Key Insights

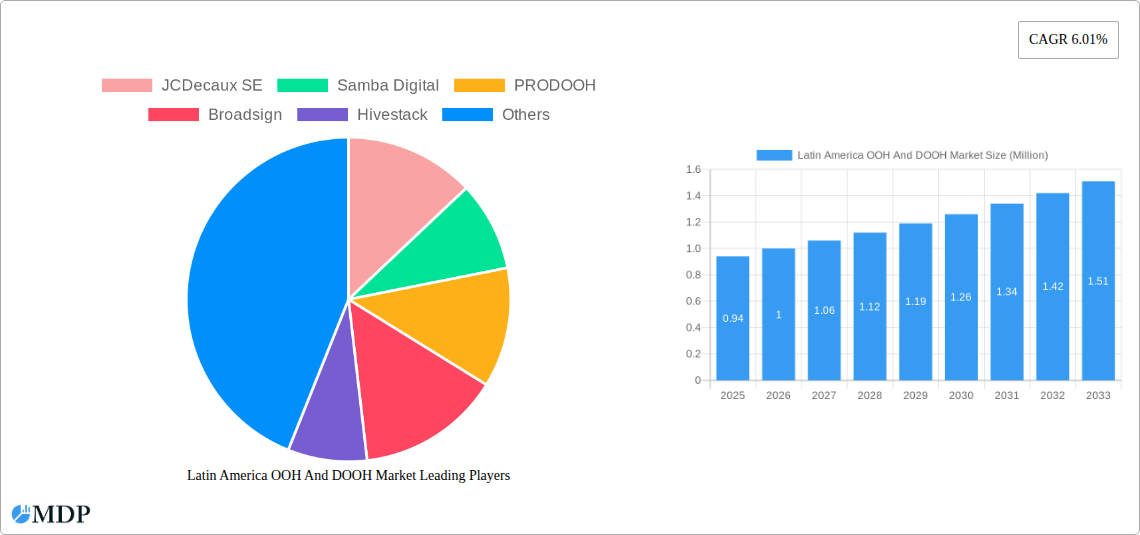

The Latin America Out-of-Home (OOH) and Digital Out-of-Home (DOOH) market is poised for significant expansion, projected to reach an estimated USD 0.94 million in 2025 and sustain a robust Compound Annual Growth Rate (CAGR) of 6.01% through 2033. This growth is primarily propelled by the increasing adoption of digital technologies that offer dynamic content delivery and enhanced targeting capabilities, transforming traditional static billboards into interactive and data-driven advertising platforms. The shift towards programmatic DOOH, allowing for automated buying and selling of ad space, is a key driver, enabling advertisers to reach specific audiences more efficiently across various locations.

Latin America OOH And DOOH Market Market Size (In Million)

Key segments driving this market evolution include Digital OOH (DOOH) solutions, particularly LED screens, which are becoming ubiquitous in high-traffic areas. The application of OOH advertising is broadening, with significant uptake in transportation hubs like airports and within transit systems such as buses, alongside street furniture and other place-based media. This diversification allows for pervasive brand presence across consumer journeys. Furthermore, the end-user landscape is expanding, with the Automotive, Retail and Consumer Goods, Healthcare, and BFSI sectors increasingly leveraging OOH and DOOH for impactful campaigns. Emerging economies within Latin America, such as Brazil, Mexico, and Colombia, are expected to lead this growth trajectory due to rising disposable incomes, increasing urbanization, and greater investment in advertising infrastructure. While the market is expanding, potential restraints could include evolving privacy regulations and the initial capital investment required for advanced DOOH infrastructure, which may necessitate strategic partnerships and innovative financing models.

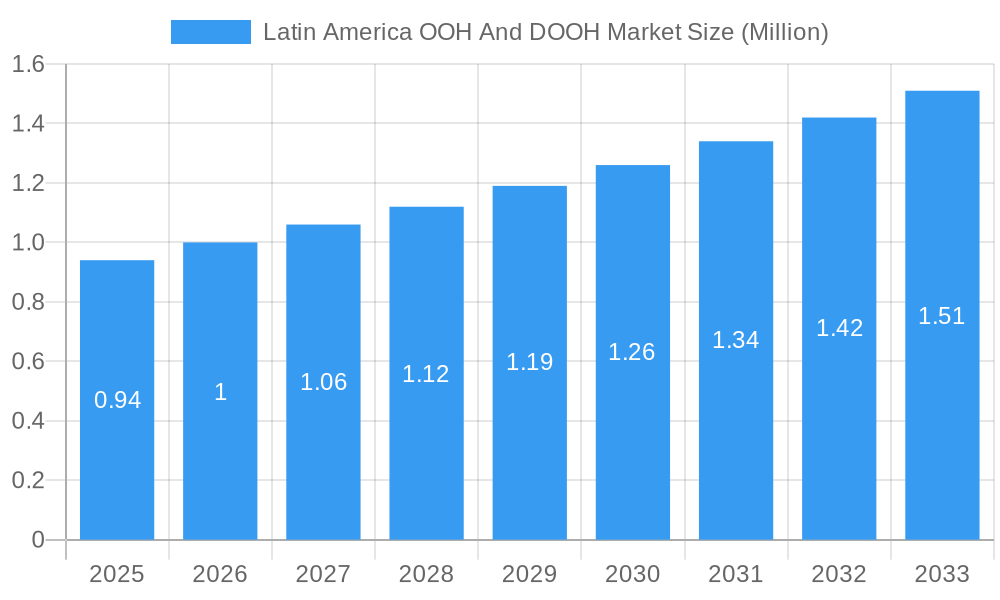

Latin America OOH And DOOH Market Company Market Share

Dive deep into the dynamic and rapidly evolving Latin America Out-of-Home (OOH) and Digital Out-of-Home (DOOH) advertising market. This comprehensive report, covering the study period from 2019 to 2033 with a base year of 2025, provides unparalleled insights for industry stakeholders seeking to capitalize on this high-growth region. Explore the intricate interplay of market forces, technological advancements, and evolving consumer behavior that are reshaping the advertising landscape across Latin America. With a forecast period extending from 2025 to 2033, this report offers a robust roadmap for strategic decision-making and investment.

Latin America OOH And DOOH Market Market Dynamics & Concentration

The Latin America OOH and DOOH market is characterized by a moderate concentration of key players, with a growing influx of innovative companies driving market expansion. Market share is increasingly being influenced by digital transformation and programmatic capabilities. Innovation drivers include the widespread adoption of programmatic OOH, the integration of data analytics for targeted campaigns, and the development of interactive DOOH experiences. Regulatory frameworks are evolving to accommodate the digital shift, with a focus on data privacy and ad standards. Product substitutes, while present in digital media, are increasingly being integrated within the OOH ecosystem. End-user trends showcase a strong demand for measurable and data-driven OOH solutions, particularly from the Automotive, Retail and Consumer Goods, Healthcare, and BFSI sectors. M&A activities are on the rise as larger entities seek to consolidate their market position and acquire technological capabilities. While specific M&A deal counts are dynamic, recent years have seen a consistent increase in strategic acquisitions and partnerships aimed at expanding reach and technological prowess.

Latin America OOH And DOOH Market Industry Trends & Analysis

The Latin America OOH and DOOH market is poised for significant growth, fueled by increasing urbanization, a rising middle class, and a surge in digital infrastructure across the region. The CAGR for the DOOH segment is projected to be substantially higher than traditional OOH, driven by the enhanced capabilities of digital screens. Technological disruptions are paramount, with programmatic DOOH emerging as a game-changer, enabling automated buying and selling of ad space, sophisticated audience targeting, and real-time campaign optimization. This shift is significantly impacting market penetration of digital formats, which are rapidly gaining ground. Consumer preferences are evolving towards more engaging and interactive advertising experiences. Viewers are more receptive to dynamic content, personalized messaging, and integrated calls to action delivered through DOOH. The competitive dynamics are intensifying, with both global OOH giants and agile local players vying for market share. The development of sophisticated ad tech platforms and the increasing availability of high-quality digital inventory are key factors driving this competition. The integration of artificial intelligence and machine learning for audience insights and campaign personalization is also becoming a critical differentiator. Furthermore, the growing demand for accountability and return on investment (ROI) from advertisers is pushing OOH providers to offer more sophisticated measurement tools and analytics. This report will delve into these trends, providing a detailed analysis of their impact on market growth and strategic positioning.

Leading Markets & Segments in Latin America OOH And DOOH Market

The Billboard segment is a dominant force within the Latin America OOH and DOOH market, particularly in major urban centers, owing to its high visibility and broad reach. However, the Transportation (Transit) segment, encompassing Airports and Other (Buses, etc.), is experiencing exponential growth. This surge is driven by increasing passenger traffic and the strategic placement of digital screens in high-dwell-time environments, offering advertisers captive audiences. Street Furniture also holds significant importance, providing localized reach and engaging consumers at ground level. The dominance of Digital OOH (LED Screens), including Programmatic OOH, is a defining trend across all these applications. Programmatic OOH offers unprecedented flexibility, targeting capabilities, and efficiency, making it increasingly attractive to advertisers.

- Dominant Regions: Key economic hubs like Brazil and Mexico are leading the charge, driven by substantial advertising spends and developing digital infrastructures.

- Segment Dominance Drivers:

- Transportation (Airports): High-value audience, captive viewership, and prime locations for luxury and travel-related brands. Economic policies promoting tourism and infrastructure development in airports are key drivers.

- Billboards: Cost-effectiveness for broad reach, especially in developing markets. Urbanization and infrastructure development projects that increase outdoor advertising real estate are crucial.

- Digital OOH (Programmatic OOH): Technological advancements, increasing programmatic adoption, and the demand for data-driven campaign management. Government initiatives supporting digital transformation and smart city development play a role.

- End-User Dominance:

- Retail and Consumer Goods: This sector consistently invests heavily due to OOH's ability to drive immediate purchase decisions and build brand awareness.

- Automotive: Leverages OOH for new model launches and brand visibility in high-traffic areas.

- BFSI: Utilizes OOH for brand building and reaching specific demographic segments.

Latin America OOH And DOOH Market Product Developments

The Latin America OOH and DOOH market is witnessing a wave of innovative product developments focused on enhancing engagement, measurability, and efficiency. Key innovations include the integration of interactive touchscreens, augmented reality (AR) experiences, and programmatic capabilities that allow for real-time campaign adjustments. The increasing use of high-resolution LED screens offers superior visual appeal and dynamic content delivery. Advancements in data analytics and audience measurement technologies are providing advertisers with deeper insights into campaign performance and consumer behavior. These developments aim to bridge the gap between traditional OOH's reach and digital media's measurability, offering a compelling value proposition to advertisers seeking impactful and accountable campaigns.

Key Drivers of Latin America OOH And DOOH Market Growth

Several factors are propelling the growth of the Latin America OOH and DOOH market. The accelerating digital transformation across the region is a primary driver, leading to increased adoption of DOOH screens and programmatic buying. Economic recovery and increasing disposable incomes are boosting advertising expenditures across various sectors. Furthermore, growing urbanization and infrastructure development are creating new opportunities for OOH placements. The demand for more targeted and measurable advertising solutions is also a significant catalyst, pushing the industry towards data-driven strategies. The inherent strengths of OOH, such as its broad reach and ability to create impactful brand experiences, combined with the technological advancements of DOOH, are creating a powerful synergy for market expansion.

Challenges in the Latin America OOH And DOOH Market Market

Despite the robust growth trajectory, the Latin America OOH and DOOH market faces several challenges. Regulatory hurdles and varying advertising laws across different countries can complicate campaign execution and expansion. Supply chain disruptions, though easing, can still impact the deployment of new digital screens. Intense competition from other media channels, including digital and social media, necessitates continuous innovation and demonstration of ROI. Furthermore, the initial investment cost for advanced DOOH infrastructure can be a barrier for some media owners. Economic volatility in certain Latin American countries can also lead to fluctuations in advertising budgets.

Emerging Opportunities in Latin America OOH And DOOH Market

The Latin America OOH and DOOH market is ripe with emerging opportunities. The continued expansion of programmatic DOOH platforms presents a significant avenue for growth, enabling greater efficiency and accessibility for advertisers. The development of smart city initiatives across the region will create new placements for digital advertising and integrate OOH into urban infrastructure. The increasing adoption of AI and machine learning for audience segmentation and real-time campaign optimization will unlock more precise targeting capabilities. Strategic partnerships between technology providers, media owners, and advertisers are crucial for fostering innovation and developing tailored solutions. Furthermore, the untapped potential in smaller urban centers and emerging markets offers significant expansion opportunities.

Leading Players in the Latin America OOH And DOOH Market Sector

- JCDecaux SE

- Samba Digital

- PRODOOH

- Broadsign

- Hivestack

- Mooving Walls

- Vistar Media

- Clear Channel Outdoor Americas Inc

- Adsmovil

- Location Media Xchange

Key Milestones in Latin America OOH And DOOH Market Industry

- February 2024: Hivestack by Perion, an ad platform, partnered with Eletromidia in Brazil, making 46,000 Eletromidia displays accessible via the Hivestack supply-side platform, reaching an estimated 29 million daily viewers.

- December 2023: Location Media Xchange (LMX) integrated with Latinad CMS, empowering Latin American media owners to execute programmatic campaigns seamlessly through Latinad CMS.

Strategic Outlook for Latin America OOH And DOOH Market Market

The strategic outlook for the Latin America OOH and DOOH market is overwhelmingly positive. Growth will be accelerated by the deepening integration of programmatic capabilities, enabling more data-driven and automated advertising processes. The continuous innovation in DOOH technology, including interactive features and enhanced creative possibilities, will further attract advertisers. Strategic partnerships will be instrumental in expanding market reach and developing bespoke advertising solutions. The increasing focus on sustainability and the development of smart city integrations will also present new avenues for growth and differentiation. As the region continues its digital transformation, OOH and DOOH are well-positioned to play a pivotal role in the future of advertising.

Latin America OOH And DOOH Market Segmentation

-

1. Type

- 1.1. Static (Traditional) OOH

-

1.2. Digital OOH (LED Screens)

- 1.2.1. Programmatic OOH

- 1.2.2. Other Types

-

2. Appli

- 2.1. Billboard

-

2.2. Transportation (Transit)

- 2.2.1. Airports

- 2.2.2. Others (Buses, etc.)

- 2.3. Street Furniture

- 2.4. Other Place-based Media

-

3. End-u

- 3.1. Automotive

- 3.2. Retail and Consumer Goods

- 3.3. Healthcare

- 3.4. BFSI

- 3.5. Other End-user Industries

Latin America OOH And DOOH Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America OOH And DOOH Market Regional Market Share

Geographic Coverage of Latin America OOH And DOOH Market

Latin America OOH And DOOH Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines

- 3.3. Market Restrains

- 3.3.1. Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines

- 3.4. Market Trends

- 3.4.1. The Ongoing Shift Toward Digital Advertising is Expected to Boost the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America OOH And DOOH Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Static (Traditional) OOH

- 5.1.2. Digital OOH (LED Screens)

- 5.1.2.1. Programmatic OOH

- 5.1.2.2. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Appli

- 5.2.1. Billboard

- 5.2.2. Transportation (Transit)

- 5.2.2.1. Airports

- 5.2.2.2. Others (Buses, etc.)

- 5.2.3. Street Furniture

- 5.2.4. Other Place-based Media

- 5.3. Market Analysis, Insights and Forecast - by End-u

- 5.3.1. Automotive

- 5.3.2. Retail and Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. BFSI

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 JCDecaux SE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samba Digital

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PRODOOH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Broadsign

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Hivestack

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Mooving Walls

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Vistar Media

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Clear Channel Outdoor Americas Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Adsmovil

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Location Media Xchange*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 JCDecaux SE

List of Figures

- Figure 1: Latin America OOH And DOOH Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America OOH And DOOH Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America OOH And DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Latin America OOH And DOOH Market Volume Billion Forecast, by Type 2020 & 2033

- Table 3: Latin America OOH And DOOH Market Revenue Million Forecast, by Appli 2020 & 2033

- Table 4: Latin America OOH And DOOH Market Volume Billion Forecast, by Appli 2020 & 2033

- Table 5: Latin America OOH And DOOH Market Revenue Million Forecast, by End-u 2020 & 2033

- Table 6: Latin America OOH And DOOH Market Volume Billion Forecast, by End-u 2020 & 2033

- Table 7: Latin America OOH And DOOH Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Latin America OOH And DOOH Market Volume Billion Forecast, by Region 2020 & 2033

- Table 9: Latin America OOH And DOOH Market Revenue Million Forecast, by Type 2020 & 2033

- Table 10: Latin America OOH And DOOH Market Volume Billion Forecast, by Type 2020 & 2033

- Table 11: Latin America OOH And DOOH Market Revenue Million Forecast, by Appli 2020 & 2033

- Table 12: Latin America OOH And DOOH Market Volume Billion Forecast, by Appli 2020 & 2033

- Table 13: Latin America OOH And DOOH Market Revenue Million Forecast, by End-u 2020 & 2033

- Table 14: Latin America OOH And DOOH Market Volume Billion Forecast, by End-u 2020 & 2033

- Table 15: Latin America OOH And DOOH Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Latin America OOH And DOOH Market Volume Billion Forecast, by Country 2020 & 2033

- Table 17: Brazil Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Brazil Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Argentina Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Argentina Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Chile Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Chile Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Colombia Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Colombia Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Mexico Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Peru Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Peru Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Venezuela Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Venezuela Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Ecuador Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Ecuador Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Bolivia Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Bolivia Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Paraguay Latin America OOH And DOOH Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Paraguay Latin America OOH And DOOH Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America OOH And DOOH Market?

The projected CAGR is approximately 6.01%.

2. Which companies are prominent players in the Latin America OOH And DOOH Market?

Key companies in the market include JCDecaux SE, Samba Digital, PRODOOH, Broadsign, Hivestack, Mooving Walls, Vistar Media, Clear Channel Outdoor Americas Inc, Adsmovil, Location Media Xchange*List Not Exhaustive.

3. What are the main segments of the Latin America OOH And DOOH Market?

The market segments include Type , Appli, End-u.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines.

6. What are the notable trends driving market growth?

The Ongoing Shift Toward Digital Advertising is Expected to Boost the Market's Growth.

7. Are there any restraints impacting market growth?

Ongoing Shift Toward Digital Advertising; Increasing Use of Recommendation Engines.

8. Can you provide examples of recent developments in the market?

February 2024: Hivestack by Perion, which operates a digital OOH advertising platform, announced its partnership with Eletromidia, an OOH media company based in Brazil. As part of the partnership, 46,000 Eletromidia displays across Brazil will be available to advertisers via the Hivestack supply side platform, with daily viewership estimated at 29 million for the Eletromidia display network.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America OOH And DOOH Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America OOH And DOOH Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America OOH And DOOH Market?

To stay informed about further developments, trends, and reports in the Latin America OOH And DOOH Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence