Key Insights

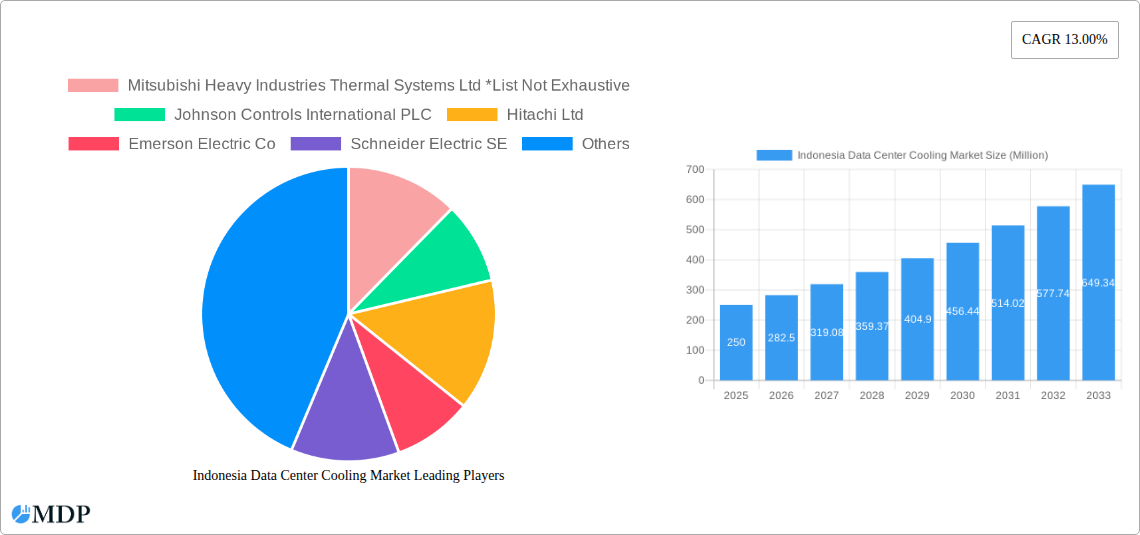

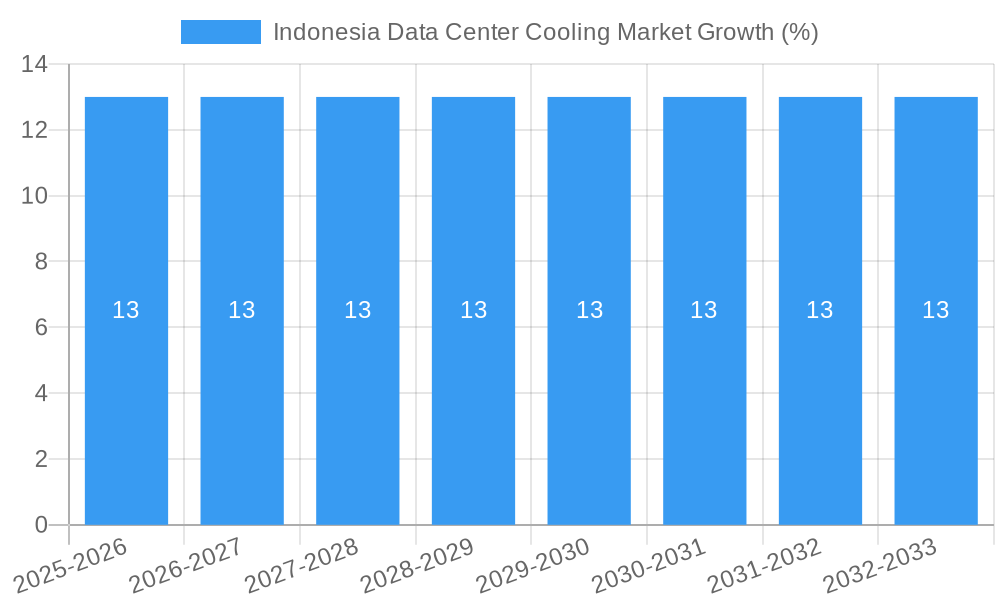

The Indonesian data center cooling market is poised for significant expansion, driven by the nation's rapidly digitizing economy and burgeoning demand for reliable IT infrastructure. With an estimated market size of approximately USD 250 million in 2025 and a robust Compound Annual Growth Rate (CAGR) of 13.00% projected through 2033, the market is set to reach a substantial valuation. This growth is primarily fueled by the increasing adoption of hyperscale data centers, necessitated by the exponential rise in data generation from digital services, e-commerce, and cloud computing. Furthermore, the ongoing digital transformation across various end-user verticals, including IT & Telecom, Retail & Consumer Goods, and Healthcare, is creating a persistent need for advanced and efficient cooling solutions to ensure optimal server performance and minimize downtime.

The market's expansion is further bolstered by a growing awareness and implementation of sophisticated cooling technologies. While air-based cooling solutions like chillers and CRAHs remain foundational, liquid-based cooling, particularly direct-to-chip and immersion cooling, is gaining traction due to its superior efficiency in handling high-density heat loads generated by modern high-performance computing. However, the market faces certain restraints, including the high initial capital expenditure associated with advanced cooling systems and the need for skilled personnel for installation and maintenance. Despite these challenges, the compelling drivers of digital transformation, increasing data volumes, and the strategic imperative for reliable data center operations in Indonesia will undoubtedly propel the market forward. Investments in energy-efficient solutions and innovative cooling strategies will be crucial for players looking to capitalize on this dynamic and growing market.

This comprehensive report provides an in-depth analysis of the Indonesia Data Center Cooling Market, examining its dynamic growth, technological advancements, and competitive landscape. Forecasted to reach significant figures by 2033, this study is essential for understanding the critical infrastructure supporting Indonesia's burgeoning digital economy. We delve into market drivers, challenges, emerging opportunities, and key players, offering actionable insights for stakeholders navigating this rapidly evolving sector. With a study period spanning 2019–2033, a base year of 2025, and a forecast period of 2025–2033, this report offers a robust outlook on data center cooling solutions in Indonesia, including hyperscale data center cooling, enterprise data center cooling, and colocation data center cooling.

Indonesia Data Center Cooling Market Market Dynamics & Concentration

The Indonesia Data Center Cooling Market is characterized by increasing market concentration, driven by significant investments in infrastructure and the growing demand for advanced cooling technologies. Key innovation drivers include the relentless pursuit of energy efficiency and the need to manage increasing heat loads from high-density computing. Regulatory frameworks, while still developing, are beginning to emphasize sustainability and operational efficiency, influencing technology adoption. Product substitutes, such as improved air management systems, offer alternatives but are increasingly being complemented by sophisticated liquid cooling solutions. End-user trends are strongly influenced by the rapid digitalization across sectors like IT & Telecom, Retail & Consumer Goods, and Healthcare, demanding robust and scalable cooling. Merger and acquisition (M&A) activities are on the rise, with an estimated X deal counts in recent years, as larger players seek to expand their footprint and technological capabilities. Major market players hold substantial market share, indicating a consolidating yet competitive environment.

Indonesia Data Center Cooling Market Industry Trends & Analysis

The Indonesia Data Center Cooling Market is experiencing robust growth, projected to witness a Compound Annual Growth Rate (CAGR) of XX% during the forecast period (2025–2033). This expansion is fueled by several key trends. The increasing adoption of cloud computing and the exponential growth of data generation are necessitating the build-out and expansion of data center facilities, directly driving demand for advanced cooling systems. Technological disruptions, particularly the rise of liquid-based cooling technologies like Immersion Cooling and Direct-to-Chip Cooling, are reshaping the market, offering superior thermal management for high-density computing environments. Consumer preferences are shifting towards more energy-efficient and sustainable cooling solutions, prompting manufacturers to invest in green technologies and intelligent cooling management systems. Competitive dynamics are intense, with established players and new entrants vying for market share through product innovation, strategic partnerships, and competitive pricing. The market penetration of advanced cooling solutions is steadily increasing as awareness of their benefits, such as reduced operational costs and enhanced reliability, grows among data center operators. The continuous demand for IT & Telecom infrastructure, coupled with the expanding digital services landscape, forms a cornerstone of this market's trajectory.

Leading Markets & Segments in Indonesia Data Center Cooling Market

The Indonesia Data Center Cooling Market exhibits significant dominance across several key segments.

Cooling Technology:

- Air-based Cooling continues to hold a substantial market share, with Chiller and Economizer systems being a primary choice for their efficiency in large-scale deployments. CRAH (Computer Room Air Handler) units remain crucial for maintaining precise temperature and humidity control within server rooms, supporting Enterprise (On-premise) and Colocation facilities.

- However, Liquid-based Cooling is rapidly gaining traction, driven by the increasing power density of modern IT equipment. Immersion Cooling and Direct-to-Chip Cooling are emerging as critical solutions for high-performance computing (HPC) environments found in Hyperscaler (Owned & Leased) data centers and specialized IT & Telecom infrastructure. The growing interest in advanced cooling for AI and machine learning workloads is a significant driver.

Type:

- Hyperscaler (Owned & Leased) data centers represent a major segment due to their massive scale and high power demands, necessitating the most advanced cooling solutions. The ongoing expansion of cloud services in Indonesia fuels this segment's growth.

- Colocation facilities are also experiencing significant expansion as businesses seek flexible and scalable IT infrastructure. This drives demand for a variety of cooling technologies to cater to diverse tenant needs.

- Enterprise (On-premise) data centers, while potentially smaller in scale, still require robust cooling solutions, particularly those in critical sectors like Healthcare and Federal & Institutional agencies.

End-user Vertical:

- The IT & Telecom sector is the largest consumer of data center cooling solutions, driven by the rapid expansion of 5G networks, cloud services, and digital transformation initiatives.

- Retail & Consumer Goods is a growing vertical, fueled by the rise of e-commerce and the need for robust backend infrastructure.

- Healthcare is increasingly relying on data-intensive applications and digital record-keeping, necessitating reliable and efficient cooling for their data centers.

- Media & Entertainment also contributes significantly due to the demands of content streaming and digital production.

- Federal & Institutional agencies require secure and reliable data infrastructure, driving demand for advanced cooling to ensure operational continuity.

Economic policies promoting digital infrastructure development and government initiatives supporting data center investments are key drivers for the dominance of these segments. Infrastructure development, including reliable power supply and connectivity, is paramount for the growth of these segments.

Indonesia Data Center Cooling Market Product Developments

Recent product developments in the Indonesia Data Center Cooling Market underscore a strong focus on efficiency and performance. Sanyo Denki's unveiling of the San Ace 160AD ACDC fan in June 2023, offering industry-leading airflow and static pressure with low power consumption, signifies advancements in air-based cooling components for industrial and HVAC applications. Simultaneously, Gigabyte's February 2022 introduction of high-performance computing servers featuring advanced direct liquid cooling systems, powered by AMD EPYC and Nvidia A100, highlights the increasing integration of liquid cooling for demanding computational tasks. These innovations address the growing need for effective thermal management of high-density racks and AI workloads, providing enhanced reliability and operational efficiency.

Key Drivers of Indonesia Data Center Cooling Market Growth

Several factors are propelling the Indonesia Data Center Cooling Market. The accelerating pace of digital transformation across all industries is a primary driver, increasing the demand for data storage and processing capabilities. This is closely followed by the substantial investments in cloud infrastructure by global hyperscalers and local enterprises seeking to expand their digital footprint. The increasing adoption of high-density computing solutions, including AI and IoT technologies, generates higher heat loads, necessitating more advanced and efficient cooling systems. Furthermore, growing awareness of energy efficiency and sustainability mandates is pushing data center operators towards adopting greener cooling technologies to reduce operational costs and environmental impact. Government initiatives supporting the development of the digital economy and data center infrastructure also play a crucial role in market expansion.

Challenges in the Indonesia Data Center Cooling Market Market

Despite robust growth, the Indonesia Data Center Cooling Market faces several challenges. High initial investment costs for advanced cooling solutions, particularly liquid cooling technologies, can be a significant barrier for some operators. Ensuring a reliable and consistent power supply, critical for data center operations and cooling systems, remains a concern in certain regions of Indonesia. Navigating complex regulatory frameworks and obtaining necessary permits for data center construction and operation can also be time-consuming and challenging. Furthermore, the availability of skilled personnel for the installation, operation, and maintenance of sophisticated cooling systems presents another hurdle. Competitive pressures from both domestic and international players can also impact pricing and market entry strategies.

Emerging Opportunities in Indonesia Data Center Cooling Market

The Indonesia Data Center Cooling Market presents substantial emerging opportunities. The continuous growth of edge computing and the increasing demand for low-latency processing are creating opportunities for decentralized data center cooling solutions. Strategic partnerships between technology providers, data center operators, and energy companies can foster innovation in renewable energy integration for cooling systems, further enhancing sustainability. The development of intelligent and AI-driven cooling management systems offers significant potential for optimizing energy consumption and operational efficiency. Furthermore, government incentives and a growing focus on digital infrastructure development are creating a favorable environment for market expansion, particularly in underserved regions.

Leading Players in the Indonesia Data Center Cooling Market Sector

- Mitsubishi Heavy Industries Thermal Systems Ltd

- Johnson Controls International PLC

- Hitachi Ltd

- Emerson Electric Co

- Schneider Electric SE

- Fujitsu General Limited

- Stulz GmbH

- Vertiv Group Corp

Key Milestones in Indonesia Data Center Cooling Market Industry

- June 2023: Sanyo Denki unveiled the San Ace 160AD, a groundbreaking 160x160x51mm ACDC fan and waterproof ACDC fan, boasting industry-leading airflow and static pressure with low power consumption, ideal for various cooling applications.

- February 2022: Gigabyte introduced cutting-edge high-performance computing servers powered by AMD EPYC and Nvidia A100 components, enhanced with CoolIT's advanced direct liquid cooling system, marking a significant step in liquid cooling integration for demanding workloads.

Strategic Outlook for Indonesia Data Center Cooling Market Market

The Indonesia Data Center Cooling Market is poised for sustained growth, driven by a confluence of increasing digitalization, cloud adoption, and technological innovation. Strategic opportunities lie in the development and deployment of energy-efficient and sustainable cooling solutions, including advanced liquid cooling technologies that cater to the rising heat densities of modern IT infrastructure. Emphasis on smart cooling management systems that leverage AI for optimization and predictive maintenance will be crucial. Collaboration between industry players and government bodies to streamline regulatory processes and promote green data center development will further accelerate market expansion. The market's strategic outlook points towards a future dominated by intelligent, efficient, and environmentally conscious cooling solutions.

Indonesia Data Center Cooling Market Segmentation

-

1. Cooling Technology

-

1.1. Air-based Cooling

- 1.1.1. Chiller and Economizer

- 1.1.2. CRAH

- 1.1.3. Cooling

- 1.1.4. Other Cooling Technology

-

1.2. Liquid-based Cooling

- 1.2.1. Immersion Cooling

- 1.2.2. Direct-to-Chip Cooling

- 1.2.3. Rear-Door Heat Exchanger

-

1.1. Air-based Cooling

-

2. Type

- 2.1. Hyperscaler (Owned & Leased)

- 2.2. Enterprise (On-premise)

- 2.3. Colocation

-

3. End-user Vertical

- 3.1. IT & Telecom

- 3.2. Retail & Consumer Goods

- 3.3. Healthcare

- 3.4. Media & Entertainment

- 3.5. Federal & Institutional agencies

- 3.6. Other End Users

Indonesia Data Center Cooling Market Segmentation By Geography

- 1. Indonesia

Indonesia Data Center Cooling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Development of IT Infrastructure in the Region; Emergence of Green Data Centers

- 3.3. Market Restrains

- 3.3.1 Costs

- 3.3.2 Adaptability Requirements

- 3.3.3 and Power Outages

- 3.4. Market Trends

- 3.4.1. Liquid-based cooling is the fastest growing segment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 5.1.1. Air-based Cooling

- 5.1.1.1. Chiller and Economizer

- 5.1.1.2. CRAH

- 5.1.1.3. Cooling

- 5.1.1.4. Other Cooling Technology

- 5.1.2. Liquid-based Cooling

- 5.1.2.1. Immersion Cooling

- 5.1.2.2. Direct-to-Chip Cooling

- 5.1.2.3. Rear-Door Heat Exchanger

- 5.1.1. Air-based Cooling

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hyperscaler (Owned & Leased)

- 5.2.2. Enterprise (On-premise)

- 5.2.3. Colocation

- 5.3. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.3.1. IT & Telecom

- 5.3.2. Retail & Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. Media & Entertainment

- 5.3.5. Federal & Institutional agencies

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Mitsubishi Heavy Industries Thermal Systems Ltd *List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Johnson Controls International PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hitachi Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emerson Electric Co

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Schneider Electric SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fujitsu General Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stulz GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Vertiv Group Corp

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Mitsubishi Heavy Industries Thermal Systems Ltd *List Not Exhaustive

List of Figures

- Figure 1: Indonesia Data Center Cooling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Data Center Cooling Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 3: Indonesia Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Indonesia Data Center Cooling Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 5: Indonesia Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Indonesia Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Indonesia Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 8: Indonesia Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 9: Indonesia Data Center Cooling Market Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 10: Indonesia Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Data Center Cooling Market?

The projected CAGR is approximately 13.00%.

2. Which companies are prominent players in the Indonesia Data Center Cooling Market?

Key companies in the market include Mitsubishi Heavy Industries Thermal Systems Ltd *List Not Exhaustive, Johnson Controls International PLC, Hitachi Ltd, Emerson Electric Co, Schneider Electric SE, Fujitsu General Limited, Stulz GmbH, Vertiv Group Corp.

3. What are the main segments of the Indonesia Data Center Cooling Market?

The market segments include Cooling Technology, Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Development of IT Infrastructure in the Region; Emergence of Green Data Centers.

6. What are the notable trends driving market growth?

Liquid-based cooling is the fastest growing segment.

7. Are there any restraints impacting market growth?

Costs. Adaptability Requirements. and Power Outages.

8. Can you provide examples of recent developments in the market?

June 2023: Sanyo Denki unveiled the San Ace 160AD, a groundbreaking 160x160x51mm ACDC fan and waterproof ACDC fan. This innovative product boasts the industry's highest airflow and static pressure, making it an ideal choice for applications such as cooling switchboards, industrial equipment, and air conditioners. It excels in delivering exceptional cooling performance while maintaining low power consumption.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Data Center Cooling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Data Center Cooling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Data Center Cooling Market?

To stay informed about further developments, trends, and reports in the Indonesia Data Center Cooling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence