Key Insights

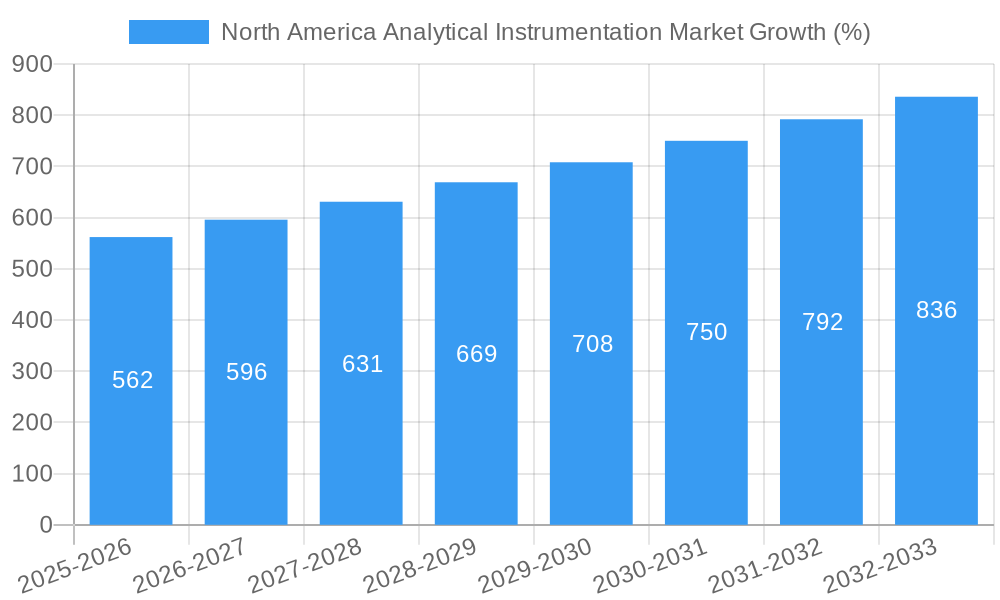

The North American analytical instrumentation market, valued at $9.15 billion in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 5.81% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning life sciences sector, encompassing pharmaceuticals, biotechnology, and academic research, is a major consumer of advanced analytical instruments for drug discovery, genomics research, and proteomics studies. Secondly, increasing regulatory scrutiny and the need for stringent quality control across various industries, particularly food testing and chemical manufacturing, are driving demand for precise and reliable analytical technologies. Furthermore, technological advancements leading to miniaturization, increased sensitivity, and improved automation of analytical instruments contribute significantly to market growth. The strong presence of major players like Thermo Fisher Scientific, Agilent Technologies, and Waters Corporation, with their extensive R&D efforts and comprehensive product portfolios, further solidifies the market's positive trajectory.

Growth within specific segments is expected to vary. Mass spectrometry, owing to its versatility and high sensitivity, likely enjoys a larger share, closely followed by chromatography techniques which are widely used for separation and analysis of complex mixtures. Within end-user industries, the life sciences sector is anticipated to remain the dominant force, given the high investment in research and development and the ever-increasing demand for advanced analytical solutions. However, growth in the chemical and petrochemical sectors, driven by the need for precise material characterization and quality control, should also contribute substantially to overall market expansion. While potential restraints such as high instrument costs and specialized expertise requirements exist, the overall market outlook remains optimistic due to the continuous expansion of research and development activities across various sectors and the enduring need for sophisticated analytical solutions.

North America Analytical Instrumentation Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of the North America Analytical Instrumentation Market, offering invaluable insights for stakeholders across the industry. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is your essential guide to understanding current market dynamics and predicting future trends. The market is segmented by product type (Chromatography, Molecular Analysis Spectroscopy, Elemental Analysis Spectroscopy, Mass Spectroscopy, Analytical Microscopes, Other Product Types) and end-user industry (Life Sciences, Chemical and Petrochemical, Material Sciences, Food Testing, Oil and Gas, Research and Academia, Other End-Users). The report also includes a detailed analysis of key players like Bio-Rad Laboratories Inc, PerkinElmer Inc, Waters Corporation, Thermo Fisher Scientific Inc, Mettler Toledo International, Agilent Technologies Inc, Malvern Panalytical Ltd (Spectris Plc), Bruker Corporation, and Shimadzu Corporation.

North America Analytical Instrumentation Market Market Dynamics & Concentration

The North American analytical instrumentation market exhibits a moderately concentrated landscape, with several major players holding significant market share. The market share of the top five companies is estimated to be approximately 65% in 2025. Innovation is a key driver, with companies continuously developing advanced instruments and software to meet the evolving needs of various end-user industries. Stringent regulatory frameworks, particularly in sectors like pharmaceuticals and food safety, influence instrument adoption and necessitate compliance. The market also sees some level of substitution with the emergence of alternative technologies, but established methods remain dominant. End-user trends show increasing demand for higher throughput, automation, and data analytics capabilities. Mergers and acquisitions (M&A) play a significant role in market consolidation, with an estimated xx M&A deals occurring between 2019 and 2024.

- Market Concentration: Top 5 players hold approximately 65% market share (2025 Estimate).

- Innovation Drivers: Advancements in chromatography, mass spectrometry, and spectroscopy technologies.

- Regulatory Frameworks: Stringent regulations in pharmaceutical and food safety sectors.

- Product Substitutes: Emergence of alternative technologies, but limited impact on market dominance.

- End-User Trends: Increasing demand for automation, higher throughput, and data analytics.

- M&A Activities: Estimated xx M&A deals between 2019 and 2024.

North America Analytical Instrumentation Market Industry Trends & Analysis

The North American analytical instrumentation market is projected to experience a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth is fueled by several key factors. Technological disruptions, such as miniaturization, increased sensitivity, and improved data processing capabilities, are driving adoption across diverse industries. Consumer preferences are shifting towards faster analysis times, reduced operational costs, and user-friendly interfaces. The competitive landscape is characterized by intense rivalry, with companies focusing on innovation, strategic partnerships, and acquisitions to gain market share. Market penetration continues to expand as new applications are discovered and the adoption of advanced analytical techniques increases across all sectors. Specifically, the life sciences sector is driving substantial growth, while the chemical and petrochemical industries also contribute significantly. The market penetration rate in the life science industry is estimated to be around xx% in 2025.

Leading Markets & Segments in North America Analytical Instrumentation Market

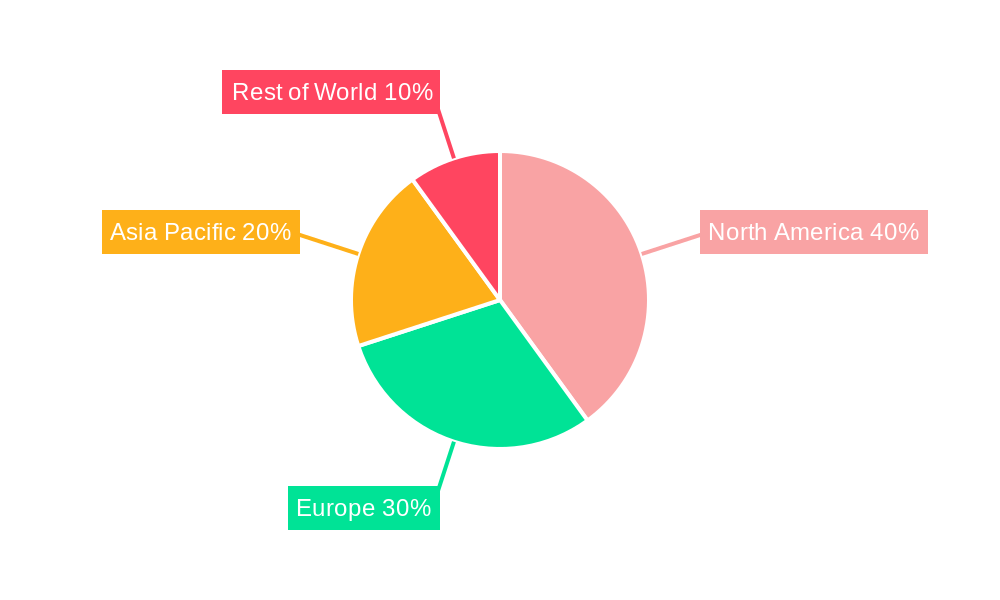

The Life Sciences sector is currently the dominant end-user industry in the North American analytical instrumentation market, driven by increasing research and development activities, drug discovery efforts, and stringent regulatory requirements. Within product types, Chromatography and Mass Spectroscopy segments are leading, owing to their wide applicability in various analytical workflows. The United States holds the largest market share within North America.

Key Drivers by Segment:

- Life Sciences: High R&D spending, drug discovery, and stringent regulatory compliance.

- Chemical and Petrochemical: Demand for quality control, process optimization, and environmental monitoring.

- Chromatography: Wide applicability across various industries, well-established technology.

- Mass Spectroscopy: High sensitivity and selectivity for complex sample analysis.

Dominance Analysis:

The United States dominates the North American market due to a strong presence of research institutions, pharmaceutical companies, and advanced manufacturing facilities. The high concentration of key players further strengthens its market leadership.

North America Analytical Instrumentation Market Product Developments

Recent product innovations center around enhanced sensitivity, miniaturization, and improved data analysis capabilities. New applications are constantly emerging, expanding the market into diverse fields. Companies are focusing on developing user-friendly interfaces and integrating advanced automation features to enhance productivity and streamline workflows. This focus on user-experience and improved efficiency is a key competitive advantage in a market where both performance and ease-of-use are critical success factors.

Key Drivers of North America Analytical Instrumentation Market Growth

The market's growth is driven by several factors: Technological advancements, including increased sensitivity, automation, and miniaturization, are improving efficiency and expanding applications. Economic growth in key sectors like pharmaceuticals and biotechnology fuels demand. Stringent regulatory requirements in industries such as food safety and environmental monitoring necessitate the adoption of advanced analytical instrumentation.

Challenges in the North America Analytical Instrumentation Market Market

Several factors restrain market growth. High instrument costs and maintenance expenses can be prohibitive for some users. Supply chain disruptions can impact instrument availability and lead times. Intense competition from established and emerging players creates pressure on pricing and profitability. These challenges collectively limit market expansion and penetration among smaller laboratories and companies.

Emerging Opportunities in North America Analytical Instrumentation Market

Long-term growth opportunities are driven by ongoing technological innovations, particularly in areas such as lab-on-a-chip devices and portable analytical systems. Strategic partnerships between instrumentation manufacturers and software developers are creating integrated solutions with advanced data analytics capabilities. Expansion into emerging markets and applications, such as point-of-care diagnostics and environmental monitoring, also presents significant growth potential.

Leading Players in the North America Analytical Instrumentation Market Sector

- Bio-Rad Laboratories Inc

- PerkinElmer Inc

- Waters Corporation

- Thermo Fisher Scientific Inc

- Mettler Toledo International

- Agilent Technologies Inc

- Malvern Panalytical Ltd (Spectris Plc)

- Bruker Corporation

- Shimadzu Corporation

Key Milestones in North America Analytical Instrumentation Market Industry

- January 2022: Bruker Corporation acquired Prolab Instruments GmbH, expanding its liquid chromatography capabilities.

- November 2021: Shimadzu Corporation collaborated with NCVC to develop a novel technique for detecting a cerebrovascular disease risk factor.

Strategic Outlook for North America Analytical Instrumentation Market Market

The North American analytical instrumentation market is poised for continued growth driven by technological innovation, increasing demand from various end-user industries, and strategic partnerships. Companies that invest in R&D, focus on user-friendly solutions, and expand into emerging applications will be well-positioned to capitalize on future market opportunities. The market's long-term prospects remain strong, supported by ongoing advancements in analytical technologies and the increasing need for precise and efficient analytical solutions across diverse sectors.

North America Analytical Instrumentation Market Segmentation

-

1. Product Type

- 1.1. Chromatography

- 1.2. Molecular Analysis Spectroscopy

- 1.3. Elemental Analysis Spectroscopy

- 1.4. Mass Spectroscopy

- 1.5. Analytical Microscopes

- 1.6. Other Product Types

-

2. End-user Industry

- 2.1. Life Sciences

- 2.2. Chemical and Petrochemical

- 2.3. Material Sciences

- 2.4. Food Testing

- 2.5. Oil and Gas

- 2.6. Research and Academia

- 2.7. Other End-Users

North America Analytical Instrumentation Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Analytical Instrumentation Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Development of Precision Medicines

- 3.3. Market Restrains

- 3.3.1. High Initial Cost

- 3.4. Market Trends

- 3.4.1. Life Sciences Segment Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Analytical Instrumentation Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Chromatography

- 5.1.2. Molecular Analysis Spectroscopy

- 5.1.3. Elemental Analysis Spectroscopy

- 5.1.4. Mass Spectroscopy

- 5.1.5. Analytical Microscopes

- 5.1.6. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Life Sciences

- 5.2.2. Chemical and Petrochemical

- 5.2.3. Material Sciences

- 5.2.4. Food Testing

- 5.2.5. Oil and Gas

- 5.2.6. Research and Academia

- 5.2.7. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. United States North America Analytical Instrumentation Market Analysis, Insights and Forecast, 2019-2031

- 7. Canada North America Analytical Instrumentation Market Analysis, Insights and Forecast, 2019-2031

- 8. Mexico North America Analytical Instrumentation Market Analysis, Insights and Forecast, 2019-2031

- 9. Rest of North America North America Analytical Instrumentation Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 Bio-Rad Laboratories Inc *List Not Exhaustive

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Perkinelmer Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Waters Corporation

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Thermo Fisher Scientific Inc

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mettler Toledo International

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Agilent Technologies Inc

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Malvern Panalytical Ltd (Spectris Plc)

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Bruker Corporation

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Shimadzu Corporation

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Bio-Rad Laboratories Inc *List Not Exhaustive

List of Figures

- Figure 1: North America Analytical Instrumentation Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: North America Analytical Instrumentation Market Share (%) by Company 2024

List of Tables

- Table 1: North America Analytical Instrumentation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: North America Analytical Instrumentation Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: North America Analytical Instrumentation Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 4: North America Analytical Instrumentation Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 5: North America Analytical Instrumentation Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: North America Analytical Instrumentation Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 7: North America Analytical Instrumentation Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: North America Analytical Instrumentation Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 9: North America Analytical Instrumentation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: North America Analytical Instrumentation Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 11: United States North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: United States North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 13: Canada North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Canada North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Mexico North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Mexico North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Rest of North America North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Rest of North America North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: North America Analytical Instrumentation Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 20: North America Analytical Instrumentation Market Volume K Unit Forecast, by Product Type 2019 & 2032

- Table 21: North America Analytical Instrumentation Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 22: North America Analytical Instrumentation Market Volume K Unit Forecast, by End-user Industry 2019 & 2032

- Table 23: North America Analytical Instrumentation Market Revenue Million Forecast, by Country 2019 & 2032

- Table 24: North America Analytical Instrumentation Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 25: United States North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: United States North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Canada North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Canada North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: Mexico North America Analytical Instrumentation Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Mexico North America Analytical Instrumentation Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Analytical Instrumentation Market?

The projected CAGR is approximately 5.81%.

2. Which companies are prominent players in the North America Analytical Instrumentation Market?

Key companies in the market include Bio-Rad Laboratories Inc *List Not Exhaustive, Perkinelmer Inc, Waters Corporation, Thermo Fisher Scientific Inc, Mettler Toledo International, Agilent Technologies Inc, Malvern Panalytical Ltd (Spectris Plc), Bruker Corporation, Shimadzu Corporation.

3. What are the main segments of the North America Analytical Instrumentation Market?

The market segments include Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.15 Million as of 2022.

5. What are some drivers contributing to market growth?

Development of Precision Medicines.

6. What are the notable trends driving market growth?

Life Sciences Segment Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High Initial Cost.

8. Can you provide examples of recent developments in the market?

January 2022 - Bruker Corporation announced the acquisition of Prolab Instruments GmbH, a Swiss technology company specializing in low-flow, high-precision liquid chromatography technology and systems.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Analytical Instrumentation Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Analytical Instrumentation Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Analytical Instrumentation Market?

To stay informed about further developments, trends, and reports in the North America Analytical Instrumentation Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence