Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: India Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: India Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: South Korea Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: South Korea Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Southeast Asia Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Southeast Asia Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Australia Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Australia Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Indonesia Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Indonesia Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Phillipes Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Phillipes Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Singapore Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Singapore Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: Thailandc Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Thailandc Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 63: Rest of Asia Pacific Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Rest of Asia Pacific Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 65: Global Online Fine Art Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: Global Online Fine Art Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 67: Brazil Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Brazil Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: Argentina Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Argentina Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: Peru Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Peru Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: Chile Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Chile Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Colombia Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Colombia Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: Ecuador Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Ecuador Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 79: Venezuela Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 80: Venezuela Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 81: Rest of South America Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 82: Rest of South America Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 83: Global Online Fine Art Market Revenue Million Forecast, by Country 2019 & 2032

- Table 84: Global Online Fine Art Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 85: United States Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: United States Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Canada Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Canada Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Mexico Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: Mexico Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: Global Online Fine Art Market Revenue Million Forecast, by Country 2019 & 2032

- Table 92: Global Online Fine Art Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 93: United Arab Emirates Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: United Arab Emirates Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 95: Saudi Arabia Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Saudi Arabia Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 97: South Africa Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: South Africa Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: Rest of Middle East and Africa Online Fine Art Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Rest of Middle East and Africa Online Fine Art Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 101: Global Online Fine Art Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 102: Global Online Fine Art Market Volume K Unit Forecast, by Channel 2019 & 2032

- Table 103: Global Online Fine Art Market Revenue Million Forecast, by Medium 2019 & 2032

- Table 104: Global Online Fine Art Market Volume K Unit Forecast, by Medium 2019 & 2032

- Table 105: Global Online Fine Art Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 106: Global Online Fine Art Market Volume K Unit Forecast, by Sector 2019 & 2032

- Table 107: Global Online Fine Art Market Revenue Million Forecast, by Country 2019 & 2032

- Table 108: Global Online Fine Art Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 109: Global Online Fine Art Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 110: Global Online Fine Art Market Volume K Unit Forecast, by Channel 2019 & 2032

- Table 111: Global Online Fine Art Market Revenue Million Forecast, by Medium 2019 & 2032

- Table 112: Global Online Fine Art Market Volume K Unit Forecast, by Medium 2019 & 2032

- Table 113: Global Online Fine Art Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 114: Global Online Fine Art Market Volume K Unit Forecast, by Sector 2019 & 2032

- Table 115: Global Online Fine Art Market Revenue Million Forecast, by Country 2019 & 2032

- Table 116: Global Online Fine Art Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 117: Global Online Fine Art Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 118: Global Online Fine Art Market Volume K Unit Forecast, by Channel 2019 & 2032

- Table 119: Global Online Fine Art Market Revenue Million Forecast, by Medium 2019 & 2032

- Table 120: Global Online Fine Art Market Volume K Unit Forecast, by Medium 2019 & 2032

- Table 121: Global Online Fine Art Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 122: Global Online Fine Art Market Volume K Unit Forecast, by Sector 2019 & 2032

- Table 123: Global Online Fine Art Market Revenue Million Forecast, by Country 2019 & 2032

- Table 124: Global Online Fine Art Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 125: Global Online Fine Art Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 126: Global Online Fine Art Market Volume K Unit Forecast, by Channel 2019 & 2032

- Table 127: Global Online Fine Art Market Revenue Million Forecast, by Medium 2019 & 2032

- Table 128: Global Online Fine Art Market Volume K Unit Forecast, by Medium 2019 & 2032

- Table 129: Global Online Fine Art Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 130: Global Online Fine Art Market Volume K Unit Forecast, by Sector 2019 & 2032

- Table 131: Global Online Fine Art Market Revenue Million Forecast, by Country 2019 & 2032

- Table 132: Global Online Fine Art Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 133: Global Online Fine Art Market Revenue Million Forecast, by Channel 2019 & 2032

- Table 134: Global Online Fine Art Market Volume K Unit Forecast, by Channel 2019 & 2032

- Table 135: Global Online Fine Art Market Revenue Million Forecast, by Medium 2019 & 2032

- Table 136: Global Online Fine Art Market Volume K Unit Forecast, by Medium 2019 & 2032

- Table 137: Global Online Fine Art Market Revenue Million Forecast, by Sector 2019 & 2032

- Table 138: Global Online Fine Art Market Volume K Unit Forecast, by Sector 2019 & 2032

- Table 139: Global Online Fine Art Market Revenue Million Forecast, by Country 2019 & 2032

- Table 140: Global Online Fine Art Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Online Fine Art Market?

The projected CAGR is approximately 8.55%.

2. Which companies are prominent players in the Online Fine Art Market?

Key companies in the market include Artnet AG, Artfinder (ART DISCOVERY LIMITED), Sotheby's Inc, William Doyle Galleries Inc, SINGULAR, Kooness, Saatchi Online Inc, Artellite Limited, Artsy, Christie's, Catawiki B V, The Artling Pte Ltd, Invaluable LLC, Auction Technology Group PLC (thesaleroom com).

3. What are the main segments of the Online Fine Art Market?

The market segments include Channel, Medium, Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.78 Million as of 2022.

5. What are some drivers contributing to market growth?

Ease of Convenience of Shoppers Elevated Through No Traveling and Simpler Access Across Global Borders; Higher Return on Investment.

6. What are the notable trends driving market growth?

Dealers to Hold Major Share in the Channel Segment.

7. Are there any restraints impacting market growth?

Incidents of Fraudulent Transactions and Cyber Crime; Opening of Physical Spaces. Galleries. and Auctions Impacting Online Sales.

8. Can you provide examples of recent developments in the market?

August 2023 - Phillips, an auction house known for handling the work of up-and-coming artists, is reportedly entering the world of eCommerce. The house will begin selling fine art directly to collectors through its new online platform, Dropshop. The launch is part of Phillips' commitment to diversifying its portfolio and helping artists get their work to a wider audience. Phillips will collect a fee for every sale and will offer a 3% commission back to artists if a piece purchased from the platform is resold through Phillips in the future. Prices on the Dropshop platform will range from USD 5,000 to USD 50,000 but may increase in some instances. As for art galleries or curators wishing to use Phillips' service, Lo Iacono hinted that may be a possibility in the future.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Online Fine Art Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Online Fine Art Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Online Fine Art Market?

To stay informed about further developments, trends, and reports in the Online Fine Art Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence