Key Insights

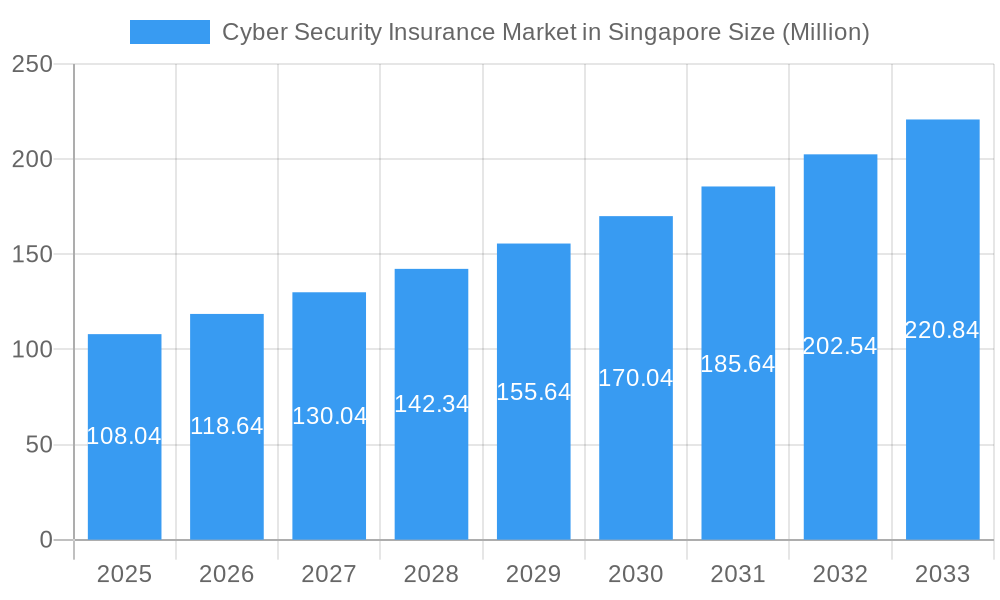

The Singaporean Cyber Security Insurance market is poised for significant expansion, projected to reach a substantial USD 108.04 million by 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 9.85% over the forecast period of 2025-2033. The increasing sophistication and frequency of cyber threats, coupled with a heightened awareness of potential financial and reputational damage, are primary drivers propelling this market forward. Businesses of all sizes, from Small and Medium-sized Enterprises (SMEs) to large corporations, are recognizing cyber insurance not just as a protective measure but as an essential component of their overall risk management strategy. The growing reliance on digital infrastructure and the increasing volume of sensitive data being handled across industries like Financial Services, Healthcare, and Professional Services further amplify the demand for comprehensive cyber insurance solutions.

Cyber Security Insurance Market in Singapore Market Size (In Million)

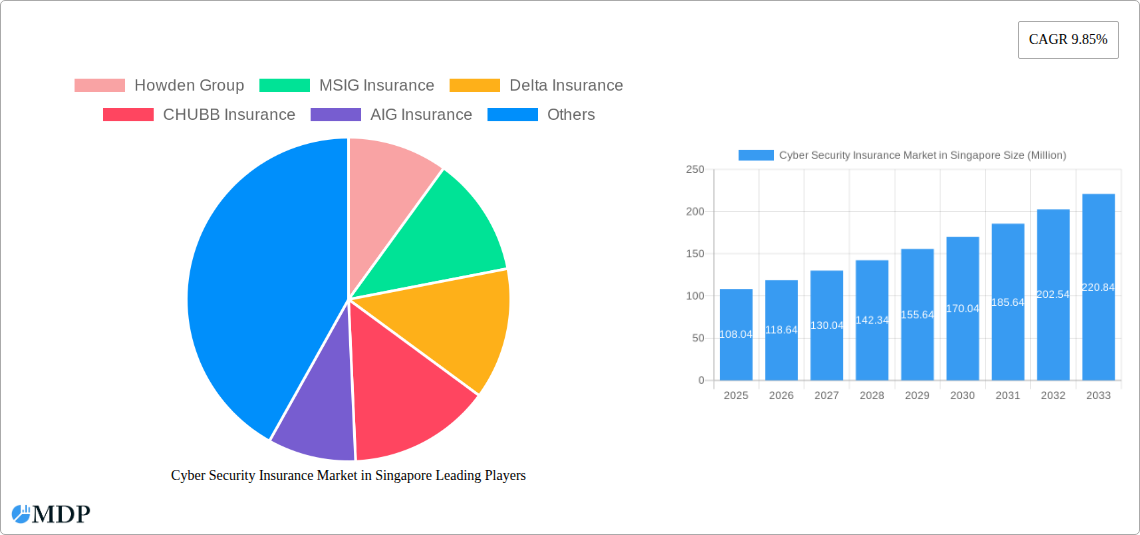

The market is characterized by a dynamic landscape of evolving threats and an equally adaptive insurance sector. While the market is driven by the escalating need for protection against data breaches, ransomware attacks, and business interruption due to cyber incidents, it also faces certain restraints. These may include the complexity of underwriting cyber risk, the potential for adverse selection, and the challenge of accurately pricing these evolving risks. However, emerging trends such as the integration of AI and machine learning in risk assessment and claims management, along with an increasing focus on proactive cybersecurity measures being incentivized by insurers, are expected to shape the future trajectory of the market. Key industry players like Howden Group, MSIG Insurance, and AIG Insurance are actively innovating to offer tailored policies that cater to the diverse needs of various end-users, including Personal, SMEs, and Corporates, across critical sectors.

Cyber Security Insurance Market in Singapore Company Market Share

Unleash Your Business Potential: Singapore's Cyber Security Insurance Market Report (2019-2033)

Navigate the evolving landscape of cyber threats and secure your organization with comprehensive insights into Singapore's burgeoning Cyber Security Insurance Market. This definitive report, spanning from 2019 to 2033 with a base year of 2025, provides an in-depth analysis of market dynamics, industry trends, leading players, and crucial growth drivers. Designed to empower industry stakeholders, this report offers actionable intelligence to inform strategic decisions and capitalize on emerging opportunities in the digital age. Discover how businesses are fortifying their defenses against an escalating cyber risk environment.

Cyber Security Insurance Market in Singapore Market Dynamics & Concentration

The Cyber Security Insurance Market in Singapore is characterized by a dynamic interplay of increasing cyber threats, evolving regulatory frameworks, and a growing awareness of digital risk among businesses of all sizes. Market concentration is moderately fragmented, with a few key players holding significant market share, yet the entry of new specialized providers and the expansion of existing insurers' offerings indicate a competitive and evolving landscape. Innovation drivers are primarily fueled by the relentless sophistication of cyberattacks, pushing insurers to develop more tailored and comprehensive coverage options. Regulatory frameworks, such as Singapore's Cybersecurity Act, play a pivotal role in mandating robust security measures and consequently, driving the demand for cyber insurance. Product substitutes, while present in traditional business interruption or liability policies, often lack the specific coverage for the unique and rapidly evolving risks posed by cyber incidents. End-user trends highlight a significant shift towards greater adoption, particularly among Small and Medium-sized Enterprises (SMEs) and Corporates, who recognize the potential for devastating financial and reputational damage. Merger and acquisition (M&A) activities are expected to play a role in market consolidation and the expansion of service offerings, with potential deal counts anticipated to rise as insurers seek to bolster their capabilities and market reach.

- Market Concentration: Moderately fragmented with key established players and emerging specialized providers.

- Innovation Drivers: Sophistication of cyber threats, evolving regulatory demands, and demand for specialized coverage.

- Regulatory Frameworks: Singapore Cybersecurity Act and other data protection regulations are key market enablers.

- Product Substitutes: Traditional business interruption and liability policies offer limited, non-specific coverage.

- End-User Trends: Growing adoption across SMEs and Corporates due to increasing cyber risk awareness.

- M&A Activities: Potential for consolidation and strategic partnerships to enhance market presence and product portfolios.

Cyber Security Insurance Market in Singapore Industry Trends & Analysis

The Cyber Security Insurance Market in Singapore is poised for significant growth, driven by an escalating cyber threat landscape and a heightened awareness among businesses regarding their digital vulnerabilities. The compound annual growth rate (CAGR) is projected to be robust, reflecting the increasing recognition of cyber insurance as a critical risk management tool. Market penetration, though steadily increasing, still holds substantial room for expansion, particularly within the SME segment, which often has more limited resources to implement comprehensive in-house cybersecurity measures. Technological disruptions are a double-edged sword; while they create new attack vectors and risks, they also enable insurers to leverage advanced analytics and AI for better risk assessment and claims management. Consumer preferences are shifting towards more comprehensive policies that cover not only direct financial losses but also business interruption, reputational damage, and the costs associated with incident response and recovery. The competitive dynamics are intensifying, with both established global insurers and specialized cyber insurance providers vying for market share. This competition fosters innovation in product design, pricing models, and value-added services such as pre-breach risk mitigation and post-breach support. The increasing adoption of cloud computing and the Internet of Things (IoT) further expands the attack surface, necessitating proactive cyber insurance solutions. Furthermore, the growing sophistication of ransomware attacks, data breaches, and phishing schemes directly correlates with the demand for robust cyber insurance policies that can mitigate these specific threats. The rise of remote work and the distributed nature of modern businesses also contribute to a more complex and vulnerable digital infrastructure, making cyber insurance an indispensable component of an organization's overall risk management strategy. The market is also witnessing a trend towards parametric insurance products that trigger payouts based on predefined cyber event metrics, offering faster claim settlements and greater predictability for policyholders.

Leading Markets & Segments in Cyber Security Insurance Market in Singapore

The Cyber Security Insurance Market in Singapore demonstrates strong dominance within the Corporate end-user segment and the Financial Services industry. This is primarily driven by the significant financial assets and sensitive data these entities handle, making them prime targets for sophisticated cyberattacks. The sheer volume of transactions and the interconnectedness of financial institutions mean that a single breach can have catastrophic consequences, both financially and reputationally. Regulatory requirements within the financial sector also mandate stringent data protection and cybersecurity measures, further bolstering the need for comprehensive cyber insurance.

Dominant End-User Segment: Corporates

- Key Drivers: High value of intellectual property and sensitive customer data, significant financial resources to protect, stringent regulatory compliance obligations, and a greater understanding of potential financial and reputational losses. Economic policies that encourage digital transformation also indirectly boost cyber insurance demand among large enterprises.

- Detailed Dominance Analysis: Corporates, including multinational corporations and large local enterprises, are the largest purchasers of cyber insurance due to their extensive digital footprints and the high cost of potential cyber incidents. They often require bespoke policies that address complex risks associated with global operations and intricate supply chains.

Dominant Industry Segment: Financial Services

- Key Drivers: The critical nature of financial data, the high stakes of data breaches and system disruptions, and a robust regulatory environment (e.g., Monetary Authority of Singapore regulations) that mandates strong cybersecurity. The interconnected nature of the financial ecosystem means a breach in one institution can have ripple effects across the entire sector.

- Detailed Dominance Analysis: Banks, investment firms, insurance companies, and fintech businesses are highly proactive in acquiring cyber insurance. They face constant threats from advanced persistent threats (APTs), ransomware, and sophisticated financial fraud schemes. The financial sector's proactive approach to risk management and its deep understanding of potential financial fallout solidify its position as a leading segment.

Other Significant Segments:

- SMEs: While not the largest currently, SMEs represent a rapidly growing segment due to increasing cyber awareness and the availability of more accessible and tailored insurance products. Their limited IT resources make them vulnerable, driving a need for external risk mitigation.

- Healthcare: This sector is a growing focus due to the sensitive nature of patient data (PHI) and the increasing reliance on digital health records and connected medical devices, creating new attack surfaces.

- Government Bodies/Agencies: Essential for protecting critical national infrastructure and sensitive government data, though procurement processes can be complex.

- Professional Services: Firms in this sector, such as law firms and consultancies, handle confidential client information, making them targets for data theft and breaches.

Cyber Security Insurance Market in Singapore Product Developments

Product developments in Singapore's Cyber Security Insurance Market are marked by increasing specialization and the integration of advanced risk mitigation services. Insurers are moving beyond traditional coverage to offer comprehensive solutions that address the full spectrum of cyber risks. This includes enhanced coverage for business interruption due to cyber events, ransomware payments, and regulatory fines and penalties. Innovations also focus on providing pre-breach services such as cybersecurity assessments, vulnerability testing, and employee training, aimed at proactively reducing the likelihood and impact of incidents. Post-breach support is becoming a standard offering, encompassing incident response coordination, forensic investigation, legal counsel, and public relations assistance, all crucial for swift and effective recovery. Emerging trends include the development of parametric cyber insurance products, which simplify claims processing by triggering payouts based on predefined, verifiable cyber event metrics, offering faster financial relief to policyholders.

Key Drivers of Cyber Security Insurance Market in Singapore Growth

The growth of Singapore's Cyber Security Insurance Market is propelled by several interconnected factors. Foremost is the escalating sophistication and frequency of cyberattacks, including ransomware, phishing, and data breaches, which pose significant financial and reputational risks to businesses. Stringent regulatory mandates, such as the Personal Data Protection Act (PDPA) and the Cybersecurity Act, compel organizations to implement robust cybersecurity measures and encourage the adoption of cyber insurance as a risk transfer mechanism. A growing awareness among businesses of all sizes regarding their digital vulnerabilities and the potential impact of cyber incidents is a crucial driver. Furthermore, the increasing digitalization of industries and the growing adoption of cloud computing and IoT technologies expand the attack surface, necessitating comprehensive protection. Economic growth and digital transformation initiatives in Singapore also indirectly fuel demand by increasing the reliance on digital infrastructure.

Challenges in the Cyber Security Insurance Market in Singapore Market

Despite robust growth, the Cyber Security Insurance Market in Singapore faces several challenges. A significant hurdle is the underinsurance or lack of awareness, particularly among SMEs, who may underestimate their cyber risk or perceive insurance as too costly. The dynamic and evolving nature of cyber threats makes it challenging for insurers to accurately assess risk and price policies effectively, leading to potential underpricing or overpricing. Data availability and quality for underwriting can also be a limitation, as historical data on cyber incidents may be incomplete or inconsistent. Supply chain vulnerabilities are another concern, where a breach in a supplier can trigger claims against the insured, making comprehensive risk assessment complex. Talent scarcity in cybersecurity expertise, both within businesses and for insurers to effectively manage and underwrite cyber risks, presents a systemic challenge. The cost of premiums can also be a deterrent, especially for smaller businesses with tight budgets, despite the potential severity of cyber losses.

Emerging Opportunities in Cyber Security Insurance Market in Singapore

Emerging opportunities in Singapore's Cyber Security Insurance Market lie in several key areas. The increasing adoption of cloud computing and AI by businesses presents a growing need for specialized cloud security insurance and AI-driven risk assessment tools. The expansion of IoT devices in homes and industries creates new attack vectors, opening avenues for tailored IoT cybersecurity insurance. The growing demand for proactive risk management services from insurers, beyond just financial compensation, offers opportunities for bundled solutions that include cybersecurity consulting, training, and incident response planning. Strategic partnerships between insurers, cybersecurity firms, and technology providers can create innovative integrated offerings and expand market reach. The Singapore government's focus on developing a smart nation and its commitment to cybersecurity also create a fertile ground for the growth of the cyber insurance market, with potential for collaboration and the development of industry-specific solutions. Furthermore, the increasing regulatory scrutiny on data privacy and cybersecurity globally will continue to drive demand for robust insurance coverage.

Leading Players in the Cyber Security Insurance Market in Singapore Sector

- Howden Group

- MSIG Insurance

- Delta Insurance

- CHUBB Insurance

- AIG Insurance

- AXA

- TIQ (Etiga Insurance)

- Tokio Marine Insurance Group

- QBE Singapore

- Sompo International

Key Milestones in Cyber Security Insurance Market in Singapore Industry

- April 2023: Asian insurance company FWD Singapore announced the expansion of its home insurance coverage by protecting homeowners from cyber fraud through its complimentary FWD cyber insurance. FWD Cyber insurance provides coverage for some of the most common scams, up to USD 3739.50 in coverage for financial loss arising directly from an online marketplace fraud, and up to USD 3739.50 in coverage for financial loss to customers' bank accounts or digital wallets arising directly from a cyber event. This move highlights a growing trend of embedding cyber protection within broader insurance products.

- March 2022: Chubb acquired renewal rights of DUAL Asia's Financial Lines portfolios in Hong Kong SAR and Singapore. Chubb purchased the business assets, including the intellectual property and underwriting models. The parties took over DUAL's client portfolio renewal rights, effective from 18 June 2022. This acquisition signifies market consolidation and the strategic expansion of established players into key Asian markets, particularly in the financial lines and cyber insurance space.

Strategic Outlook for Cyber Security Insurance Market in Singapore Market

The strategic outlook for Singapore's Cyber Security Insurance Market remains exceptionally positive, driven by sustained growth accelerators. The increasing digitalization of Singapore's economy, coupled with a proactive government stance on cybersecurity, will continue to fuel demand for comprehensive cyber risk transfer solutions. Insurers that focus on developing innovative, tailored products that go beyond basic coverage, incorporating robust pre- and post-breach services, will gain a competitive edge. Strategic collaborations with cybersecurity firms and technology providers will be crucial for offering integrated solutions and enhancing risk assessment capabilities. Furthermore, as awareness permeates across all business segments, particularly SMEs, there will be significant opportunities for market penetration through accessible and affordable insurance offerings. The ongoing evolution of cyber threats will necessitate continuous adaptation and product development, ensuring the market remains dynamic and responsive to emerging risks.

Cyber Security Insurance Market in Singapore Segmentation

-

1. End-User

- 1.1. Personal

- 1.2. SMEs

- 1.3. Corporates

-

2. Industry

- 2.1. Financial Services

- 2.2. Government Bodies/Agencies

- 2.3. Healthcare

- 2.4. Professional Services

- 2.5. Other Industries

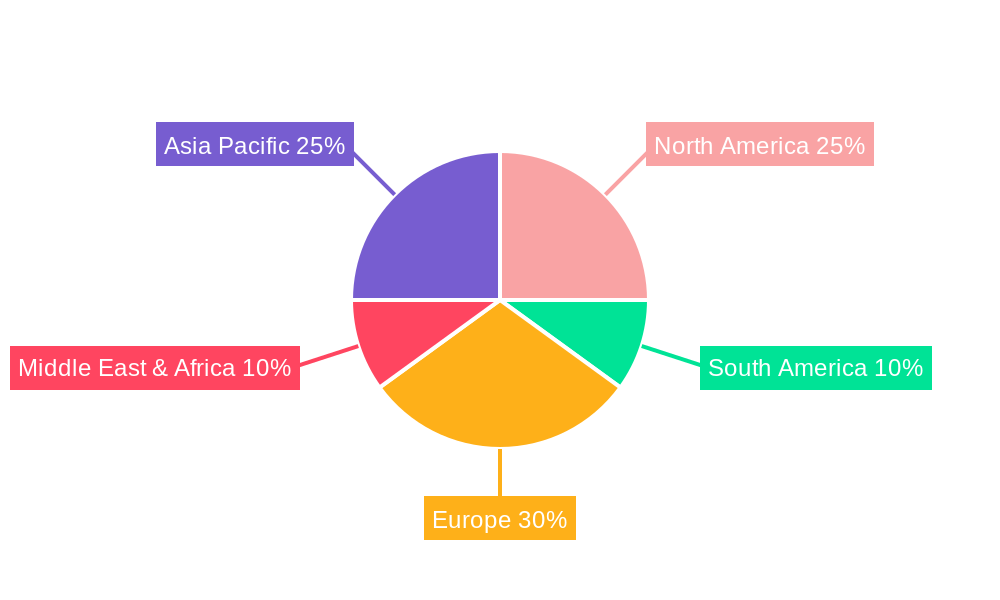

Cyber Security Insurance Market in Singapore Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cyber Security Insurance Market in Singapore Regional Market Share

Geographic Coverage of Cyber Security Insurance Market in Singapore

Cyber Security Insurance Market in Singapore REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.85% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Embedded Insurance is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Inflation is Restraining the Property and Casualty Insurance Market of Singapore

- 3.4. Market Trends

- 3.4.1. Data Breaches and Loss of Confidential Information is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 5.1.1. Personal

- 5.1.2. SMEs

- 5.1.3. Corporates

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Financial Services

- 5.2.2. Government Bodies/Agencies

- 5.2.3. Healthcare

- 5.2.4. Professional Services

- 5.2.5. Other Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by End-User

- 6. North America Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 6.1.1. Personal

- 6.1.2. SMEs

- 6.1.3. Corporates

- 6.2. Market Analysis, Insights and Forecast - by Industry

- 6.2.1. Financial Services

- 6.2.2. Government Bodies/Agencies

- 6.2.3. Healthcare

- 6.2.4. Professional Services

- 6.2.5. Other Industries

- 6.1. Market Analysis, Insights and Forecast - by End-User

- 7. South America Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 7.1.1. Personal

- 7.1.2. SMEs

- 7.1.3. Corporates

- 7.2. Market Analysis, Insights and Forecast - by Industry

- 7.2.1. Financial Services

- 7.2.2. Government Bodies/Agencies

- 7.2.3. Healthcare

- 7.2.4. Professional Services

- 7.2.5. Other Industries

- 7.1. Market Analysis, Insights and Forecast - by End-User

- 8. Europe Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 8.1.1. Personal

- 8.1.2. SMEs

- 8.1.3. Corporates

- 8.2. Market Analysis, Insights and Forecast - by Industry

- 8.2.1. Financial Services

- 8.2.2. Government Bodies/Agencies

- 8.2.3. Healthcare

- 8.2.4. Professional Services

- 8.2.5. Other Industries

- 8.1. Market Analysis, Insights and Forecast - by End-User

- 9. Middle East & Africa Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 9.1.1. Personal

- 9.1.2. SMEs

- 9.1.3. Corporates

- 9.2. Market Analysis, Insights and Forecast - by Industry

- 9.2.1. Financial Services

- 9.2.2. Government Bodies/Agencies

- 9.2.3. Healthcare

- 9.2.4. Professional Services

- 9.2.5. Other Industries

- 9.1. Market Analysis, Insights and Forecast - by End-User

- 10. Asia Pacific Cyber Security Insurance Market in Singapore Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 10.1.1. Personal

- 10.1.2. SMEs

- 10.1.3. Corporates

- 10.2. Market Analysis, Insights and Forecast - by Industry

- 10.2.1. Financial Services

- 10.2.2. Government Bodies/Agencies

- 10.2.3. Healthcare

- 10.2.4. Professional Services

- 10.2.5. Other Industries

- 10.1. Market Analysis, Insights and Forecast - by End-User

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Howden Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 MSIG Insurance

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Delta Insurance

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CHUBB Insurance

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AIG Insurance

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AXA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 TIQ ( Etiga Insurance)

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Tokio Marine Insurance Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 QBE Singapore**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Sompo International

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Howden Group

List of Figures

- Figure 1: Global Cyber Security Insurance Market in Singapore Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2025 & 2033

- Figure 3: North America Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2025 & 2033

- Figure 4: North America Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2025 & 2033

- Figure 5: North America Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2025 & 2033

- Figure 6: North America Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2025 & 2033

- Figure 9: South America Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2025 & 2033

- Figure 10: South America Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2025 & 2033

- Figure 11: South America Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2025 & 2033

- Figure 12: South America Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2025 & 2033

- Figure 15: Europe Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2025 & 2033

- Figure 16: Europe Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2025 & 2033

- Figure 17: Europe Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2025 & 2033

- Figure 18: Europe Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2025 & 2033

- Figure 21: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2025 & 2033

- Figure 22: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2025 & 2033

- Figure 23: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2025 & 2033

- Figure 24: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Cyber Security Insurance Market in Singapore Revenue (Million), by End-User 2025 & 2033

- Figure 27: Asia Pacific Cyber Security Insurance Market in Singapore Revenue Share (%), by End-User 2025 & 2033

- Figure 28: Asia Pacific Cyber Security Insurance Market in Singapore Revenue (Million), by Industry 2025 & 2033

- Figure 29: Asia Pacific Cyber Security Insurance Market in Singapore Revenue Share (%), by Industry 2025 & 2033

- Figure 30: Asia Pacific Cyber Security Insurance Market in Singapore Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Cyber Security Insurance Market in Singapore Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2020 & 2033

- Table 2: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2020 & 2033

- Table 3: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2020 & 2033

- Table 5: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2020 & 2033

- Table 6: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2020 & 2033

- Table 11: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2020 & 2033

- Table 12: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2020 & 2033

- Table 17: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2020 & 2033

- Table 18: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2020 & 2033

- Table 29: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2020 & 2033

- Table 30: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by End-User 2020 & 2033

- Table 38: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Industry 2020 & 2033

- Table 39: Global Cyber Security Insurance Market in Singapore Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Cyber Security Insurance Market in Singapore Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyber Security Insurance Market in Singapore?

The projected CAGR is approximately 9.85%.

2. Which companies are prominent players in the Cyber Security Insurance Market in Singapore?

Key companies in the market include Howden Group, MSIG Insurance, Delta Insurance, CHUBB Insurance, AIG Insurance, AXA, TIQ ( Etiga Insurance), Tokio Marine Insurance Group, QBE Singapore**List Not Exhaustive, Sompo International.

3. What are the main segments of the Cyber Security Insurance Market in Singapore?

The market segments include End-User, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 108.04 Million as of 2022.

5. What are some drivers contributing to market growth?

Embedded Insurance is Driving the Market.

6. What are the notable trends driving market growth?

Data Breaches and Loss of Confidential Information is Driving the Market.

7. Are there any restraints impacting market growth?

Inflation is Restraining the Property and Casualty Insurance Market of Singapore.

8. Can you provide examples of recent developments in the market?

April 2023: Asian insurance company FWD Singapore announced the expansion of its home insurance coverage by protecting homeowners from cyber fraud through its complimentary FWD cyber insurance. FWD Cyber insurance provides coverage for some of the most common scams, up to USD 3739.50 in coverage for financial loss arising directly from an online marketplace fraud, and up to USD 3739.50 in coverage for financial loss to customers' bank accounts or digital wallets arising directly from a cyber event.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cyber Security Insurance Market in Singapore," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cyber Security Insurance Market in Singapore report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cyber Security Insurance Market in Singapore?

To stay informed about further developments, trends, and reports in the Cyber Security Insurance Market in Singapore, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence