Key Insights

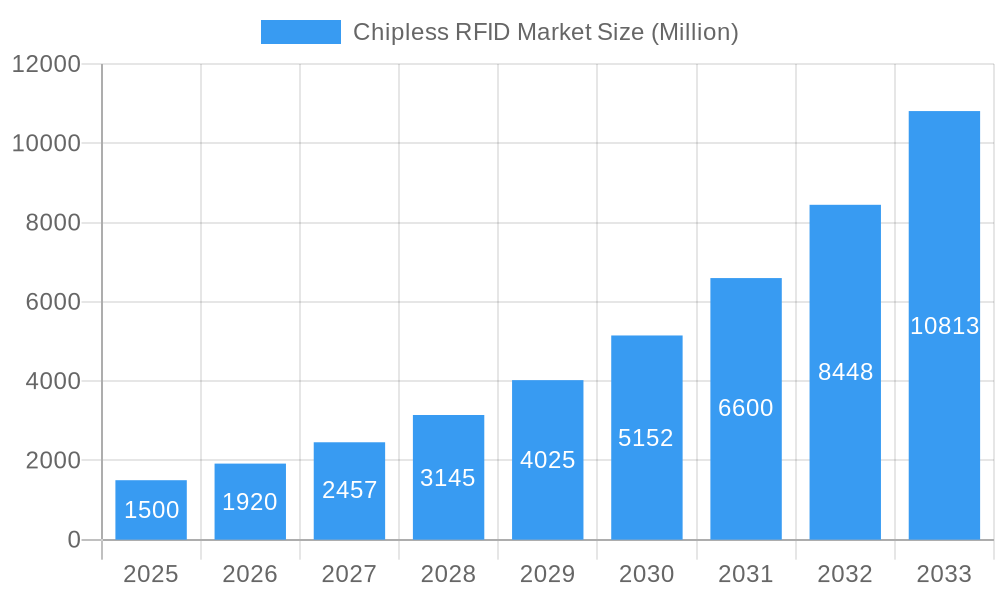

The Chipless RFID market is projected for significant expansion, anticipating a market size of $14.58 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 8.5%. This growth is propelled by the inherent cost-effectiveness, enhanced integration, and scalability of chipless RFID solutions over conventional systems. Key growth catalysts include escalating demand for advanced supply chain visibility and inventory management across various sectors, the widespread integration of smart technologies in consumer electronics, and the need for efficient, low-cost asset tracking. Ongoing innovation in tag design and manufacturing is further bolstering the development of versatile chipless RFID solutions.

Chipless RFID Market Market Size (In Billion)

Several emerging trends are shaping the market's landscape. The increasing adoption of smart cards and tickets for secure identification and ticketing systems is a significant driver. In retail, chipless RFID is transforming inventory management, minimizing shrinkage, and improving customer experiences through expedited checkout. The healthcare sector is utilizing this technology for precise tracking of medical devices and pharmaceuticals, ensuring regulatory adherence and patient safety. Logistics and transportation sectors are experiencing enhanced fleet management and real-time shipment monitoring. The BFSI sector is exploring its application in secure payment and access control systems. While market opportunities are substantial, factors such as the necessity for standardization, interoperability, and initial reader infrastructure investment require strategic attention. Leading companies like Avery Dennison and NXP Semiconductors are actively investing in R&D to address these challenges and maximize market potential.

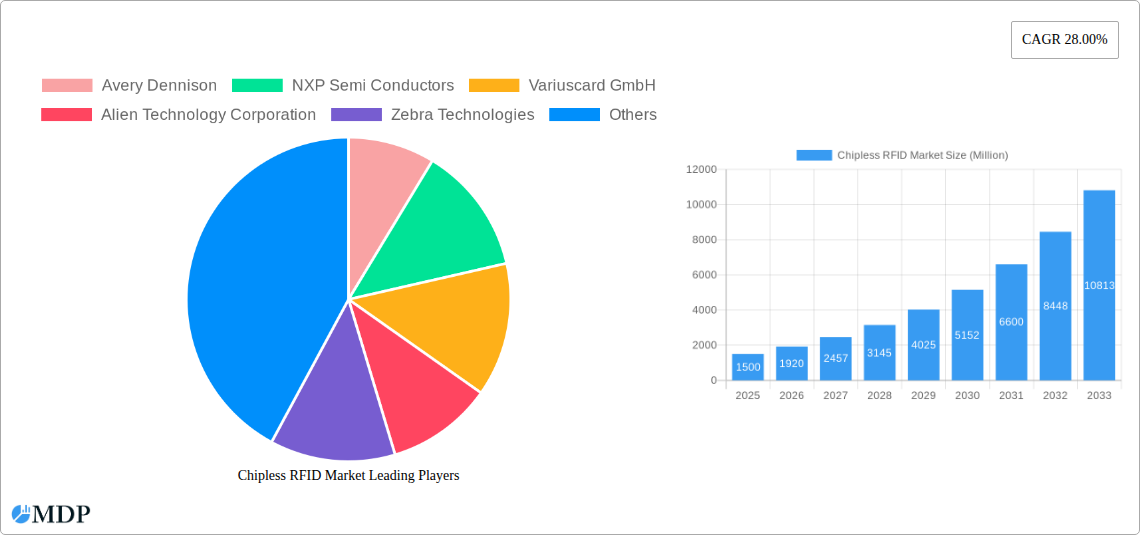

Chipless RFID Market Company Market Share

Chipless RFID Market: Unlocking the Future of Identification and Tracking - Comprehensive Report Description

Dive deep into the revolutionary Chipless RFID Market with this in-depth, SEO-optimized report. Explore the explosive growth, cutting-edge innovations, and strategic landscape shaping the future of identification and tracking solutions from 2019 to 2033. This comprehensive analysis provides actionable insights for industry stakeholders, investors, and technology providers seeking to capitalize on this dynamic market.

This report leverages high-traffic keywords like "chipless RFID tags," "RFID market analysis," "smart card technology," "retail RFID," "healthcare RFID," "logistics RFID," and "BFSI RFID" to ensure maximum visibility and engagement with key decision-makers.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

Chipless RFID Market Dynamics & Concentration

The Chipless RFID Market is characterized by moderate to high concentration, driven by a handful of key players investing heavily in research and development. Innovation is the primary driver, with continuous advancements in miniaturization, cost reduction, and enhanced functionality fueling market expansion. Regulatory frameworks, particularly in data privacy and security, are evolving to accommodate the increasing adoption of RFID technology, influencing implementation strategies across industries. While traditional barcodes remain a product substitute, their limitations in terms of read range and data capacity are increasingly pushing businesses towards chipless RFID. End-user trends are leaning towards enhanced supply chain visibility, inventory management efficiency, and personalized customer experiences, all directly benefiting from chipless RFID capabilities. Mergers and acquisitions (M&A) are expected to continue as larger entities seek to integrate innovative chipless RFID solutions into their portfolios, consolidating market share and fostering further technological integration. Key M&A activities in recent years indicate a strong trend towards consolidation, with an estimated xx deal counts anticipated in the forecast period. Dominant players like Avery Dennison and NXP Semiconductors hold a significant market share, estimated at xx%, by driving product innovation and strategic partnerships.

Chipless RFID Market Industry Trends & Analysis

The Chipless RFID Market is poised for substantial growth, projected to expand at a compelling Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. This robust expansion is underpinned by a confluence of powerful market growth drivers, including the escalating demand for real-time asset tracking and inventory management solutions across diverse industries. Technological disruptions are at the forefront, with ongoing advancements in materials science, antenna design, and signal processing enabling the development of more cost-effective, durable, and versatile chipless RFID tags. Consumer preferences are increasingly shifting towards enhanced product traceability and personalized experiences, directly fueling the adoption of chipless RFID in applications such as smart packaging and loyalty programs. The competitive landscape is intensifying, marked by a strategic race among leading players to innovate and capture market share through product differentiation and application-specific solutions. Market penetration is steadily increasing, especially in sectors like retail and logistics, where the tangible benefits of improved efficiency and reduced operational costs are readily apparent. The estimated market penetration in the retail sector is projected to reach xx% by 2033, showcasing the transformative impact of this technology. The increasing complexity of global supply chains necessitates more sophisticated tracking mechanisms, positioning chipless RFID as a critical enabler of end-to-end visibility. Furthermore, the growing focus on counterfeit detection and product authentication in industries like pharmaceuticals and luxury goods is a significant catalyst for chipless RFID adoption.

Leading Markets & Segments in Chipless RFID Market

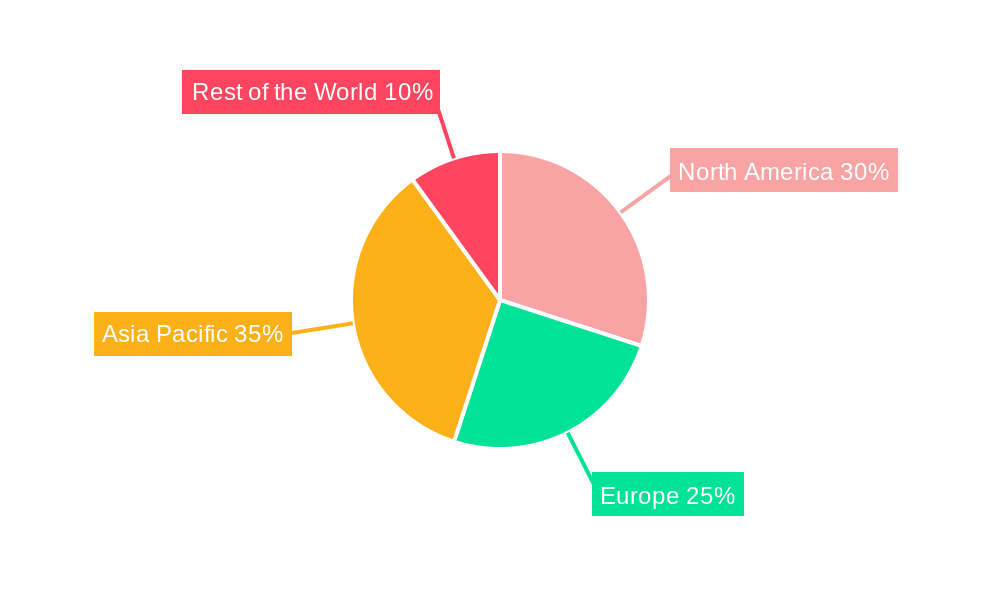

The Retail end-user industry is projected to dominate the Chipless RFID Market, driven by the imperative for enhanced inventory accuracy, reduced stockouts, and improved customer engagement. The Tag product type segment is expected to hold the largest market share within the forecast period, owing to the foundational role of tags in enabling chipless RFID functionalities. Geographically, North America is anticipated to lead the market, propelled by strong government initiatives supporting smart infrastructure development and a high adoption rate of advanced technologies across its diverse industries.

Product Type Dominance:

- Tags: The continuous innovation in tag design, including printable and flexible RFID tags, makes them the most sought-after component. Economic policies supporting widespread adoption and the need for high-volume, low-cost identification solutions bolster this segment. The estimated market size for tags is xx Million by 2033.

- Reader: Advances in reader technology, offering faster read speeds and extended range, are crucial for efficient data capture. Infrastructure development in smart cities and automated systems directly contributes to reader market growth.

- Middleware: As data volumes increase, sophisticated middleware solutions are vital for seamless integration and data analysis. The growing complexity of supply chains necessitates robust middleware for effective management.

Application Dominance:

- Smart Cards: Beyond traditional payment applications, smart cards integrated with chipless RFID are finding new uses in access control, secure identification, and public transit. Regulatory frameworks mandating secure authentication are key drivers. The market for smart cards is estimated at xx Million by 2033.

- Smart Tickets: The increasing reliance on digital ticketing for events, transportation, and access control fuels the growth of this segment. Consumer preference for convenience and contactless solutions further accelerates adoption.

- Other Applications: This broad category encompasses emerging use cases in wearable technology, industrial automation, and smart home devices, showcasing the versatility of chipless RFID.

End-user Industry Dominance:

- Retail: High adoption rates are driven by the need for real-time inventory management, reduced shrinkage, and personalized customer experiences. The estimated market size for the retail sector is xx Million by 2033.

- Logistics and Transportation: Enhanced supply chain visibility, real-time tracking of goods, and improved route optimization are critical advantages. Economic policies promoting efficient trade and supply chain resilience are key contributors.

- Healthcare: Applications in patient identification, medication tracking, and asset management are critical for patient safety and operational efficiency. Regulatory compliance and the increasing demand for secure data management are significant drivers.

- BFSI: Secure access control, fraud prevention, and efficient customer verification are key applications. The estimated market size for BFSI is xx Million by 2033.

Chipless RFID Market Product Developments

Recent product developments in the Chipless RFID Market are centered around enhancing miniaturization, improving read reliability in challenging environments, and reducing manufacturing costs. Innovations include the development of self-powered chipless RFID tags utilizing energy harvesting technologies and the integration of printed electronics for ultra-low-cost tag production. These advancements are expanding the application scope to include disposable sensors, smart packaging, and even integration into textiles. The competitive advantage lies in offering tailor-made solutions with superior performance characteristics, such as enhanced data security and wider operating frequencies, making them ideal for niche applications and emerging markets.

Key Drivers of Chipless RFID Market Growth

The Chipless RFID Market's growth is propelled by several key drivers. Technological advancements in material science and antenna design are enabling the creation of more compact, affordable, and robust RFID tags. The increasing demand for supply chain visibility and inventory management across industries like retail and logistics is a primary economic driver, leading to significant operational cost savings and efficiency gains. Furthermore, supportive government initiatives and evolving regulatory frameworks that promote the adoption of secure identification and tracking solutions are creating a conducive environment for market expansion. The growing need for product authentication and counterfeit prevention in sectors such as pharmaceuticals and luxury goods is also a significant catalyst for adoption.

Challenges in the Chipless RFID Market Market

Despite its promising growth, the Chipless RFID Market faces several challenges. Initial implementation costs can be a significant barrier for small and medium-sized enterprises (SMEs). Interoperability issues between different RFID systems and the lack of universal standards can hinder widespread adoption. Data security and privacy concerns remain a critical hurdle, requiring robust encryption and access control mechanisms to build trust among users. Supply chain disruptions and the availability of raw materials for tag manufacturing can also impact production and pricing. Competitive pressures from alternative technologies like QR codes also present a challenge, necessitating continuous innovation and clear demonstration of ROI. The estimated impact of these challenges on market growth is approximately xx% in terms of delayed adoption.

Emerging Opportunities in Chipless RFID Market

The Chipless RFID Market is ripe with emerging opportunities for long-term growth. The expansion of the Internet of Things (IoT) presents a significant catalyst, as chipless RFID tags can serve as cost-effective identifiers for connected devices. Strategic partnerships and collaborations between RFID manufacturers, software providers, and end-users are fostering the development of integrated solutions for niche applications. Market expansion into developing economies offers substantial untapped potential, driven by increasing industrialization and the need for modern tracking systems. Technological breakthroughs in biocompatible and biodegradable RFID tags are opening doors for applications in healthcare and environmental monitoring, further diversifying the market. The estimated potential for new market segments is valued at xx Million by 2033.

Leading Players in the Chipless RFID Market Sector

- Avery Dennison

- NXP Semiconductors

- Variuscard GmbH

- Alien Technology Corporation

- Zebra Technologies

- IDTRONIC GmbH

Key Milestones in Chipless RFID Market Industry

- 2019: Introduction of printable chipless RFID tags with enhanced durability.

- 2020: Significant advancements in low-cost chipless RFID reader technology.

- 2021: Increased investment in R&D for miniaturized chipless RFID solutions.

- 2022: Strategic partnerships formed to integrate chipless RFID into supply chain management platforms.

- 2023: Emergence of specialized chipless RFID solutions for the pharmaceutical industry.

- 2024: Growing adoption of chipless RFID for asset tracking in smart city initiatives.

Strategic Outlook for Chipless RFID Market Market

The strategic outlook for the Chipless RFID Market is exceptionally positive, driven by a combination of technological innovation and increasing industry demand. Growth accelerators include the continued development of ultra-low-cost printable RFID solutions, enabling broader adoption across price-sensitive markets. The increasing integration of chipless RFID with AI and machine learning is poised to unlock advanced analytics for predictive maintenance and supply chain optimization. Furthermore, the growing emphasis on sustainability and circular economy principles will likely spur the development of eco-friendly chipless RFID tags, creating new market niches. The future potential lies in creating highly customized and intelligent identification solutions that seamlessly integrate into existing business processes, driving significant value creation for stakeholders.

Chipless RFID Market Segmentation

-

1. Product Type

- 1.1. Tag

- 1.2. Reader

- 1.3. Middleware

-

2. Application

- 2.1. Smart Cards

- 2.2. Smart Tickets

- 2.3. Other Applications

-

3. End-user Industry

- 3.1. Retail

- 3.2. Healthcare

- 3.3. Logistics and Transportation

- 3.4. BFSI

- 3.5. Other End-user Industries

Chipless RFID Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Chipless RFID Market Regional Market Share

Geographic Coverage of Chipless RFID Market

Chipless RFID Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Manufacturing Advantages of Chipless RFIDs; Rising Utilization of Access Control and Security Application

- 3.3. Market Restrains

- 3.3.1. ; High Initial Installation Cost and Device Interoperability

- 3.4. Market Trends

- 3.4.1. Healthcare Sector to Contribute Significantly to the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Chipless RFID Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Tag

- 5.1.2. Reader

- 5.1.3. Middleware

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Smart Cards

- 5.2.2. Smart Tickets

- 5.2.3. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Retail

- 5.3.2. Healthcare

- 5.3.3. Logistics and Transportation

- 5.3.4. BFSI

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Chipless RFID Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Tag

- 6.1.2. Reader

- 6.1.3. Middleware

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Smart Cards

- 6.2.2. Smart Tickets

- 6.2.3. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-user Industry

- 6.3.1. Retail

- 6.3.2. Healthcare

- 6.3.3. Logistics and Transportation

- 6.3.4. BFSI

- 6.3.5. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Chipless RFID Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Tag

- 7.1.2. Reader

- 7.1.3. Middleware

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Smart Cards

- 7.2.2. Smart Tickets

- 7.2.3. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-user Industry

- 7.3.1. Retail

- 7.3.2. Healthcare

- 7.3.3. Logistics and Transportation

- 7.3.4. BFSI

- 7.3.5. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Chipless RFID Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Tag

- 8.1.2. Reader

- 8.1.3. Middleware

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Smart Cards

- 8.2.2. Smart Tickets

- 8.2.3. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-user Industry

- 8.3.1. Retail

- 8.3.2. Healthcare

- 8.3.3. Logistics and Transportation

- 8.3.4. BFSI

- 8.3.5. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of the World Chipless RFID Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Tag

- 9.1.2. Reader

- 9.1.3. Middleware

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Smart Cards

- 9.2.2. Smart Tickets

- 9.2.3. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-user Industry

- 9.3.1. Retail

- 9.3.2. Healthcare

- 9.3.3. Logistics and Transportation

- 9.3.4. BFSI

- 9.3.5. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Avery Dennison

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 NXP Semi Conductors

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Variuscard GmbH

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Alien Technology Corporation

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Zebra Technologies

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 IDTRONIC GmbH

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.1 Avery Dennison

List of Figures

- Figure 1: Global Chipless RFID Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Chipless RFID Market Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Chipless RFID Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Chipless RFID Market Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Chipless RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Chipless RFID Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 7: North America Chipless RFID Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 8: North America Chipless RFID Market Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Chipless RFID Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Chipless RFID Market Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Europe Chipless RFID Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Chipless RFID Market Revenue (billion), by Application 2025 & 2033

- Figure 13: Europe Chipless RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: Europe Chipless RFID Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 15: Europe Chipless RFID Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 16: Europe Chipless RFID Market Revenue (billion), by Country 2025 & 2033

- Figure 17: Europe Chipless RFID Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Chipless RFID Market Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Chipless RFID Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Chipless RFID Market Revenue (billion), by Application 2025 & 2033

- Figure 21: Asia Pacific Chipless RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Asia Pacific Chipless RFID Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 23: Asia Pacific Chipless RFID Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 24: Asia Pacific Chipless RFID Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Asia Pacific Chipless RFID Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Chipless RFID Market Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Rest of the World Chipless RFID Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of the World Chipless RFID Market Revenue (billion), by Application 2025 & 2033

- Figure 29: Rest of the World Chipless RFID Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Rest of the World Chipless RFID Market Revenue (billion), by End-user Industry 2025 & 2033

- Figure 31: Rest of the World Chipless RFID Market Revenue Share (%), by End-user Industry 2025 & 2033

- Figure 32: Rest of the World Chipless RFID Market Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of the World Chipless RFID Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Chipless RFID Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Chipless RFID Market Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Chipless RFID Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 4: Global Chipless RFID Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Chipless RFID Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global Chipless RFID Market Revenue billion Forecast, by Application 2020 & 2033

- Table 7: Global Chipless RFID Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 8: Global Chipless RFID Market Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global Chipless RFID Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global Chipless RFID Market Revenue billion Forecast, by Application 2020 & 2033

- Table 11: Global Chipless RFID Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 12: Global Chipless RFID Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Chipless RFID Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global Chipless RFID Market Revenue billion Forecast, by Application 2020 & 2033

- Table 15: Global Chipless RFID Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 16: Global Chipless RFID Market Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global Chipless RFID Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global Chipless RFID Market Revenue billion Forecast, by Application 2020 & 2033

- Table 19: Global Chipless RFID Market Revenue billion Forecast, by End-user Industry 2020 & 2033

- Table 20: Global Chipless RFID Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Chipless RFID Market?

The projected CAGR is approximately 8.5%.

2. Which companies are prominent players in the Chipless RFID Market?

Key companies in the market include Avery Dennison, NXP Semi Conductors, Variuscard GmbH, Alien Technology Corporation, Zebra Technologies, IDTRONIC GmbH.

3. What are the main segments of the Chipless RFID Market?

The market segments include Product Type, Application, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 14.58 billion as of 2022.

5. What are some drivers contributing to market growth?

; Manufacturing Advantages of Chipless RFIDs; Rising Utilization of Access Control and Security Application.

6. What are the notable trends driving market growth?

Healthcare Sector to Contribute Significantly to the Market Growth.

7. Are there any restraints impacting market growth?

; High Initial Installation Cost and Device Interoperability.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Chipless RFID Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Chipless RFID Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Chipless RFID Market?

To stay informed about further developments, trends, and reports in the Chipless RFID Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence