Key Insights

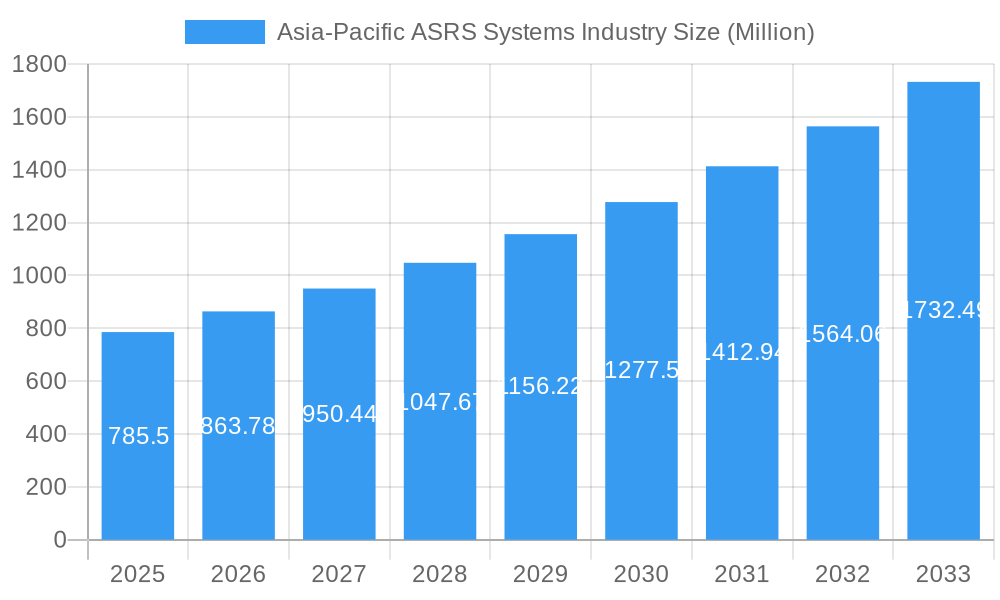

The Asia-Pacific Automated Storage and Retrieval Systems (ASRS) market is projected to reach an estimated 6.51 billion by 2033, with a Compound Annual Growth Rate (CAGR) of 8.01% from 2024. This expansion is driven by the increasing demand for operational efficiency and reduced labor costs. The rapid growth of e-commerce and the complexity of modern supply chains necessitate advanced ASRS for optimized inventory management and accelerated order fulfillment. The integration of Industry 4.0 technologies like IoT and AI enhances ASRS intelligence and connectivity, further boosting adoption. Strong manufacturing output and the drive for automation in sectors such as automotive and food & beverage are significant growth catalysts. Government initiatives promoting industrial automation and smart manufacturing in key Asia-Pacific nations also foster market penetration.

Asia-Pacific ASRS Systems Industry Market Size (In Billion)

The market is observing a trend towards sophisticated ASRS solutions, including Vertical Lift Modules (VLMs) and Carousel systems, favored for their space efficiency and accessibility. High initial investment costs may present a barrier for small and medium-sized enterprises (SMEs). However, technological advancements are reducing costs, and increased training programs, alongside the clear long-term return on investment (ROI), are mitigating these challenges. The market is highly competitive, with key players focusing on innovation and strategic collaborations.

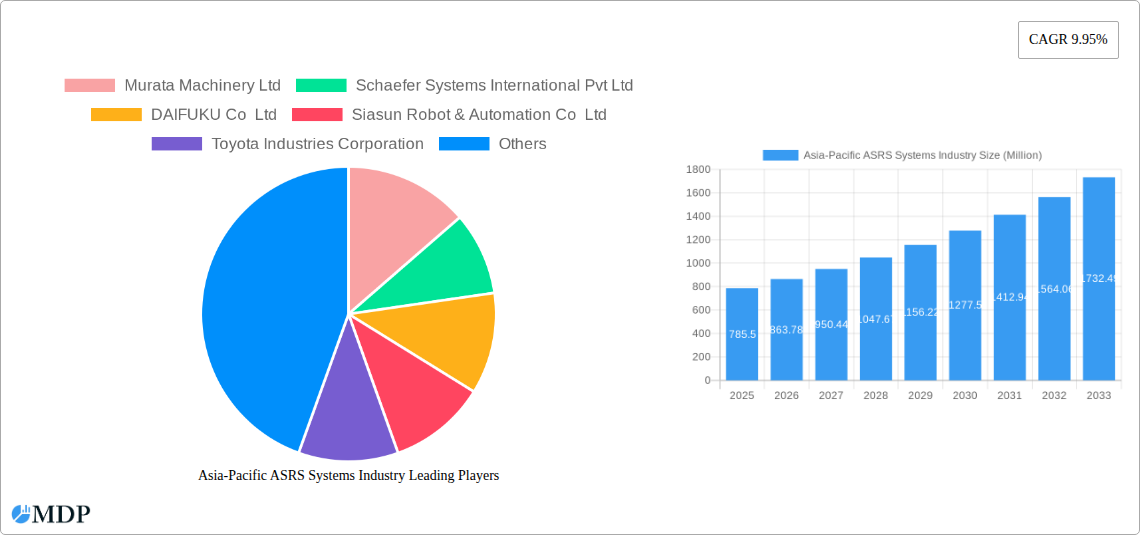

Asia-Pacific ASRS Systems Industry Company Market Share

Asia-Pacific ASRS Market Analysis & Forecast (2024-2033)

This comprehensive report offers in-depth insights into the Asia-Pacific Automated Storage and Retrieval Systems (ASRS) market from 2024 to 2033. Analyzing market dynamics, technological advancements, and strategic drivers, this study covers critical segments including Fixed Aisle Systems, Carousels, and Vertical Lift Modules, serving diverse end-user industries such as Airports, Automotive, Food & Beverage, General Manufacturing, Post & Parcel, and Retail. This report provides actionable intelligence for stakeholders to capitalize on the rapid automation adoption and supply chain optimization trends in Asia-Pacific.

Asia-Pacific ASRS Systems Industry Market Dynamics & Concentration

The Asia-Pacific ASRS Systems Industry is characterized by a moderate market concentration, with a few key players dominating significant market share. Innovation is driven by the relentless pursuit of efficiency, space optimization, and labor cost reduction across various industries. Regulatory frameworks, while still evolving in some countries, are increasingly favoring automation to boost productivity and safety standards. Product substitutes, such as traditional warehousing methods, are steadily being eroded by the superior benefits of ASRS. End-user trends point towards a growing demand for flexible, scalable, and intelligent warehousing solutions. Mergers and acquisitions (M&A) activities, though not exceptionally high in number, are strategic in nature, aimed at expanding market reach, acquiring technological capabilities, and consolidating market positions. For instance, a potential key M&A deal in the recent past could have involved a leading ASRS provider acquiring a smaller, specialized robotics firm to enhance its autonomous capabilities. The market share distribution is led by major players like DAIFUKU Co Ltd and Murata Machinery Ltd. The number of significant M&A deals in the past five years is approximately 5-8, indicating a consolidating but competitive landscape.

Asia-Pacific ASRS Systems Industry Industry Trends & Analysis

The Asia-Pacific ASRS Systems Industry is on an exponential growth trajectory, fueled by a confluence of powerful market growth drivers and transformative technological disruptions. The escalating demand for e-commerce fulfillment, coupled with the imperative for efficient supply chain management in sectors like Food and Beverage and Post and Parcel, is acting as a significant catalyst. Automation adoption is not merely a trend but a strategic necessity for businesses aiming to combat rising labor costs, mitigate labor shortages, and enhance operational throughput. The CAGR of the Asia-Pacific ASRS market is estimated to be robust, projected at approximately 12-15% over the forecast period. Technological advancements, including the integration of AI, IoT, and advanced robotics, are enhancing the intelligence and adaptability of ASRS solutions, enabling predictive maintenance, real-time data analytics, and dynamic inventory management. Consumer preferences are increasingly geared towards faster delivery times and greater product availability, directly impacting warehousing operations and the need for sophisticated ASRS. The competitive dynamics are intensifying, with established global players vying for market dominance alongside innovative local contenders. Market penetration of ASRS, while varying by country and industry, is steadily increasing, signifying a paradigm shift towards automated logistics infrastructure. The Food and Beverage sector, in particular, is witnessing a surge in demand for temperature-controlled ASRS solutions, as highlighted by the SSI SCHAEFER and ORCA collaboration, which showcases the capability to handle extensive pallet volumes in specialized environments. The overall adoption rate is also boosted by government initiatives promoting industrial automation and smart manufacturing.

Leading Markets & Segments in Asia-Pacific ASRS Systems Industry

The Asia-Pacific ASRS Systems Industry exhibits distinct regional and sectoral dominance. China stands out as the leading market, driven by its massive manufacturing base, burgeoning e-commerce sector, and significant government investment in advanced logistics infrastructure. Economic policies promoting industrial upgrades and digital transformation further bolster its leading position.

Dominant Product Type: Fixed Aisle System

- Key Drivers: Cost-effectiveness for high-density storage, proven reliability in large-scale operations, and compatibility with various warehouse footprints.

- Dominance Analysis: Fixed aisle systems, particularly Very Narrow Aisle (VNA) trucks, continue to be the workhorse of ASRS, offering substantial storage capacity in a compact footprint, making them ideal for large distribution centers and manufacturing facilities in China and Japan. Their widespread adoption is supported by their versatility across numerous applications.

Dominant End-User Industry: General Manufacturing

- Key Drivers: Need for efficient material flow, reduction of work-in-progress (WIP) inventory, and improved traceability within production lines.

- Dominance Analysis: The General Manufacturing sector, encompassing a wide range of industries, relies heavily on ASRS for streamlined internal logistics. This includes optimizing the storage and retrieval of raw materials, components, and finished goods, thereby enhancing production efficiency and reducing lead times. Countries like South Korea and Taiwan, with their strong manufacturing ecosystems, are major contributors to this segment's growth.

Emerging Strong Segments:

- Post and Parcel: Rapid growth in e-commerce necessitates faster sorting and dispatch, driving ASRS adoption for high-speed sortation and last-mile logistics.

- Food and Beverage: Increasing demand for temperature-controlled warehousing and stricter food safety regulations are pushing the adoption of specialized ASRS solutions. The ORCA Taguig facility exemplifies this trend.

The Automotive sector also presents significant opportunities due to the complexity of supply chains and the need for Just-In-Time (JIT) inventory management. The integration of ASRS in automotive plants ensures a seamless flow of parts and components.

Asia-Pacific ASRS Systems Industry Product Developments

Product development in the Asia-Pacific ASRS Systems Industry is heavily focused on enhanced automation, AI-driven intelligence, and specialized solutions. Innovations include the deployment of advanced robotics for intricate picking and sorting operations, as exemplified by Murata Machinery Ltd's "ALPHABOT" system designed for significant reduction in manual labor. Vertical Lift Modules (VLMs) and Carousel systems are being refined for greater speed, accuracy, and space utilization, catering to the growing demand from the retail and post-and-parcel sectors for rapid order fulfillment. The integration of IoT sensors for real-time monitoring and predictive maintenance is a key trend, ensuring maximum uptime and operational efficiency, thereby providing a competitive advantage in an increasingly demanding market.

Key Drivers of Asia-Pacific ASRS Systems Industry Growth

The Asia-Pacific ASRS Systems Industry is experiencing robust growth driven by several pivotal factors. The escalating e-commerce penetration across the region necessitates highly efficient and rapid fulfillment operations, directly boosting demand for automated warehousing. Furthermore, a growing awareness of the labor shortage and rising labor costs compels businesses to invest in automation for improved productivity and operational cost savings. Government initiatives promoting Industry 4.0, smart manufacturing, and digital transformation in countries like China and Japan provide substantial impetus. Technological advancements, including the integration of AI, robotics, and IoT, are making ASRS solutions more intelligent, flexible, and cost-effective. The need for enhanced supply chain visibility and resilience in the face of global disruptions also plays a crucial role in driving ASRS adoption.

Challenges in the Asia-Pacific ASRS Systems Industry Market

Despite its strong growth, the Asia-Pacific ASRS Systems Industry faces several challenges. The high initial capital investment for ASRS implementation can be a significant barrier, particularly for Small and Medium-sized Enterprises (SMEs). Integration complexities with existing legacy systems and the need for skilled personnel to operate and maintain these advanced systems pose another hurdle. Cybersecurity concerns related to interconnected automated systems require robust protective measures. Furthermore, varying levels of technological adoption and infrastructure development across different countries within the region create a fragmented market landscape. Supply chain disruptions, though a driver for automation, can also impact the deployment and maintenance of ASRS equipment.

Emerging Opportunities in Asia-Pacific ASRS Systems Industry

Emerging opportunities in the Asia-Pacific ASRS Systems Industry are ripe for exploitation. The increasing focus on sustainability and green logistics presents an opportunity for ASRS providers to offer energy-efficient solutions and optimize warehouse space, thereby reducing environmental impact. The growth of specialized industries like pharmaceuticals and electronics, requiring stringent control over storage conditions and traceability, opens avenues for custom-designed ASRS. Strategic partnerships and collaborations between ASRS manufacturers, technology providers, and logistics companies can lead to integrated, end-to-end solutions. Furthermore, the continued expansion of e-commerce into tier-2 and tier-3 cities within emerging economies creates demand for scalable and adaptable ASRS solutions.

Leading Players in the Asia-Pacific ASRS Systems Industry Sector

- Murata Machinery Ltd

- Schaefer Systems International Pvt Ltd

- DAIFUKU Co Ltd

- Siasun Robot & Automation Co Ltd

- Toyota Industries Corporation

- System Logistics S p A

- Kardex Group

- Noblelift Intelligent Equipment Co Ltd

- Hanwha Group

- GEEK+ INC

Key Milestones in Asia-Pacific ASRS Systems Industry Industry

- August 2020: Murata Machinery Ltd signed a contract with Alpen Co. Ltd to construct Japan's first 3D robot warehousing system, "ALPHABOT." This system, set for introduction at the Alpen Komaki Distribution Center by July 2021, aims to significantly complement storage capacity and reduce picking, sorting, and packaging operations by approximately 60%, impacting operational efficiency and cost savings.

- February 2020: SSI SCHAEFER collaborated with ORCA, a Philippines-based cold chain solutions provider, to launch the country's first cold chain storage system. This development, powering ORCA Taguig with nearly 20,000 pallet positions of frozen storage and the capability to move approximately 4,800 pallets daily, highlights the growing importance of temperature-controlled ASRS in the Food and Beverage and agriculture sectors, enhancing freshness and reducing spoilage.

Strategic Outlook for Asia-Pacific ASRS Systems Industry Market

The strategic outlook for the Asia-Pacific ASRS Systems Industry is exceptionally positive, driven by ongoing digital transformation and the imperative for hyper-efficient supply chains. Future growth will be accelerated by the increasing adoption of AI and machine learning for predictive analytics and autonomous operations, leading to smarter warehouses. The demand for modular and scalable ASRS solutions will continue to rise, catering to the dynamic needs of businesses and enabling easier expansion. Strategic opportunities lie in developing integrated solutions that encompass not just storage but also advanced robotics for picking, packing, and last-mile delivery. Furthermore, focusing on customized ASRS for specialized industries like pharmaceuticals and fresh produce will unlock significant market potential. Collaborations with emerging technology firms and a strong emphasis on after-sales service and support will be crucial for sustained success.

Asia-Pacific ASRS Systems Industry Segmentation

-

1. Product Type

- 1.1. Fixed Aisle System

- 1.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 1.3. Vertical Lift Module

-

2. End-User Industries

- 2.1. Airports

- 2.2. Automotive

- 2.3. Food and Beverage

- 2.4. General Manufacturing

- 2.5. Post and Parcel

- 2.6. Retail

- 2.7. Other End-user Industries

Asia-Pacific ASRS Systems Industry Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

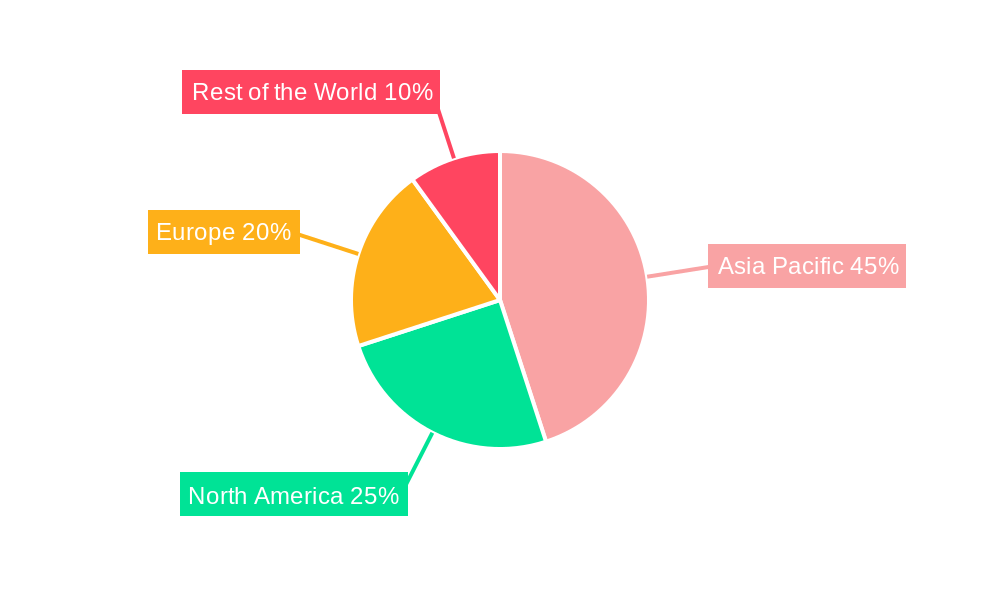

Asia-Pacific ASRS Systems Industry Regional Market Share

Geographic Coverage of Asia-Pacific ASRS Systems Industry

Asia-Pacific ASRS Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Emphasis on Workplace Safety; Increasing Concerns about Labor Costs

- 3.3. Market Restrains

- 3.3.1. Need for Skilled Workforce and Concerns over Replacement of Manual Labor

- 3.4. Market Trends

- 3.4.1. Retail Industry is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific ASRS Systems Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fixed Aisle System

- 5.1.2. Carousel (Horizontal Carousel + Vertical Carousel)

- 5.1.3. Vertical Lift Module

- 5.2. Market Analysis, Insights and Forecast - by End-User Industries

- 5.2.1. Airports

- 5.2.2. Automotive

- 5.2.3. Food and Beverage

- 5.2.4. General Manufacturing

- 5.2.5. Post and Parcel

- 5.2.6. Retail

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Murata Machinery Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Schaefer Systems International Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DAIFUKU Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Siasun Robot & Automation Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toyota Industries Corporation

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 System Logistics S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kardex Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Noblelift Intelligent Equipment Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Hanwha Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 GEEK+ INC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Murata Machinery Ltd

List of Figures

- Figure 1: Asia-Pacific ASRS Systems Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific ASRS Systems Industry Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific ASRS Systems Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Asia-Pacific ASRS Systems Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 3: Asia-Pacific ASRS Systems Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Asia-Pacific ASRS Systems Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Asia-Pacific ASRS Systems Industry Revenue billion Forecast, by End-User Industries 2020 & 2033

- Table 6: Asia-Pacific ASRS Systems Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: China Asia-Pacific ASRS Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Japan Asia-Pacific ASRS Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: South Korea Asia-Pacific ASRS Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: India Asia-Pacific ASRS Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Australia Asia-Pacific ASRS Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: New Zealand Asia-Pacific ASRS Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Indonesia Asia-Pacific ASRS Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Malaysia Asia-Pacific ASRS Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Singapore Asia-Pacific ASRS Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Thailand Asia-Pacific ASRS Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Vietnam Asia-Pacific ASRS Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Philippines Asia-Pacific ASRS Systems Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific ASRS Systems Industry?

The projected CAGR is approximately 8.01%.

2. Which companies are prominent players in the Asia-Pacific ASRS Systems Industry?

Key companies in the market include Murata Machinery Ltd, Schaefer Systems International Pvt Ltd, DAIFUKU Co Ltd, Siasun Robot & Automation Co Ltd, Toyota Industries Corporation, System Logistics S p A, Kardex Group, Noblelift Intelligent Equipment Co Ltd , Hanwha Group, GEEK+ INC.

3. What are the main segments of the Asia-Pacific ASRS Systems Industry?

The market segments include Product Type, End-User Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Increased Emphasis on Workplace Safety; Increasing Concerns about Labor Costs.

6. What are the notable trends driving market growth?

Retail Industry is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Need for Skilled Workforce and Concerns over Replacement of Manual Labor.

8. Can you provide examples of recent developments in the market?

August 2020 - Murata Machinery Ltd has signed a contract with Alpen Co. Ltd to construct Japan's first 3D robot warehousing system, "ALPHABOT." ALPHABOT will be introduced at the Alpen Komaki Distribution Center, one of Alpen Group's main distribution centers, to complement its storage capacity and reduce picking, sorting, and packaging operations by approximately 60%. The system is scheduled to go into the process in July 2021.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific ASRS Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific ASRS Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific ASRS Systems Industry?

To stay informed about further developments, trends, and reports in the Asia-Pacific ASRS Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence