Key Insights

India's travel insurance market is projected for significant expansion, driven by increasing travel propensity and enhanced awareness of financial protection. The market is expected to reach $1.17 billion by 2025, with a Compound Annual Growth Rate (CAGR) of 10.64% through 2033. Key growth drivers include a rising middle class with higher disposable income, a surge in inbound tourism, government tourism promotion initiatives, and increased digital accessibility. Evolving travel patterns, including adventure tourism and extended stays, necessitate comprehensive coverage, further fueling market growth. The COVID-19 pandemic has also underscored the importance of health and travel-related insurance, acting as a long-term catalyst for adoption.

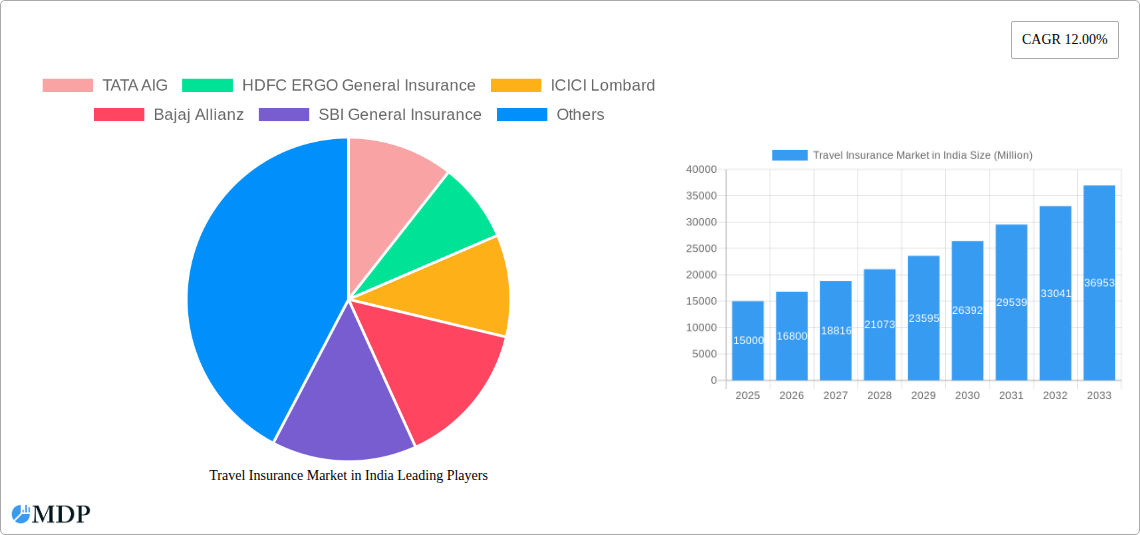

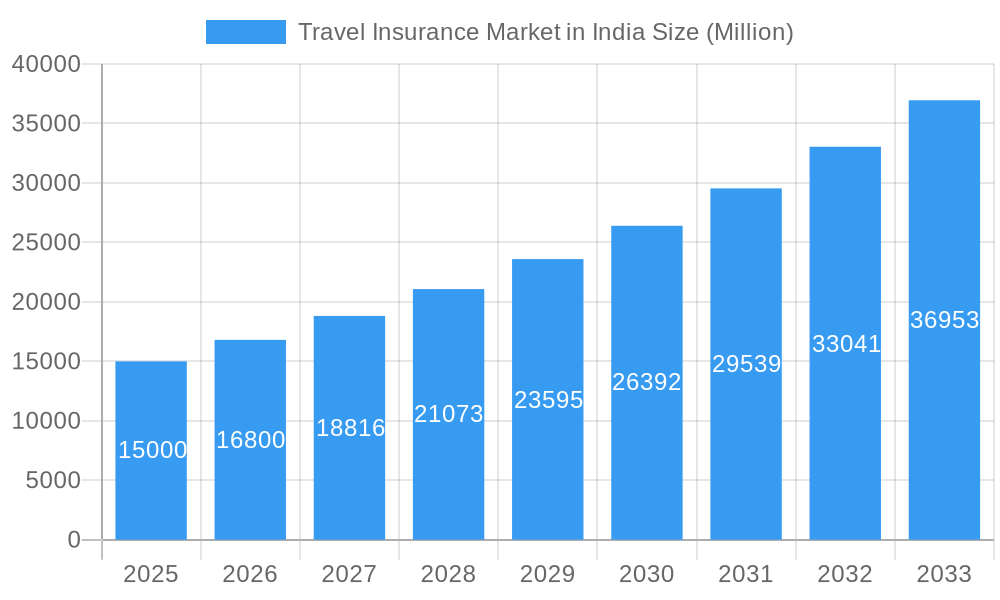

Travel Insurance Market in India Market Size (In Billion)

The market is segmented by product type and distribution channel. Single-trip and annual multi-trip policies are prevalent, with annual policies gaining popularity among frequent travelers. Direct sales and online travel agents are emerging as dominant distribution channels, aligning with digital consumer behavior. Airports and hotels also serve as important outlets, particularly for last-minute purchases. Key end-user segments include senior citizens and family travelers, who prioritize comprehensive medical and emergency support. Business travelers also represent a consistent segment seeking tailored policies. The competitive landscape comprises established insurers and new entrants focused on product innovation and digital engagement.

Travel Insurance Market in India Company Market Share

This report provides a strategic analysis of the India Travel Insurance Market, offering critical insights into its dynamics, trends, and future trajectory. Covering 2019-2033, with a base year of 2025 and an estimated market size of $1.17 billion, this research is vital for insurers, brokers, travel agencies, and investors. We analyze market concentration, innovation drivers, regulatory environments, and detailed segment performance to provide actionable intelligence for informed decision-making.

Travel Insurance Market in India Market Dynamics & Concentration

The Indian travel insurance market is characterized by a moderate to high level of concentration, with a few key players dominating a significant share. This concentration is influenced by strong brand recognition, extensive distribution networks, and regulatory compliance. Innovation is a key driver, fueled by the need to offer customized policies and cater to diverse traveler needs. Regulatory frameworks, particularly those set by the IRDAI, play a pivotal role in shaping product offerings and market entry. Product substitutes, such as credit card insurance and fragmented travel protection plans, exist but often lack the comprehensive coverage provided by dedicated travel insurance. End-user trends are shifting towards increased awareness of travel risks, driving demand for specialized plans. Merger and acquisition (M&A) activities, though not extensively documented, are anticipated to play a role in market consolidation as larger entities seek to expand their portfolios and reach. The market has witnessed approximately 3 significant M&A deals in the historical period. Key companies in the market include TATA AIG General Insurance Company Limited, HDFC ERGO General Insurance Company Limited, ICICI Lombard General Insurance Company Limited, Bajaj Allianz General Insurance Company Limited, SBI General Insurance Company Limited, Royal Sundaram General Insurance Co. Limited, Chola MS General Insurance Company Limited, Reliance General Insurance Company Limited, Apollo Munich Health Insurance Company Limited (now merged with HDFC ERGO), and Religare Health Insurance Company Limited.

Travel Insurance Market in India Industry Trends & Analysis

The travel insurance industry in India is experiencing robust growth, driven by several compelling factors. A significant CAGR of approximately 15% is projected over the forecast period, signaling substantial expansion. Market penetration, currently around 8%, is expected to rise as awareness of travel risks increases and more Indians embrace international and domestic travel. Technological disruptions are reshaping the landscape, with the advent of AI-powered customer service, personalized policy recommendations, and seamless online policy issuance and claims processing. Consumer preferences are increasingly leaning towards comprehensive coverage options that include medical emergencies, trip cancellations, baggage loss, and even adventure sports. The competitive dynamics are intensifying, with established players launching innovative products and digital-first insurers entering the fray, offering competitive pricing and user-friendly interfaces. The rising disposable incomes and a growing middle class with a penchant for international travel are foundational growth drivers. Furthermore, increased government initiatives promoting tourism and simplified visa processes for Indian citizens travelling abroad are contributing to this upward trend. The digital transformation of the insurance sector, coupled with a greater understanding of the financial implications of unforeseen events during travel, are creating a fertile ground for sustained market expansion. The focus on digital distribution channels and simplified policy terms is making travel insurance more accessible and appealing to a wider demographic. The evolving needs of modern travelers, from solo adventurers to large family groups, necessitate adaptable and feature-rich insurance solutions, pushing companies to continuously innovate.

Leading Markets & Segments in Travel Insurance Market in India

The travel insurance market in India is segmented across various dimensions, each presenting unique growth opportunities and dominant forces.

Insurance Coverage:

- Single-Trip Travel Insurance: This segment holds a dominant position due to its affordability and suitability for short-term travel needs. It is driven by frequent leisure travelers and business trips.

- Annual Multi-trip Travel Insurance: This segment is gaining traction among frequent travelers, including business professionals and families who travel multiple times a year. Its convenience and cost-effectiveness for regular travelers are key drivers.

- Others (e.g., student insurance, specific event insurance): While smaller, this segment is experiencing growth driven by niche markets like educational travel and specialized adventure tourism.

Distribution Channel:

- Online Travel Agents (OTAs): This is the fastest-growing and increasingly dominant channel, leveraging the convenience of bundled bookings and digital accessibility. Key drivers include digital adoption and the rise of online travel platforms.

- Direct Sales: Insurers' own websites and sales teams are crucial for building customer relationships and offering customized solutions.

- Brokers & Other Insurance Intermediaries: These channels cater to a more informed customer base seeking expert advice and tailored plans.

- Airports And Hotels: This channel captures impulse purchases and travelers seeking immediate coverage.

End-User:

- Family Travelers: This segment represents a significant and growing market, driven by increasing family vacations and the need for comprehensive protection against common travel disruptions.

- Business Travelers: This segment is characterized by frequent and often last-minute travel, demanding flexible and robust coverage for business-related risks.

- Senior Citizens: With a growing elderly population and increased international travel post-retirement, this segment requires specialized plans addressing age-specific health concerns and travel needs.

- Others (Education Travelers, etc.): This includes students traveling abroad for studies, backpackers, and adventure enthusiasts, each with unique coverage requirements.

The dominance of online channels reflects the evolving digital landscape in India, while the increasing demand for multi-trip policies underscores a shift towards long-term travel planning. The growing awareness among various traveler groups about the importance of financial security during their journeys is propelling the growth of all segments.

Travel Insurance Market in India Product Developments

Product development in the Indian travel insurance market is rapidly evolving to meet diverse customer needs. Insurers are focusing on offering customizable policies with add-on covers for specific risks like adventure sports, pre-existing medical conditions, and even cyber protection during travel. The integration of technology, such as AI-driven risk assessment and personalized policy recommendations, is enhancing customer experience. Digital platforms are enabling faster policy issuance and streamlined claims processing, thereby improving customer satisfaction and building competitive advantages. Innovations are geared towards creating comprehensive yet affordable solutions, making travel insurance more accessible to a wider segment of the population. The focus on user-friendly policy wording and transparent terms is also a key trend.

Key Drivers of Travel Insurance Market in India Growth

Several key factors are propelling the growth of the travel insurance market in India. The increasing disposable income and a burgeoning middle class with a greater propensity for both domestic and international travel are significant economic drivers. Growing awareness of travel-related risks, amplified by global events and media coverage, is a crucial catalyst. Government initiatives promoting tourism and ease of travel, coupled with the simplification of visa processes for Indian citizens, are directly boosting outbound travel. Technological advancements in digital distribution channels and claims processing are enhancing accessibility and customer convenience. Regulatory support from bodies like IRDAI, which encourages product innovation and consumer protection, also plays a vital role.

Challenges in the Travel Insurance Market in India Market

Despite robust growth, the Indian travel insurance market faces several challenges. Low penetration rates persist due to a lack of awareness and a perception of travel insurance as an unnecessary expense for short trips. The complex nature of policy terms and conditions can deter potential buyers. Intense competition among insurers leads to price wars, potentially impacting profitability. Regulatory hurdles and the need for continuous compliance can also be challenging. Furthermore, issues related to efficient claims settlement and the potential for fraudulent claims require constant vigilance and robust systems. Supply chain issues, particularly in the context of global travel disruptions, can impact product availability and pricing.

Emerging Opportunities in Travel Insurance Market in India

The travel insurance market in India is ripe with emerging opportunities for sustained long-term growth. The rapid growth of the digital economy presents immense potential for online distribution and the development of innovative, tech-driven insurance products. Strategic partnerships between insurers, travel agencies, airlines, and OTAs can expand reach and customer acquisition. The increasing popularity of niche travel segments like medical tourism, adventure tourism, and educational travel offers avenues for specialized policy development. The growing awareness of health and safety post-pandemic is a significant catalyst, driving demand for comprehensive travel health insurance. Furthermore, the untapped rural market and the increasing number of outbound student travelers present substantial expansion opportunities.

Leading Players in the Travel Insurance Market in India Sector

- TATA AIG General Insurance Company Limited

- HDFC ERGO General Insurance Company Limited

- ICICI Lombard General Insurance Company Limited

- Bajaj Allianz General Insurance Company Limited

- SBI General Insurance Company Limited

- Royal Sundaram General Insurance Co. Limited

- Chola MS General Insurance Company Limited

- Reliance General Insurance Company Limited

- Religare Health Insurance Company Limited

Key Milestones in Travel Insurance Market in India Industry

- January 2023: The Insurance Regulatory and Development Authority of India (IRDAI) mandated Know Your Customer (KYC) documentation for purchasing new health, auto, and travel insurance policies from January 1, 2023. Insurers are now required to collect KYC documents for any new life and non-life insurance policy purchase, irrespective of the premium amount. This initiative aims to enhance transparency and prevent fraudulent activities.

- August 2022: ICICI Lombard, a leading private non-life insurance company in India, launched a comprehensive suite of 14 new or enhanced insurance solutions. This includes new riders, add-ons, and upgrades across Health, Motor, Travel, and Corporate segments, demonstrating a commitment to expanding its product portfolio and catering to evolving customer needs.

Strategic Outlook for Travel Insurance Market in India Market

The strategic outlook for the travel insurance market in India is exceptionally positive, driven by accelerating growth trends. The market is poised for significant expansion, fueled by increasing outbound tourism, rising disposable incomes, and a growing awareness of the need for financial protection during travel. Leveraging digital transformation to enhance customer experience through seamless online policy issuance and efficient claims processing will be crucial. The development of specialized products catering to niche segments like senior citizens, business travelers, and adventure enthusiasts will unlock new revenue streams. Strategic collaborations with travel ecosystem players will expand distribution reach and create value-added offerings. The focus on simplifying policy structures and enhancing transparency will further boost market penetration and consumer confidence, solidifying India's position as a key growth market in the global travel insurance landscape.

Travel Insurance Market in India Segmentation

-

1. Insurance Coverage

- 1.1. Single-Trip Travel Insurance

- 1.2. Annual Multi-trip Travel Insurance

- 1.3. Others

-

2. Distribution Channel

- 2.1. Direct Sales

- 2.2. Online Travel Agents

- 2.3. Airports And Hotels

- 2.4. Brokers

- 2.5. Other Insurance Intermediaries

-

3. End-User

- 3.1. Senior Citizens

- 3.2. Business Travelers

- 3.3. Family Travelers

- 3.4. Others (Education Travelers, etc)

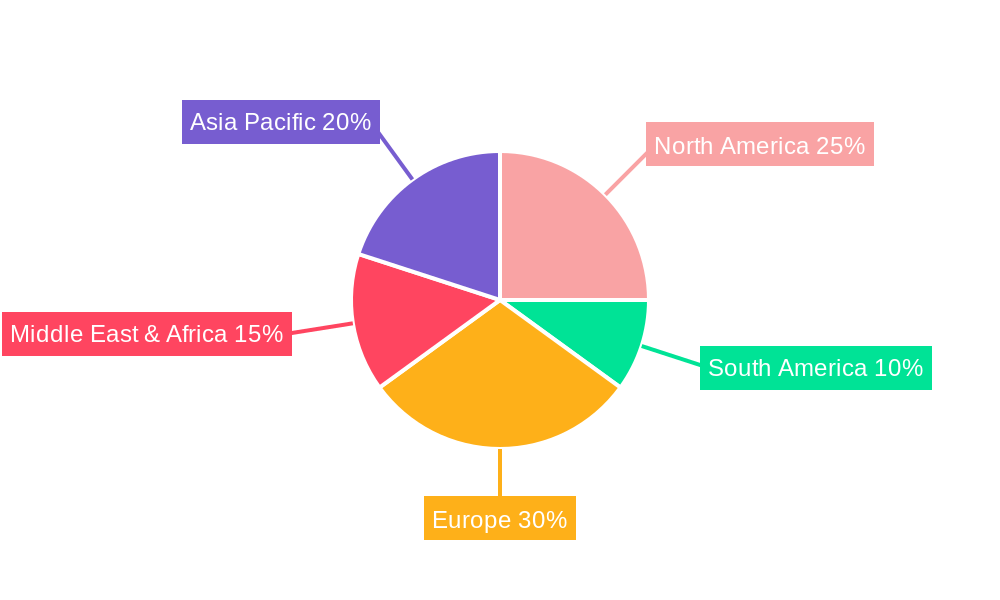

Travel Insurance Market in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Travel Insurance Market in India Regional Market Share

Geographic Coverage of Travel Insurance Market in India

Travel Insurance Market in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.64% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Boost in tourism post pandemic

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Travel Insurance Market in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 5.1.1. Single-Trip Travel Insurance

- 5.1.2. Annual Multi-trip Travel Insurance

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Direct Sales

- 5.2.2. Online Travel Agents

- 5.2.3. Airports And Hotels

- 5.2.4. Brokers

- 5.2.5. Other Insurance Intermediaries

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Senior Citizens

- 5.3.2. Business Travelers

- 5.3.3. Family Travelers

- 5.3.4. Others (Education Travelers, etc)

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 6. North America Travel Insurance Market in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 6.1.1. Single-Trip Travel Insurance

- 6.1.2. Annual Multi-trip Travel Insurance

- 6.1.3. Others

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Direct Sales

- 6.2.2. Online Travel Agents

- 6.2.3. Airports And Hotels

- 6.2.4. Brokers

- 6.2.5. Other Insurance Intermediaries

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Senior Citizens

- 6.3.2. Business Travelers

- 6.3.3. Family Travelers

- 6.3.4. Others (Education Travelers, etc)

- 6.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 7. South America Travel Insurance Market in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 7.1.1. Single-Trip Travel Insurance

- 7.1.2. Annual Multi-trip Travel Insurance

- 7.1.3. Others

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Direct Sales

- 7.2.2. Online Travel Agents

- 7.2.3. Airports And Hotels

- 7.2.4. Brokers

- 7.2.5. Other Insurance Intermediaries

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Senior Citizens

- 7.3.2. Business Travelers

- 7.3.3. Family Travelers

- 7.3.4. Others (Education Travelers, etc)

- 7.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 8. Europe Travel Insurance Market in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 8.1.1. Single-Trip Travel Insurance

- 8.1.2. Annual Multi-trip Travel Insurance

- 8.1.3. Others

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Direct Sales

- 8.2.2. Online Travel Agents

- 8.2.3. Airports And Hotels

- 8.2.4. Brokers

- 8.2.5. Other Insurance Intermediaries

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Senior Citizens

- 8.3.2. Business Travelers

- 8.3.3. Family Travelers

- 8.3.4. Others (Education Travelers, etc)

- 8.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 9. Middle East & Africa Travel Insurance Market in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 9.1.1. Single-Trip Travel Insurance

- 9.1.2. Annual Multi-trip Travel Insurance

- 9.1.3. Others

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Direct Sales

- 9.2.2. Online Travel Agents

- 9.2.3. Airports And Hotels

- 9.2.4. Brokers

- 9.2.5. Other Insurance Intermediaries

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Senior Citizens

- 9.3.2. Business Travelers

- 9.3.3. Family Travelers

- 9.3.4. Others (Education Travelers, etc)

- 9.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 10. Asia Pacific Travel Insurance Market in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 10.1.1. Single-Trip Travel Insurance

- 10.1.2. Annual Multi-trip Travel Insurance

- 10.1.3. Others

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Direct Sales

- 10.2.2. Online Travel Agents

- 10.2.3. Airports And Hotels

- 10.2.4. Brokers

- 10.2.5. Other Insurance Intermediaries

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Senior Citizens

- 10.3.2. Business Travelers

- 10.3.3. Family Travelers

- 10.3.4. Others (Education Travelers, etc)

- 10.1. Market Analysis, Insights and Forecast - by Insurance Coverage

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 TATA AIG

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 HDFC ERGO General Insurance

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ICICI Lombard

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bajaj Allianz

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SBI General Insurance

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Royal Sundaram

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Chola MS

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Reliance

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Apollo Munich

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Religare**List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 TATA AIG

List of Figures

- Figure 1: Global Travel Insurance Market in India Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Travel Insurance Market in India Revenue (billion), by Insurance Coverage 2025 & 2033

- Figure 3: North America Travel Insurance Market in India Revenue Share (%), by Insurance Coverage 2025 & 2033

- Figure 4: North America Travel Insurance Market in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: North America Travel Insurance Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: North America Travel Insurance Market in India Revenue (billion), by End-User 2025 & 2033

- Figure 7: North America Travel Insurance Market in India Revenue Share (%), by End-User 2025 & 2033

- Figure 8: North America Travel Insurance Market in India Revenue (billion), by Country 2025 & 2033

- Figure 9: North America Travel Insurance Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Travel Insurance Market in India Revenue (billion), by Insurance Coverage 2025 & 2033

- Figure 11: South America Travel Insurance Market in India Revenue Share (%), by Insurance Coverage 2025 & 2033

- Figure 12: South America Travel Insurance Market in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: South America Travel Insurance Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: South America Travel Insurance Market in India Revenue (billion), by End-User 2025 & 2033

- Figure 15: South America Travel Insurance Market in India Revenue Share (%), by End-User 2025 & 2033

- Figure 16: South America Travel Insurance Market in India Revenue (billion), by Country 2025 & 2033

- Figure 17: South America Travel Insurance Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Travel Insurance Market in India Revenue (billion), by Insurance Coverage 2025 & 2033

- Figure 19: Europe Travel Insurance Market in India Revenue Share (%), by Insurance Coverage 2025 & 2033

- Figure 20: Europe Travel Insurance Market in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: Europe Travel Insurance Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Europe Travel Insurance Market in India Revenue (billion), by End-User 2025 & 2033

- Figure 23: Europe Travel Insurance Market in India Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Europe Travel Insurance Market in India Revenue (billion), by Country 2025 & 2033

- Figure 25: Europe Travel Insurance Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Travel Insurance Market in India Revenue (billion), by Insurance Coverage 2025 & 2033

- Figure 27: Middle East & Africa Travel Insurance Market in India Revenue Share (%), by Insurance Coverage 2025 & 2033

- Figure 28: Middle East & Africa Travel Insurance Market in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Middle East & Africa Travel Insurance Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Middle East & Africa Travel Insurance Market in India Revenue (billion), by End-User 2025 & 2033

- Figure 31: Middle East & Africa Travel Insurance Market in India Revenue Share (%), by End-User 2025 & 2033

- Figure 32: Middle East & Africa Travel Insurance Market in India Revenue (billion), by Country 2025 & 2033

- Figure 33: Middle East & Africa Travel Insurance Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Travel Insurance Market in India Revenue (billion), by Insurance Coverage 2025 & 2033

- Figure 35: Asia Pacific Travel Insurance Market in India Revenue Share (%), by Insurance Coverage 2025 & 2033

- Figure 36: Asia Pacific Travel Insurance Market in India Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 37: Asia Pacific Travel Insurance Market in India Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 38: Asia Pacific Travel Insurance Market in India Revenue (billion), by End-User 2025 & 2033

- Figure 39: Asia Pacific Travel Insurance Market in India Revenue Share (%), by End-User 2025 & 2033

- Figure 40: Asia Pacific Travel Insurance Market in India Revenue (billion), by Country 2025 & 2033

- Figure 41: Asia Pacific Travel Insurance Market in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Travel Insurance Market in India Revenue billion Forecast, by Insurance Coverage 2020 & 2033

- Table 2: Global Travel Insurance Market in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global Travel Insurance Market in India Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Global Travel Insurance Market in India Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global Travel Insurance Market in India Revenue billion Forecast, by Insurance Coverage 2020 & 2033

- Table 6: Global Travel Insurance Market in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global Travel Insurance Market in India Revenue billion Forecast, by End-User 2020 & 2033

- Table 8: Global Travel Insurance Market in India Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United States Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Canada Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Global Travel Insurance Market in India Revenue billion Forecast, by Insurance Coverage 2020 & 2033

- Table 13: Global Travel Insurance Market in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 14: Global Travel Insurance Market in India Revenue billion Forecast, by End-User 2020 & 2033

- Table 15: Global Travel Insurance Market in India Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Brazil Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Argentina Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Global Travel Insurance Market in India Revenue billion Forecast, by Insurance Coverage 2020 & 2033

- Table 20: Global Travel Insurance Market in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 21: Global Travel Insurance Market in India Revenue billion Forecast, by End-User 2020 & 2033

- Table 22: Global Travel Insurance Market in India Revenue billion Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 24: Germany Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: France Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Italy Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Spain Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Russia Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Benelux Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 30: Nordics Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 32: Global Travel Insurance Market in India Revenue billion Forecast, by Insurance Coverage 2020 & 2033

- Table 33: Global Travel Insurance Market in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Travel Insurance Market in India Revenue billion Forecast, by End-User 2020 & 2033

- Table 35: Global Travel Insurance Market in India Revenue billion Forecast, by Country 2020 & 2033

- Table 36: Turkey Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 37: Israel Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 38: GCC Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: North Africa Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: South Africa Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Global Travel Insurance Market in India Revenue billion Forecast, by Insurance Coverage 2020 & 2033

- Table 43: Global Travel Insurance Market in India Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 44: Global Travel Insurance Market in India Revenue billion Forecast, by End-User 2020 & 2033

- Table 45: Global Travel Insurance Market in India Revenue billion Forecast, by Country 2020 & 2033

- Table 46: China Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 47: India Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 48: Japan Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 49: South Korea Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 51: Oceania Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Travel Insurance Market in India Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Travel Insurance Market in India?

The projected CAGR is approximately 10.64%.

2. Which companies are prominent players in the Travel Insurance Market in India?

Key companies in the market include TATA AIG, HDFC ERGO General Insurance, ICICI Lombard, Bajaj Allianz, SBI General Insurance, Royal Sundaram, Chola MS, Reliance, Apollo Munich, Religare**List Not Exhaustive.

3. What are the main segments of the Travel Insurance Market in India?

The market segments include Insurance Coverage, Distribution Channel, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.17 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Boost in tourism post pandemic.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In January 2023, The Insurance Regulatory and Development Authority of India (IRDAI) made KYC mandatory for buying new health, auto, and travel insurance from January 1, 2023, insurers to collect KYC documents purchasing a new life and non-life insurance policy, irrespective of the premium

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Travel Insurance Market in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Travel Insurance Market in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Travel Insurance Market in India?

To stay informed about further developments, trends, and reports in the Travel Insurance Market in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence