Key Insights

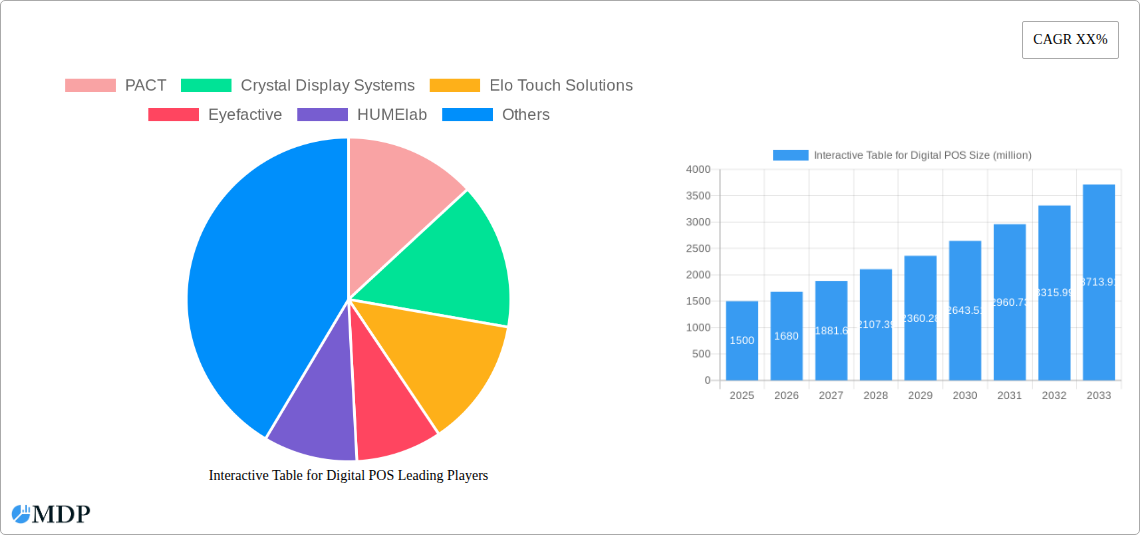

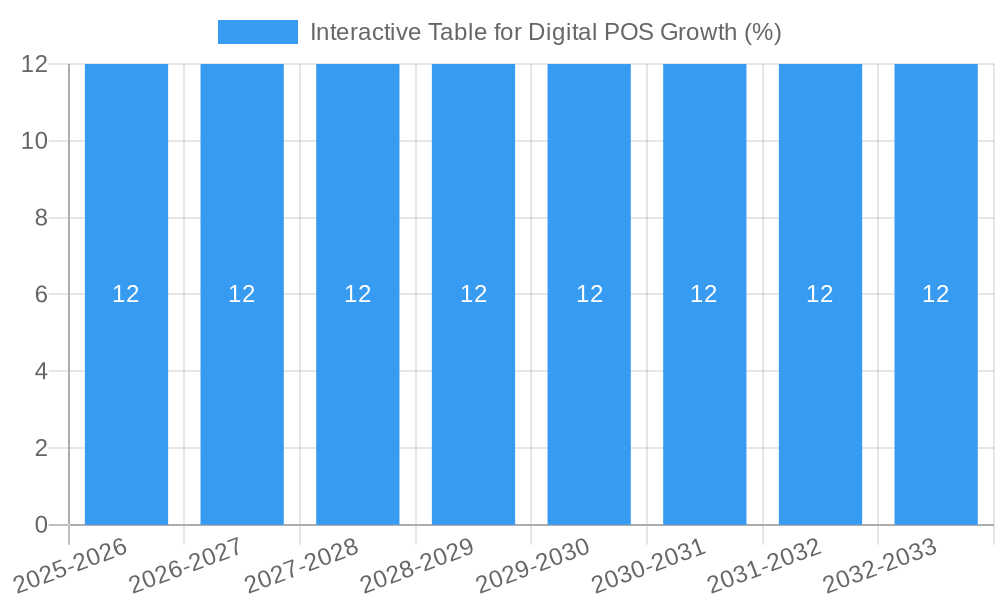

The Interactive Table for Digital POS market is poised for substantial growth, driven by the increasing demand for enhanced customer experiences and efficient transaction processing in retail and hospitality sectors. With an estimated market size of approximately USD 1.5 billion in 2025, the market is projected to expand at a robust Compound Annual Growth Rate (CAGR) of around 12% during the forecast period of 2025-2033. This growth is primarily fueled by the adoption of advanced technologies like OLED displays, offering superior visual appeal and interactivity, and the burgeoning trend of "phygital" retail, seamlessly blending physical and digital touchpoints. Malls and shopping centers, alongside the dining room segment, represent key application areas where interactive tables are revolutionizing customer engagement, from personalized recommendations to streamlined ordering and payment processes. The integration of these tables into point-of-sale (POS) systems significantly improves operational efficiency, reduces wait times, and provides valuable data insights for businesses.

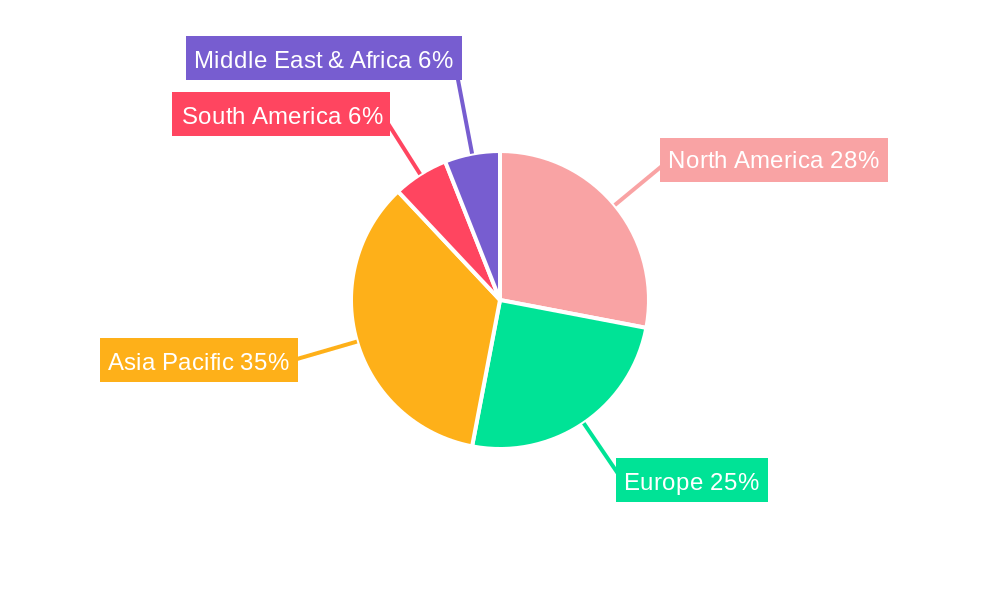

The market's trajectory is further bolstered by a series of positive trends, including the rising disposable incomes and evolving consumer expectations for engaging and convenient shopping experiences. The increasing penetration of smartphones and the growing comfort of consumers with digital interfaces also contribute significantly to this market expansion. However, certain restraints, such as the initial high investment cost associated with sophisticated interactive table technology and potential challenges in integration with existing legacy POS systems, may temper rapid adoption in some segments. Despite these challenges, the competitive landscape is dynamic, with key players like Samsung, LG Display, and BOE actively innovating and expanding their product portfolios. The Asia Pacific region, led by China and India, is expected to be a major growth engine due to its massive retail market and rapid technological adoption, while North America and Europe continue to be mature markets with a strong focus on advanced digital solutions.

Here is an SEO-optimized and engaging report description for the "Interactive Table for Digital POS" market, incorporating your specified details and structure:

Report Title: Interactive Table for Digital POS Market: Dynamics, Trends, and Future Outlook (2019-2033)

Report Description:

Unlock critical insights into the rapidly evolving Interactive Table for Digital POS market. This comprehensive report, spanning the study period of 2019–2033 with a base year of 2025, provides an in-depth analysis of market dynamics, industry trends, leading segments, product developments, key drivers, challenges, and emerging opportunities. Essential for stakeholders including manufacturers, solution providers, retailers, investors, and industry analysts, this report offers actionable intelligence on market concentration, technological innovations, consumer preferences, and competitive landscapes. Discover the future trajectory of digital point-of-sale solutions and identify strategic avenues for growth in this dynamic sector. This report is guaranteed to be used without modification and requires no further edits.

Interactive Table for Digital POS Market Dynamics & Concentration

The Interactive Table for Digital POS market exhibits a moderate to high concentration, with key players like Samsung, LG Display, and BOE holding significant market share, estimated to be over 50 million units cumulatively. Innovation drivers are primarily fueled by advancements in touch screen technology, AI integration for personalized customer experiences, and the growing demand for seamless digital retail environments. Regulatory frameworks are largely driven by data privacy concerns and consumer protection laws, with evolving compliance requirements impacting deployment strategies. Product substitutes, while present in traditional POS systems, are increasingly being outpaced by the immersive and interactive capabilities of digital tables. End-user trends point towards a preference for enhanced customer engagement, efficient order management, and data-driven insights in retail and hospitality settings. Merger and acquisition (M&A) activities, with an estimated count of over 15 major deals in the historical period (2019-2024), are focused on consolidating technological expertise and expanding market reach. The market is projected to see further consolidation as companies strive for competitive advantage.

Interactive Table for Digital POS Industry Trends & Analysis

The Interactive Table for Digital POS industry is experiencing robust growth, driven by a convergence of technological advancements and evolving consumer expectations. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033, with an estimated market size of over 500 million units by 2033. Technological disruptions are a major catalyst, with the integration of advanced touch technologies, high-resolution displays (including OLED and advanced LCD panels), and sophisticated software platforms enabling rich, interactive user experiences. The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) further enhances functionalities such as personalized recommendations, dynamic pricing, and data analytics, providing retailers with invaluable customer insights. Consumer preferences are shifting towards experiential retail, where interactive tables offer a unique and engaging way to browse products, place orders, and access information. This is particularly evident in segments like dining rooms and malls, where customers seek convenience and a modern shopping or dining experience. Competitive dynamics are characterized by intense innovation, with companies focusing on developing more durable, intuitive, and cost-effective solutions. Market penetration is steadily increasing across various sectors, as businesses recognize the ROI and competitive edge offered by these advanced POS systems. The industry is also witnessing a trend towards greater customization and integration with existing retail ecosystems, further solidifying its position as a critical component of modern digital retail strategies.

Leading Markets & Segments in Interactive Table for Digital POS

The Interactive Table for Digital POS market is dominated by the Malls and Shopping Centers application segment, which is projected to account for over 45% of the market share by 2033, with an estimated market size exceeding 225 million units. Key drivers for this dominance include the high footfall, the need for enhanced customer engagement in competitive retail environments, and the integration of interactive tables for product discovery, navigation, and personalized promotions.

- Malls and Shopping Centers:

- Economic Policies: Favorable retail policies and investments in urban development encourage the modernization of shopping centers.

- Infrastructure: The presence of robust digital infrastructure within malls facilitates the seamless deployment and operation of interactive tables.

- Consumer Behavior: Increasing consumer demand for interactive and personalized shopping experiences drives adoption.

- Technological Integration: Retailers are investing in technologies that offer competitive advantages, with interactive tables at the forefront.

The Dining Room segment also represents a significant and rapidly growing market, expected to capture approximately 30% of the market by 2033, with an estimated market size of over 150 million units. The appeal lies in streamlining order taking, reducing wait times, enabling visual menu browsing, and facilitating table management.

- Dining Room:

- Customer Convenience: Interactive tables offer a direct and efficient way for diners to order, customize meals, and make payments.

- Operational Efficiency: Restaurants benefit from reduced order errors, faster table turnover, and optimized staff allocation.

- Enhanced Experience: The ability to view high-quality images and descriptions of dishes improves the dining experience and can lead to higher average checks.

- Technological Adoption: The hospitality industry is increasingly embracing digital solutions to improve service quality and customer satisfaction.

In terms of Types, the LCD segment currently holds the largest market share, estimated at over 60% due to its cost-effectiveness and widespread availability, with an estimated market size exceeding 300 million units. However, the OLED segment is experiencing rapid growth, projected to expand significantly by 2033 due to its superior display quality and energy efficiency, capturing an estimated 35% of the market.

Types (LCD):

- Cost-Effectiveness: LCD technology offers a lower entry price point for businesses.

- Durability and Reliability: Established technology with a proven track record in commercial environments.

- Wide Availability: Extensive supply chain and manufacturing capabilities ensure consistent availability.

Types (OLED):

- Superior Visuals: Unmatched contrast ratios, vibrant colors, and true blacks enhance product presentation.

- Energy Efficiency: Lower power consumption compared to traditional LCDs.

- Design Flexibility: Thinner and more flexible form factors allow for innovative table designs.

- Growing Consumer Demand: Increasing awareness and appreciation for high-quality display technology.

Interactive Table for Digital POS Product Developments

Product developments in the Interactive Table for Digital POS sector are centered on enhancing user interface intuitiveness, integrating advanced sensory feedback, and optimizing durability for high-traffic environments. Innovations include multi-touch capabilities, integrated payment solutions, and advanced analytics for customer behavior tracking. Companies are focusing on developing robust, spill-resistant designs and leveraging AI for personalized recommendations and real-time customer support. Competitive advantages are derived from seamless software integration, customizability to brand aesthetics, and the ability to deliver data-rich insights for businesses. The trend is towards creating immersive, frictionless customer journeys that bridge the gap between physical and digital retail.

Key Drivers of Interactive Table for Digital POS Growth

The growth of the Interactive Table for Digital POS market is propelled by several key factors. Firstly, the escalating demand for enhanced customer experiences and personalized interactions in retail and hospitality environments is a primary driver. Secondly, rapid advancements in touch screen technology, display resolutions (including the rise of OLED), and processing power are making these solutions more sophisticated and cost-effective. Thirdly, the increasing adoption of digital transformation strategies by businesses to improve operational efficiency, streamline ordering processes, and gather valuable customer data further fuels market expansion. Finally, the growing trend of experiential retail, where interactive elements are crucial for engagement, is a significant catalyst for sustained growth.

Challenges in the Interactive Table for Digital POS Market

Despite its growth, the Interactive Table for Digital POS market faces several challenges. High initial investment costs can be a barrier for small and medium-sized businesses. Integration complexities with existing legacy systems and the need for skilled IT support can also hinder widespread adoption. Furthermore, concerns regarding data security and privacy require robust compliance measures. Durability and maintenance in demanding public environments remain critical considerations, necessitating ongoing innovation in material science and design. Finally, intense competition from established POS providers and emerging tech companies exerts pressure on pricing and innovation cycles.

Emerging Opportunities in Interactive Table for Digital POS

Emerging opportunities in the Interactive Table for Digital POS market are abundant, driven by technological advancements and evolving consumer expectations. The integration of Augmented Reality (AR) and Virtual Reality (VR) capabilities within interactive tables offers highly immersive product visualization and try-on experiences. AI-powered predictive analytics will further personalize customer interactions and optimize inventory management. The expansion of interactive tables into new sectors, such as museums, educational institutions, and healthcare facilities, presents significant growth potential. Strategic partnerships between technology providers and retail brands for co-created solutions will also drive market penetration and innovation. Furthermore, the increasing focus on sustainability and eco-friendly designs will open doors for manufacturers offering greener alternatives.

Leading Players in the Interactive Table for Digital POS Sector

- PACT

- Crystal Display Systems

- Elo Touch Solutions

- Eyefactive

- HUMElab

- Interactive-Scape

- LG Display

- Litemax

- Parador

- Samsung

- TouchLay

- TriggerPoint Media

- BOE

Key Milestones in Interactive Table for Digital POS Industry

- 2019: Increased adoption of capacitive touch technology for enhanced responsiveness and accuracy.

- 2020: Launch of integrated payment modules, streamlining checkout processes.

- 2021: Significant advancements in display resolutions and color accuracy, particularly with OLED integration.

- 2022: Emergence of AI-driven personalization features for product recommendations.

- 2023: Growing focus on antimicrobial coatings and enhanced durability for public-facing devices.

- 2024: Increased M&A activity as companies seek to consolidate market share and technological expertise.

- 2025 (Estimated): Widespread adoption of multi-touch interfaces and seamless integration with mobile devices.

- 2026-2033 (Forecast): Integration of AR/VR capabilities and advanced predictive analytics.

Strategic Outlook for Interactive Table for Digital POS Market

The strategic outlook for the Interactive Table for Digital POS market is overwhelmingly positive, characterized by sustained growth and continuous innovation. The market is poised to benefit from the ongoing digital transformation across retail and hospitality, with businesses prioritizing customer engagement and operational efficiency. Key growth accelerators include the deepening integration of AI and IoT technologies, enabling hyper-personalized customer journeys and data-driven decision-making. Future success will hinge on developing more intuitive user interfaces, robust connectivity solutions, and adaptable form factors to meet diverse business needs. Strategic partnerships, focused R&D on emerging technologies like AR/VR, and a keen understanding of evolving consumer preferences will be crucial for capitalizing on the immense market potential and maintaining a competitive edge in the coming years.

Interactive Table for Digital POS Segmentation

-

1. Application

- 1.1. Malls and Shopping Centers

- 1.2. Dining Room

- 1.3. Others

-

2. Types

- 2.1. OLED

- 2.2. LCD

- 2.3. Others

Interactive Table for Digital POS Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Interactive Table for Digital POS REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Interactive Table for Digital POS Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Malls and Shopping Centers

- 5.1.2. Dining Room

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. OLED

- 5.2.2. LCD

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Interactive Table for Digital POS Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Malls and Shopping Centers

- 6.1.2. Dining Room

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. OLED

- 6.2.2. LCD

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Interactive Table for Digital POS Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Malls and Shopping Centers

- 7.1.2. Dining Room

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. OLED

- 7.2.2. LCD

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Interactive Table for Digital POS Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Malls and Shopping Centers

- 8.1.2. Dining Room

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. OLED

- 8.2.2. LCD

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Interactive Table for Digital POS Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Malls and Shopping Centers

- 9.1.2. Dining Room

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. OLED

- 9.2.2. LCD

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Interactive Table for Digital POS Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Malls and Shopping Centers

- 10.1.2. Dining Room

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. OLED

- 10.2.2. LCD

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 PACT

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Crystal Display Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Elo Touch Solutions

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Eyefactive

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 HUMElab

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Interactive-Scape

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 LG Display

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Litemax

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Parador

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Samsung

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 TouchLay

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 TriggerPoint Media

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 TriggerPoint Media

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 BOE

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 PACT

List of Figures

- Figure 1: Global Interactive Table for Digital POS Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: Global Interactive Table for Digital POS Volume Breakdown (K, %) by Region 2024 & 2032

- Figure 3: North America Interactive Table for Digital POS Revenue (million), by Application 2024 & 2032

- Figure 4: North America Interactive Table for Digital POS Volume (K), by Application 2024 & 2032

- Figure 5: North America Interactive Table for Digital POS Revenue Share (%), by Application 2024 & 2032

- Figure 6: North America Interactive Table for Digital POS Volume Share (%), by Application 2024 & 2032

- Figure 7: North America Interactive Table for Digital POS Revenue (million), by Types 2024 & 2032

- Figure 8: North America Interactive Table for Digital POS Volume (K), by Types 2024 & 2032

- Figure 9: North America Interactive Table for Digital POS Revenue Share (%), by Types 2024 & 2032

- Figure 10: North America Interactive Table for Digital POS Volume Share (%), by Types 2024 & 2032

- Figure 11: North America Interactive Table for Digital POS Revenue (million), by Country 2024 & 2032

- Figure 12: North America Interactive Table for Digital POS Volume (K), by Country 2024 & 2032

- Figure 13: North America Interactive Table for Digital POS Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Interactive Table for Digital POS Volume Share (%), by Country 2024 & 2032

- Figure 15: South America Interactive Table for Digital POS Revenue (million), by Application 2024 & 2032

- Figure 16: South America Interactive Table for Digital POS Volume (K), by Application 2024 & 2032

- Figure 17: South America Interactive Table for Digital POS Revenue Share (%), by Application 2024 & 2032

- Figure 18: South America Interactive Table for Digital POS Volume Share (%), by Application 2024 & 2032

- Figure 19: South America Interactive Table for Digital POS Revenue (million), by Types 2024 & 2032

- Figure 20: South America Interactive Table for Digital POS Volume (K), by Types 2024 & 2032

- Figure 21: South America Interactive Table for Digital POS Revenue Share (%), by Types 2024 & 2032

- Figure 22: South America Interactive Table for Digital POS Volume Share (%), by Types 2024 & 2032

- Figure 23: South America Interactive Table for Digital POS Revenue (million), by Country 2024 & 2032

- Figure 24: South America Interactive Table for Digital POS Volume (K), by Country 2024 & 2032

- Figure 25: South America Interactive Table for Digital POS Revenue Share (%), by Country 2024 & 2032

- Figure 26: South America Interactive Table for Digital POS Volume Share (%), by Country 2024 & 2032

- Figure 27: Europe Interactive Table for Digital POS Revenue (million), by Application 2024 & 2032

- Figure 28: Europe Interactive Table for Digital POS Volume (K), by Application 2024 & 2032

- Figure 29: Europe Interactive Table for Digital POS Revenue Share (%), by Application 2024 & 2032

- Figure 30: Europe Interactive Table for Digital POS Volume Share (%), by Application 2024 & 2032

- Figure 31: Europe Interactive Table for Digital POS Revenue (million), by Types 2024 & 2032

- Figure 32: Europe Interactive Table for Digital POS Volume (K), by Types 2024 & 2032

- Figure 33: Europe Interactive Table for Digital POS Revenue Share (%), by Types 2024 & 2032

- Figure 34: Europe Interactive Table for Digital POS Volume Share (%), by Types 2024 & 2032

- Figure 35: Europe Interactive Table for Digital POS Revenue (million), by Country 2024 & 2032

- Figure 36: Europe Interactive Table for Digital POS Volume (K), by Country 2024 & 2032

- Figure 37: Europe Interactive Table for Digital POS Revenue Share (%), by Country 2024 & 2032

- Figure 38: Europe Interactive Table for Digital POS Volume Share (%), by Country 2024 & 2032

- Figure 39: Middle East & Africa Interactive Table for Digital POS Revenue (million), by Application 2024 & 2032

- Figure 40: Middle East & Africa Interactive Table for Digital POS Volume (K), by Application 2024 & 2032

- Figure 41: Middle East & Africa Interactive Table for Digital POS Revenue Share (%), by Application 2024 & 2032

- Figure 42: Middle East & Africa Interactive Table for Digital POS Volume Share (%), by Application 2024 & 2032

- Figure 43: Middle East & Africa Interactive Table for Digital POS Revenue (million), by Types 2024 & 2032

- Figure 44: Middle East & Africa Interactive Table for Digital POS Volume (K), by Types 2024 & 2032

- Figure 45: Middle East & Africa Interactive Table for Digital POS Revenue Share (%), by Types 2024 & 2032

- Figure 46: Middle East & Africa Interactive Table for Digital POS Volume Share (%), by Types 2024 & 2032

- Figure 47: Middle East & Africa Interactive Table for Digital POS Revenue (million), by Country 2024 & 2032

- Figure 48: Middle East & Africa Interactive Table for Digital POS Volume (K), by Country 2024 & 2032

- Figure 49: Middle East & Africa Interactive Table for Digital POS Revenue Share (%), by Country 2024 & 2032

- Figure 50: Middle East & Africa Interactive Table for Digital POS Volume Share (%), by Country 2024 & 2032

- Figure 51: Asia Pacific Interactive Table for Digital POS Revenue (million), by Application 2024 & 2032

- Figure 52: Asia Pacific Interactive Table for Digital POS Volume (K), by Application 2024 & 2032

- Figure 53: Asia Pacific Interactive Table for Digital POS Revenue Share (%), by Application 2024 & 2032

- Figure 54: Asia Pacific Interactive Table for Digital POS Volume Share (%), by Application 2024 & 2032

- Figure 55: Asia Pacific Interactive Table for Digital POS Revenue (million), by Types 2024 & 2032

- Figure 56: Asia Pacific Interactive Table for Digital POS Volume (K), by Types 2024 & 2032

- Figure 57: Asia Pacific Interactive Table for Digital POS Revenue Share (%), by Types 2024 & 2032

- Figure 58: Asia Pacific Interactive Table for Digital POS Volume Share (%), by Types 2024 & 2032

- Figure 59: Asia Pacific Interactive Table for Digital POS Revenue (million), by Country 2024 & 2032

- Figure 60: Asia Pacific Interactive Table for Digital POS Volume (K), by Country 2024 & 2032

- Figure 61: Asia Pacific Interactive Table for Digital POS Revenue Share (%), by Country 2024 & 2032

- Figure 62: Asia Pacific Interactive Table for Digital POS Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Interactive Table for Digital POS Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Interactive Table for Digital POS Volume K Forecast, by Region 2019 & 2032

- Table 3: Global Interactive Table for Digital POS Revenue million Forecast, by Application 2019 & 2032

- Table 4: Global Interactive Table for Digital POS Volume K Forecast, by Application 2019 & 2032

- Table 5: Global Interactive Table for Digital POS Revenue million Forecast, by Types 2019 & 2032

- Table 6: Global Interactive Table for Digital POS Volume K Forecast, by Types 2019 & 2032

- Table 7: Global Interactive Table for Digital POS Revenue million Forecast, by Region 2019 & 2032

- Table 8: Global Interactive Table for Digital POS Volume K Forecast, by Region 2019 & 2032

- Table 9: Global Interactive Table for Digital POS Revenue million Forecast, by Application 2019 & 2032

- Table 10: Global Interactive Table for Digital POS Volume K Forecast, by Application 2019 & 2032

- Table 11: Global Interactive Table for Digital POS Revenue million Forecast, by Types 2019 & 2032

- Table 12: Global Interactive Table for Digital POS Volume K Forecast, by Types 2019 & 2032

- Table 13: Global Interactive Table for Digital POS Revenue million Forecast, by Country 2019 & 2032

- Table 14: Global Interactive Table for Digital POS Volume K Forecast, by Country 2019 & 2032

- Table 15: United States Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: United States Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 17: Canada Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 18: Canada Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 19: Mexico Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 20: Mexico Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 21: Global Interactive Table for Digital POS Revenue million Forecast, by Application 2019 & 2032

- Table 22: Global Interactive Table for Digital POS Volume K Forecast, by Application 2019 & 2032

- Table 23: Global Interactive Table for Digital POS Revenue million Forecast, by Types 2019 & 2032

- Table 24: Global Interactive Table for Digital POS Volume K Forecast, by Types 2019 & 2032

- Table 25: Global Interactive Table for Digital POS Revenue million Forecast, by Country 2019 & 2032

- Table 26: Global Interactive Table for Digital POS Volume K Forecast, by Country 2019 & 2032

- Table 27: Brazil Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Brazil Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 29: Argentina Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 30: Argentina Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 31: Rest of South America Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 32: Rest of South America Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 33: Global Interactive Table for Digital POS Revenue million Forecast, by Application 2019 & 2032

- Table 34: Global Interactive Table for Digital POS Volume K Forecast, by Application 2019 & 2032

- Table 35: Global Interactive Table for Digital POS Revenue million Forecast, by Types 2019 & 2032

- Table 36: Global Interactive Table for Digital POS Volume K Forecast, by Types 2019 & 2032

- Table 37: Global Interactive Table for Digital POS Revenue million Forecast, by Country 2019 & 2032

- Table 38: Global Interactive Table for Digital POS Volume K Forecast, by Country 2019 & 2032

- Table 39: United Kingdom Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 40: United Kingdom Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 41: Germany Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: Germany Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 43: France Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: France Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 45: Italy Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Italy Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 47: Spain Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 48: Spain Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 49: Russia Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 50: Russia Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 51: Benelux Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 52: Benelux Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 53: Nordics Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 54: Nordics Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 55: Rest of Europe Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Europe Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 57: Global Interactive Table for Digital POS Revenue million Forecast, by Application 2019 & 2032

- Table 58: Global Interactive Table for Digital POS Volume K Forecast, by Application 2019 & 2032

- Table 59: Global Interactive Table for Digital POS Revenue million Forecast, by Types 2019 & 2032

- Table 60: Global Interactive Table for Digital POS Volume K Forecast, by Types 2019 & 2032

- Table 61: Global Interactive Table for Digital POS Revenue million Forecast, by Country 2019 & 2032

- Table 62: Global Interactive Table for Digital POS Volume K Forecast, by Country 2019 & 2032

- Table 63: Turkey Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 64: Turkey Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 65: Israel Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 66: Israel Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 67: GCC Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 68: GCC Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 69: North Africa Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 70: North Africa Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 71: South Africa Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 72: South Africa Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 73: Rest of Middle East & Africa Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East & Africa Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 75: Global Interactive Table for Digital POS Revenue million Forecast, by Application 2019 & 2032

- Table 76: Global Interactive Table for Digital POS Volume K Forecast, by Application 2019 & 2032

- Table 77: Global Interactive Table for Digital POS Revenue million Forecast, by Types 2019 & 2032

- Table 78: Global Interactive Table for Digital POS Volume K Forecast, by Types 2019 & 2032

- Table 79: Global Interactive Table for Digital POS Revenue million Forecast, by Country 2019 & 2032

- Table 80: Global Interactive Table for Digital POS Volume K Forecast, by Country 2019 & 2032

- Table 81: China Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 82: China Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 83: India Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 84: India Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 85: Japan Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 86: Japan Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 87: South Korea Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 88: South Korea Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 89: ASEAN Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 90: ASEAN Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 91: Oceania Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 92: Oceania Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

- Table 93: Rest of Asia Pacific Interactive Table for Digital POS Revenue (million) Forecast, by Application 2019 & 2032

- Table 94: Rest of Asia Pacific Interactive Table for Digital POS Volume (K) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Interactive Table for Digital POS?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Interactive Table for Digital POS?

Key companies in the market include PACT, Crystal Display Systems, Elo Touch Solutions, Eyefactive, HUMElab, Interactive-Scape, LG Display, Litemax, Parador, Samsung, TouchLay, TriggerPoint Media, TriggerPoint Media, BOE.

3. What are the main segments of the Interactive Table for Digital POS?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4350.00, USD 6525.00, and USD 8700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Interactive Table for Digital POS," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Interactive Table for Digital POS report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Interactive Table for Digital POS?

To stay informed about further developments, trends, and reports in the Interactive Table for Digital POS, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence