Key Insights

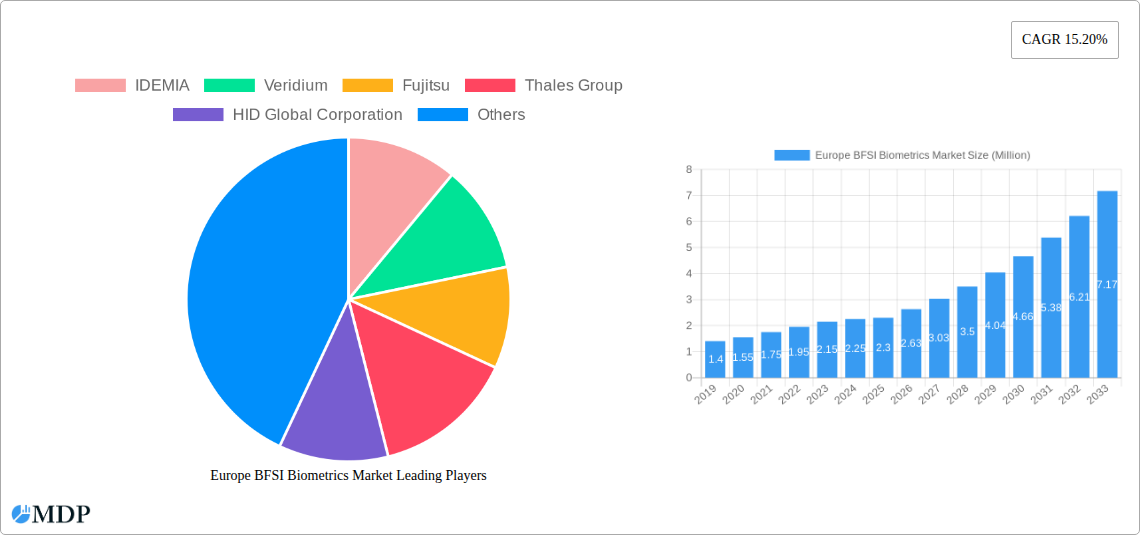

The Europe BFSI Biometrics Market is poised for significant expansion, projecting a substantial market size of $2.30 million in 2025 and a remarkable Compound Annual Growth Rate (CAGR) of 15.20% through 2033. This robust growth is primarily propelled by the escalating demand for enhanced security solutions across financial institutions. Key drivers include the imperative to combat sophisticated fraud, the growing adoption of digital banking services, and stringent regulatory frameworks mandating robust identity verification processes. The market is witnessing a decisive shift towards advanced biometric modalities like facial and voice recognition, offering seamless and secure authentication experiences for customers. Multi-factor authentication, integrating biometrics with traditional methods, is becoming a standard to fortify defenses against unauthorized access. The increasing prevalence of mobile banking and online transactions further accentuates the need for user-friendly yet highly secure authentication, making biometrics an indispensable component of the BFSI ecosystem.

Europe BFSI Biometrics Market Market Size (In Million)

The forecast period is characterized by innovation and diversification within biometric technologies. While contact-based solutions like fingerprint scanners remain prevalent, the market is increasingly embracing non-contact methods such as iris and vein recognition for their superior hygiene and accuracy, particularly relevant in a post-pandemic world. The application landscape is broadening beyond traditional door security and ATMs to encompass critical areas like internet banking, mobile banking, and payment authentication, where swift and secure user identification is paramount. Leading companies are actively investing in research and development to offer more sophisticated and integrated biometric solutions, fostering a competitive environment. Europe, with its strong regulatory push for data privacy and security, particularly countries like the United Kingdom, Germany, and France, represents a significant and dynamic market for BFSI biometrics, actively driving adoption and innovation.

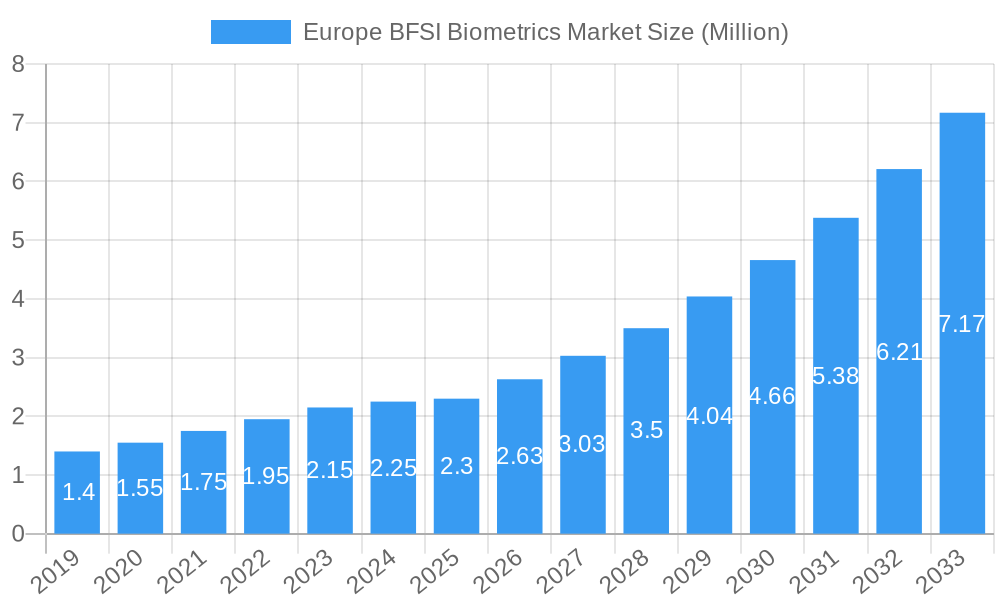

Europe BFSI Biometrics Market Company Market Share

Europe BFSI Biometrics Market: Unlocking Secure and Seamless Financial Transactions

Report Description:

Dive deep into the burgeoning Europe BFSI Biometrics Market, a critical sector experiencing exponential growth driven by the paramount need for enhanced security and superior customer experience in financial services. This comprehensive report provides an in-depth analysis of the market dynamics, industry trends, and competitive landscape for biometric solutions within the Banking, Financial Services, and Insurance (BFSI) sector across Europe. Covering a robust Study Period of 2019–2033, with a Base Year of 2025 and a detailed Forecast Period of 2025–2033, this report leverages extensive data from the Historical Period of 2019–2024 to offer actionable insights and a strategic outlook. Explore the key growth drivers, technological innovations, regulatory influences, and emerging opportunities shaping the future of secure financial transactions. Understand the dominance of specific authentication types, contact methods, product categories, and applications, and gain crucial knowledge of the leading players and their strategic initiatives. This report is an indispensable resource for financial institutions, technology providers, investors, and industry stakeholders seeking to capitalize on the transformative potential of biometrics in the European BFSI landscape.

Europe BFSI Biometrics Market Market Dynamics & Concentration

The Europe BFSI Biometrics Market is characterized by moderate to high concentration, with a few key players holding significant market share. Innovation is a primary driver, fueled by the constant demand for more secure and user-friendly authentication methods to combat fraud and enhance customer experience. Robust regulatory frameworks, such as GDPR, while initially posing challenges, are increasingly fostering the adoption of compliant biometric solutions. Product substitutes, including traditional password-based systems and one-time passwords (OTPs), are gradually being overshadowed by the superior security and convenience offered by biometrics. End-user trends clearly indicate a growing preference for frictionless authentication, especially in mobile and online banking channels. Mergers and acquisitions (M&A) activities are a notable feature, with larger entities acquiring smaller, innovative companies to expand their technology portfolios and market reach. The market has witnessed approximately 5-10 significant M&A deals in the last three years, reflecting a consolidation trend aimed at strengthening competitive positions. Market share for leading vendors like IDEMIA and Thales Group is estimated to be in the range of 15-20% each, with other players like HID Global Corporation and Fujitsu contributing significantly.

Europe BFSI Biometrics Market Industry Trends & Analysis

The Europe BFSI Biometrics Market is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 18-22% during the forecast period of 2025-2033. This expansion is largely attributed to the increasing digitalization of financial services and the escalating threat of cyber-attacks and identity fraud. Financial institutions are actively investing in biometric technologies to secure online banking, mobile transactions, and ATM access, thereby fostering greater customer trust and reducing operational costs associated with fraud detection and resolution. Technological advancements are continuously introducing more sophisticated and accurate biometric modalities, such as advanced facial recognition algorithms, faster fingerprint sensors, and improved voice and iris recognition systems. The integration of artificial intelligence (AI) and machine learning (ML) is further enhancing the performance and security of these solutions, enabling real-time threat detection and adaptive authentication. Consumer preferences are shifting towards biometric authentication due to its inherent convenience and perceived security. Users are increasingly willing to adopt fingerprint or facial scans for quick logins and transaction approvals, moving away from cumbersome password management. The competitive dynamics are intensifying, with both established technology giants and agile startups vying for market dominance. Companies are focusing on developing integrated biometric solutions that can support multiple authentication factors, catering to diverse security needs across various BFSI applications. The market penetration of biometric solutions in the European BFSI sector is estimated to be around 35-40% in 2025, with significant room for further adoption. This growth is further propelled by the increasing adoption of contactless payment methods and the growing demand for enhanced security in remote working environments.

Leading Markets & Segments in Europe BFSI Biometrics Market

The European BFSI Biometrics Market exhibits strong dominance across several segments, driven by distinct needs and technological advancements. Multi-factor Authentication is the most significant authentication type, accounting for an estimated 60-65% of the market share in 2025. This is due to the stringent security requirements in financial services, where layering multiple authentication factors (including biometrics, passwords, and OTPs) is crucial for robust protection.

- Key Drivers for Multi-factor Authentication Dominance:

- Regulatory mandates for enhanced security.

- Growing sophistication of cyber threats.

- Customer demand for secure yet convenient access.

Non-contact Based biometrics hold a commanding lead in market adoption, estimated at 70-75% in 2025. This preference is fueled by hygiene concerns and the desire for faster, more seamless authentication experiences, particularly in public-facing applications.

- Key Drivers for Non-contact Based Biometrics Dominance:

- Hygiene and public health considerations.

- Faster transaction processing times.

- Ease of integration into existing infrastructure.

Among product types, Fingerprint Identification is the most prevalent, capturing an estimated 40-45% of the market share in 2025. Its widespread adoption is attributed to its maturity, cost-effectiveness, and integration into a vast array of devices, including smartphones and payment cards. Facial Recognition is rapidly gaining traction, projected to grow at a CAGR of over 25% during the forecast period, driven by advancements in AI and its application in mobile banking and video surveillance.

- Key Drivers for Fingerprint Identification Dominance:

- Mature technology and widespread device integration.

- Relatively lower cost of implementation.

- User familiarity.

In terms of applications, Internet Banking and Mobile Banking represent the largest segments, collectively accounting for over 50% of the market in 2025. The surge in digital banking activities necessitates secure and convenient authentication methods for user login and transaction authorization. Payment Authentication is another critical and rapidly growing application, driven by the proliferation of contactless payments and secure online transactions.

- Key Drivers for Internet Banking & Mobile Banking Dominance:

- Exponential growth in digital banking services.

- Need for secure customer onboarding and access.

- Enhanced user experience and reduced friction.

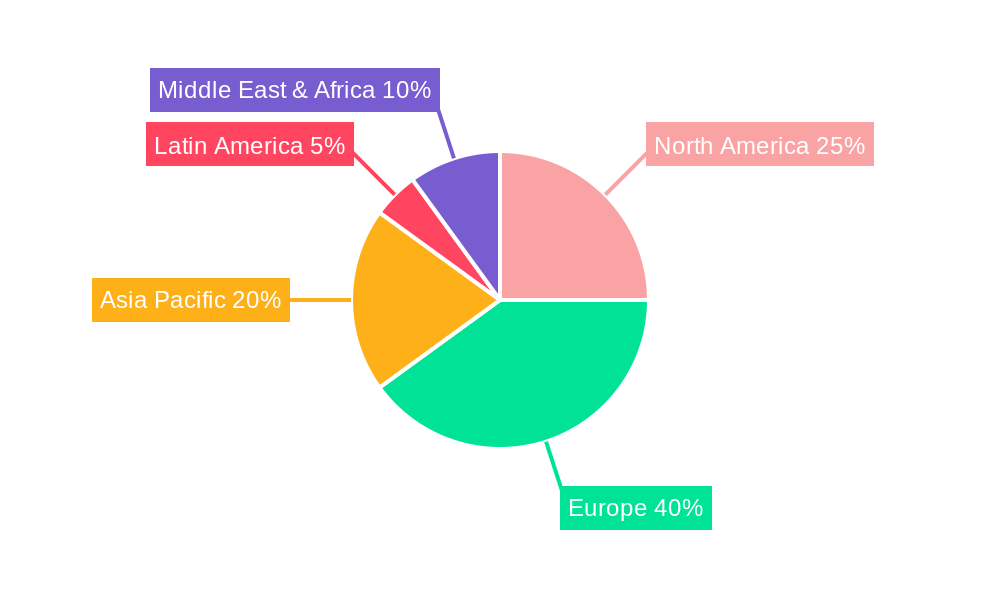

Geographically, Germany, United Kingdom, and France are the leading markets within Europe, driven by strong economic conditions, high digital banking penetration, and proactive regulatory environments that encourage the adoption of advanced security measures.

Europe BFSI Biometrics Market Product Developments

The Europe BFSI Biometrics Market is characterized by continuous product innovation aimed at enhancing security, speed, and user convenience. Leading companies are actively developing next-generation biometric sensors and algorithms that offer higher accuracy and faster processing times. For instance, advancements in fingerprint sensors are enabling faster transaction speeds and improved power efficiency, particularly crucial for biometric payment cards. Facial recognition technology is becoming more sophisticated, incorporating liveness detection and anti-spoofing measures to bolster security against fraudulent attempts. The integration of multimodal biometrics, combining different authentication factors, is a growing trend, offering unparalleled security levels and flexibility. These developments are driven by the need to meet evolving customer expectations for seamless and secure access to financial services across various channels, from mobile apps to ATMs and online platforms.

Key Drivers of Europe BFSI Biometrics Market Growth

The Europe BFSI Biometrics Market is propelled by several interconnected factors. Firstly, the escalating threat of sophisticated cybercrimes and identity fraud necessitates more robust authentication solutions beyond traditional passwords. Secondly, the rapid digital transformation within the BFSI sector, with an increasing shift towards online and mobile banking, creates a demand for frictionless yet secure user experiences. Thirdly, favorable regulatory landscapes, such as those promoting data privacy and security (e.g., GDPR), indirectly encourage the adoption of advanced security technologies like biometrics that comply with these mandates. Furthermore, the increasing consumer adoption of smartphones and other smart devices equipped with biometric capabilities makes the integration and use of these technologies more natural and accessible for end-users. The desire for enhanced customer convenience and reduced transaction times also plays a significant role, as biometrics offer a faster and more intuitive way to authenticate.

Challenges in the Europe BFSI Biometrics Market Market

Despite its rapid growth, the Europe BFSI Biometrics Market faces several challenges. Data privacy and security concerns remain a significant hurdle, with consumers and regulators expressing apprehension about the storage and potential misuse of sensitive biometric data. Ensuring compliance with stringent regulations like GDPR, while implementing and managing biometric systems, adds complexity and cost for financial institutions. High implementation costs associated with integrating new biometric systems into existing legacy infrastructure can be a deterrent for some organizations, especially smaller ones. Interoperability issues between different biometric vendors and platforms can also pose challenges, hindering seamless integration and scalability. Finally, user acceptance and trust can vary across demographics, with some individuals expressing reservations about the accuracy or invasiveness of certain biometric technologies, requiring ongoing education and reassurance efforts.

Emerging Opportunities in Europe BFSI Biometrics Market

The Europe BFSI Biometrics Market is ripe with emerging opportunities driven by technological advancements and evolving consumer behaviors. The increasing demand for contactless and frictionless authentication presents a significant opportunity for solutions like advanced facial and iris recognition. The growth of digital identity solutions and the push for decentralized identity management offer fertile ground for biometric-based identity verification. Furthermore, the expansion of embedded biometrics within payment cards and wearable devices opens up new avenues for secure and convenient transactions. Strategic partnerships between fintech companies and established financial institutions can accelerate the adoption of innovative biometric solutions. The development of AI-powered behavioral biometrics that analyze user interaction patterns for authentication also presents a promising area for future growth, offering an additional layer of passive security.

Leading Players in the Europe BFSI Biometrics Market Sector

- IDEMIA

- Veridium

- Fujitsu

- Thales Group

- HID Global Corporation

- Fulcrum Biometrics Inc

- Precise Biometrics AB

- Verint VoiceVoice

- M2SYS Technologies

- Aware Inc

Key Milestones in Europe BFSI Biometrics Market Industry

- December 2023: Fingerprint Cards (Fingerprints) announced the launch of an advanced iteration of Thales Gemalto biometric payment cards, primed for widespread global implementation. This cutting-edge solution from Thales incorporates Fingerprints' T-Shape sensor (T2) and biometric payment software platform, providing users with accelerated transaction speed, heightened power efficiency, and bolstered security measures.

- October 2023: Entersekt launched the integration of mobile application authentication with biometrics for financial institutions utilizing the Q2 Digital Banking Platform. Previously, Entersekt allowed bank and credit union clients to use biometrics for client login and transaction authentication through a browser. This new release extends the biometric authentication capabilities to their mobile banking platform, ensuring a seamless user experience across various banking channels.

Strategic Outlook for Europe BFSI Biometrics Market Market

The strategic outlook for the Europe BFSI Biometrics Market remains exceptionally positive, driven by an unyielding demand for enhanced security and seamless user experiences. Future growth will be accelerated by the continued evolution of multimodal biometric solutions, offering robust layered security for increasingly complex financial transactions. The integration of biometrics with blockchain technology for secure identity management presents a significant long-term opportunity. Financial institutions will increasingly focus on leveraging biometric data for personalized customer engagement and fraud prevention, moving beyond simple authentication. Strategic investments in research and development for more accurate, cost-effective, and privacy-preserving biometric technologies will be crucial for market leadership. Furthermore, collaborations between technology providers and BFSI players to create industry-wide standards for biometric authentication will foster wider adoption and market maturation. The market is poised for sustained expansion as it becomes integral to the digital fabric of European finance.

Europe BFSI Biometrics Market Segmentation

-

1. Authentication Type

- 1.1. Single Authentication Factor

- 1.2. Multi-factor Authentication

-

2. Contact Type

- 2.1. Contact-based

- 2.2. Non-contact Based

-

3. Product Type

- 3.1. Voice Recognition

- 3.2. Facial Recognition

- 3.3. Fingerprint Identification

- 3.4. Vein Recognition

- 3.5. Iris Recognition

-

4. Application

- 4.1. Door Security

- 4.2. ATM

- 4.3. Internet Banking

- 4.4. Mobile Banking

- 4.5. Payment Authentication

Europe BFSI Biometrics Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe BFSI Biometrics Market Regional Market Share

Geographic Coverage of Europe BFSI Biometrics Market

Europe BFSI Biometrics Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 15.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Digitalization of Banking Services; Biometrics Enable Banks to Improve Customer Engagement Levels

- 3.3. Market Restrains

- 3.3.1. Increasing Digitalization of Banking Services; Biometrics Enable Banks to Improve Customer Engagement Levels

- 3.4. Market Trends

- 3.4.1. Fingerprint Biometric to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe BFSI Biometrics Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Authentication Type

- 5.1.1. Single Authentication Factor

- 5.1.2. Multi-factor Authentication

- 5.2. Market Analysis, Insights and Forecast - by Contact Type

- 5.2.1. Contact-based

- 5.2.2. Non-contact Based

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Voice Recognition

- 5.3.2. Facial Recognition

- 5.3.3. Fingerprint Identification

- 5.3.4. Vein Recognition

- 5.3.5. Iris Recognition

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Door Security

- 5.4.2. ATM

- 5.4.3. Internet Banking

- 5.4.4. Mobile Banking

- 5.4.5. Payment Authentication

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Authentication Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 IDEMIA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Veridium

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fujitsu

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Thales Group

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 HID Global Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fulcrum Biometrics Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Precise Biometrics AB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Verint VoiceVault

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 M2SYS Technologies

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Aware Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 IDEMIA

List of Figures

- Figure 1: Europe BFSI Biometrics Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe BFSI Biometrics Market Share (%) by Company 2025

List of Tables

- Table 1: Europe BFSI Biometrics Market Revenue Million Forecast, by Authentication Type 2020 & 2033

- Table 2: Europe BFSI Biometrics Market Volume Billion Forecast, by Authentication Type 2020 & 2033

- Table 3: Europe BFSI Biometrics Market Revenue Million Forecast, by Contact Type 2020 & 2033

- Table 4: Europe BFSI Biometrics Market Volume Billion Forecast, by Contact Type 2020 & 2033

- Table 5: Europe BFSI Biometrics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Europe BFSI Biometrics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 7: Europe BFSI Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Europe BFSI Biometrics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 9: Europe BFSI Biometrics Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: Europe BFSI Biometrics Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: Europe BFSI Biometrics Market Revenue Million Forecast, by Authentication Type 2020 & 2033

- Table 12: Europe BFSI Biometrics Market Volume Billion Forecast, by Authentication Type 2020 & 2033

- Table 13: Europe BFSI Biometrics Market Revenue Million Forecast, by Contact Type 2020 & 2033

- Table 14: Europe BFSI Biometrics Market Volume Billion Forecast, by Contact Type 2020 & 2033

- Table 15: Europe BFSI Biometrics Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 16: Europe BFSI Biometrics Market Volume Billion Forecast, by Product Type 2020 & 2033

- Table 17: Europe BFSI Biometrics Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Europe BFSI Biometrics Market Volume Billion Forecast, by Application 2020 & 2033

- Table 19: Europe BFSI Biometrics Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Europe BFSI Biometrics Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: United Kingdom Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United Kingdom Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Germany Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: France Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: France Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Italy Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Italy Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Spain Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Spain Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Netherlands Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Netherlands Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Belgium Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Belgium Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: Sweden Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Sweden Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Norway Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Norway Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Poland Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Poland Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Denmark Europe BFSI Biometrics Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Denmark Europe BFSI Biometrics Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe BFSI Biometrics Market?

The projected CAGR is approximately 15.20%.

2. Which companies are prominent players in the Europe BFSI Biometrics Market?

Key companies in the market include IDEMIA, Veridium, Fujitsu, Thales Group, HID Global Corporation, Fulcrum Biometrics Inc, Precise Biometrics AB, Verint VoiceVault, M2SYS Technologies, Aware Inc.

3. What are the main segments of the Europe BFSI Biometrics Market?

The market segments include Authentication Type, Contact Type, Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Digitalization of Banking Services; Biometrics Enable Banks to Improve Customer Engagement Levels.

6. What are the notable trends driving market growth?

Fingerprint Biometric to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Increasing Digitalization of Banking Services; Biometrics Enable Banks to Improve Customer Engagement Levels.

8. Can you provide examples of recent developments in the market?

December 2023: Fingerprint Cards (Fingerprints) announced the launch of an advanced iteration of Thales Gemalto biometric payment cards, primed for widespread global implementation. This cutting-edge solution from Thales incorporates Fingerprints' T-Shape sensor (T2) and biometric payment software platform, providing users with accelerated transaction speed, heightened power efficiency, and bolstered security measures.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe BFSI Biometrics Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe BFSI Biometrics Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe BFSI Biometrics Market?

To stay informed about further developments, trends, and reports in the Europe BFSI Biometrics Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence