Key Insights

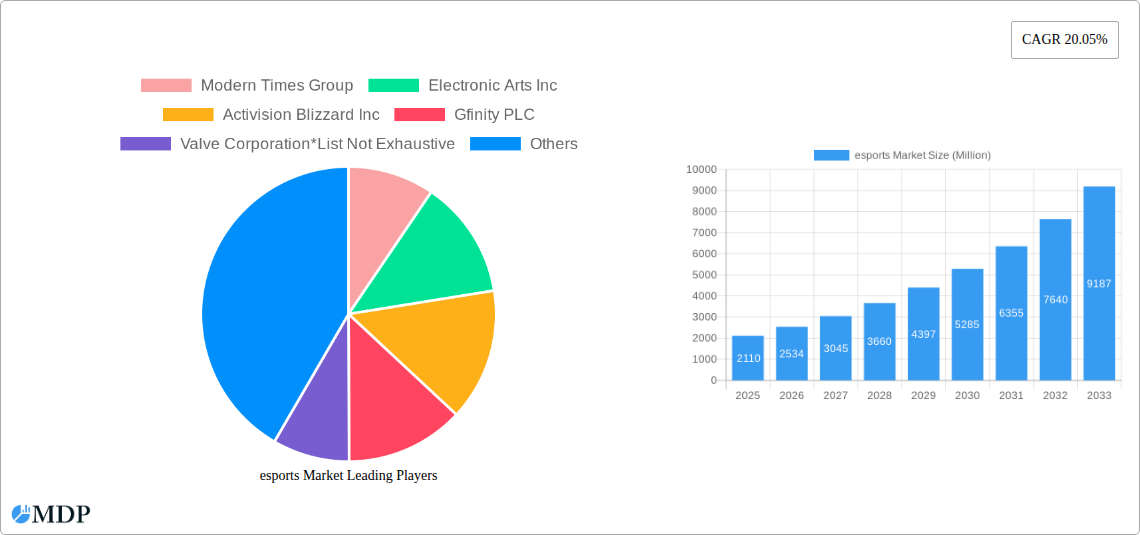

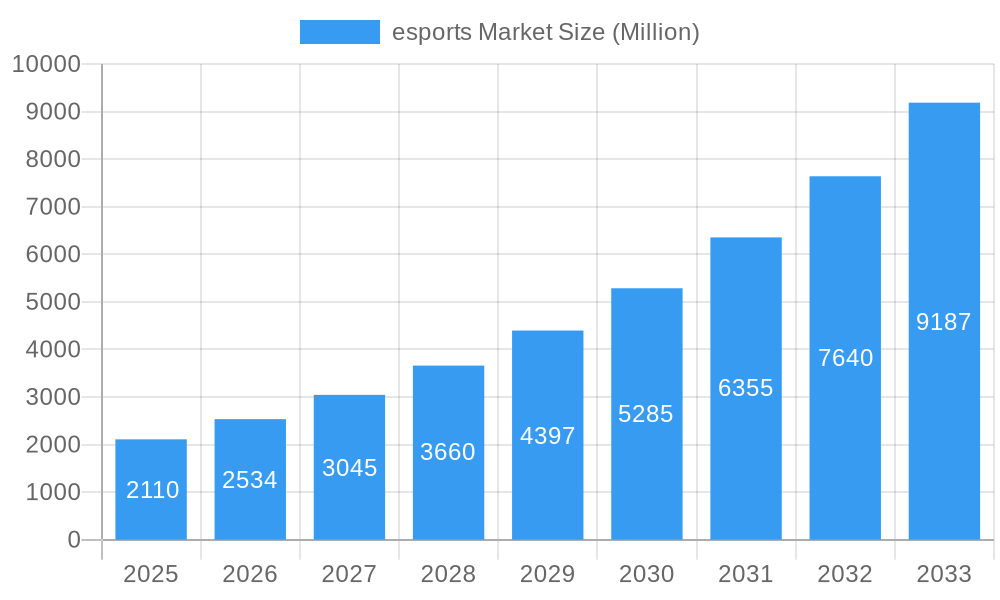

The global esports market is poised for explosive growth, projected to reach a substantial $2.11 billion in 2025. Fueled by a remarkable Compound Annual Growth Rate (CAGR) of 20.05%, this dynamic industry is on track to continue its upward trajectory throughout the forecast period of 2025-2033. A primary driver of this expansion is the increasing professionalization of esports, with significant investments in tournaments, player development, and infrastructure. The burgeoning popularity of streaming platforms like Twitch and YouTube has democratized access to esports content, attracting a massive and engaged global audience. This accessibility, coupled with growing mainstream media recognition and corporate sponsorship, is propelling the market forward. Furthermore, advancements in technology, including the integration of augmented and virtual reality, are expected to create new avenues for immersive fan experiences and further stimulate market demand.

esports Market Market Size (In Billion)

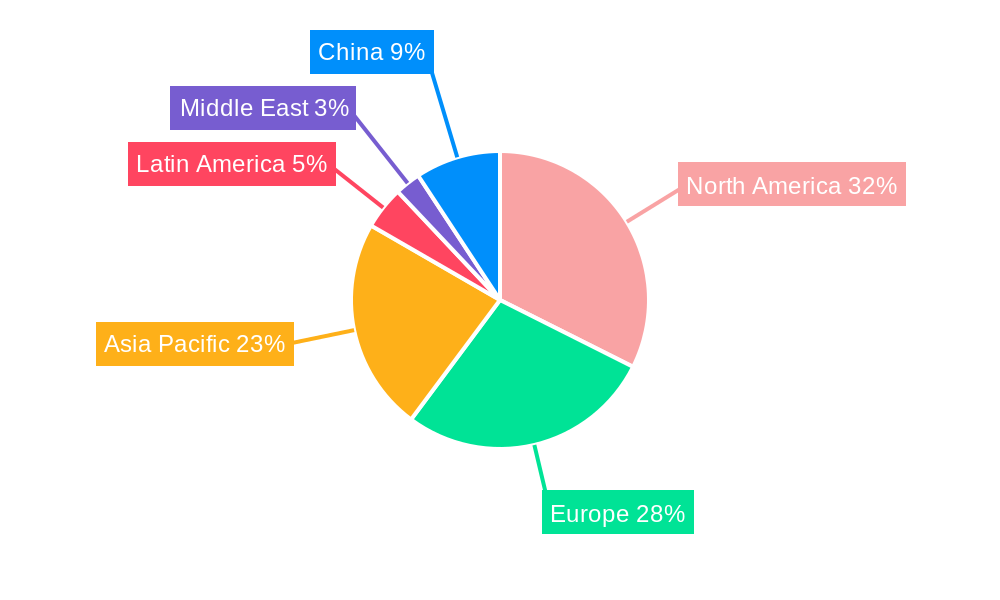

Key revenue streams within the esports ecosystem are diverse and growing. Media rights are becoming increasingly lucrative as broadcasters and streaming services vie for exclusive content. Advertising and sponsorships, particularly from non-endemic brands seeking to reach a younger, digitally-savvy demographic, represent a significant and expanding segment. Merchandise and ticket sales for live events also contribute substantially, reflecting the passionate fan base and the spectacle of professional esports competitions. The market is segmented across various streaming platforms, with Twitch and YouTube leading the charge, but other platforms are also carving out their niches. Major players like Electronic Arts Inc., Activision Blizzard Inc., and Tencent Holdings Ltd. (through Riot Games Inc.) are at the forefront of this revolution, driving innovation and market expansion. Geographically, North America and Europe currently dominate, but the Asia Pacific region, particularly China, is emerging as a critical growth engine, indicating a shift in global esports influence.

esports Market Company Market Share

Dive deep into the rapidly evolving world of competitive gaming with this in-depth analysis of the global esports market. Covering the period from 2019 to 2033, with a core focus on 2025-2033, this report provides an essential roadmap for investors, game developers, tournament organizers, sponsors, and media platforms seeking to capitalize on this multi-billion dollar industry. Understand the intricate market dynamics, identify key growth drivers, and uncover emerging opportunities within esports. This report leverages high-traffic keywords such as "esports market growth," "esports revenue," "esports sponsorship," "esports viewership," "competitive gaming," "esports tournaments," and "esports platforms" to maximize search visibility and attract industry stakeholders.

esports Market Market Dynamics & Concentration

The esports market is characterized by a dynamic and ever-shifting landscape, with a moderate concentration of key players alongside a vibrant ecosystem of emerging entities. Innovation is a primary driver, fueled by advancements in game development, streaming technology, and hardware capabilities. Regulatory frameworks are still maturing, with varying approaches across different regions, impacting everything from player contracts to prize money distribution. Product substitutes, while not direct competitors in terms of engagement, include traditional sports and other forms of entertainment vying for consumer attention and disposable income. End-user trends are dominated by a growing demographic of digitally native consumers who prioritize interactive and community-driven experiences. Mergers and acquisitions (M&A) are on the rise as established media companies and tech giants seek to gain a foothold in this lucrative market. For instance, the acquisition of Activision Blizzard by Microsoft signals a significant consolidation trend. With an estimated $xx Million in M&A deal counts within the historical period, this activity underscores the market's attractiveness. Market share is fragmented but shifting, with key players like Valve Corporation and Riot Games Inc. holding substantial influence through their popular titles and thriving esports ecosystems.

esports Market Industry Trends & Analysis

The global esports market is poised for unprecedented growth, driven by a confluence of factors that are reshaping the entertainment industry. The compound annual growth rate (CAGR) is projected to be xx% over the forecast period (2025-2033), underscoring its status as a high-growth sector. Technological disruptions are at the forefront, with advancements in virtual reality (VR) and augmented reality (AR) promising to create more immersive esports experiences. The increasing penetration of high-speed internet and mobile devices globally has democratized access to both playing and spectating esports, broadening its appeal beyond traditional gaming demographics. Consumer preferences are evolving rapidly, with a growing demand for professional-level competition, engaging content, and strong community engagement. Players and fans alike are drawn to the high-stakes drama of esports tournaments, the camaraderie of online communities, and the accessibility of streaming platforms. Competitive dynamics are intensifying, not only among game developers and publishers but also between various stakeholders, including media rights holders, sponsors, and tournament organizers, all vying for a share of the expanding esports pie. The rise of influencer marketing and the integration of esports into mainstream media further fuel this expansion. The market penetration continues to rise as more individuals engage with esports content and participate in amateur and professional circuits.

Leading Markets & Segments in esports Market

The esports market exhibits significant regional dominance, with Asia-Pacific, particularly China and South Korea, leading in terms of viewership, player base, and revenue generation. North America and Europe are also crucial markets, showcasing robust growth in sponsorship and media rights. Within the Revenue Model, Media Rights are a cornerstone, generating an estimated $xx Million in 2025, reflecting the increasing value of broadcast rights for major tournaments. Advertising and Sponsorships represent another substantial revenue stream, projected to reach $xx Million in 2025, attracting global brands eager to connect with the coveted youth demographic. Merchandise and Tickets contribute a significant $xx Million in 2025, driven by the passion of dedicated fan bases and the allure of live events.

- Key Drivers for Media Rights Dominance:

- Growing demand for exclusive broadcast content from major streaming platforms.

- Increased investment from traditional sports broadcasters looking to tap into new audiences.

- The development of sophisticated rights management and distribution networks.

- Key Drivers for Advertising and Sponsorships Dominance:

- The highly engaged and digitally savvy esports audience.

- The ability for brands to achieve targeted marketing through specific game titles and communities.

- Innovative activation opportunities beyond traditional advertising.

- Key Drivers for Merchandise and Tickets Dominance:

- Strong fan loyalty and desire to support favorite teams and players.

- The growing trend of live esports events and the associated fan experience.

- Expansion of official merchandise lines and collectibles.

On the Streaming Platform front, Twitch remains the dominant player, capturing a significant share of the $xx Million market in 2025. YouTube follows closely, offering a robust platform for VOD content and live broadcasts. Other Streaming Platforms, including DouYu and Hayu, are critical in specific regional markets, contributing to the overall $xx Million in 2025 for this segment.

- Key Drivers for Twitch Dominance:

- First-mover advantage and established community features.

- Extensive creator ecosystem and monetization tools.

- Exclusive broadcasting deals for major esports titles.

- Key Drivers for YouTube Dominance:

- Vast existing user base and widespread accessibility.

- Strong VOD capabilities and search engine optimization.

- Investment in esports content and partnerships.

- Key Drivers for Other Streaming Platforms:

- Localized content and language support catering to specific regions.

- Partnerships with regional game developers and tournament organizers.

- Emergence of niche streaming platforms catering to specific esports genres.

esports Market Product Developments

Product development in the esports market is rapidly advancing, focusing on enhancing the competitive gaming experience and expanding audience engagement. Innovations in gaming hardware, such as ultra-low latency monitors and responsive peripherals, provide players with a critical edge. Software developments include advanced anti-cheat systems and sophisticated game analytics tools that refine gameplay and spectating. The development of new esports titles and the continuous evolution of existing ones, like those benefiting from NVIDIA Reflex technology, are crucial for sustaining player interest and viewership. These advancements aim to create a more immersive, accessible, and fair competitive environment, directly translating to increased player participation and spectator enthusiasm, thereby fostering market growth.

Key Drivers of esports Market Growth

The esports market's growth is propelled by several powerful forces. Technologically, the widespread availability of high-speed internet, powerful gaming hardware, and accessible streaming platforms has dramatically lowered barriers to entry. Economically, increasing investments from venture capital, established corporations, and media conglomerates are injecting significant capital into the industry. Regulatory developments, while varied, are gradually leading to more structured leagues and player protections, fostering professionalism. The growing popularity of competitive gaming among younger demographics, coupled with the aspirational appeal of professional esports athletes, fuels massive viewership and participation. Furthermore, the increasing integration of esports into mainstream culture, including its inclusion in major sporting events, further validates its legitimacy and expands its reach.

Challenges in the esports Market Market

Despite its robust growth, the esports market faces several challenges. Regulatory inconsistencies across different countries can create complex legal landscapes for international tournaments and player contracts, potentially leading to $xx Million in lost opportunities. The intense competition for sponsorships and media rights can drive down valuations for smaller entities, creating a significant barrier to entry. Supply chain issues for gaming hardware can impact both professional players and the broader gaming community. Furthermore, the risk of burnout among professional players due to demanding schedules and the need for continuous skill development presents an ongoing human capital challenge, estimated to affect xx% of professional players annually. Maintaining consistent engagement and preventing audience fragmentation across a multitude of games and platforms remains a key challenge for sustained growth.

Emerging Opportunities in esports Market

The future of the esports market is brimming with opportunities. Technological breakthroughs in VR and AR are poised to revolutionize spectator experiences, creating entirely new avenues for engagement and monetization, potentially adding $xx Million to the market by 2030. Strategic partnerships between game developers, publishers, and non-endemic brands will continue to unlock new revenue streams and expand the market's reach. The growing demand for educational content and training programs related to esports presents a significant opportunity for specialized academies and online courses. Furthermore, the expansion of esports into new geographical regions, particularly in emerging markets, offers substantial untapped potential for growth and investment.

Leading Players in the esports Market Sector

- Modern Times Group

- Electronic Arts Inc.

- Activision Blizzard Inc.

- Gfinity PLC

- Valve Corporation

- Riot Games Inc. (Tencent Holdings Ltd)

- Faceit

- Epic Games Inc.

- Capcom Co Ltd

Key Milestones in esports Market Industry

- January 2022: Introduction of 1440p NVIDIA G-SYNC esports screens and seven new games benefiting from NVIDIA Reflex, significantly reducing system latency. This development is expected to flourish the esports market by enhancing player experience and competitiveness.

- February 2022: Nintendo's Direct event in 2022 featured new game announcements, including "Switch Sports" and "Mario Strikers." The release of multiple new games is expected to drive market expansion and player engagement.

Strategic Outlook for esports Market Market

The strategic outlook for the esports market is exceptionally positive, characterized by sustained growth driven by technological innovation and increasing mainstream adoption. Future market potential lies in further professionalization of leagues, enhanced data analytics for team performance, and the development of more sophisticated fan engagement tools. Strategic opportunities include expanding into untapped geographical markets, forging deeper collaborations between game developers and content creators, and leveraging emerging technologies like blockchain for digital collectibles and fan ownership models. The increasing integration of esports with traditional media and entertainment industries will continue to accelerate its trajectory, solidifying its position as a dominant force in global entertainment.

esports Market Segmentation

-

1. Revenue Model

- 1.1. Media Rights

- 1.2. Advertising and Sponsorships

- 1.3. Merchandise and Tickets

- 1.4. Other Revenue Models

-

2. Streaming Platform

- 2.1. Twitch

- 2.2. YouTube

- 2.3. Other Streaming Platforms ( DouYu and Hayu )

esports Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

- 3. China

- 4. Asia Pacific

-

5. Japan

- 5.1. India

- 5.2. South Korea

- 5.3. Rest of Asia Pacific

- 6. Latin America

- 7. Middle East

esports Market Regional Market Share

Geographic Coverage of esports Market

esports Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.05% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Popularity of Video Games; Growing Awareness about eSports

- 3.3. Market Restrains

- 3.3.1 Issues Such as Piracy

- 3.3.2 Laws and Regulations

- 3.3.3 and Concerns Relating to Fraud During Gaming Transactions

- 3.4. Market Trends

- 3.4.1. Advertising to be the Largest Sources of eSports Revenue

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global esports Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Revenue Model

- 5.1.1. Media Rights

- 5.1.2. Advertising and Sponsorships

- 5.1.3. Merchandise and Tickets

- 5.1.4. Other Revenue Models

- 5.2. Market Analysis, Insights and Forecast - by Streaming Platform

- 5.2.1. Twitch

- 5.2.2. YouTube

- 5.2.3. Other Streaming Platforms ( DouYu and Hayu )

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. China

- 5.3.4. Asia Pacific

- 5.3.5. Japan

- 5.3.6. Latin America

- 5.3.7. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Revenue Model

- 6. North America esports Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Revenue Model

- 6.1.1. Media Rights

- 6.1.2. Advertising and Sponsorships

- 6.1.3. Merchandise and Tickets

- 6.1.4. Other Revenue Models

- 6.2. Market Analysis, Insights and Forecast - by Streaming Platform

- 6.2.1. Twitch

- 6.2.2. YouTube

- 6.2.3. Other Streaming Platforms ( DouYu and Hayu )

- 6.1. Market Analysis, Insights and Forecast - by Revenue Model

- 7. Europe esports Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Revenue Model

- 7.1.1. Media Rights

- 7.1.2. Advertising and Sponsorships

- 7.1.3. Merchandise and Tickets

- 7.1.4. Other Revenue Models

- 7.2. Market Analysis, Insights and Forecast - by Streaming Platform

- 7.2.1. Twitch

- 7.2.2. YouTube

- 7.2.3. Other Streaming Platforms ( DouYu and Hayu )

- 7.1. Market Analysis, Insights and Forecast - by Revenue Model

- 8. China esports Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Revenue Model

- 8.1.1. Media Rights

- 8.1.2. Advertising and Sponsorships

- 8.1.3. Merchandise and Tickets

- 8.1.4. Other Revenue Models

- 8.2. Market Analysis, Insights and Forecast - by Streaming Platform

- 8.2.1. Twitch

- 8.2.2. YouTube

- 8.2.3. Other Streaming Platforms ( DouYu and Hayu )

- 8.1. Market Analysis, Insights and Forecast - by Revenue Model

- 9. Asia Pacific esports Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Revenue Model

- 9.1.1. Media Rights

- 9.1.2. Advertising and Sponsorships

- 9.1.3. Merchandise and Tickets

- 9.1.4. Other Revenue Models

- 9.2. Market Analysis, Insights and Forecast - by Streaming Platform

- 9.2.1. Twitch

- 9.2.2. YouTube

- 9.2.3. Other Streaming Platforms ( DouYu and Hayu )

- 9.1. Market Analysis, Insights and Forecast - by Revenue Model

- 10. Japan esports Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Revenue Model

- 10.1.1. Media Rights

- 10.1.2. Advertising and Sponsorships

- 10.1.3. Merchandise and Tickets

- 10.1.4. Other Revenue Models

- 10.2. Market Analysis, Insights and Forecast - by Streaming Platform

- 10.2.1. Twitch

- 10.2.2. YouTube

- 10.2.3. Other Streaming Platforms ( DouYu and Hayu )

- 10.1. Market Analysis, Insights and Forecast - by Revenue Model

- 11. Latin America esports Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Revenue Model

- 11.1.1. Media Rights

- 11.1.2. Advertising and Sponsorships

- 11.1.3. Merchandise and Tickets

- 11.1.4. Other Revenue Models

- 11.2. Market Analysis, Insights and Forecast - by Streaming Platform

- 11.2.1. Twitch

- 11.2.2. YouTube

- 11.2.3. Other Streaming Platforms ( DouYu and Hayu )

- 11.1. Market Analysis, Insights and Forecast - by Revenue Model

- 12. Middle East esports Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Revenue Model

- 12.1.1. Media Rights

- 12.1.2. Advertising and Sponsorships

- 12.1.3. Merchandise and Tickets

- 12.1.4. Other Revenue Models

- 12.2. Market Analysis, Insights and Forecast - by Streaming Platform

- 12.2.1. Twitch

- 12.2.2. YouTube

- 12.2.3. Other Streaming Platforms ( DouYu and Hayu )

- 12.1. Market Analysis, Insights and Forecast - by Revenue Model

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Modern Times Group

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Electronic Arts Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Activision Blizzard Inc

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Gfinity PLC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Valve Corporation*List Not Exhaustive

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Riot Games Inc ( Tencent Holdings Ltd)

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Faceit

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Epic Games Inc

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Capcom Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.1 Modern Times Group

List of Figures

- Figure 1: Global esports Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America esports Market Revenue (Million), by Revenue Model 2025 & 2033

- Figure 3: North America esports Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 4: North America esports Market Revenue (Million), by Streaming Platform 2025 & 2033

- Figure 5: North America esports Market Revenue Share (%), by Streaming Platform 2025 & 2033

- Figure 6: North America esports Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America esports Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe esports Market Revenue (Million), by Revenue Model 2025 & 2033

- Figure 9: Europe esports Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 10: Europe esports Market Revenue (Million), by Streaming Platform 2025 & 2033

- Figure 11: Europe esports Market Revenue Share (%), by Streaming Platform 2025 & 2033

- Figure 12: Europe esports Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe esports Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: China esports Market Revenue (Million), by Revenue Model 2025 & 2033

- Figure 15: China esports Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 16: China esports Market Revenue (Million), by Streaming Platform 2025 & 2033

- Figure 17: China esports Market Revenue Share (%), by Streaming Platform 2025 & 2033

- Figure 18: China esports Market Revenue (Million), by Country 2025 & 2033

- Figure 19: China esports Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Asia Pacific esports Market Revenue (Million), by Revenue Model 2025 & 2033

- Figure 21: Asia Pacific esports Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 22: Asia Pacific esports Market Revenue (Million), by Streaming Platform 2025 & 2033

- Figure 23: Asia Pacific esports Market Revenue Share (%), by Streaming Platform 2025 & 2033

- Figure 24: Asia Pacific esports Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Asia Pacific esports Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Japan esports Market Revenue (Million), by Revenue Model 2025 & 2033

- Figure 27: Japan esports Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 28: Japan esports Market Revenue (Million), by Streaming Platform 2025 & 2033

- Figure 29: Japan esports Market Revenue Share (%), by Streaming Platform 2025 & 2033

- Figure 30: Japan esports Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Japan esports Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Latin America esports Market Revenue (Million), by Revenue Model 2025 & 2033

- Figure 33: Latin America esports Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 34: Latin America esports Market Revenue (Million), by Streaming Platform 2025 & 2033

- Figure 35: Latin America esports Market Revenue Share (%), by Streaming Platform 2025 & 2033

- Figure 36: Latin America esports Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Latin America esports Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East esports Market Revenue (Million), by Revenue Model 2025 & 2033

- Figure 39: Middle East esports Market Revenue Share (%), by Revenue Model 2025 & 2033

- Figure 40: Middle East esports Market Revenue (Million), by Streaming Platform 2025 & 2033

- Figure 41: Middle East esports Market Revenue Share (%), by Streaming Platform 2025 & 2033

- Figure 42: Middle East esports Market Revenue (Million), by Country 2025 & 2033

- Figure 43: Middle East esports Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global esports Market Revenue Million Forecast, by Revenue Model 2020 & 2033

- Table 2: Global esports Market Revenue Million Forecast, by Streaming Platform 2020 & 2033

- Table 3: Global esports Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global esports Market Revenue Million Forecast, by Revenue Model 2020 & 2033

- Table 5: Global esports Market Revenue Million Forecast, by Streaming Platform 2020 & 2033

- Table 6: Global esports Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States esports Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada esports Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Rest of North America esports Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global esports Market Revenue Million Forecast, by Revenue Model 2020 & 2033

- Table 11: Global esports Market Revenue Million Forecast, by Streaming Platform 2020 & 2033

- Table 12: Global esports Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Germany esports Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom esports Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: France esports Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Rest of Europe esports Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Global esports Market Revenue Million Forecast, by Revenue Model 2020 & 2033

- Table 18: Global esports Market Revenue Million Forecast, by Streaming Platform 2020 & 2033

- Table 19: Global esports Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: Global esports Market Revenue Million Forecast, by Revenue Model 2020 & 2033

- Table 21: Global esports Market Revenue Million Forecast, by Streaming Platform 2020 & 2033

- Table 22: Global esports Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: Global esports Market Revenue Million Forecast, by Revenue Model 2020 & 2033

- Table 24: Global esports Market Revenue Million Forecast, by Streaming Platform 2020 & 2033

- Table 25: Global esports Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: India esports Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: South Korea esports Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific esports Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Global esports Market Revenue Million Forecast, by Revenue Model 2020 & 2033

- Table 30: Global esports Market Revenue Million Forecast, by Streaming Platform 2020 & 2033

- Table 31: Global esports Market Revenue Million Forecast, by Country 2020 & 2033

- Table 32: Global esports Market Revenue Million Forecast, by Revenue Model 2020 & 2033

- Table 33: Global esports Market Revenue Million Forecast, by Streaming Platform 2020 & 2033

- Table 34: Global esports Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the esports Market?

The projected CAGR is approximately 20.05%.

2. Which companies are prominent players in the esports Market?

Key companies in the market include Modern Times Group, Electronic Arts Inc, Activision Blizzard Inc, Gfinity PLC, Valve Corporation*List Not Exhaustive, Riot Games Inc ( Tencent Holdings Ltd), Faceit, Epic Games Inc, Capcom Co Ltd.

3. What are the main segments of the esports Market?

The market segments include Revenue Model, Streaming Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.11 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Popularity of Video Games; Growing Awareness about eSports.

6. What are the notable trends driving market growth?

Advertising to be the Largest Sources of eSports Revenue.

7. Are there any restraints impacting market growth?

Issues Such as Piracy. Laws and Regulations. and Concerns Relating to Fraud During Gaming Transactions.

8. Can you provide examples of recent developments in the market?

January 2022 - A new category of 1440p NVIDIA G-SYNC esports screens and seven new games benefit from low latency thanks to NVIDIA Reflex. Since reducing system latency is recognized by gamers and game developers as essential to a quality gaming experience, the NVIDIA Reflex low latency ecosystem has grown significantly over the past year. Eight top-ten competitive shooters, including Apex Legends, Valorant, and Fortnite, support Reflex. Each month, more than 20 million GeForce gamers battle with Reflex ON. More than 50 mouse and screens support their Reflex Analyzer, enabling players to assess system latency quickly. Such developments are expected to flourish the esports market in the forecast period.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "esports Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the esports Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the esports Market?

To stay informed about further developments, trends, and reports in the esports Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence