Key Insights

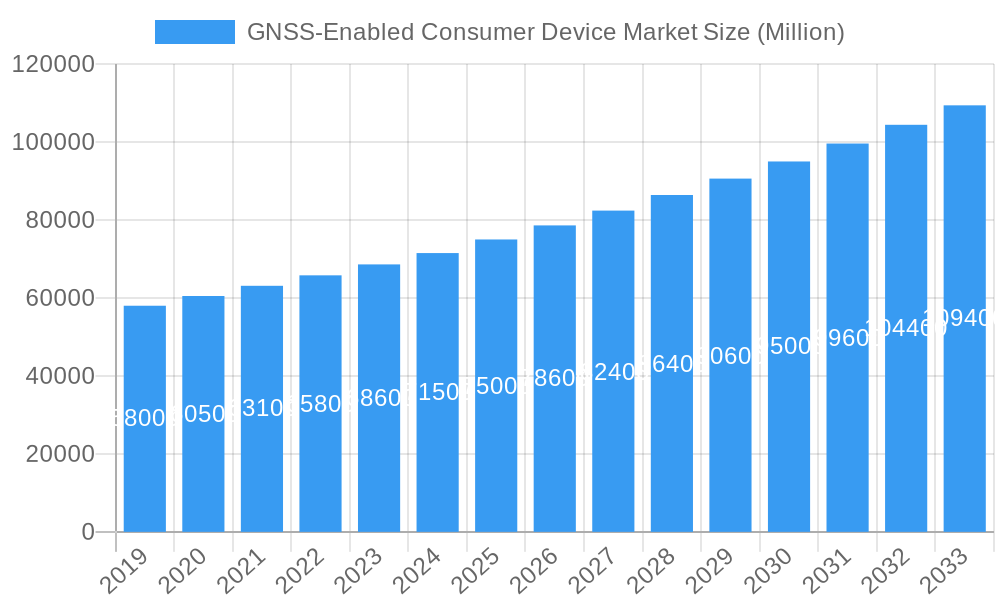

The global GNSS-enabled consumer device market is projected to experience significant expansion, reaching an estimated market size of $335.04 billion by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of 11.17% during the forecast period 2025-2033. Key growth catalysts include the pervasive integration of GNSS technology into diverse consumer electronics, from smartphones and wearables offering advanced navigation and fitness tracking, to personal tracking devices for safety and asset management. The escalating demand for location-aware applications in health, fitness, outdoor recreation, and personal security directly fuels this upward trend. Continuous innovation in GNSS chipsets, leading to smaller, more power-efficient, and accurate devices, further enhances feasibility and appeal for manufacturers across various product categories.

GNSS-Enabled Consumer Device Market Market Size (In Billion)

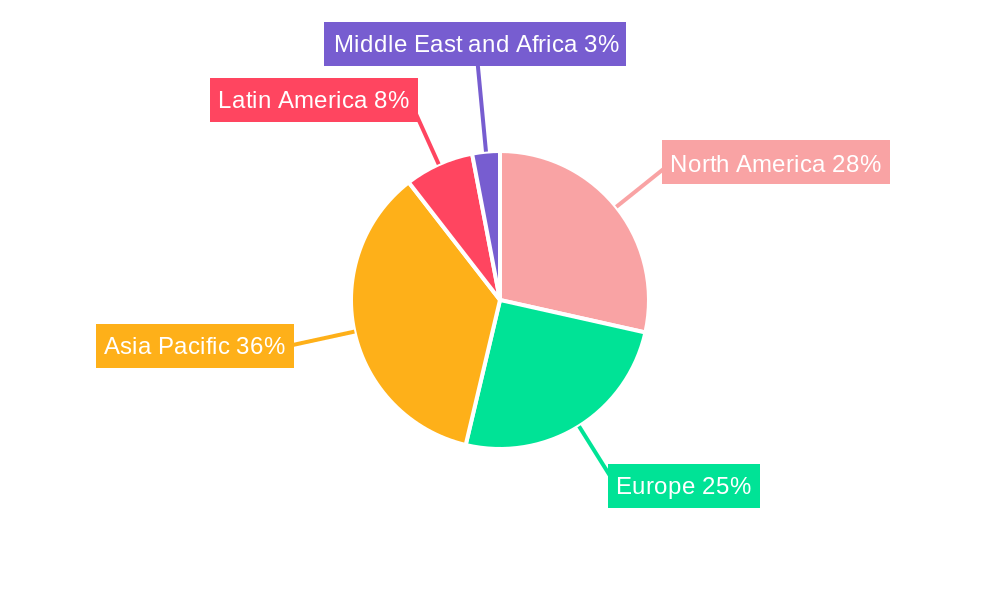

Market expansion is further shaped by compelling trends, notably the rise of the Internet of Things (IoT) ecosystem, where connected devices rely heavily on precise location data. Wearable technology, including smartwatches and fitness trackers, is witnessing rapid adoption, increasingly incorporating GNSS for accurate activity monitoring and navigation. Potential restraints may include evolving data privacy regulations and the cost of advanced GNSS chipsets in niche applications. However, the inherent value of accurate positioning and navigation in everyday consumer devices, coupled with aggressive innovation from leading companies, ensures a dynamic and promising future for the GNSS-enabled consumer device market. The Asia Pacific region is anticipated to dominate, driven by a large consumer base and increasing disposable incomes.

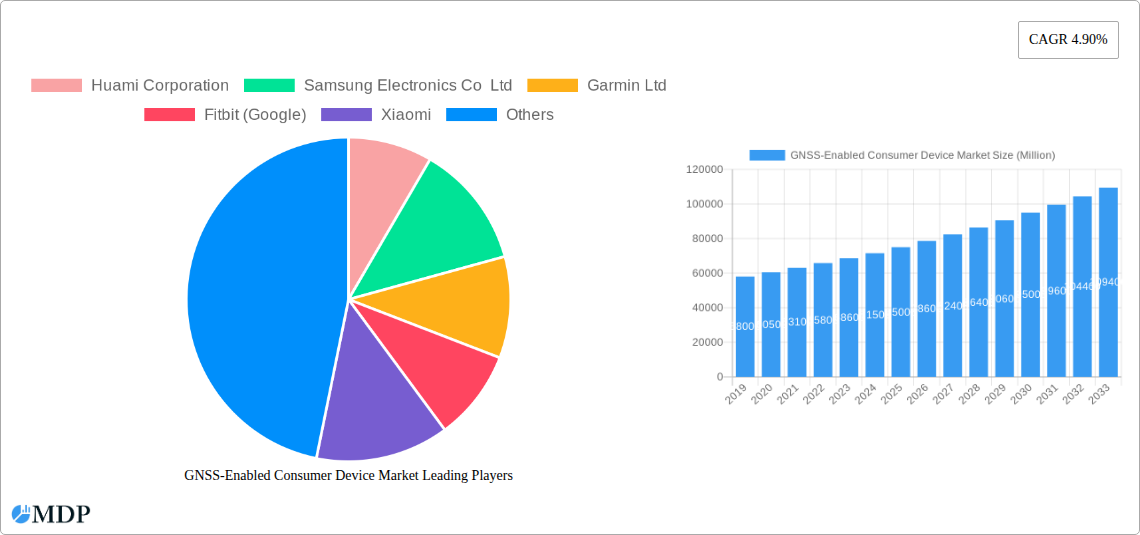

GNSS-Enabled Consumer Device Market Company Market Share

The GNSS-enabled consumer device market is characterized by a dynamic interplay of innovation, competition, and evolving end-user demands. Market concentration is moderately high, with key players like Apple Inc., Samsung Electronics Co Ltd, and Xiaomi holding substantial market share. Huami Corporation and Fitbit (Google) are significant contenders, particularly in the wearables segment. Innovation is primarily driven by advancements in GNSS chipset miniaturization, increased power efficiency, and multi-constellation support for enhanced accuracy. While regulatory frameworks are generally permissive for consumer electronics, increasing focus on data privacy and security is influencing GNSS data utilization. Product substitutes like Wi-Fi triangulation and cellular network positioning exist but often lack the precision and global coverage of GNSS, especially for outdoor applications. End-user trends highlight a growing demand for location-aware services in fitness tracking, navigation, and enhanced safety features. Mergers and acquisitions (M&A) are a significant factor in shaping market concentration, indicating a trend towards consolidation and strategic acquisition of complementary technologies and market access.

GNSS-Enabled Consumer Device Market Industry Trends & Analysis

The GNSS-enabled consumer device market is experiencing robust growth, driven by a confluence of technological advancements, expanding application areas, and escalating consumer adoption. The market penetration of GNSS capabilities within consumer electronics has seen a steady increase, from approximately 45% in 2019 to an estimated 70% in 2025. This upward trajectory is underpinned by a compound annual growth rate (CAGR) of around 12.5% projected for the forecast period of 2025–2033. Key growth drivers include the ubiquitous integration of GNSS in smartphones, which serve as the primary gateway for location-based services. The burgeoning wearables market, encompassing smartwatches and fitness trackers, is another significant contributor, offering enhanced health and fitness monitoring features powered by precise location tracking. Technological disruptions, such as the advent of multi-frequency GNSS receivers, are improving accuracy and reliability even in challenging urban environments. Furthermore, the development of low-power GNSS chipsets is crucial for extending battery life in portable devices, a critical factor for consumer satisfaction. Consumer preferences are increasingly skewed towards devices that offer personalized experiences and convenience through location intelligence. This includes a growing demand for advanced navigation features, real-time location sharing for safety, and sophisticated fitness analytics. The competitive dynamics are characterized by intense innovation, with companies vying for market leadership through superior technology, diverse product portfolios, and strategic partnerships. The industry is also witnessing a shift towards greater integration of AI and machine learning with GNSS data to provide more intelligent insights and predictive capabilities. The rising disposable income in emerging economies further fuels market expansion, as more consumers gain access to advanced GNSS-enabled devices.

Leading Markets & Segments in GNSS-Enabled Consumer Device Market

The GNSS-enabled consumer device market is dominated by the Smartphones, Tablets & Wearables segment, which accounts for an estimated 65% of the total market value. This dominance is driven by the sheer volume of smartphone sales globally and the rapid proliferation of smartwatches and fitness trackers. Within this segment, Smartphones represent the largest share, with an estimated xx Million units shipped annually. The primary drivers for this segment's leadership include the inherent functionality of GNSS in navigation and location-based applications, which are integral to the smartphone user experience. Economic policies in major markets like North America and Asia-Pacific, characterized by high disposable incomes and a strong appetite for consumer electronics, further bolster this segment's growth. Infrastructure development, particularly the widespread availability of cellular networks and the increasing accessibility of Wi-Fi hotspots, complements GNSS functionality, creating a seamless location-aware ecosystem.

Personal Tracking Devices represent the second-largest segment, holding an estimated 20% market share. This segment includes devices like GPS trackers for pets, children, and valuable assets. The growing awareness among consumers regarding personal safety and security is a key driver for this segment.

The Low-Power Asset Trackers segment, while smaller at an estimated 10% market share, is experiencing rapid growth, particularly in logistics and supply chain management. The demand for real-time tracking of goods and inventory, coupled with the need for long battery life, makes these devices highly attractive.

The Other Device Types segment, encompassing devices like rugged outdoor equipment and specialized sports gadgets, accounts for the remaining 5% market share. While niche, this segment is crucial for driving innovation in specialized GNSS applications. The dominance of the Smartphones, Tablets & Wearables segment is further reinforced by ongoing technological advancements, such as the integration of multi-constellation GNSS receivers and improved power management, which enhance the user experience and broaden the applicability of these devices.

GNSS-Enabled Consumer Device Market Product Developments

Product developments in the GNSS-enabled consumer device market are characterized by a relentless pursuit of enhanced accuracy, power efficiency, and miniaturization. Innovations include the integration of multi-frequency and multi-constellation GNSS chipsets, enabling devices to receive signals from multiple satellite systems (GPS, GLONASS, Galileo, BeiDou), thus significantly improving positional accuracy, especially in challenging environments like urban canyons. Furthermore, advancements in ultra-low-power GNSS solutions are extending battery life in wearables and personal tracking devices, a critical factor for consumer adoption. The growing trend towards sensor fusion, where GNSS data is combined with inertial measurement units (IMUs) and other sensors, provides more robust and reliable positioning for applications like indoor navigation and advanced fitness tracking. The market is also witnessing the development of GNSS modules with built-in connectivity options (Bluetooth, Wi-Fi, Cellular) for seamless data transmission and a more integrated user experience.

Key Drivers of GNSS-Enabled Consumer Device Market Growth

Several key factors are propelling the growth of the GNSS-enabled consumer device market. Technological advancements, particularly in chipset miniaturization and power efficiency, are making GNSS integration more feasible and cost-effective across a wider range of consumer electronics. The increasing demand for location-aware applications, such as fitness tracking, navigation, ride-sharing services, and enhanced safety features in wearables and smartphones, is a significant market driver. Economic factors, including rising disposable incomes in emerging markets, are expanding the consumer base for these sophisticated devices. Additionally, government initiatives supporting the deployment and modernization of GNSS infrastructure, like Galileo and BeiDou, are indirectly fostering market growth by ensuring reliable signal availability and accuracy. The growing prevalence of the Internet of Things (IoT) ecosystem also presents opportunities for GNSS-enabled devices to contribute to interconnected smart environments.

Challenges in the GNSS-Enabled Consumer Device Market Market

Despite its robust growth, the GNSS-enabled consumer device market faces several challenges. Regulatory hurdles related to data privacy and security can impact the collection and utilization of sensitive location data, requiring companies to implement stringent compliance measures. Supply chain disruptions, as witnessed in recent years, can affect the availability and cost of essential components, including GNSS chipsets. Competitive pressures are intense, with numerous players vying for market share, leading to pricing challenges and a constant need for innovation to stay ahead. The development of increasingly sophisticated spoofing and jamming techniques poses a threat to GNSS signal integrity, necessitating advancements in signal security and resilience. Furthermore, the dependency on satellite signals means that performance can be affected by atmospheric conditions and signal blockage, requiring robust fallback mechanisms and hybrid positioning solutions.

Emerging Opportunities in GNSS-Enabled Consumer Device Market

Emerging opportunities in the GNSS-enabled consumer device market are driven by transformative technological breakthroughs and evolving consumer needs. The expansion of augmented reality (AR) and virtual reality (VR) applications presents a significant opportunity, as precise location data is crucial for immersive AR experiences and location-based VR content. The growth of the automotive industry's adoption of GNSS for advanced driver-assistance systems (ADAS) and autonomous driving features, even in consumer-grade vehicles, opens up a lucrative avenue. The increasing integration of GNSS with 5G technology promises faster data processing and lower latency, enabling new real-time location-based services. Furthermore, the expansion of indoor navigation capabilities, leveraging a combination of GNSS and other positioning technologies like Wi-Fi and Bluetooth beacons, offers significant potential for retail, logistics, and smart building applications. Strategic partnerships between GNSS chipset manufacturers, device OEMs, and software developers will be critical in unlocking these opportunities.

Leading Players in the GNSS-Enabled Consumer Device Market Sector

- Huami Corporation

- Samsung Electronics Co Ltd

- Garmin Ltd

- Fitbit (Google)

- Xiaomi

- Huawei Technologies Co Ltd

- Fossil Group Inc

- Apple Inc

- Samsung

Key Milestones in GNSS-Enabled Consumer Device Market Industry

- 2019: Widespread adoption of multi-constellation support (GPS, GLONASS, Galileo) in premium smartphones.

- 2020: Introduction of advanced health tracking features utilizing GNSS in smartwatches, fueling wearable market growth.

- 2021: Increased focus on low-power GNSS chipsets enabling longer battery life for personal tracking devices.

- 2022: Growing integration of GNSS with AI for enhanced navigation and predictive location-based services.

- 2023: Significant advancements in GNSS accuracy and reliability in challenging urban environments through multi-frequency solutions.

- 2024: Increased consumer demand for GNSS-enabled devices in emerging economies.

- 2025: Estimated xx Million units of GNSS-enabled consumer devices to be shipped globally.

- 2026–2033: Projected continued robust growth driven by technological innovation and expanding application scope.

Strategic Outlook for GNSS-Enabled Consumer Device Market Market

The strategic outlook for the GNSS-enabled consumer device market is overwhelmingly positive, characterized by sustained innovation and expanding market reach. Growth accelerators include the continued miniaturization and enhanced efficiency of GNSS technology, making it more accessible for a broader spectrum of consumer electronics. The increasing convergence of GNSS with other emerging technologies like 5G, AI, and AR/VR will unlock novel use cases and enhance user experiences. Strategic partnerships and collaborations among industry players, from chipset manufacturers to application developers, will be crucial for driving ecosystem growth and addressing complex market demands. The expansion into emerging markets, coupled with a growing consumer awareness of the benefits of location-aware technologies, presents significant untapped potential. Companies that focus on delivering superior accuracy, enhanced power management, and seamless integration with other digital services will be well-positioned to capture market share and lead in this dynamic sector.

GNSS-Enabled Consumer Device Market Segmentation

-

1. Device Type

- 1.1. Smartphones

- 1.2. Tablets & Wearables

- 1.3. Personal Tracking Devices

- 1.4. Low-Power Asset Trackers

- 1.5. Other Device Types

GNSS-Enabled Consumer Device Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

GNSS-Enabled Consumer Device Market Regional Market Share

Geographic Coverage of GNSS-Enabled Consumer Device Market

GNSS-Enabled Consumer Device Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Wearables and tracking devices are boosting the GNSS market

- 3.2.2 whilst smartphone shipments are maturing

- 3.3. Market Restrains

- 3.3.1 Algorithms

- 3.3.2 Mathematical and Other Complexities Associated with the Gesture Recognition Technology

- 3.4. Market Trends

- 3.4.1. The Smartphones Segment is Expected to Considerably Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global GNSS-Enabled Consumer Device Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 5.1.1. Smartphones

- 5.1.2. Tablets & Wearables

- 5.1.3. Personal Tracking Devices

- 5.1.4. Low-Power Asset Trackers

- 5.1.5. Other Device Types

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Latin America

- 5.2.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Device Type

- 6. North America GNSS-Enabled Consumer Device Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 6.1.1. Smartphones

- 6.1.2. Tablets & Wearables

- 6.1.3. Personal Tracking Devices

- 6.1.4. Low-Power Asset Trackers

- 6.1.5. Other Device Types

- 6.1. Market Analysis, Insights and Forecast - by Device Type

- 7. Europe GNSS-Enabled Consumer Device Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 7.1.1. Smartphones

- 7.1.2. Tablets & Wearables

- 7.1.3. Personal Tracking Devices

- 7.1.4. Low-Power Asset Trackers

- 7.1.5. Other Device Types

- 7.1. Market Analysis, Insights and Forecast - by Device Type

- 8. Asia Pacific GNSS-Enabled Consumer Device Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 8.1.1. Smartphones

- 8.1.2. Tablets & Wearables

- 8.1.3. Personal Tracking Devices

- 8.1.4. Low-Power Asset Trackers

- 8.1.5. Other Device Types

- 8.1. Market Analysis, Insights and Forecast - by Device Type

- 9. Latin America GNSS-Enabled Consumer Device Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 9.1.1. Smartphones

- 9.1.2. Tablets & Wearables

- 9.1.3. Personal Tracking Devices

- 9.1.4. Low-Power Asset Trackers

- 9.1.5. Other Device Types

- 9.1. Market Analysis, Insights and Forecast - by Device Type

- 10. Middle East and Africa GNSS-Enabled Consumer Device Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 10.1.1. Smartphones

- 10.1.2. Tablets & Wearables

- 10.1.3. Personal Tracking Devices

- 10.1.4. Low-Power Asset Trackers

- 10.1.5. Other Device Types

- 10.1. Market Analysis, Insights and Forecast - by Device Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Huami Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Samsung Electronics Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Garmin Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fitbit (Google)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Xiaomi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Huawei Technologies Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fossil Group Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Apple Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Samsung

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Huami Corporation

List of Figures

- Figure 1: Global GNSS-Enabled Consumer Device Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: Global GNSS-Enabled Consumer Device Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America GNSS-Enabled Consumer Device Market Revenue (billion), by Device Type 2025 & 2033

- Figure 4: North America GNSS-Enabled Consumer Device Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 5: North America GNSS-Enabled Consumer Device Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 6: North America GNSS-Enabled Consumer Device Market Volume Share (%), by Device Type 2025 & 2033

- Figure 7: North America GNSS-Enabled Consumer Device Market Revenue (billion), by Country 2025 & 2033

- Figure 8: North America GNSS-Enabled Consumer Device Market Volume (K Unit), by Country 2025 & 2033

- Figure 9: North America GNSS-Enabled Consumer Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: North America GNSS-Enabled Consumer Device Market Volume Share (%), by Country 2025 & 2033

- Figure 11: Europe GNSS-Enabled Consumer Device Market Revenue (billion), by Device Type 2025 & 2033

- Figure 12: Europe GNSS-Enabled Consumer Device Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 13: Europe GNSS-Enabled Consumer Device Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 14: Europe GNSS-Enabled Consumer Device Market Volume Share (%), by Device Type 2025 & 2033

- Figure 15: Europe GNSS-Enabled Consumer Device Market Revenue (billion), by Country 2025 & 2033

- Figure 16: Europe GNSS-Enabled Consumer Device Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: Europe GNSS-Enabled Consumer Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe GNSS-Enabled Consumer Device Market Volume Share (%), by Country 2025 & 2033

- Figure 19: Asia Pacific GNSS-Enabled Consumer Device Market Revenue (billion), by Device Type 2025 & 2033

- Figure 20: Asia Pacific GNSS-Enabled Consumer Device Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 21: Asia Pacific GNSS-Enabled Consumer Device Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 22: Asia Pacific GNSS-Enabled Consumer Device Market Volume Share (%), by Device Type 2025 & 2033

- Figure 23: Asia Pacific GNSS-Enabled Consumer Device Market Revenue (billion), by Country 2025 & 2033

- Figure 24: Asia Pacific GNSS-Enabled Consumer Device Market Volume (K Unit), by Country 2025 & 2033

- Figure 25: Asia Pacific GNSS-Enabled Consumer Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific GNSS-Enabled Consumer Device Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Latin America GNSS-Enabled Consumer Device Market Revenue (billion), by Device Type 2025 & 2033

- Figure 28: Latin America GNSS-Enabled Consumer Device Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 29: Latin America GNSS-Enabled Consumer Device Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 30: Latin America GNSS-Enabled Consumer Device Market Volume Share (%), by Device Type 2025 & 2033

- Figure 31: Latin America GNSS-Enabled Consumer Device Market Revenue (billion), by Country 2025 & 2033

- Figure 32: Latin America GNSS-Enabled Consumer Device Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: Latin America GNSS-Enabled Consumer Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Latin America GNSS-Enabled Consumer Device Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Middle East and Africa GNSS-Enabled Consumer Device Market Revenue (billion), by Device Type 2025 & 2033

- Figure 36: Middle East and Africa GNSS-Enabled Consumer Device Market Volume (K Unit), by Device Type 2025 & 2033

- Figure 37: Middle East and Africa GNSS-Enabled Consumer Device Market Revenue Share (%), by Device Type 2025 & 2033

- Figure 38: Middle East and Africa GNSS-Enabled Consumer Device Market Volume Share (%), by Device Type 2025 & 2033

- Figure 39: Middle East and Africa GNSS-Enabled Consumer Device Market Revenue (billion), by Country 2025 & 2033

- Figure 40: Middle East and Africa GNSS-Enabled Consumer Device Market Volume (K Unit), by Country 2025 & 2033

- Figure 41: Middle East and Africa GNSS-Enabled Consumer Device Market Revenue Share (%), by Country 2025 & 2033

- Figure 42: Middle East and Africa GNSS-Enabled Consumer Device Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 2: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 3: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 5: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 6: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 7: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 8: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 9: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 10: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 11: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 14: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 15: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 18: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 19: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 20: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 22: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Device Type 2020 & 2033

- Table 23: Global GNSS-Enabled Consumer Device Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: Global GNSS-Enabled Consumer Device Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the GNSS-Enabled Consumer Device Market?

The projected CAGR is approximately 11.17%.

2. Which companies are prominent players in the GNSS-Enabled Consumer Device Market?

Key companies in the market include Huami Corporation, Samsung Electronics Co Ltd, Garmin Ltd, Fitbit (Google), Xiaomi, Huawei Technologies Co Ltd, Fossil Group Inc, Apple Inc, Samsung.

3. What are the main segments of the GNSS-Enabled Consumer Device Market?

The market segments include Device Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 335.04 billion as of 2022.

5. What are some drivers contributing to market growth?

Wearables and tracking devices are boosting the GNSS market. whilst smartphone shipments are maturing.

6. What are the notable trends driving market growth?

The Smartphones Segment is Expected to Considerably Drive the Market's Growth.

7. Are there any restraints impacting market growth?

Algorithms. Mathematical and Other Complexities Associated with the Gesture Recognition Technology.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "GNSS-Enabled Consumer Device Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the GNSS-Enabled Consumer Device Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the GNSS-Enabled Consumer Device Market?

To stay informed about further developments, trends, and reports in the GNSS-Enabled Consumer Device Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence