Key Insights

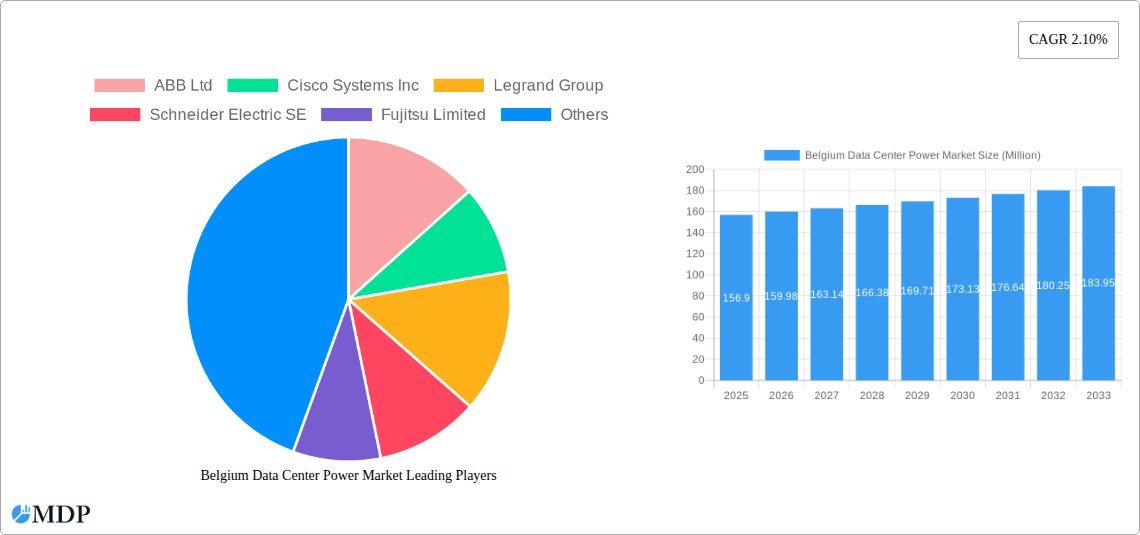

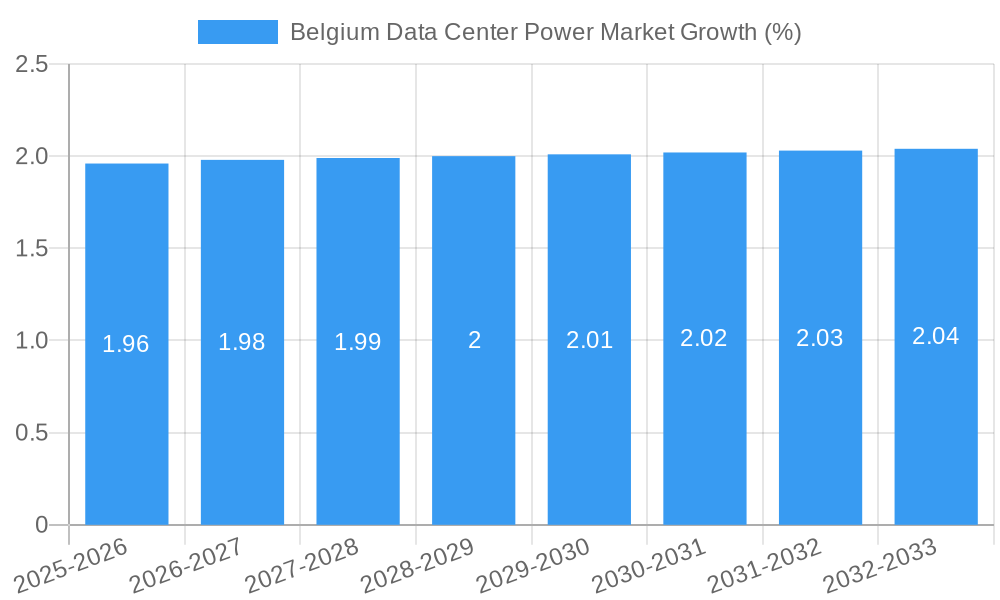

The Belgium Data Center Power Market is poised for steady expansion, projected to reach a market size of USD 156.90 million by 2025, with a Compound Annual Growth Rate (CAGR) of 2.10% anticipated through 2033. This growth is primarily propelled by the escalating demand for digital infrastructure, fueled by the burgeoning IT & Telecommunication sector, robust financial services (BFSI), and government initiatives prioritizing digitalization. The increasing adoption of cloud computing, big data analytics, and the Internet of Things (IoT) necessitates reliable and efficient power solutions, including Uninterruptible Power Supply (UPS) systems, generators, and sophisticated power distribution units (PDUs) and switchgear. Furthermore, the emphasis on energy efficiency and sustainability within data centers is driving investments in advanced critical power distribution technologies and remote power management solutions, aligning with both regulatory requirements and corporate environmental goals.

The market dynamics in Belgium are also shaped by ongoing trends in infrastructure upgrades and the deployment of new data center facilities. While the overall growth rate is moderate, specific segments are experiencing higher demand. The Services segment, encompassing installation, maintenance, and support for power infrastructure, is crucial for ensuring the seamless operation of data centers and is expected to witness significant activity. Key players like Schneider Electric SE, Eaton Corporation, and Vertiv Group Corp are instrumental in shaping the market through their innovative offerings in power management, cooling, and modular data center solutions. Emerging trends include a greater focus on hybrid power solutions, integrating renewable energy sources, and the development of intelligent power monitoring systems. However, potential restraints such as high initial investment costs for advanced power infrastructure and the evolving regulatory landscape concerning energy consumption and emissions could influence the pace of growth in certain sub-segments. The IT & Telecommunication and BFSI sectors are expected to remain dominant end-users, contributing substantially to the market's value.

Unlock the future of Belgium's digital infrastructure with our in-depth report on the Belgium Data Center Power Market. This critical analysis delves into the intricate dynamics, robust growth drivers, and key players shaping the landscape of data center power solutions in Belgium. With the exponential growth of cloud computing, AI, and IoT, the demand for reliable and efficient power infrastructure for data centers is at an all-time high. This report provides essential insights for IT & Telecommunication, BFSI, Government, and Media & Entertainment sectors, as well as other end-users, offering a strategic roadmap for investment and development.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

This comprehensive market research report leverages high-traffic keywords to ensure maximum search visibility for industry stakeholders seeking to understand the Belgian data center power ecosystem. We provide actionable intelligence on market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and strategic outlooks, all meticulously analyzed and presented.

Belgium Data Center Power Market Market Dynamics & Concentration

The Belgium Data Center Power Market is characterized by a moderate to high concentration, with key global players like ABB Ltd, Schneider Electric SE, and Eaton Corporation holding significant market share. Innovation drivers are primarily focused on enhancing energy efficiency, improving power density, and ensuring high availability for critical data center operations. Regulatory frameworks, such as those promoting sustainable energy and data privacy, are increasingly influencing the adoption of advanced power solutions. Product substitutes, while evolving, are largely limited in providing the comprehensive reliability and scalability required for modern data centers. End-user trends indicate a strong preference for outsourced colocation facilities, driving demand for robust power infrastructure from service providers. Mergers and acquisition (M&A) activities are on the rise as larger entities seek to consolidate their market position and expand their service offerings. For instance, the last two years have seen approximately 5 significant M&A deals valued at over xx Million, aimed at acquiring specialized power solution providers and expanding geographical reach within Belgium. The market share distribution shows the top 5 players commanding around 65% of the total market revenue, with ongoing competition for the remaining share.

Belgium Data Center Power Market Industry Trends & Analysis

The Belgium Data Center Power Market is witnessing robust growth, driven by Belgium's strategic location in Europe and its increasing role as a digital hub. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of xx.x% between 2025 and 2033, reaching an estimated market size of xx Billion by the end of the forecast period. Key growth drivers include the escalating demand for cloud services, the proliferation of AI and machine learning applications, and the continuous expansion of the Internet of Things (IoT) ecosystem, all of which necessitate substantial and reliable power for data center operations. Technological disruptions are a significant factor, with a notable shift towards modular data center designs, advanced cooling technologies that reduce power consumption, and the integration of renewable energy sources to power these facilities. Consumer preferences are increasingly leaning towards hyperscale and edge data centers, requiring highly scalable and efficient power distribution solutions. The competitive dynamics are intense, with a mix of established multinational corporations and specialized local providers vying for market share. Market penetration for advanced UPS systems and intelligent power distribution units (PDUs) is high, indicating a mature market segment. The increasing adoption of smart grid technologies and demand-side management solutions also plays a crucial role in optimizing power usage within data centers, contributing to overall market expansion and sustainability initiatives. The Belgian government's supportive policies for digital infrastructure development further fuel this positive trajectory.

Leading Markets & Segments in Belgium Data Center Power Market

The Power Infrastructure: Electrical Solution segment is the dominant force within the Belgium Data Center Power Market, accounting for over xx% of the total market revenue. Within this segment, Power Distribution Solutions hold the largest share, projected to reach xx Billion by 2033.

- Power Distribution Solutions: This sub-segment is further broken down into:

- UPS Systems: Critical for maintaining uninterrupted power supply, UPS systems are experiencing high demand due to increasing power fluctuations and the need for 24/7 uptime. The market for UPS systems is expected to grow at a CAGR of xx.x%.

- Generators: Essential for backup power, generators are vital for ensuring business continuity in the event of grid failures. The demand is particularly strong for high-capacity, fuel-efficient models.

- Power Distribution Units (PDUs): Intelligent PDUs that offer remote monitoring and control capabilities are seeing accelerated adoption, driving efficiency and reducing operational costs.

- Switchgear: Robust switchgear solutions are crucial for managing and distributing power safely and reliably within the data center.

- Critical Power Distribution: This encompasses specialized solutions designed for high-density racks and mission-critical applications, experiencing steady growth.

- Transfer Switches: Automatic transfer switches are indispensable for seamless power transition between primary and backup sources.

- Remote Power Panels: Offering localized power distribution and control, these are vital for flexibility and scalability in data center layouts.

The IT & Telecommunication end-user segment represents the largest consumer of data center power solutions, driven by the massive data processing and storage needs of telecommunication providers and cloud service operators. This segment alone is expected to contribute xx Billion to the market by 2033. The BFSI sector also demonstrates significant demand, driven by the stringent uptime requirements and the need for secure and reliable power for financial transactions and data management. Government initiatives to digitalize public services and enhance national cybersecurity infrastructure are also contributing to the growth of the government end-user segment.

Belgium Data Center Power Market Product Developments

Product developments in the Belgium Data Center Power Market are heavily focused on enhancing efficiency, reliability, and sustainability. Innovations in uninterruptible power supply (UPS) systems are leading to higher power densities, improved energy efficiency ratings (e.g., xx% efficiency), and smaller form factors, minimizing footprint within data centers. Advanced power distribution units (PDUs) now offer granular monitoring capabilities, predictive maintenance features, and integrated cybersecurity, providing operators with unprecedented control and insight. The development of more efficient and environmentally friendly generators, often utilizing alternative fuels or hybrid technologies, is also a key trend. Furthermore, integrated solutions that combine power management software with hardware components are emerging, offering end-to-end visibility and optimization of power infrastructure, thereby providing competitive advantages to vendors who can offer such comprehensive packages.

Key Drivers of Belgium Data Center Power Market Growth

Several key drivers are propelling the growth of the Belgium Data Center Power Market. Firstly, the continuous expansion of the digital economy, fueled by cloud computing, big data analytics, and artificial intelligence, necessitates an ever-increasing demand for data center capacity and, consequently, reliable power. Secondly, Belgium's strategic geographical location in Europe makes it an attractive hub for international data center operators, leading to significant investment in new facilities. Thirdly, government initiatives promoting digital transformation and innovation, coupled with favorable regulations for data center development, provide a conducive environment for market expansion. Lastly, the growing emphasis on sustainability and energy efficiency is driving the adoption of advanced, eco-friendly power solutions, including those integrated with renewable energy sources.

Challenges in the Belgium Data Center Power Market Market

Despite its robust growth, the Belgium Data Center Power Market faces several challenges. Regulatory hurdles, particularly concerning environmental permits and grid connection complexities, can lead to project delays and increased costs. Supply chain disruptions, as witnessed globally, can impact the availability and pricing of critical components for power infrastructure. High electricity costs in Belgium also present a significant operational challenge, driving the need for more energy-efficient solutions. Furthermore, increasing competition from both domestic and international players can put pressure on profit margins. The skilled labor shortage for installation, maintenance, and operation of advanced power systems also poses a restraint to rapid expansion.

Emerging Opportunities in Belgium Data Center Power Market

Emerging opportunities in the Belgium Data Center Power Market are largely driven by technological advancements and evolving market needs. The rapid growth of edge computing presents a significant opportunity for smaller, distributed power solutions tailored for these localized data processing centers. The increasing integration of renewable energy sources, such as solar and wind power, with data center operations, opens avenues for innovative energy storage and management systems. Artificial intelligence and machine learning are being leveraged to optimize power consumption and predictive maintenance, creating demand for intelligent power management software. Strategic partnerships between power solution providers, data center operators, and energy companies are also expected to foster market expansion by offering integrated, end-to-end solutions.

Leading Players in the Belgium Data Center Power Market Sector

- ABB Ltd

- Cisco Systems Inc

- Legrand Group

- Schneider Electric SE

- Fujitsu Limited

- Caterpillar Inc

- Rittal GmbH & Co KG

- Rolls-Royce plc

- Cummins Inc

- Vertiv Group Corp

- Eaton Corporation

Key Milestones in Belgium Data Center Power Market Industry

- 2019: Increased investment in hyperscale data center projects, driving demand for high-capacity power solutions.

- 2020: Introduction of stricter EU energy efficiency regulations, encouraging the adoption of advanced UPS and PDU technologies.

- 2021: Significant growth in demand for edge computing infrastructure, spurring interest in smaller, localized power solutions.

- 2022: Growing focus on renewable energy integration, with pilot projects for solar and wind-powered data centers.

- 2023: A surge in M&A activities as key players aim to expand their service portfolios and market reach.

- 2024 (Estimated): Continued robust growth in the colocation data center market, further boosting demand for reliable power infrastructure.

Strategic Outlook for Belgium Data Center Power Market Market

- 2019: Increased investment in hyperscale data center projects, driving demand for high-capacity power solutions.

- 2020: Introduction of stricter EU energy efficiency regulations, encouraging the adoption of advanced UPS and PDU technologies.

- 2021: Significant growth in demand for edge computing infrastructure, spurring interest in smaller, localized power solutions.

- 2022: Growing focus on renewable energy integration, with pilot projects for solar and wind-powered data centers.

- 2023: A surge in M&A activities as key players aim to expand their service portfolios and market reach.

- 2024 (Estimated): Continued robust growth in the colocation data center market, further boosting demand for reliable power infrastructure.

Strategic Outlook for Belgium Data Center Power Market Market

The strategic outlook for the Belgium Data Center Power Market remains exceptionally positive, driven by a confluence of factors including Belgium's status as a European digital hub, ongoing digital transformation initiatives, and the relentless demand for data processing and storage. Future growth will be accelerated by the continued adoption of advanced technologies like AI-powered power management and the integration of renewable energy sources. Opportunities lie in providing highly efficient, scalable, and sustainable power solutions for the burgeoning hyperscale and edge data center segments. Strategic partnerships and a focus on cybersecurity within power infrastructure will be crucial for vendors to maintain a competitive edge and capitalize on the evolving demands of this dynamic market. The market is poised for sustained expansion, with significant investment expected in the coming years.

Belgium Data Center Power Market Segmentation

-

1. Power Infrastructure

-

1.1. Electrical Solution

- 1.1.1. UPS Systems

- 1.1.2. Generators

-

1.1.3. Power Distribution Solutions

- 1.1.3.1. PDU

- 1.1.3.2. Switchgear

- 1.1.3.3. Critical Power Distribution

- 1.1.3.4. Transfer Switches

- 1.1.3.5. Remote Power Panels

- 1.1.3.6. Others

- 1.2. Service

-

1.1. Electrical Solution

-

2. End User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End Users

Belgium Data Center Power Market Segmentation By Geography

- 1. Belgium

Belgium Data Center Power Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs

- 3.3. Market Restrains

- 3.3.1. High Cost of Installation and Maintenance

- 3.4. Market Trends

- 3.4.1. IT & Telecommunication Segment to Hold a Major Share in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Belgium Data Center Power Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 5.1.1. Electrical Solution

- 5.1.1.1. UPS Systems

- 5.1.1.2. Generators

- 5.1.1.3. Power Distribution Solutions

- 5.1.1.3.1. PDU

- 5.1.1.3.2. Switchgear

- 5.1.1.3.3. Critical Power Distribution

- 5.1.1.3.4. Transfer Switches

- 5.1.1.3.5. Remote Power Panels

- 5.1.1.3.6. Others

- 5.1.2. Service

- 5.1.1. Electrical Solution

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Belgium

- 5.1. Market Analysis, Insights and Forecast - by Power Infrastructure

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ABB Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Cisco Systems Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Legrand Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Schneider Electric SE

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fujitsu Limited

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Caterpillar Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Rittal GmbH & Co KG

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Rolls-Royce plc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cummins Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vertiv Group Corp

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Eaton Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 ABB Ltd

List of Figures

- Figure 1: Belgium Data Center Power Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Belgium Data Center Power Market Share (%) by Company 2024

List of Tables

- Table 1: Belgium Data Center Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Belgium Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2019 & 2032

- Table 3: Belgium Data Center Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 4: Belgium Data Center Power Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Belgium Data Center Power Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Belgium Data Center Power Market Revenue Million Forecast, by Power Infrastructure 2019 & 2032

- Table 7: Belgium Data Center Power Market Revenue Million Forecast, by End User 2019 & 2032

- Table 8: Belgium Data Center Power Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Belgium Data Center Power Market?

The projected CAGR is approximately 2.10%.

2. Which companies are prominent players in the Belgium Data Center Power Market?

Key companies in the market include ABB Ltd, Cisco Systems Inc, Legrand Group, Schneider Electric SE, Fujitsu Limited, Caterpillar Inc, Rittal GmbH & Co KG, Rolls-Royce plc, Cummins Inc, Vertiv Group Corp, Eaton Corporation.

3. What are the main segments of the Belgium Data Center Power Market?

The market segments include Power Infrastructure, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 156.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Adoption of Mega Data Centers and Cloud Computing; Increasing Demand to Reduce Operational Costs.

6. What are the notable trends driving market growth?

IT & Telecommunication Segment to Hold a Major Share in the Market.

7. Are there any restraints impacting market growth?

High Cost of Installation and Maintenance.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Belgium Data Center Power Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Belgium Data Center Power Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Belgium Data Center Power Market?

To stay informed about further developments, trends, and reports in the Belgium Data Center Power Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence