Key Insights

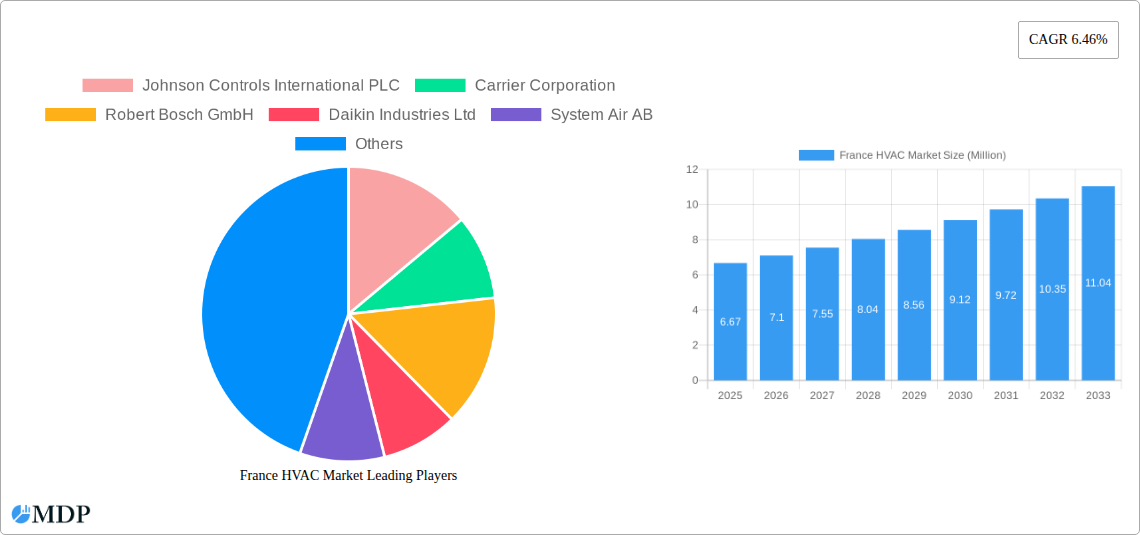

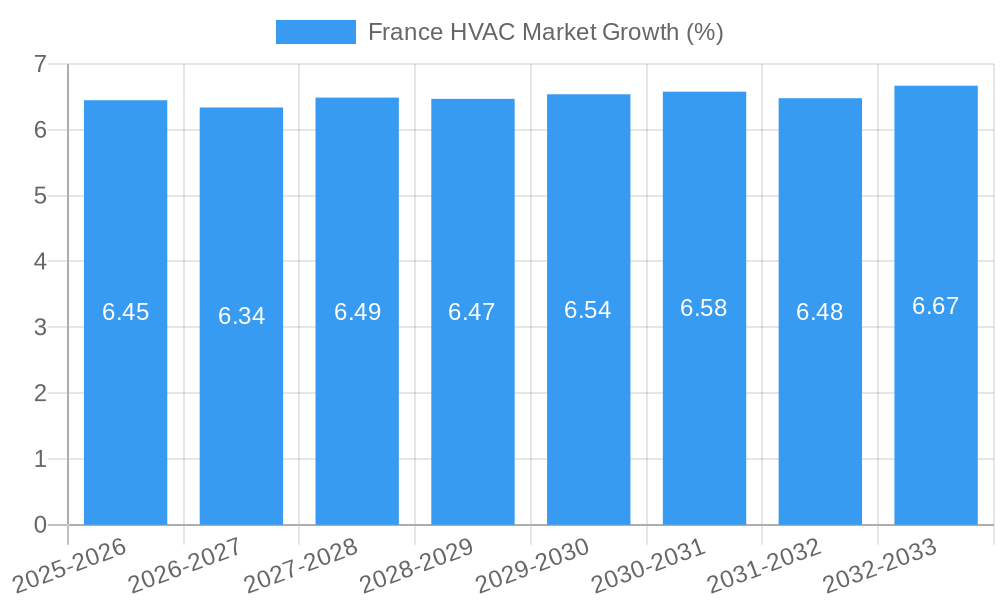

The French HVAC market is poised for robust expansion, projected to reach an estimated USD 6.67 million by 2025 and sustain a Compound Annual Growth Rate (CAGR) of 6.46% through 2033. This growth is primarily fueled by a strong emphasis on energy efficiency and sustainability across all sectors. The residential segment, driven by increasing homeowner demand for comfortable and eco-friendly living spaces, is a significant contributor. This is further amplified by government incentives and regulations promoting the adoption of high-efficiency heating and ventilation systems, as well as the replacement of aging, less efficient equipment. The commercial sector is also a key growth engine, with businesses investing in advanced HVAC solutions to reduce operational costs, improve indoor air quality (IAQ), and meet stringent environmental standards. Smart building technologies and the integration of IoT are becoming increasingly prevalent, enabling better control, predictive maintenance, and optimized energy consumption.

The industrial sector, while potentially experiencing slower adoption due to capital expenditure considerations, is seeing growth driven by the need for precise climate control in specialized manufacturing processes and an increasing focus on reducing industrial carbon footprints. Key market drivers include rising energy costs, stringent government regulations promoting energy efficiency and emissions reduction, and technological advancements in HVAC systems, such as heat pumps, smart thermostats, and advanced ventilation technologies. Restraints, such as the high initial investment cost for advanced systems and the need for skilled labor for installation and maintenance, are being addressed through innovative financing options and training programs. Major players like Johnson Controls, Carrier Corporation, and Daikin Industries are actively shaping the market through product innovation and strategic partnerships, focusing on delivering sustainable and cost-effective HVAC solutions tailored to the French market's unique demands.

Unlock the expansive potential of the French HVAC market with this in-depth, SEO-optimized report. Covering the historical period of 2019-2024 and forecasting through 2033, this analysis delves into market dynamics, key industry trends, leading segments, product developments, growth drivers, challenges, emerging opportunities, and the competitive landscape. Gain actionable insights into the HVAC equipment and services sectors, catering to residential, commercial, and industrial end-users. This report is essential for manufacturers, distributors, service providers, investors, and policymakers seeking to navigate the evolving French HVAC sector.

France HVAC Market Market Dynamics & Concentration

The French HVAC market exhibits moderate concentration, with key players like Johnson Controls International PLC, Carrier Corporation, Robert Bosch GmbH, and Daikin Industries Ltd holding significant market share. Innovation is a primary driver, fueled by stringent European Union energy efficiency directives and increasing consumer demand for sustainable solutions. Regulatory frameworks, particularly those promoting the adoption of renewable energy sources and phasing out older, less efficient systems, are shaping market dynamics. Product substitutes, such as heat pumps and advanced ventilation systems, are gaining traction, challenging traditional heating and cooling equipment. End-user trends are shifting towards smart, connected HVAC systems that offer remote monitoring, energy management, and improved indoor air quality. Mergers and acquisitions (M&A) activity is present, though sporadic, as companies seek to expand their product portfolios and geographical reach. For instance, the acquisition of smaller, specialized HVAC service providers by larger conglomerates can bolster their market presence. While specific M&A deal counts are proprietary, the strategic intent to consolidate and innovate is evident. Market share is highly dependent on segment and product category, with established brands commanding premium positions.

France HVAC Market Industry Trends & Analysis

The French HVAC market is poised for substantial growth, driven by a confluence of technological advancements, evolving consumer preferences, and supportive government policies. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% over the forecast period (2025-2033). This expansion is underpinned by the increasing demand for energy-efficient solutions, the retrofitting of older buildings to meet modern environmental standards, and the growing adoption of smart and connected HVAC systems. Technological disruptions, such as the proliferation of inverter technology, smart thermostats, and the integration of AI for optimized performance, are reshaping the competitive landscape. Consumer preferences are increasingly leaning towards systems that offer both comfort and sustainability, with a strong emphasis on reducing energy consumption and carbon footprints. This is particularly evident in the residential sector, where homeowners are actively seeking solutions that lower utility bills and contribute to a greener lifestyle. The commercial and industrial sectors are also witnessing a surge in demand for advanced HVAC technologies to comply with evolving energy regulations and improve operational efficiency. Competitive dynamics are characterized by intense innovation, with companies continuously launching new products and services to capture market share. Market penetration of high-efficiency equipment is steadily increasing, driven by subsidies and a growing awareness of the long-term economic and environmental benefits. The shift towards heat pumps, for example, as a primary heating and cooling solution, is a significant trend.

Leading Markets & Segments in France HVAC Market

Within the French HVAC market, Air Conditioning/Ventilation Equipment emerges as the dominant segment, driven by increasing demand for climate control across all end-user industries and a growing emphasis on indoor air quality. The Commercial end-user industry represents the largest market share, propelled by new construction projects, office building renovations, and the hospitality sector's continuous need for comfortable environments.

HVAC Equipment: Air Conditioning/Ventilation Equipment:

- Key Drivers: Rising summer temperatures, stringent indoor air quality regulations for public and commercial spaces, increasing adoption of energy-efficient VRF (Variable Refrigerant Flow) systems, and the growing trend of building retrofits to improve ventilation.

- Dominance Analysis: The commercial sector, encompassing offices, retail spaces, and hospitality, accounts for a substantial portion of this segment's demand due to mandatory ventilation requirements and the desire for premium occupant comfort. Government incentives for upgrading to more energy-efficient cooling and ventilation systems further bolster this dominance.

HVAC Equipment: Heating Equipment:

- Key Drivers: Government initiatives promoting renewable energy sources for heating, particularly the phase-out of fossil fuel-based heating systems, and the widespread adoption of heat pumps as a primary heating solution.

- Dominance Analysis: While the residential sector remains a significant consumer of heating equipment, the shift towards electric heating and heat pumps is a prominent trend. The industrial sector also contributes, particularly for process heating applications.

HVAC Services:

- Key Drivers: The increasing complexity of modern HVAC systems necessitates skilled maintenance, repair, and installation services. The growing installed base of HVAC equipment drives demand for ongoing service contracts and lifecycle management.

- Dominance Analysis: This segment is crucial across all end-user industries. The commercial sector's large and diverse HVAC infrastructure requires extensive ongoing maintenance, making it a major contributor to HVAC services revenue.

The Residential end-user industry is a rapidly growing segment, driven by consumer demand for comfort, energy savings, and government subsidies for energy-efficient upgrades, particularly heat pumps. The Industrial sector, while smaller in terms of unit volume, often involves larger, more complex HVAC solutions for critical processes, contributing significantly to market value. Economic policies that encourage energy efficiency and green building standards are pivotal to the growth of all segments.

France HVAC Market Product Developments

Recent product developments in the French HVAC market are focused on enhancing energy efficiency, sustainability, and user convenience. Innovations in chiller technology, exemplified by Carrier Corporation's introduction of high-performance chillers for data centers, highlight a commitment to reducing operational expenses and environmental impact. These advancements often incorporate features like hydronic free-cooling systems and variable-speed inverter drives, capable of significant energy savings. Similarly, expansions in manufacturing capabilities, such as Johnson Controls' doubling of its chiller and heat pump plant in Nantes, underscore the industry's response to escalating demand for advanced, energy-efficient HVAC solutions. These developments aim to provide competitive advantages through superior performance, reduced carbon footprints, and lower total cost of ownership, aligning with both market demand and regulatory imperatives.

Key Drivers of France HVAC Market Growth

Several key factors are propelling the growth of the French HVAC market.

- Energy Efficiency Regulations: Stringent EU and national regulations mandating higher energy efficiency standards for buildings and HVAC systems are a primary catalyst.

- Technological Advancements: The widespread adoption of smart thermostats, inverter technology, heat pumps, and integrated building management systems enhances performance and reduces energy consumption.

- Growing Environmental Awareness: Increased consumer and corporate focus on sustainability and reducing carbon footprints is driving demand for eco-friendly HVAC solutions.

- Government Incentives: Subsidies and tax credits for the installation of energy-efficient and renewable-energy-based HVAC systems encourage adoption.

- Building Retrofitting: The need to upgrade older, less efficient buildings to meet modern energy performance standards significantly boosts demand for HVAC solutions.

Challenges in the France HVAC Market Market

Despite the positive growth outlook, the French HVAC market faces several challenges.

- High Initial Cost: The upfront investment for high-efficiency HVAC systems and renewable energy solutions can be a barrier for some consumers and businesses.

- Skilled Labor Shortage: A growing shortage of qualified HVAC technicians and installers capable of handling complex, modern systems can hinder market expansion and service quality.

- Supply Chain Disruptions: Global supply chain volatility can lead to component shortages and increased lead times, impacting project timelines and costs.

- Complexity of Regulations: Navigating the intricate and evolving landscape of energy efficiency and environmental regulations can be challenging for smaller market players.

- Competition from Substitutes: The increasing availability and affordability of alternative heating and cooling methods can pose a competitive threat to traditional HVAC technologies.

Emerging Opportunities in France HVAC Market

The French HVAC market presents numerous emerging opportunities for growth and innovation. The increasing focus on decarbonization and net-zero building targets is creating substantial demand for heat pumps, geothermal systems, and hybrid solutions. The digital transformation of HVAC, with the integration of IoT, AI, and predictive maintenance, offers opportunities for service providers to offer enhanced value through smart building management and energy optimization services. Furthermore, the growing demand for improved indoor air quality, particularly in light of public health concerns, is driving innovation in advanced ventilation and air purification technologies. Strategic partnerships between HVAC manufacturers, technology providers, and energy service companies (ESCOs) can unlock new market segments and deliver integrated solutions. The retrofitting market for older commercial and residential buildings represents a significant, long-term opportunity for modernizing HVAC infrastructure.

Leading Players in the France HVAC Market Sector

- Johnson Controls International PLC

- Carrier Corporation

- Robert Bosch GmbH

- Daikin Industries Ltd

- System Air AB

- Flaktgroup Inc

- LG Electronics Inc

- BDR Thermea Group

- Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- Danfoss Inc

Key Milestones in France HVAC Market Industry

- April 2024: Carrier Corporation introduced its latest line of high-performance chillers for data centers, meticulously designed to reduce energy consumption and carbon footprints, and significantly lower data center operators' operational expenses. The flagship model, AquaForce 30XF, stands out with its innovative features: an inbuilt hydronic free-cooling system and variable-speed inverter drives. Together, these technologies can slash energy consumption by 50% when the chiller operates in full free-cooling mode.

- March 2024: Johnson Controls doubled the size of its chiller and heat pump plant in Nantes, France, making it the company's flagship manufacturing hub in Europe for York-branded chillers and heat pumps. The expanded facility already commenced operations, marking a pivotal moment for Johnson Controls. This move positions the company to cater to the escalating demand for advanced technologies and underscores its commitment to a greener, more energy-efficient future.

Strategic Outlook for France HVAC Market Market

- April 2024: Carrier Corporation introduced its latest line of high-performance chillers for data centers, meticulously designed to reduce energy consumption and carbon footprints, and significantly lower data center operators' operational expenses. The flagship model, AquaForce 30XF, stands out with its innovative features: an inbuilt hydronic free-cooling system and variable-speed inverter drives. Together, these technologies can slash energy consumption by 50% when the chiller operates in full free-cooling mode.

- March 2024: Johnson Controls doubled the size of its chiller and heat pump plant in Nantes, France, making it the company's flagship manufacturing hub in Europe for York-branded chillers and heat pumps. The expanded facility already commenced operations, marking a pivotal moment for Johnson Controls. This move positions the company to cater to the escalating demand for advanced technologies and underscores its commitment to a greener, more energy-efficient future.

Strategic Outlook for France HVAC Market Market

The strategic outlook for the French HVAC market is highly positive, driven by sustained demand for energy-efficient and sustainable solutions. Key growth accelerators include the continued rollout of smart building technologies, the increasing adoption of heat pumps and renewable energy integration, and government support for green building initiatives. Companies that focus on innovation, particularly in digital integration and smart controls, will be well-positioned to capture market share. Strategic partnerships and a focus on providing comprehensive lifecycle services, from installation to maintenance and upgrades, will be crucial for long-term success. The market is expected to see a further shift towards connected, intelligent HVAC systems that offer enhanced comfort, improved indoor air quality, and significant energy savings, aligning with France's ambitious environmental goals.

France HVAC Market Segmentation

-

1. Type of Component

-

1.1. HVAC Equipment

- 1.1.1. Heating Equipment

- 1.1.2. Air Conditioning/Ventilation Equipment

- 1.2. HVAC Services

-

1.1. HVAC Equipment

-

2. End-user Industry

- 2.1. Residential

- 2.2. Commercial

- 2.3. Industrial

France HVAC Market Segmentation By Geography

- 1. France

France HVAC Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.46% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Innovations in HVAC Technology Including Smart Systems and Renewable Energy Integration; Increased Construction and Retrofit Activity to Aid Demand

- 3.3. Market Restrains

- 3.3.1. Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Innovations in HVAC Technology Including Smart Systems and Renewable Energy Integration; Increased Construction and Retrofit Activity to Aid Demand

- 3.4. Market Trends

- 3.4.1. Residential Sector to Witness a Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France HVAC Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 5.1.1. HVAC Equipment

- 5.1.1.1. Heating Equipment

- 5.1.1.2. Air Conditioning/Ventilation Equipment

- 5.1.2. HVAC Services

- 5.1.1. HVAC Equipment

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Industrial

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. France

- 5.1. Market Analysis, Insights and Forecast - by Type of Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Johnson Controls International PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Carrier Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Robert Bosch GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Daikin Industries Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 System Air AB

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flaktgroup Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 LG Electronics Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BDR Thermea Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Danfoss Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: France HVAC Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: France HVAC Market Share (%) by Company 2024

List of Tables

- Table 1: France HVAC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: France HVAC Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: France HVAC Market Revenue Million Forecast, by Type of Component 2019 & 2032

- Table 4: France HVAC Market Volume Billion Forecast, by Type of Component 2019 & 2032

- Table 5: France HVAC Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 6: France HVAC Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 7: France HVAC Market Revenue Million Forecast, by Region 2019 & 2032

- Table 8: France HVAC Market Volume Billion Forecast, by Region 2019 & 2032

- Table 9: France HVAC Market Revenue Million Forecast, by Type of Component 2019 & 2032

- Table 10: France HVAC Market Volume Billion Forecast, by Type of Component 2019 & 2032

- Table 11: France HVAC Market Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 12: France HVAC Market Volume Billion Forecast, by End-user Industry 2019 & 2032

- Table 13: France HVAC Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: France HVAC Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France HVAC Market?

The projected CAGR is approximately 6.46%.

2. Which companies are prominent players in the France HVAC Market?

Key companies in the market include Johnson Controls International PLC, Carrier Corporation, Robert Bosch GmbH, Daikin Industries Ltd, System Air AB, Flaktgroup Inc, LG Electronics Inc, BDR Thermea Group, Mitsubishi Electric Hydronics & IT Cooling Systems SpA, Danfoss Inc.

3. What are the main segments of the France HVAC Market?

The market segments include Type of Component, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.67 Million as of 2022.

5. What are some drivers contributing to market growth?

Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Innovations in HVAC Technology Including Smart Systems and Renewable Energy Integration; Increased Construction and Retrofit Activity to Aid Demand.

6. What are the notable trends driving market growth?

Residential Sector to Witness a Significant Growth.

7. Are there any restraints impacting market growth?

Supportive Government Regulations Including Incentives for Saving Energy through Tax Credit Programs; Innovations in HVAC Technology Including Smart Systems and Renewable Energy Integration; Increased Construction and Retrofit Activity to Aid Demand.

8. Can you provide examples of recent developments in the market?

April 2024: Carrier Corporation introduced its latest line of high-performance chillers for data centers. These chillers are meticulously designed to reduce energy consumption and carbon footprints and significantly lower data center operators' operational expenses. The flagship model, AquaForce 30XF, stands out with its innovative features: an inbuilt hydronic free-cooling system and variable-speed inverter drives. Together, these technologies can slash energy consumption by 50% when the chiller operates in full free-cooling mode.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France HVAC Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France HVAC Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France HVAC Market?

To stay informed about further developments, trends, and reports in the France HVAC Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence