Key Insights

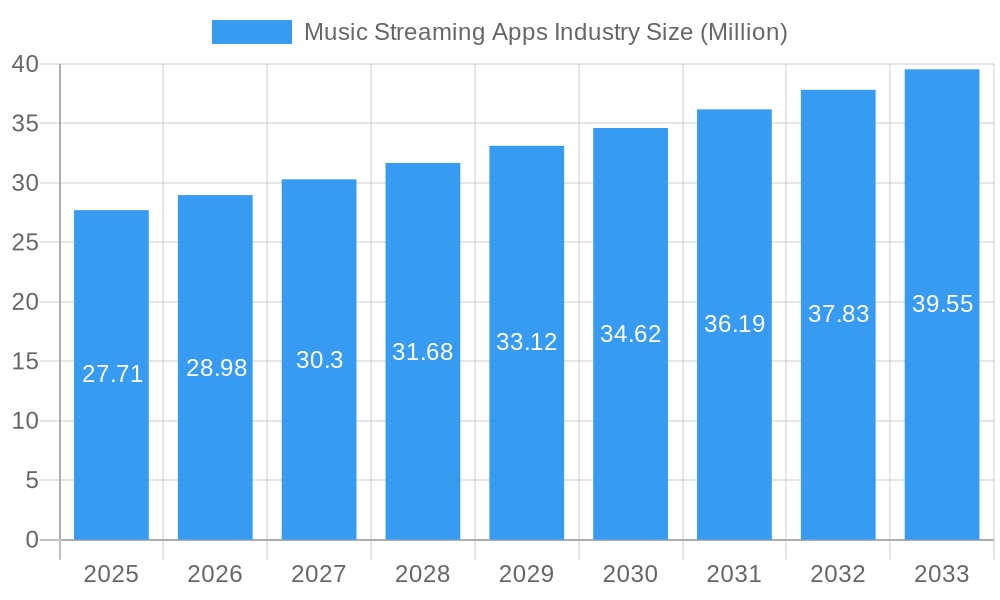

The global Music Streaming Apps market is poised for substantial growth, currently valued at approximately $27.71 million and projected to expand at a Compound Annual Growth Rate (CAGR) of 4.63% over the forecast period of 2025-2033. This robust expansion is fueled by several key drivers, including the increasing penetration of smartphones and affordable internet access worldwide, the growing adoption of subscription-based models, and the ever-evolving consumer demand for on-demand access to vast music libraries. The industry is witnessing significant trends such as the rise of personalized playlists and AI-driven recommendations, the integration of social features for enhanced user engagement, and the increasing prominence of lossless audio and spatial audio technologies. Furthermore, the proliferation of diverse content, including podcasts and exclusive artist content, is attracting a wider audience and fostering loyalty.

Music Streaming Apps Industry Market Size (In Million)

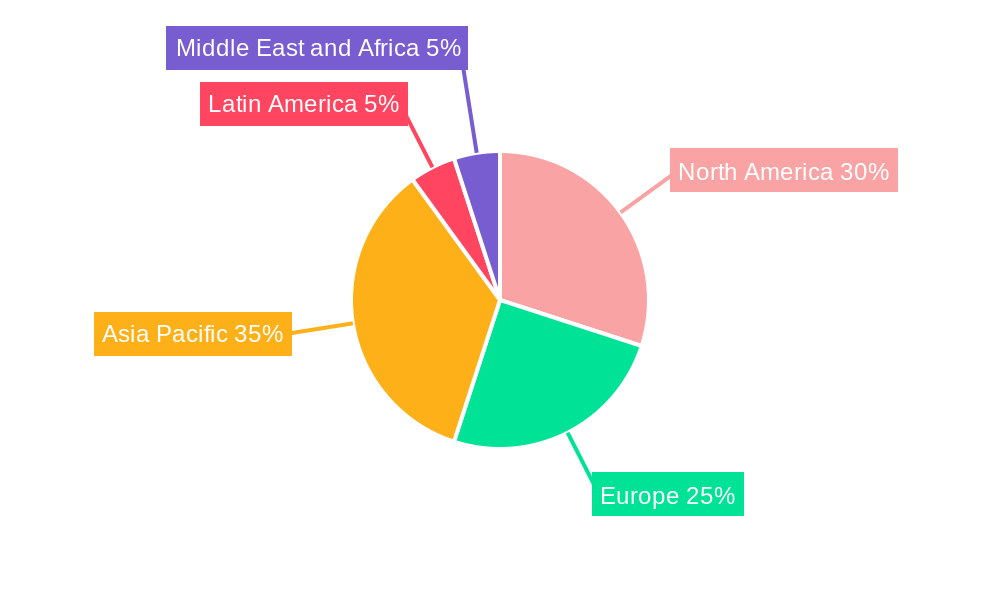

However, the market is not without its challenges. Significant restraints include intense competition among established players and emerging startups, the constant need for significant investment in content licensing and technology development, and evolving regulatory landscapes concerning digital content distribution and copyright. The market is segmented by revenue model into In-app Purchases, Advertisement, and Other Types, with In-app Purchases likely dominating due to the prevalence of freemium and premium subscription offerings. Platform-wise, both Android and iPhone segments are critical, with Android's wider global reach and iPhone's strong premium user base contributing significantly. Leading companies like Spotify AB, Apple Inc., Google LLC, Tencent Music Entertainment Group, and NetEase Inc. are at the forefront, continuously innovating to capture market share. Geographically, the Asia Pacific region is expected to emerge as a significant growth engine, driven by its large and rapidly urbanizing population, while North America and Europe are established mature markets.

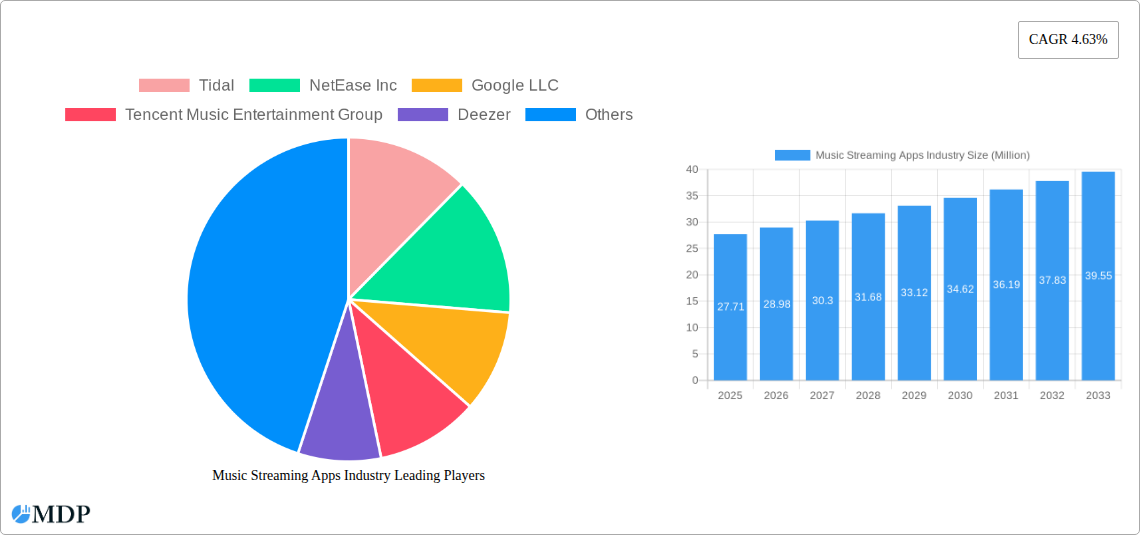

Music Streaming Apps Industry Company Market Share

Music Streaming Apps Industry Report: Market Dynamics, Trends, and Future Outlook (2019-2033)

This comprehensive report offers an in-depth analysis of the global Music Streaming Apps Industry, providing crucial insights for stakeholders looking to navigate this dynamic market. Spanning the historical period from 2019 to 2024, a base year of 2025, and a forecast period extending to 2033, this study delves into market dynamics, key trends, leading segments, product innovations, growth drivers, challenges, emerging opportunities, and the strategic outlook. With a focus on high-traffic keywords such as "music streaming market size," "music app growth," "digital music trends," and "streaming service revenue," this report is optimized for maximum search visibility and aims to attract industry professionals, investors, and decision-makers.

Music Streaming Apps Industry Market Dynamics & Concentration

The Music Streaming Apps Industry is characterized by a moderate to high level of market concentration, with a few dominant players holding significant market share. Spotify AB consistently leads in global subscriber numbers, followed closely by Apple Inc. and Google LLC (YouTube Music). NetEase Inc. and Tencent Music Entertainment Group dominate the vast Chinese market, while regional players like Wynk Music cater to specific demographics. Innovation remains a key driver, with continuous development in personalized recommendations, high-fidelity audio, and interactive features. Regulatory frameworks, though evolving, generally favor digital content distribution, but licensing complexities and royalty disputes can pose challenges. Product substitutes include traditional music sales, live concerts, and user-generated content platforms. End-user trends reveal a growing preference for ad-free subscription models, but freemium tiers remain crucial for user acquisition. Mergers and acquisition (M&A) activities, though less frequent in recent years due to market maturity, are strategic for consolidating market share and acquiring new technologies. For instance, the acquisition of SoundCloud by Spotify has been a significant move in the past. The M&A deal count has seen a decline from a peak of 15 in 2021 to an estimated 8 in 2024, reflecting a more stable competitive landscape.

- Market Concentration: High, with top 5 players accounting for over 70% of global revenue.

- Innovation Drivers: AI-powered personalization, spatial audio, social sharing features, live streaming integration.

- Regulatory Frameworks: Copyright laws, data privacy regulations (e.g., GDPR), digital content distribution policies.

- Product Substitutes: Physical music sales, radio, live music events, video streaming platforms with music content.

- End-User Trends: Subscription growth, demand for exclusive content, interest in artist discovery.

- M&A Activities: Strategic acquisitions to expand user base and technology portfolios.

Music Streaming Apps Industry Industry Trends & Analysis

The Music Streaming Apps Industry is poised for sustained growth, driven by increasing global internet penetration and the widespread adoption of smartphones. The Compound Annual Growth Rate (CAGR) for the industry is estimated to be a robust 12.5% during the forecast period (2025-2033). Market penetration is already significant in developed economies, exceeding 75%, while emerging markets present substantial untapped potential. Technological disruptions are continuously reshaping the industry. AI and machine learning algorithms are becoming more sophisticated in understanding user preferences, leading to hyper-personalized playlists and curated content discovery. The advent of 5G technology promises enhanced streaming quality and lower latency, facilitating seamless access to high-fidelity audio and immersive experiences like spatial audio. Furthermore, the integration of social features within music apps is fostering community engagement and peer-to-peer music sharing, driving organic user growth. Consumer preferences are increasingly leaning towards curated experiences, with users seeking not just music but also podcasts, audiobooks, and exclusive artist content. Freemium models remain a critical entry point, converting free users to paid subscribers through compelling value propositions and ad-free listening experiences. The competitive dynamics are intense, with established players like Spotify AB, Apple Music, and YouTube Music constantly innovating to retain and attract subscribers. Emerging players and regional services also contribute to the competitive landscape, often by focusing on niche genres or catering to specific cultural preferences. The rise of independent artists and direct-to-fan platforms is also influencing how music is discovered and consumed, challenging traditional label-centric distribution models. This evolving ecosystem necessitates continuous adaptation and strategic investment in new features and content to maintain market leadership.

Leading Markets & Segments in Music Streaming Apps Industry

North America currently holds the dominant position in the Music Streaming Apps Industry, driven by high disposable incomes, a mature digital music ecosystem, and a strong consumer appetite for premium subscription services. The United States, in particular, represents a substantial market share within this region. Asia Pacific is emerging as the fastest-growing market, fueled by increasing internet accessibility, a burgeoning young population, and the rapid adoption of smartphones in countries like India and China. The "In-app Purchases" segment consistently leads in revenue generation, reflecting the widespread adoption of premium subscription models. Users are willing to pay for ad-free listening, offline downloads, and exclusive content. The "Advertisement" segment, while smaller in revenue contribution compared to subscriptions, plays a crucial role in user acquisition for freemium tiers. Targeted advertising allows platforms to monetize their free user base while driving conversions to paid plans. The "Other Types" segment, which includes revenue from merchandise sales, concert ticket integrations, and exclusive content partnerships, is a growing area of focus for platforms looking to diversify their revenue streams.

On the platform front, both "Android" and "iPhone" (iOS) platforms command significant user bases. However, the iPhone platform often exhibits higher Average Revenue Per User (ARPU) due to its user demographic's propensity for premium services. Economic policies that support digital infrastructure development and intellectual property protection are vital for market expansion. The widespread availability of affordable smartphones and data plans is a key driver in emerging markets. Government initiatives promoting digital literacy and e-commerce further bolster the growth of music streaming services. The competitive landscape within these leading markets is fierce, with global giants and local champions vying for subscriber loyalty.

- Dominant Region: North America, with the United States as the primary market.

- Fastest Growing Region: Asia Pacific, driven by India and China.

- Leading Segment (Revenue): In-app Purchases (Subscriptions).

- Key Segment for User Acquisition: Advertisement (Freemium Tiers).

- Emerging Revenue Stream: Other Types (Merchandise, Partnerships).

- Platform Dominance: Both Android and iPhone platforms are crucial, with iPhone users often yielding higher ARPU.

- Economic Drivers: Disposable income, digital infrastructure investment, affordable data plans.

- Policy Impact: IP protection, digital literacy promotion, e-commerce support.

Music Streaming Apps Industry Product Developments

Product development in the Music Streaming Apps Industry is centered on enhancing user experience and expanding content offerings. Innovations include sophisticated AI-driven recommendation engines that go beyond genre preferences to suggest mood-based playlists and even predict future listening habits. High-fidelity audio formats like lossless streaming and spatial audio are becoming standard features, appealing to audiophiles. The integration of social features, such as collaborative playlists and in-app live concerts, fosters community engagement and a more interactive listening experience. Furthermore, platforms are increasingly incorporating podcasts, audiobooks, and exclusive creator content to become all-in-one audio hubs, providing a competitive advantage and diversifying revenue streams.

Key Drivers of Music Streaming Apps Industry Growth

The Music Streaming Apps Industry's growth is propelled by several interconnected factors. Technologically, the widespread adoption of smartphones, coupled with the expansion of high-speed internet (4G and 5G), provides the foundational infrastructure for seamless streaming. Economically, increasing disposable incomes in emerging markets and the affordable nature of subscription models make digital music accessible to a broader population. Furthermore, the continued globalization of music, facilitated by streaming platforms, expands the consumer base for artists worldwide. Regulatory frameworks that protect intellectual property rights and ensure fair compensation for artists are crucial for long-term sustainability. The increasing availability of diverse content, from niche genres to global hits and spoken-word audio, also fuels user acquisition and retention.

- Technological Advancements: Ubiquitous smartphone access, 4G/5G network expansion.

- Economic Factors: Rising disposable incomes, affordable subscription plans, globalization of music markets.

- Regulatory Support: Robust intellectual property laws, artist compensation frameworks.

- Content Diversification: Expansion beyond music to podcasts, audiobooks, and exclusive content.

Challenges in the Music Streaming Apps Industry Market

Despite its growth trajectory, the Music Streaming Apps Industry faces several significant challenges. Intense competition among established players and the emergence of new services lead to a constant battle for subscriber acquisition and retention, often necessitating aggressive pricing strategies and marketing spend. Ensuring fair artist compensation and navigating complex global music licensing agreements remain persistent hurdles, impacting profitability for both artists and platforms. The increasing cost of content acquisition, especially for exclusive releases and popular podcasts, adds financial pressure. Piracy and the availability of free, albeit illegal, streaming options continue to pose a threat to legitimate revenue streams. Furthermore, evolving data privacy regulations require continuous adaptation of user data management practices.

- Intense Competition: Subscriber acquisition and retention costs.

- Artist Compensation: Fair royalty rates and licensing complexities.

- Content Acquisition Costs: Investment in exclusive and premium content.

- Piracy and Illegal Streaming: Revenue loss and market distortion.

- Data Privacy Regulations: Compliance and user trust.

Emerging Opportunities in Music Streaming Apps Industry

The Music Streaming Apps Industry is ripe with emerging opportunities that can catalyze long-term growth. The continued expansion into underserved emerging markets offers significant untapped subscriber potential. Technological breakthroughs in areas like AI-powered music creation tools and the metaverse present novel avenues for artist-fan interaction and immersive music experiences. Strategic partnerships with hardware manufacturers, telecommunication companies, and even gaming platforms can unlock new distribution channels and revenue streams. The increasing demand for niche content, such as regional music genres, independent artist showcases, and specialized podcasts, provides opportunities for platforms to differentiate themselves. Furthermore, the integration of music streaming services with smart home devices and in-car entertainment systems is expanding accessibility and convenience for users.

Leading Players in the Music Streaming Apps Industry Sector

- Tidal

- NetEase Inc.

- Google LLC

- Tencent Music Entertainment Group

- Deezer

- Spotify AB

- SoundCloud

- Wynk Music

- Pandora

- Apple Inc.

Key Milestones in Music Streaming Apps Industry Industry

- December 2022: YouTube begins testing Custom Radio Playlist feature, allowing Google users to design personalized music stations within the YouTube Music App, enhancing artist discovery.

- May 2022: JioSaavn, in collaboration with Warner Music India, launches "Spotted," an artist discovery initiative aimed at fostering an environment for artists to perform at their best and enabling content publication.

Strategic Outlook for Music Streaming Apps Industry Market

The strategic outlook for the Music Streaming Apps Industry remains exceptionally positive, characterized by continuous innovation and market expansion. Growth accelerators will likely stem from further diversification of content beyond music to include podcasts, audiobooks, and interactive live experiences, catering to a broader range of consumer interests. The strategic focus will remain on leveraging AI for hyper-personalized user experiences and enhancing social engagement features to foster community and virality. Emerging markets, particularly in Asia and Africa, present significant untapped potential for subscriber growth, necessitating localized content strategies and affordable pricing models. Furthermore, the exploration of new revenue streams, such as virtual concerts, artist merchandise integration, and premium fan club offerings, will be crucial for sustained profitability and competitive advantage in this dynamic landscape.

Music Streaming Apps Industry Segmentation

-

1. Type

- 1.1. In-app Purchases

- 1.2. Advertisement

- 1.3. Other Types

-

2. Platform

- 2.1. Android

- 2.2. Iphone

Music Streaming Apps Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Music Streaming Apps Industry Regional Market Share

Geographic Coverage of Music Streaming Apps Industry

Music Streaming Apps Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Higher Demand for In-App Purchase Driving the Market; Market Growth Aided by Robust Smart Phone Penetration and Internet Coverage

- 3.3. Market Restrains

- 3.3.1. Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers

- 3.4. Market Trends

- 3.4.1. Rising Demand for In-App Purchases

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. In-app Purchases

- 5.1.2. Advertisement

- 5.1.3. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Android

- 5.2.2. Iphone

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. In-app Purchases

- 6.1.2. Advertisement

- 6.1.3. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Platform

- 6.2.1. Android

- 6.2.2. Iphone

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. In-app Purchases

- 7.1.2. Advertisement

- 7.1.3. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Platform

- 7.2.1. Android

- 7.2.2. Iphone

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. In-app Purchases

- 8.1.2. Advertisement

- 8.1.3. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Platform

- 8.2.1. Android

- 8.2.2. Iphone

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. In-app Purchases

- 9.1.2. Advertisement

- 9.1.3. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Platform

- 9.2.1. Android

- 9.2.2. Iphone

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Music Streaming Apps Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. In-app Purchases

- 10.1.2. Advertisement

- 10.1.3. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Platform

- 10.2.1. Android

- 10.2.2. Iphone

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Tidal

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 NetEase Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Google LLC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Tencent Music Entertainment Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Deezer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Spotify AB

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 SoundCloud

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Wynk Music*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Pandora

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Apple Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Tidal

List of Figures

- Figure 1: Global Music Streaming Apps Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 5: North America Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 6: North America Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 11: Europe Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 12: Europe Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 17: Asia Pacific Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 18: Asia Pacific Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 23: Latin America Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 24: Latin America Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Music Streaming Apps Industry Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa Music Streaming Apps Industry Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa Music Streaming Apps Industry Revenue (Million), by Platform 2025 & 2033

- Figure 29: Middle East and Africa Music Streaming Apps Industry Revenue Share (%), by Platform 2025 & 2033

- Figure 30: Middle East and Africa Music Streaming Apps Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Music Streaming Apps Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 3: Global Music Streaming Apps Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 6: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 9: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 12: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 15: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Music Streaming Apps Industry Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Music Streaming Apps Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 18: Global Music Streaming Apps Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Music Streaming Apps Industry?

The projected CAGR is approximately 4.63%.

2. Which companies are prominent players in the Music Streaming Apps Industry?

Key companies in the market include Tidal, NetEase Inc, Google LLC, Tencent Music Entertainment Group, Deezer, Spotify AB, SoundCloud, Wynk Music*List Not Exhaustive, Pandora, Apple Inc.

3. What are the main segments of the Music Streaming Apps Industry?

The market segments include Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.71 Million as of 2022.

5. What are some drivers contributing to market growth?

Higher Demand for In-App Purchase Driving the Market; Market Growth Aided by Robust Smart Phone Penetration and Internet Coverage.

6. What are the notable trends driving market growth?

Rising Demand for In-App Purchases.

7. Are there any restraints impacting market growth?

Concerns Relating to Understanding the Changing Behaviour Pattern of the Consumers.

8. Can you provide examples of recent developments in the market?

In December 2022, YouTube was on the verge of introducing the Custom Radio Playlist feature. Soon, customers of the Google-owned music streaming service would have the option to design their own station. The YouTube Music App would give consumers various options for musicians so they may discover their favorites.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Music Streaming Apps Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Music Streaming Apps Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Music Streaming Apps Industry?

To stay informed about further developments, trends, and reports in the Music Streaming Apps Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence