Key Insights

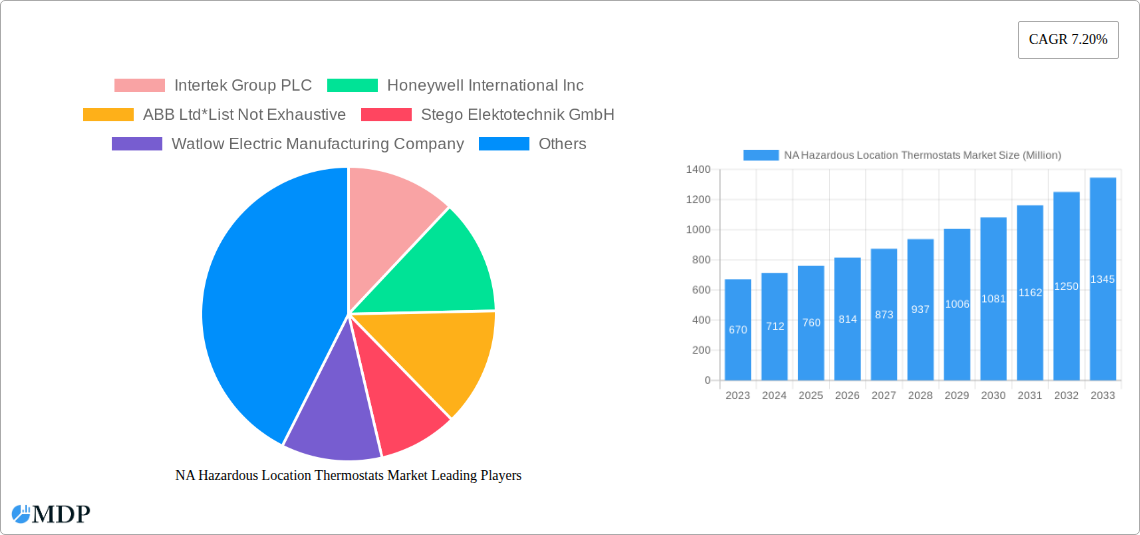

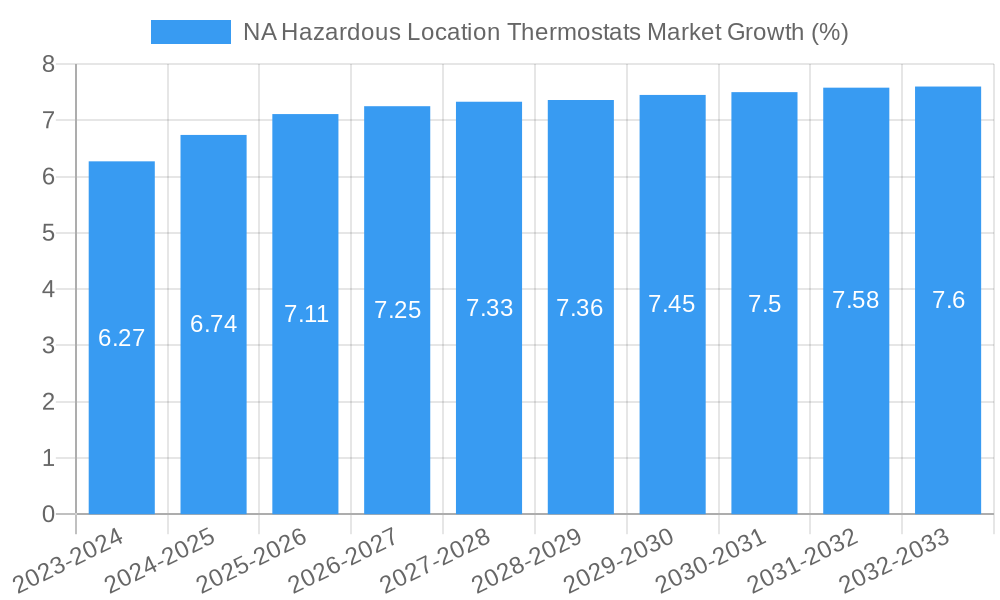

The North American Hazardous Location Thermostats market is poised for significant expansion, driven by the increasing demand for robust temperature control solutions in high-risk industrial environments. With a projected market size of approximately $750 million in 2025 and a Compound Annual Growth Rate (CAGR) of 7.20%, the market is expected to reach over $1.2 billion by 2033. This growth is primarily fueled by stringent safety regulations and the continuous need to prevent ignition in areas where flammable gases, vapors, or dust are present. Key sectors such as oil refineries, petrochemical plants, and coal mines are leading this demand, investing heavily in specialized thermostats designed to operate safely and reliably under hazardous conditions. The rising focus on operational efficiency and the prevention of costly downtime due to equipment failure further accentuates the importance of these advanced thermostat solutions.

The market's trajectory is also shaped by key trends including advancements in digital thermostat technology for remote monitoring and predictive maintenance, and the development of more compact and energy-efficient designs. Emerging applications in sectors like pulp and paper milling and grain elevators, where dust explosion risks are prevalent, are also contributing to market diversification. However, the market faces certain restraints, notably the high initial cost of specialized hazardous location equipment and the complexities associated with installation and maintenance, which can deter smaller enterprises. Despite these challenges, the unwavering commitment to safety, coupled with technological innovation and expanding industrial applications, ensures a promising outlook for the North American Hazardous Location Thermostats market, with strong growth anticipated across various segments, particularly in Division 1 and Zone 1 classifications.

Here's an SEO-optimized and engaging report description for the North America Hazardous Location Thermostats Market:

This in-depth market research report provides a definitive analysis of the North America Hazardous Location Thermostats Market, offering critical insights for industry stakeholders, manufacturers, suppliers, and investors. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this report delves into market dynamics, key trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and the competitive landscape. The North America hazardous location thermostats market is projected to experience significant growth, driven by stringent safety regulations, increasing demand from critical industries like oil & gas and petrochemicals, and ongoing technological advancements in temperature control solutions for explosive environments. The market is characterized by a mix of established players and emerging innovators, all focused on delivering reliable and compliant thermostat solutions for Division 1, Division 2, Zone 0, Zone 1, and Zone 2 environments.

NA Hazardous Location Thermostats Market Market Dynamics & Concentration

The North America Hazardous Location Thermostats Market exhibits a moderate to high concentration, with key players like Intertek Group PLC, Honeywell International Inc, and ABB Ltd holding substantial market share. Innovation drivers are primarily focused on enhancing safety features, energy efficiency, and remote monitoring capabilities for thermostats used in potentially explosive atmospheres. Regulatory frameworks, including those set by OSHA and UL standards, play a pivotal role in shaping product development and market entry strategies, ensuring compliance with stringent safety requirements for Class I, Class II, and Class III environments. Product substitutes are limited due to the specialized nature of hazardous location requirements, emphasizing the need for certified and robust thermostat solutions. End-user trends highlight a growing demand for intrinsically safe and explosion-proof thermostats across oil refineries, petrochemical plants, pulp and paper mills, coal mines, and grain elevators. Mergers and acquisitions (M&A) activities are on the rise as larger companies seek to expand their product portfolios and geographical reach. We anticipate xx M&A deals in the forecast period, contributing to market consolidation and the advancement of new technologies.

NA Hazardous Location Thermostats Market Industry Trends & Analysis

The North America Hazardous Location Thermostats Market is poised for robust growth, with an estimated Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025–2033). This expansion is fueled by several key industry trends. Firstly, the increasing stringency of safety regulations globally, particularly in North America, mandates the use of specialized thermostats in environments where flammable gases, vapors, or dusts are present. This drives demand for certified products compliant with standards like ATEX and NEC. Secondly, the burgeoning oil and gas industry, coupled with the expansion of petrochemical facilities, particularly in regions with significant reserves, represents a major application segment demanding reliable temperature control for processes and equipment to prevent ignition. The pulp and paper industry also presents consistent demand due to the presence of combustible dusts.

Technological disruptions are playing a crucial role, with manufacturers investing in research and development to introduce advanced features such as digital interfaces, remote diagnostics, and IoT connectivity for enhanced monitoring and predictive maintenance. The rise of the Internet of Things (IoT) is enabling smart thermostats that can transmit data wirelessly, allowing for real-time performance monitoring and alerts, which is highly valued in hazardous locations where manual inspections can be risky and costly. Consumer preferences are shifting towards energy-efficient solutions that minimize operational costs without compromising safety. This is leading to the development of thermostats with precise temperature control and lower power consumption.

Competitive dynamics in the market are characterized by a focus on product differentiation through certifications, material quality, and specialized functionalities tailored to specific hazardous location classifications (Class I, II, III and Division 1, 2, Zone 0, 1, 2). Companies are also competing on service offerings, including technical support and compliance consulting. The market penetration of advanced hazardous location thermostats is steadily increasing as industries recognize the long-term benefits of investing in superior safety equipment. The demand for both line-voltage and low-voltage thermostats remains strong, with specific applications dictating the preferred type.

Leading Markets & Segments in NA Hazardous Location Thermostats Market

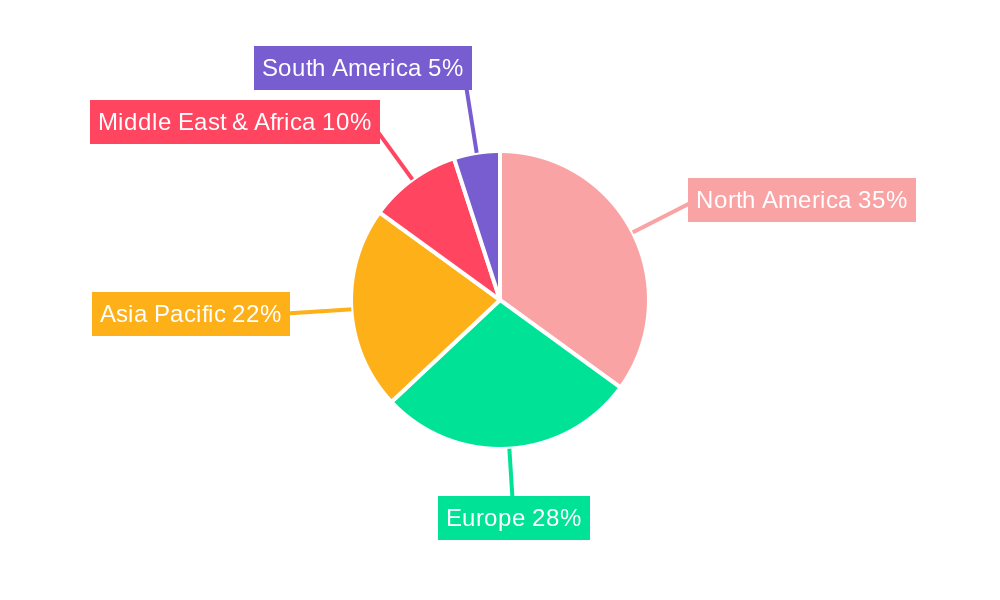

The North America Hazardous Location Thermostats Market is dominated by the United States, driven by its expansive oil and gas sector, robust petrochemical industry, and stringent safety mandates across all hazardous operational environments. Within the US, states with significant industrial activity, such as Texas, Louisiana, and Pennsylvania, represent key demand hubs.

Dominant Segments:

- Type:

- Line-voltage thermostats hold a significant market share due to their widespread use in powering heating and cooling systems within industrial facilities. Their ability to handle higher power loads makes them suitable for many large-scale industrial applications.

- Low-voltage thermostats are crucial for applications requiring finer temperature control and integration with complex control systems, particularly in sensitive petrochemical processes and control panels where safety is paramount.

- Class:

- Class I (gases and vapors) dominates the market, reflecting the extensive presence of oil refineries and petrochemical plants, which are primary users of thermostats in environments with flammable gases and vapors.

- Class II (combustible dusts) is a significant segment, driven by demand from grain elevators, coal mines, and certain manufacturing facilities where combustible dusts pose an explosion risk.

- Class III (flammable solids) represents a smaller but growing segment, with applications in specific industries handling flammable materials.

- Division:

- Division 1 environments, where ignitable concentrations of flammable gases, vapors, or dusts are present during normal operation, command the largest market share. The stringent safety requirements for these areas necessitate highly specialized and certified thermostats.

- Division 2 environments, where ignitable concentrations are not likely to exist except under abnormal operating conditions, represent a substantial portion of the market, driven by their prevalence in many industrial settings.

- Zone:

- Zone 1 and Zone 2, aligning with the IECEx system, are increasingly important, especially for companies operating internationally or adhering to global standards. Zone 1, where an explosive atmosphere is likely to occur in normal operation, sees high demand for robust solutions. Zone 2, where an explosive atmosphere is not expected to occur in normal operation, still requires specialized thermostats, albeit with potentially less stringent certification requirements.

- Application:

- Oil refineries and Petrochemical plants are the leading application segments. The critical need for precise temperature control to ensure safety and operational efficiency in these high-risk environments drives consistent demand for hazardous location thermostats. The sheer volume of operations and the inherent risks associated with handling flammable substances make these sectors paramount.

- Pulp and paper millers represent a substantial application due to the presence of combustible dusts in their processing environments.

- Coal mines require specialized thermostats for ventilation and equipment control, where the risk of methane and coal dust explosions is ever-present.

- Grain elevators are another key segment impacted by combustible dust hazards, necessitating explosion-proof temperature control solutions.

- Others, encompassing a range of manufacturing industries, chemical processing, pharmaceutical production, and wastewater treatment plants, also contribute to the market's overall growth.

Key drivers for dominance in these segments include evolving industrial safety standards, increased investment in infrastructure in these critical sectors, and the continuous need to upgrade existing facilities with more advanced and reliable temperature control systems.

NA Hazardous Location Thermostats Market Product Developments

Product development in the North America Hazardous Location Thermostats Market is intensely focused on enhancing safety, reliability, and intelligence. Innovations include thermostats with advanced intrinsic safety features, robust construction materials resistant to harsh environmental conditions, and expanded operating temperature ranges. Manufacturers are incorporating digital interfaces for easier programming and monitoring, along with integrated communication protocols (e.g., Modbus, HART) for seamless integration into SCADA and DCS systems. The trend towards energy efficiency also drives the development of thermostats with precise temperature regulation to minimize energy consumption without compromising safety. Competitive advantages are being forged through superior certification compliance, extended product lifecycles, and tailored solutions for specific hazardous area classifications (Class I, II, III and Division 1, 2, Zone 0, 1, 2).

Key Drivers of NA Hazardous Location Thermostats Market Growth

The growth of the North America Hazardous Location Thermostats Market is propelled by several key drivers. Foremost is the unwavering commitment to industrial safety, evidenced by increasingly stringent regulations from bodies like OSHA and UL, mandating the use of certified thermostats in hazardous environments. The expansion and modernization of the oil & gas and petrochemical sectors, particularly in North America, directly fuels demand for these specialized components. Technological advancements, such as the integration of IoT capabilities for remote monitoring and predictive maintenance, offer enhanced operational efficiency and safety, making advanced thermostats more attractive. Furthermore, a growing awareness of the potential catastrophic consequences of temperature control failures in hazardous locations is driving investments in higher-quality, more reliable solutions. The need to comply with evolving industry standards and ensure operational continuity also underpins market expansion.

Challenges in the NA Hazardous Location Thermostats Market Market

Despite its growth potential, the North America Hazardous Location Thermostats Market faces several challenges. The rigorous and often complex certification processes for hazardous location equipment can lead to extended product development cycles and increased costs. Supply chain disruptions, particularly for specialized components and raw materials, can impact production timelines and product availability. Intense price competition among manufacturers, especially for standard product offerings, can squeeze profit margins. Furthermore, the specialized nature of these thermostats requires a skilled workforce for installation, maintenance, and troubleshooting, posing a challenge in some regions. The evolving regulatory landscape, while a growth driver, also presents a challenge as manufacturers must continuously adapt their products to meet new or updated standards.

Emerging Opportunities in NA Hazardous Location Thermostats Market

Emerging opportunities within the North America Hazardous Location Thermostats Market are significant and multifaceted. The increasing adoption of the IECEx certification system alongside traditional NEC standards opens doors for global manufacturers and those seeking broader market reach. The growing demand for smart thermostats with advanced diagnostics and IoT connectivity presents a lucrative avenue for innovation and value-added services, such as remote monitoring and predictive maintenance platforms. Expansion into new application areas, such as renewable energy infrastructure (e.g., hydrogen production facilities) and specialized chemical processing, where hazardous conditions are present, offers untapped market potential. Strategic partnerships between thermostat manufacturers and system integrators or automation solution providers can create bundled offerings and enhance market penetration. Furthermore, the ongoing need to upgrade aging infrastructure in traditional industries will continue to drive demand for modern, compliant thermostat solutions.

Leading Players in the NA Hazardous Location Thermostats Market Sector

- Intertek Group PLC

- Honeywell International Inc

- ABB Ltd

- Stego Elektotechnik GmbH

- Watlow Electric Manufacturing Company

- Pentair Ltd

- Emerson Climate Technologies Inc

- SSHC

- R Stahl Inc

- Johnson Controls Inc

- Emerson Industrial Automation

- Bureau Veritas SA

- Magnaflux Corp

- Tempco electric Heater Corporation

Key Milestones in NA Hazardous Location Thermostats Market Industry

- 2019: Increased adoption of digital thermostats with enhanced safety features for Class I, Division 1 applications.

- 2020: Enhanced regulatory focus on Zone-rated equipment, driving demand for Zone 0, Zone 1, and Zone 2 thermostats.

- 2021: Introduction of IoT-enabled thermostats for remote monitoring in oil and gas facilities.

- 2022: Several key players announced strategic partnerships for product integration and broader market access.

- 2023: Growing demand for energy-efficient hazardous location thermostats across various industrial applications.

- 2024: Continued investment in R&D for intrinsically safe and explosion-proof temperature control solutions.

Strategic Outlook for NA Hazardous Location Thermostats Market Market

- 2019: Increased adoption of digital thermostats with enhanced safety features for Class I, Division 1 applications.

- 2020: Enhanced regulatory focus on Zone-rated equipment, driving demand for Zone 0, Zone 1, and Zone 2 thermostats.

- 2021: Introduction of IoT-enabled thermostats for remote monitoring in oil and gas facilities.

- 2022: Several key players announced strategic partnerships for product integration and broader market access.

- 2023: Growing demand for energy-efficient hazardous location thermostats across various industrial applications.

- 2024: Continued investment in R&D for intrinsically safe and explosion-proof temperature control solutions.

Strategic Outlook for NA Hazardous Location Thermostats Market Market

The strategic outlook for the North America Hazardous Location Thermostats Market is overwhelmingly positive, driven by sustained demand from critical industries and the relentless pursuit of enhanced safety and operational efficiency. Future growth will be accelerated by the integration of advanced digital technologies, including AI and machine learning for predictive analytics in temperature control, and the expansion of wireless communication capabilities. Manufacturers that focus on providing comprehensive compliance solutions, robust product portfolios catering to diverse hazardous area classifications (Class I, II, III; Division 1, 2; Zone 0, 1, 2), and superior customer support are best positioned for success. Strategic acquisitions and partnerships will continue to play a vital role in market consolidation and the expansion of technological capabilities. The increasing emphasis on sustainability and energy efficiency will also shape product development and market strategy, offering significant opportunities for innovation and competitive differentiation.

NA Hazardous Location Thermostats Market Segmentation

-

1. Type

- 1.1. Line-voltage thermostats

- 1.2. Low-voltage thermostats

-

2. Class

- 2.1. Class I

- 2.2. Class II

- 2.3. Class III

-

3. Division

- 3.1. Division 1

- 3.2. Division 2

-

4. Zone

- 4.1. Zone 0

- 4.2. Zone 1

- 4.3. Zone 2

-

5. Application

- 5.1. Oil refineries

- 5.2. Petrochemical plants

- 5.3. Pulp and paper millers

- 5.4. Coal mines

- 5.5. Grain elevators

- 5.6. Others

NA Hazardous Location Thermostats Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

NA Hazardous Location Thermostats Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.20% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Rapid Technological Developments; Increasing Applications in the Industrial Sector and Reducing Costs; Growing Safety Measures

- 3.3. Market Restrains

- 3.3.1. ; Regulations & Compliance; High Cost of Installation

- 3.4. Market Trends

- 3.4.1. Growing Safety Measures across Industries to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global NA Hazardous Location Thermostats Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Line-voltage thermostats

- 5.1.2. Low-voltage thermostats

- 5.2. Market Analysis, Insights and Forecast - by Class

- 5.2.1. Class I

- 5.2.2. Class II

- 5.2.3. Class III

- 5.3. Market Analysis, Insights and Forecast - by Division

- 5.3.1. Division 1

- 5.3.2. Division 2

- 5.4. Market Analysis, Insights and Forecast - by Zone

- 5.4.1. Zone 0

- 5.4.2. Zone 1

- 5.4.3. Zone 2

- 5.5. Market Analysis, Insights and Forecast - by Application

- 5.5.1. Oil refineries

- 5.5.2. Petrochemical plants

- 5.5.3. Pulp and paper millers

- 5.5.4. Coal mines

- 5.5.5. Grain elevators

- 5.5.6. Others

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America NA Hazardous Location Thermostats Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Line-voltage thermostats

- 6.1.2. Low-voltage thermostats

- 6.2. Market Analysis, Insights and Forecast - by Class

- 6.2.1. Class I

- 6.2.2. Class II

- 6.2.3. Class III

- 6.3. Market Analysis, Insights and Forecast - by Division

- 6.3.1. Division 1

- 6.3.2. Division 2

- 6.4. Market Analysis, Insights and Forecast - by Zone

- 6.4.1. Zone 0

- 6.4.2. Zone 1

- 6.4.3. Zone 2

- 6.5. Market Analysis, Insights and Forecast - by Application

- 6.5.1. Oil refineries

- 6.5.2. Petrochemical plants

- 6.5.3. Pulp and paper millers

- 6.5.4. Coal mines

- 6.5.5. Grain elevators

- 6.5.6. Others

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America NA Hazardous Location Thermostats Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Line-voltage thermostats

- 7.1.2. Low-voltage thermostats

- 7.2. Market Analysis, Insights and Forecast - by Class

- 7.2.1. Class I

- 7.2.2. Class II

- 7.2.3. Class III

- 7.3. Market Analysis, Insights and Forecast - by Division

- 7.3.1. Division 1

- 7.3.2. Division 2

- 7.4. Market Analysis, Insights and Forecast - by Zone

- 7.4.1. Zone 0

- 7.4.2. Zone 1

- 7.4.3. Zone 2

- 7.5. Market Analysis, Insights and Forecast - by Application

- 7.5.1. Oil refineries

- 7.5.2. Petrochemical plants

- 7.5.3. Pulp and paper millers

- 7.5.4. Coal mines

- 7.5.5. Grain elevators

- 7.5.6. Others

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe NA Hazardous Location Thermostats Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Line-voltage thermostats

- 8.1.2. Low-voltage thermostats

- 8.2. Market Analysis, Insights and Forecast - by Class

- 8.2.1. Class I

- 8.2.2. Class II

- 8.2.3. Class III

- 8.3. Market Analysis, Insights and Forecast - by Division

- 8.3.1. Division 1

- 8.3.2. Division 2

- 8.4. Market Analysis, Insights and Forecast - by Zone

- 8.4.1. Zone 0

- 8.4.2. Zone 1

- 8.4.3. Zone 2

- 8.5. Market Analysis, Insights and Forecast - by Application

- 8.5.1. Oil refineries

- 8.5.2. Petrochemical plants

- 8.5.3. Pulp and paper millers

- 8.5.4. Coal mines

- 8.5.5. Grain elevators

- 8.5.6. Others

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa NA Hazardous Location Thermostats Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Line-voltage thermostats

- 9.1.2. Low-voltage thermostats

- 9.2. Market Analysis, Insights and Forecast - by Class

- 9.2.1. Class I

- 9.2.2. Class II

- 9.2.3. Class III

- 9.3. Market Analysis, Insights and Forecast - by Division

- 9.3.1. Division 1

- 9.3.2. Division 2

- 9.4. Market Analysis, Insights and Forecast - by Zone

- 9.4.1. Zone 0

- 9.4.2. Zone 1

- 9.4.3. Zone 2

- 9.5. Market Analysis, Insights and Forecast - by Application

- 9.5.1. Oil refineries

- 9.5.2. Petrochemical plants

- 9.5.3. Pulp and paper millers

- 9.5.4. Coal mines

- 9.5.5. Grain elevators

- 9.5.6. Others

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific NA Hazardous Location Thermostats Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Line-voltage thermostats

- 10.1.2. Low-voltage thermostats

- 10.2. Market Analysis, Insights and Forecast - by Class

- 10.2.1. Class I

- 10.2.2. Class II

- 10.2.3. Class III

- 10.3. Market Analysis, Insights and Forecast - by Division

- 10.3.1. Division 1

- 10.3.2. Division 2

- 10.4. Market Analysis, Insights and Forecast - by Zone

- 10.4.1. Zone 0

- 10.4.2. Zone 1

- 10.4.3. Zone 2

- 10.5. Market Analysis, Insights and Forecast - by Application

- 10.5.1. Oil refineries

- 10.5.2. Petrochemical plants

- 10.5.3. Pulp and paper millers

- 10.5.4. Coal mines

- 10.5.5. Grain elevators

- 10.5.6. Others

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America NA Hazardous Location Thermostats Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe NA Hazardous Location Thermostats Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific NA Hazardous Location Thermostats Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Rest of the World NA Hazardous Location Thermostats Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Competitive Analysis

- 15.1. Global Market Share Analysis 2024

- 15.2. Company Profiles

- 15.2.1 Intertek Group PLC

- 15.2.1.1. Overview

- 15.2.1.2. Products

- 15.2.1.3. SWOT Analysis

- 15.2.1.4. Recent Developments

- 15.2.1.5. Financials (Based on Availability)

- 15.2.2 Honeywell International Inc

- 15.2.2.1. Overview

- 15.2.2.2. Products

- 15.2.2.3. SWOT Analysis

- 15.2.2.4. Recent Developments

- 15.2.2.5. Financials (Based on Availability)

- 15.2.3 ABB Ltd*List Not Exhaustive

- 15.2.3.1. Overview

- 15.2.3.2. Products

- 15.2.3.3. SWOT Analysis

- 15.2.3.4. Recent Developments

- 15.2.3.5. Financials (Based on Availability)

- 15.2.4 Stego Elektotechnik GmbH

- 15.2.4.1. Overview

- 15.2.4.2. Products

- 15.2.4.3. SWOT Analysis

- 15.2.4.4. Recent Developments

- 15.2.4.5. Financials (Based on Availability)

- 15.2.5 Watlow Electric Manufacturing Company

- 15.2.5.1. Overview

- 15.2.5.2. Products

- 15.2.5.3. SWOT Analysis

- 15.2.5.4. Recent Developments

- 15.2.5.5. Financials (Based on Availability)

- 15.2.6 Pentair Ltd

- 15.2.6.1. Overview

- 15.2.6.2. Products

- 15.2.6.3. SWOT Analysis

- 15.2.6.4. Recent Developments

- 15.2.6.5. Financials (Based on Availability)

- 15.2.7 Emerson Climate Technologies Inc

- 15.2.7.1. Overview

- 15.2.7.2. Products

- 15.2.7.3. SWOT Analysis

- 15.2.7.4. Recent Developments

- 15.2.7.5. Financials (Based on Availability)

- 15.2.8 SSHC

- 15.2.8.1. Overview

- 15.2.8.2. Products

- 15.2.8.3. SWOT Analysis

- 15.2.8.4. Recent Developments

- 15.2.8.5. Financials (Based on Availability)

- 15.2.9 R Stahl Inc

- 15.2.9.1. Overview

- 15.2.9.2. Products

- 15.2.9.3. SWOT Analysis

- 15.2.9.4. Recent Developments

- 15.2.9.5. Financials (Based on Availability)

- 15.2.10 Johnson Controls Inc

- 15.2.10.1. Overview

- 15.2.10.2. Products

- 15.2.10.3. SWOT Analysis

- 15.2.10.4. Recent Developments

- 15.2.10.5. Financials (Based on Availability)

- 15.2.11 Emerson Industrial Automation

- 15.2.11.1. Overview

- 15.2.11.2. Products

- 15.2.11.3. SWOT Analysis

- 15.2.11.4. Recent Developments

- 15.2.11.5. Financials (Based on Availability)

- 15.2.12 Bureau Veritas SA

- 15.2.12.1. Overview

- 15.2.12.2. Products

- 15.2.12.3. SWOT Analysis

- 15.2.12.4. Recent Developments

- 15.2.12.5. Financials (Based on Availability)

- 15.2.13 Magnaflux Corp

- 15.2.13.1. Overview

- 15.2.13.2. Products

- 15.2.13.3. SWOT Analysis

- 15.2.13.4. Recent Developments

- 15.2.13.5. Financials (Based on Availability)

- 15.2.14 Tempco electric Heater Corporation

- 15.2.14.1. Overview

- 15.2.14.2. Products

- 15.2.14.3. SWOT Analysis

- 15.2.14.4. Recent Developments

- 15.2.14.5. Financials (Based on Availability)

- 15.2.1 Intertek Group PLC

List of Figures

- Figure 1: Global NA Hazardous Location Thermostats Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America NA Hazardous Location Thermostats Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America NA Hazardous Location Thermostats Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe NA Hazardous Location Thermostats Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe NA Hazardous Location Thermostats Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific NA Hazardous Location Thermostats Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific NA Hazardous Location Thermostats Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World NA Hazardous Location Thermostats Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World NA Hazardous Location Thermostats Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America NA Hazardous Location Thermostats Market Revenue (Million), by Type 2024 & 2032

- Figure 11: North America NA Hazardous Location Thermostats Market Revenue Share (%), by Type 2024 & 2032

- Figure 12: North America NA Hazardous Location Thermostats Market Revenue (Million), by Class 2024 & 2032

- Figure 13: North America NA Hazardous Location Thermostats Market Revenue Share (%), by Class 2024 & 2032

- Figure 14: North America NA Hazardous Location Thermostats Market Revenue (Million), by Division 2024 & 2032

- Figure 15: North America NA Hazardous Location Thermostats Market Revenue Share (%), by Division 2024 & 2032

- Figure 16: North America NA Hazardous Location Thermostats Market Revenue (Million), by Zone 2024 & 2032

- Figure 17: North America NA Hazardous Location Thermostats Market Revenue Share (%), by Zone 2024 & 2032

- Figure 18: North America NA Hazardous Location Thermostats Market Revenue (Million), by Application 2024 & 2032

- Figure 19: North America NA Hazardous Location Thermostats Market Revenue Share (%), by Application 2024 & 2032

- Figure 20: North America NA Hazardous Location Thermostats Market Revenue (Million), by Country 2024 & 2032

- Figure 21: North America NA Hazardous Location Thermostats Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America NA Hazardous Location Thermostats Market Revenue (Million), by Type 2024 & 2032

- Figure 23: South America NA Hazardous Location Thermostats Market Revenue Share (%), by Type 2024 & 2032

- Figure 24: South America NA Hazardous Location Thermostats Market Revenue (Million), by Class 2024 & 2032

- Figure 25: South America NA Hazardous Location Thermostats Market Revenue Share (%), by Class 2024 & 2032

- Figure 26: South America NA Hazardous Location Thermostats Market Revenue (Million), by Division 2024 & 2032

- Figure 27: South America NA Hazardous Location Thermostats Market Revenue Share (%), by Division 2024 & 2032

- Figure 28: South America NA Hazardous Location Thermostats Market Revenue (Million), by Zone 2024 & 2032

- Figure 29: South America NA Hazardous Location Thermostats Market Revenue Share (%), by Zone 2024 & 2032

- Figure 30: South America NA Hazardous Location Thermostats Market Revenue (Million), by Application 2024 & 2032

- Figure 31: South America NA Hazardous Location Thermostats Market Revenue Share (%), by Application 2024 & 2032

- Figure 32: South America NA Hazardous Location Thermostats Market Revenue (Million), by Country 2024 & 2032

- Figure 33: South America NA Hazardous Location Thermostats Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe NA Hazardous Location Thermostats Market Revenue (Million), by Type 2024 & 2032

- Figure 35: Europe NA Hazardous Location Thermostats Market Revenue Share (%), by Type 2024 & 2032

- Figure 36: Europe NA Hazardous Location Thermostats Market Revenue (Million), by Class 2024 & 2032

- Figure 37: Europe NA Hazardous Location Thermostats Market Revenue Share (%), by Class 2024 & 2032

- Figure 38: Europe NA Hazardous Location Thermostats Market Revenue (Million), by Division 2024 & 2032

- Figure 39: Europe NA Hazardous Location Thermostats Market Revenue Share (%), by Division 2024 & 2032

- Figure 40: Europe NA Hazardous Location Thermostats Market Revenue (Million), by Zone 2024 & 2032

- Figure 41: Europe NA Hazardous Location Thermostats Market Revenue Share (%), by Zone 2024 & 2032

- Figure 42: Europe NA Hazardous Location Thermostats Market Revenue (Million), by Application 2024 & 2032

- Figure 43: Europe NA Hazardous Location Thermostats Market Revenue Share (%), by Application 2024 & 2032

- Figure 44: Europe NA Hazardous Location Thermostats Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Europe NA Hazardous Location Thermostats Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East & Africa NA Hazardous Location Thermostats Market Revenue (Million), by Type 2024 & 2032

- Figure 47: Middle East & Africa NA Hazardous Location Thermostats Market Revenue Share (%), by Type 2024 & 2032

- Figure 48: Middle East & Africa NA Hazardous Location Thermostats Market Revenue (Million), by Class 2024 & 2032

- Figure 49: Middle East & Africa NA Hazardous Location Thermostats Market Revenue Share (%), by Class 2024 & 2032

- Figure 50: Middle East & Africa NA Hazardous Location Thermostats Market Revenue (Million), by Division 2024 & 2032

- Figure 51: Middle East & Africa NA Hazardous Location Thermostats Market Revenue Share (%), by Division 2024 & 2032

- Figure 52: Middle East & Africa NA Hazardous Location Thermostats Market Revenue (Million), by Zone 2024 & 2032

- Figure 53: Middle East & Africa NA Hazardous Location Thermostats Market Revenue Share (%), by Zone 2024 & 2032

- Figure 54: Middle East & Africa NA Hazardous Location Thermostats Market Revenue (Million), by Application 2024 & 2032

- Figure 55: Middle East & Africa NA Hazardous Location Thermostats Market Revenue Share (%), by Application 2024 & 2032

- Figure 56: Middle East & Africa NA Hazardous Location Thermostats Market Revenue (Million), by Country 2024 & 2032

- Figure 57: Middle East & Africa NA Hazardous Location Thermostats Market Revenue Share (%), by Country 2024 & 2032

- Figure 58: Asia Pacific NA Hazardous Location Thermostats Market Revenue (Million), by Type 2024 & 2032

- Figure 59: Asia Pacific NA Hazardous Location Thermostats Market Revenue Share (%), by Type 2024 & 2032

- Figure 60: Asia Pacific NA Hazardous Location Thermostats Market Revenue (Million), by Class 2024 & 2032

- Figure 61: Asia Pacific NA Hazardous Location Thermostats Market Revenue Share (%), by Class 2024 & 2032

- Figure 62: Asia Pacific NA Hazardous Location Thermostats Market Revenue (Million), by Division 2024 & 2032

- Figure 63: Asia Pacific NA Hazardous Location Thermostats Market Revenue Share (%), by Division 2024 & 2032

- Figure 64: Asia Pacific NA Hazardous Location Thermostats Market Revenue (Million), by Zone 2024 & 2032

- Figure 65: Asia Pacific NA Hazardous Location Thermostats Market Revenue Share (%), by Zone 2024 & 2032

- Figure 66: Asia Pacific NA Hazardous Location Thermostats Market Revenue (Million), by Application 2024 & 2032

- Figure 67: Asia Pacific NA Hazardous Location Thermostats Market Revenue Share (%), by Application 2024 & 2032

- Figure 68: Asia Pacific NA Hazardous Location Thermostats Market Revenue (Million), by Country 2024 & 2032

- Figure 69: Asia Pacific NA Hazardous Location Thermostats Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Class 2019 & 2032

- Table 4: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Division 2019 & 2032

- Table 5: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Zone 2019 & 2032

- Table 6: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Application 2019 & 2032

- Table 7: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 11: NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 13: NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 15: NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Type 2019 & 2032

- Table 17: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Class 2019 & 2032

- Table 18: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Division 2019 & 2032

- Table 19: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Zone 2019 & 2032

- Table 20: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: United States NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Canada NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Type 2019 & 2032

- Table 26: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Class 2019 & 2032

- Table 27: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Division 2019 & 2032

- Table 28: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Zone 2019 & 2032

- Table 29: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Application 2019 & 2032

- Table 30: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 31: Brazil NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Argentina NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of South America NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Class 2019 & 2032

- Table 36: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Division 2019 & 2032

- Table 37: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Zone 2019 & 2032

- Table 38: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Application 2019 & 2032

- Table 39: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: United Kingdom NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Germany NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: France NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Italy NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Spain NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Russia NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Benelux NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Nordics NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Europe NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Type 2019 & 2032

- Table 50: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Class 2019 & 2032

- Table 51: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Division 2019 & 2032

- Table 52: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Zone 2019 & 2032

- Table 53: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Application 2019 & 2032

- Table 54: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 55: Turkey NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Israel NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: GCC NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: North Africa NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: South Africa NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East & Africa NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 61: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Type 2019 & 2032

- Table 62: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Class 2019 & 2032

- Table 63: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Division 2019 & 2032

- Table 64: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Zone 2019 & 2032

- Table 65: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Application 2019 & 2032

- Table 66: Global NA Hazardous Location Thermostats Market Revenue Million Forecast, by Country 2019 & 2032

- Table 67: China NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: India NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: Japan NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: South Korea NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: ASEAN NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Oceania NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Rest of Asia Pacific NA Hazardous Location Thermostats Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Hazardous Location Thermostats Market?

The projected CAGR is approximately 7.20%.

2. Which companies are prominent players in the NA Hazardous Location Thermostats Market?

Key companies in the market include Intertek Group PLC, Honeywell International Inc, ABB Ltd*List Not Exhaustive, Stego Elektotechnik GmbH, Watlow Electric Manufacturing Company, Pentair Ltd, Emerson Climate Technologies Inc, SSHC, R Stahl Inc, Johnson Controls Inc, Emerson Industrial Automation, Bureau Veritas SA, Magnaflux Corp, Tempco electric Heater Corporation.

3. What are the main segments of the NA Hazardous Location Thermostats Market?

The market segments include Type, Class, Division, Zone, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Rapid Technological Developments; Increasing Applications in the Industrial Sector and Reducing Costs; Growing Safety Measures.

6. What are the notable trends driving market growth?

Growing Safety Measures across Industries to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; Regulations & Compliance; High Cost of Installation.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Hazardous Location Thermostats Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Hazardous Location Thermostats Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Hazardous Location Thermostats Market?

To stay informed about further developments, trends, and reports in the NA Hazardous Location Thermostats Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence