Key Insights

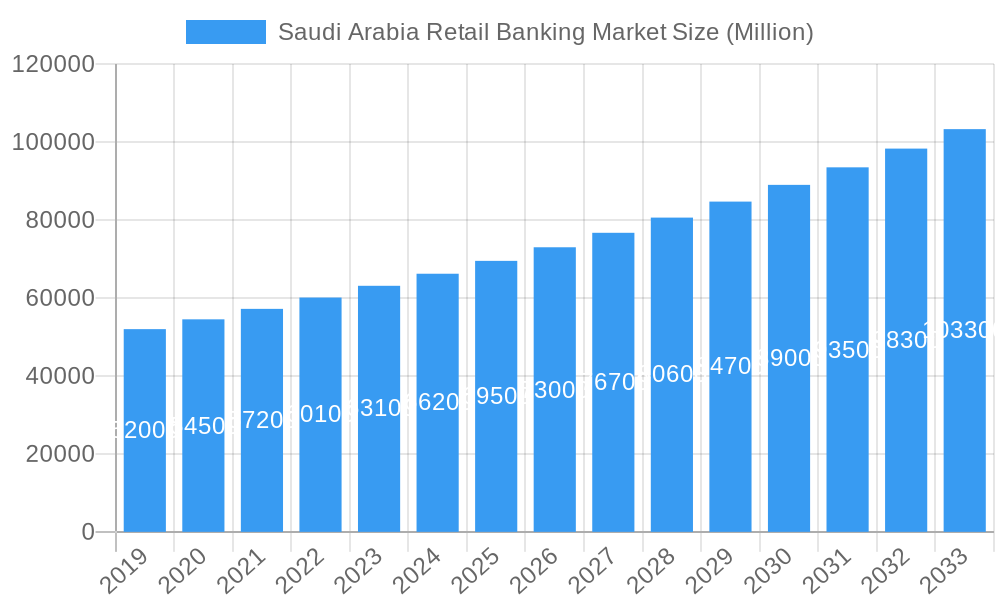

The Saudi Arabia Retail Banking Market is projected to experience significant growth, reaching a market size of $21.28 billion by 2025, with a projected Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This expansion is driven by Saudi Arabia's Vision 2030 economic diversification, increasing disposable incomes, and a growing consumer base. Rapid digital transformation in banking, including widespread technology adoption and a focus on digital customer experiences, is a primary catalyst. The rising demand for flexible financial products, such as personalized savings and accessible credit, coupled with increased debit and credit card utilization, are further propelling market growth.

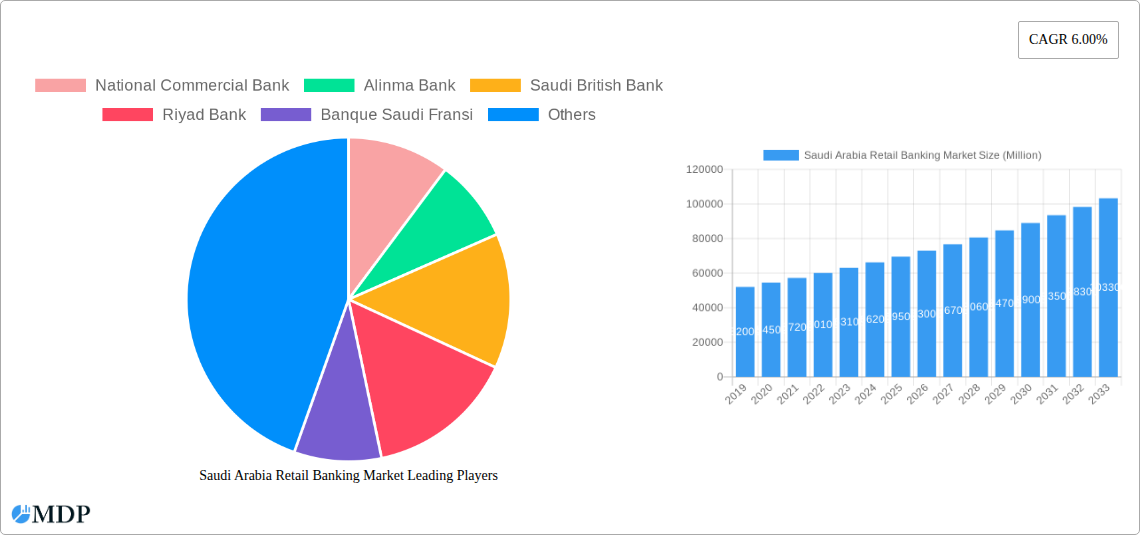

Saudi Arabia Retail Banking Market Market Size (In Billion)

Market segmentation indicates strong demand across product categories, with Transactional Accounts and Loans expected to lead, followed by Savings Accounts and Debit Cards. Credit Cards and other financial services are also anticipated to grow steadily. Within industries, Services will likely be the largest segment, reflecting increased reliance on digital platforms, customer support, and advisory services. Distribution channels are shifting, with Direct Sales (online and mobile banking) gaining prominence, while Distributors will continue to play a role in broader customer reach. Key players such as National Commercial Bank, Al Rajhi Bank, and Saudi National Bank are making strategic investments in technology and customer-centric solutions to secure market share in this dynamic environment.

Saudi Arabia Retail Banking Market Company Market Share

Saudi Arabia Retail Banking Market: Unlocking Growth and Innovation in a Digital Era

This comprehensive report offers an in-depth analysis of the Saudi Arabia retail banking market, exploring its dynamics, key trends, and future outlook from 2019 to 2033. With a base year of 2025, this study provides critical insights into the evolving landscape driven by technological advancements, shifting consumer preferences, and robust economic development. We delve into market concentration, regulatory frameworks, and the impact of leading players like National Commercial Bank, Alinma Bank, Saudi British Bank, Riyad Bank, Banque Saudi Fransi, Arab National Bank, Saudi Investment Bank, Alawwal Bank, Saudi National Bank, and Al Rajhi Bank. Discover actionable intelligence on transactional accounts, savings accounts, debit cards, credit cards, and loans, alongside the influence of hardware, software, and services in the direct sales and distributor channels.

Saudi Arabia Retail Banking Market Market Dynamics & Concentration

The Saudi Arabia retail banking market is characterized by moderate to high concentration, with a few dominant institutions holding significant market share. The Saudi National Bank, post-merger with NCB and Samba, stands as a behemoth with assets exceeding USD 239.7 billion. This consolidation drives increased competition and forces other players to innovate. Key innovation drivers include the push towards digital transformation, the adoption of FinTech solutions, and the demand for personalized banking experiences. Regulatory frameworks, primarily guided by the Saudi Central Bank (SAMA), are evolving to foster a more open and competitive environment, encouraging new entrants and the adoption of advanced technologies. Product substitutes are emerging from non-traditional financial service providers and digital wallets, compelling traditional banks to enhance their offerings. End-user trends reveal a growing preference for mobile and online banking, a desire for seamless customer journeys, and an increasing demand for Sharia-compliant financial products. Mergers and acquisitions (M&A) are a significant strategy for achieving scale and expanding market reach. While specific M&A deal counts are not publicly disclosed for every transaction, the monumental merger forming the Saudi National Bank signifies the strategic importance of consolidation in this market. The market share of the top five banks is estimated to be over 70%, indicating a concentrated yet dynamic competitive landscape.

Saudi Arabia Retail Banking Market Industry Trends & Analysis

The Saudi Arabia retail banking market is poised for significant growth, driven by a confluence of factors including a young, tech-savvy population, government initiatives promoting financial inclusion, and a burgeoning digital economy. The Compound Annual Growth Rate (CAGR) for the retail banking sector is projected to be robust, with an estimated XX% over the forecast period (2025–2033). Technological disruptions are at the forefront of this evolution. The widespread adoption of smartphones and the increasing internet penetration have fueled the demand for digital banking services, leading to a surge in mobile banking and online transaction volumes. FinTech innovation is transforming the customer experience, with advancements in AI-powered customer service, personalized financial advice, and blockchain-based solutions for faster and more secure transactions. Consumer preferences are shifting rapidly, with an emphasis on convenience, personalized services, and seamless omnichannel experiences. Customers expect 24/7 access to banking services, instant transaction capabilities, and tailored product offerings that cater to their specific financial needs. This shift is pushing banks to invest heavily in digital platforms and data analytics to understand and serve their customers better. Competitive dynamics are intensifying as traditional banks face increased competition from agile FinTech startups and challenger banks. This pressure is forcing incumbent institutions to accelerate their digital transformation strategies, improve their operational efficiencies, and focus on customer-centricity to retain and attract market share. Market penetration for digital banking services has already surpassed 70% and is expected to climb higher, underscoring the profound digital shift within the Saudi banking sector. The country’s Vision 2030 blueprint further supports this transformation by encouraging economic diversification and the development of a vibrant financial services ecosystem.

Leading Markets & Segments in Saudi Arabia Retail Banking Market

The Saudi Arabia retail banking market is dominated by segments catering to essential financial needs and leveraging technological advancements.

Dominant Product Segments:

- Transactional Accounts: These remain the bedrock of retail banking, with high penetration rates. The increasing digital adoption fuels a demand for seamless online and mobile transaction capabilities, driving growth in this segment. Banks are focusing on offering feature-rich current accounts with integrated digital payment solutions.

- Savings Accounts: Driven by a culture of saving and a growing middle class, savings accounts continue to be a significant product. Innovations in online account management, competitive interest rates, and flexible saving plans are key to attracting and retaining customers in this segment.

- Debit Cards: With the widespread adoption of point-of-sale terminals and e-commerce, debit cards are a primary payment instrument. Banks are enhancing security features, offering loyalty programs, and integrating contactless payment solutions to boost their usage.

- Credit Cards: The demand for credit cards is on the rise as consumers increasingly utilize them for purchases and financing. Banks are focusing on offering diverse credit card portfolios with attractive rewards, cashback offers, and personalized credit limits, tailored to different customer segments.

- Loans: Mortgage and personal loans are significant contributors to the retail banking market. Government initiatives supporting homeownership and personal finance needs are boosting this segment. Digital loan application processes and faster approval times are becoming critical competitive advantages.

- Other Products: This segment encompasses a range of offerings including investment products, insurance, and wealth management services. As the market matures and disposable incomes rise, there is a growing appetite for diversified financial products.

Dominant Industry Segments:

- Software: The retail banking sector is heavily reliant on sophisticated software solutions for core banking, customer relationship management (CRM), digital banking platforms, cybersecurity, and data analytics. Investment in advanced software is crucial for operational efficiency and delivering a superior customer experience.

- Services: Banking services are at the core of the industry. This includes customer support, advisory services, digital onboarding, and payment processing. The focus is shifting towards providing proactive and personalized services through various channels.

- Hardware: While digital transformation is paramount, essential hardware like ATMs, secure payment terminals, and robust IT infrastructure remain critical for the functioning of retail banking operations.

Dominant Distributional Channels:

- Direct Sales: This channel remains vital, particularly for complex financial products like mortgages and investment services, where human interaction and personalized advice are crucial. Bank branches, relationship managers, and dedicated sales teams are key components.

- Distributor: While traditional distributors might be less prevalent in retail banking compared to other sectors, partnerships with FinTech aggregators, e-commerce platforms, and payment service providers can be considered a form of distributor-like engagement, expanding reach and customer acquisition. However, the primary growth is seen in direct digital channels.

Saudi Arabia Retail Banking Market Product Developments

Product developments in the Saudi Arabia retail banking market are heavily influenced by the pursuit of enhanced customer experience and digital integration. Banks are launching innovative mobile banking applications with intuitive interfaces, offering features such as instant account opening, personalized financial dashboards, and real-time customer support via chatbots. The integration of AI for predictive analytics allows for tailored product recommendations, such as customized loan offers or savings plans based on individual spending habits and financial goals. Furthermore, there is a growing emphasis on Sharia-compliant digital products, including Islamic finance options for savings, investments, and financing. The development of open banking APIs is facilitating seamless integration with third-party FinTech providers, enabling a richer ecosystem of financial services and fostering greater competition and innovation.

Key Drivers of Saudi Arabia Retail Banking Market Growth

The growth of the Saudi Arabia retail banking market is propelled by several key factors. The nation's robust economic diversification efforts under Vision 2030 are creating new employment opportunities and increasing disposable incomes, leading to higher demand for banking services. The significant young demographic is highly receptive to digital technologies, driving the adoption of online and mobile banking platforms. The Saudi Central Bank (SAMA) actively promotes financial inclusion and innovation through its regulatory sandbox and supportive policies, encouraging FinTech adoption and the development of novel banking solutions. Furthermore, increased government spending on infrastructure and megaprojects is stimulating economic activity, thereby boosting demand for retail credit and financial products.

Challenges in the Saudi Arabia Retail Banking Market Market

Despite the positive growth trajectory, the Saudi Arabia retail banking market faces several challenges. Intense competition from both traditional banks and emerging FinTech players necessitates continuous innovation and investment, impacting profit margins. Evolving regulatory landscapes, while beneficial for innovation, can also present compliance hurdles and require significant adjustments to operational models. Cybersecurity threats and data privacy concerns are paramount, requiring substantial investment in robust security measures to protect customer information and maintain trust. Additionally, the digital divide, while shrinking, can still limit access for certain segments of the population, necessitating the maintenance of traditional service channels alongside digital offerings.

Emerging Opportunities in Saudi Arabia Retail Banking Market

The Saudi Arabia retail banking market is ripe with emerging opportunities, particularly driven by technological advancements and evolving consumer needs. The widespread adoption of artificial intelligence and machine learning presents a significant opportunity for hyper-personalization of banking services, enabling banks to offer tailored financial advice, product recommendations, and proactive customer support. The continued growth of e-commerce and the gig economy creates demand for innovative payment solutions and flexible financing options. The push towards a cashless society, supported by government initiatives, opens avenues for digital wallet development and the expansion of contactless payment technologies. Furthermore, strategic partnerships between traditional banks and FinTech companies can unlock new revenue streams and enhance customer reach through embedded finance solutions and innovative digital platforms.

Leading Players in the Saudi Arabia Retail Banking Market Sector

- National Commercial Bank

- Alinma Bank

- Saudi British Bank

- Riyad Bank

- Banque Saudi Fransi

- Arab National Bank

- Saudi Investment Bank

- Alawwal Bank

- Saudi National Bank

- Al Rajhi Bank

Key Milestones in Saudi Arabia Retail Banking Market Industry

- January 2022: Saudi National Bank announced the completion of the merger between Samba Financial Group and NCB, which is the fastest and largest merger in the history of Saudi Arabia. The merger resulted in the establishment of the largest banking entity in Saudi Arabia with assets of more than USD 239.7 billion.

- February 2022: The Ministry of Municipal and Rural Affairs and Housing honored the Saudi National Bank for its efforts in serving the housing sector within the donor community after the bank announced the completion of the delivery of its community housing initiative, which resulted in the provision of 500 housing units to the beneficiaries of the housing development program from 2017 to 2021, including 361 fully-furnished housing units and 139 housing units, supported by purchasing cards.

Strategic Outlook for Saudi Arabia Retail Banking Market Market

The strategic outlook for the Saudi Arabia retail banking market is characterized by a continued acceleration of digital transformation and a focus on customer-centricity. Banks will increasingly leverage AI and big data analytics to understand customer behavior, personalize offerings, and enhance risk management. The development of open banking ecosystems will foster collaboration with FinTechs, leading to a broader range of integrated financial services. Investments in cybersecurity and data protection will remain a top priority to build and maintain customer trust. Furthermore, banks are expected to explore new avenues for growth through product innovation, such as Sharia-compliant digital wealth management and embedded finance solutions, catering to the evolving needs of a digitally native population and supporting the Kingdom's Vision 2030 objectives.

Saudi Arabia Retail Banking Market Segmentation

-

1. Product

- 1.1. Transactional Accounts

- 1.2. Savings Accounts

- 1.3. Debit Cards

- 1.4. Credit Cards

- 1.5. Loans

- 1.6. Other Products

-

2. Industry

- 2.1. Hardware

- 2.2. Software

- 2.3. Services

-

3. Distributional Channel

- 3.1. Direct Sales

- 3.2. Distributor

Saudi Arabia Retail Banking Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Retail Banking Market Regional Market Share

Geographic Coverage of Saudi Arabia Retail Banking Market

Saudi Arabia Retail Banking Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Financial Literacy; The Spending by Retail Banks for digital banking is increasing in Saudi Arabia

- 3.3. Market Restrains

- 3.3.1. Increasing Financial Literacy; The Spending by Retail Banks for digital banking is increasing in Saudi Arabia

- 3.4. Market Trends

- 3.4.1. Increase in Saudi Retail Mortgage Loans Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Retail Banking Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Transactional Accounts

- 5.1.2. Savings Accounts

- 5.1.3. Debit Cards

- 5.1.4. Credit Cards

- 5.1.5. Loans

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Hardware

- 5.2.2. Software

- 5.2.3. Services

- 5.3. Market Analysis, Insights and Forecast - by Distributional Channel

- 5.3.1. Direct Sales

- 5.3.2. Distributor

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 National Commercial Bank

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Alinma Bank

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Saudi British Bank

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Riyad Bank

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Banque Saudi Fransi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Arab National Bank

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saudi Investment Bank

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Alawwal Bank

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi National Bank

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Al Rajhi Bank**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 National Commercial Bank

List of Figures

- Figure 1: Saudi Arabia Retail Banking Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Retail Banking Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Retail Banking Market Revenue billion Forecast, by Product 2020 & 2033

- Table 2: Saudi Arabia Retail Banking Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 3: Saudi Arabia Retail Banking Market Revenue billion Forecast, by Distributional Channel 2020 & 2033

- Table 4: Saudi Arabia Retail Banking Market Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Saudi Arabia Retail Banking Market Revenue billion Forecast, by Product 2020 & 2033

- Table 6: Saudi Arabia Retail Banking Market Revenue billion Forecast, by Industry 2020 & 2033

- Table 7: Saudi Arabia Retail Banking Market Revenue billion Forecast, by Distributional Channel 2020 & 2033

- Table 8: Saudi Arabia Retail Banking Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Retail Banking Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Saudi Arabia Retail Banking Market?

Key companies in the market include National Commercial Bank, Alinma Bank, Saudi British Bank, Riyad Bank, Banque Saudi Fransi, Arab National Bank, Saudi Investment Bank, Alawwal Bank, Saudi National Bank, Al Rajhi Bank**List Not Exhaustive.

3. What are the main segments of the Saudi Arabia Retail Banking Market?

The market segments include Product, Industry, Distributional Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 21.28 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Financial Literacy; The Spending by Retail Banks for digital banking is increasing in Saudi Arabia.

6. What are the notable trends driving market growth?

Increase in Saudi Retail Mortgage Loans Driving the Market.

7. Are there any restraints impacting market growth?

Increasing Financial Literacy; The Spending by Retail Banks for digital banking is increasing in Saudi Arabia.

8. Can you provide examples of recent developments in the market?

February 2022: The Ministry of Municipal and Rural Affairs and Housing honored the Saudi National Bank for its efforts in serving the housing sector within the donor community after the bank announced the completion of the delivery of its community housing initiative, which resulted in the provision of 500 housing units to the beneficiaries of the housing development program from 2017 to 2021, including 361 fully-furnished housing units and 139 housing units, supported by purchasing cards.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Retail Banking Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Retail Banking Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Retail Banking Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Retail Banking Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence