Key Insights

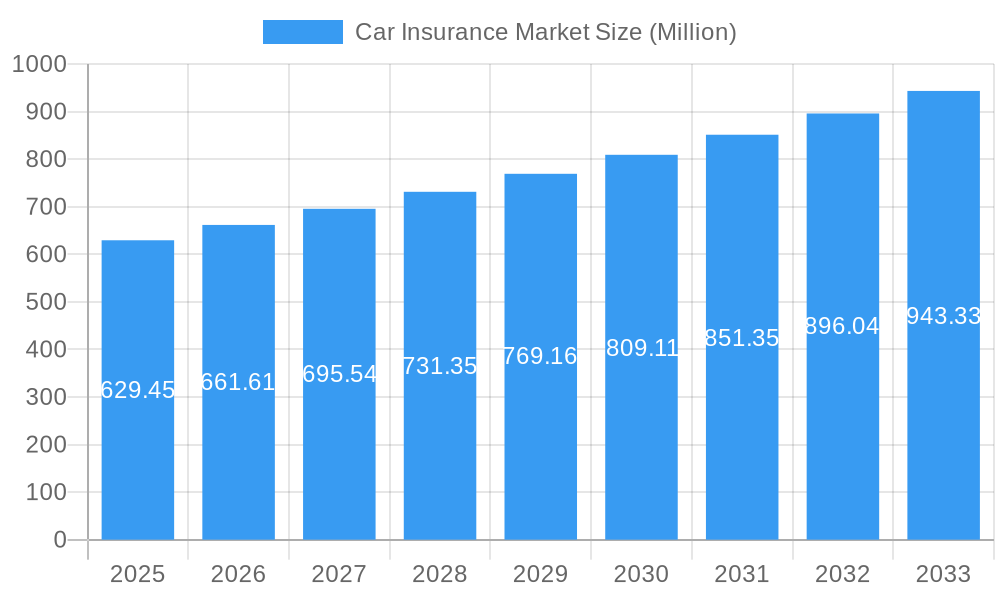

The global Car Insurance market is poised for robust growth, projected to reach a substantial USD 629.45 million by 2033, driven by an estimated CAGR of 5.13% from 2025 onwards. This expansion is fueled by a confluence of factors, including the increasing global vehicle parc, rising awareness of the necessity for financial protection against road accidents, and evolving regulatory landscapes mandating adequate insurance coverage. The market's dynamism is further propelled by technological advancements, such as telematics and AI-powered underwriting, which enhance risk assessment and customer experience, leading to more personalized and competitive insurance products. Furthermore, a growing middle class in emerging economies is contributing to a higher demand for vehicles, consequently boosting the car insurance sector. The expansion of online distribution channels and the increasing preference for digital interactions by consumers are also significant drivers.

Car Insurance Market Market Size (In Million)

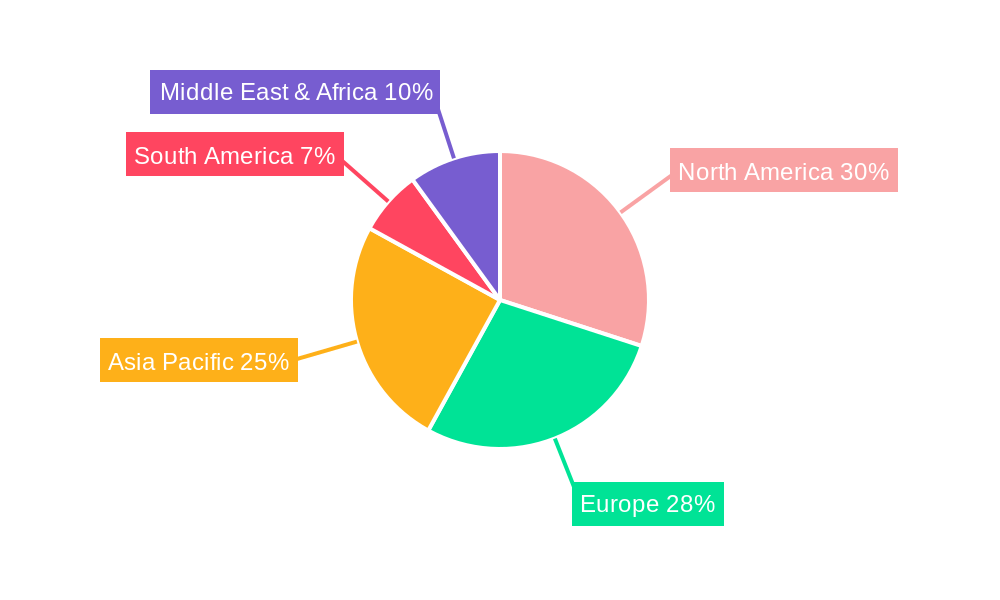

The market landscape is characterized by a diverse range of coverage options, with Third-Party Liability Coverage remaining a fundamental offering and Collision/Comprehensive/Other Optional Coverage experiencing significant uptake due to rising vehicle values and the desire for complete protection. Both personal and commercial vehicles represent key application segments, with the commercial sector showing particular growth potential driven by expanding logistics and transportation industries. The distribution channel mosaic is evolving, with direct sales and online platforms gaining prominence alongside traditional individual agents, brokers, and banks. Key players like Generali Group, Zurich Insurance Group, and American Family Insurance Group are actively innovating and expanding their reach to capture this growing market. Regional analysis indicates strong performance across North America and Europe, with significant growth opportunities anticipated in the Asia Pacific region, particularly in countries like China and India, as their automotive markets mature and insurance penetration increases.

Car Insurance Market Company Market Share

Car Insurance Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

Unlock deep insights into the dynamic global car insurance market with this in-depth report, designed to equip industry leaders, investors, and stakeholders with actionable intelligence. Spanning the historical period of 2019–2024 and projecting through to 2033, with a base and estimated year of 2025, this report provides a granular analysis of market dynamics, trends, and future opportunities. Discover key growth drivers, emerging technologies, competitive landscapes, and strategic imperatives shaping the car insurance market, auto insurance market, vehicle insurance sector, and motor insurance industry.

Car Insurance Market Market Dynamics & Concentration

The car insurance market exhibits a moderate to high concentration, with key players like Generali Group, Zurich Insurance Group, American Family Insurance Group, Allstate Corporation, Progressive Corporation, GEICO, AXA, USAA, Nationwide Mutual Insurance Company, Travelers Companies Inc, State Farm, Liberty Mutual Group, Direct Line Insurance Group, Berkshire Hathaway, and Farmers Insurance Group holding significant market share. Innovation drivers are primarily fueled by technological advancements, including telematics for usage-based insurance (UBI) and AI-powered claims processing, pushing the car insurance market growth. Regulatory frameworks, such as evolving data privacy laws and mandated coverage requirements in various regions, play a crucial role in shaping operational strategies and product offerings. Product substitutes, while limited in core coverage, are emerging in the form of embedded insurance solutions and pay-per-mile models. End-user trends lean towards personalized policies, digital engagement, and greater transparency, impacting how car insurance quotes are sought and secured. Mergers and acquisitions (M&A) activity remains a strategic lever for consolidating market share and acquiring technological capabilities. In the historical period of 2019-2024, over 15 significant M&A deals were observed, indicating a robust M&A landscape within the auto insurance market. Market share estimations reveal that the top five players collectively command approximately 60% of the global market.

Car Insurance Market Industry Trends & Analysis

The car insurance market is poised for substantial growth, driven by an expanding global vehicle parc, increasing road safety regulations, and a growing consumer awareness of the necessity of auto insurance coverage. The forecast period of 2025–2033 is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately 5.5% for the vehicle insurance sector. Technological disruptions are at the forefront, with the integration of Artificial Intelligence (AI) and Machine Learning (ML) revolutionizing underwriting, fraud detection, and customer service. Telematics and IoT devices are enabling the proliferation of Usage-Based Insurance (UBI) models, allowing insurers to offer personalized premiums based on driving behavior, a significant trend in the car insurance market. This shift caters to evolving consumer preferences for fairer pricing and customized policies, directly influencing demand for car insurance online services. Competitive dynamics are intensifying, with established players investing heavily in digital transformation to enhance customer experience and streamline operations. New entrants, often InsurTech startups, are challenging traditional models with innovative digital-first approaches, focusing on user-friendly platforms for obtaining car insurance quotes and managing policies. The market penetration of digital channels for policy acquisition and claims management is expected to exceed 70% by 2030. The increasing complexity of vehicle technology, including advanced driver-assistance systems (ADAS) and electric vehicles (EVs), also necessitates a continuous evolution in product development and risk assessment within the motor insurance industry. Furthermore, the growing emphasis on cybersecurity and data protection is a critical factor shaping the landscape of car insurance providers.

Leading Markets & Segments in Car Insurance Market

The car insurance market demonstrates distinct regional dominance and segment preferences. North America, particularly the United States, currently leads in terms of market size, driven by a large vehicle parc, robust regulatory frameworks, and high consumer spending power for auto insurance coverage. Within the United States, states with higher population density and complex traffic conditions, such as California and Texas, represent significant market pockets for car insurance providers.

Coverage:

- Third-Party Liability Coverage: This segment remains foundational, driven by mandatory legal requirements in most jurisdictions. Its dominance is sustained by its essential nature for all vehicle owners, ensuring financial protection against damages caused to third parties. Economic policies that mandate minimum liability limits directly bolster this segment.

- Collision/Comprehensive/Other Optional Coverage: This segment experiences significant growth, fueled by rising consumer demand for enhanced protection, particularly in markets with higher vehicle values and increased instances of theft and natural disasters. The increasing prevalence of expensive vehicles and advanced technologies within them also drives demand for comprehensive and collision coverage.

Application:

- Personal Vehicles: This segment constitutes the largest share of the car insurance market due to the sheer volume of privately owned vehicles globally. Factors contributing to its dominance include increasing disposable incomes, urbanization, and the growing middle class in emerging economies, leading to higher vehicle ownership rates.

- Commercial Vehicles: While smaller in volume compared to personal vehicles, this segment offers higher premium potential due to increased risk exposure, larger fleets, and specialized coverage needs. Economic growth and the expansion of logistics and transportation industries are key drivers for this segment.

Distribution Channel:

- Online: This channel is experiencing the most rapid growth, driven by consumer preference for convenience, transparency, and competitive car insurance quotes. The proliferation of smartphones and the ease of comparing policies online are key accelerators.

- Direct Sales: Insurers are increasingly investing in direct-to-consumer models, leveraging digital platforms to bypass intermediaries and build stronger customer relationships. This allows for greater control over the customer journey from policy inception to claims.

- Individual Agents & Brokers: While facing pressure from digital channels, agents and brokers continue to play a crucial role, especially for complex commercial policies and for customers seeking personalized advice and tailored solutions for their auto insurance coverage. Their expertise in navigating intricate policy details remains a significant advantage.

- Banks: Bancassurance models, where banks offer insurance products, are gaining traction in certain markets, leveraging existing customer relationships and trust.

The dominance of these segments is further shaped by evolving consumer behavior, technological adoption rates, and the varying economic policies and infrastructure development across different regions.

Car Insurance Market Product Developments

Product innovation in the car insurance market is increasingly focused on customization and technology integration. Telematics-based policies, offering pay-as-you-drive (PAYD) and behavior-based pricing, are gaining traction, leveraging connected car technology and mobile applications. AI-powered claims processing is streamlining the settlement process, improving efficiency, and enhancing customer satisfaction. Emerging products are also addressing the unique needs of electric vehicles (EVs) and autonomous driving systems, reflecting the evolving automotive landscape. These advancements provide competitive advantages by offering tailored risk management solutions and a more transparent, efficient customer experience for obtaining car insurance quotes and managing policies.

Key Drivers of Car Insurance Market Growth

Several key factors are propelling the growth of the car insurance market. Technological advancements, particularly in telematics and AI, are enabling personalized pricing models and improving operational efficiency for car insurance providers. The increasing global vehicle parc, driven by economic growth in emerging markets and sustained demand in mature economies, directly translates to a larger addressable market for auto insurance coverage. Stringent government regulations mandating minimum levels of car insurance coverage in most regions ensure a baseline demand. Furthermore, rising consumer awareness regarding the financial risks associated with vehicle ownership and the benefits of comprehensive protection is a significant driver. The continuous need for efficient and accessible car insurance online platforms also fuels growth.

Challenges in the Car Insurance Market Market

Despite robust growth, the car insurance market faces several challenges. Increasing claims frequency and severity, often exacerbated by climate change-related weather events and the rising cost of vehicle repairs due to complex technology, put pressure on profitability. Regulatory hurdles, including varying compliance requirements across different jurisdictions and evolving data privacy laws, add complexity to operations. Intense competition among established insurers and the emergence of InsurTech startups lead to price wars and pressure on margins for car insurance providers. Supply chain issues impacting the availability and cost of vehicle parts can also affect repair costs and, consequently, claims payouts. Cybersecurity threats and the need for robust data protection measures represent ongoing challenges for insurers handling sensitive customer information for auto insurance coverage.

Emerging Opportunities in Car Insurance Market

Emerging opportunities in the car insurance market are abundant, driven by innovation and evolving consumer needs. The continued development and adoption of autonomous vehicle technology present a significant long-term opportunity for specialized insurance products. The growth of mobility-as-a-service (MaaS) platforms opens avenues for embedded insurance solutions tailored to ride-sharing and on-demand transportation. Strategic partnerships between insurers and automotive manufacturers, as well as technology companies, are crucial for developing integrated solutions and enhancing customer engagement for car insurance. The untapped potential in emerging economies, with their rapidly growing vehicle ownership, offers substantial market expansion opportunities for car insurance providers seeking to offer accessible auto insurance coverage.

Leading Players in the Car Insurance Market Sector

- Generali Group

- Zurich Insurance Group

- American Family Insurance Group

- Allstate Corporation

- Progressive Corporation

- GEICO

- AXA

- USAA (United Services Automobile Association)

- Nationwide Mutual Insurance Company

- Travelers Companies Inc

- State Farm

- Liberty Mutual Group

- Direct Line Insurance Group

- Berkshire Hathaway

- Farmers Insurance Group

Key Milestones in Car Insurance Market Industry

- June 2022: StoneRidge Insurance Brokers (SIB) has formed a new partnership deal with K5 Insurance, a full-service insurance brokerage. The partnership with K5 Insurance expands its personal and commercial presence in both Manitoba and Saskatchewan. This strategic alliance enhances SIB's market reach and service offerings in key Canadian provinces.

- January 2023: Tekion, the innovator of the Automotive Retail Cloud, partnered with Polly, the leading insurance marketplace for automotive retail. Through this partnership, dealers can access Polly’s insurance quotes directly from Tekion ARC. This integration streamlines the insurance purchasing process for car buyers at the point of sale, improving the customer experience and potentially increasing policy adoption rates.

Strategic Outlook for Car Insurance Market Market

The strategic outlook for the car insurance market is characterized by a strong emphasis on digital transformation, personalization, and ecosystem integration. Insurers that successfully leverage telematics and AI to offer dynamic, usage-based pricing and personalized customer experiences will gain a competitive edge in acquiring and retaining policyholders seeking car insurance quotes. Strategic partnerships with automotive manufacturers, technology providers, and mobility platforms will be crucial for developing embedded insurance solutions and expanding market reach. Focusing on data analytics to enhance underwriting accuracy, fraud detection, and claims management will drive efficiency and profitability. The growing demand for specialized coverage for electric vehicles and autonomous driving technologies presents significant opportunities for innovation and market differentiation within the auto insurance market. Ultimately, a customer-centric approach, prioritizing transparency, convenience, and tailored solutions, will define success in the evolving car insurance market.

Car Insurance Market Segmentation

-

1. Coverage

- 1.1. Third-Party Liability Coverage

- 1.2. Collision/Comprehensive/Other Optional Coverage

-

2. Application

- 2.1. Personal Vehicles

- 2.2. Commercial Vehicles

-

3. Distribution Channel

- 3.1. Direct Sales

- 3.2. Individual Agents

- 3.3. Brokers

- 3.4. Banks

- 3.5. Online

- 3.6. Other Distribution Channels

Car Insurance Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Car Insurance Market Regional Market Share

Geographic Coverage of Car Insurance Market

Car Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.13% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Sales of Car; Increase in Number of Car Accidents

- 3.3. Market Restrains

- 3.3.1. Regulations are Posing Barriers to Entry for New Players

- 3.4. Market Trends

- 3.4.1. Rising Number of Road Accidents in America Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 5.1.1. Third-Party Liability Coverage

- 5.1.2. Collision/Comprehensive/Other Optional Coverage

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Personal Vehicles

- 5.2.2. Commercial Vehicles

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Direct Sales

- 5.3.2. Individual Agents

- 5.3.3. Brokers

- 5.3.4. Banks

- 5.3.5. Online

- 5.3.6. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Coverage

- 6. North America Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 6.1.1. Third-Party Liability Coverage

- 6.1.2. Collision/Comprehensive/Other Optional Coverage

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Personal Vehicles

- 6.2.2. Commercial Vehicles

- 6.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.3.1. Direct Sales

- 6.3.2. Individual Agents

- 6.3.3. Brokers

- 6.3.4. Banks

- 6.3.5. Online

- 6.3.6. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Coverage

- 7. South America Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 7.1.1. Third-Party Liability Coverage

- 7.1.2. Collision/Comprehensive/Other Optional Coverage

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Personal Vehicles

- 7.2.2. Commercial Vehicles

- 7.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.3.1. Direct Sales

- 7.3.2. Individual Agents

- 7.3.3. Brokers

- 7.3.4. Banks

- 7.3.5. Online

- 7.3.6. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Coverage

- 8. Europe Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 8.1.1. Third-Party Liability Coverage

- 8.1.2. Collision/Comprehensive/Other Optional Coverage

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Personal Vehicles

- 8.2.2. Commercial Vehicles

- 8.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.3.1. Direct Sales

- 8.3.2. Individual Agents

- 8.3.3. Brokers

- 8.3.4. Banks

- 8.3.5. Online

- 8.3.6. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Coverage

- 9. Middle East & Africa Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 9.1.1. Third-Party Liability Coverage

- 9.1.2. Collision/Comprehensive/Other Optional Coverage

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Personal Vehicles

- 9.2.2. Commercial Vehicles

- 9.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.3.1. Direct Sales

- 9.3.2. Individual Agents

- 9.3.3. Brokers

- 9.3.4. Banks

- 9.3.5. Online

- 9.3.6. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Coverage

- 10. Asia Pacific Car Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 10.1.1. Third-Party Liability Coverage

- 10.1.2. Collision/Comprehensive/Other Optional Coverage

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Personal Vehicles

- 10.2.2. Commercial Vehicles

- 10.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.3.1. Direct Sales

- 10.3.2. Individual Agents

- 10.3.3. Brokers

- 10.3.4. Banks

- 10.3.5. Online

- 10.3.6. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Coverage

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Generali Group

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Zurich Insurance Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 American Family Insurance Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allstate Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Progressive Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 GEICO

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 AXA

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 USAA (United Services Automobile Association)

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nationwide Mutual Insurance Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Travelers Companies Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 State Farm

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Liberty Mutual Group

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Direct Line Insurance Group**List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Berkshire Hathaway

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Farmers Insurance Group

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.1 Generali Group

List of Figures

- Figure 1: Global Car Insurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Car Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 3: North America Car Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 4: North America Car Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Car Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Car Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 7: North America Car Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 8: North America Car Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 9: North America Car Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Car Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 11: South America Car Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 12: South America Car Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 13: South America Car Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 14: South America Car Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 15: South America Car Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 16: South America Car Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 17: South America Car Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Car Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 19: Europe Car Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 20: Europe Car Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 21: Europe Car Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 22: Europe Car Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 23: Europe Car Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 24: Europe Car Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Car Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Car Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 27: Middle East & Africa Car Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 28: Middle East & Africa Car Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 29: Middle East & Africa Car Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East & Africa Car Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Car Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Car Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Car Insurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Car Insurance Market Revenue (Million), by Coverage 2025 & 2033

- Figure 35: Asia Pacific Car Insurance Market Revenue Share (%), by Coverage 2025 & 2033

- Figure 36: Asia Pacific Car Insurance Market Revenue (Million), by Application 2025 & 2033

- Figure 37: Asia Pacific Car Insurance Market Revenue Share (%), by Application 2025 & 2033

- Figure 38: Asia Pacific Car Insurance Market Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Car Insurance Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Car Insurance Market Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific Car Insurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 2: Global Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Car Insurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 6: Global Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 7: Global Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: Global Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 13: Global Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: Global Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 20: Global Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 33: Global Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 34: Global Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global Car Insurance Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 43: Global Car Insurance Market Revenue Million Forecast, by Application 2020 & 2033

- Table 44: Global Car Insurance Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 45: Global Car Insurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Car Insurance Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Car Insurance Market?

The projected CAGR is approximately 5.13%.

2. Which companies are prominent players in the Car Insurance Market?

Key companies in the market include Generali Group, Zurich Insurance Group, American Family Insurance Group, Allstate Corporation, Progressive Corporation, GEICO, AXA, USAA (United Services Automobile Association), Nationwide Mutual Insurance Company, Travelers Companies Inc, State Farm, Liberty Mutual Group, Direct Line Insurance Group**List Not Exhaustive, Berkshire Hathaway, Farmers Insurance Group.

3. What are the main segments of the Car Insurance Market?

The market segments include Coverage, Application, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 629.45 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Sales of Car; Increase in Number of Car Accidents.

6. What are the notable trends driving market growth?

Rising Number of Road Accidents in America Region.

7. Are there any restraints impacting market growth?

Regulations are Posing Barriers to Entry for New Players.

8. Can you provide examples of recent developments in the market?

June 2022: StoneRidge Insurance Brokers (SIB) has formed a new partnership deal with K5 Insurance, a full-service insurance brokerage. The partnership with K5 Insurance expands its personal and commercial presence in both Manitoba and Saskatchewan.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Car Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Car Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Car Insurance Market?

To stay informed about further developments, trends, and reports in the Car Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence