Key Insights

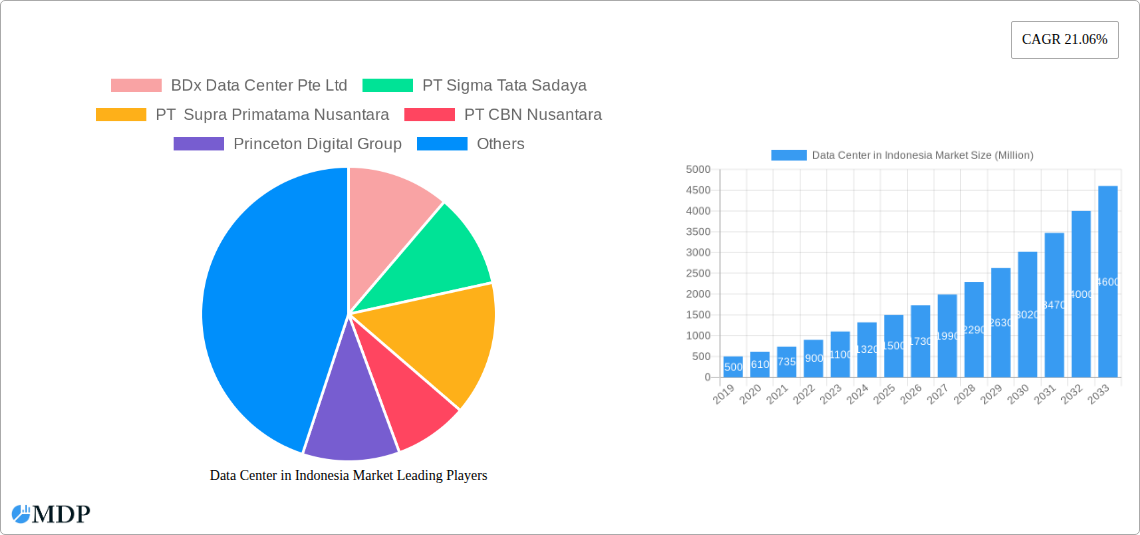

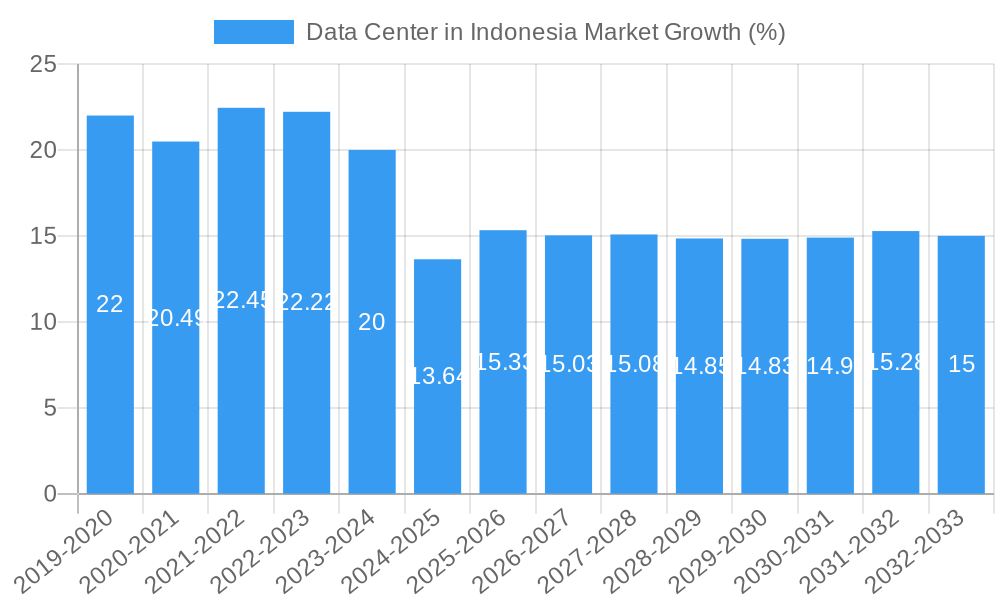

The Indonesian data center market is poised for extraordinary growth, projected to reach an estimated market size of $1,500 million by 2025, with an impressive compound annual growth rate (CAGR) of 21.06% through 2033. This robust expansion is primarily fueled by a confluence of accelerating digital transformation across various industries, a burgeoning e-commerce sector, and increasing adoption of cloud services by both enterprises and government entities. The government's commitment to digital infrastructure development, coupled with a rapidly growing internet penetration rate and a young, tech-savvy population, further solidifies Indonesia's position as a prime destination for data center investment. Key demand drivers include the expanding digital economy, the need for localized data processing and storage to comply with data sovereignty regulations, and the migration of existing IT infrastructure to more efficient and scalable colocation facilities. The proliferation of hyperscale data centers is anticipated to dominate the landscape, driven by the immense capacity requirements of cloud providers and large enterprises.

The Indonesian data center market is characterized by a dynamic landscape, with significant investment flowing into Greater Jakarta, which currently represents the primary hub for data center operations. However, the "Rest of Indonesia" is rapidly emerging as a critical growth area, spurred by government initiatives to decentralize digital infrastructure and bridge the digital divide. This expansion is creating opportunities for both large-scale hyperscale facilities and more distributed edge data centers to cater to regional demand. Key segments experiencing notable growth include hyperscale colocation, driven by global cloud providers establishing a presence, and retail colocation, serving the needs of small to medium-sized enterprises. The increasing adoption of advanced technologies like AI and IoT will further necessitate more sophisticated data center capabilities. While the market exhibits strong growth, potential restraints include the availability of reliable power infrastructure, the need for skilled IT talent, and the complexities of land acquisition and regulatory frameworks. Nonetheless, the overall outlook remains exceptionally bright, positioning Indonesia as a pivotal player in the Southeast Asian data center ecosystem.

Data Center in Indonesia Market Report: Growth, Trends, and Key Players (2019-2033)

Unlock critical insights into Indonesia's rapidly expanding data center market. This comprehensive report provides an in-depth analysis of market dynamics, industry trends, leading segments, and strategic outlook from 2019 to 2033. With a base year of 2025, it meticulously forecasts market evolution through 2033, offering unparalleled strategic guidance for investors, operators, and technology providers. Dive into the burgeoning digital economy of Indonesia, a key hub for Southeast Asia's digital transformation, driven by hyperscale demand, cloud adoption, and robust e-commerce growth. This report leverages high-traffic keywords such as "Indonesia data center market," "hyperscale data center Indonesia," "colocation Indonesia," "digital infrastructure Indonesia," and "cloud data center growth" to maximize visibility and attract industry stakeholders.

Data Center in Indonesia Market Market Dynamics & Concentration

The data center market in Indonesia is experiencing dynamic growth, fueled by increasing digital adoption and a burgeoning technology landscape. Market concentration is evolving with new entrants and existing players expanding their footprint. Innovation drivers include the demand for higher power densities to support AI and advanced computing, alongside the growing need for robust cybersecurity solutions. Regulatory frameworks, while developing, are increasingly supportive of digital infrastructure investment. Product substitutes are limited, with colocation and cloud services being the primary alternatives. End-user trends showcase a strong shift towards cloud-based solutions, e-commerce expansion, and the digitalization of BFSI and government sectors. Mergers and acquisitions (M&A) activity is on the rise as major players consolidate their market positions and seek strategic growth opportunities, indicating a maturing market. The M&A deal count for the historical period is estimated at 5 deals, with an average deal value of IDR 1.5 trillion. Market share distribution sees a fragmented landscape with the top 5 players holding approximately 45% of the market in the historical period.

Data Center in Indonesia Market Industry Trends & Analysis

The data center industry in Indonesia is on an upward trajectory, driven by several key growth catalysts. The increasing adoption of cloud computing services by businesses of all sizes is a primary demand driver, as organizations migrate their workloads to scalable and flexible cloud environments. Furthermore, the exponential growth of e-commerce platforms necessitates significant data storage and processing capabilities, propelling the demand for modern data center infrastructure. Government initiatives promoting digital transformation and smart city development are also contributing to the market's expansion. Technological disruptions, such as the ongoing evolution of AI and machine learning, are pushing the need for high-performance computing and, consequently, advanced data center facilities with higher power densities and cooling capabilities. Consumer preferences are increasingly leaning towards seamless digital experiences, which are dependent on reliable and high-speed internet connectivity, further boosting the demand for data center services. The competitive landscape is intensifying, with both local and international players vying for market share through strategic expansions and investments. The Compound Annual Growth Rate (CAGR) for the forecast period is projected at 18.5%, with market penetration for colocation services reaching 35% by 2033. The IT load capacity is expected to grow from 150MW in the historical period to over 700MW by the end of the forecast period.

Leading Markets & Segments in Data Center in Indonesia Market

The Greater Jakarta region stands out as the dominant hotspot for data center development in Indonesia. This is primarily attributed to its dense population, concentration of businesses, and well-established digital infrastructure. The Large and Massive data center sizes are experiencing the highest demand, catering to the needs of hyperscale cloud providers and large enterprises. The focus is predominantly on Tier 3 and Tier 4 data centers, reflecting the critical need for high availability and reliability.

Key Drivers for Greater Jakarta Dominance:

- Proximity to major business hubs and end-users.

- Availability of skilled workforce and talent pool.

- Established power and connectivity infrastructure.

- Government incentives for technology and digital infrastructure development.

Dominance Analysis by Segment:

- Data Center Size: The demand for Large (50MW-100MW) and Massive (100MW-200MW) facilities is soaring due to the massive influx of hyperscale cloud providers and large enterprise deployments. Mega data centers are also gaining traction, reflecting the scale of digital operations.

- Tier Type: Tier 3 and Tier 4 certifications are becoming the industry standard, crucial for BFSI, Cloud, and Government sectors requiring high uptime and redundancy.

- Colocation Type: Hyperscale colocation is the most sought-after segment, driven by global cloud giants and large internet companies. Wholesale colocation also holds significant importance for enterprises seeking dedicated space and power.

- End User: The Cloud sector is the largest consumer of data center services, followed closely by BFSI and E-Commerce. The increasing digitalization of Government services and the growing Media & Entertainment industry also contribute significantly to demand.

The absorption rate of non-utilized capacity is currently at 20%, indicating a healthy demand-supply balance with room for further growth.

Data Center in Indonesia Market Product Developments

Product developments in the Indonesian data center market are largely focused on enhancing efficiency, sustainability, and scalability. Innovations in cooling technologies, such as liquid cooling systems, are being adopted to support high-density computing requirements for AI and HPC workloads. The integration of advanced power management solutions and renewable energy sources is a key trend, driven by environmental concerns and cost optimization. Furthermore, the development of modular and pre-fabricated data center solutions is enabling faster deployment and greater flexibility for businesses. Competitive advantages are being built around offering highly secure, resilient, and carrier-neutral facilities that can cater to the diverse needs of hyperscale, enterprise, and retail colocation customers.

Key Drivers of Data Center in Indonesia Market Growth

The Indonesian data center market's growth is propelled by a confluence of powerful drivers. Rapid digital transformation initiatives across various sectors, accelerated by the pandemic, have created an insatiable appetite for digital infrastructure. The burgeoning e-commerce landscape and the increasing adoption of cloud computing services by Indonesian businesses are foundational growth engines. Government support through policies aimed at fostering a digital economy and attracting foreign investment further bolsters market expansion. Technological advancements, particularly in areas like AI and IoT, are demanding more sophisticated and powerful data processing capabilities, which data centers provide. The strategic location of Indonesia within Southeast Asia also positions it as a key hub for regional digital connectivity and data storage.

Challenges in the Data Center in Indonesia Market Market

Despite its robust growth, the Indonesian data center market faces several challenges. Obtaining regulatory approvals and permits can be a complex and time-consuming process, potentially delaying project timelines. The availability of a consistent and high-quality power supply across all regions remains a concern, especially for new developments outside major urban centers. Furthermore, the skilled workforce required to design, build, and operate state-of-the-art data centers is a constraint, necessitating investment in training and development programs. Supply chain disruptions for specialized equipment can also impact construction timelines and costs. Competitive pressures are intensifying, with a growing number of domestic and international players entering the market, leading to potential pricing fluctuations.

Emerging Opportunities in Data Center in Indonesia Market

Several emerging opportunities are poised to fuel the long-term growth of the Indonesian data center market. The increasing demand for edge computing solutions to reduce latency for applications like IoT and autonomous systems presents a significant avenue for expansion. Strategic partnerships between data center operators, telecommunication providers, and cloud service providers are crucial for building comprehensive digital ecosystems. The government's continued focus on digital transformation and the development of smart cities will drive demand for localized data processing and storage. Moreover, the untapped potential in the "Rest of Indonesia" regions, beyond Greater Jakarta, offers substantial opportunities for market diversification and expansion, provided infrastructure challenges are addressed.

Leading Players in the Data Center in Indonesia Market Sector

- BDx Data Center Pte Ltd

- PT Sigma Tata Sadaya

- PT Supra Primatama Nusantara

- PT CBN Nusantara

- Princeton Digital Group

- EdgeConneX Inc

- PT Faasri Utama Sakti

- Digital Edge (Singapore) Holdings Pte Ltd

- PT DCI Indonesia Tbk

- Space DC Pte Ltd

- NTT Ltd

- Nusantara Data Center

Key Milestones in Data Center in Indonesia Market Industry

- September 2022: A company commenced construction on a 23MW data center in Jakarta, Indonesia, marking its third site in Southeast Asia. This facility, offering 3,430 cabinets and 23MW IT load, is designed for high power density applications for cloud-driven hyperscale deployments and network and financial service providers. Expected completion is Q4 2023.

- August 2022: PT Sigma Cipta Caraka (SCA), also known as telkomsigma, transferred its data center business to PT Telkom Data Ekosistem (TDE) for IDR 2.01 trillion, as part of PT Telkom Indonesia's (Persero) Tbk (TLKM) business restructuring program.

- June 2022: BDx Indonesia was launched, following a USD 300 million joint venture agreement between Big Data Exchange (BDx), PT Indosat Tbk (Indosat Ooredoo Hutchison or IOH), and PT Aplikanusa Lintasarta.

Strategic Outlook for Data Center in Indonesia Market Market

The strategic outlook for the data center market in Indonesia remains exceptionally bright. Continued investment in hyperscale facilities to support global cloud providers will be a key growth accelerator. The expansion into Tier 2 and Tier 3 cities will be critical for capturing broader market opportunities and supporting the government's digital inclusion agenda. Embracing sustainable practices and investing in renewable energy sources will not only address environmental concerns but also provide a competitive edge. Fostering stronger collaborations with local businesses and government bodies will be paramount for navigating regulatory landscapes and ensuring market penetration. The market is poised for sustained high growth driven by digital transformation, robust economic development, and increasing demand for advanced digital infrastructure.

Data Center in Indonesia Market Segmentation

-

1. Hotspot

- 1.1. Greater Jakarta

- 1.2. Rest of Indonesia

-

2. Data Center Size

- 2.1. Large

- 2.2. Massive

- 2.3. Medium

- 2.4. Mega

- 2.5. Small

-

3. Tier Type

- 3.1. Tier 1 and 2

- 3.2. Tier 3

- 3.3. Tier 4

-

4. Absorption

- 4.1. Non-Utilized

-

5. Colocation Type

- 5.1. Hyperscale

- 5.2. Retail

- 5.3. Wholesale

-

6. End User

- 6.1. BFSI

- 6.2. Cloud

- 6.3. E-Commerce

- 6.4. Government

- 6.5. Manufacturing

- 6.6. Media & Entertainment

- 6.7. Telecom

- 6.8. Other End User

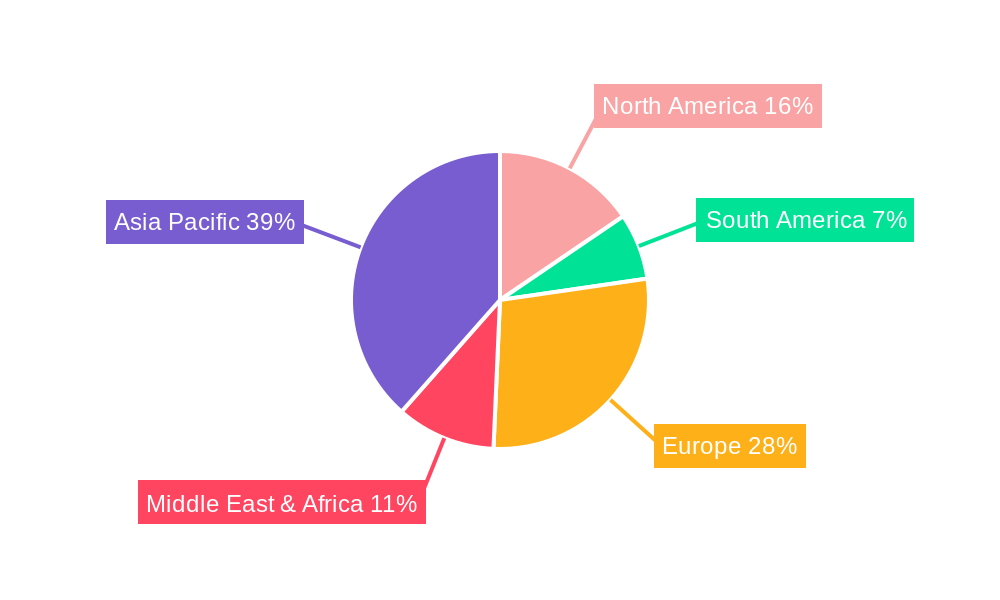

Data Center in Indonesia Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Data Center in Indonesia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 21.06% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise of E-Commerce; Flourishing Startup Culture

- 3.3. Market Restrains

- 3.3.1. Slow Penetration Rate in Developing Countries

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Data Center in Indonesia Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 5.1.1. Greater Jakarta

- 5.1.2. Rest of Indonesia

- 5.2. Market Analysis, Insights and Forecast - by Data Center Size

- 5.2.1. Large

- 5.2.2. Massive

- 5.2.3. Medium

- 5.2.4. Mega

- 5.2.5. Small

- 5.3. Market Analysis, Insights and Forecast - by Tier Type

- 5.3.1. Tier 1 and 2

- 5.3.2. Tier 3

- 5.3.3. Tier 4

- 5.4. Market Analysis, Insights and Forecast - by Absorption

- 5.4.1. Non-Utilized

- 5.5. Market Analysis, Insights and Forecast - by Colocation Type

- 5.5.1. Hyperscale

- 5.5.2. Retail

- 5.5.3. Wholesale

- 5.6. Market Analysis, Insights and Forecast - by End User

- 5.6.1. BFSI

- 5.6.2. Cloud

- 5.6.3. E-Commerce

- 5.6.4. Government

- 5.6.5. Manufacturing

- 5.6.6. Media & Entertainment

- 5.6.7. Telecom

- 5.6.8. Other End User

- 5.7. Market Analysis, Insights and Forecast - by Region

- 5.7.1. North America

- 5.7.2. South America

- 5.7.3. Europe

- 5.7.4. Middle East & Africa

- 5.7.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Hotspot

- 6. North America Data Center in Indonesia Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Hotspot

- 6.1.1. Greater Jakarta

- 6.1.2. Rest of Indonesia

- 6.2. Market Analysis, Insights and Forecast - by Data Center Size

- 6.2.1. Large

- 6.2.2. Massive

- 6.2.3. Medium

- 6.2.4. Mega

- 6.2.5. Small

- 6.3. Market Analysis, Insights and Forecast - by Tier Type

- 6.3.1. Tier 1 and 2

- 6.3.2. Tier 3

- 6.3.3. Tier 4

- 6.4. Market Analysis, Insights and Forecast - by Absorption

- 6.4.1. Non-Utilized

- 6.5. Market Analysis, Insights and Forecast - by Colocation Type

- 6.5.1. Hyperscale

- 6.5.2. Retail

- 6.5.3. Wholesale

- 6.6. Market Analysis, Insights and Forecast - by End User

- 6.6.1. BFSI

- 6.6.2. Cloud

- 6.6.3. E-Commerce

- 6.6.4. Government

- 6.6.5. Manufacturing

- 6.6.6. Media & Entertainment

- 6.6.7. Telecom

- 6.6.8. Other End User

- 6.1. Market Analysis, Insights and Forecast - by Hotspot

- 7. South America Data Center in Indonesia Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Hotspot

- 7.1.1. Greater Jakarta

- 7.1.2. Rest of Indonesia

- 7.2. Market Analysis, Insights and Forecast - by Data Center Size

- 7.2.1. Large

- 7.2.2. Massive

- 7.2.3. Medium

- 7.2.4. Mega

- 7.2.5. Small

- 7.3. Market Analysis, Insights and Forecast - by Tier Type

- 7.3.1. Tier 1 and 2

- 7.3.2. Tier 3

- 7.3.3. Tier 4

- 7.4. Market Analysis, Insights and Forecast - by Absorption

- 7.4.1. Non-Utilized

- 7.5. Market Analysis, Insights and Forecast - by Colocation Type

- 7.5.1. Hyperscale

- 7.5.2. Retail

- 7.5.3. Wholesale

- 7.6. Market Analysis, Insights and Forecast - by End User

- 7.6.1. BFSI

- 7.6.2. Cloud

- 7.6.3. E-Commerce

- 7.6.4. Government

- 7.6.5. Manufacturing

- 7.6.6. Media & Entertainment

- 7.6.7. Telecom

- 7.6.8. Other End User

- 7.1. Market Analysis, Insights and Forecast - by Hotspot

- 8. Europe Data Center in Indonesia Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Hotspot

- 8.1.1. Greater Jakarta

- 8.1.2. Rest of Indonesia

- 8.2. Market Analysis, Insights and Forecast - by Data Center Size

- 8.2.1. Large

- 8.2.2. Massive

- 8.2.3. Medium

- 8.2.4. Mega

- 8.2.5. Small

- 8.3. Market Analysis, Insights and Forecast - by Tier Type

- 8.3.1. Tier 1 and 2

- 8.3.2. Tier 3

- 8.3.3. Tier 4

- 8.4. Market Analysis, Insights and Forecast - by Absorption

- 8.4.1. Non-Utilized

- 8.5. Market Analysis, Insights and Forecast - by Colocation Type

- 8.5.1. Hyperscale

- 8.5.2. Retail

- 8.5.3. Wholesale

- 8.6. Market Analysis, Insights and Forecast - by End User

- 8.6.1. BFSI

- 8.6.2. Cloud

- 8.6.3. E-Commerce

- 8.6.4. Government

- 8.6.5. Manufacturing

- 8.6.6. Media & Entertainment

- 8.6.7. Telecom

- 8.6.8. Other End User

- 8.1. Market Analysis, Insights and Forecast - by Hotspot

- 9. Middle East & Africa Data Center in Indonesia Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Hotspot

- 9.1.1. Greater Jakarta

- 9.1.2. Rest of Indonesia

- 9.2. Market Analysis, Insights and Forecast - by Data Center Size

- 9.2.1. Large

- 9.2.2. Massive

- 9.2.3. Medium

- 9.2.4. Mega

- 9.2.5. Small

- 9.3. Market Analysis, Insights and Forecast - by Tier Type

- 9.3.1. Tier 1 and 2

- 9.3.2. Tier 3

- 9.3.3. Tier 4

- 9.4. Market Analysis, Insights and Forecast - by Absorption

- 9.4.1. Non-Utilized

- 9.5. Market Analysis, Insights and Forecast - by Colocation Type

- 9.5.1. Hyperscale

- 9.5.2. Retail

- 9.5.3. Wholesale

- 9.6. Market Analysis, Insights and Forecast - by End User

- 9.6.1. BFSI

- 9.6.2. Cloud

- 9.6.3. E-Commerce

- 9.6.4. Government

- 9.6.5. Manufacturing

- 9.6.6. Media & Entertainment

- 9.6.7. Telecom

- 9.6.8. Other End User

- 9.1. Market Analysis, Insights and Forecast - by Hotspot

- 10. Asia Pacific Data Center in Indonesia Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Hotspot

- 10.1.1. Greater Jakarta

- 10.1.2. Rest of Indonesia

- 10.2. Market Analysis, Insights and Forecast - by Data Center Size

- 10.2.1. Large

- 10.2.2. Massive

- 10.2.3. Medium

- 10.2.4. Mega

- 10.2.5. Small

- 10.3. Market Analysis, Insights and Forecast - by Tier Type

- 10.3.1. Tier 1 and 2

- 10.3.2. Tier 3

- 10.3.3. Tier 4

- 10.4. Market Analysis, Insights and Forecast - by Absorption

- 10.4.1. Non-Utilized

- 10.5. Market Analysis, Insights and Forecast - by Colocation Type

- 10.5.1. Hyperscale

- 10.5.2. Retail

- 10.5.3. Wholesale

- 10.6. Market Analysis, Insights and Forecast - by End User

- 10.6.1. BFSI

- 10.6.2. Cloud

- 10.6.3. E-Commerce

- 10.6.4. Government

- 10.6.5. Manufacturing

- 10.6.6. Media & Entertainment

- 10.6.7. Telecom

- 10.6.8. Other End User

- 10.1. Market Analysis, Insights and Forecast - by Hotspot

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 BDx Data Center Pte Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 PT Sigma Tata Sadaya

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PT Supra Primatama Nusantara

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 PT CBN Nusantara

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Princeton Digital Group

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 EdgeConneX Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 PT Faasri Utama Sakti

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Digital Edge (Singapore) Holdings Pte Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 PT DCI Indonesia Tbk

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Space DC Pte Ltd5 4 LIST OF COMPANIES STUDIE

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 NTT Ltd

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nusantara Data Center

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 BDx Data Center Pte Ltd

List of Figures

- Figure 1: Global Data Center in Indonesia Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Indonesia Data Center in Indonesia Market Revenue (Million), by Country 2024 & 2032

- Figure 3: Indonesia Data Center in Indonesia Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America Data Center in Indonesia Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 5: North America Data Center in Indonesia Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 6: North America Data Center in Indonesia Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 7: North America Data Center in Indonesia Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 8: North America Data Center in Indonesia Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 9: North America Data Center in Indonesia Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 10: North America Data Center in Indonesia Market Revenue (Million), by Absorption 2024 & 2032

- Figure 11: North America Data Center in Indonesia Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 12: North America Data Center in Indonesia Market Revenue (Million), by Colocation Type 2024 & 2032

- Figure 13: North America Data Center in Indonesia Market Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 14: North America Data Center in Indonesia Market Revenue (Million), by End User 2024 & 2032

- Figure 15: North America Data Center in Indonesia Market Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Data Center in Indonesia Market Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Data Center in Indonesia Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: South America Data Center in Indonesia Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 19: South America Data Center in Indonesia Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 20: South America Data Center in Indonesia Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 21: South America Data Center in Indonesia Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 22: South America Data Center in Indonesia Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 23: South America Data Center in Indonesia Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 24: South America Data Center in Indonesia Market Revenue (Million), by Absorption 2024 & 2032

- Figure 25: South America Data Center in Indonesia Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 26: South America Data Center in Indonesia Market Revenue (Million), by Colocation Type 2024 & 2032

- Figure 27: South America Data Center in Indonesia Market Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 28: South America Data Center in Indonesia Market Revenue (Million), by End User 2024 & 2032

- Figure 29: South America Data Center in Indonesia Market Revenue Share (%), by End User 2024 & 2032

- Figure 30: South America Data Center in Indonesia Market Revenue (Million), by Country 2024 & 2032

- Figure 31: South America Data Center in Indonesia Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Europe Data Center in Indonesia Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 33: Europe Data Center in Indonesia Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 34: Europe Data Center in Indonesia Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 35: Europe Data Center in Indonesia Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 36: Europe Data Center in Indonesia Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 37: Europe Data Center in Indonesia Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 38: Europe Data Center in Indonesia Market Revenue (Million), by Absorption 2024 & 2032

- Figure 39: Europe Data Center in Indonesia Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 40: Europe Data Center in Indonesia Market Revenue (Million), by Colocation Type 2024 & 2032

- Figure 41: Europe Data Center in Indonesia Market Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 42: Europe Data Center in Indonesia Market Revenue (Million), by End User 2024 & 2032

- Figure 43: Europe Data Center in Indonesia Market Revenue Share (%), by End User 2024 & 2032

- Figure 44: Europe Data Center in Indonesia Market Revenue (Million), by Country 2024 & 2032

- Figure 45: Europe Data Center in Indonesia Market Revenue Share (%), by Country 2024 & 2032

- Figure 46: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 47: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 48: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 49: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 50: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 51: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 52: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by Absorption 2024 & 2032

- Figure 53: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 54: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by Colocation Type 2024 & 2032

- Figure 55: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 56: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by End User 2024 & 2032

- Figure 57: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by End User 2024 & 2032

- Figure 58: Middle East & Africa Data Center in Indonesia Market Revenue (Million), by Country 2024 & 2032

- Figure 59: Middle East & Africa Data Center in Indonesia Market Revenue Share (%), by Country 2024 & 2032

- Figure 60: Asia Pacific Data Center in Indonesia Market Revenue (Million), by Hotspot 2024 & 2032

- Figure 61: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by Hotspot 2024 & 2032

- Figure 62: Asia Pacific Data Center in Indonesia Market Revenue (Million), by Data Center Size 2024 & 2032

- Figure 63: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by Data Center Size 2024 & 2032

- Figure 64: Asia Pacific Data Center in Indonesia Market Revenue (Million), by Tier Type 2024 & 2032

- Figure 65: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by Tier Type 2024 & 2032

- Figure 66: Asia Pacific Data Center in Indonesia Market Revenue (Million), by Absorption 2024 & 2032

- Figure 67: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by Absorption 2024 & 2032

- Figure 68: Asia Pacific Data Center in Indonesia Market Revenue (Million), by Colocation Type 2024 & 2032

- Figure 69: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by Colocation Type 2024 & 2032

- Figure 70: Asia Pacific Data Center in Indonesia Market Revenue (Million), by End User 2024 & 2032

- Figure 71: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by End User 2024 & 2032

- Figure 72: Asia Pacific Data Center in Indonesia Market Revenue (Million), by Country 2024 & 2032

- Figure 73: Asia Pacific Data Center in Indonesia Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Data Center in Indonesia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Data Center in Indonesia Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 3: Global Data Center in Indonesia Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 4: Global Data Center in Indonesia Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 5: Global Data Center in Indonesia Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 6: Global Data Center in Indonesia Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 7: Global Data Center in Indonesia Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Global Data Center in Indonesia Market Revenue Million Forecast, by Region 2019 & 2032

- Table 9: Global Data Center in Indonesia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Global Data Center in Indonesia Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 11: Global Data Center in Indonesia Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 12: Global Data Center in Indonesia Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 13: Global Data Center in Indonesia Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 14: Global Data Center in Indonesia Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 15: Global Data Center in Indonesia Market Revenue Million Forecast, by End User 2019 & 2032

- Table 16: Global Data Center in Indonesia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: United States Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Canada Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Mexico Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Data Center in Indonesia Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 21: Global Data Center in Indonesia Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 22: Global Data Center in Indonesia Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 23: Global Data Center in Indonesia Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 24: Global Data Center in Indonesia Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 25: Global Data Center in Indonesia Market Revenue Million Forecast, by End User 2019 & 2032

- Table 26: Global Data Center in Indonesia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Data Center in Indonesia Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 31: Global Data Center in Indonesia Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 32: Global Data Center in Indonesia Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 33: Global Data Center in Indonesia Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 34: Global Data Center in Indonesia Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 35: Global Data Center in Indonesia Market Revenue Million Forecast, by End User 2019 & 2032

- Table 36: Global Data Center in Indonesia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: United Kingdom Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Germany Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Russia Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Benelux Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Nordics Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Global Data Center in Indonesia Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 47: Global Data Center in Indonesia Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 48: Global Data Center in Indonesia Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 49: Global Data Center in Indonesia Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 50: Global Data Center in Indonesia Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 51: Global Data Center in Indonesia Market Revenue Million Forecast, by End User 2019 & 2032

- Table 52: Global Data Center in Indonesia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Turkey Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Israel Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: GCC Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: North Africa Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: South Africa Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Middle East & Africa Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Global Data Center in Indonesia Market Revenue Million Forecast, by Hotspot 2019 & 2032

- Table 60: Global Data Center in Indonesia Market Revenue Million Forecast, by Data Center Size 2019 & 2032

- Table 61: Global Data Center in Indonesia Market Revenue Million Forecast, by Tier Type 2019 & 2032

- Table 62: Global Data Center in Indonesia Market Revenue Million Forecast, by Absorption 2019 & 2032

- Table 63: Global Data Center in Indonesia Market Revenue Million Forecast, by Colocation Type 2019 & 2032

- Table 64: Global Data Center in Indonesia Market Revenue Million Forecast, by End User 2019 & 2032

- Table 65: Global Data Center in Indonesia Market Revenue Million Forecast, by Country 2019 & 2032

- Table 66: China Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 67: India Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: Japan Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 69: South Korea Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: ASEAN Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 71: Oceania Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: Rest of Asia Pacific Data Center in Indonesia Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Data Center in Indonesia Market?

The projected CAGR is approximately 21.06%.

2. Which companies are prominent players in the Data Center in Indonesia Market?

Key companies in the market include BDx Data Center Pte Ltd, PT Sigma Tata Sadaya, PT Supra Primatama Nusantara, PT CBN Nusantara, Princeton Digital Group, EdgeConneX Inc, PT Faasri Utama Sakti, Digital Edge (Singapore) Holdings Pte Ltd, PT DCI Indonesia Tbk, Space DC Pte Ltd5 4 LIST OF COMPANIES STUDIE, NTT Ltd, Nusantara Data Center.

3. What are the main segments of the Data Center in Indonesia Market?

The market segments include Hotspot, Data Center Size, Tier Type, Absorption, Colocation Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rise of E-Commerce; Flourishing Startup Culture.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Slow Penetration Rate in Developing Countries.

8. Can you provide examples of recent developments in the market?

September 2022: The company commenced construction on a 23MW data center in Jakarta, Indonesia, marking the company’s third site in South East Asia as it capitalizes on the region’s rapid digital transformation in the wake of the global pandemic.The new facility will offer 3,430 cabinets and an IT load of 23MW and is designed to cater for the growing demand for high power density applications from cloud-driven hyperscale deployments, local and international network and financial service providers. It is expected to complete by Q4 2023.August 2022: PT Sigma Cipta Caraka (SCA), also known as telkomsigma, transfers its data centre business to PT Telkom Data Ekosistem (TDE), which is worth a total of IDR 2.01 trillion. The parent company PT Telkom Indonesia (Persero) Tbk (TLKM), claimed that this transfer of the data centre business line is related to the business restructuring program held by Telkom Group.June 2022: The company announced the launch of BDx Indonesia, following the completion of a USD 300 million joint venture agreement with PT Indosat Tbk (Indosat Ooredoo Hutchison or IOH) and PT Aplikanusa Lintasarta, Big Data Exchange (BDx).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Data Center in Indonesia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Data Center in Indonesia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Data Center in Indonesia Market?

To stay informed about further developments, trends, and reports in the Data Center in Indonesia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence