Key Insights

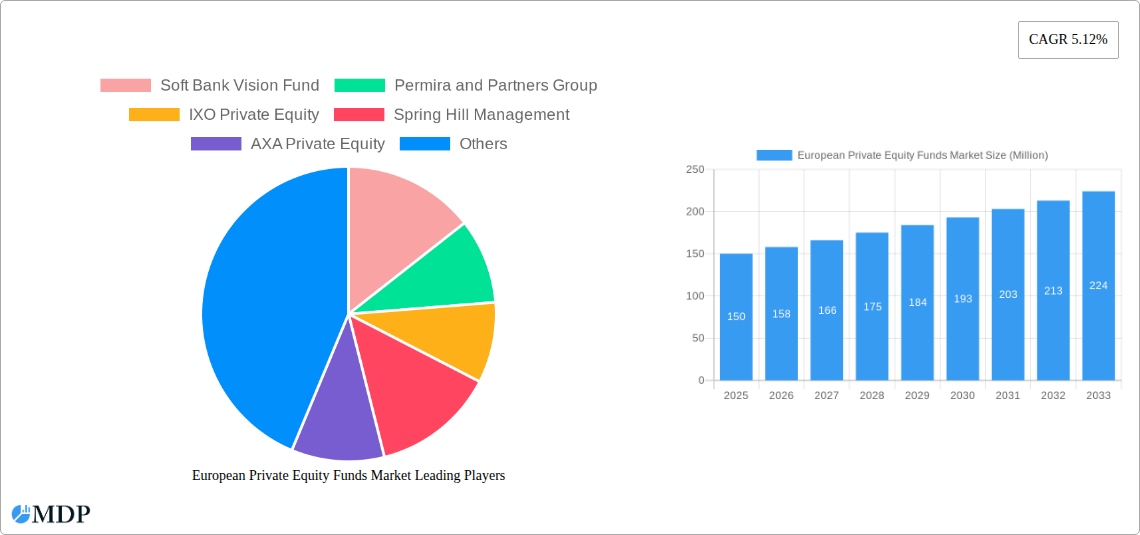

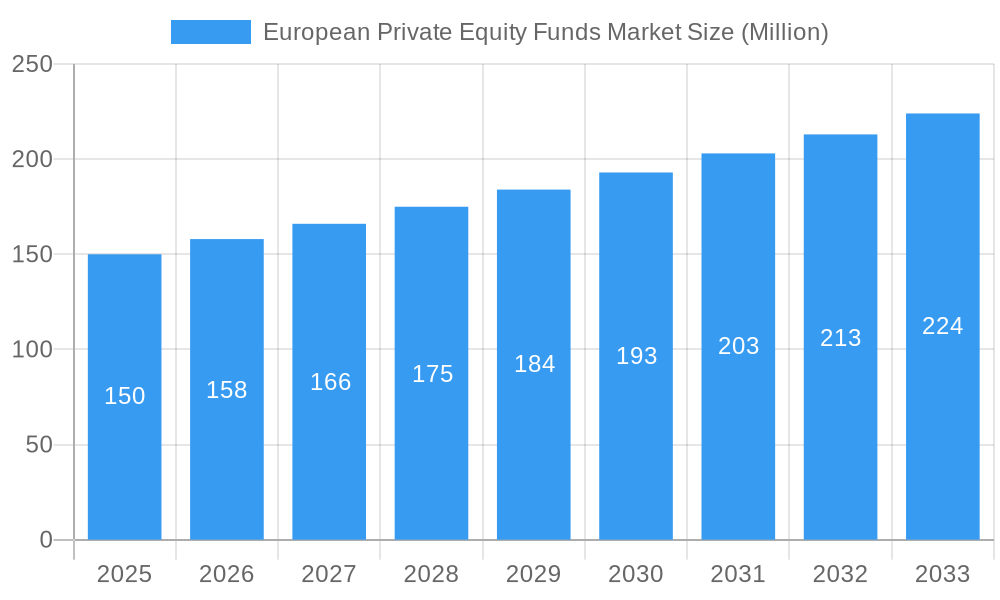

The European private equity (PE) funds market, valued at €150 million in 2025, is projected to experience robust growth, driven by several key factors. A Compound Annual Growth Rate (CAGR) of 5.12% from 2025 to 2033 indicates a significant expansion, fueled by increasing institutional investor interest seeking higher returns than traditional asset classes. The market's segmentation across investment types (large, mid, and small cap) and applications (early-stage venture capital, private equity, and leveraged buyouts) allows for diverse investment strategies, catering to a wide spectrum of risk tolerances and return expectations. Furthermore, the presence of established global players like SoftBank Vision Fund, Permira, and CVC Capital Partners, alongside regional firms like Accent Equity Partners, signifies a competitive yet dynamic market landscape, fostering innovation and investment opportunities. The strong presence of PE firms in major European economies, including Germany, France, UK, and Italy, contributes to market maturity and consistent growth. However, macroeconomic uncertainties and regulatory changes could act as potential restraints, influencing investment decisions and overall market trajectory.

European Private Equity Funds Market Market Size (In Million)

The projected growth trajectory suggests a substantial increase in market value by 2033. This expansion will likely be influenced by the evolving preferences of investors seeking exposure to high-growth sectors such as technology, healthcare, and renewable energy. The strategic focus of PE firms on operational improvements, value creation, and portfolio company exits is expected to further enhance the market’s performance. Nevertheless, potential challenges remain. Geopolitical instability, fluctuations in interest rates, and shifts in regulatory frameworks could potentially dampen investment activity in certain sectors. Continued monitoring of these factors is crucial for accurate forecasting and informed decision-making within the European private equity market.

European Private Equity Funds Market Company Market Share

European Private Equity Funds Market Report: 2019-2033

Unlocking Growth Opportunities in the Thriving European Private Equity Landscape

This comprehensive report delivers an in-depth analysis of the European Private Equity Funds Market, providing invaluable insights for investors, fund managers, and industry stakeholders. Covering the period 2019-2033, with a focus on 2025, this report unveils market dynamics, leading players, and future growth trajectories. Expect detailed analysis of investment types (Large Cap, Mid Cap, Small Cap), application areas (Early Stage Venture Capital Investment, Private Equity, Leverage Buyout), and key regional trends. Discover how major players like SoftBank Vision Fund, Permira, and Apax Partners are shaping the market and identify emerging opportunities for significant returns.

European Private Equity Funds Market Market Dynamics & Concentration

The European Private Equity Funds market exhibits a dynamic interplay of concentration, innovation, and regulatory influence. Market share is concentrated amongst a few large players, with the top 10 firms holding approximately xx% of the total market in 2024. However, a significant number of smaller and mid-sized firms contribute to overall market activity, fostering competition and innovation.

- Market Concentration: The Herfindahl-Hirschman Index (HHI) for the market in 2024 is estimated at xx, indicating a moderately concentrated market.

- M&A Activity: The number of M&A deals involving European Private Equity Funds increased to xx in 2024, indicating strong consolidation trends within the sector. Deal value totaled approximately xx Million.

- Regulatory Frameworks: EU regulations, particularly those concerning competition and investment management, significantly influence market dynamics and investment strategies. Compliance requirements and evolving regulations drive strategic decision-making.

- Innovation Drivers: Technological advancements in data analytics, portfolio management, and deal sourcing are key drivers of innovation, enhancing efficiency and investment returns.

- End-User Trends: Increased demand for private equity investments from institutional investors, family offices, and high-net-worth individuals fuels market growth. The growing preference for alternative investment strategies enhances market expansion.

European Private Equity Funds Market Industry Trends & Analysis

The European Private Equity Funds market is experiencing robust growth, driven by several factors. The Compound Annual Growth Rate (CAGR) from 2025 to 2033 is projected at xx%, fueled by increased investor appetite for private equity, technological advancements, and favorable economic conditions across various European regions. Market penetration is also on the rise, as private equity becomes an increasingly mainstream investment strategy for diverse investor groups. The market is witnessing a surge in deal activity and significant capital inflows, largely driven by the ongoing recovery from economic downturns.

Technological advancements, such as sophisticated due diligence tools and data-driven investment strategies, have substantially enhanced operational efficiency and investment decision-making within the industry. Consumer preferences, particularly towards ESG-compliant investments and technology-focused ventures, significantly influence investment allocation strategies. The competitive landscape remains highly dynamic, characterized by strategic partnerships, mergers and acquisitions, and a relentless pursuit of innovative investment approaches.

Leading Markets & Segments in European Private Equity Funds Market

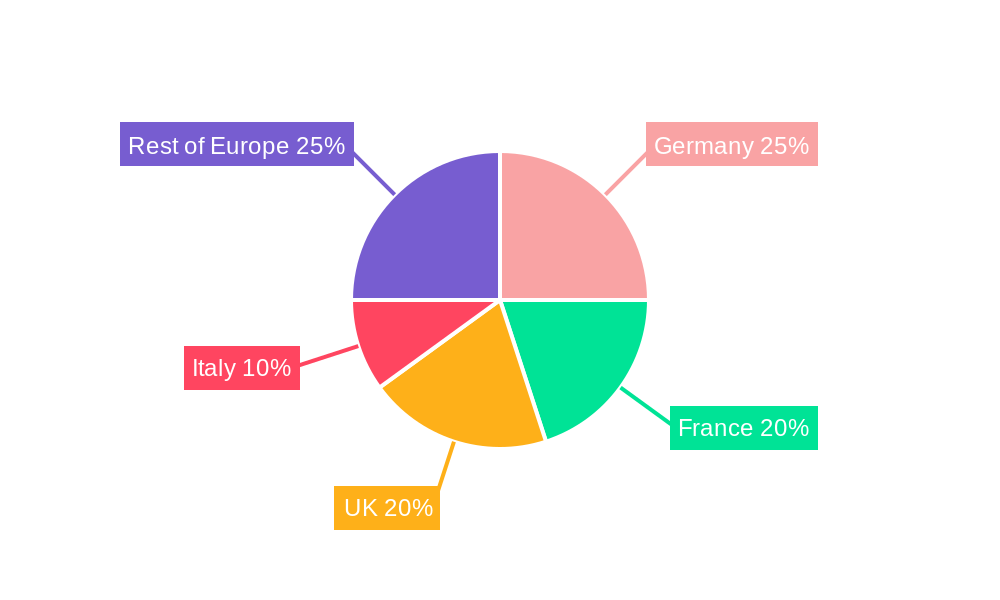

The UK and Germany remain dominant markets within the European Private Equity Funds sector, holding approximately xx% and xx% of the market share respectively in 2024. These regions benefit from established financial infrastructure, a robust regulatory environment, and a high concentration of both investors and investee companies. Other key European markets include France, the Nordic countries, and the Benelux region.

Investment Type: Large Cap investments continue to dominate, accounting for approximately xx% of the market in 2024, reflecting the increased investor interest in established, high-growth companies. Mid-Cap investments are also prevalent, with a market share of approximately xx%. Small Cap investments account for the remaining xx%.

Application: Leverage Buyout remains the most popular application within the European Private Equity Funds sector, holding approximately xx% of the market in 2024. This is followed by Private Equity investments, accounting for approximately xx%, and Early Stage Venture Capital investments, which represents approximately xx%.

Key Drivers:

- Strong Economic Growth: Positive economic growth in several European countries has fuelled deal activity.

- Government Support: Favorable government policies and initiatives aimed at fostering private equity investments have boosted market expansion.

- Abundant Capital: The availability of substantial capital from pension funds, sovereign wealth funds, and institutional investors contributes to high levels of investment.

- Robust Technological Advancements: Continuous advancements in technology enhance efficiency, improve decision-making, and create new investment opportunities.

European Private Equity Funds Market Product Developments

Recent product developments focus on improving due diligence processes, portfolio management tools, and risk assessment methodologies. The incorporation of artificial intelligence (AI) and machine learning (ML) in investment decision-making is a particularly notable advancement. Several firms are developing proprietary technologies to enhance portfolio diversification and yield optimization, providing them with a significant competitive advantage. The overall emphasis is on enhancing the efficiency and effectiveness of investment strategies while mitigating risk and maximizing returns.

Key Drivers of European Private Equity Funds Market Growth

Several factors contribute to the European Private Equity Funds market's robust growth. Favorable economic conditions in many European countries provide a strong environment for investment and deal-making. The availability of significant capital from various sources fuels investment activity. Furthermore, regulatory changes, such as those promoting private equity investments, stimulate market expansion. Technological advancements, such as AI-driven investment analytics, improve investment efficiency and returns, enhancing the appeal of private equity.

Challenges in the European Private Equity Funds Market Market

The European Private Equity Funds market faces several challenges, including increased regulatory scrutiny, which impacts deal execution and investment strategies. The competitive landscape remains highly intense, with established players and new entrants vying for market share. Economic volatility and geopolitical uncertainty can influence investor sentiment and investment decisions. Supply chain disruptions and talent scarcity are additional factors that influence industry efficiency and operational costs. These constraints can moderately reduce overall market growth and returns.

Emerging Opportunities in European Private Equity Funds Market

The European Private Equity Funds market presents several opportunities for long-term growth. The increasing focus on ESG investments creates new opportunities for funds with strong sustainability credentials. Technological breakthroughs, such as AI and blockchain technologies, are generating innovative solutions for investment management and deal sourcing. Strategic partnerships between private equity firms and technology companies can unlock new market segments and investment opportunities. The expansion of private equity investments into emerging European markets presents significant potential for growth.

Leading Players in the European Private Equity Funds Market Sector

- SoftBank Vision Fund

- Permira

- Partners Group

- IXO Private Equity

- Spring Hill Management

- AXA Private Equity

- Oakley Capital

- Heartland

- CVC Capital Partners

- Accent Equity Partners

- Other Key Players (List Not Exhaustive)

- Apax Partners

Key Milestones in European Private Equity Funds Market Industry

- February 2023: Oakley Capital raises a record Euro 2.85 Billion (USD 3.13 Billion) for its fifth flagship fund, signifying a strong investor confidence and market potential. This significantly impacts market dynamics by increasing capital available for investment.

- February 2023: Apax's pursuit of a 40% stake in a company valued at USD 2.1 Billion illustrates the ongoing consolidation within the sector and its influence on market control. This move alters the competitive landscape.

Strategic Outlook for European Private Equity Funds Market Market

The European Private Equity Funds market presents significant growth potential, driven by a confluence of factors, including increased capital availability, technological innovation, and favorable regulatory environments in key European markets. Strategic partnerships and innovative investment strategies will be crucial for continued success. The focus on ESG investments and expansion into emerging technologies will shape the long-term trajectory of the market. The market's future growth will be significantly driven by the adoption of innovative technologies and adaptable investment strategies.

European Private Equity Funds Market Segmentation

-

1. Investment Type

- 1.1. Large Cap

- 1.2. Mid Cap

- 1.3. Small Cap

-

2. Application

- 2.1. Early Stage Venture Capital Investment

- 2.2. Private Equity

- 2.3. Leverage Buyout

European Private Equity Funds Market Segmentation By Geography

- 1. Italy

- 2. Germany

- 3. France

- 4. Switzerland

- 5. United Kingdom

- 6. Rest of Europe

European Private Equity Funds Market Regional Market Share

Geographic Coverage of European Private Equity Funds Market

European Private Equity Funds Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.12% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Acts as a Restraint to the Market

- 3.4. Market Trends

- 3.4.1. Family Owned Companies Witnessing Majority Shareholding in Private Equity Industry of Europe

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 5.1.1. Large Cap

- 5.1.2. Mid Cap

- 5.1.3. Small Cap

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Early Stage Venture Capital Investment

- 5.2.2. Private Equity

- 5.2.3. Leverage Buyout

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. Switzerland

- 5.3.5. United Kingdom

- 5.3.6. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Investment Type

- 6. Italy European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Investment Type

- 6.1.1. Large Cap

- 6.1.2. Mid Cap

- 6.1.3. Small Cap

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Early Stage Venture Capital Investment

- 6.2.2. Private Equity

- 6.2.3. Leverage Buyout

- 6.1. Market Analysis, Insights and Forecast - by Investment Type

- 7. Germany European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Investment Type

- 7.1.1. Large Cap

- 7.1.2. Mid Cap

- 7.1.3. Small Cap

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Early Stage Venture Capital Investment

- 7.2.2. Private Equity

- 7.2.3. Leverage Buyout

- 7.1. Market Analysis, Insights and Forecast - by Investment Type

- 8. France European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Investment Type

- 8.1.1. Large Cap

- 8.1.2. Mid Cap

- 8.1.3. Small Cap

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Early Stage Venture Capital Investment

- 8.2.2. Private Equity

- 8.2.3. Leverage Buyout

- 8.1. Market Analysis, Insights and Forecast - by Investment Type

- 9. Switzerland European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Investment Type

- 9.1.1. Large Cap

- 9.1.2. Mid Cap

- 9.1.3. Small Cap

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Early Stage Venture Capital Investment

- 9.2.2. Private Equity

- 9.2.3. Leverage Buyout

- 9.1. Market Analysis, Insights and Forecast - by Investment Type

- 10. United Kingdom European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Investment Type

- 10.1.1. Large Cap

- 10.1.2. Mid Cap

- 10.1.3. Small Cap

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Early Stage Venture Capital Investment

- 10.2.2. Private Equity

- 10.2.3. Leverage Buyout

- 10.1. Market Analysis, Insights and Forecast - by Investment Type

- 11. Rest of Europe European Private Equity Funds Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Investment Type

- 11.1.1. Large Cap

- 11.1.2. Mid Cap

- 11.1.3. Small Cap

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Early Stage Venture Capital Investment

- 11.2.2. Private Equity

- 11.2.3. Leverage Buyout

- 11.1. Market Analysis, Insights and Forecast - by Investment Type

- 12. Competitive Analysis

- 12.1. Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Soft Bank Vision Fund

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Permira and Partners Group

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 IXO Private Equity

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Spring Hill Management

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 AXA Private Equity

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Oakley Capital

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Heartland

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 CVC Capital Partners

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Accent Equity Partners*

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Other Key Players*List Not Exhaustive

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 Apax Partners

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.1 Soft Bank Vision Fund

List of Figures

- Figure 1: European Private Equity Funds Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: European Private Equity Funds Market Share (%) by Company 2025

List of Tables

- Table 1: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 2: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: European Private Equity Funds Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 5: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 6: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 8: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 9: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 11: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 12: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 14: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 15: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 17: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 18: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: European Private Equity Funds Market Revenue Million Forecast, by Investment Type 2020 & 2033

- Table 20: European Private Equity Funds Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: European Private Equity Funds Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Private Equity Funds Market?

The projected CAGR is approximately 5.12%.

2. Which companies are prominent players in the European Private Equity Funds Market?

Key companies in the market include Soft Bank Vision Fund, Permira and Partners Group, IXO Private Equity, Spring Hill Management, AXA Private Equity, Oakley Capital, Heartland, CVC Capital Partners, Accent Equity Partners*, Other Key Players*List Not Exhaustive, Apax Partners.

3. What are the main segments of the European Private Equity Funds Market?

The market segments include Investment Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 150 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market.

6. What are the notable trends driving market growth?

Family Owned Companies Witnessing Majority Shareholding in Private Equity Industry of Europe.

7. Are there any restraints impacting market growth?

Increasing Cost Acts as a Restraint to the Market.

8. Can you provide examples of recent developments in the market?

In February 2023, Oakley Capital raises a record Euro 2.85 Billion (USD 3.13 Billion) for its fifth flagship fund. Oakley will continue to invest behind the long-term megatrends that have underpinned growth and returns across economic cycles, including the consumer shift to online, business migration to the Cloud, and the growing global demand for quality, accessible education.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Private Equity Funds Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Private Equity Funds Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Private Equity Funds Market?

To stay informed about further developments, trends, and reports in the European Private Equity Funds Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence