Key Insights

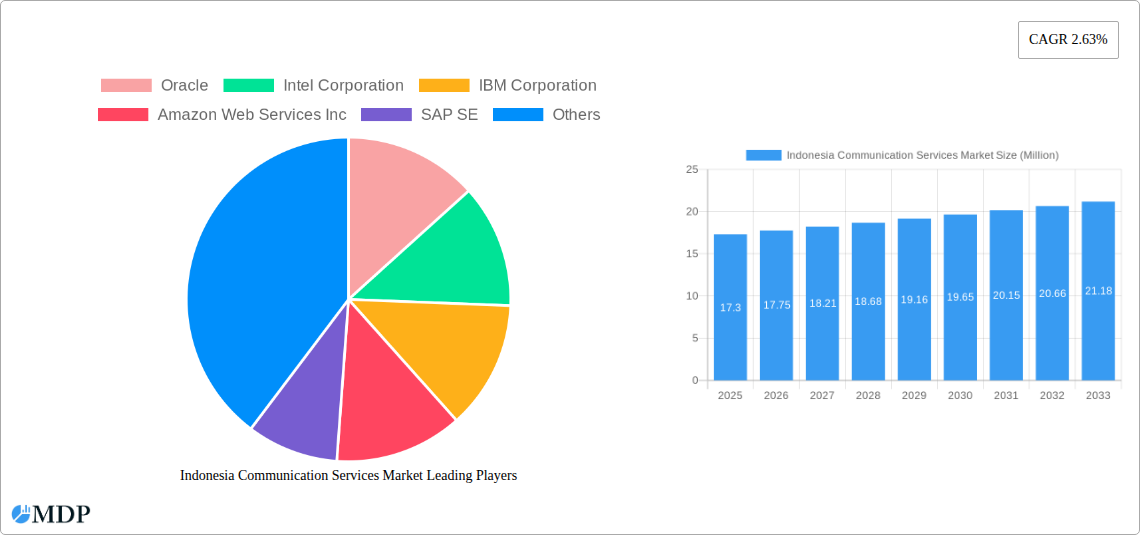

The Indonesian communication services market is poised for steady expansion, with a projected market size of USD 17.30 million and a Compound Annual Growth Rate (CAGR) of 2.63% anticipated over the forecast period. This growth is underpinned by increasing digitalization across various sectors and a rising demand for robust connectivity solutions. Fixed voice services, while a foundational element, may see a more moderate growth trajectory as mobile communication becomes increasingly dominant. Fixed data services are expected to witness substantial uplift, driven by the growing adoption of broadband internet for both residential and commercial purposes, fueling the need for higher bandwidth and more reliable data infrastructure. Mobile voice services, a cornerstone of the Indonesian communication landscape, will likely maintain a stable and significant market share, catering to the vast and diverse population. The "Other IT Services" segment, encompassing cloud computing, managed services, and cybersecurity, is predicted to be a key growth engine, reflecting the broader digital transformation initiatives undertaken by businesses in Indonesia. This segment's expansion is intrinsically linked to the increasing reliance on digital platforms for operations, communication, and data management.

The market is being propelled by several key drivers, including the government's commitment to digital infrastructure development, which aims to bridge the digital divide and improve internet accessibility across the archipelago. This initiative is further bolstered by the increasing penetration of smartphones and mobile devices, creating a sustained demand for mobile voice and data services. Furthermore, the burgeoning e-commerce sector and the rise of the digital economy are creating an insatiable appetite for reliable and high-speed communication networks. However, the market also faces certain restraints, such as the significant capital investment required for infrastructure upgrades and expansion, particularly in remote and less developed areas. Fierce competition among established players and emerging service providers can also put pressure on pricing and profitability. Despite these challenges, the Indonesian communication services market presents a compelling landscape for innovation and growth, with opportunities in areas like 5G deployment, IoT connectivity, and the expansion of digital services. Leading companies such as Oracle, Intel Corporation, IBM Corporation, Amazon Web Services Inc., SAP SE, Accenture, Microsoft, Hewlett Packard Enterprise Development LP, Fujitsu, and Toshiba IT-Services Corporation are actively investing in and shaping the future of this dynamic market, focusing on delivering enhanced customer experiences and advanced technological solutions.

Dive deep into the dynamic Indonesia communication services market with this in-depth report. Analyze telecom market Indonesia, internet service provider Indonesia, and mobile operator Indonesia trends from 2019 to 2033, with a comprehensive focus on the 2025 base year and the 2025-2033 forecast period. This report offers a crucial understanding of market dynamics, industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, key players, and strategic outlook. Leverage actionable insights for strategic planning and investment in one of Southeast Asia's fastest-growing digital economies.

Indonesia Communication Services Market Market Dynamics & Concentration

The Indonesia communication services market is characterized by moderate to high concentration, with a few dominant players controlling a significant share of the Indonesia mobile market and Indonesia fixed broadband market. Innovation is a key driver, fueled by increasing demand for high-speed internet, 5G rollout Indonesia, and digital transformation across industries. Regulatory frameworks, primarily guided by the Ministry of Communications and Informatics (MCI), play a pivotal role in shaping market access, spectrum allocation, and service quality standards. Product substitutes are emerging, particularly in the realm of over-the-top (OTT) communication services, posing a competitive challenge to traditional voice and data offerings. End-user trends highlight a growing preference for seamless, integrated connectivity solutions and a rising adoption of digital services across consumer and enterprise segments. Mergers and acquisitions (M&A) activities, though not extensively publicized, are anticipated to continue as companies seek to consolidate market positions, expand service portfolios, and achieve economies of scale. For instance, the projected M&A deal count for the forecast period is estimated to be around 10-15 significant transactions, impacting market share dynamics substantially. The overall market concentration is assessed to be around 70-75% by the top 3-5 players in the mobile segment and 60-65% in the fixed broadband segment.

Indonesia Communication Services Market Industry Trends & Analysis

The Indonesia communication services market is experiencing robust growth, driven by several interconnected factors. A significant market growth driver is the burgeoning digital economy, propelled by a large and young population with increasing internet penetration and smartphone adoption. The Indonesia internet penetration rate is projected to reach over 80% by 2025, fueling demand for data services. Technological disruptions, such as the ongoing 5G deployment Indonesia, are fundamentally reshaping the landscape, enabling new applications and enhancing user experiences, thereby contributing to a projected Compound Annual Growth Rate (CAGR) of approximately 8-10% for the forecast period. Consumer preferences are increasingly shifting towards digital-first solutions, with a demand for reliable, high-speed fixed data Indonesia and mobile voice Indonesia services, alongside an appetite for bundled offerings and value-added services. Competitive dynamics are intense, with established telecommunication operators vying for market share against new entrants and technology giants offering integrated communication platforms. The market penetration for mobile broadband is expected to exceed 90% by 2028, underscoring the pervasive nature of digital connectivity. Furthermore, the government's push for digital transformation initiatives, such as the development of smart cities and e-governance, is creating substantial opportunities for communication service providers to deliver advanced infrastructure and solutions. The growth in e-commerce and digital payments also necessitates robust and reliable communication networks, further stimulating market expansion. The increasing demand for cloud-based solutions and enterprise-grade IT services is also a significant contributor to market growth.

Leading Markets & Segments in Indonesia Communication Services Market

The Indonesia communication services market is segmented into Fixed Voice, Fixed Data, Mobile Voice, and Other IT Services. Among these, Mobile Voice and Fixed Data are anticipated to be the dominant segments throughout the forecast period.

Mobile Voice: This segment continues to be a cornerstone of the Indonesian communication landscape due to the country's vast population and high mobile phone penetration.

- Key Drivers:

- Demographics: A large, young, and digitally savvy population readily adopts mobile communication.

- Affordability: Increasingly competitive pricing strategies make mobile services accessible to a broader segment of the population.

- Network Expansion: Continued investment in expanding mobile network coverage, especially in rural and underserved areas, further boosts adoption.

- Dominance Analysis: The sheer volume of subscribers and the pervasiveness of mobile devices ensure that Mobile Voice remains a significant revenue generator. While average revenue per user (ARPU) might see gradual shifts, the overall volume will sustain its leading position.

- Key Drivers:

Fixed Data: This segment is experiencing rapid growth, driven by the increasing demand for high-speed internet connectivity for both residential and enterprise use.

- Key Drivers:

- Digital Transformation: Businesses across all sectors are adopting digital technologies, requiring robust fixed data infrastructure.

- Home Entertainment and Productivity: The rise of streaming services, online gaming, and remote work/learning fuels demand for faster and more reliable fixed internet.

- Government Initiatives: Programs aimed at enhancing digital infrastructure and bridging the digital divide are supporting the expansion of fixed broadband networks.

- Dominance Analysis: The transition from slower to faster broadband speeds, coupled with the rollout of fiber optic networks, is propelling the Fixed Data segment. As more households and businesses upgrade their connectivity, this segment is poised for substantial growth and will likely rival or surpass Mobile Voice in terms of revenue contribution by the end of the forecast period.

- Key Drivers:

Other IT Services: This broad category encompasses a range of services including cloud computing, cybersecurity, managed IT services, and digital solutions, which are experiencing substantial growth.

- Key Drivers:

- Enterprise Digitalization: Businesses are increasingly outsourcing IT functions and adopting cloud solutions to enhance efficiency and scalability.

- Data Security Concerns: Growing awareness of cybersecurity threats drives demand for advanced security services.

- Innovation and Emerging Technologies: Adoption of AI, IoT, and big data analytics requires sophisticated IT infrastructure and services.

- Dominance Analysis: While not as large as mobile or fixed data in terms of subscriber numbers, the high value of these services and their critical role in enabling digital transformation make them a high-growth area, contributing significantly to the overall market value.

- Key Drivers:

Fixed Voice: This segment, while mature, continues to serve specific enterprise needs and legacy users. Its dominance is expected to wane over the forecast period as IP-based communication and mobile alternatives become more prevalent.

- Key Drivers:

- Enterprise Continuity: Some businesses still rely on fixed voice for critical communication lines.

- Legacy Infrastructure: Existing infrastructure deployment supports continued, albeit declining, usage.

- Dominance Analysis: This segment's share is expected to decrease as newer technologies and services gain traction.

- Key Drivers:

Indonesia Communication Services Market Product Developments

Product developments in the Indonesia communication services market are increasingly focused on delivering enhanced connectivity, speed, and integrated solutions. The proliferation of 5G technology is enabling the development of advanced applications in areas like IoT, augmented reality (AR), and virtual reality (VR), offering unparalleled user experiences and new revenue streams for service providers. Innovations in fixed broadband technology, such as fiber-to-the-home (FTTH) expansion and DOCSIS 3.1, are pushing higher bandwidth capacities. Cloud-based communication platforms are gaining traction, offering scalable and flexible solutions for enterprises. Competitive advantages are being built around network quality, customer service, bundled offerings (e.g., internet, TV, mobile), and specialized IT services catering to specific industry verticals. The emphasis is on creating a seamless digital ecosystem that supports the evolving needs of both consumers and businesses in Indonesia.

Key Drivers of Indonesia Communication Services Market Growth

Several key drivers are propelling the Indonesia communication services market forward. The rapid growth of the digital economy, fueled by a young and tech-savvy population, is a primary catalyst. Government initiatives promoting digital transformation and infrastructure development, such as the national broadband plan, are creating a conducive environment for market expansion. The increasing adoption of smartphones and the expanding internet penetration rate are directly increasing demand for mobile and fixed data services. Furthermore, the ongoing 5G rollout Indonesia is unlocking new opportunities for advanced applications and services, driving innovation and investment. The burgeoning e-commerce sector and the increasing reliance on digital payment systems also necessitate robust and reliable communication networks, further stimulating market growth.

Challenges in the Indonesia Communication Services Market Market

Despite its growth potential, the Indonesia communication services market faces several challenges. Regulatory hurdles, including complex licensing procedures and spectrum allocation policies, can sometimes slow down the pace of innovation and deployment. Infrastructure development in remote and geographically challenging areas presents significant logistical and financial challenges, impacting Indonesia broadband coverage. Intense competition among service providers can lead to price wars, potentially affecting profitability and investment capacity. Furthermore, ensuring cybersecurity and protecting user data in an increasingly connected environment remains a critical concern, requiring substantial investment in security infrastructure and protocols. The digital divide, though narrowing, still exists, posing a challenge in achieving universal access to high-quality communication services.

Emerging Opportunities in Indonesia Communication Services Market

Emerging opportunities in the Indonesia communication services market are abundant, driven by technological advancements and evolving consumer and enterprise needs. The widespread adoption of 5G technology is paving the way for the development of innovative solutions in areas such as smart manufacturing, autonomous vehicles, and enhanced telemedicine. Strategic partnerships between telecommunication operators, technology providers, and content creators are crucial for developing compelling bundled services and new digital ecosystems. The ongoing digital transformation across various industries, including finance, healthcare, and education, presents significant opportunities for providers of cloud services, cybersecurity solutions, and advanced IT infrastructure. Expansion into underserved regions and the development of niche communication services tailored to specific market segments also represent lucrative avenues for growth. The increasing demand for edge computing solutions, driven by the need for low-latency processing, is another promising area.

Leading Players in the Indonesia Communication Services Market Sector

- Oracle

- Intel Corporation

- IBM Corporation

- Amazon Web Services Inc

- SAP SE

- Accenture

- Microsoft

- Hewlett Packard Enterprise Development LP

- Fujitsu

- Toshiba IT-Services Corporation

Key Milestones in Indonesia Communication Services Market Industry

- April 2023: Indonesia’s Ministry of Communications and Informatics (MCI) released a digital infrastructure to support the successful ASEAN Chairmanship. The Ministry of Communications and Informatics monitored the telecommunications network quality and internet access to ensure the smooth running of ASEAN Chairmanship 2023, held in May 2023 in Labuan Bajo, Indonesia. Telecommunications service operators have taken anticipated measures to upgrade their telecommunication network solutions.

- June 2023: Intelsat, an integrated satellite and terrestrial networks operator and provider of inflight connectivity (IFC), and Lintasarta, an Indonesian information and communication technology company, rolled out a network to cover remote areas in Indonesia via its mobile network operator subsidiary Indosat Ooredoo Hutchison (IOH). Broadband connectivity has been established in Sumatra, Kalimantan, Sulawesi, and Nusa Tenggara. Intelsat satellites with a hybrid network solution provide countrywide coverage to different population densities. The partnership will enable the company to quickly deploy and expand network coverage in Indonesia, allowing households to benefit from digital connectivity.

Strategic Outlook for Indonesia Communication Services Market Market

- April 2023: Indonesia’s Ministry of Communications and Informatics (MCI) released a digital infrastructure to support the successful ASEAN Chairmanship. The Ministry of Communications and Informatics monitored the telecommunications network quality and internet access to ensure the smooth running of ASEAN Chairmanship 2023, held in May 2023 in Labuan Bajo, Indonesia. Telecommunications service operators have taken anticipated measures to upgrade their telecommunication network solutions.

- June 2023: Intelsat, an integrated satellite and terrestrial networks operator and provider of inflight connectivity (IFC), and Lintasarta, an Indonesian information and communication technology company, rolled out a network to cover remote areas in Indonesia via its mobile network operator subsidiary Indosat Ooredoo Hutchison (IOH). Broadband connectivity has been established in Sumatra, Kalimantan, Sulawesi, and Nusa Tenggara. Intelsat satellites with a hybrid network solution provide countrywide coverage to different population densities. The partnership will enable the company to quickly deploy and expand network coverage in Indonesia, allowing households to benefit from digital connectivity.

Strategic Outlook for Indonesia Communication Services Market Market

The strategic outlook for the Indonesia communication services market is highly positive, driven by sustained demand for digital connectivity and the government's commitment to digital transformation. Future growth will be propelled by the continued expansion of 5G networks, enabling the development of sophisticated IoT applications and the realization of Industry 4.0 initiatives. Providers are expected to focus on diversifying their service portfolios beyond traditional voice and data, investing in cloud computing, cybersecurity, and managed IT services to cater to enterprise demands. Strategic partnerships and potential M&A activities will be crucial for consolidating market positions and expanding service offerings. The emphasis will be on creating integrated digital solutions that enhance customer experience and drive value creation across various sectors of the Indonesian economy. Further investment in rural connectivity and bridging the digital divide will also be a key strategic imperative.

Indonesia Communication Services Market Segmentation

-

1. Type

- 1.1. Fixed Voice

- 1.2. Fixed Data

- 1.3. Mobile Voice

- 1.4. Other IT Services

Indonesia Communication Services Market Segmentation By Geography

- 1. Indonesia

Indonesia Communication Services Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 2.63% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in the Penetration of Smartphones; Rapid Increase in the Reliance on Internet

- 3.3. Market Restrains

- 3.3.1. Rise in the Penetration of Smartphones; Rapid Increase in the Reliance on Internet

- 3.4. Market Trends

- 3.4.1. Fixed Data Communication Services to Register a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Communication Services Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Voice

- 5.1.2. Fixed Data

- 5.1.3. Mobile Voice

- 5.1.4. Other IT Services

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Oracle

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Intel Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Amazon Web Services Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 SAP SE

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Accenture

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Microsoft

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hewlett Packard Enterprise Development LP

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Fujitsu

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Toshiba IT-Services Corporation*List Not Exhaustive 7 2 *List Not Exhaustiv

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Oracle

List of Figures

- Figure 1: Indonesia Communication Services Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Indonesia Communication Services Market Share (%) by Company 2024

List of Tables

- Table 1: Indonesia Communication Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Indonesia Communication Services Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Indonesia Communication Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Indonesia Communication Services Market Volume Billion Forecast, by Type 2019 & 2032

- Table 5: Indonesia Communication Services Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Indonesia Communication Services Market Volume Billion Forecast, by Region 2019 & 2032

- Table 7: Indonesia Communication Services Market Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Indonesia Communication Services Market Volume Billion Forecast, by Type 2019 & 2032

- Table 9: Indonesia Communication Services Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Indonesia Communication Services Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Communication Services Market?

The projected CAGR is approximately 2.63%.

2. Which companies are prominent players in the Indonesia Communication Services Market?

Key companies in the market include Oracle, Intel Corporation, IBM Corporation, Amazon Web Services Inc, SAP SE, Accenture, Microsoft, Hewlett Packard Enterprise Development LP, Fujitsu, Toshiba IT-Services Corporation*List Not Exhaustive 7 2 *List Not Exhaustiv.

3. What are the main segments of the Indonesia Communication Services Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 17.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in the Penetration of Smartphones; Rapid Increase in the Reliance on Internet.

6. What are the notable trends driving market growth?

Fixed Data Communication Services to Register a Significant Growth.

7. Are there any restraints impacting market growth?

Rise in the Penetration of Smartphones; Rapid Increase in the Reliance on Internet.

8. Can you provide examples of recent developments in the market?

April 2023: Indonesia’s Ministry of Communications and Informatics (MCI) released a digital infrastructure to support the successful ASEAN Chairmanship. The Ministry of Communications and Informatics monitored the telecommunications network quality and internet access to ensure the smooth running of ASEAN Chairmanship 2023, held in May 2023 in Labuan Bajo, Indonesia. Telecommunications service operators have taken anticipated measures to upgrade their telecommunication network solutions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Communication Services Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Communication Services Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Communication Services Market?

To stay informed about further developments, trends, and reports in the Indonesia Communication Services Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence