Key Insights

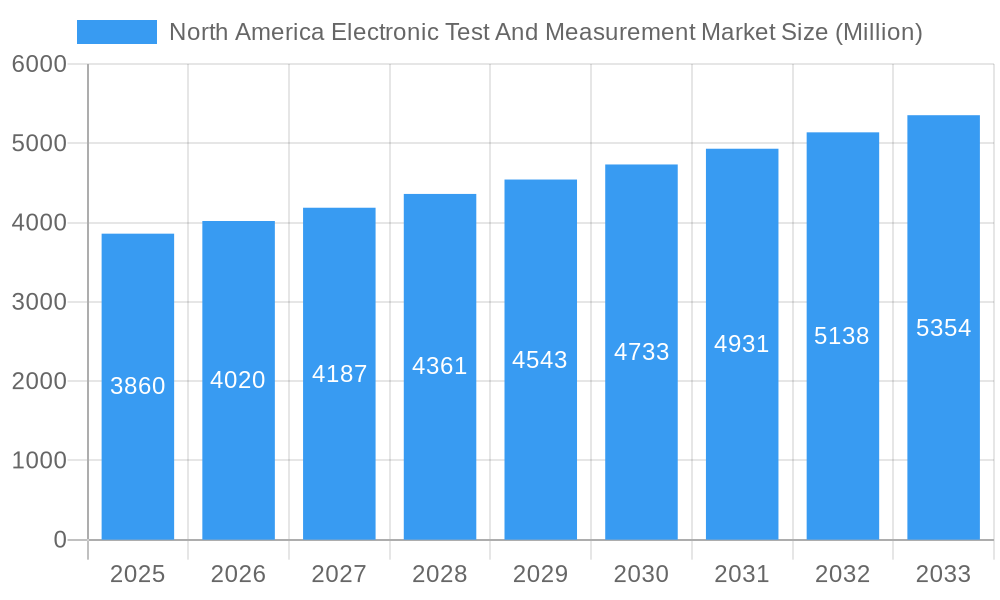

The North American electronic test and measurement (ET&M) market, valued at approximately $3.86 billion in 2025, is projected to experience robust growth, driven by several key factors. The increasing adoption of advanced technologies like 5G, IoT, and autonomous vehicles necessitates rigorous testing and validation, fueling demand for sophisticated ET&M equipment. Furthermore, the region's strong emphasis on research and development, particularly within the aerospace, automotive, and semiconductor sectors, is a significant growth catalyst. Stringent regulatory compliance requirements across various industries further contribute to market expansion. Competition among established players like Tektronix, Keysight Technologies, and Rohde & Schwarz, alongside the emergence of innovative startups, fosters innovation and drives down costs, making ET&M solutions accessible to a broader range of businesses.

North America Electronic Test And Measurement Market Market Size (In Billion)

However, the market faces certain challenges. The high initial investment required for advanced ET&M equipment can be a barrier to entry for smaller companies. Furthermore, the complexity of these systems necessitates skilled personnel for operation and maintenance, potentially limiting market penetration. Nevertheless, the overall growth trajectory remains positive, fueled by technological advancements and increasing industry demands. Given a CAGR of 4.20%, the market is poised for significant expansion throughout the forecast period (2025-2033), with consistent year-on-year growth anticipated. Specific segment breakdowns (e.g., by equipment type or application) would provide a more granular view of this dynamic market.

North America Electronic Test And Measurement Market Company Market Share

North America Electronic Test & Measurement Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Electronic Test & Measurement market, offering valuable insights for industry stakeholders, investors, and strategic decision-makers. Covering the period 2019-2033 (Study Period: 2019–2033, Base Year: 2025, Estimated Year: 2025, Forecast Period: 2025–2033, Historical Period: 2019–2024), this report delves into market dynamics, leading players, technological advancements, and future growth projections. With a focus on key segments and regional breakdowns, this report provides actionable intelligence to navigate the complexities of this dynamic market. The total market size is projected at xx Million in 2025 and is expected to reach xx Million by 2033.

North America Electronic Test And Measurement Market Dynamics & Concentration

The North American Electronic Test and Measurement market is characterized by a moderately concentrated landscape, with several major players commanding significant market share. However, the presence of numerous smaller, specialized firms contributes to a competitive environment. Market concentration is influenced by factors such as technological innovation, stringent regulatory frameworks, and the increasing demand for sophisticated testing solutions across diverse end-user industries. Key drivers include the rising adoption of advanced technologies like 5G, IoT, and autonomous vehicles, necessitating robust testing capabilities. The regulatory landscape, particularly concerning product safety and performance standards, plays a significant role in shaping market dynamics. The market also sees consistent M&A activity, with larger companies strategically acquiring smaller players to expand their product portfolio and market reach. The number of M&A deals in the last five years averaged approximately xx per year. Product substitution is minimal, but pressure arises from cost-effective solutions and open-source alternatives for specific applications. End-user trends reflect a shift toward cloud-based testing, automation, and the demand for higher throughput.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share.

- Innovation Drivers: 5G, IoT, autonomous vehicles, and advancements in semiconductor technology.

- Regulatory Frameworks: Stringent standards for product safety and performance drive demand for testing services.

- Product Substitutes: Limited, but cost-effective alternatives and open-source options exert some pressure.

- End-User Trends: Cloud-based testing, automation, and demand for higher throughput are key trends.

- M&A Activity: An average of xx M&A deals annually in recent years.

North America Electronic Test And Measurement Market Industry Trends & Analysis

The North American Electronic Test & Measurement market is experiencing robust growth, driven by a confluence of factors. The increasing complexity of electronic devices across various industries fuels the demand for advanced testing solutions. The CAGR during the forecast period is estimated at xx%. This growth is significantly propelled by the adoption of 5G technology, the expansion of the Internet of Things (IoT), and the growing automotive industry, particularly in autonomous driving and electric vehicles. Technological disruptions, such as the rise of artificial intelligence (AI) and machine learning (ML) in test automation, are reshaping the landscape, leading to more efficient and accurate testing processes. Consumer preferences are shifting towards faster, more reliable, and cost-effective testing solutions. The market exhibits strong competitive dynamics, with established players focusing on innovation and strategic partnerships to maintain their market positions. Market penetration in key segments like automotive and telecommunications is high and expected to grow further.

Leading Markets & Segments in North America Electronic Test And Measurement Market

The United States holds the dominant position in the North American Electronic Test & Measurement market, driven by its robust technological infrastructure, significant R&D investments, and a large base of electronics manufacturers. Canada and Mexico also contribute considerably, but at a smaller scale. Within segments, the semiconductor testing segment is the largest, reflecting the widespread use of semiconductors across various industries.

- Key Drivers of US Dominance:

- Strong technological infrastructure and R&D investments.

- Large base of electronics manufacturers and research institutions.

- Favorable regulatory environment and government support for innovation.

- Key Drivers of Canadian and Mexican Markets:

- Growing electronics manufacturing sector.

- Increasing demand for quality assurance and testing services.

- Proximity to the US market.

The detailed dominance analysis reveals that the US market's large size and advanced technology adoption significantly contribute to its leading role. The country’s strong regulatory framework for product safety and its highly developed semiconductor industry further fuel demand for sophisticated testing solutions. Canada and Mexico are witnessing growth, mainly due to increasing electronics manufacturing and rising quality control needs within their economies. The semiconductor testing segment is expected to maintain its leadership position due to strong growth in the semiconductor industry and increasing complexity in semiconductor devices.

North America Electronic Test And Measurement Market Product Developments

Recent product innovations focus on increased automation, improved accuracy, and integration with cloud-based platforms. New applications are emerging in areas such as 5G testing, autonomous vehicle development, and advanced materials characterization. Competitive advantages are gained through superior accuracy, faster testing speeds, and advanced software capabilities that streamline workflows and enhance data analysis. The market trend indicates a clear shift towards integrated, modular solutions that allow users to tailor their testing systems to specific needs. This focus on customization and adaptability is vital in a diverse market with various industry applications.

Key Drivers of North America Electronic Test And Measurement Market Growth

Several factors propel the growth of the North American Electronic Test & Measurement market. Technological advancements, such as the development of 5G and the expansion of IoT devices, necessitate more sophisticated testing solutions. The increasing demand for higher accuracy and faster test speeds drive innovation in testing equipment and software. Economic growth in key sectors like automotive, aerospace, and telecommunications fuels the demand for robust testing to ensure product reliability and quality. Furthermore, stringent regulatory requirements regarding product safety and performance standards necessitate stringent testing procedures, driving growth.

Challenges in the North America Electronic Test And Measurement Market

The North American Electronic Test & Measurement market faces several challenges. Supply chain disruptions, especially concerning semiconductor components, can lead to delays and increased costs. Intense competition from established players and new entrants necessitates continuous innovation and cost optimization. Regulatory compliance requirements can be complex and expensive, posing a significant challenge for smaller companies. The impact of these challenges can be quantified in terms of project delays (xx%), cost overruns (xx%), and reduced profit margins (xx%).

Emerging Opportunities in North America Electronic Test And Measurement Market

The long-term growth of the North American Electronic Test & Measurement market is poised to be driven by several significant opportunities. The growing demand for high-speed data communication, especially with the deployment of 5G, and autonomous vehicles will require more advanced testing technologies. Strategic partnerships between test equipment manufacturers and software developers, creating integrated solutions, will offer enhanced capabilities. Expansion into new markets, including specialized applications in medical devices and renewable energy, presents significant untapped potential. Furthermore, breakthroughs in AI and ML will further optimize testing processes.

Leading Players in the North America Electronic Test And Measurement Market Sector

- Tektronix Inc

- Keysight Technologies

- Rohde & Schwarz GmbH & Co KG

- National Instruments Corporation

- Fluke Corporation

- Teledyne LeCroy Inc

- Yokogawa Test & Measurement Corporation

- Teradyne Inc

- Chauvin Arnoux Group

- Advantest Corporation

- *List Not Exhaustive

Key Milestones in North America Electronic Test & Measurement Industry

- September 2024: UL Solutions appoints Keysight Technologies as the certification test partner for Thunderbolt 5 products, boosting the adoption of this high-speed connectivity technology. This significantly impacts the demand for high-speed data testing equipment.

- June 2024: ETS-Lindgren and Anritsu collaborate to provide joint test support for Narrow Band NTN (NB-NTN) protocol devices, furthering the development and adoption of this new communication technology. This collaboration impacts the demand for specialized OTA and NB-NTN testing solutions.

Strategic Outlook for North America Electronic Test And Measurement Market

The future of the North American Electronic Test & Measurement market is bright, fueled by ongoing technological advancements and expanding applications across diverse industries. The market's potential is significant, with substantial opportunities for growth in emerging technologies like 5G, IoT, and autonomous vehicles. Strategic partnerships, investments in R&D, and a focus on delivering innovative, user-friendly solutions will be crucial for success in this competitive market. The integration of AI and machine learning in testing processes will drive further efficiency gains and cost reductions, making testing solutions more accessible across diverse sectors.

North America Electronic Test And Measurement Market Segmentation

-

1. Type

- 1.1. Semiconductor Automatic Test Equipment (ATE)

- 1.2. Radio Frequency (RF) Test Equipment

- 1.3. Digital Test Equipment

- 1.4. Electrical and Environmental Test

- 1.5. Data Acquisition (DAQ)

-

2. Application

- 2.1. Communications

- 2.2. Semiconductors and Computing

- 2.3. Aerospace and Defense

- 2.4. Consumer Electronics

- 2.5. Electric Vehicles

North America Electronic Test And Measurement Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Electronic Test And Measurement Market Regional Market Share

Geographic Coverage of North America Electronic Test And Measurement Market

North America Electronic Test And Measurement Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Technological Advancements Leading to the need for Test and Measurement Equipment; Emerging Trend of Electric and Hybrid Vehicle

- 3.3. Market Restrains

- 3.3.1. Technological Advancements Leading to the need for Test and Measurement Equipment; Emerging Trend of Electric and Hybrid Vehicle

- 3.4. Market Trends

- 3.4.1. Rising Electrification in Automotive Sector is Driving the Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Electronic Test And Measurement Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Semiconductor Automatic Test Equipment (ATE)

- 5.1.2. Radio Frequency (RF) Test Equipment

- 5.1.3. Digital Test Equipment

- 5.1.4. Electrical and Environmental Test

- 5.1.5. Data Acquisition (DAQ)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Communications

- 5.2.2. Semiconductors and Computing

- 5.2.3. Aerospace and Defense

- 5.2.4. Consumer Electronics

- 5.2.5. Electric Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Tektronix Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Keysight Technologies

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rohde & Schwarz GmbH & Co KG

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 National Instruments Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fluke Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Teledyne LeCroy Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Yokogawa Test & Measurement Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Teradyne Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Chauvin Arnoux Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Advantest Corporation*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Tektronix Inc

List of Figures

- Figure 1: North America Electronic Test And Measurement Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Electronic Test And Measurement Market Share (%) by Company 2025

List of Tables

- Table 1: North America Electronic Test And Measurement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: North America Electronic Test And Measurement Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: North America Electronic Test And Measurement Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: North America Electronic Test And Measurement Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: North America Electronic Test And Measurement Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: North America Electronic Test And Measurement Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: North America Electronic Test And Measurement Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: North America Electronic Test And Measurement Market Volume Billion Forecast, by Type 2020 & 2033

- Table 9: North America Electronic Test And Measurement Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: North America Electronic Test And Measurement Market Volume Billion Forecast, by Application 2020 & 2033

- Table 11: North America Electronic Test And Measurement Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: North America Electronic Test And Measurement Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States North America Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States North America Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada North America Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada North America Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico North America Electronic Test And Measurement Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico North America Electronic Test And Measurement Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Electronic Test And Measurement Market?

The projected CAGR is approximately 4.20%.

2. Which companies are prominent players in the North America Electronic Test And Measurement Market?

Key companies in the market include Tektronix Inc, Keysight Technologies, Rohde & Schwarz GmbH & Co KG, National Instruments Corporation, Fluke Corporation, Teledyne LeCroy Inc, Yokogawa Test & Measurement Corporation, Teradyne Inc, Chauvin Arnoux Group, Advantest Corporation*List Not Exhaustive.

3. What are the main segments of the North America Electronic Test And Measurement Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.86 Million as of 2022.

5. What are some drivers contributing to market growth?

Technological Advancements Leading to the need for Test and Measurement Equipment; Emerging Trend of Electric and Hybrid Vehicle.

6. What are the notable trends driving market growth?

Rising Electrification in Automotive Sector is Driving the Demand.

7. Are there any restraints impacting market growth?

Technological Advancements Leading to the need for Test and Measurement Equipment; Emerging Trend of Electric and Hybrid Vehicle.

8. Can you provide examples of recent developments in the market?

September 2024: UL Solutions has appointed Keysight Technologies, Inc. as the certification test partner for Thunderbolt 5 products. This appointment solidifies UL Solutions' position as an Intel-authorized certification lab for Thunderbolt 5 technologies. Thunderbolt 5 significantly enhances wired connectivity, boasting data transfer speeds of up to 120 Gbps — about thrice the speed of its predecessor, Thunderbolt 4. This advanced capability supports display technologies and offers improved power delivery, enabling faster transfers of large files, including ultra-high-definition videos and intricate 3D models.June 2024: ETS-Lindgren, one of the global leaders in over-the-air (OTA) performance testing, has teamed up with Anritsu, a pioneer in telecommunications testing technology, to announce their joint test support for devices utilizing the Narrow Band NTN (NB-NTN) protocol. This collaboration merges the expertise of both companies, delivering a holistic solution for the testing and validating of NB-NTN devices. The partnership harnesses the capabilities of Anritsu’s MT8821C Radio Communication Analyzer, renowned for its RF verification and functional testing of mobile devices, in conjunction with ETS-Lindgren’s EMQuest Antenna Measurement Software and Wireless Test Solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Electronic Test And Measurement Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Electronic Test And Measurement Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Electronic Test And Measurement Market?

To stay informed about further developments, trends, and reports in the North America Electronic Test And Measurement Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence