Key Insights

The UK hedge fund industry presents a compelling investment landscape, characterized by significant market size and robust growth projections. With a projected Compound Annual Growth Rate (CAGR) of 10.48%, the market is estimated to reach $12.13 billion by 2025, with continued expansion anticipated through 2033. Key growth drivers include escalating institutional investor demand for enhanced returns, the adoption of sophisticated investment strategies adept at navigating market volatility, and a stable regulatory environment fostering investor confidence. Emerging trends encompass the proliferation of alternative strategies such as quantitative and long/short equity, increased integration of technology for advanced risk management and portfolio optimization, and a growing emphasis on Environmental, Social, and Governance (ESG) principles in investment decisions. Despite these positive indicators, the industry faces challenges including heightened regulatory oversight, ongoing geopolitical uncertainties affecting global markets, and intense competition from both established and emerging participants. The market is segmented by diverse strategies and mandates, with leading firms including Capula Investment Management, Man Group, and Brevan Howard Asset Management.

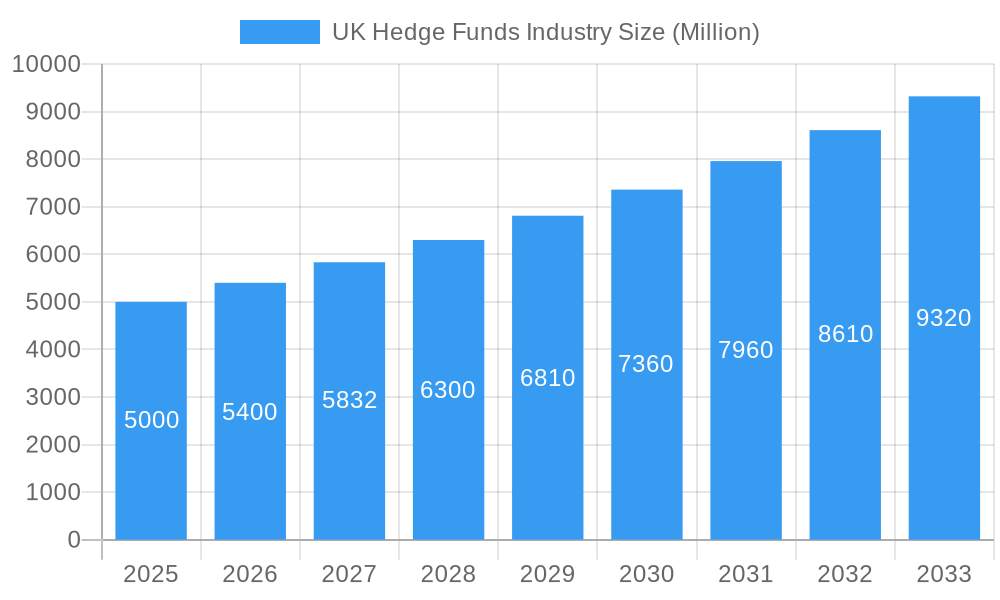

UK Hedge Funds Industry Market Size (In Billion)

The forecast period from 2025 to 2033 indicates sustained industry growth, contingent upon macroeconomic conditions and investor sentiment. The competitive success of individual firms will hinge on their adaptability to market dynamics, talent acquisition and retention, strategic innovation, and the maintenance of robust performance and risk management reputations. While regional data was not provided, it would offer crucial insights into geographic market distribution and potential growth areas. The historical period from 2019 to 2024 provides essential context for understanding the industry's trajectory and informs future market predictions.

UK Hedge Funds Industry Company Market Share

UK Hedge Funds Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the UK hedge funds industry, covering market dynamics, leading players, emerging trends, and future growth prospects. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report offers actionable insights for industry stakeholders, investors, and professionals seeking to navigate this dynamic sector. The report leverages extensive data analysis and incorporates key industry developments to deliver a precise and insightful overview of the UK hedge fund landscape. The total market value in 2025 is estimated at £xx Million.

UK Hedge Funds Industry Market Dynamics & Concentration

The UK hedge fund industry exhibits a high degree of concentration, with a few large players commanding significant market share. Market concentration is influenced by regulatory frameworks, including AIFMD (Alternative Investment Fund Managers Directive), which impacts fund structuring and operational compliance. Innovation drivers within the sector include the adoption of advanced technologies like AI and machine learning for portfolio management and risk assessment, leading to increased efficiency and potentially higher returns. Product substitutes, such as actively managed mutual funds, pose a competitive challenge. However, the unique strategies and potential for higher returns offered by hedge funds maintain their appeal to sophisticated investors. End-user trends indicate a growing demand for alternative investment strategies, particularly among institutional investors seeking diversification and enhanced risk-adjusted returns. M&A activity within the industry has been moderate in recent years, with xx deals recorded between 2019 and 2024. This suggests a trend towards consolidation among larger firms, further impacting market concentration.

- Market Share: Top 5 firms hold approximately xx% of the market.

- M&A Deal Count (2019-2024): xx

- Regulatory Framework: AIFMD, FCA regulations.

- Innovation Drivers: AI, Machine Learning, alternative data sources.

UK Hedge Funds Industry Industry Trends & Analysis

The UK hedge fund industry is undergoing a dynamic period characterized by moderate but sustained growth, propelled by a confluence of influential factors. The Compound Annual Growth Rate (CAGR) is anticipated to reach XX% between 2025 and 2033, signaling a robust and consistent expansion in the overall market valuation. Technological advancements are proving to be a significant transformative force, fundamentally altering investment methodologies, portfolio oversight, and the nuances of risk assessment. This evolution is particularly evident in the burgeoning utilization of sophisticated quantitative models, the pervasive integration of big data analytics for deeper insights, and the increasing reliance on algorithmic trading for enhanced efficiency and precision. Investor preferences are demonstrably shifting towards strategies that consistently generate alpha and deliver absolute returns, moving beyond a sole dependence on market beta. The competitive arena remains fiercely contested, compelling firms to continually seek differentiation through proprietary strategies, cutting-edge technological adoption, and superior risk management frameworks. The market penetration of alternative investments continues to expand, as high-net-worth individuals and institutional investors increasingly recognize their value in constructing diversified and resilient investment portfolios.

Leading Markets & Segments in UK Hedge Funds Industry

London remains the dominant hub for hedge fund activity in the UK, attracting a significant portion of global investment. This dominance is driven by several key factors:

- Economic Policies: Supportive regulatory environment, access to capital markets, and a highly skilled workforce.

- Infrastructure: Developed financial infrastructure, sophisticated legal framework, and well-established investor networks.

- Talent Pool: Large pool of experienced professionals and access to top-tier educational institutions.

The analysis shows that London’s strong position is unlikely to be challenged in the foreseeable future due to its established ecosystem and network effects.

UK Hedge Funds Industry Product Developments

Recent groundbreaking product innovations within the UK hedge fund sector are spearheaded by the widespread adoption of advanced quantitative strategies, the strategic integration of alternative data sources into the fabric of investment decision-making, and the bespoke development of specialized investment products meticulously designed to cater to niche market segments. These forward-thinking innovations are strategically aimed at not only augmenting portfolio returns but also at fortifying risk management protocols and assiduously addressing the ever-evolving demands of sophisticated investors. The key to achieving a sustainable competitive advantage lies in the adept leverage of cutting-edge technology and sophisticated data analytics to pinpoint undervalued assets and consistently deliver exceptional investment outcomes.

Key Drivers of UK Hedge Funds Industry Growth

Several factors contribute to the projected growth of the UK hedge funds industry. Technological advancements in data analytics and artificial intelligence are enabling more sophisticated investment strategies and improved risk management. Favorable economic conditions, particularly robust growth in global markets, provide a conducive environment for hedge fund activity. Lastly, the ongoing evolution of the regulatory environment, while presenting challenges, also offers opportunities for innovation and growth.

Challenges in the UK Hedge Funds Industry Market

The UK hedge fund industry is navigating a complex landscape fraught with significant challenges. Heightened regulatory scrutiny and the ever-increasing burden of compliance costs present a substantial obstacle for numerous firms. The competitive environment is characterized by an extreme level of intensity, with established players and agile new entrants vigorously vying for market share. Furthermore, prevailing geopolitical and macroeconomic uncertainties, including the long-term ramifications of Brexit, pose potential impediments to sustained growth and operational stability.

Emerging Opportunities in UK Hedge Funds Industry

The horizon of the UK hedge fund industry is bright with long-term growth catalysts, notably the transformative advancements in artificial intelligence and machine learning, which are paving the way for more refined and predictive investment strategies. Strategic alliances forged between hedge funds and leading technology firms hold immense potential for the creation of groundbreaking product offerings and substantial improvements in operational efficiencies. Moreover, the strategic expansion into burgeoning emerging markets presents a compelling avenue for significant growth, offering access to a broader and more diverse investor base.

Leading Players in the UK Hedge Funds Industry Sector

- Capula Investment Management LLP

- Man Group

- Brevan Howard Asset Management

- Lansdowne Partners

- Arrowgrass Capital Partners

- Marshall Wace

- Aviva Investors

- LMR Partners

- Investcorp

- BlueCrest Capital Management

Key Milestones in UK Hedge Funds Industry Industry

- January 2023: Tiger Global Management's strategic pivot towards a venture capital model, with startups now representing nearly 75% of its assets, underscores a broader industry-wide trend towards diversification into alternative asset classes and innovative investment avenues.

- January 2023: The launch of SurgoCap Partners, a female-led hedge fund with a substantial USD 1.8 billion under management, marks a significant milestone as the largest-ever debut for a female-led fund. This event highlights evolving industry demographics and the increasing prominence of diverse investment leadership and strategies.

Strategic Outlook for UK Hedge Funds Industry Market

The UK hedge fund industry's future is bright, with continued growth driven by technological innovation, evolving investor demand, and potential expansion into new markets. Strategic partnerships and the ability to adapt to regulatory changes will be crucial for sustained success. Firms that embrace data-driven investment strategies and focus on delivering consistent alpha generation will be best positioned for long-term growth.

UK Hedge Funds Industry Segmentation

-

1. Core Investment Strategies

- 1.1. Equity

- 1.2. Alternative Risk Premia

- 1.3. Crypto

- 1.4. Equities others

- 1.5. Event-Driven

- 1.6. Fixed Income Credit

- 1.7. Macro

- 1.8. Managed Futures

- 1.9. Multi-Strategy

- 1.10. Relative Value

UK Hedge Funds Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

UK Hedge Funds Industry Regional Market Share

Geographic Coverage of UK Hedge Funds Industry

UK Hedge Funds Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.48% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Assets Managed in the UK by Client Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global UK Hedge Funds Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 5.1.1. Equity

- 5.1.2. Alternative Risk Premia

- 5.1.3. Crypto

- 5.1.4. Equities others

- 5.1.5. Event-Driven

- 5.1.6. Fixed Income Credit

- 5.1.7. Macro

- 5.1.8. Managed Futures

- 5.1.9. Multi-Strategy

- 5.1.10. Relative Value

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 6. North America UK Hedge Funds Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 6.1.1. Equity

- 6.1.2. Alternative Risk Premia

- 6.1.3. Crypto

- 6.1.4. Equities others

- 6.1.5. Event-Driven

- 6.1.6. Fixed Income Credit

- 6.1.7. Macro

- 6.1.8. Managed Futures

- 6.1.9. Multi-Strategy

- 6.1.10. Relative Value

- 6.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 7. South America UK Hedge Funds Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 7.1.1. Equity

- 7.1.2. Alternative Risk Premia

- 7.1.3. Crypto

- 7.1.4. Equities others

- 7.1.5. Event-Driven

- 7.1.6. Fixed Income Credit

- 7.1.7. Macro

- 7.1.8. Managed Futures

- 7.1.9. Multi-Strategy

- 7.1.10. Relative Value

- 7.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 8. Europe UK Hedge Funds Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 8.1.1. Equity

- 8.1.2. Alternative Risk Premia

- 8.1.3. Crypto

- 8.1.4. Equities others

- 8.1.5. Event-Driven

- 8.1.6. Fixed Income Credit

- 8.1.7. Macro

- 8.1.8. Managed Futures

- 8.1.9. Multi-Strategy

- 8.1.10. Relative Value

- 8.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 9. Middle East & Africa UK Hedge Funds Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 9.1.1. Equity

- 9.1.2. Alternative Risk Premia

- 9.1.3. Crypto

- 9.1.4. Equities others

- 9.1.5. Event-Driven

- 9.1.6. Fixed Income Credit

- 9.1.7. Macro

- 9.1.8. Managed Futures

- 9.1.9. Multi-Strategy

- 9.1.10. Relative Value

- 9.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 10. Asia Pacific UK Hedge Funds Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 10.1.1. Equity

- 10.1.2. Alternative Risk Premia

- 10.1.3. Crypto

- 10.1.4. Equities others

- 10.1.5. Event-Driven

- 10.1.6. Fixed Income Credit

- 10.1.7. Macro

- 10.1.8. Managed Futures

- 10.1.9. Multi-Strategy

- 10.1.10. Relative Value

- 10.1. Market Analysis, Insights and Forecast - by Core Investment Strategies

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Capula Investment Management LLP

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Man Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Brevan Howard Asset Management

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lansdowne Partners

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Arrowgrass Capital Partners

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Marshall Wace

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Aviva Investors

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 LMR Partners

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Investcorp

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 BlueCrest Capital Management**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Capula Investment Management LLP

List of Figures

- Figure 1: Global UK Hedge Funds Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America UK Hedge Funds Industry Revenue (billion), by Core Investment Strategies 2025 & 2033

- Figure 3: North America UK Hedge Funds Industry Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 4: North America UK Hedge Funds Industry Revenue (billion), by Country 2025 & 2033

- Figure 5: North America UK Hedge Funds Industry Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America UK Hedge Funds Industry Revenue (billion), by Core Investment Strategies 2025 & 2033

- Figure 7: South America UK Hedge Funds Industry Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 8: South America UK Hedge Funds Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: South America UK Hedge Funds Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe UK Hedge Funds Industry Revenue (billion), by Core Investment Strategies 2025 & 2033

- Figure 11: Europe UK Hedge Funds Industry Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 12: Europe UK Hedge Funds Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe UK Hedge Funds Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa UK Hedge Funds Industry Revenue (billion), by Core Investment Strategies 2025 & 2033

- Figure 15: Middle East & Africa UK Hedge Funds Industry Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 16: Middle East & Africa UK Hedge Funds Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Middle East & Africa UK Hedge Funds Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific UK Hedge Funds Industry Revenue (billion), by Core Investment Strategies 2025 & 2033

- Figure 19: Asia Pacific UK Hedge Funds Industry Revenue Share (%), by Core Investment Strategies 2025 & 2033

- Figure 20: Asia Pacific UK Hedge Funds Industry Revenue (billion), by Country 2025 & 2033

- Figure 21: Asia Pacific UK Hedge Funds Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global UK Hedge Funds Industry Revenue billion Forecast, by Core Investment Strategies 2020 & 2033

- Table 2: Global UK Hedge Funds Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 3: Global UK Hedge Funds Industry Revenue billion Forecast, by Core Investment Strategies 2020 & 2033

- Table 4: Global UK Hedge Funds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 5: United States UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 6: Canada UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 7: Mexico UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Global UK Hedge Funds Industry Revenue billion Forecast, by Core Investment Strategies 2020 & 2033

- Table 9: Global UK Hedge Funds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Brazil UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Argentina UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Global UK Hedge Funds Industry Revenue billion Forecast, by Core Investment Strategies 2020 & 2033

- Table 14: Global UK Hedge Funds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 15: United Kingdom UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Germany UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Spain UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Russia UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Benelux UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 22: Nordics UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Global UK Hedge Funds Industry Revenue billion Forecast, by Core Investment Strategies 2020 & 2033

- Table 25: Global UK Hedge Funds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Turkey UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Israel UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: GCC UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: North Africa UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: South Africa UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global UK Hedge Funds Industry Revenue billion Forecast, by Core Investment Strategies 2020 & 2033

- Table 33: Global UK Hedge Funds Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 34: China UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: India UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 36: Japan UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: South Korea UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: ASEAN UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Oceania UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific UK Hedge Funds Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the UK Hedge Funds Industry?

The projected CAGR is approximately 10.48%.

2. Which companies are prominent players in the UK Hedge Funds Industry?

Key companies in the market include Capula Investment Management LLP, Man Group, Brevan Howard Asset Management, Lansdowne Partners, Arrowgrass Capital Partners, Marshall Wace, Aviva Investors, LMR Partners, Investcorp, BlueCrest Capital Management**List Not Exhaustive.

3. What are the main segments of the UK Hedge Funds Industry?

The market segments include Core Investment Strategies.

4. Can you provide details about the market size?

The market size is estimated to be USD 12.13 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Assets Managed in the UK by Client Type.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2023: Tiger Global Management fund is accelerating its transformation from a traditional stock-picking hedge find to a venture capital investment business, with startup bets now accounting for nearly 75% of the firm's assets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "UK Hedge Funds Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the UK Hedge Funds Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the UK Hedge Funds Industry?

To stay informed about further developments, trends, and reports in the UK Hedge Funds Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence