Key Insights

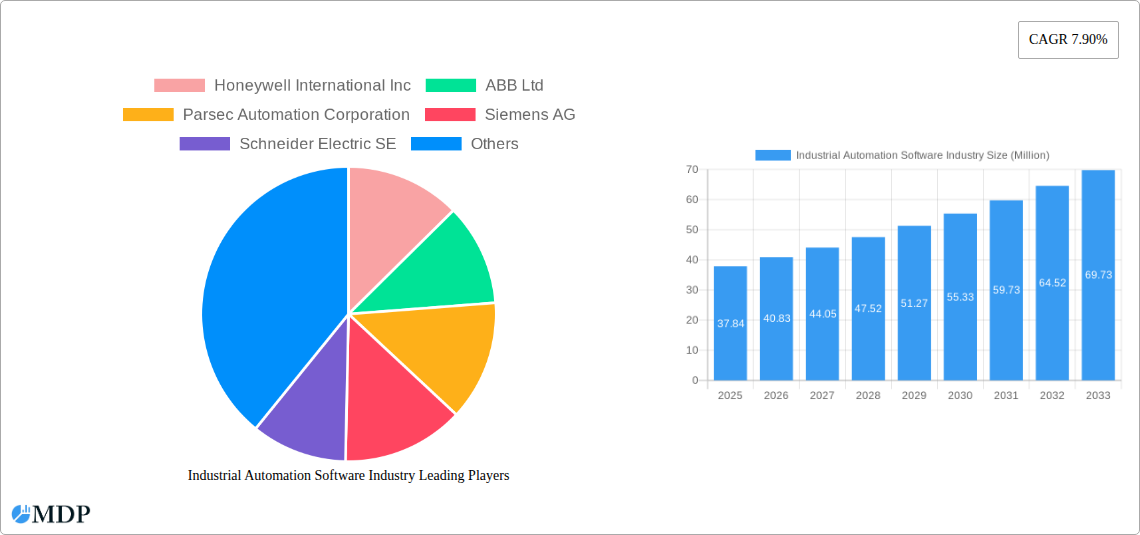

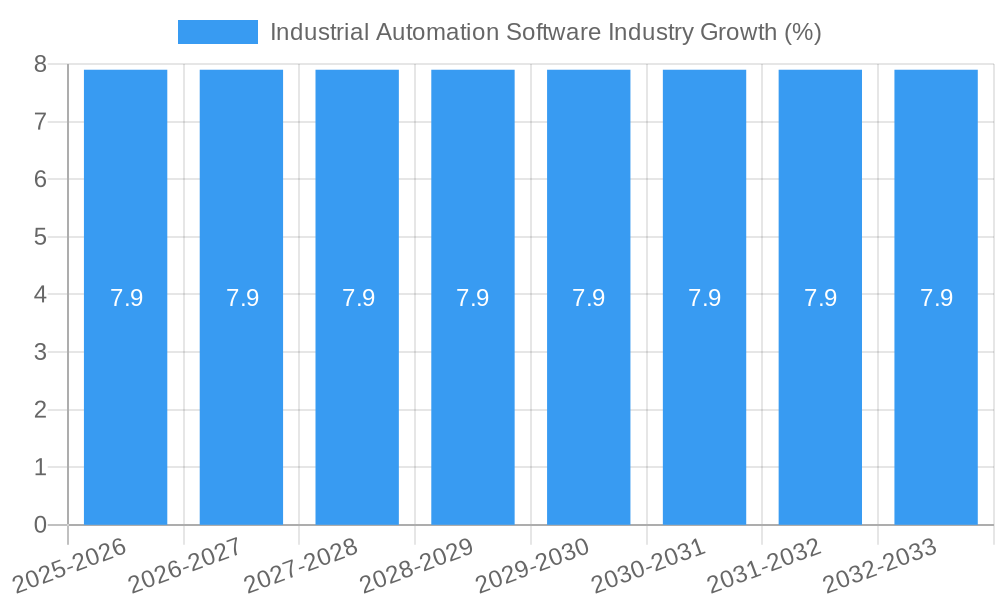

The Industrial Automation Software market is poised for substantial growth, projected to reach an estimated USD 37.84 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 7.90% expected throughout the forecast period of 2025-2033. This expansion is primarily fueled by the escalating need for enhanced operational efficiency, stringent quality control, and increased productivity across various manufacturing and industrial sectors. Key drivers include the increasing adoption of smart manufacturing technologies, the growing demand for real-time data analysis for informed decision-making, and the imperative to comply with evolving industry regulations and safety standards. The integration of the Industrial Internet of Things (IIoT) is also a significant catalyst, enabling seamless communication between devices and systems, thereby optimizing production processes and reducing downtime.

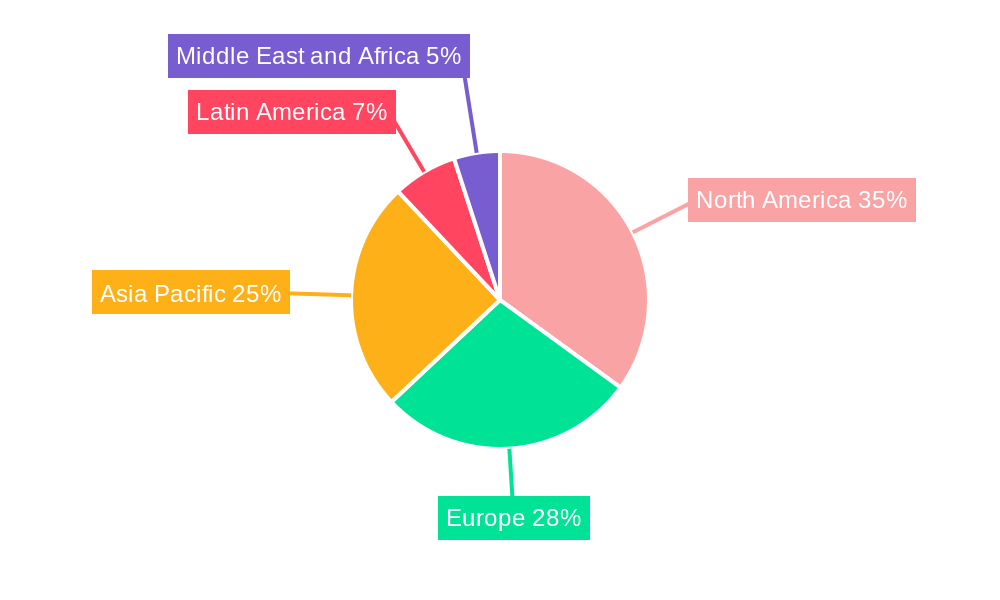

The market is segmented into critical product categories, including Supervisory Control and Data Acquisition (SCADA) systems, Distributed Control Systems (DCS), Manufacturing Execution Systems (MES), Human Machine Interface (HMI), and Programmable Logic Controllers (PLC). These segments cater to diverse end-user industries such as the Power Industry, Automotive Industry, Oil and Gas Industry, and a range of Other End-user Industries. North America is anticipated to lead the market due to its early adoption of advanced automation technologies and significant investments in industrial modernization. However, the Asia Pacific region is expected to witness the fastest growth, driven by rapid industrialization, a burgeoning manufacturing base, and government initiatives promoting digital transformation. While the market presents significant opportunities, potential restraints include the high initial implementation costs of automation solutions and the cybersecurity risks associated with interconnected industrial systems. Addressing these challenges through strategic partnerships and robust security measures will be crucial for sustained market development.

Industrial Automation Software Industry: Market Analysis, Trends, and Future Outlook (2019-2033)

This comprehensive report delves into the dynamic Industrial Automation Software industry, offering deep insights into market dynamics, key trends, and future growth trajectories. With a study period spanning from 2019 to 2033, this analysis leverages a base year of 2025 and a forecast period of 2025-2033, building upon historical data from 2019-2024. We explore the intricate interplay of technological advancements, evolving end-user demands, and strategic initiatives shaping this multi-billion dollar sector. Our focus is on delivering actionable intelligence to industry stakeholders, investors, and decision-makers navigating the complexities of industrial digitalization and automation. The global Industrial Automation Software market is projected to witness robust growth, driven by the increasing adoption of smart manufacturing technologies and the demand for enhanced operational efficiency across diverse sectors. This report provides a granular view of market segmentation, leading players, and emerging opportunities, making it an indispensable resource for understanding the future of industrial operations.

Industrial Automation Software Industry Market Dynamics & Concentration

The Industrial Automation Software industry is characterized by a moderately concentrated market structure, with a few dominant players holding significant market share, estimated to be around 70% by leading companies. Innovation is a primary driver, fueled by the relentless pursuit of enhanced operational efficiency, predictive maintenance, and real-time data analytics. Key innovation hubs are emerging in regions with strong manufacturing bases and advanced research & development capabilities. Regulatory frameworks are evolving to support digital transformation initiatives, with a focus on data security, interoperability standards, and Industry 4.0 adoption. Product substitutes exist, primarily in the form of manual processes or less sophisticated software solutions, but the benefits of advanced automation software in terms of cost savings and productivity gains are increasingly outweighing these alternatives.

End-user trends reveal a strong demand for integrated solutions that offer seamless data flow across the entire production lifecycle. Companies are increasingly looking for software that can optimize resource allocation, improve quality control, and enable remote monitoring and management. Mergers and acquisitions (M&A) activities are a significant aspect of market dynamics, with an estimated XX M&A deals in the past two years, driven by the desire for market expansion, technology acquisition, and portfolio diversification. Notable M&A targets include companies specializing in niche automation solutions or those with strong regional presence. The overall market concentration is expected to remain, but with potential for new entrants to gain traction through specialized offerings or innovative business models.

Key Market Dynamics:

- Increasing adoption of Industry 4.0 principles.

- Growing demand for cloud-based automation solutions.

- Emphasis on cybersecurity in industrial environments.

- Rise of artificial intelligence (AI) and machine learning (ML) in automation.

M&A Activity Insights:

- Acquisitions focused on expanding software capabilities.

- Strategic partnerships to enhance product portfolios.

- Consolidation driven by the need for economies of scale.

Industrial Automation Software Industry Industry Trends & Analysis

The Industrial Automation Software industry is poised for substantial growth, driven by several intertwined trends and technological advancements. The pervasive shift towards Industry 4.0 and smart manufacturing principles is a primary catalyst, as businesses across sectors recognize the imperative of digitalizing their operations for enhanced competitiveness. This digital transformation is characterized by the integration of advanced technologies such as the Internet of Things (IoT), artificial intelligence (AI), machine learning (ML), and cloud computing into industrial processes. The market penetration of these technologies is steadily increasing, with an estimated XX% in the manufacturing sector alone.

The pursuit of operational efficiency and cost reduction remains a cornerstone of demand. Industrial automation software empowers companies to optimize resource utilization, minimize waste, improve product quality, and reduce downtime through predictive maintenance. The Compound Annual Growth Rate (CAGR) for the industrial automation software market is projected to be approximately XX% over the forecast period, reflecting the sustained investment in these solutions. Technological disruptions are constantly reshaping the landscape, with advancements in areas like edge computing enabling real-time data processing closer to the source of generation, thereby reducing latency and improving responsiveness.

Consumer preferences are evolving towards more integrated, user-friendly, and scalable software solutions. There is a growing demand for platforms that can provide end-to-end visibility and control over complex manufacturing environments, facilitating better decision-making and agile responses to market changes. Competitive dynamics are intense, with established players continually innovating and smaller, agile companies emerging with specialized solutions. The ongoing digital transformation is not merely about implementing new technologies; it's about a fundamental shift in how industries operate, manage their assets, and interact with their value chains. The increasing sophistication of automation software also addresses the growing need for enhanced safety protocols and compliance with stringent industry regulations. The integration of AI-driven insights for process optimization and anomaly detection is becoming a standard expectation, further pushing the boundaries of what industrial automation can achieve. The rise of cybersecurity concerns is also shaping development, with a strong emphasis on robust security features to protect critical industrial infrastructure.

Key Growth Drivers:

- Digitalization and Industry 4.0 Adoption: The widespread embrace of smart manufacturing practices fuels the demand for advanced automation software.

- Operational Efficiency and Cost Optimization: Companies are investing in software to streamline processes, reduce waste, and improve productivity.

- Technological Advancements: Integration of AI, ML, IoT, and cloud computing enhances the capabilities of automation solutions.

- Predictive Maintenance: Software enabling early detection of equipment failures reduces downtime and maintenance costs.

- Enhanced Data Analytics: Real-time data processing and insights empower better decision-making.

Market Penetration and CAGR:

- Estimated Market Penetration: XX% across key industrial sectors.

- Projected CAGR (2025-2033): XX%.

Leading Markets & Segments in Industrial Automation Software Industry

The Industrial Automation Software industry is segmented across various product categories and end-user industries, each exhibiting unique growth drivers and market dominance.

Product Segments:

- Supervisory Control and Data Acquisition (SCADA): This segment holds a significant market share due to its critical role in monitoring and controlling industrial processes across vast geographical areas.

- Key Drivers: Need for centralized control, real-time data visualization, and efficient operational management in sectors like power and utilities. Economic policies promoting infrastructure development and grid modernization further bolster SCADA adoption.

- Distributed Control System (DCS): DCS commands a substantial portion of the market, particularly in complex process industries requiring precise control and high reliability.

- Key Drivers: Increasing demand for sophisticated process control in oil and gas, chemical, and pharmaceutical industries. Advancements in hardware and software integration contribute to its dominance.

- Manufacturing Execution Systems (MES): MES is witnessing rapid growth as manufacturers focus on optimizing production operations and improving shop-floor efficiency.

- Key Drivers: The push for agile manufacturing, real-time production tracking, quality management, and compliance with industry standards. Government initiatives supporting advanced manufacturing also play a crucial role.

- Human Machine Interface (HMI): HMI remains a vital segment, providing intuitive interfaces for operators to interact with automated systems.

- Key Drivers: The growing need for user-friendly interfaces that enhance operator efficiency and reduce errors. Integration with advanced analytics and visualization tools drives its continued relevance.

- Programmable Logic Controller (PLC): PLCs form the backbone of many automation systems and continue to hold a strong market position due to their reliability and versatility.

- Key Drivers: Their established presence in various industries, cost-effectiveness, and ability to handle a wide range of control tasks. Continuous innovation in PLC capabilities supports their widespread adoption.

End-User Industry Segments:

- Power Industry: This sector represents a dominant end-user for industrial automation software, driven by the need for grid stability, efficient energy generation, and renewable energy integration.

- Key Drivers: Modernization of power grids, increasing adoption of smart grid technologies, and the growing demand for renewable energy sources necessitate advanced automation for optimal performance and management. Regulatory frameworks promoting energy efficiency also contribute.

- Automotive Industry: The automotive sector is a significant consumer, leveraging automation software for assembly line optimization, quality control, and the development of connected vehicles.

- Key Drivers: The pursuit of efficient and flexible production lines, the integration of robotics, and the increasing complexity of vehicle manufacturing processes. Government incentives for automotive manufacturing and technological advancements in vehicle production are key factors.

- Oil and Gas Industry: This industry relies heavily on industrial automation software for exploration, production, refining, and the safe transportation of resources.

- Key Drivers: The need for precise control in harsh environments, remote monitoring of assets, and stringent safety regulations. Investments in digital oilfield technologies and the focus on operational safety and efficiency are major drivers.

- Other End-user Industries: This broad category includes sectors like pharmaceuticals, food and beverage, discrete manufacturing, and chemicals, all of which are increasingly adopting automation software to enhance their operations.

- Key Drivers: Growing emphasis on product quality, regulatory compliance, and the need for customized automation solutions tailored to specific industry requirements.

Industrial Automation Software Industry Product Developments

- Key Drivers: Need for centralized control, real-time data visualization, and efficient operational management in sectors like power and utilities. Economic policies promoting infrastructure development and grid modernization further bolster SCADA adoption.

- Key Drivers: Increasing demand for sophisticated process control in oil and gas, chemical, and pharmaceutical industries. Advancements in hardware and software integration contribute to its dominance.

- Key Drivers: The push for agile manufacturing, real-time production tracking, quality management, and compliance with industry standards. Government initiatives supporting advanced manufacturing also play a crucial role.

- Key Drivers: The growing need for user-friendly interfaces that enhance operator efficiency and reduce errors. Integration with advanced analytics and visualization tools drives its continued relevance.

- Key Drivers: Their established presence in various industries, cost-effectiveness, and ability to handle a wide range of control tasks. Continuous innovation in PLC capabilities supports their widespread adoption.

- Power Industry: This sector represents a dominant end-user for industrial automation software, driven by the need for grid stability, efficient energy generation, and renewable energy integration.

- Key Drivers: Modernization of power grids, increasing adoption of smart grid technologies, and the growing demand for renewable energy sources necessitate advanced automation for optimal performance and management. Regulatory frameworks promoting energy efficiency also contribute.

- Automotive Industry: The automotive sector is a significant consumer, leveraging automation software for assembly line optimization, quality control, and the development of connected vehicles.

- Key Drivers: The pursuit of efficient and flexible production lines, the integration of robotics, and the increasing complexity of vehicle manufacturing processes. Government incentives for automotive manufacturing and technological advancements in vehicle production are key factors.

- Oil and Gas Industry: This industry relies heavily on industrial automation software for exploration, production, refining, and the safe transportation of resources.

- Key Drivers: The need for precise control in harsh environments, remote monitoring of assets, and stringent safety regulations. Investments in digital oilfield technologies and the focus on operational safety and efficiency are major drivers.

- Other End-user Industries: This broad category includes sectors like pharmaceuticals, food and beverage, discrete manufacturing, and chemicals, all of which are increasingly adopting automation software to enhance their operations.

- Key Drivers: Growing emphasis on product quality, regulatory compliance, and the need for customized automation solutions tailored to specific industry requirements.

Industrial Automation Software Industry Product Developments

The Industrial Automation Software industry is witnessing continuous product innovation aimed at enhancing functionality, user experience, and integration capabilities. Companies are actively developing software solutions that leverage AI and machine learning to enable predictive maintenance, optimize production scheduling, and improve quality control with greater precision. The trend towards cloud-based platforms is accelerating, offering enhanced scalability, remote accessibility, and easier data management. Seamless integration with other enterprise systems, such as ERP and MES, is a key focus, creating a more cohesive and efficient digital ecosystem. Furthermore, there is a significant emphasis on developing cybersecurity features to protect industrial control systems from evolving threats. The introduction of software-centric universal automation systems, like Schneider Electric's EcoStruxure Automation Expert, represents a paradigm shift towards greater interoperability and flexibility in automation solutions.

Key Drivers of Industrial Automation Software Industry Growth

The growth of the Industrial Automation Software industry is propelled by several interconnected factors. The escalating demand for enhanced operational efficiency and productivity across manufacturing and processing industries is a primary driver. The imperative to reduce operational costs, minimize downtime, and improve product quality fuels investment in automation solutions. Furthermore, the pervasive adoption of Industry 4.0 principles and the smart factory concept necessitates advanced software to manage interconnected devices, analyze vast amounts of data, and enable real-time decision-making. Technological advancements, including the integration of Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT), are creating new possibilities for intelligent automation and predictive capabilities. Supportive government initiatives and policies promoting industrial digitalization and technological innovation also play a crucial role in fostering market expansion.

- Technological Advancements: AI, ML, IoT, and cloud computing are enabling more sophisticated and intelligent automation.

- Industry 4.0 Adoption: The shift towards smart manufacturing requires integrated automation software for seamless operations.

- Demand for Efficiency and Cost Reduction: Companies are seeking solutions to optimize processes and minimize operational expenses.

- Government Support: Initiatives promoting industrial digitalization and technological upgrades are a significant catalyst.

Challenges in the Industrial Automation Software Industry Market

Despite the robust growth, the Industrial Automation Software industry faces several challenges. The significant upfront investment required for implementing advanced automation software can be a barrier for small and medium-sized enterprises (SMEs). Cybersecurity threats pose a continuous challenge, as the increasing interconnectedness of industrial systems makes them vulnerable to cyberattacks, necessitating robust security protocols and ongoing vigilance. The shortage of skilled labor capable of implementing, operating, and maintaining complex automation systems is another restraint. Furthermore, the integration of disparate legacy systems with new automation software can be complex and time-consuming, leading to compatibility issues and implementation delays. Competitive pressures can also lead to price erosion, impacting profit margins for some vendors.

- High Implementation Costs: Significant initial investment can deter some businesses.

- Cybersecurity Risks: Protecting sensitive industrial data and systems from cyber threats is paramount.

- Skilled Labor Shortage: A lack of qualified personnel to manage and operate advanced automation systems.

- Integration Complexity: Challenges in integrating new software with existing legacy systems.

Emerging Opportunities in Industrial Automation Software Industry

The Industrial Automation Software industry is replete with emerging opportunities driven by technological advancements and evolving market needs. The widespread adoption of edge computing presents a significant opportunity for delivering real-time analytics and control closer to the production floor, reducing latency and improving responsiveness. The increasing focus on sustainability and energy efficiency is creating demand for automation software that can optimize resource consumption and minimize environmental impact. The expansion of the Industrial Internet of Things (IIoT) ecosystem further amplifies opportunities for data-driven insights and predictive capabilities, enabling more proactive operational management. Strategic partnerships and collaborations, such as the one between ABB and SKF, are crucial for developing comprehensive solutions that address specific industry challenges and drive innovation. The growing demand for customized and specialized automation solutions tailored to niche industries also presents fertile ground for growth.

Leading Players in the Industrial Automation Software Industry Sector

- Honeywell International Inc

- ABB Ltd

- Parsec Automation Corporation

- Siemens AG

- Schneider Electric SE

- Tata Consultancy Services Limited

- Rockwell Automation Inc

- Hitachi Ltd

- General Electric Company

- HCL Technologies Limited

- SAP SE

- Emerson Electric Company

Key Milestones in Industrial Automation Software Industry Industry

- July 2022: ABB and SKF entered into a Memorandum of Understanding (MoU) to explore the possibilities for collaboration in the automation of manufacturing processes. Through the partnership, the companies will identify and evaluate solutions to improve manufacturing capabilities and support clients' increased production efficiency. This collaboration signals a strategic move towards enhancing manufacturing efficiency through integrated automation solutions.

- May 2022: Schneider Electric launched version 22.0 of EcoStruxure Automation Expert, further enhancing the capabilities of its software-centric universal automation system. The solution provides end-to-end digital continuity through close integration with AVEVA applications. This release highlights the industry's focus on universal automation and seamless integration for improved digital continuity.

Strategic Outlook for Industrial Automation Software Industry Market

The strategic outlook for the Industrial Automation Software industry is highly promising, driven by a confluence of technological innovation and increasing industry adoption. Future growth will be accelerated by the continued integration of advanced technologies such as Artificial Intelligence (AI), Machine Learning (ML), and the Industrial Internet of Things (IIoT), enabling more intelligent and predictive automation. The emphasis on cloud-based solutions and edge computing will drive scalability, accessibility, and real-time data processing capabilities. Strategic partnerships and collaborations will be instrumental in developing comprehensive solutions that address complex industry challenges and foster cross-sector innovation. The growing demand for sustainable and energy-efficient operations presents a significant opportunity for automation software that optimizes resource utilization. Furthermore, the ongoing digital transformation across various end-user industries, coupled with supportive government policies, will continue to fuel the adoption of industrial automation software, paving the way for a more efficient, resilient, and intelligent industrial future.

Industrial Automation Software Industry Segmentation

-

1. Product

- 1.1. Supervisory Control and Data Acquisition (SCADA)

- 1.2. Distributed Control System (DCS)

- 1.3. Manufacturing Execution Systems (MES)

- 1.4. Human Machine Interface (HMI)

- 1.5. Programmable Logic Controller (PLC)

-

2. End-user Industry

- 2.1. Power Industry

- 2.2. Automotive Industry

- 2.3. Oil and Gas Industry

- 2.4. Other End-user Industries

Industrial Automation Software Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Industrial Automation Software Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Demand for Automation for Qualitative and Reliable Manufacturing; Growing Need for Mass Production with Reduced Operation Cost; Surge in Adoption of Industry 4.0 and Enabling Technologies

- 3.3. Market Restrains

- 3.3.1. Limited Availability of Professionals and Awareness of Security; High Implementation Costs for Factory Automation Solutions

- 3.4. Market Trends

- 3.4.1. SCADA has a Significant Impact on the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Supervisory Control and Data Acquisition (SCADA)

- 5.1.2. Distributed Control System (DCS)

- 5.1.3. Manufacturing Execution Systems (MES)

- 5.1.4. Human Machine Interface (HMI)

- 5.1.5. Programmable Logic Controller (PLC)

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Power Industry

- 5.2.2. Automotive Industry

- 5.2.3. Oil and Gas Industry

- 5.2.4. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Supervisory Control and Data Acquisition (SCADA)

- 6.1.2. Distributed Control System (DCS)

- 6.1.3. Manufacturing Execution Systems (MES)

- 6.1.4. Human Machine Interface (HMI)

- 6.1.5. Programmable Logic Controller (PLC)

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. Power Industry

- 6.2.2. Automotive Industry

- 6.2.3. Oil and Gas Industry

- 6.2.4. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Supervisory Control and Data Acquisition (SCADA)

- 7.1.2. Distributed Control System (DCS)

- 7.1.3. Manufacturing Execution Systems (MES)

- 7.1.4. Human Machine Interface (HMI)

- 7.1.5. Programmable Logic Controller (PLC)

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. Power Industry

- 7.2.2. Automotive Industry

- 7.2.3. Oil and Gas Industry

- 7.2.4. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Supervisory Control and Data Acquisition (SCADA)

- 8.1.2. Distributed Control System (DCS)

- 8.1.3. Manufacturing Execution Systems (MES)

- 8.1.4. Human Machine Interface (HMI)

- 8.1.5. Programmable Logic Controller (PLC)

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. Power Industry

- 8.2.2. Automotive Industry

- 8.2.3. Oil and Gas Industry

- 8.2.4. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Latin America Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Supervisory Control and Data Acquisition (SCADA)

- 9.1.2. Distributed Control System (DCS)

- 9.1.3. Manufacturing Execution Systems (MES)

- 9.1.4. Human Machine Interface (HMI)

- 9.1.5. Programmable Logic Controller (PLC)

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. Power Industry

- 9.2.2. Automotive Industry

- 9.2.3. Oil and Gas Industry

- 9.2.4. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Middle East and Africa Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Supervisory Control and Data Acquisition (SCADA)

- 10.1.2. Distributed Control System (DCS)

- 10.1.3. Manufacturing Execution Systems (MES)

- 10.1.4. Human Machine Interface (HMI)

- 10.1.5. Programmable Logic Controller (PLC)

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. Power Industry

- 10.2.2. Automotive Industry

- 10.2.3. Oil and Gas Industry

- 10.2.4. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. North America Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Industrial Automation Software Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Honeywell International Inc

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 ABB Ltd

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Parsec Automation Corporation

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Siemens AG

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Schneider Electric SE

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Tata Consultancy Services Limited

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Rockwell Automation Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Hitachi Ltd

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 General Electric Company

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 HCL Technologies Limited

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 SAP SE

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Emerson Electric Company

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global Industrial Automation Software Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Industrial Automation Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Industrial Automation Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Industrial Automation Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Industrial Automation Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Industrial Automation Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Industrial Automation Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Industrial Automation Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Industrial Automation Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Industrial Automation Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Industrial Automation Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Industrial Automation Software Industry Revenue (Million), by Product 2024 & 2032

- Figure 13: North America Industrial Automation Software Industry Revenue Share (%), by Product 2024 & 2032

- Figure 14: North America Industrial Automation Software Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Industrial Automation Software Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Industrial Automation Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Industrial Automation Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Industrial Automation Software Industry Revenue (Million), by Product 2024 & 2032

- Figure 19: Europe Industrial Automation Software Industry Revenue Share (%), by Product 2024 & 2032

- Figure 20: Europe Industrial Automation Software Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Industrial Automation Software Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Industrial Automation Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Industrial Automation Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Industrial Automation Software Industry Revenue (Million), by Product 2024 & 2032

- Figure 25: Asia Pacific Industrial Automation Software Industry Revenue Share (%), by Product 2024 & 2032

- Figure 26: Asia Pacific Industrial Automation Software Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Industrial Automation Software Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Industrial Automation Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Industrial Automation Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Industrial Automation Software Industry Revenue (Million), by Product 2024 & 2032

- Figure 31: Latin America Industrial Automation Software Industry Revenue Share (%), by Product 2024 & 2032

- Figure 32: Latin America Industrial Automation Software Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Industrial Automation Software Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Industrial Automation Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Industrial Automation Software Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Industrial Automation Software Industry Revenue (Million), by Product 2024 & 2032

- Figure 37: Middle East and Africa Industrial Automation Software Industry Revenue Share (%), by Product 2024 & 2032

- Figure 38: Middle East and Africa Industrial Automation Software Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa Industrial Automation Software Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa Industrial Automation Software Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Industrial Automation Software Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Industrial Automation Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Industrial Automation Software Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 3: Global Industrial Automation Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Industrial Automation Software Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Industrial Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Industrial Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Industrial Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Industrial Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Industrial Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Industrial Automation Software Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Industrial Automation Software Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 16: Global Industrial Automation Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Industrial Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Industrial Automation Software Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 19: Global Industrial Automation Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Industrial Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Industrial Automation Software Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 22: Global Industrial Automation Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Industrial Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Industrial Automation Software Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 25: Global Industrial Automation Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Industrial Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Industrial Automation Software Industry Revenue Million Forecast, by Product 2019 & 2032

- Table 28: Global Industrial Automation Software Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Industrial Automation Software Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Automation Software Industry?

The projected CAGR is approximately 7.90%.

2. Which companies are prominent players in the Industrial Automation Software Industry?

Key companies in the market include Honeywell International Inc, ABB Ltd, Parsec Automation Corporation, Siemens AG, Schneider Electric SE, Tata Consultancy Services Limited, Rockwell Automation Inc, Hitachi Ltd, General Electric Company, HCL Technologies Limited, SAP SE, Emerson Electric Company.

3. What are the main segments of the Industrial Automation Software Industry?

The market segments include Product, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 37.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Demand for Automation for Qualitative and Reliable Manufacturing; Growing Need for Mass Production with Reduced Operation Cost; Surge in Adoption of Industry 4.0 and Enabling Technologies.

6. What are the notable trends driving market growth?

SCADA has a Significant Impact on the Market Growth.

7. Are there any restraints impacting market growth?

Limited Availability of Professionals and Awareness of Security; High Implementation Costs for Factory Automation Solutions.

8. Can you provide examples of recent developments in the market?

July 2022 - ABB and SKF entered into a Memorandum of Understanding (MoU) to explore the possibilities for collaboration in the automation of manufacturing processes. Through the partnership, the companies will identify and evaluate solutions to improve manufacturing capabilities and support clients' increased production efficiency.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Automation Software Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Automation Software Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Automation Software Industry?

To stay informed about further developments, trends, and reports in the Industrial Automation Software Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence