Key Insights

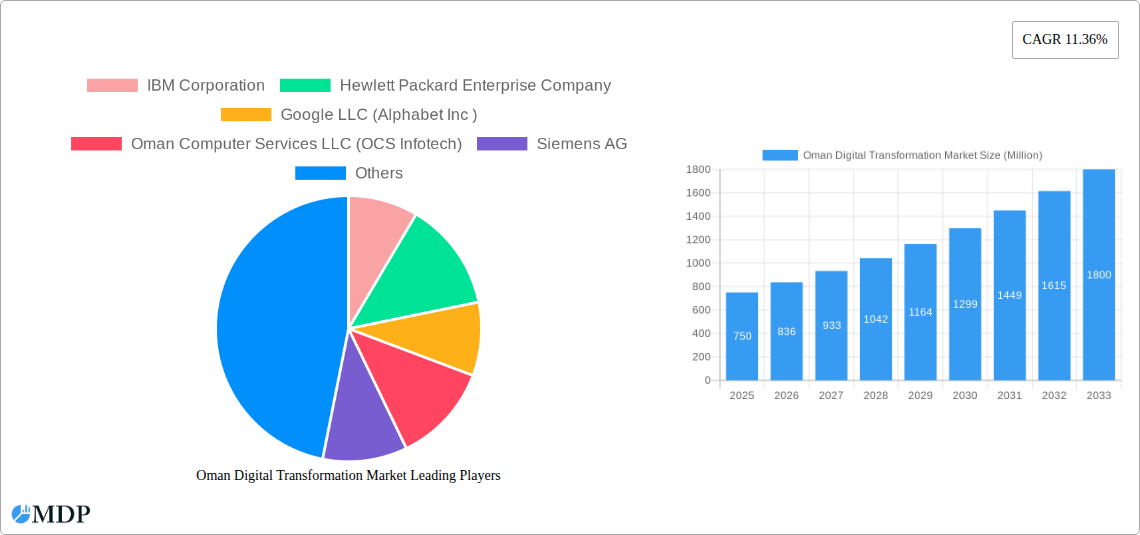

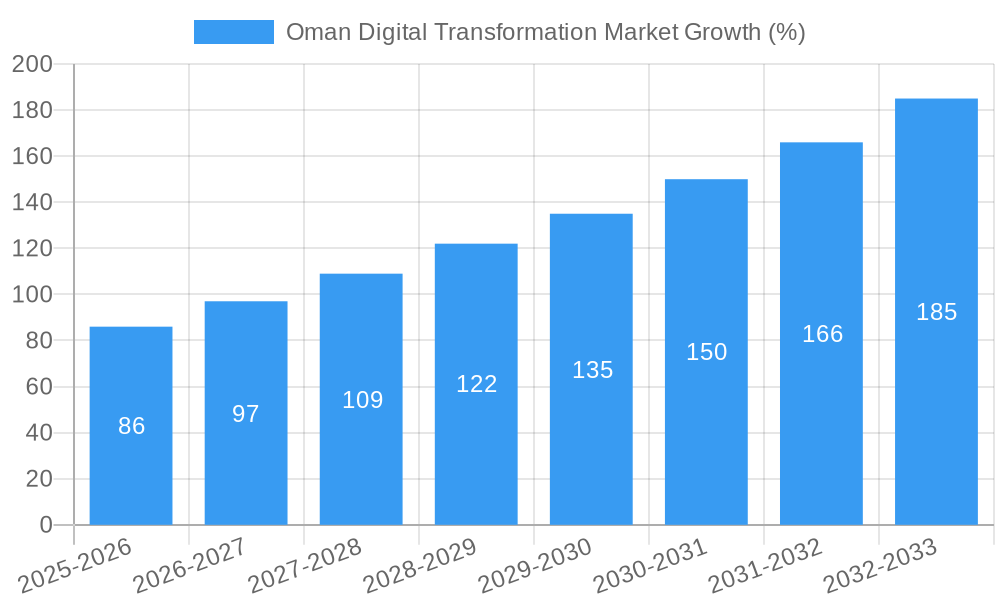

The Oman digital transformation market, exhibiting a robust Compound Annual Growth Rate (CAGR) of 11.36%, is poised for significant expansion between 2025 and 2033. Driven by government initiatives promoting digitalization across sectors, coupled with increasing investments in advanced technologies like AI/ML, IoT, and cloud computing, the market is witnessing rapid adoption. Key growth drivers include the rising need for improved operational efficiency, enhanced customer experience, and strengthened national cybersecurity. The market is segmented across various components (hardware, software, services), technologies (analytics, IoT, etc.), and end-user industries (oil & gas, healthcare, finance, etc.). While the precise market size in 2025 isn't specified, considering a typical range for such markets and the provided CAGR, a reasonable estimate would place it between $500 million and $1 billion. This figure is a projection based on observed growth trends in similar regional markets and is not based on any undisclosed data.

The market's growth trajectory is significantly influenced by factors like increasing internet and smartphone penetration, a burgeoning young and tech-savvy population, and government support for digital infrastructure development. However, challenges remain, including a potential skills gap in the IT sector, and the need for robust data privacy and security frameworks. Leading players like IBM, Hewlett Packard Enterprise, Google, and Microsoft are actively competing in this dynamic market, investing in strategic partnerships and expanding their service offerings to cater to the evolving demands of Omani businesses and government agencies. The forecast period (2025-2033) promises substantial growth opportunities, with specific segments like AI/ML and cloud computing projected to witness especially rapid expansion. This presents a promising investment landscape for both domestic and international players.

Oman Digital Transformation Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Oman Digital Transformation Market, offering invaluable insights for stakeholders across the technology, telecommunications, and various end-user industries. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report delivers a crucial understanding of the market's current state and future trajectory. The market is valued at xx Million in 2025 and is projected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period.

Oman Digital Transformation Market Dynamics & Concentration

The Oman Digital Transformation market is characterized by a moderate level of concentration, with key players like IBM, Hewlett Packard Enterprise, and Google holding significant market share. However, local players such as Oman Computer Services LLC (OCS Infotech) and Ooredoo Oman are also making substantial contributions. Market concentration is expected to evolve with increasing M&A activity and the entry of new players. Innovation is primarily driven by government initiatives promoting digitalization across sectors, alongside the growing adoption of advanced technologies like AI and IoT. The regulatory framework, while supportive of digital transformation, requires continuous adaptation to address emerging challenges. Product substitution is a notable factor, with cloud-based solutions increasingly replacing traditional on-premise systems. End-user trends reveal a strong preference for flexible, scalable, and cost-effective solutions, influencing vendor strategies.

- Market Share: Leading players hold approximately xx% of the market share collectively in 2025, with the remaining share distributed among smaller players and emerging entrants.

- M&A Activity: The number of M&A deals in the Oman Digital Transformation market increased from xx in 2019 to xx in 2024, indicating a growing interest in consolidation and expansion.

Oman Digital Transformation Market Industry Trends & Analysis

The Oman Digital Transformation Market is experiencing robust growth, driven by several key factors. The government's Vision 2040, emphasizing technological advancement, fuels substantial investment in digital infrastructure. The burgeoning adoption of cloud computing, AI, and IoT across sectors like oil & gas, tourism, and healthcare accelerates market expansion. Consumer preferences shift towards digitally-enabled services and experiences, enhancing the demand for digital transformation solutions. Competitive dynamics are characterized by both international and local players vying for market share, leading to innovative offerings and strategic partnerships. Market penetration of key technologies like cloud computing is expected to reach xx% by 2033, while the overall market exhibits a CAGR of xx% during the forecast period.

Leading Markets & Segments in Oman Digital Transformation Market

The Oil, Gas, and Utilities sector currently dominates the Oman Digital Transformation Market, followed closely by the Government and Defense sector. This dominance stems from significant investments in optimizing operational efficiency and enhancing security through digital technologies. The growth of the Telecommunication Services segment is expected to surpass others in the forecast period owing to significant investments in 5G infrastructure and the expansion of broadband access.

Key Drivers by Segment:

- Oil, Gas, and Utilities: Government investments in smart grids, automation, and data analytics.

- Government and Defense: Focus on e-governance, cybersecurity, and national digital infrastructure development.

- Telecommunication Services: Expansion of 5G infrastructure and increasing mobile penetration rates.

- Hardware: Growing demand for high-performance computing and data storage solutions to support digital initiatives.

- Software: Increasing adoption of enterprise resource planning (ERP) systems and cloud-based applications.

- IT and Infrastructure Services: Demand for cloud migration, data center modernization, and cybersecurity services.

Dominance Analysis: The Oil, Gas, and Utilities sector maintains its leading position due to the substantial capital investment in digital transformation projects aimed at optimizing resource management and enhancing safety. However, the Government and Defense sector is catching up rapidly due to national digitalization strategies. The Telecommunication Services sector is poised for significant expansion due to infrastructure investments and expanding mobile penetration.

Oman Digital Transformation Market Product Developments

Recent product innovations focus on integrating AI and ML capabilities into existing solutions, offering advanced analytics and automation features. Cloud-based solutions are gaining prominence due to their scalability and cost-effectiveness. The market sees a strong emphasis on cybersecurity solutions as digital transformation increases vulnerabilities. New product applications are emerging in areas like smart city development, digital health, and supply chain optimization, showcasing significant market fit and addressing specific industry needs.

Key Drivers of Oman Digital Transformation Market Growth

Government initiatives such as Vision 2040 and the National Digital Economy Strategy are powerful drivers, fostering investment and innovation. Economic diversification and the need for increased operational efficiency across various sectors fuel market growth. Technological advancements, such as the rise of 5G and cloud computing, create new opportunities for digital transformation. The regulatory landscape, while evolving, remains generally supportive of digital adoption and innovation.

Challenges in the Oman Digital Transformation Market

Cybersecurity threats pose a significant challenge, demanding robust security measures. Talent scarcity in specialized digital skills can hinder adoption. The cost of implementing digital transformation solutions can be substantial, particularly for smaller businesses. Digital literacy gaps among the population necessitate targeted training initiatives. Furthermore, effective integration of new technologies with legacy systems remains a challenge for many organizations.

Emerging Opportunities in Oman Digital Transformation Market

The expansion of 5G infrastructure presents lucrative opportunities for enhanced connectivity and innovative services. Strategic partnerships between local and international companies are fostering growth and expertise transfer. Government support for digital skills development creates a talented workforce. Growing adoption of cloud computing and other advanced technologies offers substantial growth potential. Moreover, Oman's strategic location can contribute to its emergence as a regional hub for digital transformation.

Leading Players in the Oman Digital Transformation Market Sector

- IBM Corporation

- Hewlett Packard Enterprise Company

- Google LLC (Alphabet Inc)

- Oman Computer Services LLC (OCS Infotech)

- Siemens AG

- Omani Qatari Telecommunications Company SAOG (Ooredoo Oman)

- Microsoft Corporation

- Oman Telecommunications Company

- Amazon Web Services Inc (Amazon Com Inc)

- Oracle Corporation

- SAP SE

Key Milestones in Oman Digital Transformation Market Industry

- April 2023: Muscat Leading Investment Group adopts SAP and Inflexion solutions for enhanced business visibility and agility.

- October 2022: Siemens partners with OTE Group to deploy EV chargers, supporting Oman's transition to sustainable transportation and smart infrastructure development.

Strategic Outlook for Oman Digital Transformation Market Market

The Oman Digital Transformation Market is poised for continued strong growth, driven by government support, technological advancements, and increasing private sector investment. Strategic partnerships and the development of a skilled workforce are crucial for sustained success. Focus on addressing cybersecurity challenges and bridging the digital literacy gap will be key to unlocking the market's full potential. The market's future trajectory hinges on the successful implementation of national digitalization strategies and the effective leveraging of emerging technologies.

Oman Digital Transformation Market Segmentation

-

1. Component

- 1.1. Hardware

- 1.2. Software

- 1.3. IT and Infrastructure Services

- 1.4. Telecommunication Services

-

2. Technology

- 2.1. Analytics and AI and Ml

- 2.2. IoT

- 2.3. Edge Computing

- 2.4. Industrial Robotics

- 2.5. Extended Reality

- 2.6. Blockchain

- 2.7. Cybersecurity

- 2.8. 3D Printing

- 2.9. Other Technologies

-

3. End-user Industry

- 3.1. Oil, Gas, and Utilities

- 3.2. Travel and Hospitality

- 3.3. Healthcare

- 3.4. Financial Services

- 3.5. Manufacturing and Construction

- 3.6. Government and Defense

- 3.7. Other En

Oman Digital Transformation Market Segmentation By Geography

- 1. Oman

Oman Digital Transformation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.36% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Events and Tourism Demanding Automation; Government Policies and Ppp Initiatives; Rising Industrial Automation

- 3.3. Market Restrains

- 3.3.1. Lack of Awareness

- 3.4. Market Trends

- 3.4.1. Ongoing Events and Tourism Demanding Automation to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Oman Digital Transformation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT and Infrastructure Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Analytics and AI and Ml

- 5.2.2. IoT

- 5.2.3. Edge Computing

- 5.2.4. Industrial Robotics

- 5.2.5. Extended Reality

- 5.2.6. Blockchain

- 5.2.7. Cybersecurity

- 5.2.8. 3D Printing

- 5.2.9. Other Technologies

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Oil, Gas, and Utilities

- 5.3.2. Travel and Hospitality

- 5.3.3. Healthcare

- 5.3.4. Financial Services

- 5.3.5. Manufacturing and Construction

- 5.3.6. Government and Defense

- 5.3.7. Other En

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Oman

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 IBM Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Hewlett Packard Enterprise Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Google LLC (Alphabet Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Oman Computer Services LLC (OCS Infotech)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Siemens AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Omani Qatari Telecommunications Company SAOG (Ooredoo Oman)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oman Telecommunications Compan

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Amazon Web Services Inc (Amazon Com Inc )

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Oracle Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 SAP SE

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 IBM Corporation

List of Figures

- Figure 1: Oman Digital Transformation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Oman Digital Transformation Market Share (%) by Company 2024

List of Tables

- Table 1: Oman Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Oman Digital Transformation Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Oman Digital Transformation Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 4: Oman Digital Transformation Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Oman Digital Transformation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Oman Digital Transformation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Oman Digital Transformation Market Revenue Million Forecast, by Component 2019 & 2032

- Table 8: Oman Digital Transformation Market Revenue Million Forecast, by Technology 2019 & 2032

- Table 9: Oman Digital Transformation Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 10: Oman Digital Transformation Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Oman Digital Transformation Market?

The projected CAGR is approximately 11.36%.

2. Which companies are prominent players in the Oman Digital Transformation Market?

Key companies in the market include IBM Corporation, Hewlett Packard Enterprise Company, Google LLC (Alphabet Inc ), Oman Computer Services LLC (OCS Infotech), Siemens AG, Omani Qatari Telecommunications Company SAOG (Ooredoo Oman), Microsoft Corporation, Oman Telecommunications Compan, Amazon Web Services Inc (Amazon Com Inc ), Oracle Corporation, SAP SE.

3. What are the main segments of the Oman Digital Transformation Market?

The market segments include Component, Technology, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Events and Tourism Demanding Automation; Government Policies and Ppp Initiatives; Rising Industrial Automation.

6. What are the notable trends driving market growth?

Ongoing Events and Tourism Demanding Automation to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Lack of Awareness.

8. Can you provide examples of recent developments in the market?

In April 2023, Muscat Leading Investment Group, a company in Oman, planned to adopt digital transformation solutions using SAP and Inflexion. Through this digital transformation journey powered by Inflexion and SAP, Muscat's Leading Investment Group may get greater visibility and control over all aspects of its business operations, enabling it to respond quickly to the changing needs of all stakeholders and the dynamic business environment.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Oman Digital Transformation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Oman Digital Transformation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Oman Digital Transformation Market?

To stay informed about further developments, trends, and reports in the Oman Digital Transformation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence