Key Insights

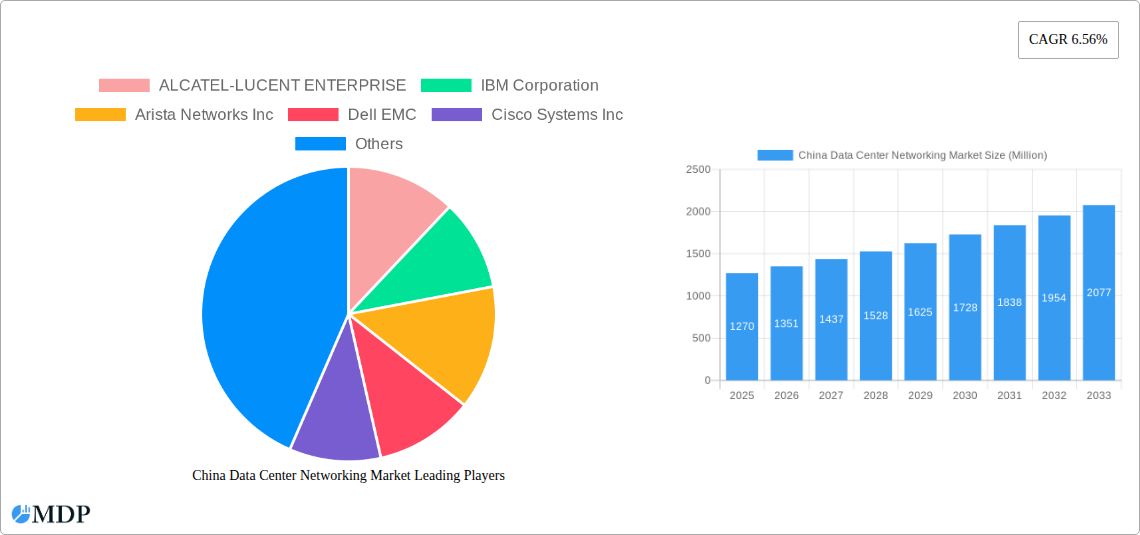

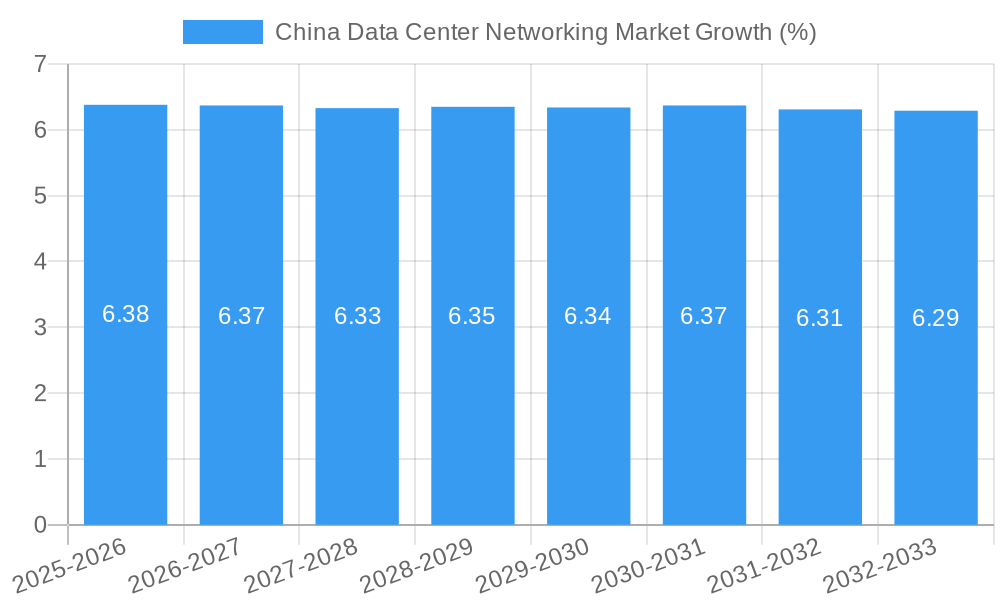

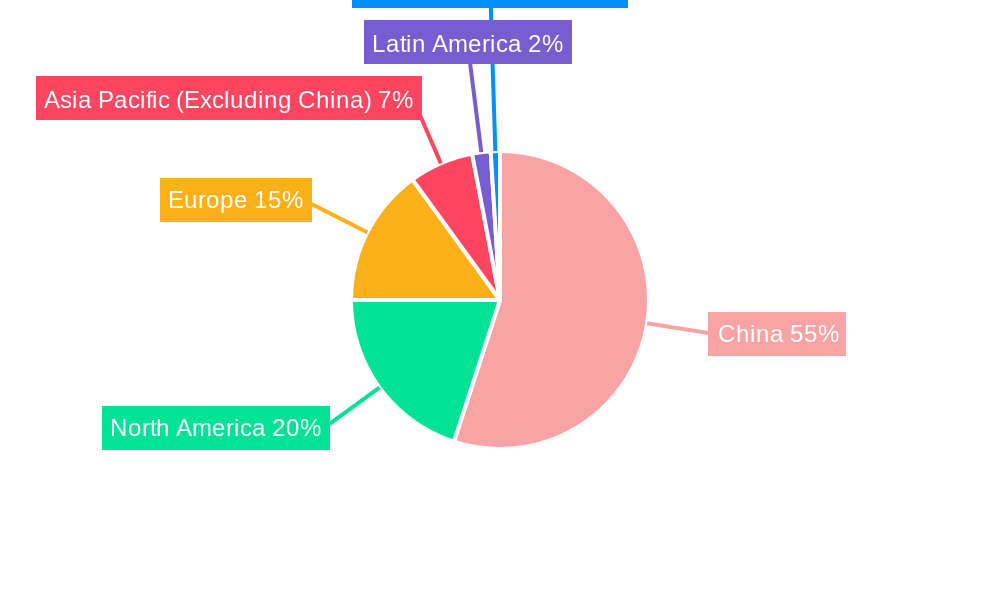

The China Data Center Networking Market is poised for substantial growth, with an estimated market size of USD 1.27 billion in 2025 and a projected Compound Annual Growth Rate (CAGR) of 6.56% through 2033. This robust expansion is primarily fueled by the escalating demand for high-speed connectivity and increased data processing capabilities driven by digital transformation initiatives across various industries. Key growth drivers include the burgeoning adoption of cloud computing, the proliferation of big data analytics, and the continuous evolution of technologies like 5G, artificial intelligence (AI), and the Internet of Things (IoT). These advancements necessitate more sophisticated and efficient networking infrastructure to handle the massive influx of data generated and processed within data centers. Furthermore, the growing investment in building new data center facilities and upgrading existing ones to support these advanced applications will significantly contribute to market expansion.

The market segmentation reveals a dynamic landscape. In terms of components, Ethernet Switches and Routers are expected to dominate due to their foundational role in data center networks, while Application Delivery Controllers (ADCs) are gaining traction for their ability to optimize application performance and security. The Services segment, particularly Installation & Integration and Support & Maintenance, will witness strong growth as enterprises increasingly rely on specialized expertise to manage complex networking environments. End-users like IT & Telecommunication, BFSI, and Government are leading the adoption, leveraging advanced networking solutions for critical operations. Emerging trends include the adoption of software-defined networking (SDN) and network function virtualization (NFV) for greater agility and automation, alongside an increasing focus on cybersecurity and energy efficiency within data center networks. While the market presents immense opportunities, potential restraints could include the high cost of advanced networking equipment and the need for skilled professionals to manage these sophisticated systems, alongside evolving regulatory landscapes in China.

Here is an SEO-optimized and engaging report description for the China Data Center Networking Market, designed for maximum visibility and stakeholder attraction:

Unlock critical intelligence on the rapidly evolving China Data Center Networking Market. This comprehensive report provides an in-depth analysis of market dynamics, key trends, leading players, and future opportunities from 2019 to 2033, with a base and estimated year of 2025. Dive into the market’s trajectory, driven by explosive data growth, AI adoption, and digital transformation initiatives. We deliver actionable insights into market segmentation by product (Ethernet Switches, Routers, SAN, ADC, Other) and services (Installation & Integration, Training & Consulting, Support & Maintenance), alongside end-user verticals such as IT & Telecommunication, BFSI, Government, and Media & Entertainment. Essential for network architects, IT decision-makers, investors, and solution providers, this report offers a data-driven roadmap to navigate one of the world's most dynamic technology landscapes.

China Data Center Networking Market Market Dynamics & Concentration

The China Data Center Networking Market is characterized by dynamic innovation and intense competition, driven by China's ambitious digital economy goals. Market concentration is relatively high, with leading global and domestic vendors vying for market share. Key innovation drivers include the relentless demand for higher bandwidth, lower latency, and enhanced security, fueled by the proliferation of AI, big data analytics, and cloud computing. Regulatory frameworks, while evolving to support technological advancement, also play a significant role in shaping market entry and product standards. Product substitutes are emerging, particularly in software-defined networking (SDN) and network function virtualization (NFV), challenging traditional hardware-centric solutions. End-user trends are clearly shifting towards hyperscale data centers and edge computing deployments, demanding highly scalable and efficient networking infrastructure. Mergers and acquisitions (M&A) activities, while not as frequent as in some mature markets, are strategic plays to consolidate market positions and acquire cutting-edge technologies. The overall market share is distributed among a mix of established giants and agile local players, with the latter increasingly gaining traction due to government support and localized solutions.

- Market Share: Dominated by a few key players, with increasing influence from domestic vendors.

- M&A Activities: Primarily focused on technology acquisition and market expansion.

China Data Center Networking Market Industry Trends & Analysis

The China Data Center Networking Market is experiencing robust growth, propelled by a confluence of technological advancements and burgeoning digital infrastructure demands. The estimated market size for 2025 is projected to be in the range of XX Billion USD. This growth is fundamentally driven by the explosive expansion of data generation and consumption across all sectors, necessitating sophisticated networking solutions to handle the increasing traffic volumes. Technological disruptions are at the forefront, with the widespread adoption of 5G, artificial intelligence (AI), and the Internet of Things (IoT) significantly increasing the complexity and requirements for data center networks. These technologies demand higher bandwidth, ultra-low latency, and enhanced processing capabilities, pushing the boundaries of existing networking paradigms.

Consumer preferences, though an indirect driver for enterprise infrastructure, are shaped by the demand for seamless digital experiences – from streaming high-definition content to real-time gaming and immersive augmented reality applications. This translates into a direct need for more powerful and efficient data center networks. Competitive dynamics are fierce, with a mix of global networking leaders and rapidly evolving Chinese enterprises constantly innovating to capture market share. Companies are investing heavily in R&D to develop solutions that cater to the unique needs of the Chinese market, including those for AI-specific workloads and edge data centers.

The Compound Annual Growth Rate (CAGR) for the China Data Center Networking Market is expected to be substantial over the forecast period of 2025–2033, estimated at XX%. This impressive growth is attributed to several key factors:

- Digital Transformation Initiatives: Widespread adoption of cloud computing, big data, and AI across industries.

- 5G Network Expansion: The rollout of 5G is creating a significant demand for high-capacity data center interconnectivity.

- Hyperscale Data Center Growth: Major cloud providers and enterprises are continuously expanding their data center footprints.

- Government Support & Policies: Favorable policies promoting technological self-sufficiency and digital infrastructure development.

- Emergence of Edge Computing: The need for localized data processing is driving the deployment of smaller, more distributed data centers.

Market penetration of advanced networking technologies, such as Software-Defined Networking (SDN) and Network Function Virtualization (NFV), is steadily increasing, offering greater agility, programmability, and cost-efficiency. The market is also witnessing a growing demand for specialized networking equipment designed to support high-performance computing (HPC) and AI training workloads. The competitive landscape is characterized by strategic alliances, product differentiation, and a focus on delivering end-to-end networking solutions that address the entire data center ecosystem.

Leading Markets & Segments in China Data Center Networking Market

The China Data Center Networking Market is a multifaceted landscape with distinct areas of dominance, driven by specific economic policies, infrastructure development, and evolving end-user demands. Among the Components, Ethernet Switches are the undisputed leaders, forming the backbone of modern data centers. Their widespread adoption is fueled by their versatility, high port densities, and cost-effectiveness in supporting massive data flows. The demand for higher speeds, such as 100GbE, 400GbE, and even 800GbE, is a significant growth driver, directly correlated with the expansion of hyperscale and enterprise data centers. Routers also hold a substantial market share, critical for inter-data center connectivity and WAN integration. Storage Area Networks (SAN) remain vital for high-performance storage access, particularly in enterprise environments, while Application Delivery Controllers (ADC) are indispensable for optimizing application performance and availability.

The Services segment is experiencing significant growth, with Installation & Integration services being paramount as new and upgraded data center infrastructure is deployed. Support & Maintenance is a recurring revenue stream, ensuring the continuous operation and optimization of complex networks. Training & Consulting services are crucial for helping organizations leverage the full potential of advanced networking technologies and manage their evolving IT environments.

In terms of End-Users, the IT & Telecommunication sector is the largest consumer of data center networking solutions. The rapid expansion of cloud services, mobile networks, and digital platforms necessitates massive investments in robust and scalable networking infrastructure. The BFSI (Banking, Financial Services, and Insurance) sector is another critical segment, demanding highly secure, reliable, and low-latency networks for financial transactions, trading platforms, and data analytics. The Government sector is increasingly investing in smart city initiatives, e-governance platforms, and national cybersecurity infrastructure, all of which rely heavily on advanced data center networking. The Media & Entertainment sector, with its growing demand for high-definition content streaming, online gaming, and virtual/augmented reality experiences, also contributes significantly to the market's growth.

Key drivers for the dominance of these segments include:

- Economic Policies: Government initiatives promoting digital infrastructure development and technological self-reliance.

- Infrastructure Development: Continuous investment in building new data centers and upgrading existing ones to meet increasing demand.

- Technological Advancements: The relentless pursuit of higher speeds, lower latency, and greater intelligence in networking equipment.

- Digital Transformation Mandates: Enterprises across all sectors accelerating their digital transformation journeys.

- Data Growth and Analytics: The exponential increase in data volume and the need for efficient processing and analysis.

The dominance of Ethernet Switches is further amplified by the modularity and scalability they offer, allowing data centers to grow organically. The IT & Telecommunication sector's dominance stems from its role as a foundational provider of digital services, requiring the most extensive and advanced networking capabilities. The BFSI sector's stringent requirements for security and reliability underscore the importance of specialized, high-performance networking solutions.

China Data Center Networking Market Product Developments

Product developments in the China Data Center Networking Market are characterized by a strong emphasis on high performance, AI-readiness, and enhanced security. Innovations are driven by the need to support ever-increasing data traffic and complex workloads. Key trends include the introduction of switches with higher port densities and faster speeds (e.g., 400GbE and 800GbE), alongside advancements in AI-powered network management and analytics for predictive maintenance and anomaly detection. Companies are focusing on solutions that facilitate seamless connectivity between traditional data centers and edge computing deployments, ensuring consistent performance and data integrity. The integration of advanced security features directly into networking hardware, such as the advancements highlighted in key milestones, is crucial for addressing the growing cybersecurity landscape in China. These product developments are designed to offer competitive advantages by providing greater efficiency, lower operational costs, and improved application performance for end-users.

Key Drivers of China Data Center Networking Market Growth

The China Data Center Networking Market's growth is propelled by a powerful combination of technological, economic, and strategic factors. The relentless surge in data generation from mobile devices, IoT, and digital services necessitates a corresponding expansion and upgrade of networking infrastructure. China's aggressive push for digital transformation across all industries, from manufacturing to healthcare, fuels the demand for robust data center solutions. Furthermore, the rapid rollout and adoption of 5G technology create a significant need for high-bandwidth, low-latency interconnectivity, directly benefiting data center networking. Government initiatives aimed at fostering technological self-sufficiency and developing a leading digital economy provide substantial impetus and support for domestic and international players in this market. Finally, the burgeoning adoption of Artificial Intelligence (AI) and Machine Learning (ML) applications requires increasingly powerful and sophisticated networking capabilities within data centers.

Challenges in the China Data Center Networking Market Market

Despite its robust growth, the China Data Center Networking Market faces several challenges. Stricter regulatory compliance and data sovereignty laws can pose barriers to entry and operational complexities for foreign companies. The supply chain for advanced networking components can be subject to geopolitical influences and disruptions, impacting availability and cost. Intense competition among both global giants and emerging domestic players leads to price pressures and necessitates continuous innovation to maintain market share. Furthermore, the significant upfront investment required for deploying and upgrading state-of-the-art data center networking infrastructure can be a restraint for some organizations. The rapid pace of technological change also demands continuous learning and adaptation, posing a challenge for IT teams.

Emerging Opportunities in China Data Center Networking Market

Emerging opportunities in the China Data Center Networking Market are primarily driven by technological breakthroughs and evolving market demands. The ongoing expansion of AI and machine learning applications presents a significant opportunity for specialized networking solutions that can handle massive datasets and complex computations. The continued build-out of 5G infrastructure, coupled with the proliferation of edge computing, creates a demand for distributed and intelligent networking architectures. Strategic partnerships between technology providers, cloud service providers, and enterprises are crucial for developing integrated solutions that address specific industry needs. Furthermore, the increasing focus on green data centers and energy efficiency offers opportunities for networking vendors to offer power-optimized solutions and management tools. The government's emphasis on smart cities and digital governance will continue to drive demand for secure and scalable networking infrastructure.

Leading Players in the China Data Center Networking Market Sector

- ALCATEL-LUCENT ENTERPRISE

- IBM Corporation

- Arista Networks Inc

- Dell EMC

- Cisco Systems Inc

- Juniper Networks Inc

- Extreme Networks Inc

- NEC Corporation

- Schneider Electric

- VMware Inc

Key Milestones in China Data Center Networking Market Industry

- March 2023: Huawei's CloudEngine 16800, 8800, and 6800 series data center switches passed the security evaluation by SGS Brightsight and earned Common Criteria (CC) Evaluation Assurance Level 4 Augmented (EAL4+) for its products, enhancing trust and security in their offerings.

- June 2023: Huawei launched CloudEngine 16800-X, a data center switch specifically designed for diversified computing power, signaling a move towards more specialized hardware to support advanced AI and HPC workloads.

Strategic Outlook for China Data Center Networking Market Market

- March 2023: Huawei's CloudEngine 16800, 8800, and 6800 series data center switches passed the security evaluation by SGS Brightsight and earned Common Criteria (CC) Evaluation Assurance Level 4 Augmented (EAL4+) for its products, enhancing trust and security in their offerings.

- June 2023: Huawei launched CloudEngine 16800-X, a data center switch specifically designed for diversified computing power, signaling a move towards more specialized hardware to support advanced AI and HPC workloads.

Strategic Outlook for China Data Center Networking Market Market

The strategic outlook for the China Data Center Networking Market remains exceptionally strong, driven by ongoing digital transformation and substantial government support. Key growth accelerators include the continued expansion of hyperscale and enterprise data centers, fueled by the insatiable demand for cloud services and big data analytics. The widespread adoption of 5G networks and the burgeoning field of edge computing will create further demand for sophisticated, low-latency networking solutions. Companies that can offer highly integrated, AI-enabled, and secure networking platforms will be well-positioned to capture significant market share. Strategic investments in R&D, focusing on next-generation networking technologies like AI-driven automation and ultra-high-speed interconnects, will be crucial for sustained success. Furthermore, navigating the evolving regulatory landscape and fostering strong local partnerships will be essential for long-term growth and market leadership. The market presents significant opportunities for innovation and expansion over the coming decade.

China Data Center Networking Market Segmentation

-

1. Component

-

1.1. By Product

- 1.1.1. Ethernet Switches

- 1.1.2. Routers

- 1.1.3. Storage Area Network (SAN)

- 1.1.4. Application Delivery Controller (ADC)

- 1.1.5. Other Networking Equipment

-

1.2. By Services

- 1.2.1. Installation & Integration

- 1.2.2. Training & Consulting

- 1.2.3. Support & Maintenance

-

1.1. By Product

-

2. End-User

- 2.1. IT & Telecommunication

- 2.2. BFSI

- 2.3. Government

- 2.4. Media & Entertainment

- 2.5. Other End-Users

China Data Center Networking Market Segmentation By Geography

- 1. China

China Data Center Networking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.56% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Utilization of Cloud Storage is Driving the Market Growth; Rising Need for Backup and Storage is Expanding the Market Demand

- 3.3. Market Restrains

- 3.3.1. Lack of Skilled Professionals is Hindering the Market Demand

- 3.4. Market Trends

- 3.4.1. IT and Telecom to have significant market share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Data Center Networking Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. By Product

- 5.1.1.1. Ethernet Switches

- 5.1.1.2. Routers

- 5.1.1.3. Storage Area Network (SAN)

- 5.1.1.4. Application Delivery Controller (ADC)

- 5.1.1.5. Other Networking Equipment

- 5.1.2. By Services

- 5.1.2.1. Installation & Integration

- 5.1.2.2. Training & Consulting

- 5.1.2.3. Support & Maintenance

- 5.1.1. By Product

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. IT & Telecommunication

- 5.2.2. BFSI

- 5.2.3. Government

- 5.2.4. Media & Entertainment

- 5.2.5. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 ALCATEL-LUCENT ENTERPRISE

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IBM Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Arista Networks Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Dell EMC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Cisco Systems Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Juniper Networks Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Extreme Networks Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 NEC Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Schneider Electric

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 VMware Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 ALCATEL-LUCENT ENTERPRISE

List of Figures

- Figure 1: China Data Center Networking Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: China Data Center Networking Market Share (%) by Company 2024

List of Tables

- Table 1: China Data Center Networking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: China Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 3: China Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 4: China Data Center Networking Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: China Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: China Data Center Networking Market Revenue Million Forecast, by Component 2019 & 2032

- Table 7: China Data Center Networking Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: China Data Center Networking Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Data Center Networking Market?

The projected CAGR is approximately 6.56%.

2. Which companies are prominent players in the China Data Center Networking Market?

Key companies in the market include ALCATEL-LUCENT ENTERPRISE, IBM Corporation, Arista Networks Inc, Dell EMC, Cisco Systems Inc, Juniper Networks Inc, Extreme Networks Inc, NEC Corporation, Schneider Electric, VMware Inc.

3. What are the main segments of the China Data Center Networking Market?

The market segments include Component, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Utilization of Cloud Storage is Driving the Market Growth; Rising Need for Backup and Storage is Expanding the Market Demand.

6. What are the notable trends driving market growth?

IT and Telecom to have significant market share.

7. Are there any restraints impacting market growth?

Lack of Skilled Professionals is Hindering the Market Demand.

8. Can you provide examples of recent developments in the market?

March 2023: Huawei's CloudEngine 16800, 8800, and 6800 series data center switches passed the security evaluation by SGS Brightsight and earned Common Criteria (CC) Evaluation Assurance Level 4 Augmented (EAL4+) for its products.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Data Center Networking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Data Center Networking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Data Center Networking Market?

To stay informed about further developments, trends, and reports in the China Data Center Networking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence