Key Insights

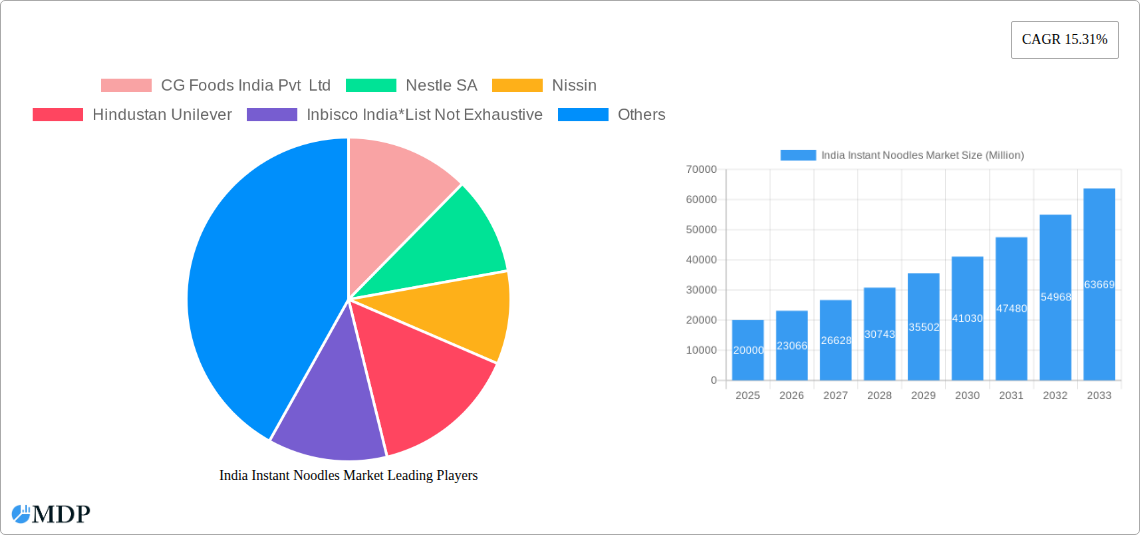

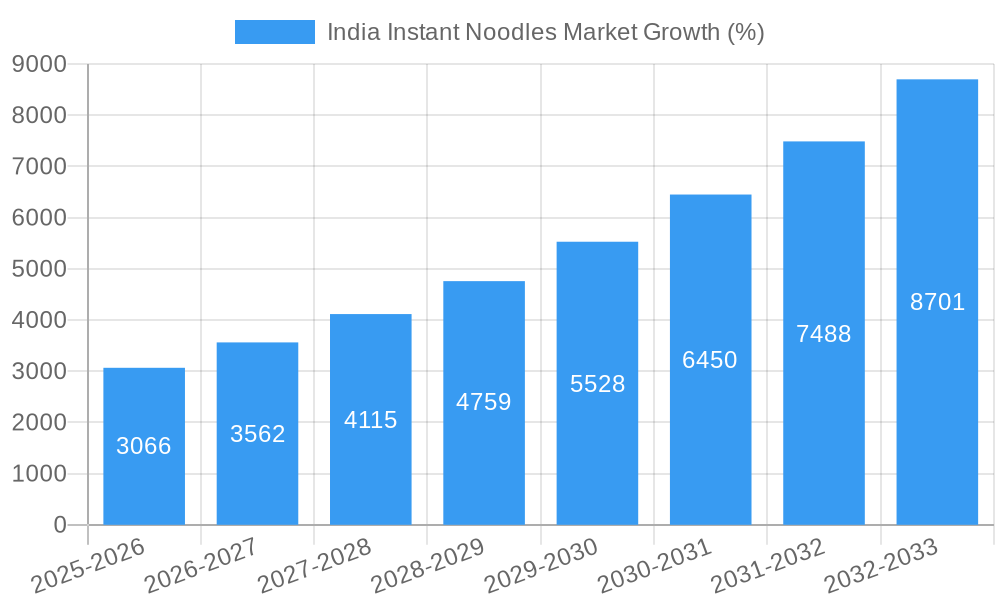

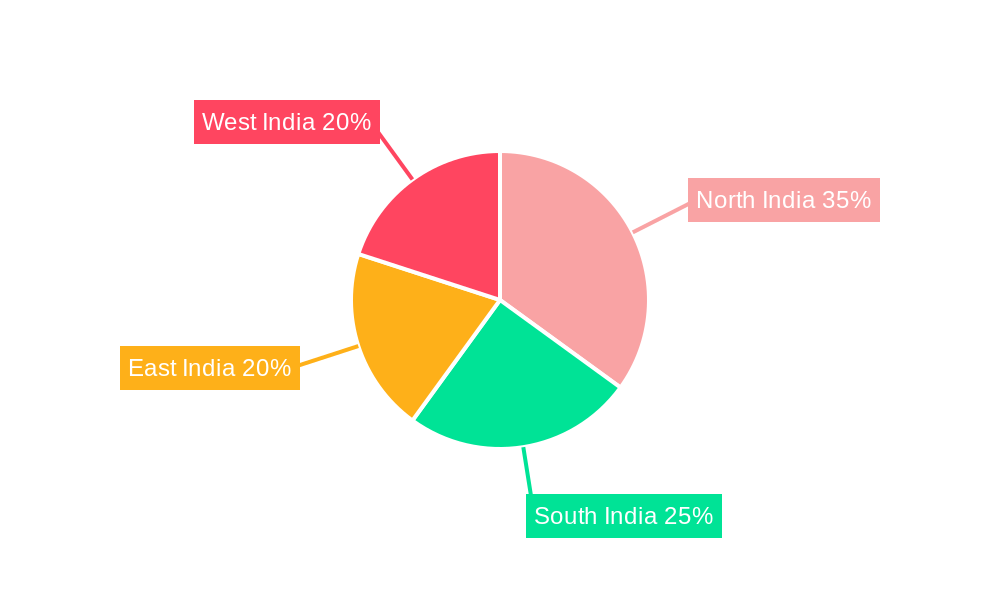

The Indian instant noodles market, valued at approximately ₹XX million in 2025, is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) of 15.31% from 2025 to 2033. This expansion is driven by several key factors. Rising disposable incomes, particularly among younger demographics, fuel increased demand for convenient and affordable food options. The burgeoning urban population, coupled with changing lifestyles and busy schedules, further contributes to the market's growth. A wide range of product variations, including cup noodles, bowl noodles, and different flavor profiles, cater to diverse consumer preferences. Furthermore, aggressive marketing campaigns and strategic distribution networks by key players like Nestle, Nissin, and Hindustan Unilever, enhance market penetration and brand visibility. The market is segmented by product type (cup/bowl, packet) and distribution channel (supermarkets/hypermarkets, convenience/grocery stores, online retail stores). The online retail segment is witnessing particularly strong growth, fueled by e-commerce penetration and the convenience of home delivery. However, challenges remain, including increasing health concerns regarding sodium and artificial ingredients, leading to a growing demand for healthier alternatives. Competition among established players and the emergence of new brands also influence market dynamics. Regional variations exist, with potentially higher demand in urban centers of North and West India compared to other regions.

The market’s future hinges on innovation and adaptation. Companies are likely to focus on developing healthier options, such as noodles with added vegetables or whole grains, to address consumer concerns. Expanding into rural markets and leveraging digital marketing strategies will be critical for sustained growth. The introduction of new flavors and formats, catering to evolving preferences, and strengthening supply chains to ensure consistent product availability will remain crucial competitive factors. The sustained growth is likely to attract further foreign direct investment and consolidation within the industry. Strategic partnerships and collaborations to enhance product reach and distribution will further shape the landscape of the Indian instant noodles market.

India Instant Noodles Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the India instant noodles market, offering invaluable insights for industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report meticulously examines market dynamics, trends, and future growth potential. The report covers key players like CG Foods India Pvt Ltd, Nestle SA, Nissin, Hindustan Unilever, and more, providing a granular understanding of the competitive landscape. Discover detailed segment analysis by product type (Cup/Bowl, Packet) and distribution channel (Supermarkets/Hypermarkets, Convenience/Grocery Stores, Online Retail Stores, Other Distribution Channels). This report is essential for businesses seeking to navigate this dynamic and rapidly evolving market. The total market size in 2025 is estimated at xx Million.

India Instant Noodles Market Dynamics & Concentration

The Indian instant noodles market is characterized by a dynamic interplay of factors influencing its concentration and growth. Market concentration is moderately high, with a few major players commanding significant market share. However, the presence of numerous smaller regional and emerging brands indicates a competitive landscape. Innovation is a key driver, with companies continuously introducing new flavors, formats, and healthier options to cater to evolving consumer preferences. Regulatory frameworks, while generally supportive of food processing, are subject to periodic changes impacting production and labeling. Product substitutes, such as other ready-to-eat meals and traditional snacks, present a challenge. End-user trends indicate a growing demand for healthier, more convenient, and diverse instant noodle options. M&A activities have been relatively modest in recent years, with xx M&A deals recorded between 2019 and 2024, suggesting potential for future consolidation.

- Market Share: Major players hold approximately xx% of the market, while smaller players contribute the remaining xx%.

- M&A Activity: The number of M&A deals witnessed a slight increase in recent years, suggesting potential market consolidation.

- Innovation Drivers: Healthier ingredients, unique flavors (e.g., Korean-inspired), and convenient packaging are driving innovation.

- Regulatory Framework: Food safety regulations and labeling requirements influence product development and market entry.

India Instant Noodles Market Industry Trends & Analysis

The India instant noodles market exhibits robust growth, driven by several key factors. The market experienced a Compound Annual Growth Rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). Market penetration is currently at xx%, reflecting significant untapped potential for growth, especially in rural areas and among younger demographics. Technological advancements in production and packaging enhance efficiency and product quality. Consumer preferences are shifting towards healthier options, leading to the introduction of products made with whole grains, less sodium, and added nutrients. Intense competition among established and emerging players fuels innovation and price wars, benefiting consumers.

Leading Markets & Segments in India Instant Noodles Market

The Indian instant noodles market exhibits significant regional variations in consumption patterns. The Northern and Eastern regions dominate, accounting for xx% of total consumption. This dominance is attributed to factors such as higher disposable incomes and a greater acceptance of convenience food. The "Packet" segment represents the largest share of the product type market, while Supermarkets/Hypermarkets constitute the primary distribution channel.

- Key Drivers (Northern and Eastern Regions):

- Higher disposable incomes

- Strong preference for convenient food options

- Established distribution networks

- By Product Type: The Packet segment holds a larger market share due to its affordability and wider availability.

- By Distribution Channel: Supermarkets/Hypermarkets dominate due to their organized retail presence and large customer base.

India Instant Noodles Market Product Developments

Recent product developments focus on health and wellness, with the introduction of healthier instant noodle options made with whole grains and minimizing processed ingredients. Companies are also exploring diverse flavors inspired by global cuisines to cater to evolving consumer tastes. Technological advancements in production processes enhance efficiency and reduce costs. These developments aim to attract health-conscious consumers while maintaining the convenience and affordability that define the instant noodle category.

Key Drivers of India Instant Noodles Market Growth

Several factors fuel the growth of the Indian instant noodles market. Firstly, the expanding young population and rising disposable incomes increase demand for convenient food options. Secondly, rapid urbanization and changing lifestyles lead to increased consumption of ready-to-eat meals. Thirdly, technological advancements in food processing and packaging improve efficiency and product quality. Finally, strategic marketing and product diversification by key players enhance market penetration.

Challenges in the India Instant Noodles Market

The Indian instant noodles market faces challenges like fluctuating raw material prices affecting production costs and profit margins. Concerns over the nutritional content of traditional instant noodles necessitate innovation in healthier alternatives. Intense competition among multiple players creates price pressures, impacting profitability. The market is also susceptible to shifts in consumer preferences, requiring continuous product adaptation.

Emerging Opportunities in India Instant Noodles Market

The Indian instant noodles market presents significant opportunities. Growing demand for healthier and more nutritious instant noodles drives opportunities for innovative products. Expanding into rural markets with targeted distribution strategies can unlock substantial growth potential. Strategic partnerships and collaborations can enhance distribution reach and product innovation. Exploring new flavor profiles and convenient packaging formats can attract a wider range of consumers.

Leading Players in the India Instant Noodles Market Sector

- CG Foods India Pvt Ltd

- Nestle SA

- Nissin

- Hindustan Unilever

- Inbisco India

- Knorr Soupy Noodles

- Patanjali

- ITC

- GSK Consumer Healthcare (India) Ltd

- Capital Food India

Key Milestones in India Instant Noodles Market Industry

- January 2023: WickedGud launched a line of healthy instant noodles made from oats, lentils, and whole grains.

- September 2022: Wai Wai introduced Spicy Korean-style hot noodles targeting Northeast India.

- April 2022: Yu Foodlabs unveiled two signature instant noodle bowls with unique Indian flavors.

Strategic Outlook for India Instant Noodles Market Market

The India instant noodles market is poised for sustained growth, driven by favorable demographics, evolving consumer preferences, and product innovation. Strategic opportunities exist in developing healthier products, expanding distribution networks, and targeting underserved markets. Companies focusing on product differentiation, strong branding, and effective marketing will be well-positioned to capitalize on this market's potential.

India Instant Noodles Market Segmentation

-

1. Product Type

- 1.1. Cup/Bowl

- 1.2. Packet

-

2. Distribution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience/ Grocery Stores

- 2.3. Online Retail Stores

- 2.4. Other Distribution Channels

India Instant Noodles Market Segmentation By Geography

- 1. India

India Instant Noodles Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.31% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Exotic Flavor Combined with Nutritional Value; Growing Demand for Convenient Foods

- 3.3. Market Restrains

- 3.3.1. Increasing Prevalence of Diabetes and Obesity Hamper the Market Growth

- 3.4. Market Trends

- 3.4.1. Popularity of Convenient Food Options

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Instant Noodles Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cup/Bowl

- 5.1.2. Packet

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience/ Grocery Stores

- 5.2.3. Online Retail Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North India India Instant Noodles Market Analysis, Insights and Forecast, 2019-2031

- 7. South India India Instant Noodles Market Analysis, Insights and Forecast, 2019-2031

- 8. East India India Instant Noodles Market Analysis, Insights and Forecast, 2019-2031

- 9. West India India Instant Noodles Market Analysis, Insights and Forecast, 2019-2031

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2024

- 10.2. Company Profiles

- 10.2.1 CG Foods India Pvt Ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Nestle SA

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Nissin

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Hindustan Unilever

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Inbisco India*List Not Exhaustive

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Knorr Soupy Noodles

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Patanjali

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 ITC

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 GSK Consumer Healthcare (India) Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Capital Food India

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 CG Foods India Pvt Ltd

List of Figures

- Figure 1: India Instant Noodles Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Instant Noodles Market Share (%) by Company 2024

List of Tables

- Table 1: India Instant Noodles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Instant Noodles Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: India Instant Noodles Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 4: India Instant Noodles Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: India Instant Noodles Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: North India India Instant Noodles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: South India India Instant Noodles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: East India India Instant Noodles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: West India India Instant Noodles Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: India Instant Noodles Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 11: India Instant Noodles Market Revenue Million Forecast, by Distribution Channel 2019 & 2032

- Table 12: India Instant Noodles Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Instant Noodles Market?

The projected CAGR is approximately 15.31%.

2. Which companies are prominent players in the India Instant Noodles Market?

Key companies in the market include CG Foods India Pvt Ltd, Nestle SA, Nissin, Hindustan Unilever, Inbisco India*List Not Exhaustive, Knorr Soupy Noodles, Patanjali, ITC, GSK Consumer Healthcare (India) Ltd, Capital Food India.

3. What are the main segments of the India Instant Noodles Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Exotic Flavor Combined with Nutritional Value; Growing Demand for Convenient Foods.

6. What are the notable trends driving market growth?

Popularity of Convenient Food Options.

7. Are there any restraints impacting market growth?

Increasing Prevalence of Diabetes and Obesity Hamper the Market Growth.

8. Can you provide examples of recent developments in the market?

January 2023: WickedGud, a direct-to-consumer (D2C) health food brand, introduced a new line of instant noodles crafted from a blend of oats, lentils, whole wheat, millets, and brown rice. These noodles are 100% free from refined flour (maida), devoid of any added oils, and entirely free from harmful chemicals. They offer a wholesome and nutritious alternative compared to traditional instant noodles.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Instant Noodles Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Instant Noodles Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Instant Noodles Market?

To stay informed about further developments, trends, and reports in the India Instant Noodles Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence