Key Insights

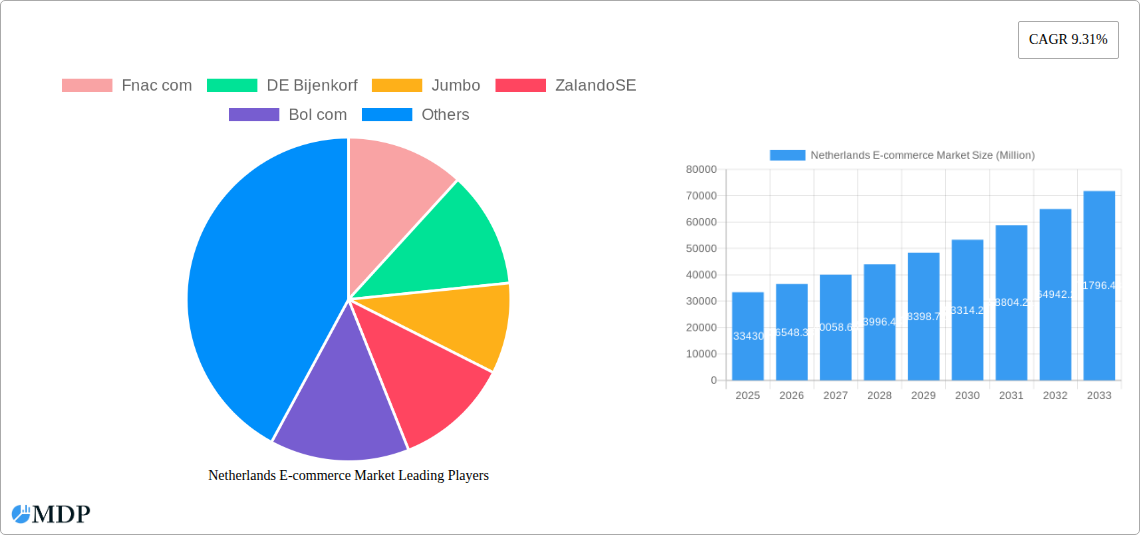

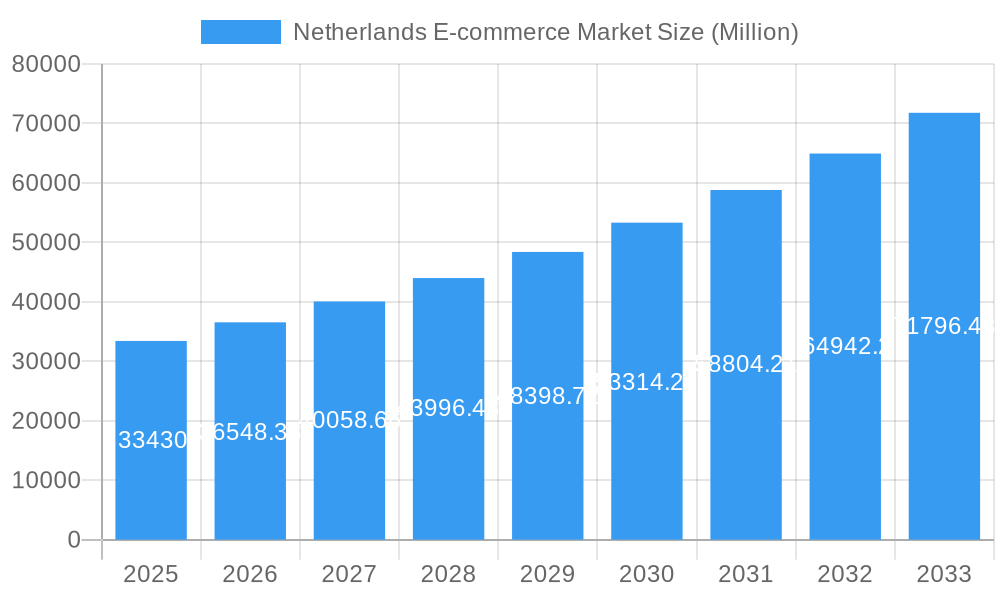

The Netherlands e-commerce market, valued at €33.43 billion in 2025, exhibits robust growth, projected to expand at a compound annual growth rate (CAGR) of 9.31% from 2025 to 2033. This growth is fueled by several key factors. Increasing internet and smartphone penetration across all demographics, coupled with a rising preference for online shopping convenience, drives significant B2C e-commerce expansion. Furthermore, the Netherlands' strong logistics infrastructure and efficient delivery systems facilitate seamless online transactions, enhancing consumer experience. The B2B e-commerce segment also contributes significantly, propelled by the adoption of digital procurement and supply chain management solutions within businesses. Established players like Amazon, Bol.com, and Zalando, alongside strong domestic players such as Albert Heijn and Coolblue, compete fiercely, fostering innovation and competitive pricing. The market segmentation, comprising B2B and B2C e-commerce across various application categories, reflects the diverse nature of the online retail landscape. While challenges remain—such as maintaining data security and addressing potential cybersecurity threats—the market's fundamental drivers point towards continued upward trajectory.

Netherlands E-commerce Market Market Size (In Billion)

The sustained growth in the Netherlands e-commerce market is expected to be further amplified by several emerging trends. The increasing popularity of mobile commerce and the seamless integration of online and offline shopping experiences ("omnichannel" retail) will contribute to higher transaction volumes. Growth in specialized online marketplaces catering to niche markets and the adoption of advanced technologies such as artificial intelligence (AI) for personalized recommendations and efficient order fulfillment will also significantly shape the market landscape. However, potential regulatory changes impacting data privacy and consumer protection, along with maintaining competitive pricing strategies amidst fluctuating economic conditions, present ongoing challenges for market participants. Nevertheless, the overall outlook for the Netherlands e-commerce market remains positive, promising continued expansion in the coming years.

Netherlands E-commerce Market Company Market Share

Netherlands E-commerce Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Netherlands e-commerce market, covering market dynamics, industry trends, leading players, and future opportunities. With a focus on B2B and B2C segments, this report offers actionable insights for businesses operating in or planning to enter this thriving market. The study period spans 2019-2033, with 2025 as the base and estimated year. The forecast period is 2025-2033, and the historical period is 2019-2024. Expect detailed data on market size (GMV) and B2B e-commerce market size across these periods.

Netherlands E-commerce Market Dynamics & Concentration

The Netherlands e-commerce market is characterized by high market concentration, with a few dominant players capturing significant market share. Innovation is a key driver, fueled by technological advancements in areas like mobile commerce, personalized shopping experiences, and advanced logistics. The regulatory framework, while generally supportive of e-commerce, presents certain challenges related to data privacy and consumer protection. Product substitutes, such as traditional brick-and-mortar retail, continue to compete, though their influence is steadily diminishing. End-user trends show a strong preference for convenience, speed, and personalized offerings. Mergers and acquisitions (M&A) activity remains significant, shaping the competitive landscape and driving consolidation within the market. For the period 2019-2024, the average annual M&A deal count is estimated to be xx. The top 5 players likely hold xx% of the overall market share in 2024.

Netherlands E-commerce Market Industry Trends & Analysis

The Netherlands e-commerce market exhibits robust growth, driven by rising internet penetration, increasing smartphone usage, and a shift in consumer preferences towards online shopping. Technological disruptions, such as the rise of mobile commerce and the adoption of artificial intelligence (AI) in marketing and personalization, are transforming the industry. Consumer preferences are evolving towards seamless omnichannel experiences, faster delivery options, and increased transparency. Competitive dynamics are intense, with both established players and new entrants vying for market share. The Compound Annual Growth Rate (CAGR) for the Netherlands e-commerce market during 2019-2024 is estimated at xx%, with market penetration reaching xx% in 2024. The market is expected to continue growing, driven by factors such as the rising adoption of e-payment methods, increasing consumer trust in online platforms, and the growth of cross-border e-commerce.

Leading Markets & Segments in Netherlands E-commerce Market

The Netherlands e-commerce market is dominated by the B2C segment, with a significantly larger GMV compared to the B2B segment. While detailed regional breakdown data is required for a comprehensive analysis, the national market is anticipated to be the dominant segment within the country.

By B2C E-commerce (GMV in Million):

- 2018: xx

- 2019: xx

- 2020: xx

- 2021: xx

- 2022: xx

- 2023: xx (projected)

- 2024: xx (projected)

- 2025: xx (estimated)

By B2B E-commerce (Market size in Million):

- 2018: xx

- 2019: xx

- 2020: xx

- 2021: xx

- 2022: xx

- 2023: xx (projected)

- 2024: xx (projected)

- 2025: xx (estimated)

- 2028: xx (projected)

Key drivers for this dominance include strong digital infrastructure, high internet penetration, and a technologically savvy population. Government policies promoting digitalization and robust logistics networks also contribute to the market’s success.

Netherlands E-commerce Market Product Developments

The Netherlands e-commerce market is witnessing rapid product innovation, with a focus on enhancing the customer experience through personalized recommendations, improved search functionality, and seamless checkout processes. Technological trends such as augmented reality (AR) and virtual reality (VR) are being incorporated to enhance product visualization and engagement. The market fit of these innovations is strong, driven by the increasing demand for convenience and personalized online shopping experiences.

Key Drivers of Netherlands E-commerce Market Growth

Several factors fuel the growth of the Netherlands e-commerce market. Technological advancements, particularly in mobile commerce and AI-powered personalization, offer convenient and tailored shopping experiences. Strong economic conditions and high consumer spending power support increased online purchases. Finally, a supportive regulatory environment fosters innovation and investment within the industry.

Challenges in the Netherlands E-commerce Market

The Netherlands e-commerce market faces challenges such as maintaining data security and privacy in the wake of increasing cyber threats. Supply chain disruptions can lead to delayed deliveries and increased costs. Intense competition necessitates continuous innovation and operational efficiency to remain competitive.

Emerging Opportunities in Netherlands E-commerce Market

The Netherlands e-commerce market presents several significant long-term growth opportunities. The increasing adoption of omnichannel strategies, expansion into cross-border e-commerce, and strategic partnerships can unlock new revenue streams and market share. Continued technological innovation, including the adoption of blockchain for enhanced supply chain transparency, can provide competitive advantages.

Leading Players in the Netherlands E-commerce Market Sector

- Fnac com

- DE Bijenkorf

- Jumbo

- Zalando SE

- Bol com

- Coolblue

- Amazon com Inc

- Wehkamp

- About you

- Albert Heijn

Key Milestones in Netherlands E-commerce Market Industry

- February 2023: Eurostat reports that 92% of Netherlands citizens aged 16-74 accessed the internet in 2022, with 75% purchasing goods or services online – highlighting the high penetration and usage driving e-commerce growth.

- September 2022: DHL's acquisition of a majority stake in Monta signifies a significant investment in e-fulfillment infrastructure, boosting the capacity and efficiency of smaller e-commerce businesses in the Netherlands and beyond.

Strategic Outlook for Netherlands E-commerce Market

The Netherlands e-commerce market presents significant long-term growth potential. Strategic investments in technology, logistics, and customer experience will be crucial for success. Companies that can adapt to evolving consumer preferences and leverage technological advancements will be best positioned to capture market share and drive growth in the years to come.

Netherlands E-commerce Market Segmentation

-

1. Application

- 1.1. Beauty and Personal Care

- 1.2. Consumer Electronics

- 1.3. Fashion and Apparel

- 1.4. Food and Beverage

- 1.5. Furniture and Home

- 1.6. Other Applications (Toys, DIY, Media, etc.)

Netherlands E-commerce Market Segmentation By Geography

- 1. Netherlands

Netherlands E-commerce Market Regional Market Share

Geographic Coverage of Netherlands E-commerce Market

Netherlands E-commerce Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.31% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Adoption of Digitalization; Growing Interest of Consumers to Shop Clothes Through E-commerce Channels

- 3.3. Market Restrains

- 3.3.1. Ethical Issues associated with Deployment of AI-based Systems in Military and Defense

- 3.4. Market Trends

- 3.4.1. Increase in Adoption of Digitalization is Expected to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Netherlands E-commerce Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Beauty and Personal Care

- 5.1.2. Consumer Electronics

- 5.1.3. Fashion and Apparel

- 5.1.4. Food and Beverage

- 5.1.5. Furniture and Home

- 5.1.6. Other Applications (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Netherlands

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Fnac com

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DE Bijenkorf

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jumbo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 ZalandoSE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bol com

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Coolblue

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Amazon com Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wehkamp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 About you

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Albert Heijn

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Fnac com

List of Figures

- Figure 1: Netherlands E-commerce Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Netherlands E-commerce Market Share (%) by Company 2025

List of Tables

- Table 1: Netherlands E-commerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Netherlands E-commerce Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Netherlands E-commerce Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Netherlands E-commerce Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Netherlands E-commerce Market?

The projected CAGR is approximately 9.31%.

2. Which companies are prominent players in the Netherlands E-commerce Market?

Key companies in the market include Fnac com, DE Bijenkorf, Jumbo, ZalandoSE, Bol com, Coolblue, Amazon com Inc, Wehkamp, About you, Albert Heijn.

3. What are the main segments of the Netherlands E-commerce Market?

The market segments include Application .

4. Can you provide details about the market size?

The market size is estimated to be USD 33.43 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Adoption of Digitalization; Growing Interest of Consumers to Shop Clothes Through E-commerce Channels.

6. What are the notable trends driving market growth?

Increase in Adoption of Digitalization is Expected to Drive the Market.

7. Are there any restraints impacting market growth?

Ethical Issues associated with Deployment of AI-based Systems in Military and Defense.

8. Can you provide examples of recent developments in the market?

February 2023: According to Eurostat, In 2022, 91% of EU citizens aged 16 to 74 had accessed the internet, with 75% purchasing or ordering products or services for personal use. The proportion of e-shoppers increased by 20 percentage points (pp) from 55% in 2012 to 75% in 2022. The highest shares of internet users who ordered goods or services or bought over the internet in 2022 were recorded in the Netherlands (92%)

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Netherlands E-commerce Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Netherlands E-commerce Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Netherlands E-commerce Market?

To stay informed about further developments, trends, and reports in the Netherlands E-commerce Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence