Key Insights

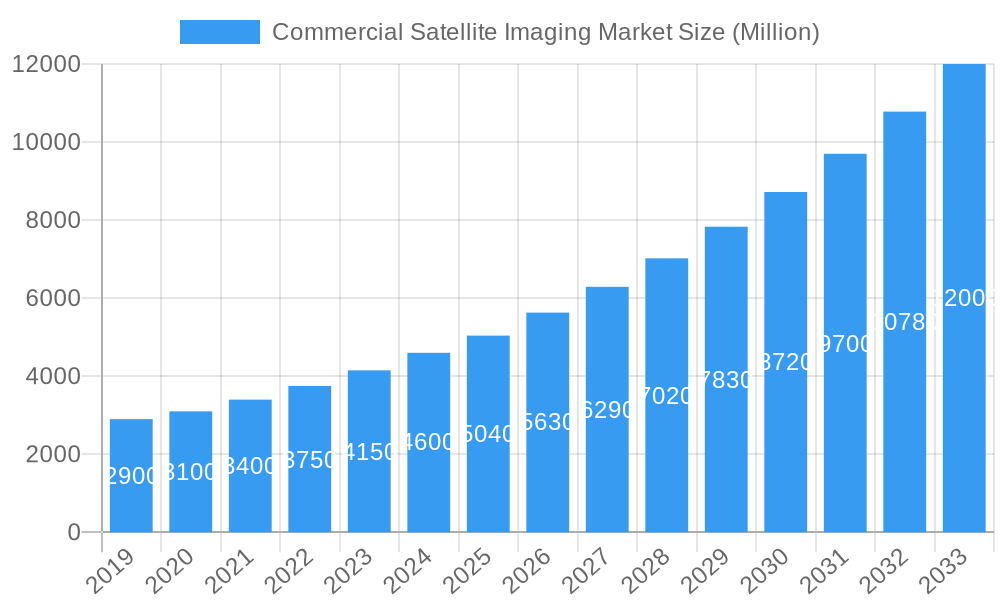

The Commercial Satellite Imaging Market is poised for substantial growth, projected to reach a valuation of approximately $5.04 billion in 2025 with an impressive Compound Annual Growth Rate (CAGR) of 11.84% through 2033. This robust expansion is fueled by a confluence of critical drivers including the escalating demand for high-resolution geospatial data across various sectors. Key applications such as Geospatial Data Acquisition and Mapping, Natural Resource Management, and Surveillance and Security are at the forefront of this growth. The increasing need for real-time intelligence for defense and intelligence operations, alongside enhanced capabilities in disaster management and construction planning, further propels the market forward. Moreover, advancements in satellite technology, including miniaturization, increased spectral resolution, and faster data processing, are making satellite imagery more accessible and actionable for a wider range of end-users.

Commercial Satellite Imaging Market Market Size (In Billion)

The market's segmentation reveals a diverse landscape of applications and end-user verticals. Government and Military & Defense sectors represent significant consumers of commercial satellite imagery, leveraging it for national security, strategic planning, and border monitoring. The Construction, Transportation & Logistics, and Energy sectors are increasingly adopting these solutions for infrastructure development, supply chain optimization, and resource exploration. Emerging applications in precision agriculture and environmental monitoring within Forestry & Agriculture are also contributing to market expansion. While strong market demand and technological innovation are key drivers, potential restraints such as high initial investment costs for satellite development and launch, alongside regulatory hurdles and data privacy concerns, need careful consideration by industry players.

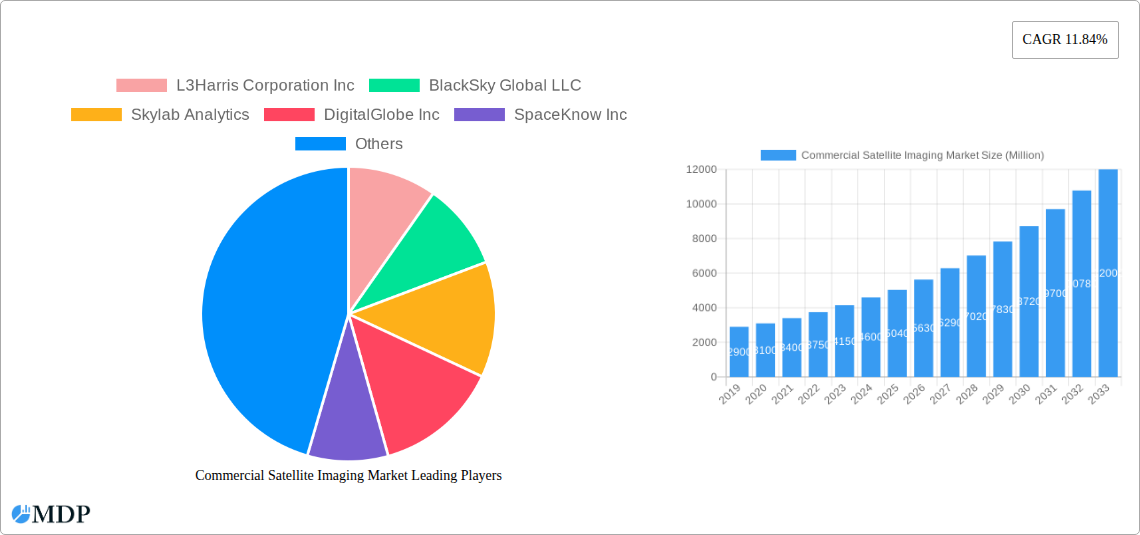

Commercial Satellite Imaging Market Company Market Share

This comprehensive market research report delves into the dynamic Commercial Satellite Imaging Market, providing an in-depth analysis of its growth trajectories, key trends, and strategic landscape. Explore the burgeoning demand for high-resolution satellite imagery and advanced geospatial analytics, driven by defense, environmental monitoring, infrastructure development, and a myriad of other critical applications. Our report offers actionable intelligence for industry stakeholders, including satellite imagery providers, geospatial analytics firms, government agencies, and end-user industries seeking to leverage the power of Earth observation.

The study covers the historical period (2019–2024), the base year (2025), and projects market performance through the forecast period (2025–2033), with an estimated year of 2025. We analyze the market's structure, from geospatial data acquisition and mapping to specialized applications like disaster management and defense and intelligence. Key end-user verticals examined include government, construction, military and defense, energy, and forestry and agriculture.

Key players analyzed in this report include L3Harris Corporation Inc, BlackSky Global LLC, Skylab Analytics, DigitalGlobe Inc, SpaceKnow Inc, ImageSat International NV, Galileo Group Inc, European Space Imaging (EUSI) GmbH, Planet Labs Inc, UrtheCast Corp.

Commercial Satellite Imaging Market Dynamics & Concentration

The Commercial Satellite Imaging Market is characterized by a moderate to high concentration, with a few prominent players dominating a significant portion of the market share. Innovation is a key driver, fueled by advancements in satellite technology, sensor capabilities, and data processing algorithms. The increasing availability of high-resolution imagery, faster revisit times, and sophisticated analytical tools are continuously pushing the boundaries of what's possible. Regulatory frameworks, while sometimes presenting hurdles, are also evolving to support the broader adoption of commercial satellite data, particularly in areas like national security and environmental monitoring. Product substitutes, such as aerial imagery and terrestrial surveying, exist but often fall short in terms of coverage, scalability, and cost-effectiveness for large-scale, global applications. End-user trends indicate a growing reliance on geospatial intelligence for decision-making across diverse sectors. Mergers and acquisitions (M&A) activities are prevalent, with companies strategically acquiring complementary technologies and customer bases to strengthen their competitive positions and expand service offerings. For instance, recent M&A activity has seen an increase in deals aimed at integrating analytics platforms with imagery acquisition capabilities, reflecting a trend towards offering end-to-end solutions.

Commercial Satellite Imaging Market Industry Trends & Analysis

The Commercial Satellite Imaging Market is experiencing robust growth, propelled by an escalating demand for actionable geospatial intelligence. This growth is significantly driven by the increasing adoption of high-resolution satellite imagery and advanced analytics across various sectors. The defense and intelligence sector remains a cornerstone of this market, leveraging satellite data for enhanced surveillance, reconnaissance, and situational awareness. Simultaneously, the government sector is increasingly utilizing satellite imaging for applications ranging from urban planning and infrastructure monitoring to environmental conservation and disaster response. Technological advancements are playing a pivotal role, with the development of smaller, more agile satellites, improved sensor resolution, and faster data downlink capabilities contributing to more frequent and precise data acquisition. The proliferation of cloud-based platforms and Artificial Intelligence (AI) is democratizing access to satellite data and enabling sophisticated analysis, transforming raw imagery into valuable insights. Furthermore, the rising awareness of climate change and the need for sustainable resource management are fueling demand in the natural resource management, forestry and agriculture, and conservation and research segments. The construction and transportation industries are also benefiting from satellite imagery for project planning, progress monitoring, and logistical optimization. The market penetration of commercial satellite imaging is widening as its cost-effectiveness and scalability become more apparent compared to traditional methods. The Compound Annual Growth Rate (CAGR) of this market is projected to be substantial over the forecast period, reflecting its expanding applications and increasing adoption rates.

Leading Markets & Segments in Commercial Satellite Imaging Market

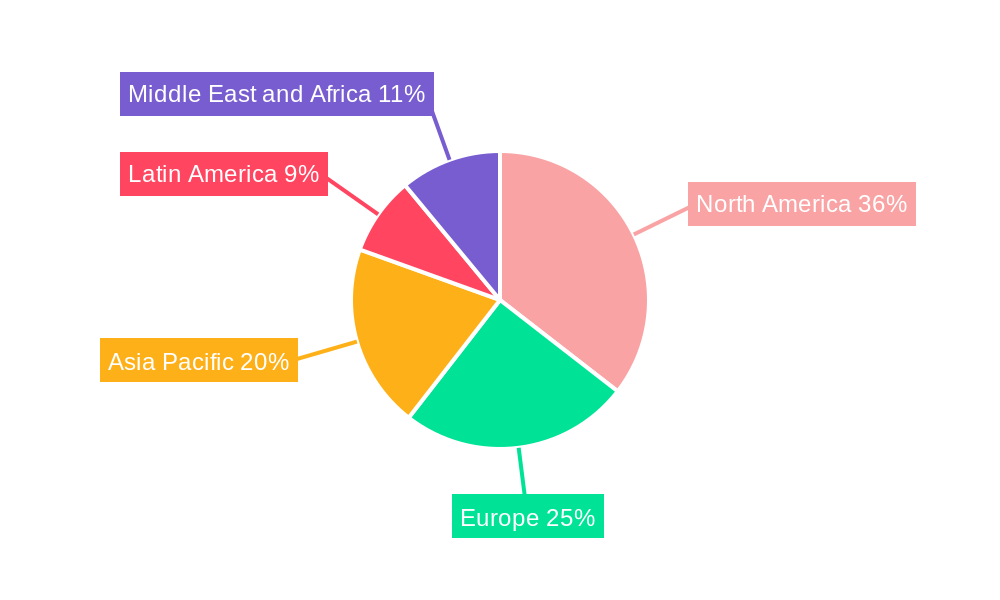

The Commercial Satellite Imaging Market showcases significant dominance in specific regions and segments, driven by a confluence of factors including economic policies, infrastructure development, and geopolitical imperatives.

Dominant Application Segments:

- Geospatial Data Acquisition and Mapping: This foundational application segment consistently leads the market, providing the raw data for a multitude of downstream uses. Its dominance is driven by the ever-increasing need for up-to-date and accurate geographic information for cartography, urban planning, and land management. Economic policies promoting infrastructure development and land use planning directly fuel demand in this area.

- Defense and Intelligence: This segment is a major revenue generator, characterized by substantial government investments. The ongoing global security landscape and the need for enhanced surveillance and reconnaissance capabilities are paramount drivers. Regulatory frameworks supporting defense procurement and classified data utilization reinforce its leadership.

- Surveillance and Security: Closely linked to defense, this broader segment encompasses commercial security applications, border monitoring, and critical infrastructure protection. Growing concerns about security threats and the need for continuous monitoring contribute to its strong market position.

Dominant End-user Verticals:

- Government: This vertical represents the largest consumer of commercial satellite imagery, encompassing national defense, intelligence agencies, environmental protection agencies, and municipal governments. Government procurement programs, often driven by national security and public service mandates, are significant market accelerators. Infrastructure spending and urban development initiatives further bolster this segment's demand.

- Military and Defense: As highlighted, this sub-segment of the government vertical is a primary driver of market growth due to extensive funding for intelligence, surveillance, and reconnaissance (ISR) operations. The need for real-time battlefield awareness and strategic intelligence maintains its leading position.

Regional Dominance: While global in scope, North America and Europe currently represent the largest markets for commercial satellite imaging, driven by advanced technological adoption, robust government spending in defense and intelligence, and significant investments in infrastructure and environmental monitoring. However, the Asia-Pacific region is experiencing rapid growth due to increasing investments in smart city initiatives, defense modernization, and infrastructure development. The economic policies in these regions often prioritize technological advancement and data-driven decision-making, which directly translates to higher demand for commercial satellite imaging services.

Commercial Satellite Imaging Market Product Developments

Product development in the Commercial Satellite Imaging Market is characterized by a relentless pursuit of higher resolution, improved spectral capabilities, and faster data delivery. Companies are innovating with smaller, more agile satellites capable of rapid tasking and revisit times, as well as advanced optical and radar sensors that can penetrate cloud cover and provide detailed information day or night. The integration of artificial intelligence and machine learning algorithms for automated image analysis is a significant trend, enabling users to extract actionable insights more efficiently. These developments are crucial for competitive advantage, allowing providers to cater to niche applications in precision agriculture, urban planning, and disaster response with greater accuracy and speed. The focus is on delivering not just raw imagery, but comprehensive geospatial solutions that address specific end-user needs.

Key Drivers of Commercial Satellite Imaging Market Growth

The Commercial Satellite Imaging Market is propelled by several key drivers. Technologically, advancements in sensor resolution, satellite constellation capacity, and on-board processing capabilities enable the acquisition of more detailed and timely data. Economically, the increasing cost-effectiveness of satellite imagery compared to traditional methods, coupled with a growing understanding of its value in optimizing operations and decision-making, is a major impetus. Regulatory factors, such as government initiatives to leverage commercial data for national security and environmental monitoring, and the growing adoption of open data policies, are further accelerating market expansion. The rise of cloud computing and AI-powered analytics is democratizing access to sophisticated geospatial insights, making it easier for a wider range of industries to benefit from satellite imagery.

Challenges in the Commercial Satellite Imaging Market Market

Despite its promising growth, the Commercial Satellite Imaging Market faces several challenges. High upfront investment costs for satellite development and launch remain a significant barrier for new entrants. Regulatory hurdles, particularly regarding data licensing, export controls, and data privacy, can complicate global market access and operational deployment. Intense competition among a growing number of providers can lead to price pressures and necessitate continuous innovation to maintain market share. Furthermore, supply chain disruptions for critical components and launch services can impact operational timelines and costs. The cybersecurity of satellite data and ground infrastructure is also a growing concern, requiring robust security measures to prevent unauthorized access and manipulation.

Emerging Opportunities in Commercial Satellite Imaging Market

Emerging opportunities in the Commercial Satellite Imaging Market are abundant and driven by technological breakthroughs and evolving market needs. The increasing maturity of synthetic aperture radar (SAR) technology is opening new avenues for all-weather, day-and-night imaging applications in sectors like maritime surveillance and underground infrastructure monitoring. Strategic partnerships between satellite imagery providers and AI/machine learning companies are creating powerful new analytical capabilities, offering deeper insights into complex datasets. The growing emphasis on sustainability and climate action presents immense opportunities for satellite data in environmental monitoring, carbon footprint assessment, and natural resource management. Furthermore, the expansion of satellite constellations and the development of edge computing capabilities onboard satellites are paving the way for near real-time data processing and faster decision-making in critical applications.

Leading Players in the Commercial Satellite Imaging Market Sector

- L3Harris Corporation Inc

- BlackSky Global LLC

- Skylab Analytics

- DigitalGlobe Inc

- SpaceKnow Inc

- ImageSat International NV

- Galileo Group Inc

- European Space Imaging (EUSI) GmbH

- Planet Labs Inc

- UrtheCast Corp

Key Milestones in Commercial Satellite Imaging Market Industry

- February 2024: The National Geospatial-Intelligence Agency (NGA) is supercharging its use of commercial satellite imagery and analytics with a procurement program, “Luno.” The Luno program seeks to leverage commercial satellite imagery and data analytics to enhance NGA’s global monitoring capabilities, underscoring the increasing reliance of intelligence agencies on commercial assets.

- 2023: Increased deployment of small satellite constellations by various commercial entities, leading to enhanced revisit rates and higher data acquisition frequencies, thereby improving the timeliness of critical information.

- 2022: Significant advancements in AI-powered analytics for satellite imagery, enabling automated feature extraction, change detection, and predictive modeling, thereby increasing the value proposition for end-users.

- 2021: Major government agencies, globally, formalized partnerships and procurement strategies to integrate commercial satellite imagery into their operational workflows, recognizing its cost-effectiveness and agility.

Strategic Outlook for Commercial Satellite Imaging Market Market

The strategic outlook for the Commercial Satellite Imaging Market is exceptionally positive, driven by an accelerating demand for geospatial intelligence across a wide spectrum of industries. Growth accelerators include the continued miniaturization and cost reduction of satellite technology, enabling more constellations and higher revisit rates. The burgeoning field of AI and machine learning will further unlock the potential of satellite data, transforming raw imagery into sophisticated, actionable insights for complex problem-solving. Strategic opportunities lie in forging deeper partnerships between imagery providers and analytics firms to offer end-to-end solutions, as well as expanding into emerging markets with significant infrastructure development and environmental monitoring needs. The increasing integration of satellite data with other data sources, such as IoT sensors and ground-based observations, will create a more comprehensive understanding of the Earth's systems, driving innovation and market expansion.

Commercial Satellite Imaging Market Segmentation

-

1. Application

- 1.1. Geospatial Data Acquisition and Mapping

- 1.2. Natural Resource Management

- 1.3. Surveillance and Security

- 1.4. Conservation and Research

- 1.5. Construction and Development

- 1.6. Disaster Management

- 1.7. Defense and Intelligence

-

2. End-user Vertical

- 2.1. Government

- 2.2. Construction

- 2.3. Transportation and Logistics

- 2.4. Military and Defense

- 2.5. Energy

- 2.6. Forestry and Agriculture

- 2.7. Other End-user Verticals

Commercial Satellite Imaging Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Commercial Satellite Imaging Market Regional Market Share

Geographic Coverage of Commercial Satellite Imaging Market

Commercial Satellite Imaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Requirement for Efficient Monitoring of Vast Land Areas; Rising Smart City Initiatives; Big Data and Imagery Analytics

- 3.3. Market Restrains

- 3.3.1. High-resolution Images Offered by Other Imaging Technologies

- 3.4. Market Trends

- 3.4.1. Military and Defense is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Geospatial Data Acquisition and Mapping

- 5.1.2. Natural Resource Management

- 5.1.3. Surveillance and Security

- 5.1.4. Conservation and Research

- 5.1.5. Construction and Development

- 5.1.6. Disaster Management

- 5.1.7. Defense and Intelligence

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Government

- 5.2.2. Construction

- 5.2.3. Transportation and Logistics

- 5.2.4. Military and Defense

- 5.2.5. Energy

- 5.2.6. Forestry and Agriculture

- 5.2.7. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Geospatial Data Acquisition and Mapping

- 6.1.2. Natural Resource Management

- 6.1.3. Surveillance and Security

- 6.1.4. Conservation and Research

- 6.1.5. Construction and Development

- 6.1.6. Disaster Management

- 6.1.7. Defense and Intelligence

- 6.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.2.1. Government

- 6.2.2. Construction

- 6.2.3. Transportation and Logistics

- 6.2.4. Military and Defense

- 6.2.5. Energy

- 6.2.6. Forestry and Agriculture

- 6.2.7. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. Europe Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Geospatial Data Acquisition and Mapping

- 7.1.2. Natural Resource Management

- 7.1.3. Surveillance and Security

- 7.1.4. Conservation and Research

- 7.1.5. Construction and Development

- 7.1.6. Disaster Management

- 7.1.7. Defense and Intelligence

- 7.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.2.1. Government

- 7.2.2. Construction

- 7.2.3. Transportation and Logistics

- 7.2.4. Military and Defense

- 7.2.5. Energy

- 7.2.6. Forestry and Agriculture

- 7.2.7. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Asia Pacific Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Geospatial Data Acquisition and Mapping

- 8.1.2. Natural Resource Management

- 8.1.3. Surveillance and Security

- 8.1.4. Conservation and Research

- 8.1.5. Construction and Development

- 8.1.6. Disaster Management

- 8.1.7. Defense and Intelligence

- 8.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.2.1. Government

- 8.2.2. Construction

- 8.2.3. Transportation and Logistics

- 8.2.4. Military and Defense

- 8.2.5. Energy

- 8.2.6. Forestry and Agriculture

- 8.2.7. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Latin America Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Geospatial Data Acquisition and Mapping

- 9.1.2. Natural Resource Management

- 9.1.3. Surveillance and Security

- 9.1.4. Conservation and Research

- 9.1.5. Construction and Development

- 9.1.6. Disaster Management

- 9.1.7. Defense and Intelligence

- 9.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.2.1. Government

- 9.2.2. Construction

- 9.2.3. Transportation and Logistics

- 9.2.4. Military and Defense

- 9.2.5. Energy

- 9.2.6. Forestry and Agriculture

- 9.2.7. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Middle East and Africa Commercial Satellite Imaging Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Geospatial Data Acquisition and Mapping

- 10.1.2. Natural Resource Management

- 10.1.3. Surveillance and Security

- 10.1.4. Conservation and Research

- 10.1.5. Construction and Development

- 10.1.6. Disaster Management

- 10.1.7. Defense and Intelligence

- 10.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.2.1. Government

- 10.2.2. Construction

- 10.2.3. Transportation and Logistics

- 10.2.4. Military and Defense

- 10.2.5. Energy

- 10.2.6. Forestry and Agriculture

- 10.2.7. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 L3Harris Corporation Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BlackSky Global LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Skylab Analytics

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DigitalGlobe Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SpaceKnow Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ImageSat International NV

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Galileo Group Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 European Space Imaging (EUSI) GmbH

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Planet Labs Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 UrtheCast Corp

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 L3Harris Corporation Inc

List of Figures

- Figure 1: Global Commercial Satellite Imaging Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Satellite Imaging Market Revenue (Million), by Application 2025 & 2033

- Figure 3: North America Commercial Satellite Imaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 5: North America Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 6: North America Commercial Satellite Imaging Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Commercial Satellite Imaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Commercial Satellite Imaging Market Revenue (Million), by Application 2025 & 2033

- Figure 9: Europe Commercial Satellite Imaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 10: Europe Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 11: Europe Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 12: Europe Commercial Satellite Imaging Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Commercial Satellite Imaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Commercial Satellite Imaging Market Revenue (Million), by Application 2025 & 2033

- Figure 15: Asia Pacific Commercial Satellite Imaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 16: Asia Pacific Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 17: Asia Pacific Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 18: Asia Pacific Commercial Satellite Imaging Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Commercial Satellite Imaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Latin America Commercial Satellite Imaging Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Latin America Commercial Satellite Imaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Latin America Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 23: Latin America Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 24: Latin America Commercial Satellite Imaging Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Latin America Commercial Satellite Imaging Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Commercial Satellite Imaging Market Revenue (Million), by Application 2025 & 2033

- Figure 27: Middle East and Africa Commercial Satellite Imaging Market Revenue Share (%), by Application 2025 & 2033

- Figure 28: Middle East and Africa Commercial Satellite Imaging Market Revenue (Million), by End-user Vertical 2025 & 2033

- Figure 29: Middle East and Africa Commercial Satellite Imaging Market Revenue Share (%), by End-user Vertical 2025 & 2033

- Figure 30: Middle East and Africa Commercial Satellite Imaging Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Middle East and Africa Commercial Satellite Imaging Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 3: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 6: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 9: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 11: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 12: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 15: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Application 2020 & 2033

- Table 17: Global Commercial Satellite Imaging Market Revenue Million Forecast, by End-user Vertical 2020 & 2033

- Table 18: Global Commercial Satellite Imaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Satellite Imaging Market?

The projected CAGR is approximately 11.84%.

2. Which companies are prominent players in the Commercial Satellite Imaging Market?

Key companies in the market include L3Harris Corporation Inc, BlackSky Global LLC, Skylab Analytics, DigitalGlobe Inc, SpaceKnow Inc, ImageSat International NV, Galileo Group Inc, European Space Imaging (EUSI) GmbH, Planet Labs Inc, UrtheCast Corp.

3. What are the main segments of the Commercial Satellite Imaging Market?

The market segments include Application, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Requirement for Efficient Monitoring of Vast Land Areas; Rising Smart City Initiatives; Big Data and Imagery Analytics.

6. What are the notable trends driving market growth?

Military and Defense is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

High-resolution Images Offered by Other Imaging Technologies.

8. Can you provide examples of recent developments in the market?

February 2024 - The National Geospatial-Intelligence Agency is supercharging its use of commercial satellite imagery and analytics with a procurement program, “Luno.” The Luno program seeks to leverage commercial satellite imagery and data analytics to enhance NGA’s global monitoring capabilities.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Satellite Imaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Satellite Imaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Satellite Imaging Market?

To stay informed about further developments, trends, and reports in the Commercial Satellite Imaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence