Key Insights

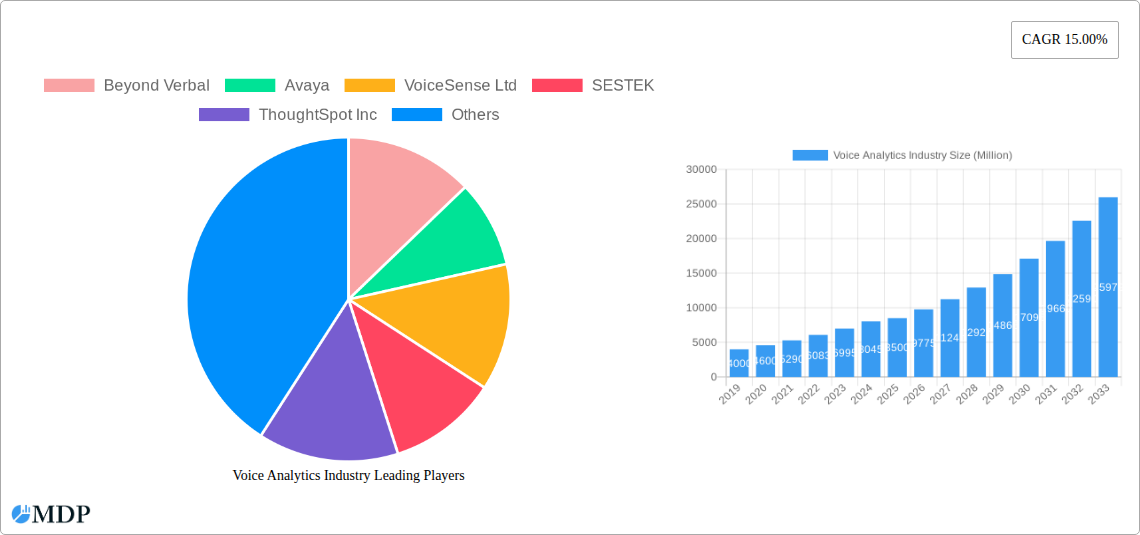

The global Voice Analytics market is poised for exceptional growth, projected to reach a substantial market size of approximately $8,500 million by 2025, with a remarkable Compound Annual Growth Rate (CAGR) of 15.00%. This robust expansion is primarily fueled by the escalating demand for enhanced customer experience, driven by organizations across diverse sectors recognizing the strategic value of extracting actionable insights from customer interactions. Key drivers include the burgeoning need for sentiment analysis to understand customer emotions, proactive risk and fraud detection through anomaly identification in voice patterns, and the optimization of sales and marketing strategies by analyzing call content. The increasing adoption of AI and machine learning technologies is further accelerating this growth, enabling more sophisticated and accurate voice analysis capabilities.

The market landscape is characterized by a dynamic interplay of technological advancements and evolving business needs. Solutions and services are the primary components driving market adoption, with cloud deployments gaining significant traction due to their scalability, flexibility, and cost-effectiveness. Small and Medium-sized Enterprises (SMEs) are increasingly leveraging voice analytics to compete effectively with larger corporations, while large enterprises are integrating these solutions to streamline operations and deepen customer relationships. Key application areas such as health monitoring, sentiment analysis, sales & marketing, risk & fraud detection, and call monitoring are witnessing significant investment. Geographically, North America and Europe currently lead the market, but the Asia Pacific region, particularly India and China, is emerging as a high-growth frontier due to rapid digital transformation and a growing tech-savvy population. Leading companies like Verint Systems, Avaya, and Uniphore are at the forefront of innovation, offering a wide array of sophisticated voice analytics platforms.

Gain unparalleled insights into the rapidly evolving Voice Analytics market. This comprehensive report, covering the historical period of 2019–2024, base year 2025, and an extensive forecast period from 2025–2033, offers a deep dive into market dynamics, trends, and future projections. Essential for industry stakeholders, CXOs, analysts, and decision-makers, this analysis equips you with the knowledge to navigate this high-growth sector. Discover how AI-powered voice analysis, speech analytics, and conversation intelligence are revolutionizing customer engagement, operational efficiency, and risk management across diverse verticals. With a projected CAGR of XX% and an estimated market size of XX Million by 2033, this report is your indispensable guide to understanding the competitive landscape, key growth drivers, and emerging opportunities within the Voice Analytics industry.

Voice Analytics Industry Market Dynamics & Concentration

The Voice Analytics industry is characterized by a dynamic market concentration, driven by continuous innovation in AI and machine learning, leading to advanced speech recognition and sentiment analysis capabilities. Key innovation drivers include the increasing demand for enhanced customer experience (CX), the need for real-time call monitoring and analysis, and the burgeoning adoption of contact center AI. Regulatory frameworks, while still developing in some regions, are increasingly focusing on data privacy and security, impacting data handling practices. Product substitutes, such as manual call analysis or basic CRM analytics, are rapidly losing ground to sophisticated voice analytics solutions. End-user trends highlight a strong preference for cloud-based solutions offering scalability and cost-effectiveness, alongside a growing demand for specialized applications like health monitoring and risk & fraud detection. Mergers and acquisitions (M&A) activity is a significant indicator of market consolidation and strategic expansion, with XX M&A deals recorded in the historical period. The market share distribution indicates a highly competitive environment with a few dominant players and a significant number of emerging technology providers.

- Market Concentration: Highly competitive with a mix of established players and agile startups.

- Innovation Drivers: AI advancements, CX improvement mandates, real-time data needs, regulatory compliance.

- Regulatory Frameworks: Evolving data privacy and security standards influencing platform development.

- Product Substitutes: Declining relevance of manual analysis and basic CRM tools.

- End-User Trends: Strong preference for cloud deployments, demand for specialized applications.

- M&A Activities: Indicative of consolidation and strategic growth initiatives.

Voice Analytics Industry Industry Trends & Analysis

The Voice Analytics industry is experiencing robust growth, propelled by several key trends that are reshaping business operations and customer interactions. The escalating demand for deeper customer understanding is a primary market growth driver, with organizations leveraging speech analytics to uncover customer sentiment, identify pain points, and personalize engagements. Technological disruptions, particularly in the fields of Natural Language Processing (NLP) and machine learning, are enabling more accurate and nuanced analysis of vocal data, moving beyond simple keyword spotting to understanding tone, emotion, and intent. Consumer preferences are increasingly aligned with personalized and efficient service, driving the adoption of voice analytics solutions that can predict needs and offer proactive support. Competitive dynamics are intense, with companies investing heavily in R&D to differentiate their offerings through advanced features, seamless integrations, and specialized industry solutions. The market penetration of voice analytics is expected to accelerate as businesses recognize its ROI in improving sales performance, reducing operational costs, and enhancing compliance. The CAGR for the Voice Analytics market is projected to be XX% during the forecast period. This sustained growth reflects the intrinsic value of transforming unstructured voice data into actionable business intelligence.

Leading Markets & Segments in Voice Analytics Industry

The North America region continues to dominate the Voice Analytics market, driven by early adoption of advanced technologies, a mature enterprise ecosystem, and significant investment in AI and data analytics. Within North America, the United States holds the largest market share due to the presence of major technology companies and a strong emphasis on customer experience across various sectors.

Key segment dominance analysis:

- Component: The Solution segment is leading due to its comprehensive analytical capabilities, offering end-to-end voice data processing and insight generation. Services, while crucial for implementation and support, follow closely as organizations seek to maximize their investment in voice analytics solutions.

- Deployment: Cloud deployment dominates the market owing to its scalability, flexibility, cost-effectiveness, and ease of integration. On-premise solutions are primarily adopted by organizations with stringent data security and compliance requirements, particularly in government sectors.

- Organization Size: Large Enterprises are the primary adopters of voice analytics, leveraging its power for large-scale customer interactions and complex data analysis. However, Small and Medium-sized Enterprises (SMEs) are increasingly recognizing the benefits, leading to a growing adoption rate with more accessible and affordable cloud-based solutions.

- Application: Call monitoring and Sentiment Analysis are the most prominent applications, driven by the immediate need to improve customer service and understand customer satisfaction. Sales & Marketing applications are also experiencing significant growth as businesses use voice analytics to optimize sales pitches and marketing campaigns. Risk & Fraud Detection and Health Monitoring are emerging as high-growth areas with specialized applications.

- End-user Vertical: The BFSI sector leads in adoption due to its high volume of customer interactions and stringent regulatory requirements for compliance and fraud detection. Retail & E-commerce and Telecom & IT are also major contributors, focusing on enhancing customer experience and operational efficiency. Healthcare is rapidly adopting voice analytics for patient monitoring and clinical insights, while Government & Defence utilizes it for security and intelligence purposes.

Voice Analytics Industry Product Developments

Product developments in the Voice Analytics industry are characterized by an increasing integration of advanced AI and machine learning capabilities, enhancing the accuracy and depth of insights derived from voice data. Innovations focus on real-time sentiment analysis, emotion detection, and the ability to identify specific customer intents and behaviors. Competitive advantages are being carved out through the development of specialized solutions for niche applications, such as proactive health monitoring and sophisticated fraud detection. The market fit is improving as solutions become more user-friendly, scalable, and capable of seamless integration with existing enterprise systems. Key technological trends include the rise of conversational AI platforms that leverage voice analytics to power intelligent virtual agents and provide contextual customer support.

Key Drivers of Voice Analytics Industry Growth

The growth of the Voice Analytics industry is propelled by a confluence of technological advancements, economic imperatives, and evolving regulatory landscapes.

- Technological Advancements: The continuous improvement in AI, machine learning, and Natural Language Processing (NLP) fuels more accurate and nuanced voice analysis, enabling deeper insights into customer sentiment and intent.

- Economic Imperatives: Businesses are increasingly recognizing the ROI of voice analytics in enhancing customer experience (CX), optimizing operational efficiency, reducing churn, and improving sales performance.

- Regulatory Compliance: Growing emphasis on data privacy and security, coupled with the need for robust compliance in sectors like BFSI and healthcare, drives the adoption of voice analytics for auditing and monitoring purposes.

- Data Proliferation: The exponential growth of unstructured voice data from customer interactions presents a rich source of intelligence that businesses are eager to exploit.

Challenges in the Voice Analytics Industry Market

Despite its promising growth, the Voice Analytics industry faces several challenges that can temper its expansion. Regulatory hurdles, particularly concerning data privacy and the ethical use of voice data, can lead to compliance complexities and slow down adoption in certain regions. Supply chain issues, though less pronounced than in hardware-centric industries, can impact the timely availability of specialized components or cloud infrastructure for some providers. Fierce competitive pressures necessitate continuous innovation and aggressive pricing strategies, which can strain profit margins for smaller players. Furthermore, the integration of voice analytics solutions with legacy enterprise systems often presents technical challenges, requiring significant IT resources and expertise.

Emerging Opportunities in Voice Analytics Industry

Emerging opportunities in the Voice Analytics industry are centered around technological breakthroughs and strategic market expansion. The development of more sophisticated emotion recognition and intent prediction algorithms presents a significant catalyst for growth, enabling hyper-personalized customer interactions. Strategic partnerships between voice analytics providers and CRM, cloud, or IoT platforms are creating integrated ecosystems that offer enhanced value propositions. Market expansion into untapped verticals such as education for personalized learning, and the burgeoning gig economy for agent performance management, offers substantial long-term growth potential. The increasing demand for predictive analytics powered by voice data also opens doors for proactive problem-solving and anticipatory customer service strategies.

Leading Players in the Voice Analytics Industry Sector

- Beyond Verbal

- Avaya

- VoiceSense Ltd

- SESTEK

- ThoughtSpot Inc

- Invoca Inc

- Talkdesk

- Verint Systems

- audEERING GmbH

- VoiceBase Inc

- RankMiner Inc

- Uniphore

Key Milestones in Voice Analytics Industry Industry

- September 2022: Contact center AI platform Observe.AI launched a new set of tools for determining what the AI's data analysis signifies. The new Conversation Intelligence Consulting Services provides a mechanism for contact centers to integrate better and analyze how user interactions with human and virtual agents are progressing and what can be done to improve them.

- June 2022: QuadraByte, LLC announced its collaboration with Vonage as a Vonage Voice API integration partner. QuadraByte, a provider of an Intelligence Economy, integrates its experience into the Vonage relationship, allowing Vonage customers to quickly interface with Voice API and implement improved calling experiences.

Strategic Outlook for Voice Analytics Industry Market

- September 2022: Contact center AI platform Observe.AI launched a new set of tools for determining what the AI's data analysis signifies. The new Conversation Intelligence Consulting Services provides a mechanism for contact centers to integrate better and analyze how user interactions with human and virtual agents are progressing and what can be done to improve them.

- June 2022: QuadraByte, LLC announced its collaboration with Vonage as a Vonage Voice API integration partner. QuadraByte, a provider of an Intelligence Economy, integrates its experience into the Vonage relationship, allowing Vonage customers to quickly interface with Voice API and implement improved calling experiences.

Strategic Outlook for Voice Analytics Industry Market

The strategic outlook for the Voice Analytics industry market is exceptionally positive, driven by an accelerating adoption curve across all major sectors. Growth accelerators include the continued advancement of AI, leading to more intuitive and powerful analytical tools, and the increasing recognition of voice data as a critical business asset. The demand for personalized customer experiences and proactive service delivery will further fuel market expansion. Strategic opportunities lie in developing industry-specific solutions, fostering interoperability with broader enterprise software stacks, and exploring new applications in areas like employee training and well-being. The market is poised for sustained growth as organizations globally prioritize data-driven decision-making and seek to unlock the full potential of their customer interactions.

Voice Analytics Industry Segmentation

-

1. Component

- 1.1. Solution

- 1.2. Services

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. Organization Size

- 3.1. Small and Medium-sized Enterprises

- 3.2. Large Enterprises

-

4. Application

- 4.1. Health Monitoring

- 4.2. Sentiment Analysis

- 4.3. Sales & Marketing

- 4.4. Risk & Fraud Detection

- 4.5. Call monitoring

-

5. End-user Vertical

- 5.1. Retail & E-commerce

- 5.2. Telecom & IT

- 5.3. BFSI

- 5.4. Healthcare

- 5.5. Government & Defence

- 5.6. Other End-user Verticals

Voice Analytics Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Voice Analytics Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Investments in Optical Fiber Communication Infrastructure

- 3.3. Market Restrains

- 3.3.1. Instant Loss of Liquidity

- 3.4. Market Trends

- 3.4.1. Applications driving the growth of the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Voice Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solution

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by Organization Size

- 5.3.1. Small and Medium-sized Enterprises

- 5.3.2. Large Enterprises

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Health Monitoring

- 5.4.2. Sentiment Analysis

- 5.4.3. Sales & Marketing

- 5.4.4. Risk & Fraud Detection

- 5.4.5. Call monitoring

- 5.5. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.5.1. Retail & E-commerce

- 5.5.2. Telecom & IT

- 5.5.3. BFSI

- 5.5.4. Healthcare

- 5.5.5. Government & Defence

- 5.5.6. Other End-user Verticals

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. Latin America

- 5.6.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. North America Voice Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Component

- 6.1.1. Solution

- 6.1.2. Services

- 6.2. Market Analysis, Insights and Forecast - by Deployment

- 6.2.1. Cloud

- 6.2.2. On-premise

- 6.3. Market Analysis, Insights and Forecast - by Organization Size

- 6.3.1. Small and Medium-sized Enterprises

- 6.3.2. Large Enterprises

- 6.4. Market Analysis, Insights and Forecast - by Application

- 6.4.1. Health Monitoring

- 6.4.2. Sentiment Analysis

- 6.4.3. Sales & Marketing

- 6.4.4. Risk & Fraud Detection

- 6.4.5. Call monitoring

- 6.5. Market Analysis, Insights and Forecast - by End-user Vertical

- 6.5.1. Retail & E-commerce

- 6.5.2. Telecom & IT

- 6.5.3. BFSI

- 6.5.4. Healthcare

- 6.5.5. Government & Defence

- 6.5.6. Other End-user Verticals

- 6.1. Market Analysis, Insights and Forecast - by Component

- 7. Europe Voice Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Component

- 7.1.1. Solution

- 7.1.2. Services

- 7.2. Market Analysis, Insights and Forecast - by Deployment

- 7.2.1. Cloud

- 7.2.2. On-premise

- 7.3. Market Analysis, Insights and Forecast - by Organization Size

- 7.3.1. Small and Medium-sized Enterprises

- 7.3.2. Large Enterprises

- 7.4. Market Analysis, Insights and Forecast - by Application

- 7.4.1. Health Monitoring

- 7.4.2. Sentiment Analysis

- 7.4.3. Sales & Marketing

- 7.4.4. Risk & Fraud Detection

- 7.4.5. Call monitoring

- 7.5. Market Analysis, Insights and Forecast - by End-user Vertical

- 7.5.1. Retail & E-commerce

- 7.5.2. Telecom & IT

- 7.5.3. BFSI

- 7.5.4. Healthcare

- 7.5.5. Government & Defence

- 7.5.6. Other End-user Verticals

- 7.1. Market Analysis, Insights and Forecast - by Component

- 8. Asia Pacific Voice Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Component

- 8.1.1. Solution

- 8.1.2. Services

- 8.2. Market Analysis, Insights and Forecast - by Deployment

- 8.2.1. Cloud

- 8.2.2. On-premise

- 8.3. Market Analysis, Insights and Forecast - by Organization Size

- 8.3.1. Small and Medium-sized Enterprises

- 8.3.2. Large Enterprises

- 8.4. Market Analysis, Insights and Forecast - by Application

- 8.4.1. Health Monitoring

- 8.4.2. Sentiment Analysis

- 8.4.3. Sales & Marketing

- 8.4.4. Risk & Fraud Detection

- 8.4.5. Call monitoring

- 8.5. Market Analysis, Insights and Forecast - by End-user Vertical

- 8.5.1. Retail & E-commerce

- 8.5.2. Telecom & IT

- 8.5.3. BFSI

- 8.5.4. Healthcare

- 8.5.5. Government & Defence

- 8.5.6. Other End-user Verticals

- 8.1. Market Analysis, Insights and Forecast - by Component

- 9. Latin America Voice Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Component

- 9.1.1. Solution

- 9.1.2. Services

- 9.2. Market Analysis, Insights and Forecast - by Deployment

- 9.2.1. Cloud

- 9.2.2. On-premise

- 9.3. Market Analysis, Insights and Forecast - by Organization Size

- 9.3.1. Small and Medium-sized Enterprises

- 9.3.2. Large Enterprises

- 9.4. Market Analysis, Insights and Forecast - by Application

- 9.4.1. Health Monitoring

- 9.4.2. Sentiment Analysis

- 9.4.3. Sales & Marketing

- 9.4.4. Risk & Fraud Detection

- 9.4.5. Call monitoring

- 9.5. Market Analysis, Insights and Forecast - by End-user Vertical

- 9.5.1. Retail & E-commerce

- 9.5.2. Telecom & IT

- 9.5.3. BFSI

- 9.5.4. Healthcare

- 9.5.5. Government & Defence

- 9.5.6. Other End-user Verticals

- 9.1. Market Analysis, Insights and Forecast - by Component

- 10. Middle East and Africa Voice Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Component

- 10.1.1. Solution

- 10.1.2. Services

- 10.2. Market Analysis, Insights and Forecast - by Deployment

- 10.2.1. Cloud

- 10.2.2. On-premise

- 10.3. Market Analysis, Insights and Forecast - by Organization Size

- 10.3.1. Small and Medium-sized Enterprises

- 10.3.2. Large Enterprises

- 10.4. Market Analysis, Insights and Forecast - by Application

- 10.4.1. Health Monitoring

- 10.4.2. Sentiment Analysis

- 10.4.3. Sales & Marketing

- 10.4.4. Risk & Fraud Detection

- 10.4.5. Call monitoring

- 10.5. Market Analysis, Insights and Forecast - by End-user Vertical

- 10.5.1. Retail & E-commerce

- 10.5.2. Telecom & IT

- 10.5.3. BFSI

- 10.5.4. Healthcare

- 10.5.5. Government & Defence

- 10.5.6. Other End-user Verticals

- 10.1. Market Analysis, Insights and Forecast - by Component

- 11. North America Voice Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 12. Europe Voice Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Rest of Europe

- 13. Asia Pacific Voice Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 India

- 13.1.2 China

- 13.1.3 Japan

- 13.1.4 Rest of Asia Pacific

- 14. Latin America Voice Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Rest of Latin America

- 15. Middle East and Africa Voice Analytics Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United Arab Emirates

- 15.1.2 Saudi Arabia

- 15.1.3 Rest of Middle East and Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Beyond Verbal

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Avaya

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 VoiceSense Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 SESTEK

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 ThoughtSpot Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Invoca Inc *List Not Exhaustive

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Talkdesk

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Verint Systems

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 audEERING GmbH

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 VoiceBase Inc

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 RankMiner Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Uniphore

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.1 Beyond Verbal

List of Figures

- Figure 1: Global Voice Analytics Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Voice Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Voice Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Voice Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Voice Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Voice Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Voice Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Voice Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Voice Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Voice Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Voice Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Voice Analytics Industry Revenue (Million), by Component 2024 & 2032

- Figure 13: North America Voice Analytics Industry Revenue Share (%), by Component 2024 & 2032

- Figure 14: North America Voice Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 15: North America Voice Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 16: North America Voice Analytics Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 17: North America Voice Analytics Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 18: North America Voice Analytics Industry Revenue (Million), by Application 2024 & 2032

- Figure 19: North America Voice Analytics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 20: North America Voice Analytics Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 21: North America Voice Analytics Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 22: North America Voice Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: North America Voice Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Europe Voice Analytics Industry Revenue (Million), by Component 2024 & 2032

- Figure 25: Europe Voice Analytics Industry Revenue Share (%), by Component 2024 & 2032

- Figure 26: Europe Voice Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 27: Europe Voice Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 28: Europe Voice Analytics Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 29: Europe Voice Analytics Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 30: Europe Voice Analytics Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Europe Voice Analytics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Europe Voice Analytics Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 33: Europe Voice Analytics Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 34: Europe Voice Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Europe Voice Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Asia Pacific Voice Analytics Industry Revenue (Million), by Component 2024 & 2032

- Figure 37: Asia Pacific Voice Analytics Industry Revenue Share (%), by Component 2024 & 2032

- Figure 38: Asia Pacific Voice Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 39: Asia Pacific Voice Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 40: Asia Pacific Voice Analytics Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 41: Asia Pacific Voice Analytics Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 42: Asia Pacific Voice Analytics Industry Revenue (Million), by Application 2024 & 2032

- Figure 43: Asia Pacific Voice Analytics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 44: Asia Pacific Voice Analytics Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 45: Asia Pacific Voice Analytics Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 46: Asia Pacific Voice Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 47: Asia Pacific Voice Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 48: Latin America Voice Analytics Industry Revenue (Million), by Component 2024 & 2032

- Figure 49: Latin America Voice Analytics Industry Revenue Share (%), by Component 2024 & 2032

- Figure 50: Latin America Voice Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 51: Latin America Voice Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 52: Latin America Voice Analytics Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 53: Latin America Voice Analytics Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 54: Latin America Voice Analytics Industry Revenue (Million), by Application 2024 & 2032

- Figure 55: Latin America Voice Analytics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 56: Latin America Voice Analytics Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 57: Latin America Voice Analytics Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 58: Latin America Voice Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 59: Latin America Voice Analytics Industry Revenue Share (%), by Country 2024 & 2032

- Figure 60: Middle East and Africa Voice Analytics Industry Revenue (Million), by Component 2024 & 2032

- Figure 61: Middle East and Africa Voice Analytics Industry Revenue Share (%), by Component 2024 & 2032

- Figure 62: Middle East and Africa Voice Analytics Industry Revenue (Million), by Deployment 2024 & 2032

- Figure 63: Middle East and Africa Voice Analytics Industry Revenue Share (%), by Deployment 2024 & 2032

- Figure 64: Middle East and Africa Voice Analytics Industry Revenue (Million), by Organization Size 2024 & 2032

- Figure 65: Middle East and Africa Voice Analytics Industry Revenue Share (%), by Organization Size 2024 & 2032

- Figure 66: Middle East and Africa Voice Analytics Industry Revenue (Million), by Application 2024 & 2032

- Figure 67: Middle East and Africa Voice Analytics Industry Revenue Share (%), by Application 2024 & 2032

- Figure 68: Middle East and Africa Voice Analytics Industry Revenue (Million), by End-user Vertical 2024 & 2032

- Figure 69: Middle East and Africa Voice Analytics Industry Revenue Share (%), by End-user Vertical 2024 & 2032

- Figure 70: Middle East and Africa Voice Analytics Industry Revenue (Million), by Country 2024 & 2032

- Figure 71: Middle East and Africa Voice Analytics Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Voice Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Voice Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Global Voice Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 4: Global Voice Analytics Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 5: Global Voice Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Voice Analytics Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 7: Global Voice Analytics Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 8: Global Voice Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: United States Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Canada Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Voice Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Germany Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United Kingdom Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: France Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Global Voice Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 17: India Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: China Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Japan Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Rest of Asia Pacific Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Global Voice Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Brazil Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Argentina Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Rest of Latin America Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Global Voice Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: United Arab Emirates Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Saudi Arabia Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Middle East and Africa Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Global Voice Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 30: Global Voice Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 31: Global Voice Analytics Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 32: Global Voice Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 33: Global Voice Analytics Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 34: Global Voice Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 35: United States Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Canada Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Global Voice Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 38: Global Voice Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 39: Global Voice Analytics Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 40: Global Voice Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 41: Global Voice Analytics Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 42: Global Voice Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 43: Germany Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: United Kingdom Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: France Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Rest of Europe Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Global Voice Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 48: Global Voice Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 49: Global Voice Analytics Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 50: Global Voice Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 51: Global Voice Analytics Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 52: Global Voice Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 53: India Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: China Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Japan Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Rest of Asia Pacific Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 57: Global Voice Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 58: Global Voice Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 59: Global Voice Analytics Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 60: Global Voice Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 61: Global Voice Analytics Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 62: Global Voice Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 63: Brazil Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Argentina Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 65: Rest of Latin America Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Global Voice Analytics Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 67: Global Voice Analytics Industry Revenue Million Forecast, by Deployment 2019 & 2032

- Table 68: Global Voice Analytics Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 69: Global Voice Analytics Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 70: Global Voice Analytics Industry Revenue Million Forecast, by End-user Vertical 2019 & 2032

- Table 71: Global Voice Analytics Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 72: United Arab Emirates Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 73: Saudi Arabia Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Middle East and Africa Voice Analytics Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Voice Analytics Industry?

The projected CAGR is approximately 15.00%.

2. Which companies are prominent players in the Voice Analytics Industry?

Key companies in the market include Beyond Verbal, Avaya, VoiceSense Ltd, SESTEK, ThoughtSpot Inc, Invoca Inc *List Not Exhaustive, Talkdesk, Verint Systems, audEERING GmbH, VoiceBase Inc, RankMiner Inc, Uniphore.

3. What are the main segments of the Voice Analytics Industry?

The market segments include Component, Deployment, Organization Size, Application, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Investments in Optical Fiber Communication Infrastructure.

6. What are the notable trends driving market growth?

Applications driving the growth of the market.

7. Are there any restraints impacting market growth?

Instant Loss of Liquidity.

8. Can you provide examples of recent developments in the market?

September 2022: Contact center AI platform Observe.AI launched a new set of tools for determining what the AI's data analysis signifies. The new Conversation Intelligence Consulting Services provides a mechanism for contact centers to integrate better and analyze how user interactions with human and virtual agents are progressing and what can be done to improve them.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Voice Analytics Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Voice Analytics Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Voice Analytics Industry?

To stay informed about further developments, trends, and reports in the Voice Analytics Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence