Key Insights

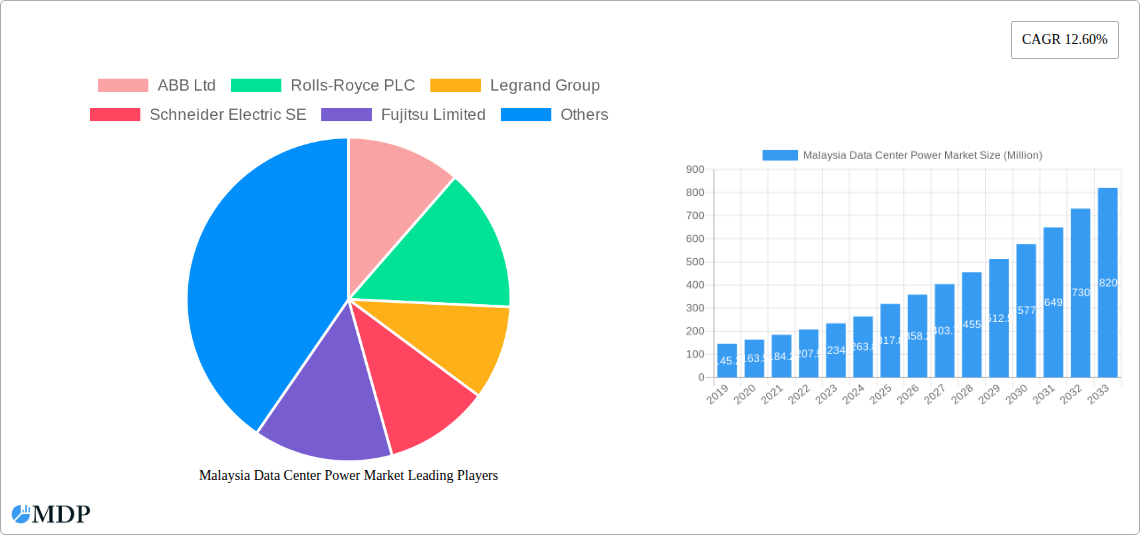

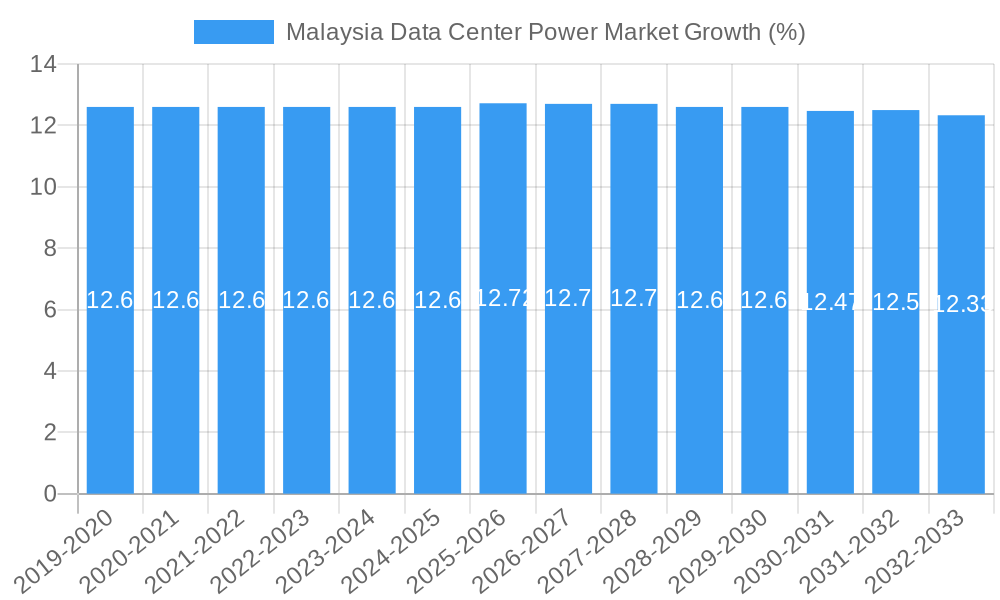

The Malaysia Data Center Power Market is poised for substantial expansion, projected to reach an estimated market size of USD 317.80 million by 2025. This growth is fueled by a robust Compound Annual Growth Rate (CAGR) of 12.60% over the forecast period (2025-2033), indicating a highly dynamic and promising sector. A significant driver of this expansion is the escalating demand for reliable and uninterrupted power solutions to support the burgeoning data center infrastructure in Malaysia. This includes the continuous rise in cloud computing adoption, the proliferation of digitalization across various industries, and the government's commitment to developing a robust digital economy. The increasing complexity and power requirements of modern data centers necessitate advanced power solutions such as Uninterruptible Power Supply (UPS) systems, high-efficiency generators, and sophisticated power distribution units (PDUs). The market is also benefiting from technological advancements in power management and a growing focus on energy efficiency to mitigate operational costs and environmental impact.

The market's trajectory is further shaped by key trends including the integration of smart grid technologies, the adoption of renewable energy sources for data center operations, and the increasing deployment of edge data centers. These trends address the growing need for sustainability and localized data processing. While the market enjoys strong growth, potential restraints include the high initial capital expenditure for advanced power infrastructure and the availability of skilled labor for installation and maintenance. However, the overwhelming demand from critical end-user segments such as IT and Telecommunication, BFSI, and Government, who rely heavily on continuous power availability, is expected to outweigh these challenges. Key players like ABB Ltd, Schneider Electric SE, and Cummins Inc. are actively investing in R&D and expanding their offerings to cater to the evolving needs of the Malaysian data center power landscape, driving innovation and competition within the sector.

Malaysia Data Center Power Market: Unlocking Growth in a Digital Hub

This comprehensive report provides an in-depth analysis of the Malaysia Data Center Power Market, a critical sector experiencing rapid expansion driven by digital transformation and increasing demand for robust IT infrastructure. Spanning a study period from 2019 to 2033, with a base year of 2025, this report offers invaluable insights for industry stakeholders, including power infrastructure providers, service companies, and end-users in the IT & Telecommunication, BFSI, Government, and Media & Entertainment sectors. Our analysis leverages high-traffic keywords and actionable data to illuminate market dynamics, key trends, leading players, and future strategic opportunities within Malaysia's burgeoning data center landscape.

Malaysia Data Center Power Market Market Dynamics & Concentration

The Malaysia Data Center Power Market is characterized by a moderate to high concentration, with established global players vying for market share alongside emerging local entities. Innovation drivers are primarily fueled by the escalating demand for hyperscale and colocation data centers, necessitating advanced power solutions that ensure high availability, energy efficiency, and cybersecurity. Regulatory frameworks are evolving to support green initiatives and energy-efficient operations, influencing product development and market entry strategies. Product substitutes, while present in the form of less sophisticated power backup systems, are increasingly being phased out in favor of specialized, high-performance data center power infrastructure. End-user trends strongly indicate a preference for scalable, reliable, and intelligent power management solutions to support the growing data processing and storage needs across all sectors. Merger and acquisition (M&A) activities are anticipated to see a steady increase as larger players aim to consolidate market presence and acquire cutting-edge technologies. While specific M&A deal counts are confidential, the sector’s growth trajectory suggests significant strategic consolidation in the coming years. Market share is fragmented across key segments like UPS systems and generators, with a few dominant players holding substantial influence.

Malaysia Data Center Power Market Industry Trends & Analysis

The Malaysia Data Center Power Market is poised for exceptional growth, projected to exhibit a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period of 2025–2033. This robust expansion is propelled by a confluence of powerful growth drivers. The escalating adoption of cloud computing services, the proliferation of Artificial Intelligence (AI) and Machine Learning (ML) applications, and the increasing penetration of the Internet of Things (IoT) devices are creating an insatiable demand for data processing and storage capabilities, directly translating to a need for more sophisticated and high-capacity data center infrastructure. Furthermore, the Malaysian government's strategic initiatives to position the nation as a digital hub in Southeast Asia, coupled with favorable foreign direct investment policies, are attracting significant investment in data center development. Technological disruptions are playing a pivotal role, with advancements in power electronics leading to more efficient and compact UPS systems, intelligent power distribution units (PDUs), and advanced generator technologies that offer improved fuel efficiency and reduced emissions. The integration of smart grid technologies and renewable energy sources into data center power management is also gaining traction, aligning with global sustainability goals and reducing operational costs. Consumer preferences are increasingly leaning towards highly reliable, secure, and energy-efficient power solutions that minimize downtime and support business continuity. Leading end-users, particularly in the IT and Telecommunication and BFSI sectors, are prioritizing data center power solutions that offer advanced monitoring capabilities, predictive maintenance, and automated fault detection to ensure uninterrupted operations. Competitive dynamics are intensifying, with both global power management giants and specialized data center solution providers vying for market dominance. This healthy competition is fostering innovation and driving down costs, benefiting end-users. Market penetration for advanced data center power solutions is expected to reach xx% by 2033, indicating a significant shift from conventional power backup systems to purpose-built data center infrastructure.

Leading Markets & Segments in Malaysia Data Center Power Market

The Power Infrastructure: Electrical Solution segment stands as the dominant force within the Malaysia Data Center Power Market, driven by the foundational necessity of reliable and robust power for data center operations. Within this segment, UPS Systems hold a significant share, ensuring uninterrupted power supply during grid outages and fluctuations, crucial for maintaining data integrity and availability.

- Key Drivers for UPS Systems Dominance:

- High Availability Requirements: Essential for all data centers to prevent data loss and service disruption.

- Increasing Power Density: Modern servers require more stable and clean power, which UPS systems provide.

- Technological Advancements: Modular UPS designs offer scalability and efficiency.

Generators represent another critical component, providing long-term backup power for extended outages. The increasing scale of data center deployments necessitates higher capacity and more efficient generator solutions.

- Key Drivers for Generator Dominance:

- Redundancy: Critical for Tier III and Tier IV data centers.

- Fuel Efficiency: Growing emphasis on reducing operational costs and environmental impact.

- Integration with Smart Grids: Enabling participation in demand response programs.

The Power Distribution Solutions (PDU, Switchgear, Critical Power Distribution, Transfer Switches, Remote Power Panels, Others) segment is also witnessing substantial growth. PDUs, in particular, are evolving with intelligent features for monitoring and control, enhancing operational efficiency and security.

- Key Drivers for Power Distribution Solutions Dominance:

- Granular Power Management: Enabling precise control and monitoring of power to individual racks.

- Scalability and Flexibility: Adapting to changing rack configurations and power needs.

- Enhanced Security Features: Locking mechanisms and remote management capabilities.

The Service segment, encompassing installation, maintenance, and support, is a vital growth catalyst. As data centers become more complex, the demand for specialized expertise in managing and maintaining power infrastructure is escalating.

- Key Drivers for Service Segment Growth:

- Complex System Integration: Requiring skilled professionals for installation and commissioning.

- Preventive Maintenance: Crucial for ensuring uptime and extending equipment lifespan.

- Remote Monitoring and Management: Offering proactive issue detection and resolution.

Among end-users, the IT and Telecommunication sector leads in power consumption and investment in data center infrastructure, followed closely by the BFSI sector due to its stringent uptime requirements and massive data processing needs. The Government sector is also a significant contributor, driven by e-governance initiatives and national digital transformation agendas. The Media and Entertainment sector, with its increasing reliance on digital content streaming and production, is also a growing consumer of data center power.

- Dominance Analysis of End-Users:

- IT and Telecommunication: Largest hyperscale and colocation operators, driving demand for high-density power solutions.

- BFSI: Focus on resilience, security, and low latency, necessitating robust and redundant power systems.

- Government: Investing in smart city initiatives and digital public services, requiring scalable and secure data center power.

Malaysia Data Center Power Market Product Developments

Malaysia's data center power market is experiencing a wave of innovative product developments aimed at enhancing efficiency, reliability, and security. Companies are launching advanced UPS Systems with higher power densities and improved energy efficiency ratings, such as modular designs that allow for scalable deployment. Power Distribution Units (PDUs) are increasingly equipped with intelligent features, including remote monitoring, outlet-level control, and integrated security mechanisms like locking mechanisms to prevent accidental disconnections. Generator technologies are evolving towards greater fuel efficiency and reduced emissions, with advancements in control systems for seamless integration with UPS and grid power. Furthermore, the development of integrated power management solutions that combine UPS, PDUs, and monitoring software is a key trend, offering a holistic approach to data center power infrastructure management and providing a competitive advantage through enhanced operational visibility and control.

Key Drivers of Malaysia Data Center Power Market Growth

The Malaysian data center power market's growth is primarily fueled by the accelerating digitalization across all economic sectors. The surge in cloud adoption, the expansion of e-commerce platforms, and the increasing reliance on big data analytics necessitate robust and scalable data center infrastructure. Government initiatives promoting Malaysia as a regional digital hub, coupled with attractive foreign investment policies, are attracting substantial capital into data center development. Furthermore, the growing adoption of advanced technologies such as Artificial Intelligence (AI), the Internet of Things (IoT), and 5G networks are creating an unprecedented demand for high-performance computing power, directly translating into increased data center power requirements. Energy efficiency and sustainability are also becoming key drivers, pushing for the adoption of advanced power management solutions that reduce operational costs and environmental impact.

Challenges in the Malaysia Data Center Power Market Market

Despite its strong growth trajectory, the Malaysia Data Center Power Market faces several challenges. The increasing complexity of data center power infrastructure demands specialized technical expertise for installation, maintenance, and troubleshooting, leading to a potential skills gap. High capital expenditure for advanced power solutions can be a barrier for smaller operators or new entrants. Fluctuations in the global supply chain for critical components can impact project timelines and costs. Furthermore, evolving environmental regulations and the need for sustainable power solutions require continuous investment in greener technologies, which can add to operational expenses. Competitive pressures from established players and the introduction of new technologies also necessitate constant innovation and adaptation.

Emerging Opportunities in Malaysia Data Center Power Market

Significant catalysts are driving long-term growth in the Malaysia Data Center Power Market. The burgeoning demand for hyperscale and edge data centers presents a substantial opportunity for providers of high-density power solutions. Strategic partnerships between power infrastructure providers, data center operators, and technology companies are emerging, fostering innovation and collaborative solutions. The increasing focus on renewable energy integration within data centers opens avenues for solutions that leverage solar, wind, and other sustainable sources. Furthermore, the ongoing digital transformation across industries in Malaysia, coupled with the nation's strategic location in Southeast Asia, positions it as a prime market for further data center expansion, creating sustained demand for advanced power management technologies and services.

Leading Players in the Malaysia Data Center Power Market Sector

- ABB Ltd

- Rolls-Royce PLC

- Legrand Group

- Schneider Electric SE

- Fujitsu Limited

- Caterpillar Inc

- Rittal GmbH & Co KG

- Cisco Systems Inc

- Cummins Inc

- Vertiv Group Corp

- Eaton Corporation

Key Milestones in Malaysia Data Center Power Market Industry

- December 2023: Eaton, an intelligent power management company, launched its new Rack PDU G4 (4th generation), offering high security and business continuity for data centers. This product features C39 outlets, securely connecting C14 and C20 power cords with a locking mechanism and a built-in high retention system.

- November 2023: ABB Ltd announced the launch of the Protecta Power panel board, designed for industrial, commercial, and institutional buildings. This integrated panel board features digital monitoring and control technology, enhancing durability and safety.

Strategic Outlook for Malaysia Data Center Power Market Market

The strategic outlook for the Malaysia Data Center Power Market is exceptionally positive, driven by sustained demand for digital infrastructure. Growth accelerators include the continued expansion of hyperscale and colocation facilities, fueled by increasing cloud adoption and regional digital hub initiatives. Investments in edge computing infrastructure and the integration of renewable energy sources into data center power strategies will further shape market dynamics. Companies that focus on offering intelligent, energy-efficient, and highly reliable power solutions, coupled with robust service and support capabilities, will be well-positioned for success. Strategic partnerships and technological innovation in areas like advanced cooling integration and smart grid connectivity will be crucial for capturing future market potential.

Malaysia Data Center Power Market Segmentation

-

1. Power Infrastructure

-

1.1. Electrical Solution

- 1.1.1. UPS Systems

- 1.1.2. Generators

-

1.1.3. Power Distribution Solutions

- 1.1.3.1. PDU

- 1.1.3.2. Switchgear

- 1.1.3.3. Critical Power Distribution

- 1.1.3.4. Transfer Switches

- 1.1.3.5. Remote Power Panels

- 1.1.3.6. Others

- 1.2. Service

-

1.1. Electrical Solution

-

2. End User

- 2.1. IT and Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media and Entertainment

- 2.5. Other End Users

Malaysia Data Center Power Market Segmentation By Geography

- 1. Malaysia

Malaysia Data Center Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 12.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. The IT and Telecommunication Segment Holds a Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Malaysia Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 5.1.1. Electrical Solution

- 5.1.1.1. UPS Systems

- 5.1.1.2. Generators

- 5.1.1.3. Power Distribution Solutions

- 5.1.1.3.1. PDU

- 5.1.1.3.2. Switchgear

- 5.1.1.3.3. Critical Power Distribution

- 5.1.1.3.4. Transfer Switches

- 5.1.1.3.5. Remote Power Panels

- 5.1.1.3.6. Others

- 5.1.2. Service

- 5.1.1. Electrical Solution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT and Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media and Entertainment

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Malaysia

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Rolls-Royce PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Legrand Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider Electric SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fujitsu Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rittal GmbH & Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Cisco Systems Inc *List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cummins Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vertiv Group Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eaton Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Malaysia Data Center Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Malaysia Data Center Power Market Share (%) by Company 2024

List of Tables

- Table 1: Malaysia Data Center Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Malaysia Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2019 & 2032

- Table 3: Malaysia Data Center Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Malaysia Data Center Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Malaysia Data Center Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Malaysia Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2019 & 2032

- Table 7: Malaysia Data Center Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Malaysia Data Center Power Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Malaysia Data Center Power Market?

The projected CAGR is approximately 12.60%.

2. Which companies are prominent players in the Malaysia Data Center Power Market?

Key companies in the market include ABB Ltd, Rolls-Royce PLC, Legrand Group, Schneider Electric SE, Fujitsu Limited, Caterpillar Inc, Rittal GmbH & Co KG, Cisco Systems Inc *List Not Exhaustive, Cummins Inc, Vertiv Group Corp, Eaton Corporation.

3. What are the main segments of the Malaysia Data Center Power Market?

The market segments include Power Infrastructure, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 317.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

The IT and Telecommunication Segment Holds a Major Share in the Market.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

December 2023: Eaton, an intelligent power management company, announced the launch of its new Rack PDU G4 (4th generation) that provides a high security and business continuity data center. It is also combined with C39 outlets that securely connect both C14 and C20 power cords, backed by a locking mechanism and a built-in high retention system that secures the power cord.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Malaysia Data Center Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Malaysia Data Center Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Malaysia Data Center Power Market?

To stay informed about further developments, trends, and reports in the Malaysia Data Center Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence