Key Insights

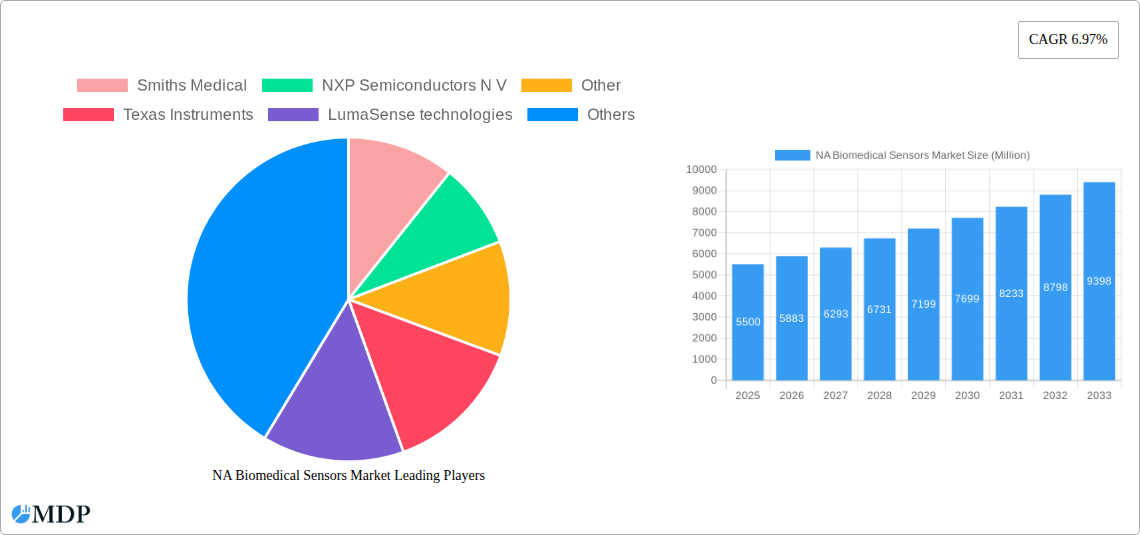

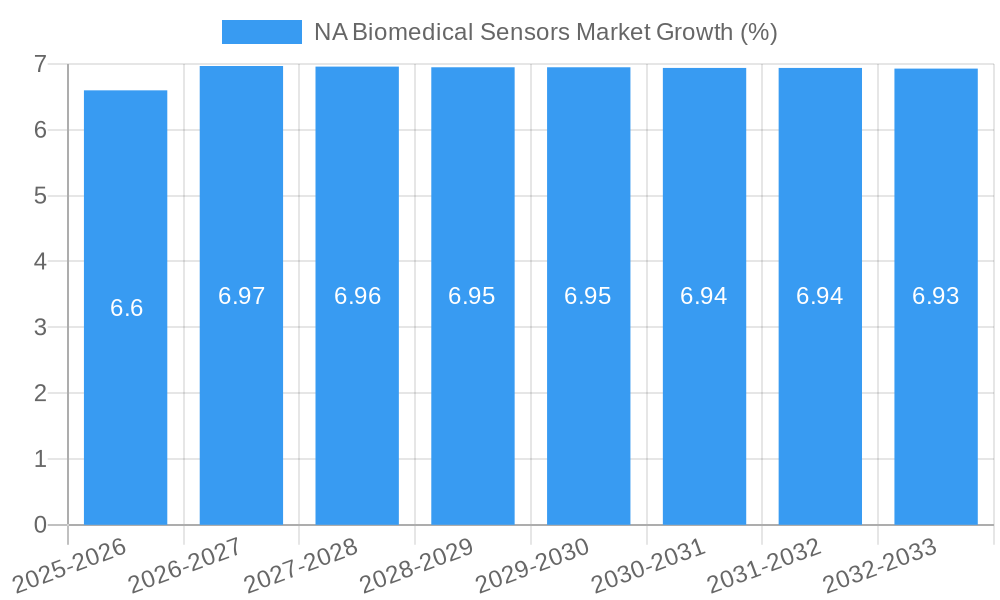

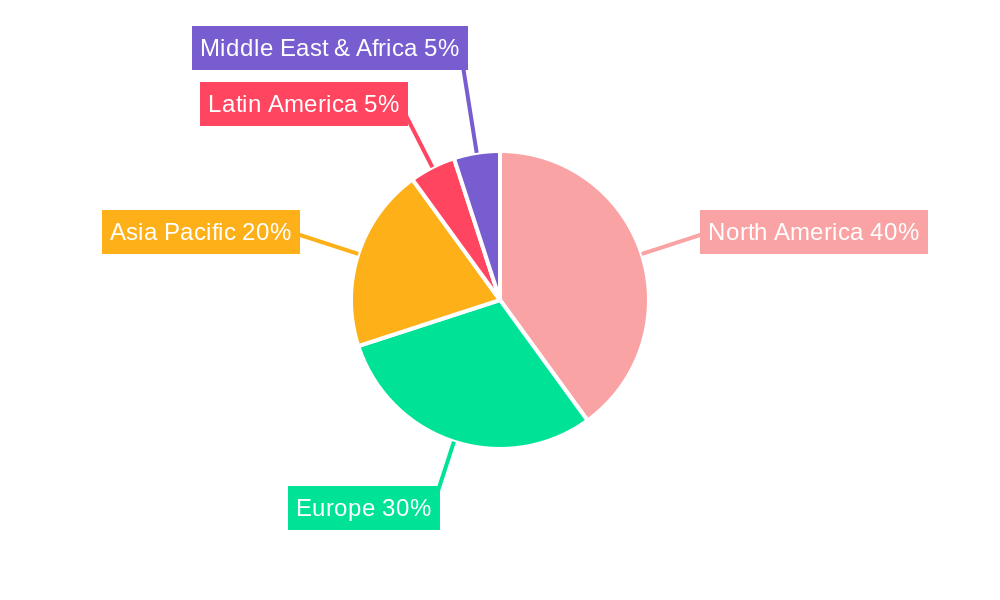

The North American biomedical sensor market is poised for significant expansion, driven by an increasing demand for advanced healthcare solutions and a growing elderly population. With an estimated market size of $XX million and a projected CAGR of 6.97% from 2019 to 2033, the market's robust growth is underpinned by technological advancements and a rising prevalence of chronic diseases. Key growth drivers include the escalating adoption of wearable health devices, the growing need for remote patient monitoring systems, and the continuous innovation in sensor technologies like image and biochemical sensors. The pharmaceutical and healthcare industries are at the forefront of this expansion, heavily investing in research and development to integrate sophisticated sensors into diagnostics, therapeutics, and medical imaging. The North American region, encompassing the United States, Canada, and Mexico, is expected to be a dominant force in this market due to its advanced healthcare infrastructure, higher disposable incomes, and proactive regulatory environment supporting medical device innovation.

The market is characterized by diverse segmentation, with wireless sensors gaining traction due to their convenience and unobtrusiveness, complementing traditional wired systems. Within sensor types, temperature, pressure, and biochemical sensors are critical for a wide range of applications, from vital sign monitoring to disease detection. The increasing emphasis on preventive healthcare and fitness tracking is further fueling the demand for motion and inertial sensors. Despite the promising outlook, market restraints such as stringent regulatory hurdles for new device approvals and high initial investment costs for advanced sensor technologies could pose challenges. However, these are likely to be mitigated by ongoing research and development efforts, strategic partnerships between technology providers and healthcare institutions, and a growing focus on cost-effective sensor solutions to improve accessibility in the healthcare sector. The market is witnessing a strong presence of key players like Medtronic PLC, GE Healthcare, and Smiths Medical, whose continuous innovation and strategic expansions are shaping the competitive landscape.

Unlock critical insights into the North American biomedical sensors market, a rapidly evolving sector poised for significant expansion. This comprehensive report, spanning the study period of 2019–2033 with a base and estimated year of 2025, provides an in-depth analysis of market dynamics, industry trends, leading segments, product developments, and key players. With a forecast period from 2025–2033, this research is essential for stakeholders seeking to capitalize on emerging opportunities in healthcare technology, diagnostics, and patient monitoring.

The North American biomedical sensors market is experiencing robust growth, driven by increasing demand for advanced healthcare solutions, rising prevalence of chronic diseases, and continuous technological innovation. This report offers a detailed examination of market concentration, innovation drivers, regulatory frameworks, product substitutes, end-user trends, and M&A activities. Industry leaders are actively investing in research and development to enhance sensor accuracy, miniaturization, and connectivity, fueling market expansion.

NA Biomedical Sensors Market Market Dynamics & Concentration

The North American biomedical sensors market exhibits a moderately concentrated landscape, characterized by the presence of established global players and emerging niche innovators. Market concentration is influenced by significant R&D investments and a strong intellectual property landscape. Innovation drivers include the escalating demand for personalized medicine, the integration of AI and machine learning in diagnostic devices, and the increasing adoption of wearable health trackers. Regulatory frameworks, such as those established by the FDA, play a crucial role in shaping product development and market entry, ensuring safety and efficacy. Product substitutes, while present in some basic sensing applications, are increasingly being differentiated by performance, integration capabilities, and data analytics. End-user trends are strongly skewed towards minimally invasive diagnostics, remote patient monitoring, and preventative healthcare solutions, directly impacting the demand for sophisticated biomedical sensors. Mergers and acquisitions (M&A) activities are moderately active, with larger companies acquiring innovative startups to expand their product portfolios and technological capabilities. For instance, recent M&A deals aim to consolidate expertise in areas like advanced biochemical sensing and wireless connectivity.

- Market Concentration: Moderately concentrated.

- Innovation Drivers: Personalized medicine, AI integration, wearable technology.

- Regulatory Frameworks: FDA oversight, stringent approval processes.

- Product Substitutes: Limited for advanced applications, differentiated by performance.

- End-User Trends: Minimally invasive diagnostics, remote monitoring, preventative care.

- M&A Activities: Moderate, focused on technological acquisition.

NA Biomedical Sensors Market Industry Trends & Analysis

The North American biomedical sensors market is experiencing a significant growth trajectory, fueled by a confluence of technological advancements, evolving healthcare paradigms, and a growing awareness of proactive health management. The estimated market size is projected to reach $xx Billion in 2025, with a projected Compound Annual Growth Rate (CAGR) of xx% during the forecast period of 2025–2033. This robust growth is primarily attributed to the increasing prevalence of chronic diseases such as cardiovascular conditions, diabetes, and respiratory disorders, which necessitate continuous monitoring and advanced diagnostic tools. The rising adoption of wearable medical devices and remote patient monitoring (RPM) systems is a key market penetrator, enabling early detection, improved patient outcomes, and reduced healthcare costs. Technological disruptions, including the miniaturization of sensors, advancements in wireless communication protocols (e.g., Bluetooth Low Energy, 5G), and the integration of artificial intelligence (AI) and machine learning (ML) for data analysis, are revolutionizing the capabilities of biomedical sensors. Consumers are increasingly demanding user-friendly, non-invasive, and data-rich solutions that empower them to manage their health proactively. This shift in consumer preference is compelling manufacturers to develop innovative sensor technologies that offer higher accuracy, greater comfort, and seamless integration with digital health platforms. The competitive dynamics within the market are intense, with a strong emphasis on product differentiation through enhanced performance, novel applications, and strategic partnerships. Companies are investing heavily in research and development to gain a competitive edge, focusing on areas such as biosensors for early disease detection, inertial sensors for gait analysis and rehabilitation, and image sensors for advanced medical imaging. The growing emphasis on value-based healthcare models further propels the demand for sensors that can demonstrate tangible improvements in patient care and cost-effectiveness. Furthermore, the expanding healthcare infrastructure in North America, coupled with favorable government initiatives promoting digital health adoption, creates a fertile ground for the sustained growth of the biomedical sensors market. The historical period from 2019–2024 has laid a strong foundation, with steady growth driven by initial adoption of advanced sensing technologies in clinical settings.

Leading Markets & Segments in NA Biomedical Sensors Market

The North American biomedical sensors market is characterized by its dynamic segmentation across various types, sensor technologies, industries, and applications, with the United States emerging as the dominant country due to its advanced healthcare infrastructure, high R&D spending, and early adoption of medical technologies.

By Type:

- Wireless Biomedical Sensors: This segment is experiencing the most rapid growth, driven by the increasing demand for wearable devices, remote patient monitoring, and implantable sensors. The convenience and mobility offered by wireless technology are paramount for applications like continuous glucose monitoring, ECG monitoring, and motion tracking.

- Key Drivers: Miniaturization, improved battery life, enhanced data security, seamless integration with mobile devices and cloud platforms.

- Wired Biomedical Sensors: While still significant in established medical equipment like MRI machines and ventilators, wired sensors are gradually being complemented or replaced by wireless alternatives in newer applications where flexibility and patient comfort are prioritized.

- Key Drivers: High accuracy and reliability in fixed installations, cost-effectiveness for specific large-scale medical devices.

By Sensor Type:

- Temperature Sensors: Crucial for monitoring body temperature in diagnostics, fever detection, and ensuring the efficacy of cold chain management for pharmaceuticals and vaccines.

- Key Drivers: Demand in fever detection devices, neonatal care, and pharmaceutical logistics.

- Pressure Sensors: Essential for applications like blood pressure monitoring, intraocular pressure measurement, and wound care management.

- Key Drivers: Growing cardiovascular disease prevalence, need for non-invasive monitoring solutions.

- Biochemical Sensors: A high-growth segment encompassing biosensors for glucose monitoring, pathogen detection, drug discovery, and diagnostic assays.

- Key Drivers: Advancements in nanotechnology and biotechnology, increasing focus on early disease detection and personalized treatment.

- Inertial Sensors & Motion Sensors: Vital for rehabilitation, gait analysis, fall detection, sports medicine, and ergonomic assessments.

- Key Drivers: Rising demand in physical therapy, sports science, and elderly care.

- Electrocardiogram (ECG) Sensors: Critical for cardiac monitoring, both in clinical settings and through wearable devices for continuous arrhythmia detection.

- Key Drivers: Increasing cardiovascular disease burden, adoption of wearable ECG monitors.

- Image Sensors: Integral to medical imaging modalities like X-rays, CT scans, and MRI, enabling detailed visualization for diagnosis.

- Key Drivers: Technological advancements in resolution and sensitivity for more accurate diagnostics.

By Industry:

- Healthcare: The largest and most significant industry, encompassing hospitals, clinics, diagnostic laboratories, and home healthcare providers.

- Key Drivers: Expanding healthcare access, aging population, increasing per capita healthcare spending.

- Pharmaceutical: Crucial for drug development, quality control, and cold chain monitoring of sensitive medications.

- Key Drivers: Rigorous quality control requirements, need for precise temperature monitoring of biologics.

By Application:

- Monitoring: This broad application area includes vital signs monitoring, chronic disease management, and post-operative patient tracking.

- Key Drivers: Shift towards home-based care and preventative health strategies.

- Diagnostics: Encompasses a wide range of diagnostic tests and procedures, from blood glucose testing to early cancer detection.

- Key Drivers: Demand for rapid, accurate, and minimally invasive diagnostic solutions.

- Medical Imaging: The use of image sensors in various medical imaging technologies for diagnostic purposes.

- Key Drivers: Advancements in imaging technology leading to better disease visualization.

- Fitness and Wellness: Driven by the burgeoning market for wearable fitness trackers and health monitoring devices.

- Key Drivers: Growing consumer interest in personal health and activity tracking.

NA Biomedical Sensors Market Product Developments

Product developments in the NA biomedical sensors market are focused on enhancing precision, miniaturization, and connectivity. Innovations in biochemical sensors are enabling earlier and more accurate disease detection, while advancements in inertial and motion sensors are revolutionizing rehabilitation and fitness tracking. The integration of wireless capabilities is a dominant trend, facilitating seamless data transfer for remote monitoring and personalized healthcare. Companies are also developing novel materials and fabrication techniques to create more biocompatible and long-lasting implantable sensors. These developments are driven by a need for cost-effective, user-friendly, and highly reliable solutions that can address the growing demands of the healthcare sector.

Key Drivers of NA Biomedical Sensors Market Growth

The North American biomedical sensors market's growth is propelled by several key factors. Technological advancements, including the miniaturization of sensors, development of novel materials for biocompatibility, and improvements in wireless communication, are critical. The increasing prevalence of chronic diseases like diabetes, cardiovascular diseases, and respiratory disorders necessitates continuous patient monitoring, driving demand for sophisticated sensors. The growing aging population across North America further fuels the need for advanced healthcare solutions and home-based monitoring. Government initiatives and favorable reimbursement policies promoting telehealth and remote patient monitoring also play a significant role. Furthermore, rising healthcare expenditure and a strong focus on preventative healthcare encourage the adoption of innovative diagnostic and monitoring technologies.

- Technological Innovation: Miniaturization, wireless connectivity, AI integration.

- Chronic Disease Burden: Rising incidence of diseases like diabetes, CVD.

- Aging Population: Increased demand for elder care and remote monitoring solutions.

- Government Support: Favorable policies for telehealth and digital health.

- Healthcare Spending & Preventative Care: Increased investment in advanced health technologies.

Challenges in the NA Biomedical Sensors Market Market

Despite its robust growth, the NA biomedical sensors market faces several challenges. Stringent regulatory approval processes by agencies like the FDA can lead to prolonged time-to-market for new products. High research and development costs associated with creating advanced sensing technologies and the need for extensive clinical trials can be a significant barrier. Interoperability issues between different devices and platforms can hinder seamless data integration. Data privacy and security concerns are paramount, especially with the increasing volume of sensitive patient data being transmitted wirelessly. Supply chain disruptions, as witnessed in recent global events, can impact the availability of critical components and raw materials. Cost-sensitivity in certain healthcare segments can also limit the adoption of premium-priced advanced sensors.

- Regulatory Hurdles: Lengthy FDA approval processes.

- R&D Investment: High costs for development and clinical validation.

- Interoperability: Challenges in device and platform integration.

- Data Security & Privacy: Protecting sensitive patient information.

- Supply Chain Vulnerabilities: Risks of component shortages.

- Cost Constraints: Price sensitivity in certain healthcare segments.

Emerging Opportunities in NA Biomedical Sensors Market

The NA biomedical sensors market is ripe with emerging opportunities. The continuous development of point-of-care diagnostics utilizing advanced biosensors offers rapid and accurate disease identification outside traditional lab settings. The expansion of wearable technology for continuous health monitoring beyond fitness tracking, into clinical applications like early detection of neurological disorders and cardiac anomalies, presents a significant avenue for growth. AI-driven predictive analytics applied to sensor data will enable proactive interventions and personalized treatment plans. The increasing adoption of implantable sensors for long-term monitoring of chronic conditions and therapeutic delivery is another promising area. Furthermore, strategic partnerships between sensor manufacturers, medical device companies, and technology firms are crucial for developing integrated solutions that leverage the full potential of biomedical sensor technology.

Leading Players in the NA Biomedical Sensors Market Sector

- Analog Devices Inc

- First sensor AG

- GE Healthcare

- Honeywell International inc

- LumaSense technologies

- Medtronic PLC

- Measurement Specialities Inc

- NXP Semiconductors N V

- Nonin Medical Inc

- STMicroelectronics N V

- Smiths Medical

- Texas Instruments

- Zephyr Technology Corp

Key Milestones in NA Biomedical Sensors Market Industry

- January 2021: Swift Sensors, a provider of industrial IoT sensor solutions, announced the launch of its secure wireless vaccine storage unit monitoring and alert system to enable medical facilities and pharmacies to monitor COVID-19 vaccine storage temperatures remotely, automate data logging, and respond quickly in case of an equipment problem or power failure.

- November 2020: FLIR launched a new FLIR SV87 Kit, which can be installed on any surface with Wi-Fi access. The kit allows maintenance personnel to track variations in vibration and heat in real-time, allowing them to predict potentially severe problems before they occur.

Strategic Outlook for NA Biomedical Sensors Market Market

The strategic outlook for the NA biomedical sensors market is exceptionally bright, driven by a sustained demand for innovative healthcare solutions and technological advancements. The market is poised for continued growth as companies focus on developing miniaturized, highly accurate, and interconnected sensor systems. Key growth accelerators include the expansion of remote patient monitoring, the integration of AI for predictive diagnostics, and the increasing use of biosensors for personalized medicine. Strategic partnerships and collaborations will be crucial for market players to leverage complementary expertise and accelerate product development. The focus will increasingly shift towards creating integrated platforms that offer comprehensive health insights, empowering both patients and healthcare providers with actionable data. The market is expected to witness further consolidation as companies seek to gain market share and technological advantages, ensuring a dynamic and competitive landscape.

NA Biomedical Sensors Market Segmentation

-

1. Type

- 1.1. Wired

- 1.2. Wireless

-

2. Sensor Type

- 2.1. Temperature

- 2.2. Pressure

- 2.3. Image sensors

- 2.4. Biochemical

- 2.5. Inertial sensors

- 2.6. Motion sensors

- 2.7. Electrocardiogram

- 2.8. Others

-

3. Industry

- 3.1. Pharmaceutical

- 3.2. Healthcare

- 3.3. Others

-

4. Application

- 4.1. Diagnostics

- 4.2. Therapeutics

- 4.3. Medical imaging

- 4.4. Monitoring

- 4.5. Fitness and Wellness

- 4.6. Others

NA Biomedical Sensors Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

NA Biomedical Sensors Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.97% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growing Demand for Fitness Devices; Increasing Spendings on Diagnostics; Rising Health Concerns

- 3.3. Market Restrains

- 3.3.1. ; High Costs of the Systems; Safety Issues Related to Prolonged Usage

- 3.4. Market Trends

- 3.4.1. Infrared Temperature Sensors to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. NA Biomedical Sensors Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Wired

- 5.1.2. Wireless

- 5.2. Market Analysis, Insights and Forecast - by Sensor Type

- 5.2.1. Temperature

- 5.2.2. Pressure

- 5.2.3. Image sensors

- 5.2.4. Biochemical

- 5.2.5. Inertial sensors

- 5.2.6. Motion sensors

- 5.2.7. Electrocardiogram

- 5.2.8. Others

- 5.3. Market Analysis, Insights and Forecast - by Industry

- 5.3.1. Pharmaceutical

- 5.3.2. Healthcare

- 5.3.3. Others

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Diagnostics

- 5.4.2. Therapeutics

- 5.4.3. Medical imaging

- 5.4.4. Monitoring

- 5.4.5. Fitness and Wellness

- 5.4.6. Others

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America NA Biomedical Sensors Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1 US

- 6.1.2 Canada

- 7. Europe NA Biomedical Sensors Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1 UK

- 7.1.2 Germany

- 7.1.3 France

- 7.1.4 Rest of Europe

- 8. Asia Pacific NA Biomedical Sensors Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1 China

- 8.1.2 India

- 8.1.3 Japan

- 8.1.4 Rest of Asia Pacific

- 9. Latin America NA Biomedical Sensors Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1 Brazil

- 9.1.2 Argentina

- 9.1.3 Mexico

- 9.1.4 Rest of Latin America

- 10. Middle East NA Biomedical Sensors Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. UAE NA Biomedical Sensors Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 Saudi Arabia

- 11.1.2 Israel

- 11.1.3 Rest of Middle East

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Smiths Medical

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 NXP Semiconductors N V

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Other

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Texas Instruments

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 LumaSense technologies

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Measurement Specialities Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 GE Healthcare

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 STMicroelectronics N V

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Nonin Medical Inc

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Medtronic PLC

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 First sensor AG

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Analog Devices Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Zephyr Technology Corp

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Honeywell International inc

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.1 Smiths Medical

List of Figures

- Figure 1: NA Biomedical Sensors Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: NA Biomedical Sensors Market Share (%) by Company 2024

List of Tables

- Table 1: NA Biomedical Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: NA Biomedical Sensors Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: NA Biomedical Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: NA Biomedical Sensors Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: NA Biomedical Sensors Market Revenue Million Forecast, by Sensor Type 2019 & 2032

- Table 6: NA Biomedical Sensors Market Volume K Unit Forecast, by Sensor Type 2019 & 2032

- Table 7: NA Biomedical Sensors Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 8: NA Biomedical Sensors Market Volume K Unit Forecast, by Industry 2019 & 2032

- Table 9: NA Biomedical Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 10: NA Biomedical Sensors Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 11: NA Biomedical Sensors Market Revenue Million Forecast, by Region 2019 & 2032

- Table 12: NA Biomedical Sensors Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 13: NA Biomedical Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: NA Biomedical Sensors Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: US NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: US NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Canada NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: NA Biomedical Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: NA Biomedical Sensors Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: UK NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: UK NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Germany NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Germany NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: France NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: France NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Rest of Europe NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 29: NA Biomedical Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 30: NA Biomedical Sensors Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 31: China NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: China NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: India NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: India NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Japan NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Japan NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Rest of Asia Pacific NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Rest of Asia Pacific NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: NA Biomedical Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 40: NA Biomedical Sensors Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 41: Brazil NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Brazil NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Argentina NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Argentina NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: Mexico NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Mexico NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Rest of Latin America NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Rest of Latin America NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: NA Biomedical Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: NA Biomedical Sensors Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 51: NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: NA Biomedical Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 54: NA Biomedical Sensors Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 55: Saudi Arabia NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Saudi Arabia NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Israel NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Israel NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Rest of Middle East NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 61: NA Biomedical Sensors Market Revenue Million Forecast, by Type 2019 & 2032

- Table 62: NA Biomedical Sensors Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 63: NA Biomedical Sensors Market Revenue Million Forecast, by Sensor Type 2019 & 2032

- Table 64: NA Biomedical Sensors Market Volume K Unit Forecast, by Sensor Type 2019 & 2032

- Table 65: NA Biomedical Sensors Market Revenue Million Forecast, by Industry 2019 & 2032

- Table 66: NA Biomedical Sensors Market Volume K Unit Forecast, by Industry 2019 & 2032

- Table 67: NA Biomedical Sensors Market Revenue Million Forecast, by Application 2019 & 2032

- Table 68: NA Biomedical Sensors Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 69: NA Biomedical Sensors Market Revenue Million Forecast, by Country 2019 & 2032

- Table 70: NA Biomedical Sensors Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 71: United States NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: United States NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: Canada NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Canada NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Mexico NA Biomedical Sensors Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Mexico NA Biomedical Sensors Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the NA Biomedical Sensors Market?

The projected CAGR is approximately 6.97%.

2. Which companies are prominent players in the NA Biomedical Sensors Market?

Key companies in the market include Smiths Medical, NXP Semiconductors N V, Other, Texas Instruments, LumaSense technologies, Measurement Specialities Inc, GE Healthcare, STMicroelectronics N V, Nonin Medical Inc, Medtronic PLC, First sensor AG, Analog Devices Inc, Zephyr Technology Corp, Honeywell International inc.

3. What are the main segments of the NA Biomedical Sensors Market?

The market segments include Type, Sensor Type, Industry, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Growing Demand for Fitness Devices; Increasing Spendings on Diagnostics; Rising Health Concerns.

6. What are the notable trends driving market growth?

Infrared Temperature Sensors to Drive the Market Growth.

7. Are there any restraints impacting market growth?

; High Costs of the Systems; Safety Issues Related to Prolonged Usage.

8. Can you provide examples of recent developments in the market?

January 2021 - Swift Sensors, a provider of industrial IoT sensor solutions, announced the launch of its secure wireless vaccine storage unit monitoring and alert system to enable medical facilities and pharmacies to monitor COVID-19 vaccine storage temperatures remotely, automate data logging, and respond quickly in case of an equipment problem or power failure.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "NA Biomedical Sensors Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the NA Biomedical Sensors Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the NA Biomedical Sensors Market?

To stay informed about further developments, trends, and reports in the NA Biomedical Sensors Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence