Key Insights

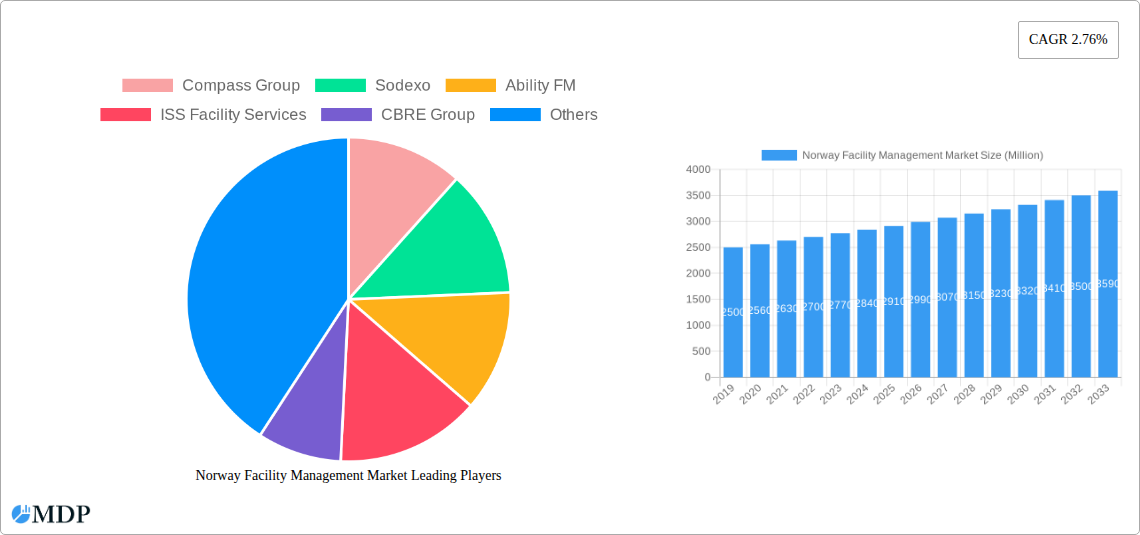

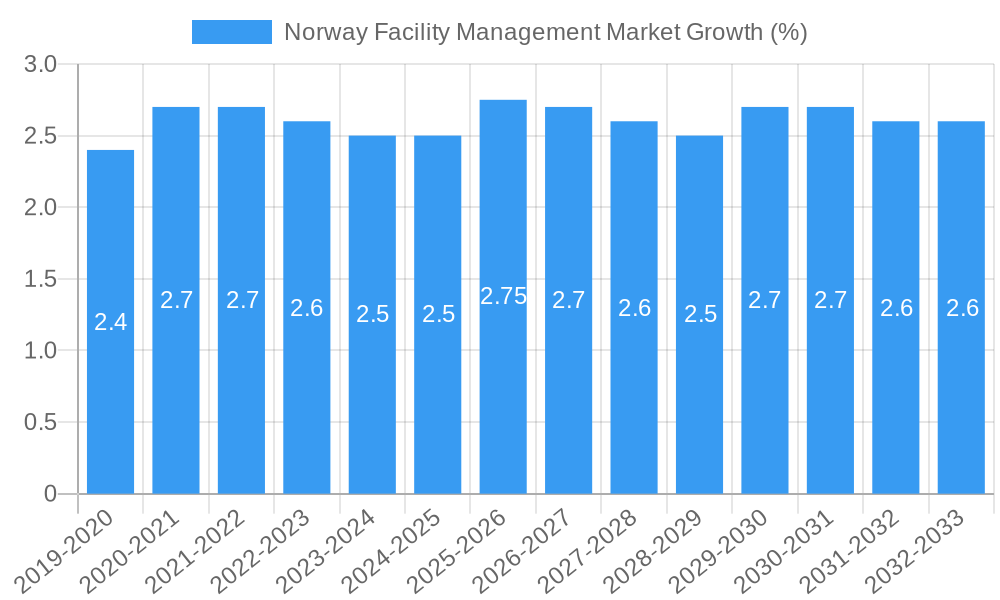

The Norwegian Facility Management (FM) market is poised for steady growth, projected to reach a significant market size by 2033, with a Compound Annual Growth Rate (CAGR) of 2.76%. This expansion is driven by increasing outsourcing of non-core functions by businesses and institutions seeking operational efficiency and cost optimization. The rising complexity of modern workplaces, coupled with a growing emphasis on sustainability and employee well-being, further fuels the demand for integrated FM solutions. Key market drivers include government initiatives promoting energy efficiency in public buildings, the continuous development of commercial and retail spaces, and the industrial sector's need for specialized maintenance and operational support. The market's structure reflects a clear demand for both in-house and outsourced FM services, with outsourced solutions gaining traction due to specialized expertise and scalability.

The FM market in Norway is segmented across various service types, including Hard FM (technical building maintenance, HVAC, electrical) and Soft FM (cleaning, security, catering, reception services). The Commercial and Retail sector, along with Institutional and Infrastructure entities, are leading the demand, followed by the Industrial and Manufacturing segments. This diverse demand landscape presents opportunities for a wide range of service providers. Leading companies such as Compass Group, Sodexo, and CBRE Group are actively participating in the market, offering comprehensive FM solutions. However, the market also faces certain restraints, including potential price pressures due to intense competition and the challenge of finding and retaining skilled labor. Despite these challenges, the overarching trend towards smart building technologies, digital transformation in FM operations, and a heightened focus on occupant experience are expected to shape the future trajectory of the Norwegian FM market, ensuring its continued relevance and expansion.

Gain an unparalleled understanding of the Norway Facility Management Market with our in-depth report. Spanning from 2019 to 2033, with a detailed base year of 2025 and a robust forecast period of 2025–2033, this study meticulously analyzes market dynamics, industry trends, leading players, and future opportunities. Discover actionable insights crucial for stakeholders, including service providers, end-users, and investors navigating this evolving landscape. Our report leverages high-traffic keywords such as "Norway Facility Management," "FM Services Norway," "Outsourced FM," "Hard FM," "Soft FM," and "Commercial Facility Management" to ensure maximum visibility for industry professionals.

Norway Facility Management Market Market Dynamics & Concentration

The Norway Facility Management Market exhibits a moderate to high concentration, with key players like Compass Group, Sodexo, ISS Facility Services, and CBRE Group holding significant market shares, estimated to be around 60% combined. Innovation drivers are primarily fueled by the increasing demand for integrated facility management solutions and the adoption of smart technologies to enhance operational efficiency and sustainability. Regulatory frameworks, particularly those focused on environmental standards and worker safety, play a crucial role in shaping service offerings and operational practices. Product substitutes, such as in-house management for certain specialized services, exist but are increasingly being outweighed by the cost-effectiveness and expertise offered by professional FM providers. End-user trends indicate a strong preference for outsourcing non-core activities to focus on core business competencies. Mergers and acquisitions (M&A) activities are on the rise, with an estimated XX M&A deal counts in the historical period (2019-2024), indicating a trend towards consolidation and market expansion. For instance, the acquisition of Facility Management business from Office Management by Verso Capital in April 2023 exemplifies this trend.

- Market Concentration: Dominated by a few key international and national players.

- Innovation Drivers: Sustainability, smart technology integration, and integrated service delivery.

- Regulatory Frameworks: Emphasis on environmental compliance, health, and safety standards.

- Product Substitutes: In-house management for niche services, evolving towards specialized outsourcing.

- End-User Trends: Growing preference for outsourcing to enhance core business focus.

- M&A Activities: Increasing consolidation and strategic partnerships to gain market share and expand service portfolios.

Norway Facility Management Market Industry Trends & Analysis

The Norway Facility Management Market is projected to witness substantial growth, driven by several key factors. The increasing complexity of modern business operations necessitates specialized facility management expertise, leading to a higher demand for both hard FM (maintenance, building operations) and soft FM (cleaning, catering, security) services. The push towards digital transformation is profoundly impacting the industry, with the integration of IoT devices, AI-powered analytics, and Building Information Modeling (BIM) enhancing predictive maintenance, energy efficiency, and space utilization. Consumer preferences are evolving towards sustainable and green FM solutions, driven by corporate social responsibility initiatives and government mandates. The competitive landscape is characterized by intense rivalry among established international players and agile local providers, fostering innovation and service differentiation. The market penetration of outsourced facility management services is steadily increasing, projected to reach approximately 65% by 2025. The CAGR for the Norway Facility Management Market is estimated to be around 5.2% during the forecast period (2025–2033). This growth is further propelled by the growing emphasis on employee well-being and productivity, with FM services playing a critical role in creating conducive work environments. The adoption of data-driven decision-making by FM providers is becoming a key differentiator, allowing for optimized resource allocation and improved client satisfaction. The continued development of advanced energy management systems and smart building technologies will also be a significant growth catalyst.

Leading Markets & Segments in Norway Facility Management Market

Within the Norway Facility Management Market, several segments demonstrate significant dominance and growth potential. Outsourced Facility Management is the leading offering type, capturing an estimated 70% of the market share, as businesses increasingly opt to focus on their core competencies. In terms of service types, Hard FM services, including technical maintenance and building operations, represent a substantial portion, driven by the aging infrastructure and the need for sophisticated building management systems. However, Soft FM services, encompassing cleaning, catering, security, and reception, are also experiencing robust growth due to their direct impact on employee productivity and customer experience.

The Commercial and Retail end-user segment is a dominant force, accounting for over 35% of the market revenue. This is attributed to the high density of office buildings, retail spaces, and the constant need for efficient operations and appealing environments. The Institutional sector, including education and healthcare facilities, represents another significant segment, characterized by long-term contracts and a consistent demand for specialized FM services. Industrial and Manufacturing facilities also contribute substantially, with a growing focus on optimizing production environments and ensuring operational uptime.

- Offering Type Dominance: Outsourced Facility Management leads due to its strategic advantages for businesses.

- Key Driver: Focus on core business operations, cost-efficiency, and access to specialized expertise.

- Service Type Dominance: Hard FM is crucial for infrastructure upkeep, while Soft FM enhances user experience and operational smoothness.

- Key Drivers: Aging infrastructure (Hard FM), employee well-being and operational efficiency (Soft FM).

- End-User Dominance: Commercial and Retail sectors lead due to high demand for comprehensive FM solutions.

- Key Drivers: Extensive property portfolios, need for brand presentation, and operational efficiency.

- Institutional Sector: Consistent demand driven by essential services and long-term service agreements.

- Key Drivers: Regulatory compliance, patient/student care, and facility longevity.

- Industrial and Manufacturing: Focus on optimizing operational environments and ensuring business continuity.

- Key Drivers: Production efficiency, safety regulations, and specialized maintenance needs.

Norway Facility Management Market Product Developments

Product developments in the Norway Facility Management Market are increasingly centered around technological integration and sustainability. Smart building technologies, including IoT-enabled sensors for real-time monitoring of energy consumption, air quality, and occupancy, are gaining traction. Advanced facility management software platforms are offering enhanced features for predictive maintenance, work order management, and remote diagnostics, improving operational efficiency and reducing downtime. The development of eco-friendly cleaning solutions and energy-efficient building management systems are key competitive advantages for service providers. These innovations cater to the growing demand for sustainable and cost-effective FM solutions, aligning with both regulatory requirements and corporate social responsibility goals.

Key Drivers of Norway Facility Management Market Growth

Several factors are propelling the growth of the Norway Facility Management Market. The increasing adoption of advanced technologies, such as AI and IoT for smart building management, is enhancing efficiency and cost-effectiveness. A growing emphasis on sustainability and green building practices is driving demand for eco-friendly FM solutions. The trend of outsourcing non-core business functions to specialized FM providers allows companies to focus on their core competencies. Additionally, the evolving nature of workplaces, with a greater focus on employee well-being and flexible working arrangements, necessitates advanced facility management to ensure productive and healthy environments.

- Technological Advancements: Integration of IoT, AI, and smart building solutions.

- Sustainability Focus: Growing demand for green FM services and energy-efficient operations.

- Outsourcing Trend: Businesses prioritizing core competencies and leveraging specialized FM expertise.

- Workplace Evolution: Need for enhanced employee well-being and productive work environments.

Challenges in the Norway Facility Management Market Market

Despite its growth, the Norway Facility Management Market faces several challenges. A significant hurdle is the shortage of skilled labor, particularly for specialized technical roles within hard FM. The increasing complexity of regulatory compliance, especially concerning environmental standards and data privacy, requires continuous adaptation and investment. Fluctuations in energy prices can impact operational costs for FM providers and their clients. Furthermore, intense competition among service providers can lead to price pressures, affecting profit margins.

- Talent Shortage: Difficulty in recruiting and retaining skilled FM professionals.

- Regulatory Compliance: Navigating complex and evolving environmental and data privacy laws.

- Energy Price Volatility: Impact on operational costs and service pricing.

- Competitive Pressures: Intense market competition leading to price sensitivity.

Emerging Opportunities in Norway Facility Management Market

Emerging opportunities in the Norway Facility Management Market are ripe for exploitation. The increasing demand for integrated FM solutions that combine hard and soft services offers a significant growth avenue. The digitalization of FM services, including the use of data analytics for predictive maintenance and optimized resource allocation, presents a competitive edge. The growing focus on creating smart and sustainable workplaces is creating demand for innovative solutions that enhance energy efficiency and occupant comfort. Strategic partnerships between FM providers and technology companies are also key catalysts for future market expansion.

Leading Players in the Norway Facility Management Market Sector

- Compass Group

- Sodexo

- Ability FM

- ISS Facility Services

- CBRE Group

- Contractia O

- Coor Service Management

- Toma Facility Services AS

Key Milestones in Norway Facility Management Market Industry

- July 2023: Bravida expands their agreement within technical Facility Management with Schneider Electric to install charging points and provide the Bravida Charge service. This is for Schneider Electric's premises in Sweden, Norway, and Denmark.

- April 2023: Verso Capital acquired the Facility Management business from Office Management, one of the leading IT and Office services providers in the Nordics. The acquired Facility Management business will focus on serving existing and new customers with a one-stop shop for a wide range of services to simplify daily life and improve efficiency in office environments.

Strategic Outlook for Norway Facility Management Market Market

The strategic outlook for the Norway Facility Management Market is highly positive, driven by ongoing technological advancements and the increasing demand for integrated, sustainable, and efficient FM solutions. The market is expected to witness further consolidation as larger players acquire smaller niche providers to expand their service portfolios and geographical reach. Emphasis on data analytics and AI-driven insights will become critical for service differentiation and operational optimization. Investments in green FM solutions and energy management will be paramount to meet evolving client expectations and regulatory demands. Strategic partnerships, particularly with technology innovators, will accelerate the development and adoption of cutting-edge FM services, ensuring long-term growth and competitive advantage in this dynamic market.

Norway Facility Management Market Segmentation

-

1. Offering Type

- 1.1. In-house Facility Management

- 1.2. Outsourced Facility Management

-

2. Service Type

- 2.1. Hard FM

- 2.2. Soft FM

-

3. End-User

- 3.1. Commercial and Retail

- 3.2. Institutional

- 3.3. Infrastructure and Public Entities

- 3.4. Industrial and Manufacturing

- 3.5. Other End-Users

Norway Facility Management Market Segmentation By Geography

- 1. Norway

Norway Facility Management Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.76% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Tech innovations in Facilities Management is Expected to Witness Significant Growth; Renewed Emphasis on Workplace Optimization and Productivity

- 3.3. Market Restrains

- 3.3.1. Diminishing Profit Margins and Ongoing Changes in Macro-environment

- 3.4. Market Trends

- 3.4.1. In-house Facility Management Offering Type Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Norway Facility Management Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering Type

- 5.1.1. In-house Facility Management

- 5.1.2. Outsourced Facility Management

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Hard FM

- 5.2.2. Soft FM

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Commercial and Retail

- 5.3.2. Institutional

- 5.3.3. Infrastructure and Public Entities

- 5.3.4. Industrial and Manufacturing

- 5.3.5. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Norway

- 5.1. Market Analysis, Insights and Forecast - by Offering Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Compass Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Sodexo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ability FM

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ISS Facility Services

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 CBRE Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Contractia O

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Coor Service Management

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toma Facility Services AS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Compass Group

List of Figures

- Figure 1: Norway Facility Management Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Norway Facility Management Market Share (%) by Company 2024

List of Tables

- Table 1: Norway Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Norway Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 3: Norway Facility Management Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 4: Norway Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 5: Norway Facility Management Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Norway Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Norway Facility Management Market Revenue Million Forecast, by Offering Type 2019 & 2032

- Table 8: Norway Facility Management Market Revenue Million Forecast, by Service Type 2019 & 2032

- Table 9: Norway Facility Management Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 10: Norway Facility Management Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Norway Facility Management Market?

The projected CAGR is approximately 2.76%.

2. Which companies are prominent players in the Norway Facility Management Market?

Key companies in the market include Compass Group, Sodexo, Ability FM, ISS Facility Services, CBRE Group, Contractia O, Coor Service Management, Toma Facility Services AS.

3. What are the main segments of the Norway Facility Management Market?

The market segments include Offering Type, Service Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Tech innovations in Facilities Management is Expected to Witness Significant Growth; Renewed Emphasis on Workplace Optimization and Productivity.

6. What are the notable trends driving market growth?

In-house Facility Management Offering Type Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Diminishing Profit Margins and Ongoing Changes in Macro-environment.

8. Can you provide examples of recent developments in the market?

July 2023: Bravida expands their agreement within technical Facility Management with Schneider Electric to install charging points and provide the Bravida Charge service. This is for Schneider Electric's premises in Sweden, Norway, and Denmark.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Norway Facility Management Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Norway Facility Management Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Norway Facility Management Market?

To stay informed about further developments, trends, and reports in the Norway Facility Management Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence