Key Insights

The European online grocery delivery market is poised for significant expansion, driven by evolving consumer habits and technological progress. The market is projected to reach $81.81 billion by 2025, with a robust Compound Annual Growth Rate (CAGR) of 22.46% from 2025 to 2033. Key growth drivers include increasing e-commerce adoption across demographics, the demand for convenience and time savings, and the proliferation of quick commerce platforms offering rapid delivery. Technological enhancements in logistics and user-friendly applications further optimize the customer experience. While competitive pressures and last-mile delivery costs present challenges, the market outlook remains positive. The UK, Germany, and France are leading markets, supported by strong e-commerce infrastructure and consumer spending. Future dynamics will be shaped by the continued rise of quick commerce, growing online grocery penetration in Eastern Europe, and innovative delivery solutions. Intense competition among established and emerging players will foster strategic collaborations and further innovation.

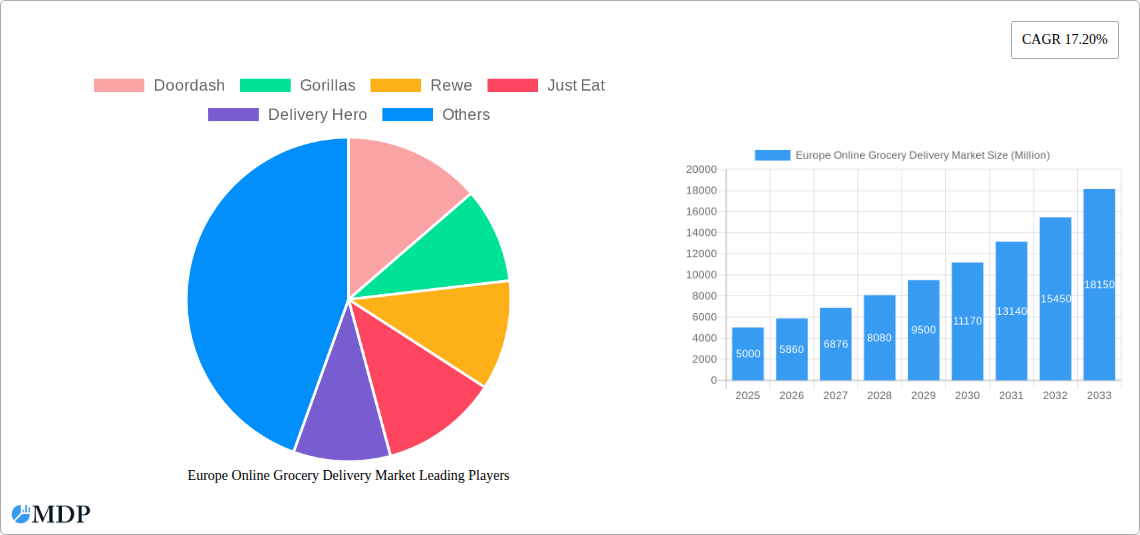

Europe Online Grocery Delivery Market Market Size (In Billion)

Market segmentation reveals distinct consumer preferences, with retail delivery, quick commerce, and meal kit delivery representing key segments. Retail delivery offers a broad product selection, while quick commerce excels in delivering immediate convenience through rapid fulfillment. Meal kit services cater to consumers seeking simplified meal preparation. Geographically, while Western Europe remains dominant, Eastern European markets are emerging as substantial growth opportunities. The forecast period anticipates sustained high growth, influenced by ongoing consumer engagement and technological advancements.

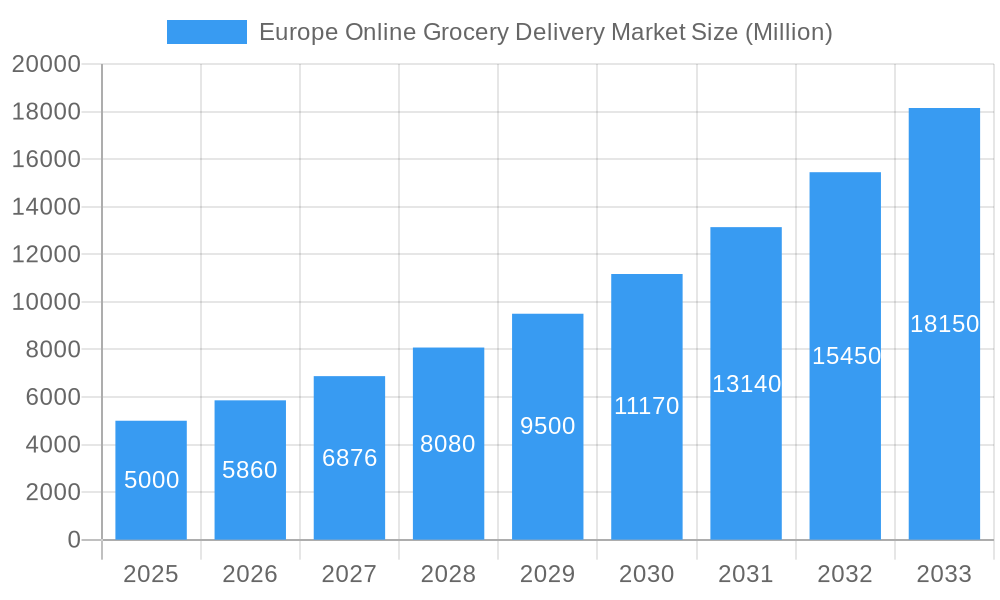

Europe Online Grocery Delivery Market Company Market Share

Europe Online Grocery Delivery Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the rapidly evolving Europe online grocery delivery market, offering invaluable insights for stakeholders, investors, and industry professionals. With a detailed examination of market dynamics, trends, leading players, and future opportunities, this report is an essential resource for navigating this dynamic sector. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033.

Europe Online Grocery Delivery Market Market Dynamics & Concentration

The European online grocery delivery market is experiencing significant growth, driven by increasing consumer demand for convenience, technological advancements, and the expansion of quick commerce options. Market concentration is moderate, with several key players vying for dominance. However, the market is witnessing a rise in mergers and acquisitions (M&A) activity, indicating consolidation trends. The regulatory landscape varies across European countries, impacting market entry and operations. The presence of established supermarket chains alongside dedicated delivery-only services creates a dynamic competitive landscape.

- Market Share: The top five players (Doordash, Gorillas, Just Eat, Delivery Hero, and Uber Eats) hold an estimated xx% of the market share in 2025.

- M&A Activity: The number of M&A deals in the sector increased by xx% between 2021 and 2022, reflecting the industry's consolidation efforts.

- Innovation Drivers: Technological advancements, such as AI-powered logistics and improved delivery apps, are major drivers of innovation.

- Regulatory Framework: Differing regulations across countries affect operational costs and expansion strategies.

- Product Substitutes: Traditional grocery shopping and local markets remain competitive substitutes.

- End-User Trends: Growing preference for convenient, contactless grocery delivery is boosting market growth.

Europe Online Grocery Delivery Market Industry Trends & Analysis

The European online grocery delivery market is experiencing robust growth, fueled by evolving consumer preferences and technological innovations. The market witnessed a compound annual growth rate (CAGR) of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). This growth is driven by factors such as rising disposable incomes, increasing urbanization, and the growing popularity of quick commerce models offering ultra-fast delivery. Technological disruptions, such as the use of autonomous vehicles and drone delivery, are further transforming the industry. Market penetration is expected to reach xx% by 2033, driven by increasing adoption rates among various demographics. Competitive dynamics are characterized by fierce rivalry among established players and the emergence of new entrants, prompting strategic partnerships and acquisitions to enhance market share.

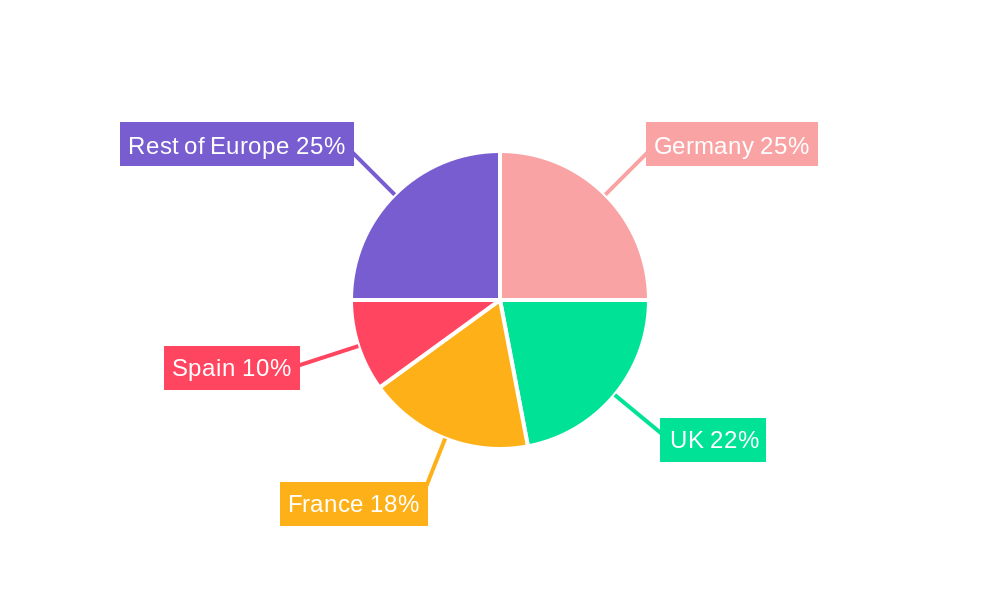

Leading Markets & Segments in Europe Online Grocery Delivery Market

The United Kingdom and Germany represent the largest markets in Europe for online grocery delivery, driven by factors such as high internet penetration, robust e-commerce infrastructure, and a high proportion of urban populations.

By Product Type:

- Quick Commerce: This segment demonstrates the fastest growth, driven by the demand for rapid delivery of essential groceries.

- Retail Delivery: This segment is mature, yet continues to expand due to increased service options and partnerships with supermarkets.

- Meal Kit Delivery: This niche segment shows steady growth, catering to consumers seeking convenient and healthy meal options.

By Country:

- United Kingdom: High internet penetration, strong e-commerce infrastructure, and a sizable urban population contribute to the UK's leading market position. Key drivers include favourable economic policies and developed logistics networks.

- Germany: Strong economic growth and an increasing preference for online convenience drive substantial growth in the German market. Well-developed logistics infrastructure and favorable regulatory frameworks support market expansion.

- France: France's online grocery delivery market shows consistent growth but lags behind the UK and Germany, primarily due to established traditional shopping habits and a slower digital adoption rate in some regions.

- Spain: Similar to France, Spain presents a market with growth potential, but the expansion rate is influenced by factors like regional differences in infrastructure and consumer behavior.

- Eastern Europe: The market in Eastern Europe shows significant potential for future growth due to increasing internet and smartphone penetration and rising disposable incomes. However, challenges remain in logistics and infrastructure.

- Rest of Europe: This segment exhibits diverse growth rates depending on each country’s economic development, digital infrastructure, and consumer behavior.

Europe Online Grocery Delivery Market Product Developments

The market is witnessing continuous product innovation, including improvements to delivery apps, expansion of product offerings, and the integration of new technologies like AI and machine learning for efficient route optimization and demand forecasting. These developments enhance customer experience and operational efficiency, driving stronger market competition and adoption. The focus on personalized recommendations and subscription-based services is also gaining momentum.

Key Drivers of Europe Online Grocery Delivery Market Growth

Several factors contribute to the growth of the European online grocery delivery market:

- Technological advancements: Improvements in mobile technology, delivery infrastructure, and logistics software enhance efficiency and customer experience.

- Economic growth: Rising disposable incomes and increasing urbanization drive consumer demand for convenient online shopping.

- Favorable regulatory environment: Supportive government policies in certain countries are fostering market growth.

Challenges in the Europe Online Grocery Delivery Market Market

The market faces challenges, including:

- High operational costs: Labor, logistics, and technology investments pose significant expenses.

- Intense competition: The market is highly fragmented, with numerous players competing for market share, leading to price wars.

- Regulatory hurdles: Varying regulations across different European countries complicate market entry and operations.

- Supply chain disruptions: External factors, like those experienced in recent years, can affect product availability and delivery times.

Emerging Opportunities in Europe Online Grocery Delivery Market

The market presents several exciting long-term growth opportunities:

- Expansion into smaller cities and rural areas: Reaching underserved markets offers significant growth potential.

- Strategic partnerships: Collaborations between online platforms and traditional grocery retailers can unlock new market segments.

- Technological innovation: The integration of AI, drone delivery, and autonomous vehicles can revolutionize logistics and delivery efficiency.

- Focus on sustainability: Implementing eco-friendly delivery options and reducing carbon footprints will appeal to environmentally conscious consumers.

Leading Players in the Europe Online Grocery Delivery Market Sector

Key Milestones in Europe Online Grocery Delivery Market Industry

- January 2023: Sainsbury's partners with Just Eat Takeaway for faster grocery delivery, launching in over 175 stores initially.

- February 2022: Rohlik Group expands its Knusper.de service into Germany's Rhine-Main Metropolitan Region, offering over 9,000 items.

Strategic Outlook for Europe Online Grocery Delivery Market Market

The European online grocery delivery market is poised for continued robust growth, driven by technological advancements, changing consumer behavior, and strategic initiatives by major players. Opportunities exist for companies to focus on innovative delivery models, personalized services, and expansion into underserved markets. Strategic partnerships and investments in technology will play a crucial role in shaping the future of the market. Sustainable practices and a focus on customer experience will further enhance market competitiveness.

Europe Online Grocery Delivery Market Segmentation

-

1. Product Type

- 1.1. Retail Delivery

- 1.2. Quick Commerce

- 1.3. Meal Kit Delivery

Europe Online Grocery Delivery Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Online Grocery Delivery Market Regional Market Share

Geographic Coverage of Europe Online Grocery Delivery Market

Europe Online Grocery Delivery Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 22.46% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Attractive Offers and Payment Flexibility to Boost the Demand of the Market

- 3.3. Market Restrains

- 3.3.1. High-priced products and additional delivery charges; Inconsistency in product quality

- 3.4. Market Trends

- 3.4.1. Attractive Offers and Payment Flexibility to Boost the Demand of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Online Grocery Delivery Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Retail Delivery

- 5.1.2. Quick Commerce

- 5.1.3. Meal Kit Delivery

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Doordash

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Gorillas

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rewe

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Just Eat

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Delivery Hero

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Uber Eats

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Flink

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amazon com Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Zomato

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Getir

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Doordash

List of Figures

- Figure 1: Europe Online Grocery Delivery Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Online Grocery Delivery Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Online Grocery Delivery Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Europe Online Grocery Delivery Market Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Europe Online Grocery Delivery Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 4: Europe Online Grocery Delivery Market Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United Kingdom Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Germany Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: France Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Italy Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Spain Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Netherlands Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Belgium Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Sweden Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Norway Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Poland Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Denmark Europe Online Grocery Delivery Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Online Grocery Delivery Market?

The projected CAGR is approximately 22.46%.

2. Which companies are prominent players in the Europe Online Grocery Delivery Market?

Key companies in the market include Doordash, Gorillas, Rewe, Just Eat, Delivery Hero, Uber Eats, Flink, Amazon com Inc, Zomato, Getir.

3. What are the main segments of the Europe Online Grocery Delivery Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 81.81 billion as of 2022.

5. What are some drivers contributing to market growth?

Shift in Shopping Mode Preferences of the people; Increasing Urbanization; Attractive Offers and Payment Flexibility to Boost the Demand of the Market.

6. What are the notable trends driving market growth?

Attractive Offers and Payment Flexibility to Boost the Demand of the Market.

7. Are there any restraints impacting market growth?

High-priced products and additional delivery charges; Inconsistency in product quality.

8. Can you provide examples of recent developments in the market?

January 2023: Sainsbury's, the UK's largest supermarket chain, has partnered with online meal ordering and delivery service Eat Takeaway to provide speedier home delivery for groceries across the country. Customers can order things from Sainsbury's for delivery in under 30 minutes using the Just Eat app. The cooperation will begin with more than 175 stores by the end of February, with a nationwide rollout planned for 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Online Grocery Delivery Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Online Grocery Delivery Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Online Grocery Delivery Market?

To stay informed about further developments, trends, and reports in the Europe Online Grocery Delivery Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence