Key Insights

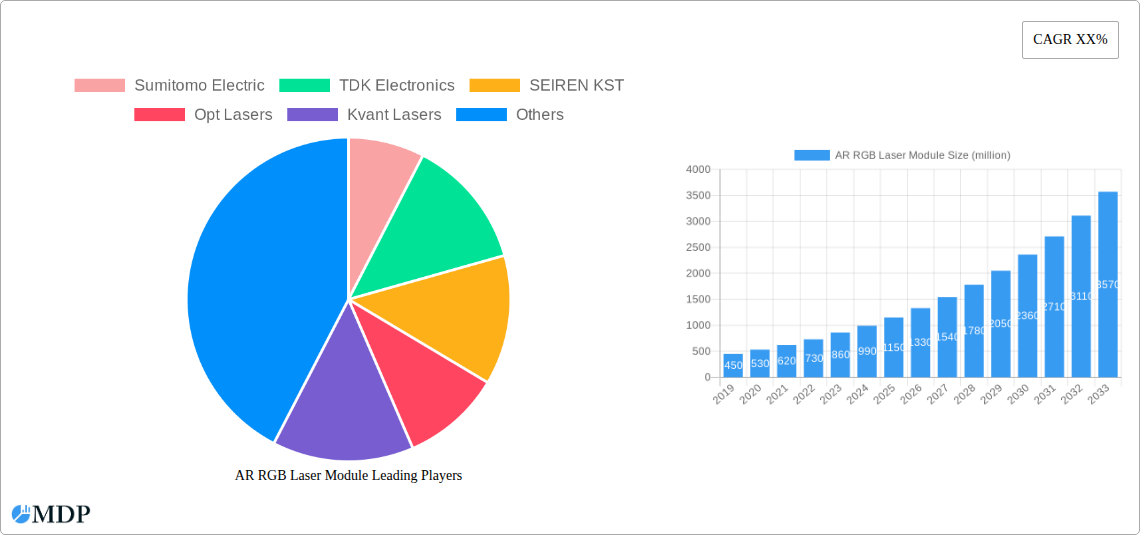

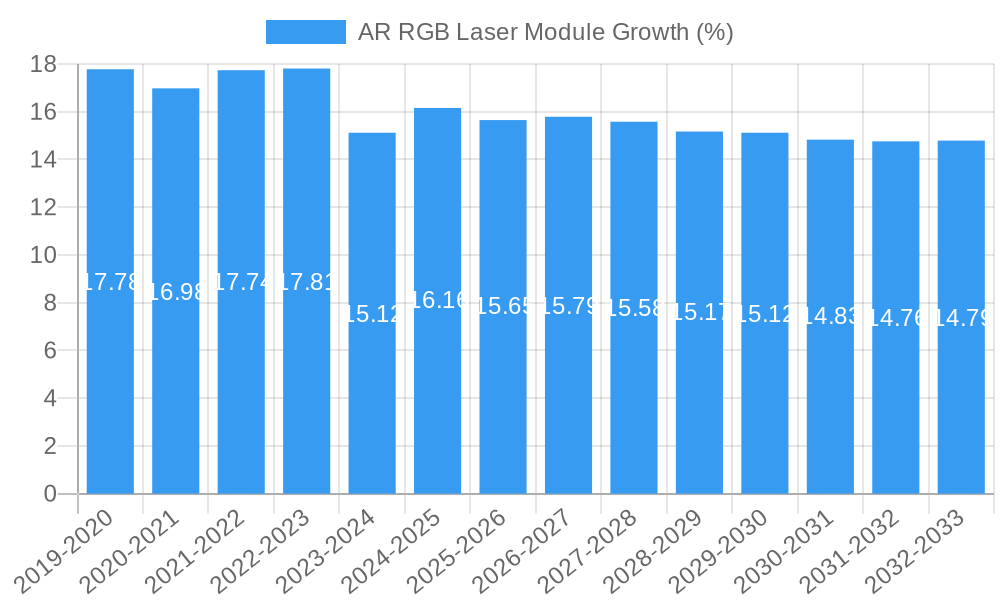

The AR RGB laser module market is experiencing robust expansion, projected to reach a valuation of approximately $1.5 billion by 2025, with a compelling compound annual growth rate (CAGR) of around 18-20% anticipated through 2033. This significant growth is primarily fueled by the escalating demand for immersive augmented reality (AR) and virtual reality (VR) experiences across consumer electronics, gaming, and enterprise applications. The miniaturization and enhanced performance of RGB laser modules are critical enablers for the development of lighter, more compact, and visually superior AR/VR glasses. Furthermore, advancements in laser projection technology for applications beyond AR/VR, such as industrial marking, medical devices, and advanced displays, are contributing to market momentum. The market’s trajectory is also positively influenced by increasing investments in AR/VR research and development and the growing adoption of these technologies in various sectors, driving the need for high-quality, high-brightness laser sources.

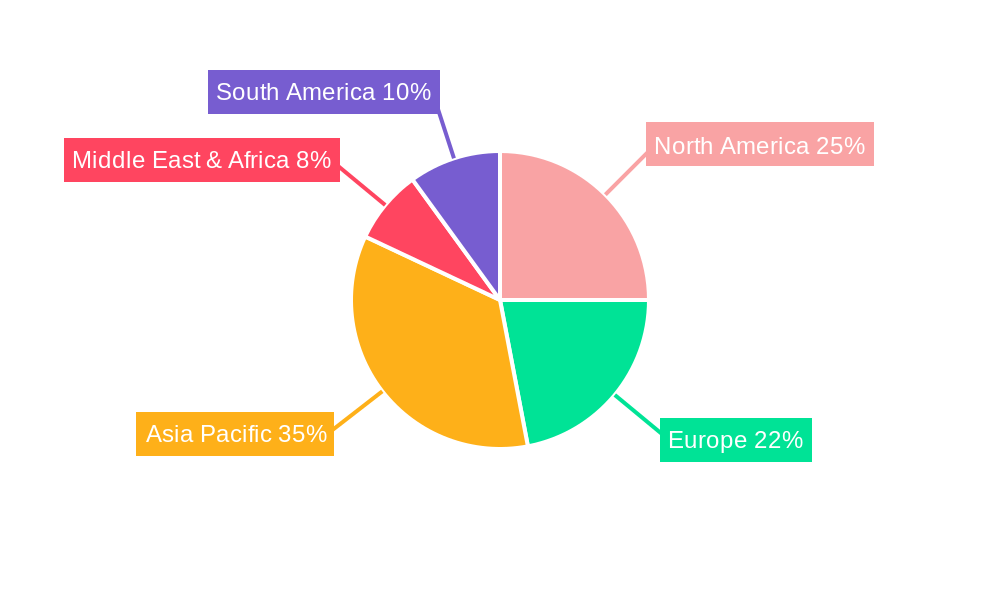

However, certain factors present potential headwinds. The high cost associated with cutting-edge AR RGB laser modules and the need for sophisticated manufacturing processes could pose a restraint to widespread adoption, particularly in price-sensitive markets. Furthermore, the development of alternative display technologies and potential regulatory hurdles related to laser safety standards may influence market dynamics. Despite these challenges, the pervasive integration of AR into everyday life and the continuous innovation in laser technology are expected to overcome these limitations. The market is segmented by application, with AR/VR glasses commanding a significant share, and by type, with modules exceeding 10W likely to see increasing demand for high-performance applications. Geographically, Asia Pacific, led by China and Japan, is poised to dominate, driven by its robust electronics manufacturing base and rapid technological adoption. North America and Europe are also significant contributors, propelled by strong R&D capabilities and the early adoption of advanced technologies.

Unleashing Immersive Realities: A Comprehensive Analysis of the AR RGB Laser Module Market (2019–2033)

Dive deep into the dynamic world of Augmented Reality (AR) and experience the future of visual technology with this in-depth report on the AR RGB Laser Module market. This comprehensive analysis provides actionable insights for industry stakeholders, from manufacturers and suppliers to investors and AR/VR developers. Covering the historical period of 2019-2024, the base and estimated year of 2025, and projecting through 2033, this report offers a detailed roadmap of market trends, leading players, and future opportunities. We meticulously examine key segments, including applications like AR/VR Glasses and Laser Projectors, and power types such as Below 5W, 5W to 10W, and Above 10W, utilizing a million-unit scale for all quantifiable data.

AR RGB Laser Module Market Dynamics & Concentration

The AR RGB Laser Module market is characterized by a moderate concentration, with key players like Sumitomo Electric, TDK Electronics, and SEIREN KST holding significant market share in specific sub-segments. Innovation drivers are primarily fueled by the burgeoning demand for higher resolution, improved energy efficiency, and miniaturization for widespread AR/VR adoption. Regulatory frameworks are gradually evolving to address safety standards for laser projection in consumer devices, influencing product design and adoption rates. Product substitutes, such as micro-LED displays, pose a competitive threat, but AR RGB laser modules maintain an advantage in brightness, color accuracy, and power efficiency for certain high-performance applications. End-user trends are strongly skewed towards immersive gaming, professional training simulations, and advanced industrial visualization, driving demand for robust and high-fidelity AR experiences. Mergers and acquisitions (M&A) activities, though not yet at a fever pitch, are anticipated to increase as larger electronics conglomerates seek to integrate advanced laser projection capabilities into their AR ecosystems. Anticipated M&A deal counts are projected to reach approximately 15-20 significant transactions within the forecast period, signaling consolidation and strategic alignment.

AR RGB Laser Module Industry Trends & Analysis

The AR RGB Laser Module industry is poised for robust growth, propelled by escalating demand for immersive visual experiences across various sectors. The market is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 18.5% during the forecast period, with market penetration expected to reach a significant milestone of over 25 million units by 2033. This growth is fundamentally driven by rapid advancements in AR/VR technology, including the development of lighter, more comfortable headsets and the increasing availability of compelling AR content. Technological disruptions, such as the integration of advanced laser driver ICs and miniaturized optical components, are enabling the creation of more compact and power-efficient AR RGB laser modules, thereby expanding their applicability. Consumer preferences are increasingly shifting towards enhanced realism and interactive digital overlays in entertainment, gaming, and everyday applications, directly fueling the demand for high-performance AR displays. The competitive landscape is dynamic, with established players investing heavily in R&D to differentiate their offerings, while new entrants are emerging with innovative solutions, particularly in niche markets. The increasing adoption of laser projection in industrial settings for augmented maintenance, remote assistance, and design visualization also represents a significant growth avenue, contributing to the overall market expansion. The integration of AI in AR systems, enabling more intelligent and context-aware visual information, will further stimulate the demand for sophisticated laser modules capable of delivering precise and dynamic imagery.

Leading Markets & Segments in AR RGB Laser Module

The AR/VR Glasses segment is undeniably the dominant force within the AR RGB Laser Module market, driven by the burgeoning consumer electronics industry and the increasing adoption of mixed reality devices for entertainment, gaming, and productivity. By 2033, this segment is projected to account for over 70% of the total market volume, representing hundreds of millions of units. Within the AR/VR Glasses application, the demand is primarily concentrated on modules with power outputs Below 5W, as manufacturers prioritize ultra-low power consumption and miniaturization for wearable devices. This sub-segment alone is anticipated to contribute approximately 55% of the total market volume. However, a substantial growth trajectory is also observed for modules in the 5W to 10W range, catering to more advanced AR headsets and specialized professional-grade devices requiring higher brightness and field of view.

In terms of regional dominance, North America and Asia Pacific are leading the charge, collectively holding over 60% of the market share. North America's dominance is fueled by its mature AR/VR ecosystem, significant consumer spending on high-tech gadgets, and strong investment in research and development by major tech companies. Key drivers here include government initiatives supporting technological innovation and robust venture capital funding for AR startups. Asia Pacific, on the other hand, is experiencing rapid growth due to its massive consumer base, expanding manufacturing capabilities for electronic components, and increasing disposable income, leading to a surge in demand for consumer electronics, including AR/VR devices.

The Laser Projector segment, while currently smaller than AR/VR Glasses, is exhibiting impressive growth, particularly in niche applications like interactive signage, portable entertainment devices, and scientific visualization. This segment is expected to grow at a CAGR of over 20% and will likely capture around 20% of the market by 2033, with a notable demand for 5W to 10W and Above 10W modules for enhanced brightness and projection capabilities. The Others segment, encompassing a diverse range of applications like automotive heads-up displays, medical imaging, and industrial inspection systems, is also a significant contributor, expected to account for the remaining 10% of the market share. Within this segment, a balanced demand exists across all power types, driven by specific performance requirements of each application.

AR RGB Laser Module Product Developments

Product development in the AR RGB Laser Module sector is rapidly advancing, focusing on enhancing key performance metrics such as brightness, color gamut, energy efficiency, and miniaturization. Innovations include the integration of advanced GaN-based laser diodes for superior optical power and spectral purity, enabling more vivid and lifelike AR experiences. Developments in optical engine design are leading to smaller form factors, crucial for seamless integration into sleek AR/VR headsets and wearable devices. Furthermore, enhanced thermal management solutions are being implemented to ensure reliable operation and extended lifespan, even under demanding conditions. The competitive advantage lies in offering modules that achieve a wider color spectrum (closer to Rec.2020), higher contrast ratios, and lower power consumption per lumen, directly addressing the critical needs of immersive AR applications and positioning manufacturers at the forefront of this evolving technology.

Key Drivers of AR RGB Laser Module Growth

The exponential growth of the AR RGB Laser Module market is driven by a confluence of factors. Technologically, the relentless pursuit of higher resolution displays, brighter projections, and wider color gamuts in AR/VR devices directly fuels demand. Advancements in semiconductor manufacturing, particularly in GaN-based laser diode technology, are enabling more efficient and compact modules. Economically, the expanding consumer electronics market, coupled with increasing disposable incomes globally, makes advanced AR devices more accessible. Government initiatives and industry investments in R&D for immersive technologies also play a crucial role. Regulatory frameworks promoting laser safety standards, when clearly defined, can also stimulate market growth by providing a stable environment for innovation and consumer trust. The growing investment in enterprise AR solutions for training, remote assistance, and design further accelerates adoption.

Challenges in the AR RGB Laser Module Market

Despite its promising growth, the AR RGB Laser Module market faces several challenges. Regulatory hurdles concerning eye safety standards for laser projection in consumer devices can slow down product adoption and necessitate costly compliance measures. Supply chain issues, particularly for specialized laser diode components and advanced optical elements, can lead to production delays and increased costs. Intense competitive pressures from alternative display technologies, such as micro-LED and high-brightness LCDs, require continuous innovation and cost optimization. Furthermore, the high initial cost of advanced AR RGB laser modules can be a barrier for widespread consumer adoption in price-sensitive markets. The complexity of integrating these modules into consumer-ready AR devices also presents a technical challenge for some manufacturers, impacting the pace of market penetration.

Emerging Opportunities in AR RGB Laser Module

Emerging opportunities within the AR RGB Laser Module market are largely catalyzed by technological breakthroughs and strategic market expansion. The development of ultra-compact, high-brightness modules for standalone AR glasses represents a significant growth avenue, moving beyond tethered devices. Strategic partnerships between laser module manufacturers and leading AR/VR headset developers are crucial for co-creation and faster time-to-market. The expansion into industrial metaverse applications, including digital twins, predictive maintenance, and enhanced worker safety, presents a substantial long-term growth catalyst. Furthermore, the increasing demand for AR solutions in sectors like education, healthcare, and automotive infotainment offers diversification and new revenue streams. Innovations in adaptive laser projection, capable of adjusting to ambient light conditions and user focus, will further unlock new use cases.

Leading Players in the AR RGB Laser Module Sector

- Sumitomo Electric

- TDK Electronics

- SEIREN KST

- Opt Lasers

- Kvant Lasers

- Elite Optoelectronics

- RGB Laser Systems

- SwissLas

- TriLite

Key Milestones in AR RGB Laser Module Industry

- 2019: Introduction of miniaturized GaN-based RGB laser diodes enabling smaller AR module designs.

- 2020: First commercial AR/VR headsets featuring integrated RGB laser projection systems launched, driving early market adoption.

- 2021: Significant advancements in laser driver ICs leading to improved power efficiency in AR modules.

- 2022: Increased investment in AR technologies by major tech giants, signaling market confidence and accelerating R&D efforts.

- 2023: Emergence of compact laser projection solutions for enterprise AR applications, expanding beyond consumer devices.

- 2024: Development of advanced optical engines for wider field-of-view AR experiences using RGB laser modules.

- 2025 (Estimated): Expected standardization of certain eye safety regulations for AR laser modules, facilitating broader market acceptance.

- 2026: Anticipated commercialization of next-generation AR modules with significantly enhanced color accuracy and brightness.

- 2028: Projection of substantial growth in industrial metaverse adoption, creating demand for robust AR laser solutions.

- 2030: Expected widespread integration of AR RGB laser modules in advanced automotive heads-up displays.

- 2033: Market penetration of AR RGB laser modules reaching over 25 million units annually.

Strategic Outlook for AR RGB Laser Module Market

The strategic outlook for the AR RGB Laser Module market is overwhelmingly positive, driven by continuous technological innovation and expanding application frontiers. Growth accelerators include the increasing demand for high-fidelity visual experiences in both consumer and enterprise sectors, the ongoing miniaturization and efficiency improvements of laser modules, and the growing adoption of AR in industrial metaverse and professional training. Strategic opportunities lie in forging deeper collaborations with AR/VR hardware manufacturers to co-develop next-generation displays, focusing on niche markets with specific performance requirements, and leveraging advancements in AI to enhance AR functionality powered by these laser modules. The market is set to witness sustained growth, propelled by the fundamental shift towards an augmented digital future.

AR RGB Laser Module Segmentation

-

1. Application

- 1.1. AR/VR Glasses

- 1.2. Laser Projector

- 1.3. Others

-

2. Types

- 2.1. Below 5W

- 2.2. 5W to 10W

- 2.3. Above 10W

AR RGB Laser Module Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

AR RGB Laser Module REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global AR RGB Laser Module Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. AR/VR Glasses

- 5.1.2. Laser Projector

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Below 5W

- 5.2.2. 5W to 10W

- 5.2.3. Above 10W

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America AR RGB Laser Module Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. AR/VR Glasses

- 6.1.2. Laser Projector

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Below 5W

- 6.2.2. 5W to 10W

- 6.2.3. Above 10W

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America AR RGB Laser Module Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. AR/VR Glasses

- 7.1.2. Laser Projector

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Below 5W

- 7.2.2. 5W to 10W

- 7.2.3. Above 10W

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe AR RGB Laser Module Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. AR/VR Glasses

- 8.1.2. Laser Projector

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Below 5W

- 8.2.2. 5W to 10W

- 8.2.3. Above 10W

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa AR RGB Laser Module Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. AR/VR Glasses

- 9.1.2. Laser Projector

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Below 5W

- 9.2.2. 5W to 10W

- 9.2.3. Above 10W

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific AR RGB Laser Module Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. AR/VR Glasses

- 10.1.2. Laser Projector

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Below 5W

- 10.2.2. 5W to 10W

- 10.2.3. Above 10W

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Sumitomo Electric

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TDK Electronics

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 SEIREN KST

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Opt Lasers

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Kvant Lasers

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Elite Optoelectronics

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RGB Laser Systems

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 SwissLas

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 TriLite

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 Sumitomo Electric

List of Figures

- Figure 1: Global AR RGB Laser Module Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America AR RGB Laser Module Revenue (million), by Application 2024 & 2032

- Figure 3: North America AR RGB Laser Module Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America AR RGB Laser Module Revenue (million), by Types 2024 & 2032

- Figure 5: North America AR RGB Laser Module Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America AR RGB Laser Module Revenue (million), by Country 2024 & 2032

- Figure 7: North America AR RGB Laser Module Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America AR RGB Laser Module Revenue (million), by Application 2024 & 2032

- Figure 9: South America AR RGB Laser Module Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America AR RGB Laser Module Revenue (million), by Types 2024 & 2032

- Figure 11: South America AR RGB Laser Module Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America AR RGB Laser Module Revenue (million), by Country 2024 & 2032

- Figure 13: South America AR RGB Laser Module Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe AR RGB Laser Module Revenue (million), by Application 2024 & 2032

- Figure 15: Europe AR RGB Laser Module Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe AR RGB Laser Module Revenue (million), by Types 2024 & 2032

- Figure 17: Europe AR RGB Laser Module Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe AR RGB Laser Module Revenue (million), by Country 2024 & 2032

- Figure 19: Europe AR RGB Laser Module Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa AR RGB Laser Module Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa AR RGB Laser Module Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa AR RGB Laser Module Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa AR RGB Laser Module Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa AR RGB Laser Module Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa AR RGB Laser Module Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific AR RGB Laser Module Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific AR RGB Laser Module Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific AR RGB Laser Module Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific AR RGB Laser Module Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific AR RGB Laser Module Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific AR RGB Laser Module Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global AR RGB Laser Module Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global AR RGB Laser Module Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global AR RGB Laser Module Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global AR RGB Laser Module Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global AR RGB Laser Module Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global AR RGB Laser Module Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global AR RGB Laser Module Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global AR RGB Laser Module Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global AR RGB Laser Module Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global AR RGB Laser Module Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global AR RGB Laser Module Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global AR RGB Laser Module Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global AR RGB Laser Module Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global AR RGB Laser Module Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global AR RGB Laser Module Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global AR RGB Laser Module Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global AR RGB Laser Module Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global AR RGB Laser Module Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global AR RGB Laser Module Revenue million Forecast, by Country 2019 & 2032

- Table 41: China AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific AR RGB Laser Module Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the AR RGB Laser Module?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the AR RGB Laser Module?

Key companies in the market include Sumitomo Electric, TDK Electronics, SEIREN KST, Opt Lasers, Kvant Lasers, Elite Optoelectronics, RGB Laser Systems, SwissLas, TriLite.

3. What are the main segments of the AR RGB Laser Module?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "AR RGB Laser Module," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the AR RGB Laser Module report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the AR RGB Laser Module?

To stay informed about further developments, trends, and reports in the AR RGB Laser Module, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence