Key Insights

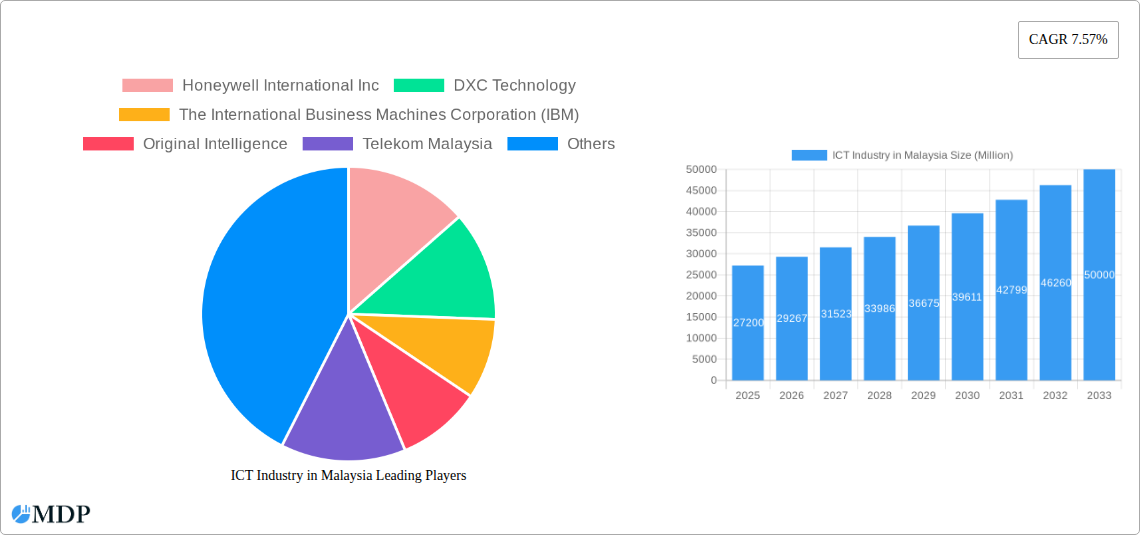

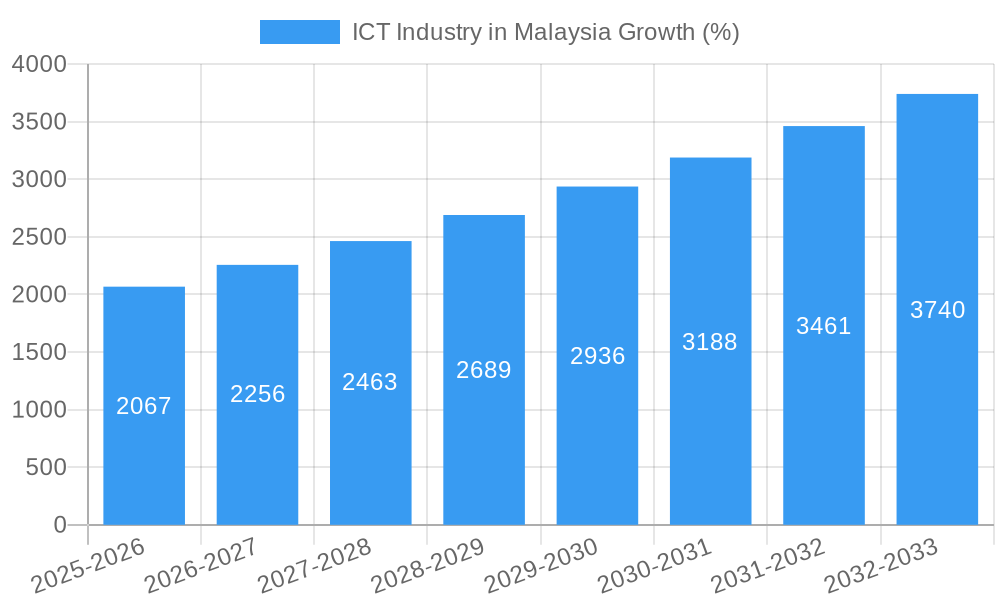

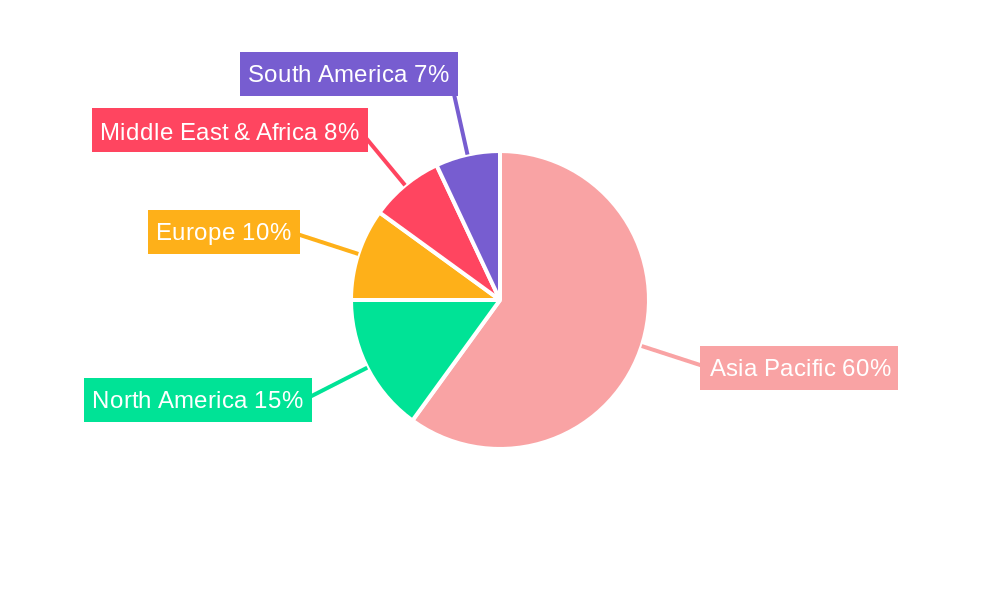

The Malaysian ICT industry, valued at approximately RM 27.2 billion (assuming "Million" refers to Malaysian Ringgit) in 2025, is projected to experience robust growth, driven by increasing digitalization across sectors, robust government support for digital infrastructure development, and a burgeoning e-commerce landscape. The 7.57% Compound Annual Growth Rate (CAGR) from 2025 to 2033 suggests a significant expansion of the market, reaching an estimated value exceeding RM 50 billion by 2033. Key growth drivers include the rising adoption of cloud computing, the expansion of 5G networks, and increasing investments in cybersecurity solutions. The BFSI, IT & Telecom, and Government sectors are major contributors to market growth, fueled by substantial investments in digital transformation initiatives. However, challenges such as the digital skills gap and cybersecurity threats pose potential restraints to growth. The market is segmented across hardware, software, IT services, and telecommunication services, with large enterprises and SMEs contributing significantly to the demand. Companies like Telekom Malaysia, Maxis Communications, and others listed are key players navigating this dynamic environment. The regional breakdown shows strong performance in the Asia Pacific region, with Malaysia being a significant contributor due to its strategic geographic location and government initiatives.

The competitive landscape is characterized by both global tech giants and local players, creating a balance of international expertise and localized market understanding. While global companies like IBM and HP offer advanced technologies, Malaysian players are thriving by adapting to the unique needs of the local market. Future growth hinges on effective addressal of the skill gap, continued investment in infrastructure, and robust cybersecurity measures. This will ensure the continued successful expansion of the Malaysian ICT sector, cementing its role as a key driver of economic growth and technological advancement in Southeast Asia. Further research into specific segment performance, particularly concerning the evolving roles of SMEs and the penetration rates of various ICT solutions within different industry verticals, is vital for a comprehensive understanding of market opportunities.

Unlocking Growth in Malaysia's ICT Sector: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of Malaysia's ICT industry, offering invaluable insights for stakeholders across hardware, software, IT services, and telecommunication services. Covering the period 2019-2033, with a focus on 2025, this report is essential for navigating the dynamic landscape of this rapidly evolving market. Expect detailed analysis of market size (in Millions), CAGR, market share, and key growth drivers, supported by real-world examples and forecasts.

ICT Industry in Malaysia Market Dynamics & Concentration

This section analyzes the competitive landscape of Malaysia's ICT sector, examining market concentration, innovation drivers, regulatory influences, and mergers & acquisitions (M&A) activity. The Malaysian ICT market is characterized by a mix of both large multinational corporations and smaller, agile players. Market concentration is moderate, with a few dominant players in each segment, but with significant room for smaller companies to thrive, particularly in niche areas.

- Market Concentration: The top 5 players account for approximately xx% of the total market revenue in 2025 (estimated). This suggests a relatively competitive market with opportunities for both established players and new entrants.

- Innovation Drivers: Government initiatives promoting digitalization, coupled with the increasing adoption of cloud computing, AI, and IoT, are key drivers of innovation. The push towards 5G infrastructure further fuels this momentum.

- Regulatory Framework: The Malaysian Communications and Multimedia Commission (MCMC) plays a significant role in shaping the industry's regulatory landscape. The framework is designed to foster competition while ensuring the security and integrity of the digital ecosystem.

- Product Substitutes: The ICT industry witnesses constant evolution, with new technologies constantly emerging. This means continuous innovation is crucial for companies to stay competitive.

- End-User Trends: Increasing digital literacy among consumers and businesses fuels demand for advanced ICT solutions. Growing demand for cloud-based services, cybersecurity, and data analytics is reshaping the sector.

- M&A Activity: The number of M&A deals in the Malaysian ICT sector fluctuates; for example, there were xx deals in 2024. This points to continuous consolidation and strategic repositioning in the market.

ICT Industry in Malaysia Industry Trends & Analysis

This section delves into the key trends shaping Malaysia's ICT market, including market growth, technological disruptions, consumer behavior, and competitive dynamics. The sector is poised for significant growth driven by government investment in digital infrastructure, and increasing adoption of technology by businesses and consumers.

The Malaysian ICT market is projected to witness a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), driven by increasing digitalization, robust government support, and a rising young population. Market penetration of broadband internet and mobile devices continues to increase, creating ample opportunity for growth across various segments. Technological disruptions like the rise of 5G, cloud computing, and artificial intelligence (AI) are reshaping business models and customer expectations. Consumer preferences are shifting towards more integrated and personalized digital experiences, with a growing emphasis on data privacy and security. Competitive dynamics are characterized by both fierce competition and strategic partnerships, as companies seek to expand their market share and offer comprehensive solutions. The market exhibits diverse customer segments, catering to both large enterprises and SMEs, spanning across multiple industry verticals.

Leading Markets & Segments in ICT Industry in Malaysia

This section identifies the leading segments and drivers of growth within the Malaysian ICT market. The Malaysian ICT market is diverse, with strong growth across various segments.

- Dominant Segments: Telecommunication services continue to be a leading segment, driven by high mobile penetration and the ongoing rollout of 5G networks. The IT services segment is also experiencing robust growth, fueled by rising digitalization across various industries.

- Key Drivers by Segment:

- Hardware: Government initiatives to promote the adoption of advanced technologies in various sectors and industries, increased investment in infrastructure.

- Software: Growing demand for enterprise resource planning (ERP), customer relationship management (CRM), and data analytics software.

- IT Services: High demand for cloud services, cybersecurity solutions, and managed IT services.

- Telecommunication Services: Increasing mobile penetration, expansion of 5G networks, and rising demand for high-speed internet access.

- SMEs: Government schemes providing funding and support for digital adoption are boosting growth among SMEs.

- Large Enterprises: Focus on digital transformation initiatives and investment in advanced technologies drives growth among large enterprises.

- BFSI: Strong demand for secure digital banking solutions, fraud detection systems, and data analytics platforms.

- IT & Telecom: High demand for advanced infrastructure and innovative solutions.

- Government: Major investments in digital infrastructure and e-governance projects.

- Retail & E-commerce: Rising e-commerce activity, leading to a growth in demand for digital payment gateways, logistics management systems, and online retail solutions.

- Manufacturing: Adoption of Industry 4.0 technologies, driving demand for automation, robotics, and data analytics.

- Energy & Utilities: Smart grid solutions and digital energy management systems are increasing the demand for ICT solutions.

- Other Industry Verticals: Various other industry sectors are increasingly relying on ICT solutions to enhance efficiency and productivity.

ICT Industry in Malaysia Product Developments

The Malaysian ICT industry is witnessing continuous product innovation, driven by technological advancements and evolving customer needs. New applications of AI, big data analytics, and the Internet of Things (IoT) are transforming various sectors. The market is seeing the development of tailored solutions for specific industry verticals, showcasing a keen understanding of market needs. This focus on innovation enhances competitive advantages, allowing companies to offer superior solutions and capture greater market share.

Key Drivers of ICT Industry in Malaysia Growth

Several factors are driving the growth of Malaysia's ICT sector. Government initiatives like the Malaysia Digital Economy Blueprint are boosting digital adoption across businesses. The expansion of 5G infrastructure enhances connectivity, fostering innovation and growth. The increasing adoption of cloud computing, AI, and IoT solutions by businesses across all sizes further fuels market expansion. Malaysia's young and tech-savvy population is also a key driver.

Challenges in the ICT Industry in Malaysia Market

The Malaysian ICT sector faces challenges such as cybersecurity threats, which are estimated to cost the country xx Million annually. The shortage of skilled talent also hampers growth, with an estimated shortage of xx skilled professionals by 2025. Increased competition from regional players and the need for continuous innovation pose further challenges. Supply chain disruptions, exacerbated by global events, also impact the industry.

Emerging Opportunities in ICT Industry in Malaysia

Emerging opportunities include the growing demand for 5G-enabled services, expanding e-commerce activities creating opportunities for fintech and logistics technology solutions. Government initiatives fostering innovation and investment in digital infrastructure are paving the way for further growth. Strategic partnerships between local and international ICT players are driving the development of sophisticated solutions tailored for the Malaysian market.

Leading Players in the ICT Industry in Malaysia Sector

- Honeywell International Inc

- DXC Technology

- The International Business Machines Corporation (IBM)

- Original Intelligence

- Telekom Malaysia

- Maxis Communications

- TIME dotCom (Time)

- Celcom Axiata

- Oracle Corporation

- Tata Consultancy Services (TCS)

- Digi Telecommunications

- Wipro Technologies

- U Mobile

- Hewlett-Packard (HP)

Key Milestones in ICT Industry in Malaysia Industry

- May 2022: Maxis launches a VoIP solution for enterprises, offering flexible subscription models.

- March 2022: Honeywell Malaysia partners with PETRONAS to create carbon-neutral energy solutions.

Strategic Outlook for ICT Industry in Malaysia Market

The Malaysian ICT sector holds significant growth potential driven by ongoing government support, expanding digital infrastructure, and increasing adoption of advanced technologies across various sectors. Strategic partnerships, investments in R&D, and a focus on talent development are crucial for realizing this potential. The future looks bright for companies that adapt to the evolving technological landscape and meet the demands of a digitally driven economy.

ICT Industry in Malaysia Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Small and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

ICT Industry in Malaysia Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

ICT Industry in Malaysia REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Implementation of 5G is Back on Track; Poised to Become the Digital Hub of Asia

- 3.3. Market Restrains

- 3.3.1. Managing Regulatory and Compliance Needs Across the World

- 3.4. Market Trends

- 3.4.1. Poised to Become the Digital Hub of Asia

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global ICT Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Small and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America ICT Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. IT Services

- 6.1.4. Telecommunication Services

- 6.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 6.2.1. Small and Medium Enterprises

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.3.1. BFSI

- 6.3.2. IT and Telecom

- 6.3.3. Government

- 6.3.4. Retail and E-commerce

- 6.3.5. Manufacturing

- 6.3.6. Energy and Utilities

- 6.3.7. Other Industry Verticals

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. South America ICT Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. IT Services

- 7.1.4. Telecommunication Services

- 7.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 7.2.1. Small and Medium Enterprises

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.3.1. BFSI

- 7.3.2. IT and Telecom

- 7.3.3. Government

- 7.3.4. Retail and E-commerce

- 7.3.5. Manufacturing

- 7.3.6. Energy and Utilities

- 7.3.7. Other Industry Verticals

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Europe ICT Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. IT Services

- 8.1.4. Telecommunication Services

- 8.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 8.2.1. Small and Medium Enterprises

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.3.1. BFSI

- 8.3.2. IT and Telecom

- 8.3.3. Government

- 8.3.4. Retail and E-commerce

- 8.3.5. Manufacturing

- 8.3.6. Energy and Utilities

- 8.3.7. Other Industry Verticals

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East & Africa ICT Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. IT Services

- 9.1.4. Telecommunication Services

- 9.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 9.2.1. Small and Medium Enterprises

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.3.1. BFSI

- 9.3.2. IT and Telecom

- 9.3.3. Government

- 9.3.4. Retail and E-commerce

- 9.3.5. Manufacturing

- 9.3.6. Energy and Utilities

- 9.3.7. Other Industry Verticals

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Asia Pacific ICT Industry in Malaysia Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. IT Services

- 10.1.4. Telecommunication Services

- 10.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 10.2.1. Small and Medium Enterprises

- 10.2.2. Large Enterprises

- 10.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 10.3.1. BFSI

- 10.3.2. IT and Telecom

- 10.3.3. Government

- 10.3.4. Retail and E-commerce

- 10.3.5. Manufacturing

- 10.3.6. Energy and Utilities

- 10.3.7. Other Industry Verticals

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Honeywell International Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 DXC Technology

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 The International Business Machines Corporation (IBM)

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Original Intelligence

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Telekom Malaysia

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Maxis Communications

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TIME dotCom (Time)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Celcom Axiata*List Not Exhaustive

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Oracle Corporation

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Tata Consultancy Services (TCS)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Digi Telecommunications

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Wipro Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 U Mobile

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Hewlett-Packard (HP)

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Honeywell International Inc

List of Figures

- Figure 1: Global ICT Industry in Malaysia Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Malaysia ICT Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 3: Malaysia ICT Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 4: North America ICT Industry in Malaysia Revenue (Million), by Type 2024 & 2032

- Figure 5: North America ICT Industry in Malaysia Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America ICT Industry in Malaysia Revenue (Million), by Size of Enterprise 2024 & 2032

- Figure 7: North America ICT Industry in Malaysia Revenue Share (%), by Size of Enterprise 2024 & 2032

- Figure 8: North America ICT Industry in Malaysia Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 9: North America ICT Industry in Malaysia Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 10: North America ICT Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 11: North America ICT Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 12: South America ICT Industry in Malaysia Revenue (Million), by Type 2024 & 2032

- Figure 13: South America ICT Industry in Malaysia Revenue Share (%), by Type 2024 & 2032

- Figure 14: South America ICT Industry in Malaysia Revenue (Million), by Size of Enterprise 2024 & 2032

- Figure 15: South America ICT Industry in Malaysia Revenue Share (%), by Size of Enterprise 2024 & 2032

- Figure 16: South America ICT Industry in Malaysia Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 17: South America ICT Industry in Malaysia Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 18: South America ICT Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 19: South America ICT Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe ICT Industry in Malaysia Revenue (Million), by Type 2024 & 2032

- Figure 21: Europe ICT Industry in Malaysia Revenue Share (%), by Type 2024 & 2032

- Figure 22: Europe ICT Industry in Malaysia Revenue (Million), by Size of Enterprise 2024 & 2032

- Figure 23: Europe ICT Industry in Malaysia Revenue Share (%), by Size of Enterprise 2024 & 2032

- Figure 24: Europe ICT Industry in Malaysia Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 25: Europe ICT Industry in Malaysia Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 26: Europe ICT Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 27: Europe ICT Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 28: Middle East & Africa ICT Industry in Malaysia Revenue (Million), by Type 2024 & 2032

- Figure 29: Middle East & Africa ICT Industry in Malaysia Revenue Share (%), by Type 2024 & 2032

- Figure 30: Middle East & Africa ICT Industry in Malaysia Revenue (Million), by Size of Enterprise 2024 & 2032

- Figure 31: Middle East & Africa ICT Industry in Malaysia Revenue Share (%), by Size of Enterprise 2024 & 2032

- Figure 32: Middle East & Africa ICT Industry in Malaysia Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 33: Middle East & Africa ICT Industry in Malaysia Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 34: Middle East & Africa ICT Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 35: Middle East & Africa ICT Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific ICT Industry in Malaysia Revenue (Million), by Type 2024 & 2032

- Figure 37: Asia Pacific ICT Industry in Malaysia Revenue Share (%), by Type 2024 & 2032

- Figure 38: Asia Pacific ICT Industry in Malaysia Revenue (Million), by Size of Enterprise 2024 & 2032

- Figure 39: Asia Pacific ICT Industry in Malaysia Revenue Share (%), by Size of Enterprise 2024 & 2032

- Figure 40: Asia Pacific ICT Industry in Malaysia Revenue (Million), by Industry Vertical 2024 & 2032

- Figure 41: Asia Pacific ICT Industry in Malaysia Revenue Share (%), by Industry Vertical 2024 & 2032

- Figure 42: Asia Pacific ICT Industry in Malaysia Revenue (Million), by Country 2024 & 2032

- Figure 43: Asia Pacific ICT Industry in Malaysia Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global ICT Industry in Malaysia Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global ICT Industry in Malaysia Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global ICT Industry in Malaysia Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: Global ICT Industry in Malaysia Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: Global ICT Industry in Malaysia Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global ICT Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Global ICT Industry in Malaysia Revenue Million Forecast, by Type 2019 & 2032

- Table 8: Global ICT Industry in Malaysia Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 9: Global ICT Industry in Malaysia Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 10: Global ICT Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 11: United States ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Canada ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Mexico ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global ICT Industry in Malaysia Revenue Million Forecast, by Type 2019 & 2032

- Table 15: Global ICT Industry in Malaysia Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 16: Global ICT Industry in Malaysia Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 17: Global ICT Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Brazil ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Argentina ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of South America ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global ICT Industry in Malaysia Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global ICT Industry in Malaysia Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 23: Global ICT Industry in Malaysia Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 24: Global ICT Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 25: United Kingdom ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Germany ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: France ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Italy ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Spain ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Russia ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Benelux ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Nordics ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Rest of Europe ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Global ICT Industry in Malaysia Revenue Million Forecast, by Type 2019 & 2032

- Table 35: Global ICT Industry in Malaysia Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 36: Global ICT Industry in Malaysia Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 37: Global ICT Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 38: Turkey ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Israel ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: GCC ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: North Africa ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: South Africa ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Rest of Middle East & Africa ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Global ICT Industry in Malaysia Revenue Million Forecast, by Type 2019 & 2032

- Table 45: Global ICT Industry in Malaysia Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 46: Global ICT Industry in Malaysia Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 47: Global ICT Industry in Malaysia Revenue Million Forecast, by Country 2019 & 2032

- Table 48: China ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: India ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Japan ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: South Korea ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: ASEAN ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 53: Oceania ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific ICT Industry in Malaysia Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the ICT Industry in Malaysia?

The projected CAGR is approximately 7.57%.

2. Which companies are prominent players in the ICT Industry in Malaysia?

Key companies in the market include Honeywell International Inc, DXC Technology, The International Business Machines Corporation (IBM), Original Intelligence, Telekom Malaysia, Maxis Communications, TIME dotCom (Time), Celcom Axiata*List Not Exhaustive, Oracle Corporation, Tata Consultancy Services (TCS), Digi Telecommunications, Wipro Technologies, U Mobile, Hewlett-Packard (HP).

3. What are the main segments of the ICT Industry in Malaysia?

The market segments include Type, Size of Enterprise, Industry Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 27.20 Million as of 2022.

5. What are some drivers contributing to market growth?

Implementation of 5G is Back on Track; Poised to Become the Digital Hub of Asia.

6. What are the notable trends driving market growth?

Poised to Become the Digital Hub of Asia.

7. Are there any restraints impacting market growth?

Managing Regulatory and Compliance Needs Across the World.

8. Can you provide examples of recent developments in the market?

In May 2022, Maxis, one of the leading telecom players in Malaysia, disclosed the launch of a VOIP solution for enterprises. This solution offers a flexible subscription model that enables organizations to grow at any moment, allowing them to utilize their fixed business number on mobile devices anywhere.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "ICT Industry in Malaysia," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the ICT Industry in Malaysia report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the ICT Industry in Malaysia?

To stay informed about further developments, trends, and reports in the ICT Industry in Malaysia, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence