Key Insights

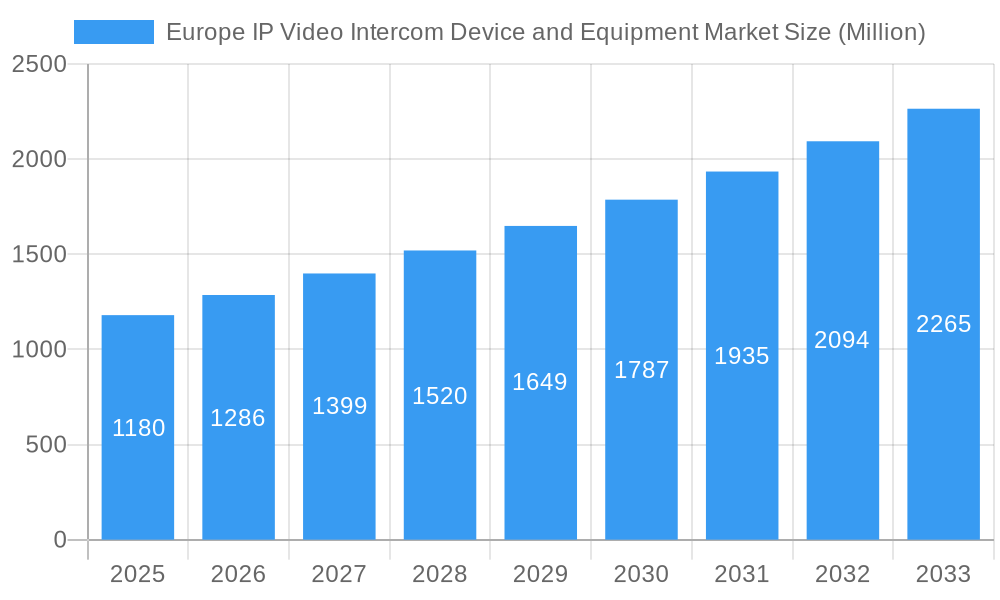

The Europe IP Video Intercom Device and Equipment Market is poised for significant expansion, currently valued at approximately USD 1.18 billion in 2025. This robust growth is driven by a projected Compound Annual Growth Rate (CAGR) of 8.97% over the forecast period of 2025-2033, indicating a dynamic and evolving market landscape. The increasing adoption of advanced security solutions across residential, commercial, and government sectors is a primary catalyst. Trends such as the integration of facial recognition and fingerprint scanning technologies are enhancing security protocols and user convenience, making IP video intercoms a preferred choice. Furthermore, the growing demand for smart home devices and the trend towards interconnected security ecosystems are fueling market penetration. The convenience and enhanced safety offered by wireless and battery-powered options are also contributing to market expansion, catering to a wider range of installation scenarios and user preferences.

Europe IP Video Intercom Device and Equipment Market Market Size (In Billion)

Despite the promising outlook, certain restraints may influence the pace of growth. High initial installation costs for sophisticated IP video intercom systems could be a barrier for some segments, particularly smaller residential or commercial entities. The need for robust internet connectivity and potential cybersecurity concerns associated with networked devices also require careful consideration and mitigation strategies. However, the strong emphasis on property security, coupled with increasing disposable incomes and technological advancements that are driving down costs and improving user experience, are expected to outweigh these challenges. The market is segmented into various product types, including wired, wireless, and battery-powered devices, and features such as motion detection and night vision are becoming standard. Key players like Honeywell, Samsung Electronics, and Hangzhou Hikvision are actively innovating and expanding their product portfolios to capture market share across Europe, particularly in key regions like the United Kingdom, Germany, and France.

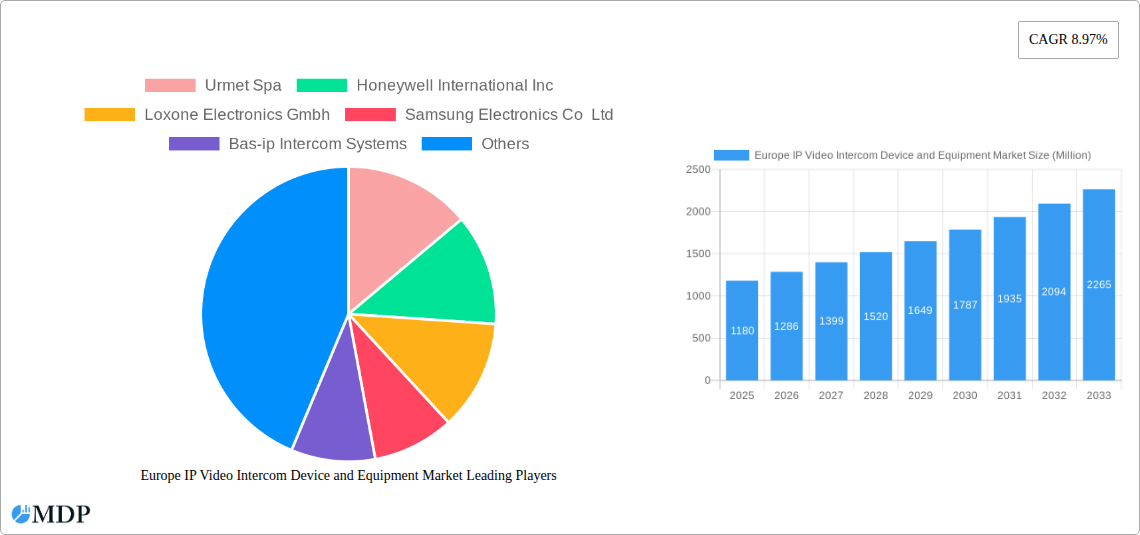

Europe IP Video Intercom Device and Equipment Market Company Market Share

Unlock the Future of Secure Access: Europe IP Video Intercom Device and Equipment Market Report (2019–2033)

Gain unparalleled insights into the dynamic Europe IP Video Intercom Device and Equipment Market. This comprehensive report, covering the period from 2019 to 2033 with a base year of 2025, provides an in-depth analysis of market drivers, emerging trends, leading players, and future opportunities. Essential for manufacturers, distributors, integrators, and investors, this report offers actionable intelligence to navigate the evolving landscape of secure communication and access control. Discover market projections, key growth segments, and strategic recommendations to capitalize on the escalating demand for advanced IP video intercom solutions across commercial, residential, and government sectors.

Europe IP Video Intercom Device and Equipment Market Market Dynamics & Concentration

The Europe IP Video Intercom Device and Equipment Market exhibits a moderate to high concentration, with key players like Hangzhou Hikvision Digital Technology Co Ltd, Samsung Electronics Co Ltd, Honeywell International Inc, Urmet Spa, and 2N Telekomunikace holding significant market shares. Innovation is a primary driver, fueled by advancements in AI, IoT integration, and enhanced security features such as facial recognition and fingerprint scanning. Regulatory frameworks, particularly concerning data privacy (GDPR) and cybersecurity, are increasingly shaping product development and market entry strategies. Product substitutes, primarily traditional audio intercoms and basic access control systems, are steadily losing ground to the superior functionality and connectivity of IP video intercoms. End-user trends indicate a strong preference for integrated smart home and building management systems, driving demand for interoperable solutions. Mergers and acquisitions (M&A) activities are expected to continue as larger players seek to expand their product portfolios and market reach. For instance, the integration of smart home ecosystems by companies like Ring (Amazon Inc) and Netatmo (Legrand) highlights this trend. Estimated M&A deal counts for the forecast period are projected to be between 8 to 12, indicating strategic consolidation.

Europe IP Video Intercom Device and Equipment Market Industry Trends & Analysis

The Europe IP Video Intercom Device and Equipment Market is experiencing robust growth, propelled by an escalating emphasis on enhanced security, convenience, and smart building integration. The compound annual growth rate (CAGR) for the forecast period (2025–2033) is projected to be approximately 12.5%. Technological advancements are at the forefront of this expansion. The increasing adoption of Artificial Intelligence (AI) for features like facial recognition and intelligent motion detection is significantly improving the accuracy and efficiency of these systems. Furthermore, the proliferation of wireless and battery-powered devices is broadening the applicability of IP video intercoms, especially in retrofitting older buildings where wired installations are challenging. Consumer preferences are shifting towards seamless integration with existing smart home ecosystems, demanding interoperability and user-friendly interfaces. The competitive landscape is characterized by both established giants and agile innovators, with a constant drive to develop more sophisticated and feature-rich products. Market penetration is steadily increasing, particularly in urban centers, as awareness of the benefits of IP video intercoms grows among both commercial and residential users. The convergence of security and communication technologies is creating new avenues for revenue generation and market expansion. The anticipated market size for 2025 is estimated to be XX Billion Euros, with substantial growth projected through 2033.

Leading Markets & Segments in Europe IP Video Intercom Device and Equipment Market

The Residential segment is emerging as a dominant force in the Europe IP Video Intercom Device and Equipment Market, driven by the increasing adoption of smart home technology and a heightened consumer focus on home security and convenience. Within this segment, wireless and battery-powered product types are witnessing significant traction due to their ease of installation and flexibility, particularly in existing properties. The demand for advanced features is soaring, with facial recognition and fingerprint scanning leading the charge in providing secure and touchless access control, thereby enhancing user experience and hygiene.

Dominant End-User Segment: Residential

- Key Drivers: Growing disposable incomes, increasing prevalence of smart home devices, rising concerns about personal safety and property security, and a desire for remote access and monitoring capabilities.

- Analysis: The European residential market is characterized by a high density of homeowners actively seeking to upgrade their living spaces with modern technology. The convenience of remotely viewing visitors, granting access, and receiving package deliveries via smartphone apps is a major catalyst.

Dominant Product Type: Wireless & Battery-powered

- Key Drivers: Ease of installation, minimal disruption to existing infrastructure, flexibility in placement, and cost-effectiveness compared to wired solutions for retrofits.

- Analysis: The ease of DIY installation for wireless devices appeals to a broad consumer base, eliminating the need for professional electricians. Battery-powered options further enhance this convenience, offering quick deployment and minimal maintenance.

Dominant Feature: Facial Recognition & Fingerprint Scanning

- Key Drivers: Enhanced security, convenience of keyless entry, improved user authentication, and the growing trend towards biometric identification.

- Analysis: Biometric features offer a superior level of security and convenience compared to traditional keys or PIN codes. The seamless integration with mobile apps allows for personalized access permissions and detailed audit trails, appealing to both technologically savvy consumers and security-conscious individuals.

Leading Geographic Markets: Germany, the United Kingdom, France, and the Netherlands are expected to lead the market due to their high adoption rates of smart home technologies, strong economic conditions, and proactive government initiatives promoting smart city development.

Europe IP Video Intercom Device and Equipment Market Product Developments

Product development in the Europe IP Video Intercom Device and Equipment Market is characterized by a relentless pursuit of enhanced intelligence, seamless connectivity, and superior user experience. Innovations are focused on integrating advanced AI capabilities for smarter threat detection and visitor management, alongside more intuitive mobile interfaces for remote control and monitoring. The trend towards miniaturization and aesthetic design allows these devices to blend seamlessly into various architectural styles. Competitive advantages are being carved out through robust cybersecurity measures, wider field-of-view cameras, improved audio clarity, and enhanced interoperability with other smart home and building automation systems. The integration of features like facial recognition and fingerprint scanning is transforming intercoms from mere communication devices into sophisticated access control and security hubs.

Key Drivers of Europe IP Video Intercom Device and Equipment Market Growth

The growth of the Europe IP Video Intercom Device and Equipment Market is significantly propelled by several key factors. Firstly, the escalating global concern for enhanced security and the desire for remote monitoring capabilities across both residential and commercial properties are driving demand. Secondly, the rapid advancement and adoption of Internet of Things (IoT) technology are enabling seamless integration of intercom systems with smart home ecosystems and building management systems, offering greater convenience and automation. Thirdly, the increasing sophistication of video analytics, including facial recognition and AI-powered motion detection, provides advanced security features. Finally, supportive government initiatives promoting smart city development and enhanced public safety are indirectly fostering market growth.

Challenges in the Europe IP Video Intercom Device and Equipment Market Market

Despite the promising growth trajectory, the Europe IP Video Intercom Device and Equipment Market faces several challenges. Data privacy concerns and stringent regulations like GDPR necessitate robust security protocols and transparent data handling practices, which can increase development and compliance costs. Cybersecurity threats remain a significant concern, as compromised intercom systems could lead to unauthorized access and data breaches, impacting consumer trust. Interoperability issues between different manufacturers' systems can hinder seamless integration and create fragmentation in the market. Furthermore, the initial cost of advanced IP video intercom systems can be a barrier for some price-sensitive segments of the market, especially in the residential sector. Supply chain disruptions and the global shortage of certain electronic components can also impact production volumes and lead times.

Emerging Opportunities in Europe IP Video Intercom Device and Equipment Market

Emerging opportunities in the Europe IP Video Intercom Device and Equipment Market are centered on the continued integration of AI and advanced biometrics, expanding into niche markets, and fostering strategic partnerships. The development of AI-powered intercoms capable of distinguishing between residents, visitors, and delivery personnel offers enhanced convenience and security. Further leveraging technologies like fingerprint scanning and facial recognition in conjunction with mobile credentials presents lucrative avenues for high-security applications. Expansion into less saturated markets within Eastern Europe, alongside increased penetration in multi-dwelling units and commercial complexes, offers substantial growth potential. Strategic collaborations with smart home platform providers and security service companies can unlock new distribution channels and create bundled service offerings, driving recurring revenue streams.

Leading Players in the Europe IP Video Intercom Device and Equipment Market Sector

- Urmet Spa

- Honeywell International Inc

- Loxone Electronics Gmbh

- Samsung Electronics Co Ltd

- Bas-ip Intercom Systems

- Ring (amazon inc)

- Siedle

- Hangzhou Hikvision Digital Technology Co Ltd

- Alpha Communications

- Farfisa

- Doorbird (bird Home Automation Gmbh)

- Commend International Gmbh (tkh Group Nv)

- 2n Telekomunikace

- Netatmo (legrand)

- Paxton Access Ltd

- Panasonic Corporation

Key Milestones in Europe IP Video Intercom Device and Equipment Market Industry

- September 2021: Axis ARTPEC 7 processor powers the 2N IP Style. This key development introduced superb image quality and efficient compression to the intercom, excelling in maintaining image color even in low-light situations. The 2N IP Style features a 5-megapixel camera with a maximum resolution of 2560 x 1920 pixels or QHD widescreen resolution (2560 x 1440 pixels) and wide viewing angles (144° horizontal and 126° vertical).

- May 2021: DoorBird expanded its product portfolio by incorporating door intercoms with an integrated fingerprint sensor. IP video door stations of the D21x series were integrated with fingerprint technology from Fingerprint Cards AB, facilitating biometric authentication through fingerprint.

Strategic Outlook for Europe IP Video Intercom Device and Equipment Market Market

The strategic outlook for the Europe IP Video Intercom Device and Equipment Market is exceptionally bright, driven by an ongoing demand for sophisticated security solutions and seamless smart building integration. Key growth accelerators include the continued miniaturization of devices, enhanced AI capabilities for predictive analytics and personalized user experiences, and the expansion of interoperability standards to create truly connected environments. Companies that focus on robust cybersecurity, intuitive user interfaces, and the integration of advanced biometric features like facial recognition and fingerprint scanning will be well-positioned for success. Furthermore, exploring strategic partnerships with smart home ecosystems, property developers, and security service providers will be crucial for expanding market reach and capturing new revenue streams. The increasing adoption of cloud-based services for remote management and data analytics presents a significant opportunity for recurring revenue and value-added services.

Europe IP Video Intercom Device and Equipment Market Segmentation

-

1. End-User

- 1.1. Commercial

- 1.2. Residential

- 1.3. Government Or Others

-

2. Product Type

- 2.1. Wired

- 2.2. Wireless

- 2.3. Battery-powered

-

3. Features

- 3.1. Facial recognition

- 3.2. Fingerprint scanning

- 3.3. Motion detection

- 3.4. Night vision

Europe IP Video Intercom Device and Equipment Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

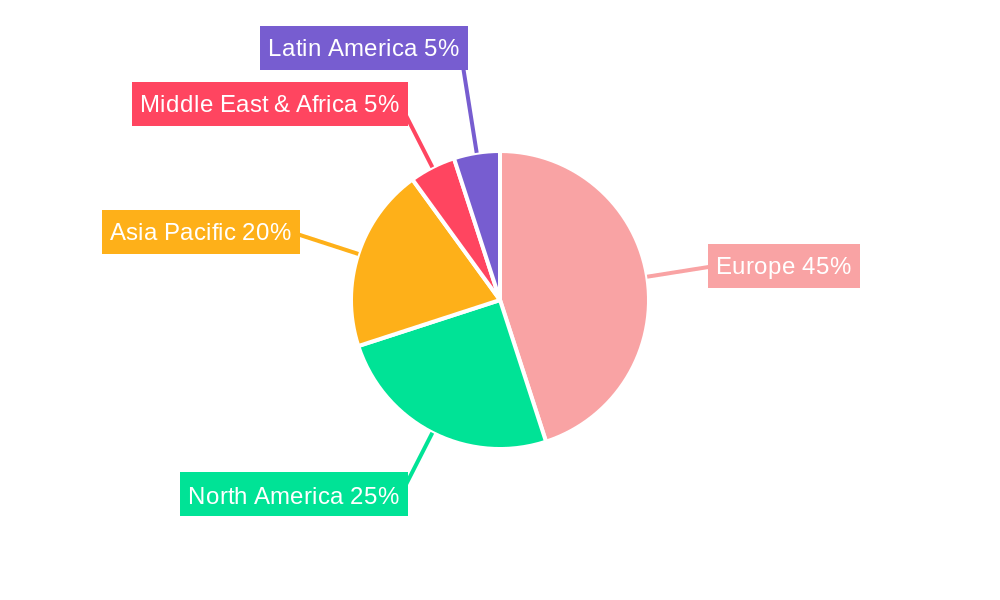

Europe IP Video Intercom Device and Equipment Market Regional Market Share

Geographic Coverage of Europe IP Video Intercom Device and Equipment Market

Europe IP Video Intercom Device and Equipment Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.97% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Incentive to Maintain High Hygiene Standards in Professional Environments; High Demand from Professional Services in Healthcare

- 3.3. Market Restrains

- 3.3.1. Increasing Vulnerability Related To Cyber-attacks and Frauds

- 3.4. Market Trends

- 3.4.1. Increasing Home Security Concern Owing to Growing Crime Rate to Drive the Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe IP Video Intercom Device and Equipment Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.1.3. Government Or Others

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.2.3. Battery-powered

- 5.3. Market Analysis, Insights and Forecast - by Features

- 5.3.1. Facial recognition

- 5.3.2. Fingerprint scanning

- 5.3.3. Motion detection

- 5.3.4. Night vision

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Urmet Spa

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Loxone Electronics Gmbh

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung Electronics Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bas-ip Intercom Systems

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ring (amazon inc)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Siedle

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hangzhou Hikvision Digital Technology Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Alpha Communications

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Farfisa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Doorbird (bird Home Automation Gmbh)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Commend International Gmbh (tkh Group Nv)

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 2n Telekomunikace

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Netatmo (legrand)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Paxton Access Ltd

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Panasonic Corporation

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.1 Urmet Spa

List of Figures

- Figure 1: Europe IP Video Intercom Device and Equipment Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe IP Video Intercom Device and Equipment Market Share (%) by Company 2025

List of Tables

- Table 1: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 2: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 3: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 4: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 5: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Features 2020 & 2033

- Table 6: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Features 2020 & 2033

- Table 7: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 10: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by End-User 2020 & 2033

- Table 11: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 13: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Features 2020 & 2033

- Table 14: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Features 2020 & 2033

- Table 15: Europe IP Video Intercom Device and Equipment Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Europe IP Video Intercom Device and Equipment Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United Kingdom Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United Kingdom Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Germany Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: France Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: France Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Italy Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Italy Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 25: Spain Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Spain Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: Netherlands Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Netherlands Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: Belgium Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Belgium Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Sweden Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Sweden Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Norway Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Norway Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Poland Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Poland Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Denmark Europe IP Video Intercom Device and Equipment Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Denmark Europe IP Video Intercom Device and Equipment Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe IP Video Intercom Device and Equipment Market?

The projected CAGR is approximately 8.97%.

2. Which companies are prominent players in the Europe IP Video Intercom Device and Equipment Market?

Key companies in the market include Urmet Spa, Honeywell International Inc, Loxone Electronics Gmbh, Samsung Electronics Co Ltd, Bas-ip Intercom Systems, Ring (amazon inc), Siedle, Hangzhou Hikvision Digital Technology Co Ltd, Alpha Communications, Farfisa, Doorbird (bird Home Automation Gmbh), Commend International Gmbh (tkh Group Nv), 2n Telekomunikace, Netatmo (legrand), Paxton Access Ltd, Panasonic Corporation.

3. What are the main segments of the Europe IP Video Intercom Device and Equipment Market?

The market segments include End-User, Product Type , Features .

4. Can you provide details about the market size?

The market size is estimated to be USD 1.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Incentive to Maintain High Hygiene Standards in Professional Environments; High Demand from Professional Services in Healthcare.

6. What are the notable trends driving market growth?

Increasing Home Security Concern Owing to Growing Crime Rate to Drive the Growth.

7. Are there any restraints impacting market growth?

Increasing Vulnerability Related To Cyber-attacks and Frauds.

8. Can you provide examples of recent developments in the market?

September 2021 - Axis ARTPEC 7 processor powers the 2N IP Style, a Sweden-based key player in the IP camera industry, was introduced. The ARTPEC 7 processor provides superb image quality and efficient compression to the 2N IP Style intercom. The ARTPEC 7 processor excels in maintaining image color even in low-light situations. A 5-megapixel camera with a maximum resolution of 2560 x 1920 pixels or QHD widescreen resolution (2560 x 1440 pixels) is included with the 2N IP Style. The camera's wide viewing angles (144° horizontal and 126° vertical) ensure that the resident can see everything outside their door.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe IP Video Intercom Device and Equipment Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe IP Video Intercom Device and Equipment Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe IP Video Intercom Device and Equipment Market?

To stay informed about further developments, trends, and reports in the Europe IP Video Intercom Device and Equipment Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence