Key Insights

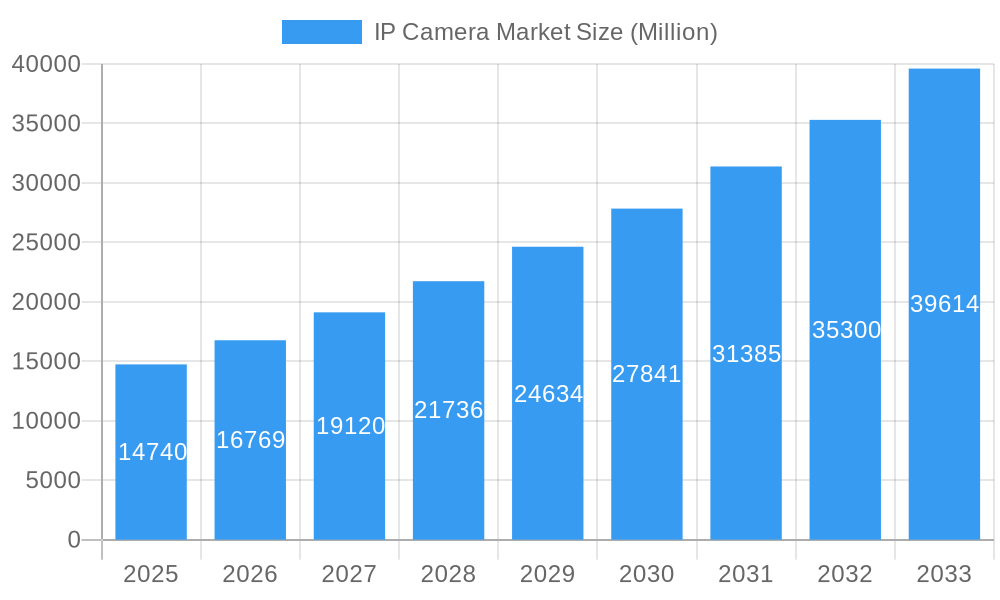

The global IP camera market is poised for significant expansion, projected to reach an estimated \$14.74 billion by 2025 and continue its upward trajectory. This robust growth is fueled by a compound annual growth rate (CAGR) of approximately 13.90% over the study period of 2019-2033. The increasing adoption of advanced security solutions across various sectors is a primary driver, with rising concerns about safety and surveillance in residential, commercial, industrial, and government sectors necessitating sophisticated IP camera systems. The technological advancements in camera capabilities, such as higher resolutions, enhanced low-light performance, AI-powered analytics for threat detection, and cloud-based storage solutions, are further accelerating market penetration. Moreover, the growing demand for smart city initiatives and the integration of IP cameras with other IoT devices are creating new avenues for market growth.

IP Camera Market Market Size (In Billion)

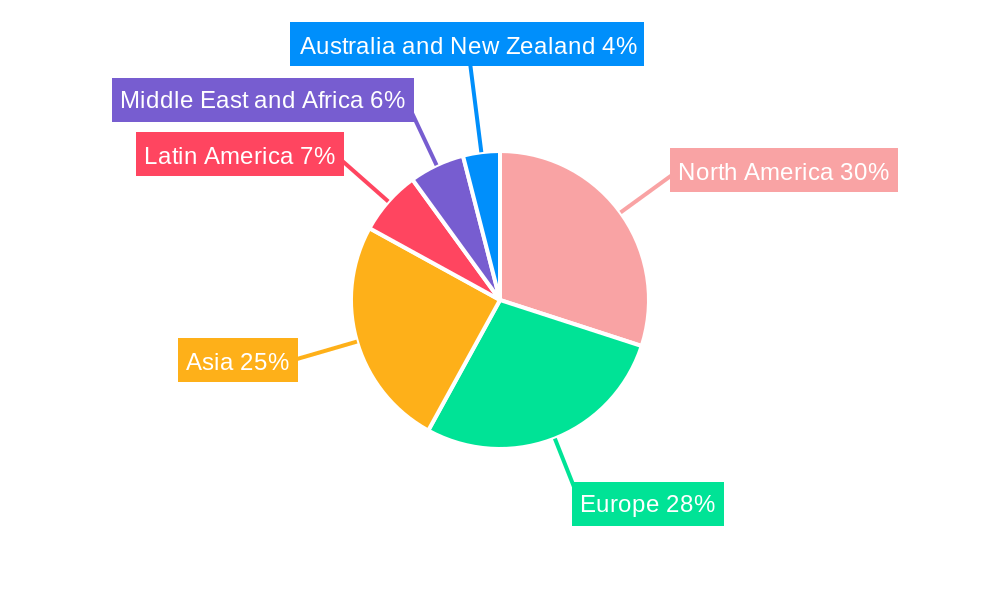

The market segmentation reveals a diverse landscape, with Fixed IP cameras and Pan-Tilt-Zoom (PTZ) cameras holding substantial shares due to their widespread application in different surveillance scenarios. The increasing preference for integrated security systems and the need for scalable and remotely manageable surveillance solutions are driving the demand for these types. In terms of end-user industries, the commercial and industrial sectors are leading the adoption, driven by the requirement for enhanced security in facilities, critical infrastructure, and retail environments. However, the residential sector is witnessing accelerated growth, fueled by the increasing affordability and ease of installation of smart home security systems. Geographically, North America and Europe currently dominate the market, characterized by high adoption rates of advanced security technologies. Asia, however, is expected to emerge as a rapidly growing region, propelled by increasing investments in smart city projects, infrastructure development, and a burgeoning demand for enhanced security in emerging economies.

IP Camera Market Company Market Share

This comprehensive report offers an in-depth analysis of the global IP Camera Market, projecting its trajectory to 2033. Leveraging high-traffic keywords such as "IP camera market size," "network camera growth," "CCTV market trends," and "surveillance technology," this report is meticulously designed to maximize search visibility and attract industry stakeholders, including manufacturers, distributors, integrators, and end-users. With a study period of 2019–2033, a base year of 2025, and a forecast period of 2025–2033, this analysis provides actionable insights into market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and strategic outlook. The report values are presented in millions.

IP Camera Market Market Dynamics & Concentration

The IP Camera Market exhibits moderate to high concentration, with leading players like Hangzhou Hikvision Digital Technology Co Ltd, Honeywell International Inc, and Johnson Controls International PLC dominating significant market share. The market share of these top entities is estimated to be around 70% of the total market value. Innovation drivers are primarily fueled by advancements in AI-powered analytics, edge computing, and enhanced resolution capabilities, pushing the boundaries of traditional surveillance. Regulatory frameworks, particularly concerning data privacy and security in regions like Europe (GDPR) and North America, are shaping product development and deployment strategies. Product substitutes, such as analog CCTV systems, are gradually losing ground due to the superior features and scalability of IP cameras. End-user trends indicate a strong demand for smart, integrated security solutions across residential, commercial, industrial, and government sectors. Mergers and Acquisitions (M&A) activities are strategic initiatives to gain market share and technological prowess. In the historical period, there were approximately 25-30 M&A deals annually. The recent acquisition of Silent Sentinel by Motorola Solutions Inc in February 2024 exemplifies this trend, aiming to bolster capabilities in specialized, long-range surveillance.

IP Camera Market Industry Trends & Analysis

The IP Camera Market is poised for robust expansion, driven by a confluence of factors. The increasing global emphasis on security and safety across all sectors serves as a primary growth catalyst. Technological disruptions, particularly the integration of Artificial Intelligence (AI) and Machine Learning (ML) into IP cameras, are transforming surveillance from passive recording to proactive threat detection and intelligent analysis. Features like facial recognition, object detection, anomaly detection, and behavioral analysis are becoming standard, significantly enhancing the value proposition. The CAGR for the forecast period is projected to be approximately 12.5%, indicating substantial market growth. Market penetration is steadily increasing, especially in developing economies where adoption of advanced security systems is accelerating. Consumer preferences are shifting towards user-friendly interfaces, remote accessibility through mobile applications, and cloud-based storage solutions, offering greater flexibility and convenience. Competitive dynamics within the market are characterized by intense innovation, price competition, and strategic partnerships aimed at expanding product portfolios and geographical reach. The growing adoption of IoT devices and the need for seamless integration with other smart systems further bolster the demand for interconnected IP camera solutions. The market penetration for IP cameras in developed economies is estimated to be over 65%, while emerging markets are showing a rapid growth rate in adoption.

Leading Markets & Segments in IP Camera Market

The IP Camera Market is segmented by Type and End-user Industry, with each segment exhibiting distinct growth patterns and market dominance.

By Type:

- Fixed IP Cameras: These cameras, often a foundational element for widespread surveillance, are expected to maintain a significant market share due to their cost-effectiveness and suitability for continuous monitoring in fixed locations. Key drivers for their dominance include their robust performance in everyday security scenarios and their widespread application in commercial and residential settings. Their market share is estimated at around 45%.

- Pan-Tilt-Zoom (PTZ) IP Cameras: PTZ cameras are crucial for dynamic surveillance needs, offering wider coverage and the ability to track moving subjects. Their adoption is particularly strong in applications requiring flexibility and comprehensive area monitoring, such as large industrial sites, public spaces, and transportation hubs. The increasing demand for advanced tracking and surveillance capabilities fuels their growth. Their market share is approximately 30%.

- Varifocal IP Cameras: These cameras offer adjustable focal lengths, providing a balance between fixed and PTZ capabilities, making them suitable for a wide range of applications where specific field-of-view adjustments are necessary. Their versatility contributes to their steady demand across various sectors. Their market share is estimated at 25%.

By End-user Industry:

- Industrial: The industrial sector represents a dominant segment, driven by the critical need for enhanced safety, asset protection, and operational efficiency in manufacturing plants, oil and gas facilities, and logistics centers. The adoption of IP cameras with advanced analytics for process monitoring, predictive maintenance, and worker safety is a key growth driver. Government regulations and the increasing complexity of industrial operations further necessitate robust surveillance solutions. Their market share is projected to be around 35%.

- Commercial: The commercial sector, encompassing retail, hospitality, banking, and office buildings, is another significant contributor to the IP camera market. This segment is driven by the need to prevent theft, monitor employee performance, ensure customer safety, and manage operations effectively. The growth of smart buildings and integrated security systems is a major trend. Their market share is estimated at 30%.

- Government and Law Enforcement: This sector is a consistent and substantial consumer of IP cameras, driven by public safety initiatives, border security, traffic management, and critical infrastructure protection. The deployment of advanced surveillance networks for crime prevention, investigation, and emergency response is a primary factor. Their market share is approximately 25%.

- Residential: The residential segment is witnessing rapid growth due to increasing awareness of home security, the affordability of IP cameras, and the rise of smart home ecosystems. Features like remote monitoring, two-way audio, and integration with smart assistants are key adoption drivers. Their market share is estimated at 10%.

Geographically, North America and Europe are currently the leading markets, characterized by high adoption rates and a strong demand for advanced security solutions. However, the Asia-Pacific region is expected to emerge as the fastest-growing market due to rapid industrialization, urbanization, and increasing security concerns.

IP Camera Market Product Developments

Product developments in the IP Camera Market are characterized by a relentless pursuit of enhanced intelligence and integration. Innovations are heavily focused on embedding AI capabilities for advanced video analytics, enabling features like facial recognition, anomaly detection, and people counting. The trend towards higher resolutions (4K and above) and improved low-light performance ensures clearer imagery for accurate identification. Edge computing is enabling cameras to process data locally, reducing latency and bandwidth requirements. Furthermore, the integration of these cameras into broader IoT ecosystems and smart building management systems is a key competitive advantage, offering a unified approach to security and operational efficiency.

Key Drivers of IP Camera Market Growth

- Rising Security Concerns: Escalating global security threats and a heightened focus on public safety are driving demand for sophisticated surveillance systems.

- Technological Advancements: The integration of AI, ML, and IoT is enhancing camera capabilities, offering intelligent analytics and seamless connectivity.

- Smart City Initiatives: The global push for smart cities necessitates robust video surveillance for traffic management, public safety, and infrastructure monitoring.

- Increasing Adoption of IoT: The growing network of connected devices creates a demand for IP cameras that can integrate and communicate within these ecosystems.

- Government Regulations and Mandates: Many governments are implementing stricter security regulations, encouraging the adoption of advanced surveillance technologies.

Challenges in the IP Camera Market Market

- Data Privacy and Security Concerns: Stringent data privacy regulations and the risk of cyber threats can hinder adoption and deployment.

- High Initial Investment Costs: While decreasing, the upfront cost of advanced IP camera systems can still be a barrier for smaller businesses and residential users.

- Interoperability Issues: Ensuring seamless integration between cameras from different manufacturers and existing security infrastructure can be complex.

- Bandwidth and Storage Requirements: High-resolution video streams demand significant bandwidth and storage, posing infrastructure challenges.

- Skilled Workforce Shortage: The deployment and maintenance of complex IP camera systems require specialized technical expertise, which is not always readily available.

Emerging Opportunities in IP Camera Market

Emerging opportunities in the IP Camera Market are significant, driven by several key catalysts. The continued advancement in AI and machine learning algorithms will unlock new applications for video analytics, such as predictive policing and sophisticated crowd management. The growth of the smart home market presents a substantial opportunity for integrated residential security solutions. Furthermore, the increasing demand for specialized cameras in niche applications like thermal imaging for industrial monitoring and long-range surveillance for border security offers significant growth potential. Strategic partnerships between IP camera manufacturers and software providers, cloud service providers, and system integrators will be crucial for developing comprehensive, end-to-end security solutions. The expansion into emerging economies with developing infrastructure also presents untapped market potential.

Leading Players in the IP Camera Market Sector

- Motorola Solutions Inc

- Honeywell International Inc

- Johnson Controls International PLC

- Cisco Systems Inc

- Hangzhou Hikvision Digital Technology Co Ltd

- D-Link Limited

- Matrix Comsec Pvt Ltd

- 3dEYE Inc

- Panasonic Corporation

- Ajax Systems Inc

- Sony Corporation

Key Milestones in IP Camera Market Industry

- February 2024: Motorola Solutions acquired Silent Sentinel, a provider of specialized, long-range cameras. This acquisition is poised to enhance Motorola Solutions' capabilities in advanced perimeter security and long-distance surveillance.

- January 2024: Johnson Controls India unveiled new security cameras—Illustra Standard Gen3. This launch underscores Johnson Controls' commitment to the 'Make in India' initiative and aims to provide comprehensive security solutions across various industries, including access control and cloud solutions.

Strategic Outlook for IP Camera Market Market

The IP Camera Market is characterized by a dynamic and forward-looking strategic outlook. Growth accelerators will be centered around the continued integration of Artificial Intelligence for advanced video analytics, enabling more proactive and intelligent security solutions. The expansion of smart city projects globally will continue to drive demand for scalable and interconnected surveillance networks. The increasing adoption of cloud-based services for data storage and management will also play a pivotal role, offering enhanced accessibility and flexibility. Furthermore, strategic partnerships and collaborations will be crucial for companies to innovate and offer comprehensive security ecosystems that go beyond basic video surveillance, encompassing access control, intrusion detection, and data analytics. The focus will increasingly shift towards providing value-added services and customized solutions to meet the diverse needs of end-users.

IP Camera Market Segmentation

-

1. Type

- 1.1. Fixed

- 1.2. Pan-Tilt-Zoom (PTZ)

- 1.3. Varifocal

-

2. End-user Industry

- 2.1. Residential

- 2.2. Commerci

- 2.3. Industrial

- 2.4. Government and law enforcement

IP Camera Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Latin America

- 5. Middle East and Africa

- 6. Australia and New Zealand

IP Camera Market Regional Market Share

Geographic Coverage of IP Camera Market

IP Camera Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing integration of IP cameras with smart home technologies and expansion of smart cities; Rising demand for security surveillance; Growing demand for high-resolution cameras

- 3.3. Market Restrains

- 3.3.1. Data privacy and security concerns; High installation and maintenance costs

- 3.4. Market Trends

- 3.4.1. The Commercial Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed

- 5.1.2. Pan-Tilt-Zoom (PTZ)

- 5.1.3. Varifocal

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Residential

- 5.2.2. Commerci

- 5.2.3. Industrial

- 5.2.4. Government and law enforcement

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.3.6. Australia and New Zealand

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Fixed

- 6.1.2. Pan-Tilt-Zoom (PTZ)

- 6.1.3. Varifocal

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Residential

- 6.2.2. Commerci

- 6.2.3. Industrial

- 6.2.4. Government and law enforcement

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Fixed

- 7.1.2. Pan-Tilt-Zoom (PTZ)

- 7.1.3. Varifocal

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Residential

- 7.2.2. Commerci

- 7.2.3. Industrial

- 7.2.4. Government and law enforcement

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Fixed

- 8.1.2. Pan-Tilt-Zoom (PTZ)

- 8.1.3. Varifocal

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Residential

- 8.2.2. Commerci

- 8.2.3. Industrial

- 8.2.4. Government and law enforcement

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Fixed

- 9.1.2. Pan-Tilt-Zoom (PTZ)

- 9.1.3. Varifocal

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Residential

- 9.2.2. Commerci

- 9.2.3. Industrial

- 9.2.4. Government and law enforcement

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Fixed

- 10.1.2. Pan-Tilt-Zoom (PTZ)

- 10.1.3. Varifocal

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Residential

- 10.2.2. Commerci

- 10.2.3. Industrial

- 10.2.4. Government and law enforcement

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Australia and New Zealand IP Camera Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Fixed

- 11.1.2. Pan-Tilt-Zoom (PTZ)

- 11.1.3. Varifocal

- 11.2. Market Analysis, Insights and Forecast - by End-user Industry

- 11.2.1. Residential

- 11.2.2. Commerci

- 11.2.3. Industrial

- 11.2.4. Government and law enforcement

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Motorola Solutions Inc

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Honeywell International Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Johnson Controls International PLC

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Cisco Systems Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hangzhou Hikvision Digital Technology Co Ltd

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 D-Link Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Matrix Comsec Pvt Ltd

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 3dEYE Inc

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Panasonic Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Ajax Systems Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Sony Corporation

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Motorola Solutions Inc

List of Figures

- Figure 1: Global IP Camera Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America IP Camera Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America IP Camera Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America IP Camera Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 5: North America IP Camera Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 6: North America IP Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America IP Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe IP Camera Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe IP Camera Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe IP Camera Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 11: Europe IP Camera Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 12: Europe IP Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe IP Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia IP Camera Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia IP Camera Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia IP Camera Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 17: Asia IP Camera Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 18: Asia IP Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia IP Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America IP Camera Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Latin America IP Camera Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Latin America IP Camera Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 23: Latin America IP Camera Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Latin America IP Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America IP Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa IP Camera Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Middle East and Africa IP Camera Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East and Africa IP Camera Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 29: Middle East and Africa IP Camera Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 30: Middle East and Africa IP Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa IP Camera Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Australia and New Zealand IP Camera Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Australia and New Zealand IP Camera Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Australia and New Zealand IP Camera Market Revenue (Million), by End-user Industry 2025 & 2033

- Figure 35: Australia and New Zealand IP Camera Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 36: Australia and New Zealand IP Camera Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Australia and New Zealand IP Camera Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 3: Global IP Camera Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Global IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 9: Global IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 12: Global IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 15: Global IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 18: Global IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global IP Camera Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global IP Camera Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 21: Global IP Camera Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the IP Camera Market?

The projected CAGR is approximately 13.90%.

2. Which companies are prominent players in the IP Camera Market?

Key companies in the market include Motorola Solutions Inc, Honeywell International Inc, Johnson Controls International PLC, Cisco Systems Inc, Hangzhou Hikvision Digital Technology Co Ltd, D-Link Limited, Matrix Comsec Pvt Ltd, 3dEYE Inc, Panasonic Corporation, Ajax Systems Inc, Sony Corporation.

3. What are the main segments of the IP Camera Market?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.74 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing integration of IP cameras with smart home technologies and expansion of smart cities; Rising demand for security surveillance; Growing demand for high-resolution cameras.

6. What are the notable trends driving market growth?

The Commercial Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Data privacy and security concerns; High installation and maintenance costs.

8. Can you provide examples of recent developments in the market?

February 2024 - Motorola Solutions acquired Silent Sentinel, a provider of specialized, long-range cameras based in Ware, United Kingdom. Equipped with highly accurate detection capabilities, Silent Sentinel's cameras are claimed to be capable of identifying anomalies from up to 20 miles away (30 km) to extend the perimeter of security and support a faster, more informed response.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "IP Camera Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the IP Camera Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the IP Camera Market?

To stay informed about further developments, trends, and reports in the IP Camera Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence