Key Insights

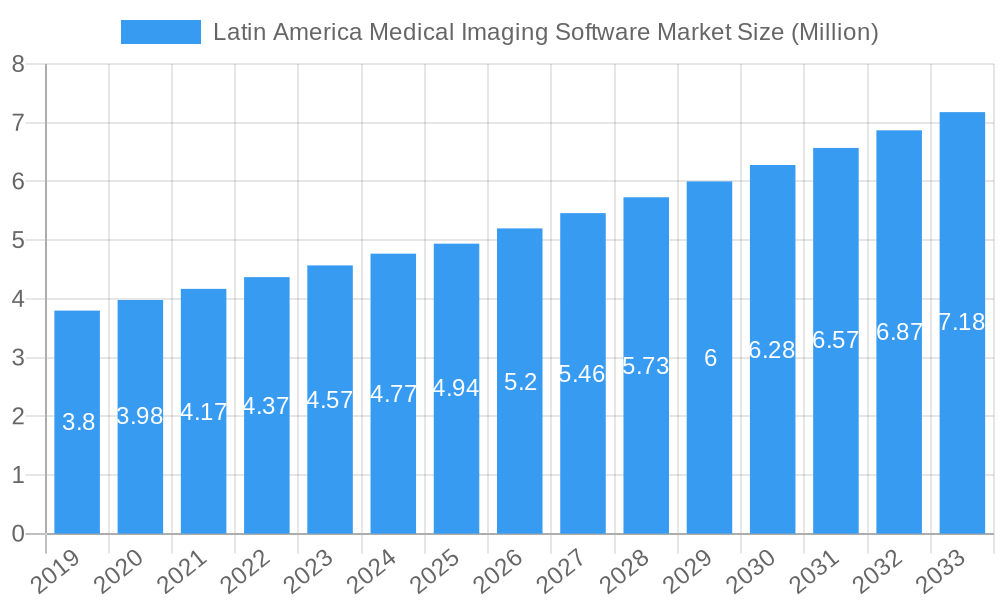

The Latin America Medical Imaging Software Market is poised for significant expansion, with an estimated market size of USD 4.94 billion in 2025, projected to grow at a robust Compound Annual Growth Rate (CAGR) of 6.26% through 2033. This growth is primarily fueled by the increasing adoption of advanced imaging modalities, such as 3D and 4D imaging, across various medical applications including cardiology, orthopaedics, and obstetrics and gynaecology. The rising prevalence of chronic diseases, coupled with a growing emphasis on early diagnosis and personalized treatment plans, is further accelerating the demand for sophisticated medical imaging software solutions in the region. Furthermore, government initiatives aimed at improving healthcare infrastructure and increasing access to advanced diagnostic technologies are playing a crucial role in driving market penetration. The increasing investment in research and development by key market players is leading to the introduction of innovative software features, enhancing diagnostic accuracy and workflow efficiency, which are essential for capturing a larger market share.

Latin America Medical Imaging Software Market Market Size (In Million)

The market is characterized by distinct segmentation, with Dental, Orthopaedic, and Cardiology applications emerging as key revenue drivers. Within imaging types, 3D and 4D imaging are witnessing substantial uptake due to their superior visualization capabilities compared to traditional 2D imaging, enabling more precise diagnoses and treatment planning. However, the market faces certain restraints, including the high cost of advanced software implementation and the need for skilled professionals to operate and interpret complex imaging data. Despite these challenges, the continuous technological advancements, such as AI-powered diagnostic tools and cloud-based solutions, are expected to mitigate these restraints and unlock new growth avenues. Key companies like Siemens Healthcare, GE Healthcare, and Philips Healthcare are actively investing in this dynamic region, offering a diverse portfolio of cutting-edge medical imaging software to cater to the evolving needs of healthcare providers and patients across Latin America.

Latin America Medical Imaging Software Market Company Market Share

This comprehensive report provides an in-depth analysis of the Latin America Medical Imaging Software Market, a rapidly evolving sector projected for significant expansion. Discover market dynamics, emerging trends, key growth drivers, and strategic opportunities from 2019 to 2033, with a base year of 2025. This report is essential for stakeholders seeking to understand the competitive landscape, technological advancements, and future trajectory of medical imaging software solutions across the region. Explore detailed segmentation by imaging type and application, alongside an analysis of leading players and crucial industry developments.

Latin America Medical Imaging Software Market Market Dynamics & Concentration

The Latin America Medical Imaging Software Market is characterized by moderate to high concentration, with a few prominent players like Siemens Healthcare, GE Healthcare, and Philips Healthcare holding significant market share. Innovation is a key driver, propelled by the increasing adoption of AI-driven diagnostic tools and cloud-based PACS solutions. Regulatory frameworks are evolving, with a growing emphasis on data privacy and cybersecurity, influencing software development and deployment. Product substitutes, such as standalone imaging hardware, exist but are increasingly being integrated with advanced software capabilities. End-user trends indicate a strong demand for user-friendly interfaces, interoperability, and cost-effective solutions, particularly in emerging economies. Mergers and acquisitions (M&A) activities are on the rise as companies seek to expand their product portfolios and geographic reach. For instance, in the historical period 2019-2024, we observed XX M&A deals, contributing to market consolidation and the introduction of innovative technologies.

Latin America Medical Imaging Software Market Industry Trends & Analysis

The Latin America Medical Imaging Software Market is experiencing robust growth, driven by several key factors. The increasing prevalence of chronic diseases, coupled with an aging population, is fueling the demand for advanced diagnostic imaging solutions. Technological advancements, particularly in Artificial Intelligence (AI), Machine Learning (ML), and cloud computing, are revolutionizing medical image analysis, leading to improved diagnostic accuracy and efficiency. AI-powered software, for example, is enhancing the interpretation of X-rays, CT scans, and MRIs, aiding in early disease detection and personalized treatment planning. The rising healthcare expenditure across Latin American countries, alongside government initiatives to improve healthcare infrastructure and access to advanced medical technologies, further supports market expansion. The growing adoption of Picture Archiving and Communication Systems (PACS) and the expansion of Electronic Health Records (EHRs) are creating a conducive environment for integrated medical imaging software solutions. Furthermore, the increasing demand for teleradiology services, especially in remote areas, is driving the need for advanced remote access and collaboration features in medical imaging software.

The market penetration of advanced imaging software is steadily increasing, with an estimated compound annual growth rate (CAGR) of xx% during the forecast period 2025–2033. Consumer preferences are shifting towards solutions that offer seamless integration with existing hospital systems, enhanced workflow optimization, and superior image quality. The competitive dynamics are shaped by a blend of global giants and local innovators, each vying to capture market share through product differentiation, strategic partnerships, and competitive pricing. The growing awareness among healthcare providers about the benefits of digital imaging solutions, including reduced radiation exposure and improved patient outcomes, is another significant growth driver.

Leading Markets & Segments in Latin America Medical Imaging Software Market

The Latin America Medical Imaging Software Market is segmented by Imaging Type and Application, with distinct growth patterns across various sub-segments.

Imaging Type:

- 2D Imaging: Continues to hold a significant market share due to its widespread use in routine diagnostics and its cost-effectiveness. Key drivers include its established workflow integration and broad applicability across various medical specialties.

- 3D Imaging: Demonstrates robust growth, driven by its superior visualization capabilities, crucial for complex diagnoses in fields like orthopedics and cardiology. The increasing availability of 3D imaging modalities and software advancements are propelling its adoption.

- 4D Imaging: While a niche segment, 4D imaging is gaining traction in specific applications like cardiac imaging and obstetrics, offering dynamic, real-time visualization of biological processes.

Application:

- Cardiology Applications: This segment is a major revenue generator, fueled by the high prevalence of cardiovascular diseases in Latin America. Advanced imaging software plays a critical role in diagnosing and managing conditions such as coronary artery disease, heart failure, and arrhythmias. The demand for real-time monitoring and predictive analytics in cardiology is a key growth accelerator.

- Orthopaedic Applications: Experiencing substantial growth, driven by the increasing incidence of sports injuries, degenerative joint diseases, and the rising adoption of minimally invasive surgical procedures. 3D imaging software is instrumental in pre-operative planning, intra-operative guidance, and post-operative assessment.

- Obstetrics and Gynaecology Applications: A stable and growing segment, with a continuous need for advanced imaging for prenatal screening, fetal anomaly detection, and reproductive health management. The demand for high-resolution imaging and advanced visualization tools for fetal development monitoring is significant.

- Mammography Applications: Crucial for early breast cancer detection, this segment is seeing increased adoption of digital mammography and advanced image analysis software, including AI-powered tools for improved screening accuracy and reduced false positives.

- Dental Applications: Driven by the increasing focus on oral health and the adoption of digital radiography and 3D dental imaging technologies, such as cone-beam computed tomography (CBCT).

- Urology and Nephrology Applications: Growing demand for advanced imaging software to diagnose and manage urinary tract infections, kidney stones, and renal diseases.

- Other Applications: Encompassing a wide range of specialties including neurology, oncology, and general radiology, contributing to the overall market growth.

The dominance of specific regions and countries within Latin America is influenced by economic policies, healthcare infrastructure development, and government investments in medical technology. Brazil and Mexico are key markets due to their larger populations and significant healthcare spending.

Latin America Medical Imaging Software Market Product Developments

Product development in the Latin America Medical Imaging Software Market is intensely focused on enhancing diagnostic accuracy and workflow efficiency through AI integration. Companies are launching advanced software solutions with features like automated image segmentation, anomaly detection, and predictive analytics, particularly for oncology and cardiology. Cloud-based platforms are gaining prominence, enabling seamless data sharing, remote access, and scalable storage. Innovations are also centered on improving user interfaces for greater ease of use and interoperability with existing hospital IT systems. For example, the integration of AI algorithms into mammography software aims to improve early detection rates of breast cancer.

Key Drivers of Latin America Medical Imaging Software Market Growth

The Latin America Medical Imaging Software Market is propelled by several critical growth drivers. Firstly, the increasing incidence of chronic diseases such as cardiovascular diseases, cancer, and diabetes necessitates sophisticated diagnostic tools, including advanced imaging software. Secondly, the growing adoption of digital health technologies, including AI, ML, and cloud computing, is revolutionizing medical image analysis and interpretation, leading to improved diagnostic accuracy and efficiency. Thirdly, rising healthcare expenditure and government initiatives aimed at modernizing healthcare infrastructure across Latin American countries are creating a more favorable market environment. Finally, the increasing demand for minimally invasive procedures and personalized medicine further amplifies the need for precise and detailed imaging data provided by advanced software solutions.

Challenges in the Latin America Medical Imaging Software Market Market

Despite the promising growth trajectory, the Latin America Medical Imaging Software Market faces several challenges. High upfront costs associated with advanced imaging software and hardware can be a barrier to adoption, particularly for smaller healthcare facilities and in less developed regions. Furthermore, a shortage of skilled radiographers and radiologists proficient in utilizing advanced software solutions can hinder efficient implementation. Regulatory hurdles and varying compliance standards across different Latin American countries can also complicate market entry and product deployment. Cybersecurity concerns and the need for robust data protection measures are paramount, especially with the increasing reliance on cloud-based solutions.

Emerging Opportunities in Latin America Medical Imaging Software Market

Emerging opportunities in the Latin America Medical Imaging Software Market are primarily driven by the burgeoning field of Artificial Intelligence and the expansion of telehealth services. The development and adoption of AI-powered diagnostic tools for early disease detection, such as cancer screening and cardiac anomaly identification, present significant growth potential. Furthermore, the increasing demand for teleradiology services, particularly in remote and underserved areas, is creating a need for robust remote viewing, collaboration, and reporting software. Strategic partnerships between software developers and healthcare providers, as well as collaborations with AI research institutions, will be crucial for harnessing these opportunities and accelerating market penetration. The growing focus on precision medicine also opens doors for specialized imaging analysis software.

Leading Players in the Latin America Medical Imaging Software Market Sector

- Sectra AB

- Esaote SpA

- Siemens Healthcare

- GE Healthcare

- Philips Healthcare

- Agfa Gevaert HealthCare

- Carestream Health

- MIM Software Inc

- Canon Medical Systems Corporation

- Delft Imaging

Key Milestones in Latin America Medical Imaging Software Market Industry

- June 2023: The Hospital Israelita Albert Einstein in Sao Paulo, Brazil, signed a software license deal with Lunit, a global supplier of AI-powered cancer treatments. Lunit will provide its AI solution for chest x-ray image processing, Lunit INSIGHT CXR, to the hospital for three years. The hospital plans to leverage this AI technology for screening chest X-ray images in its emergency room, intensive care unit, and during in-patient exams, enhancing diagnostic capabilities.

- May 2023: Thermo Fisher Scientific and Pfizer entered into a collaborative deal to expand localized access to next-generation sequencing (NGS)-based diagnostics for cancer patients in international markets. This initiative aims to accelerate the study of genes related to lung and breast cancer in over 30 countries, including Latin America, where access to sophisticated genomic testing has been limited or unavailable, potentially impacting the demand for advanced diagnostic software.

Strategic Outlook for Latin America Medical Imaging Software Market Market

The strategic outlook for the Latin America Medical Imaging Software Market is overwhelmingly positive, with a strong focus on innovation and strategic expansion. The integration of advanced AI and machine learning algorithms into imaging software will continue to be a primary growth accelerator, enabling more accurate and efficient diagnoses. The increasing demand for cloud-based solutions will drive market growth, facilitating data accessibility, collaboration, and scalability. Strategic partnerships and collaborations among technology providers, healthcare institutions, and research organizations will be crucial for developing and deploying cutting-edge solutions. Furthermore, addressing the affordability challenge and investing in training and development programs for healthcare professionals will be key to unlocking the full market potential and ensuring widespread adoption of advanced medical imaging software across the region.

Latin America Medical Imaging Software Market Segmentation

-

1. Imaging Type

- 1.1. 2D Imaging

- 1.2. 3D Imaging

- 1.3. 4D Imaging

-

2. Application

- 2.1. Dental Applications

- 2.2. Orthopaedic Applications

- 2.3. Cardiology Applications

- 2.4. Obstetrics and Gynaecology Applications

- 2.5. Mammography Applications

- 2.6. Urology and Nephrology Applications

- 2.7. Other Applications

Latin America Medical Imaging Software Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Medical Imaging Software Market Regional Market Share

Geographic Coverage of Latin America Medical Imaging Software Market

Latin America Medical Imaging Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.26% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Usage of Imaging Equipment Due to Rising Prevalence of Chronic Diseases; Growing Application of Computer-Aided Diagnostic Methods

- 3.3. Market Restrains

- 3.3.1 High Set-up Cost of the Equipment; Limited Healthcare Infrastructure

- 3.3.2 Particularly in Rural and Remote Areas

- 3.4. Market Trends

- 3.4.1. Increasing Usage of Imaging Equipment Due to Rising Prevalence of Chronic Diseases to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Medical Imaging Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Imaging Type

- 5.1.1. 2D Imaging

- 5.1.2. 3D Imaging

- 5.1.3. 4D Imaging

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Dental Applications

- 5.2.2. Orthopaedic Applications

- 5.2.3. Cardiology Applications

- 5.2.4. Obstetrics and Gynaecology Applications

- 5.2.5. Mammography Applications

- 5.2.6. Urology and Nephrology Applications

- 5.2.7. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Imaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sectra AB

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Esaote SpA

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Siemens Healthcare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 GE Healthcare

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Philips Healthcare

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Agfa Gevaert HealthCare

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Carestream Health

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 MIM Software Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Canon Medical Systems Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Delft Imagin

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Sectra AB

List of Figures

- Figure 1: Latin America Medical Imaging Software Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Latin America Medical Imaging Software Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Medical Imaging Software Market Revenue Million Forecast, by Imaging Type 2020 & 2033

- Table 2: Latin America Medical Imaging Software Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Latin America Medical Imaging Software Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Latin America Medical Imaging Software Market Revenue Million Forecast, by Imaging Type 2020 & 2033

- Table 5: Latin America Medical Imaging Software Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Latin America Medical Imaging Software Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Medical Imaging Software Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Medical Imaging Software Market?

The projected CAGR is approximately 6.26%.

2. Which companies are prominent players in the Latin America Medical Imaging Software Market?

Key companies in the market include Sectra AB, Esaote SpA, Siemens Healthcare, GE Healthcare, Philips Healthcare, Agfa Gevaert HealthCare, Carestream Health, MIM Software Inc, Canon Medical Systems Corporation, Delft Imagin.

3. What are the main segments of the Latin America Medical Imaging Software Market?

The market segments include Imaging Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Usage of Imaging Equipment Due to Rising Prevalence of Chronic Diseases; Growing Application of Computer-Aided Diagnostic Methods.

6. What are the notable trends driving market growth?

Increasing Usage of Imaging Equipment Due to Rising Prevalence of Chronic Diseases to Drive the Market Growth.

7. Are there any restraints impacting market growth?

High Set-up Cost of the Equipment; Limited Healthcare Infrastructure. Particularly in Rural and Remote Areas.

8. Can you provide examples of recent developments in the market?

June 2023: The Hospital Israelita Albert Einstein in Sao Paulo, Brazil, and Lunit, a global supplier of AI-powered cancer treatments, have signed a software license deal. According to the agreement, Lunit will provide Hospital Israelita Albert Einstein for three years, or until 2025, with its artificial intelligence (AI) solution for chest x-ray image processing, Lunit INSIGHT CXR. The hospital intends to use Lunit's AI technology to screen chest X-ray images in its emergency room, intensive care unit, and during in-patient exams.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Medical Imaging Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Medical Imaging Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Medical Imaging Software Market?

To stay informed about further developments, trends, and reports in the Latin America Medical Imaging Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence