Key Insights

The European capital market exchange ecosystem, including prominent platforms such as Euronext, Nasdaq Nordic, and the London Stock Exchange, represents a significant and evolving market. Projecting for 2025, the market size is estimated at 151.36 million, with an anticipated Compound Annual Growth Rate (CAGR) of 5.8%. Key growth drivers include heightened regulatory scrutiny fostering transparency and investor protection, the proliferation of fintech innovations improving trading efficiency and accessibility, and an increasing volume of Initial Public Offerings (IPOs) and capital-raising activities from both established corporations and emerging startups. Current trends highlight a decisive shift towards digitalization, with a substantial migration of trading activities to online platforms, alongside a growing emphasis on sustainable and responsible investing, which influences both company listings and investment approaches. Potential challenges involve geopolitical instability impacting investor confidence and complex regulatory variations across European markets hindering cross-border trading.

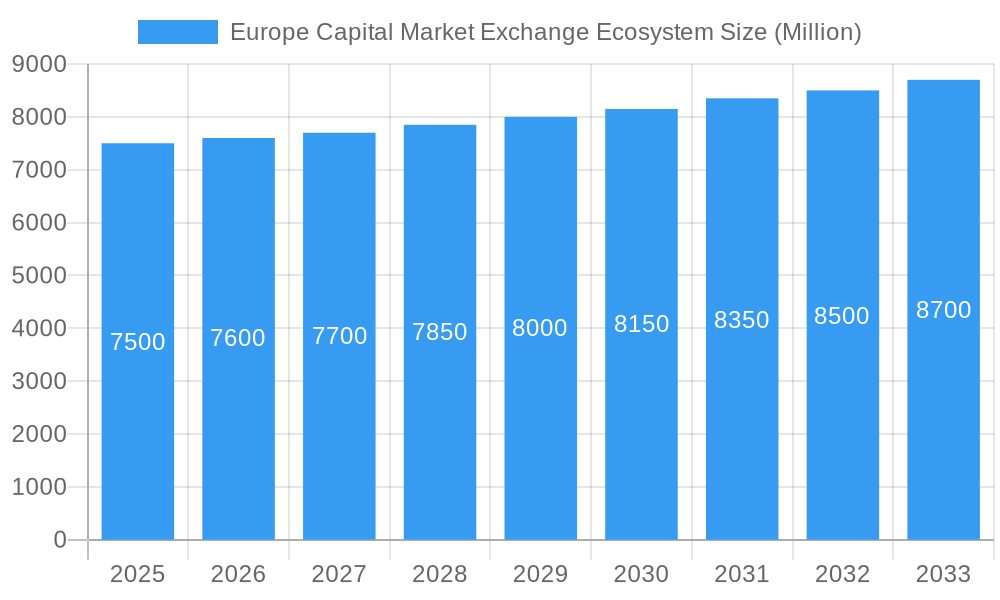

Europe Capital Market Exchange Ecosystem Market Size (In Million)

Segment analysis indicates robust growth across diverse asset classes, including equities, bonds, and derivatives. Geographically, Western European markets such as the UK, France, and Germany exhibit strong market concentration, while Central and Eastern European markets present considerable growth potential. The competitive environment features a mix of established, large-scale exchanges and specialized entities serving niche market segments. The forecast period, from 2025 to 2033, is expected to witness sustained market expansion, propelled by technological advancements and the ongoing development of the EU's single market. Nevertheless, the trajectory of the market will be significantly shaped by macroeconomic conditions and evolving regulatory frameworks. Strategic alliances and mergers & acquisitions are also poised to redefine competitive dynamics, potentially leading to increased market consolidation.

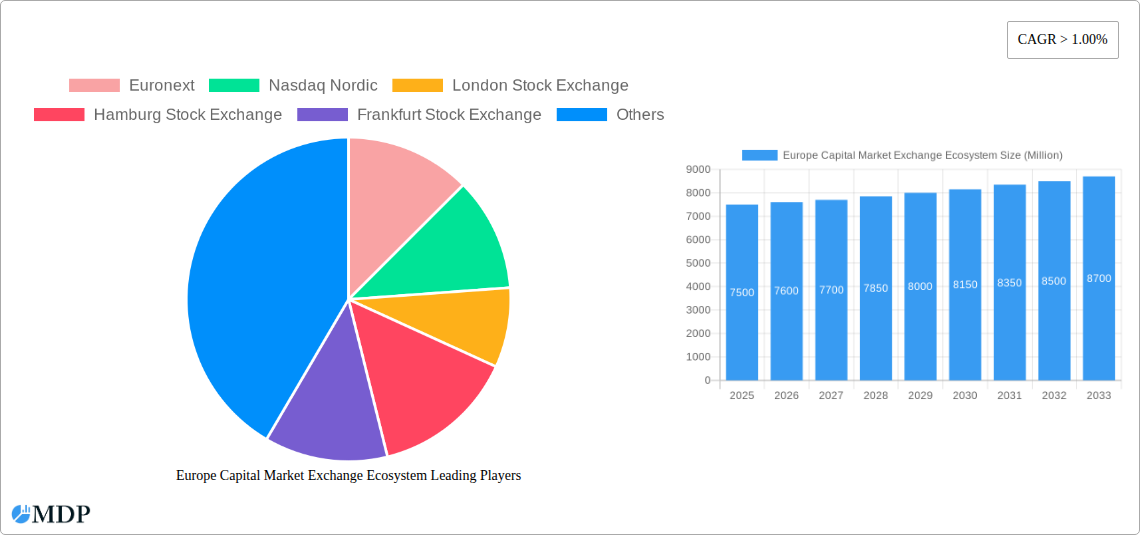

Europe Capital Market Exchange Ecosystem Company Market Share

Europe Capital Market Exchange Ecosystem: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the European capital market exchange ecosystem, offering invaluable insights for stakeholders across the industry. Covering the period from 2019 to 2033, with a focus on 2025, this report analyzes market dynamics, leading players, emerging opportunities, and key challenges. With a predicted market value exceeding EUR xx Million by 2033, understanding this dynamic landscape is crucial for informed decision-making. Download now to gain a competitive edge.

Europe Capital Market Exchange Ecosystem Market Dynamics & Concentration

This section analyzes the competitive landscape of the European capital market exchange ecosystem, examining market concentration, innovation, regulatory frameworks, and M&A activity. The historical period (2019-2024) reveals a consolidating market, with a predicted xx% market share held by the top three players in 2025.

- Market Concentration: The European capital market exchange ecosystem is characterized by a moderate level of concentration, with a few dominant players and numerous smaller exchanges. The market share distribution is expected to remain relatively stable in the forecast period (2025-2033), though further consolidation through mergers and acquisitions is anticipated.

- Innovation Drivers: Technological advancements, such as the rise of fintech and blockchain technology, are driving innovation in trading infrastructure, clearing and settlement processes, and investment products. Regulatory changes also play a significant role, pushing exchanges to adapt and improve their services.

- Regulatory Frameworks: The regulatory environment varies across European countries, impacting market structure and competitiveness. Compliance with regulations like MiFID II and other market directives shapes the operational landscape.

- Product Substitutes: The emergence of alternative trading platforms and decentralized finance (DeFi) protocols poses a potential threat to traditional exchanges. While the adoption of such alternatives remains relatively low, their growth warrants attention.

- End-User Trends: The increasing adoption of algorithmic and high-frequency trading necessitates robust and efficient exchange infrastructure capable of handling large volumes of transactions.

- M&A Activities: The past five years have witnessed a significant number of mergers and acquisitions (M&A) within the European exchange ecosystem, with approximately xx M&A deals recorded between 2019 and 2024, driven primarily by consolidation and expansion strategies. This trend is expected to continue in the coming years.

Europe Capital Market Exchange Ecosystem Industry Trends & Analysis

This section dives deep into the industry trends shaping the European capital market exchange ecosystem, including market growth drivers, technological disruptions, evolving consumer preferences, and competitive dynamics. The compound annual growth rate (CAGR) for the period 2025-2033 is estimated at xx%, driven by factors such as increased trading volumes, regulatory changes, and technological innovations. Market penetration for new technologies like blockchain-based trading platforms is projected to reach xx% by 2033. The increased adoption of digital assets and cryptocurrencies has created both opportunities and challenges for traditional exchanges, requiring them to adapt and innovate.

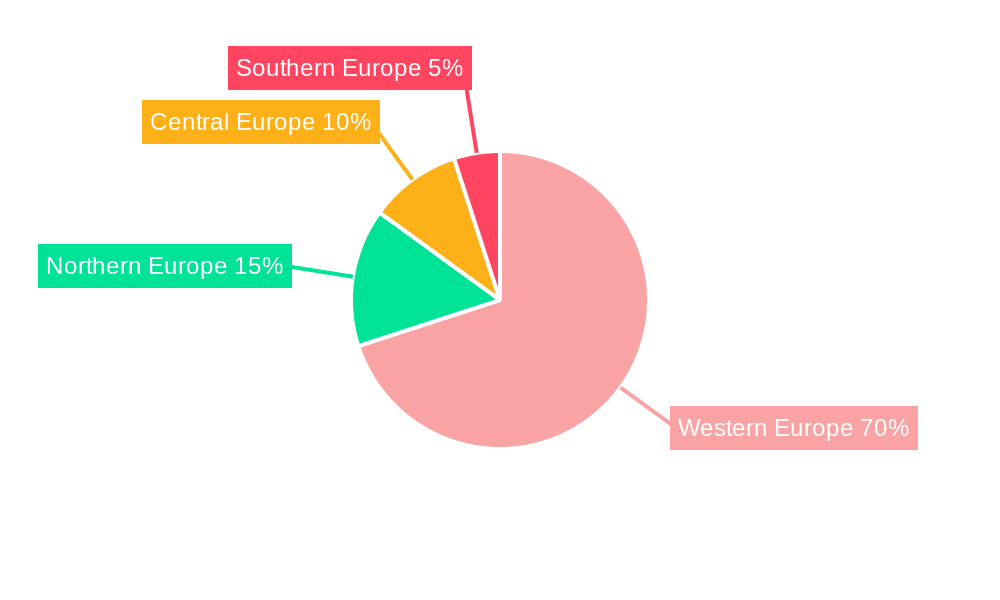

Leading Markets & Segments in Europe Capital Market Exchange Ecosystem

This section identifies the dominant regions, countries, and segments within the European capital market exchange ecosystem. The analysis reveals that the UK and the Eurozone remain the largest markets, supported by strong economic activity, well-developed financial infrastructure, and favorable regulatory environments.

- Key Drivers of Dominance:

- UK: Strong financial sector, London's position as a global financial hub, and a deep pool of investment capital.

- Eurozone: Large and diverse economies, significant trading volumes, and well-established regulatory frameworks.

- Detailed Dominance Analysis: The dominance of the UK and the Eurozone is expected to persist in the forecast period, but other regions, such as the Nordic countries and Central and Eastern Europe, are likely to experience growth driven by economic development and technological advancements.

Europe Capital Market Exchange Ecosystem Product Developments

Recent product innovations within the ecosystem have focused on improving trading efficiency, enhancing investor access, and broadening the range of available instruments. Technological advancements like high-frequency trading (HFT) systems, advanced order management systems (OMS), and data analytics tools are improving market liquidity and speed of execution. The integration of AI and machine learning algorithms allows for better risk management and fraud detection. This aligns with market demands for increased speed, transparency, and cost-effectiveness.

Key Drivers of Europe Capital Market Exchange Ecosystem Growth

Several key factors are driving the growth of the European capital market exchange ecosystem:

- Technological Advancements: Fintech innovations are streamlining trading processes and increasing efficiency.

- Economic Growth: Strong economic performance in key European markets fuels trading activity.

- Regulatory Changes: Regulatory reforms aimed at promoting market transparency and investor protection are stimulating growth.

- Increased Market Liquidity: Growing investment in technology drives greater liquidity in the market.

Challenges in the Europe Capital Market Exchange Ecosystem Market

The European capital market exchange ecosystem faces challenges:

- Regulatory Hurdles: Navigating complex and evolving regulations across diverse jurisdictions creates compliance burdens.

- Cybersecurity Threats: The increasing reliance on technology makes exchanges vulnerable to cyberattacks.

- Competition from Alternative Trading Platforms: The rise of alternative trading venues poses a competitive challenge.

Emerging Opportunities in Europe Capital Market Exchange Ecosystem

Long-term growth will be fuelled by:

- Technological Breakthroughs: Blockchain technology, artificial intelligence, and machine learning offer opportunities for enhanced security and efficiency.

- Strategic Partnerships: Collaborations among exchanges, fintech companies, and investors can unlock new growth avenues.

- Market Expansion: Expanding into underserved markets in Central and Eastern Europe represents a significant growth opportunity.

Leading Players in the Europe Capital Market Exchange Ecosystem Sector

- Euronext

- Nasdaq Nordic

- London Stock Exchange

- Hamburg Stock Exchange

- Frankfurt Stock Exchange

- Italian Stock Exchange

- SIX Swiss Exchange

- Budapest Stock Exchange

- Moscow Exchange

- Ukrainian Exchange

Key Milestones in Europe Capital Market Exchange Ecosystem Industry

- October 2023: Euronext introduces a new VaR-based margin methodology on the Euronext Milan equities, ETF, and financial derivatives markets, enhancing risk management and market stability.

- March 2023: Innovate UK and the London Stock Exchange partner to improve financial access for innovative businesses, unlocking EUR 6 trillion of long-term capital for UK growth and innovation.

Strategic Outlook for Europe Capital Market Exchange Ecosystem Market

The future of the European capital market exchange ecosystem is bright, driven by continuous technological advancements, increasing regulatory clarity, and the growing need for efficient and transparent capital markets. Strategic opportunities lie in leveraging technology to enhance operational efficiency, broaden product offerings, and expand into new markets. The focus on sustainable finance and ESG (Environmental, Social, and Governance) investing presents another key area for growth and innovation.

Europe Capital Market Exchange Ecosystem Segmentation

-

1. Type of Market

- 1.1. Primary Market

- 1.2. Secondary Market

-

2. Financial Instruments

- 2.1. Debt

- 2.2. Equity

-

3. Investors

- 3.1. Retail Investors

- 3.2. Institutional Investors

Europe Capital Market Exchange Ecosystem Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Capital Market Exchange Ecosystem Regional Market Share

Geographic Coverage of Europe Capital Market Exchange Ecosystem

Europe Capital Market Exchange Ecosystem REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Significance of Primary Market in European Capital Market Exchange Ecosystem

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Capital Market Exchange Ecosystem Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 5.1.1. Primary Market

- 5.1.2. Secondary Market

- 5.2. Market Analysis, Insights and Forecast - by Financial Instruments

- 5.2.1. Debt

- 5.2.2. Equity

- 5.3. Market Analysis, Insights and Forecast - by Investors

- 5.3.1. Retail Investors

- 5.3.2. Institutional Investors

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type of Market

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Euronext

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Nasdaq Nordic

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 London Stock Exchange

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Hamburg Stock Exchange

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Frankfurt Stock Exchange

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Italian Stock Exchange

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 SIX Swiss Exchange

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Budapest Stock Exchange

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Moscow Exchange

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Ukrainian Exchange**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Euronext

List of Figures

- Figure 1: Europe Capital Market Exchange Ecosystem Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Europe Capital Market Exchange Ecosystem Share (%) by Company 2025

List of Tables

- Table 1: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Type of Market 2020 & 2033

- Table 2: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Financial Instruments 2020 & 2033

- Table 3: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Investors 2020 & 2033

- Table 4: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Region 2020 & 2033

- Table 5: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Type of Market 2020 & 2033

- Table 6: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Financial Instruments 2020 & 2033

- Table 7: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Investors 2020 & 2033

- Table 8: Europe Capital Market Exchange Ecosystem Revenue million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Capital Market Exchange Ecosystem Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Capital Market Exchange Ecosystem?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Europe Capital Market Exchange Ecosystem?

Key companies in the market include Euronext, Nasdaq Nordic, London Stock Exchange, Hamburg Stock Exchange, Frankfurt Stock Exchange, Italian Stock Exchange, SIX Swiss Exchange, Budapest Stock Exchange, Moscow Exchange, Ukrainian Exchange**List Not Exhaustive.

3. What are the main segments of the Europe Capital Market Exchange Ecosystem?

The market segments include Type of Market, Financial Instruments, Investors.

4. Can you provide details about the market size?

The market size is estimated to be USD 151.36 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Significance of Primary Market in European Capital Market Exchange Ecosystem.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In October 2023, Euronext introduced a new VaR-based margin methodology on the Euronext Milan equities, ETF and financial derivatives markets.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Capital Market Exchange Ecosystem," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Capital Market Exchange Ecosystem report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Capital Market Exchange Ecosystem?

To stay informed about further developments, trends, and reports in the Europe Capital Market Exchange Ecosystem, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence