Key Insights

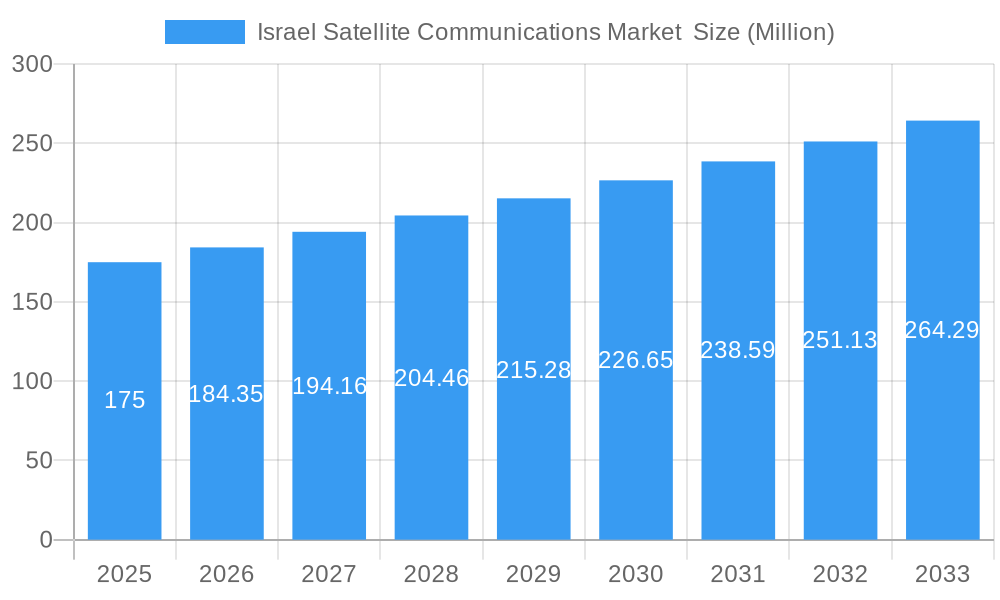

The Israel satellite communications market, exhibiting a Compound Annual Growth Rate (CAGR) of 5.20% from 2019 to 2024, is poised for continued expansion through 2033. Driven by increasing demand for high-bandwidth connectivity across various sectors, particularly defense and government, maritime, and media & entertainment, the market is witnessing significant investment in advanced satellite technologies. The market segmentation reveals a strong presence of both ground equipment and services, with portable and land-based platforms dominating the market share. While precise market sizing for 2025 is not provided, extrapolating from the historical data and the stated CAGR, a reasonable estimate for the 2025 market value would fall within the range of $150-$200 million. This growth is fueled by trends toward miniaturization, increased efficiency of satellite technology, and the burgeoning need for reliable, secure communications in remote or challenging environments. However, the market faces restraints including regulatory complexities, high initial investment costs associated with satellite infrastructure, and the competitive landscape with established global players. Israel's strategic location and its strong technological capabilities, however, position the nation as a key player in this growing sector.

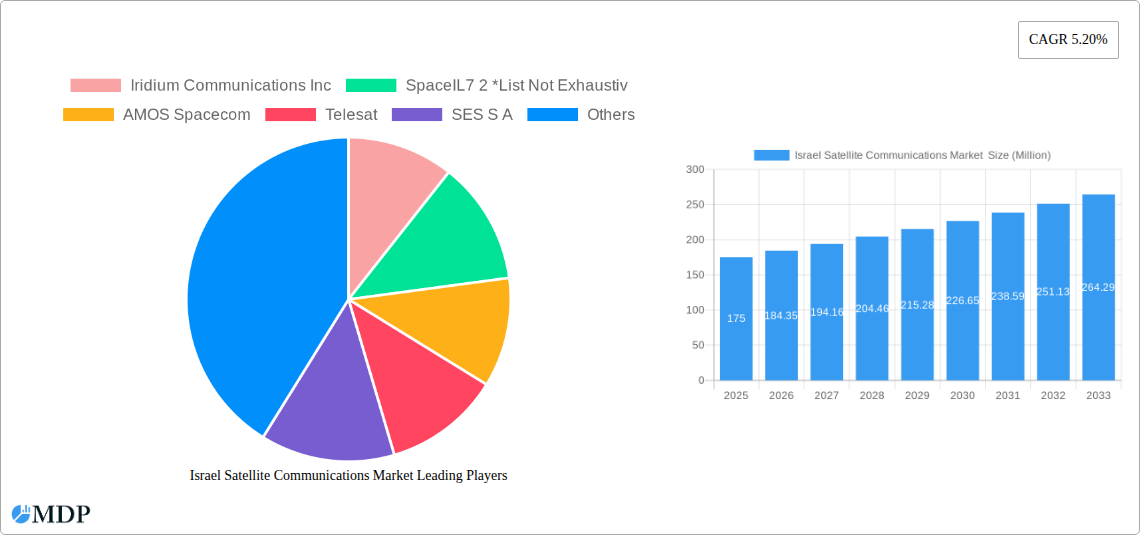

Israel Satellite Communications Market Market Size (In Million)

The leading companies in the Israeli satellite communications market, including Iridium Communications, SpaceIL, AMOS Spacecom, Telesat, and others, are actively investing in research and development to enhance satellite technology and expand their service offerings. The market's future growth will depend on continuous innovation, partnerships across sectors, and the strategic adoption of next-generation satellite technologies, like Low Earth Orbit (LEO) constellations. Government initiatives aimed at fostering technological advancement and infrastructure development will be crucial in driving further market expansion. The integration of satellite communication systems with other technologies such as 5G and IoT will also play a vital role in shaping the future of this market. This synergistic approach will likely create new opportunities and accelerate the adoption of advanced satellite communication solutions in Israel.

Israel Satellite Communications Market Company Market Share

Israel Satellite Communications Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Israel Satellite Communications Market, offering invaluable insights for industry stakeholders, investors, and strategic decision-makers. With a detailed examination of market dynamics, trends, leading players, and future opportunities, this report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 (base year 2025). The market is segmented by type (Ground Equipment, Services), platform (Portable, Land, Maritime, Airborne), and end-user vertical (Maritime, Defense & Government, Enterprises, Media & Entertainment, Others). The report's value surpasses xx Million USD and is projected to reach xx Million USD by 2033, exhibiting a CAGR of xx% during the forecast period.

Israel Satellite Communications Market Market Dynamics & Concentration

The Israeli satellite communications market exhibits a moderately concentrated landscape, with several key players holding significant market share. Market concentration is influenced by factors such as technological advancements, regulatory frameworks, and the prevalence of mergers and acquisitions (M&A). Innovation, particularly in areas like quantum communication and digital signal processing, is a key driver, pushing market expansion and fostering competition. The regulatory environment plays a significant role, shaping market access and investment. Product substitution, while present, is limited given the specialized nature of satellite communication technologies. End-user trends show a growing demand across various sectors, including defense, maritime, and media.

- Market Share: AMOS Spacecom, Gilat Satellite Networks, and Orbit Communication Systems Ltd. hold a significant share of the market, with precise figures varying due to proprietary business data.

- M&A Activity: The historical period (2019-2024) witnessed approximately xx M&A deals, primarily focusing on strategic partnerships and technological acquisitions to enhance capabilities and expand market reach. The forecast period is expected to show further consolidation.

- Innovation Drivers: Quantum communication advancements and the ongoing transition to digital signal processing are propelling growth and market differentiation.

- Regulatory Framework: Israeli government policies encouraging technological innovation and investment in space technologies support the market's growth.

Israel Satellite Communications Market Industry Trends & Analysis

The Israel satellite communications market is experiencing robust growth driven by several key factors. The increasing demand for high-bandwidth connectivity, particularly in remote areas, is a major catalyst. Technological disruptions, such as the introduction of advanced satellite technologies and the adoption of digital intermediate frequency interoperability, are enhancing efficiency and expanding the market's reach. Consumer preferences are shifting towards reliable and high-speed connectivity solutions, further fueling market expansion. The competitive dynamics involve both local and international players vying for market share through innovation, pricing strategies, and strategic partnerships. The market penetration rate is currently at xx%, projected to reach xx% by 2033.

Leading Markets & Segments in Israel Satellite Communications Market

The Israeli satellite communications market is dominated by the Defense & Government sector, driven by high security needs and strategic applications of satellite technology. The Maritime sector is also a significant contributor due to the country’s geographical position and extensive maritime activities. Within the segments:

- By Type: Services hold a larger market share than ground equipment, owing to the continuous need for data transmission and connectivity.

- By Platform: Land-based solutions currently hold the largest segment share, although the Airborne and Maritime segments are showing high growth rates.

Key Drivers:

- Strong Government Support: Significant government investment in space technology research and development fosters market growth.

- Strategic Location: Israel's geopolitical location makes it a strategic hub for satellite communication services in the Middle East and Mediterranean.

- Technological Advancement: The country’s strong technological prowess fuels innovation in satellite communication technology.

Israel Satellite Communications Market Product Developments

Recent product innovations emphasize enhanced bandwidth capabilities, improved security features, and more efficient power consumption. These improvements focus on optimizing performance and expanding applicability across various sectors, enhancing market fit and creating competitive advantages through increased efficiency and lower operational costs. The integration of digital intermediate frequency interoperability is a significant step in streamlining operations and improving interoperability across different satellite systems.

Key Drivers of Israel Satellite Communications Market Growth

Several factors propel the growth of the Israeli satellite communications market. Technological advancements, such as quantum communication and digital signal processing, are at the forefront. The substantial government investment in space technologies fosters innovation and market expansion. Favorable regulatory frameworks streamline market entry and stimulate investment, leading to robust growth and attracting both domestic and international players. Increasing demand for high-bandwidth connectivity across various sectors further fuels market expansion.

Challenges in the Israel Satellite Communications Market Market

Challenges include the high initial investment costs associated with satellite infrastructure and the inherent complexities of space technology. Supply chain disruptions and potential geopolitical uncertainties can also impact market stability. Competitive pressures from both established players and emerging technologies require constant innovation and adaptation to maintain a competitive edge. These factors collectively influence the market's overall growth trajectory.

Emerging Opportunities in Israel Satellite Communications Market

The integration of quantum communication technology presents significant growth potential, opening new avenues for secure and high-capacity communication. Strategic partnerships between Israeli companies and international players are strengthening the market's position globally. Expansion into new applications, such as the Internet of Things (IoT) and remote sensing, is expected to further propel market growth and enhance its global competitiveness.

Leading Players in the Israel Satellite Communications Market Sector

- Iridium Communications Inc

- SpaceIL7 2 *List Not Exhaustiv

- AMOS Spacecom

- Telesat

- SES S.A.

- Gilat Satellite Networks

- Quantum communication

- Inmarsat Global Limited

- Orbit Communication Systems Ltd

- ViaSat Inc

Key Milestones in Israel Satellite Communications Market Industry

- March 2023: Gilat Satellite Networks Ltd. successfully completed a proof of concept (PoC) for digital intermediate frequency interoperability, paving the way for digital transformation in the space industry.

- January 2023: Tel Aviv University (TAU) launched an initiative to develop optical and quantum-based satellite communication channels, with the TAU-SAT3 satellite aiming to demonstrate long-distance quantum communication.

Strategic Outlook for Israel Satellite Communications Market Market

The future of the Israel satellite communications market is bright, with significant growth potential driven by technological innovation, strategic partnerships, and government support. The increasing demand for reliable and high-bandwidth connectivity across diverse sectors ensures sustained growth. Focus on developing advanced technologies, expanding into new applications, and forging strategic alliances will further strengthen the market's position in the global arena, leading to long-term sustainable growth and attracting further investment.

Israel Satellite Communications Market Segmentation

-

1. Type

- 1.1. Ground Equipment

- 1.2. Services

-

2. Platform

- 2.1. Portable

- 2.2. Land

- 2.3. Maritime

- 2.4. Airborn3

-

3. End-User Vertical

- 3.1. Maritime

- 3.2. Defense and Government

- 3.3. Enterprises

- 3.4. Media and Entertainment

- 3.5. Other End-User Verticals

Israel Satellite Communications Market Segmentation By Geography

- 1. Israel

Israel Satellite Communications Market Regional Market Share

Geographic Coverage of Israel Satellite Communications Market

Israel Satellite Communications Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand of Satellite Communication in Security and Defence; Technological Advancement in Various Industries

- 3.3. Market Restrains

- 3.3.1. Regulatory and Licensing Requirements; Cybersecurity Threats to Satellite Communication

- 3.4. Market Trends

- 3.4.1. Increasing Demand of Satellite Communication in Security and Defense

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Satellite Communications Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Ground Equipment

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Portable

- 5.2.2. Land

- 5.2.3. Maritime

- 5.2.4. Airborn3

- 5.3. Market Analysis, Insights and Forecast - by End-User Vertical

- 5.3.1. Maritime

- 5.3.2. Defense and Government

- 5.3.3. Enterprises

- 5.3.4. Media and Entertainment

- 5.3.5. Other End-User Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Iridium Communications Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 SpaceIL7 2 *List Not Exhaustiv

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AMOS Spacecom

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Telesat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SES S A

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gilat Satellite Networks

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Quantum communication

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Inmarsat global limited

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Orbit Communication Systems Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 ViaSat Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Iridium Communications Inc

List of Figures

- Figure 1: Israel Satellite Communications Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Israel Satellite Communications Market Share (%) by Company 2025

List of Tables

- Table 1: Israel Satellite Communications Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Israel Satellite Communications Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 3: Israel Satellite Communications Market Revenue undefined Forecast, by End-User Vertical 2020 & 2033

- Table 4: Israel Satellite Communications Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Israel Satellite Communications Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 6: Israel Satellite Communications Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 7: Israel Satellite Communications Market Revenue undefined Forecast, by End-User Vertical 2020 & 2033

- Table 8: Israel Satellite Communications Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Satellite Communications Market ?

The projected CAGR is approximately 7.6%.

2. Which companies are prominent players in the Israel Satellite Communications Market ?

Key companies in the market include Iridium Communications Inc, SpaceIL7 2 *List Not Exhaustiv, AMOS Spacecom, Telesat, SES S A, Gilat Satellite Networks, Quantum communication, Inmarsat global limited, Orbit Communication Systems Ltd, ViaSat Inc.

3. What are the main segments of the Israel Satellite Communications Market ?

The market segments include Type, Platform, End-User Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand of Satellite Communication in Security and Defence; Technological Advancement in Various Industries.

6. What are the notable trends driving market growth?

Increasing Demand of Satellite Communication in Security and Defense.

7. Are there any restraints impacting market growth?

Regulatory and Licensing Requirements; Cybersecurity Threats to Satellite Communication.

8. Can you provide examples of recent developments in the market?

March 2023: Gilat Satellite Networks Ltd. announced the successful completion of a proof of concept (PoC) for transforming analog signals to digital signals using digital intermediate frequency interoperability. The standard paves the way for the space industry's digital revolution by enabling interoperability at the IF/RF layer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Satellite Communications Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Satellite Communications Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Satellite Communications Market ?

To stay informed about further developments, trends, and reports in the Israel Satellite Communications Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence