Key Insights

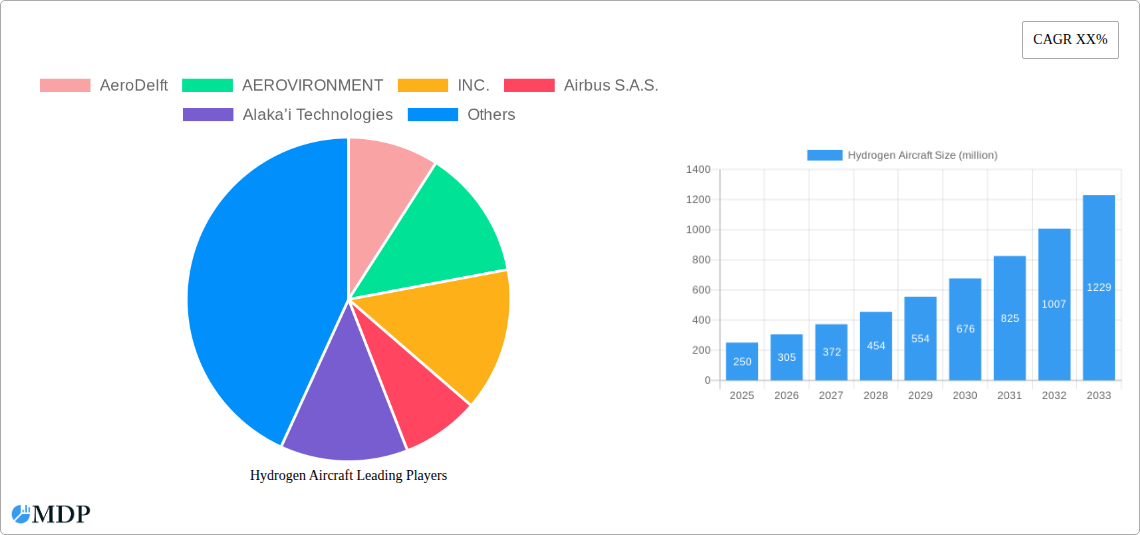

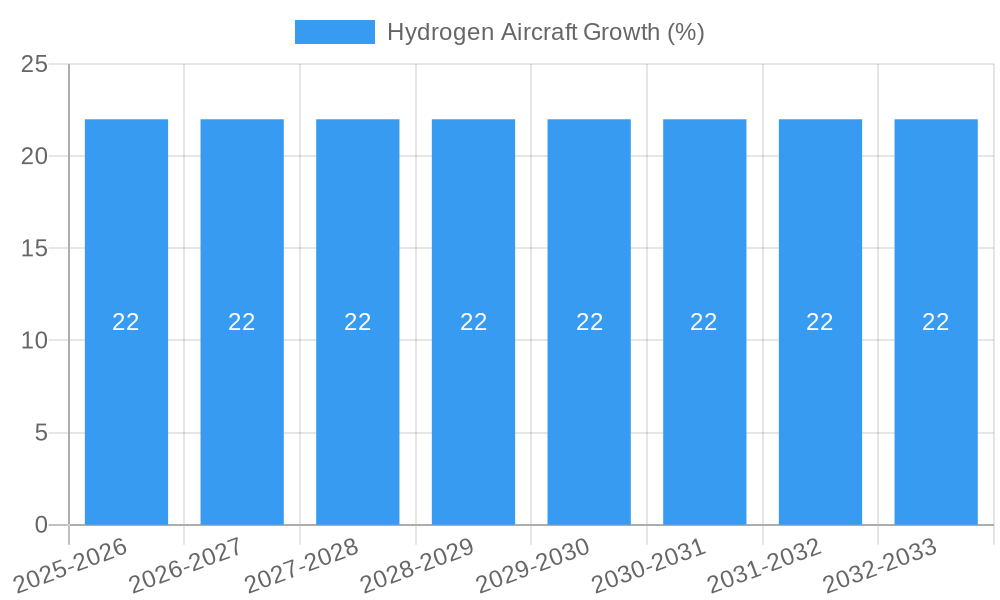

The Hydrogen Aircraft market is poised for significant expansion, driven by a critical need for sustainable aviation solutions to combat climate change. Valued at an estimated \$250 million in 2025, the market is projected to witness a robust Compound Annual Growth Rate (CAGR) of 22% from 2025 to 2033, reaching a substantial \$1.2 billion by the end of the forecast period. This rapid growth is primarily fueled by increasing government regulations and corporate commitments towards decarbonization, alongside advancements in hydrogen fuel cell technology and infrastructure development. Key applications are emerging in both passenger and cargo aircraft segments, with a particular focus on smaller aircraft categories (less than 100 seats) and specialized cargo operations, where the efficiency and range benefits of hydrogen power are most readily achievable in the near term. Emerging players are actively collaborating with established aviation giants to accelerate research, development, and certification processes, signaling a strong collaborative ecosystem within the industry.

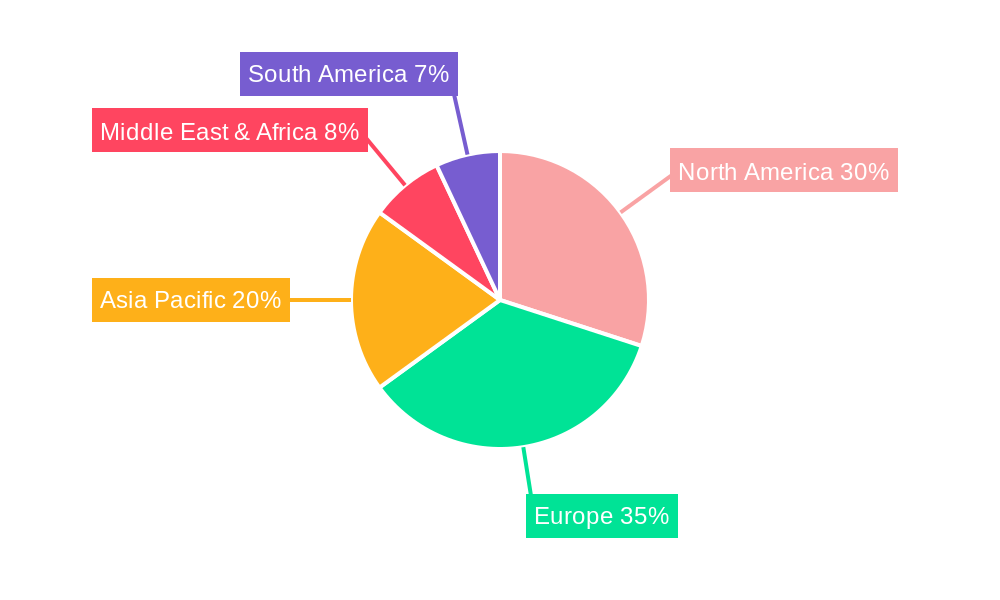

The market's trajectory is further bolstered by the inherent advantages of hydrogen, including zero-emission flight and potential for reduced operational costs once infrastructure matures. However, significant challenges remain. The primary restraints revolve around the substantial investment required for developing hydrogen production, storage, and refueling infrastructure at airports globally, as well as the lengthy and complex certification pathways for new aircraft technologies. Range and payload limitations for larger aircraft, coupled with public perception and safety concerns surrounding hydrogen use, also present hurdles. Despite these, the undeniable urgency for sustainable aviation is propelling innovation. Regions like North America and Europe are leading the charge due to strong governmental support and existing aerospace R&D capabilities, but significant growth is also anticipated in Asia Pacific as the region embraces green aviation initiatives and invests in advanced technologies. The market's segmentation by aircraft type indicates a phased adoption, with regional jets and smaller cargo planes likely to be the first beneficiaries of hydrogen propulsion.

Hydrogen Aircraft Market Report: Driving Sustainable Aviation Forward

This comprehensive report, "Hydrogen Aircraft Market Dynamics & Concentration," offers an in-depth analysis of the burgeoning hydrogen-powered aviation sector. Spanning the study period of 2019–2033, with a base and estimated year of 2025, and a forecast period from 2025–2033, this report delves into the critical forces shaping the future of sustainable air travel. We meticulously examine the market landscape, identifying key players, technological advancements, and the evolving regulatory environment. Gain actionable insights into market share, M&A activities, and the strategic imperatives for stakeholders navigating this transformative industry.

Hydrogen Aircraft Market Dynamics & Concentration

The hydrogen aircraft market is characterized by a dynamic interplay of innovation drivers, stringent regulatory frameworks, and the looming specter of product substitutes. While still nascent, concentration is gradually increasing as major aerospace giants and agile startups alike invest heavily in research and development. Leading the charge are companies like Airbus S.A.S., The Boeing Company, and ZeroAvia, Inc., alongside innovative players such as AeroDelft, Alaka’i Technologies, and Pipistrel d.o.o. The market share distribution is presently fragmented, with ZeroAvia, Inc. and Airbus S.A.S. emerging as significant contenders in specific sub-segments. Innovation drivers include the urgent need for decarbonization in aviation, government incentives for green technologies, and the inherent energy density advantages of hydrogen as a fuel source, albeit with infrastructure challenges. Regulatory bodies worldwide are actively developing standards and certifications for hydrogen-powered flight, crucial for market maturation. Product substitutes, such as sustainable aviation fuels (SAFs) and advanced battery technologies, pose a competitive threat, necessitating a clear value proposition for hydrogen aircraft. End-user trends are increasingly favoring environmentally conscious travel options, particularly among corporate clients and environmentally aware leisure travelers. Merger and acquisition (M&A) activities are projected to rise, with an estimated xx M&A deal count over the forecast period as larger entities seek to acquire specialized expertise and accelerate market entry.

Hydrogen Aircraft Industry Trends & Analysis

The hydrogen aircraft industry is poised for exponential growth, driven by a confluence of technological disruptions, escalating environmental concerns, and shifting consumer preferences. The global market is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033. This robust expansion is fueled by the urgent imperative to reduce the aviation industry's significant carbon footprint, a goal actively supported by international agreements and national climate policies. Technological disruptions are central to this growth trajectory. Companies are exploring various hydrogen propulsion architectures, including fuel cell-electric systems and direct combustion of hydrogen. ZeroAvia, Inc., with its focus on hydrogen-electric powertrains, and Airbus S.A.S., developing its ZEROe concept, are at the forefront of these innovations. The development of lightweight, efficient hydrogen storage solutions and the establishment of green hydrogen production infrastructure are critical enablers that will dictate the pace of market penetration. Consumer preferences are evolving rapidly, with an increasing demand for sustainable travel options. Airlines are recognizing this shift and are actively seeking to integrate zero-emission aircraft into their fleets to meet passenger expectations and regulatory mandates. Competitive dynamics are intensifying, with significant investments from established aerospace manufacturers and a surge of innovative startups like AeroDelft and Alaka'i Technologies. The competitive landscape is characterized by strategic partnerships aimed at co-developing critical technologies and securing supply chains. The market penetration of hydrogen aircraft is expected to accelerate as technological maturity increases and the cost of production decreases, driven by economies of scale and further innovation.

Leading Markets & Segments in Hydrogen Aircraft

The global hydrogen aircraft market is witnessing burgeoning growth across several key regions and segments, with a notable concentration of activity in Europe and North America. These regions are characterized by strong governmental support for green aviation initiatives, substantial investment in research and development, and a proactive approach to establishing hydrogen infrastructure.

Passenger Aircraft Segment Dominance

The Passenger Aircraft segment is projected to be a primary driver of hydrogen aircraft adoption. This dominance is underpinned by several key factors:

- Economic Policies and Incentives: Governments in Europe and North America are implementing generous subsidies, tax breaks, and grants specifically for the development and deployment of zero-emission aircraft. These policies aim to accelerate the transition away from fossil fuels and position these regions as leaders in the future of sustainable aviation.

- Infrastructure Development: Significant investments are being made in building hydrogen refueling infrastructure at major airports. This includes the development of production facilities for green hydrogen and the creation of robust distribution networks, crucial for supporting commercial passenger operations.

- Airline Commitments and Fleet Renewal: Major airlines are increasingly vocal about their sustainability goals and are actively exploring the integration of hydrogen-powered aircraft into their fleets. This proactive approach is driven by both regulatory pressures and the growing demand for eco-friendly travel options from the public.

- Technological Advancements in Fuel Cells and Storage: Breakthroughs in fuel cell technology and lightweight, safe hydrogen storage systems are making passenger aircraft applications increasingly viable. Companies like Airbus S.A.S. with their ZEROe program are showcasing concepts for hydrogen-powered passenger jets, ranging from regional to larger aircraft.

Aircraft Type Analysis

Within the passenger segment, initial adoption is expected to favor aircraft in the Less than 100 and 100-200 seat categories.

- Less than 100 Seats: These smaller aircraft are ideal for regional routes and are seen as a stepping stone for hydrogen technology. Their lower fuel requirements and shorter flight durations make them more manageable for early-stage deployment and infrastructure development. AeroDelft and Pipistrel d.o.o. are actively involved in developing hydrogen-powered aircraft in this category, focusing on innovative designs and testing methodologies.

- 100-200 Seats: As technology matures and infrastructure expands, the 100-200 seat category represents a significant market opportunity for medium-haul passenger transport. This segment offers a balance between passenger capacity and the current limitations of hydrogen range and refueling. ZeroAvia, Inc. is a key player here, focusing on retrofitting existing aircraft and developing new hydrogen-electric powertrains for this segment.

- More than 200 Seats: The More than 200 seat category, particularly for long-haul flights, presents the most significant technological challenges due to higher energy demands and the need for extensive hydrogen storage. However, ambitious projects by Airbus S.A.S. and The Boeing Company are actively pursuing solutions for this segment, signaling long-term potential.

Cargo Aircraft Segment Growth

The Cargo Aircraft segment also presents substantial opportunities for hydrogen aircraft. The efficiency gains and reduced operational costs associated with hydrogen propulsion are particularly attractive for cargo operations, which often involve longer flight times and a greater focus on payload capacity. The development of specialized hydrogen cargo aircraft and the retrofitting of existing cargo planes are key trends to watch.

Hydrogen Aircraft Product Developments

The hydrogen aircraft sector is characterized by rapid product innovation, driven by the pursuit of zero-emission flight. Key developments include advancements in hydrogen fuel cell technology, enabling efficient energy conversion for electric propulsion. Companies like ZeroAvia, Inc. are pioneering hybrid-hydrogen electric powertrain systems, offering retrofittable solutions for existing aircraft and new designs for regional jets. AeroDelft is actively developing a proof-of-concept hydrogen-powered aircraft to demonstrate the feasibility of its technology. Airbus S.A.S. is investing heavily in its ZEROe program, exploring various hydrogen-powered aircraft concepts for different market segments, including passenger and cargo applications. The competitive advantages lie in the significant reduction of greenhouse gas emissions, lower noise pollution, and the potential for reduced operational costs once green hydrogen production scales up. The market fit is primarily for regional aviation and short-to-medium haul passenger and cargo flights initially, with ambitions for larger aircraft in the longer term.

Key Drivers of Hydrogen Aircraft Growth

The growth of the hydrogen aircraft market is propelled by a powerful combination of factors. Firstly, the global imperative for decarbonization and stringent environmental regulations are mandating a shift towards sustainable aviation fuels and propulsion systems. Secondly, technological advancements in fuel cell efficiency, hydrogen storage, and lightweight materials are making hydrogen-powered flight increasingly feasible and economically viable. Thirdly, government incentives and substantial R&D funding in key regions like Europe and North America are accelerating innovation and de-risking investments for aerospace companies and startups. The development of green hydrogen production infrastructure, fueled by renewable energy sources, is a critical enabler for widespread adoption, making hydrogen a truly sustainable fuel.

Challenges in the Hydrogen Aircraft Market

Despite the promising outlook, the hydrogen aircraft market faces significant hurdles. Regulatory uncertainty and the lack of standardized certification processes for hydrogen-powered aircraft pose a considerable barrier to entry and adoption. The significant upfront investment required for developing new aircraft designs and retrofitting existing fleets is a major financial challenge for many companies. Furthermore, the establishment of a comprehensive and scalable green hydrogen production and distribution infrastructure at airports worldwide is a complex and costly undertaking, impacting operational feasibility and refueling times. Finally, concerns regarding the safety of hydrogen storage and handling within aircraft, although being addressed through rigorous research, require continued public and industry confidence building.

Emerging Opportunities in Hydrogen Aircraft

The hydrogen aircraft market is ripe with emerging opportunities that will fuel its long-term growth. Technological breakthroughs in solid-state hydrogen storage and advanced fuel cell designs promise to enhance aircraft range and efficiency, making hydrogen a more competitive option for longer flights. Strategic partnerships between aircraft manufacturers, hydrogen producers, and infrastructure developers are crucial for building the necessary ecosystem and accelerating market penetration. The expansion of regional aviation routes using smaller hydrogen-powered aircraft represents a significant near-term market opportunity. Moreover, the growing demand for cargo transport with reduced environmental impact opens up new avenues for hydrogen-powered freighter aircraft, potentially offering cost savings and a competitive edge for logistics companies.

Leading Players in the Hydrogen Aircraft Sector

- AeroDelft

- AEROVIRONMENT,INC.

- Airbus S.A.S.

- Alaka’i Technologies

- HES Energy Systems

- Pipistrel d.o.o.

- PJSC Tupolev

- The Boeing Company

- Urban Aeronautics Ltd

- ZeroAvia,Inc.

Key Milestones in Hydrogen Aircraft Industry

- 2019: Increased research and development funding for hydrogen aviation from governments and private entities.

- 2020: ZeroAvia, Inc. announces successful flight of its hydrogen-electric aircraft prototype, marking a significant step for hydrogen-electric propulsion.

- 2021: Airbus S.A.S. unveils its ZEROe concept, showcasing three distinct zero-emission aircraft designs powered by hydrogen.

- 2022: AeroDelft begins construction of its full-scale hydrogen-powered aircraft prototype.

- 2023: European Union announces ambitious targets for hydrogen adoption in aviation through various green deal initiatives.

- 2024: Alaka’i Technologies continues development and testing of its hydrogen-powered eVTOL technology.

- 2025 (Estimated): First successful demonstration flights of larger hydrogen-powered regional aircraft concepts are anticipated.

- 2026 onwards: Potential for early-stage certification and deployment of hydrogen-powered aircraft for specific commercial applications, particularly in cargo and regional passenger segments.

Strategic Outlook for Hydrogen Aircraft Market

The strategic outlook for the hydrogen aircraft market is exceptionally positive, driven by an accelerating global commitment to sustainable aviation. Growth accelerators include substantial investments in research and development, supportive regulatory frameworks, and the continuous refinement of hydrogen fuel cell and storage technologies. The market is projected to witness increasing collaboration between established aerospace giants and agile startups, fostering rapid innovation and market entry. Early adoption in regional and cargo aviation segments will pave the way for broader implementation across passenger fleets. The long-term potential is immense, with hydrogen poised to become a cornerstone of future zero-emission air travel.

Hydrogen Aircraft Segmentation

-

1. Application

- 1.1. Passenger Aircraft

- 1.2. Cargo Aircraft

-

2. Types

- 2.1. Less than 100

- 2.2. 100-200

- 2.3. More than 200

Hydrogen Aircraft Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hydrogen Aircraft REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hydrogen Aircraft Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Passenger Aircraft

- 5.1.2. Cargo Aircraft

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Less than 100

- 5.2.2. 100-200

- 5.2.3. More than 200

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Hydrogen Aircraft Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Passenger Aircraft

- 6.1.2. Cargo Aircraft

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Less than 100

- 6.2.2. 100-200

- 6.2.3. More than 200

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Hydrogen Aircraft Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Passenger Aircraft

- 7.1.2. Cargo Aircraft

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Less than 100

- 7.2.2. 100-200

- 7.2.3. More than 200

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Hydrogen Aircraft Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Passenger Aircraft

- 8.1.2. Cargo Aircraft

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Less than 100

- 8.2.2. 100-200

- 8.2.3. More than 200

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Hydrogen Aircraft Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Passenger Aircraft

- 9.1.2. Cargo Aircraft

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Less than 100

- 9.2.2. 100-200

- 9.2.3. More than 200

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Hydrogen Aircraft Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Passenger Aircraft

- 10.1.2. Cargo Aircraft

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Less than 100

- 10.2.2. 100-200

- 10.2.3. More than 200

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 AeroDelft

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 AEROVIRONMENT

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 INC.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Airbus S.A.S.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Alaka’i Technologies

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 HES Energy Systems

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Pipistrel d.o.o

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 PJSC Tupolev

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The Boeing Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Urban Aeronautics Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ZeroAvia

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Inc.

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 AeroDelft

List of Figures

- Figure 1: Global Hydrogen Aircraft Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Hydrogen Aircraft Revenue (million), by Application 2024 & 2032

- Figure 3: North America Hydrogen Aircraft Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Hydrogen Aircraft Revenue (million), by Types 2024 & 2032

- Figure 5: North America Hydrogen Aircraft Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Hydrogen Aircraft Revenue (million), by Country 2024 & 2032

- Figure 7: North America Hydrogen Aircraft Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Hydrogen Aircraft Revenue (million), by Application 2024 & 2032

- Figure 9: South America Hydrogen Aircraft Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Hydrogen Aircraft Revenue (million), by Types 2024 & 2032

- Figure 11: South America Hydrogen Aircraft Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Hydrogen Aircraft Revenue (million), by Country 2024 & 2032

- Figure 13: South America Hydrogen Aircraft Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Hydrogen Aircraft Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Hydrogen Aircraft Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Hydrogen Aircraft Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Hydrogen Aircraft Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Hydrogen Aircraft Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Hydrogen Aircraft Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Hydrogen Aircraft Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Hydrogen Aircraft Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Hydrogen Aircraft Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Hydrogen Aircraft Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Hydrogen Aircraft Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Hydrogen Aircraft Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Hydrogen Aircraft Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Hydrogen Aircraft Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Hydrogen Aircraft Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Hydrogen Aircraft Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Hydrogen Aircraft Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Hydrogen Aircraft Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hydrogen Aircraft Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Hydrogen Aircraft Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Hydrogen Aircraft Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Hydrogen Aircraft Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Hydrogen Aircraft Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Hydrogen Aircraft Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Hydrogen Aircraft Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Hydrogen Aircraft Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Hydrogen Aircraft Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Hydrogen Aircraft Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Hydrogen Aircraft Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Hydrogen Aircraft Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Hydrogen Aircraft Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Hydrogen Aircraft Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Hydrogen Aircraft Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Hydrogen Aircraft Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Hydrogen Aircraft Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Hydrogen Aircraft Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Hydrogen Aircraft Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Hydrogen Aircraft Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hydrogen Aircraft?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Hydrogen Aircraft?

Key companies in the market include AeroDelft, AEROVIRONMENT, INC., Airbus S.A.S., Alaka’i Technologies, HES Energy Systems, Pipistrel d.o.o, PJSC Tupolev, The Boeing Company, Urban Aeronautics Ltd, ZeroAvia, Inc..

3. What are the main segments of the Hydrogen Aircraft?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hydrogen Aircraft," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hydrogen Aircraft report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hydrogen Aircraft?

To stay informed about further developments, trends, and reports in the Hydrogen Aircraft, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence