Key Insights

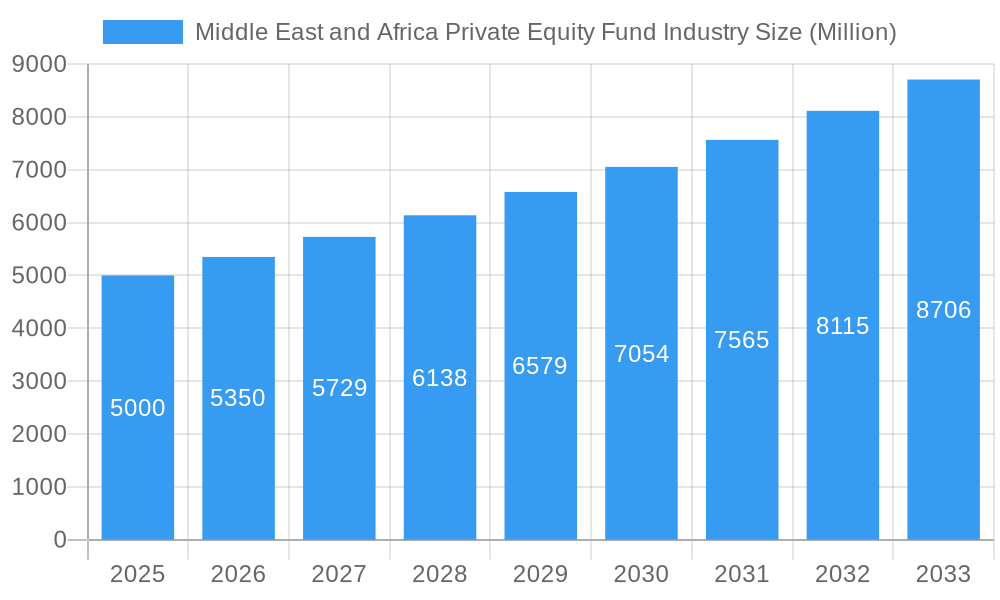

The Middle East and Africa (MEA) private equity fund industry is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of 6.41% from 2025 to 2033. This growth is underpinned by strategic government diversification initiatives, a vibrant entrepreneurial landscape, and substantial untapped potential in sectors such as technology, healthcare, and renewable energy. Increased involvement from regional family offices, sovereign wealth funds, and international investors further fuels this upward trajectory. Despite potential regulatory and geopolitical considerations, the MEA private equity market presents compelling opportunities.

Middle East and Africa Private Equity Fund Industry Market Size (In Billion)

The market exhibits diverse segmentation, with notable growth in technology, healthcare, real estate, and infrastructure sub-sectors. Leading private equity firms are strategically capitalizing on these opportunities, fostering innovation and competition. The estimated MEA private equity fund market size for 2025 is 21063.4 million, highlighting considerable growth potential and a promising outlook for investors.

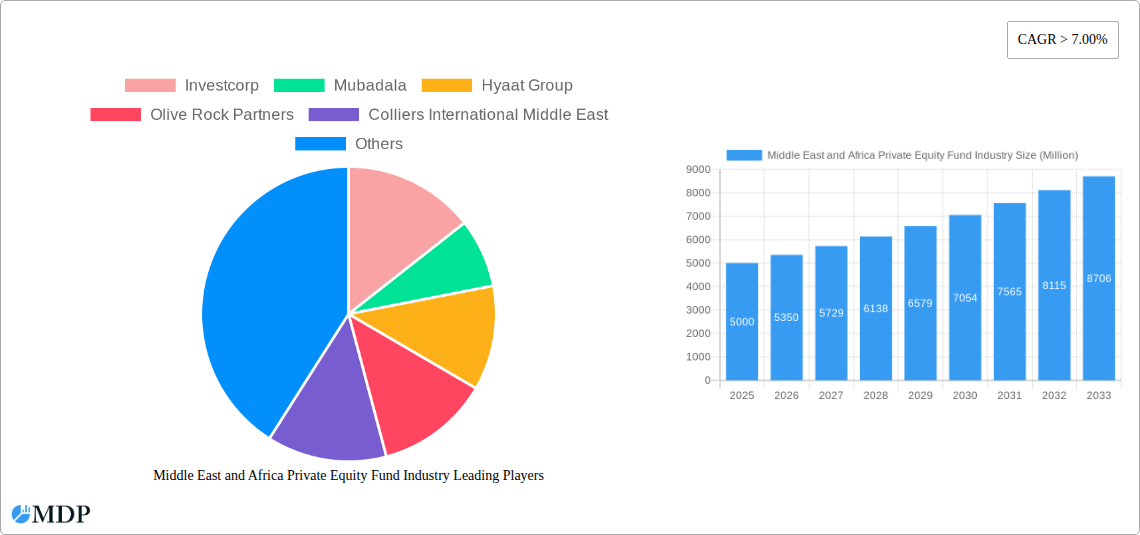

Middle East and Africa Private Equity Fund Industry Company Market Share

Middle East & Africa Private Equity Fund Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the Middle East and Africa Private Equity Fund Industry, offering crucial insights for investors, fund managers, and industry stakeholders. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report unveils the market dynamics, growth drivers, and future outlook for this dynamic sector. The report analyzes key players like Investcorp, Mubadala, Hyatt Group, Olive Rock Partners, Colliers International Middle East, Ascension Capital Partners, Saint Capital Fund, BluePeak Private Capital, Sigma Capital Holding, and Vantage Capital (list not exhaustive). Discover the key trends, challenges, and opportunities shaping the future of private equity investment in the MEA region.

Middle East and Africa Private Equity Fund Industry Market Dynamics & Concentration

The Middle East and Africa private equity market exhibits a moderately concentrated landscape, with a few dominant players commanding significant market share. In 2024, the top five firms held an estimated 40% market share, while the remaining share was distributed across numerous smaller and niche players. Market concentration is influenced by factors such as access to capital, regulatory frameworks, and established networks. Innovation within the industry is driven by technological advancements, such as the use of AI in due diligence and portfolio management. Regulatory changes, particularly those relating to foreign investment and taxation, significantly influence market dynamics. Product substitutes, such as debt financing, compete with private equity for investment opportunities. End-user trends toward sustainable and impact investing are creating new opportunities. The M&A landscape is active, with xx major transactions recorded in 2024, reflecting the consolidation and expansion efforts of major players.

- Market Share Concentration: Top 5 firms held approximately 40% of market share in 2024.

- M&A Activity: xx major transactions in 2024.

- Innovation Drivers: AI in due diligence, sustainable and impact investing.

- Regulatory Influence: Significant impact from foreign investment and taxation regulations.

Middle East and Africa Private Equity Fund Industry Industry Trends & Analysis

The MEA private equity market is experiencing robust growth, driven by several key factors. The region's increasing economic diversification, coupled with supportive government policies promoting foreign investment, is attracting significant capital inflows. Technological advancements, particularly in fintech and digital infrastructure, are facilitating investment opportunities in emerging sectors. Shifting consumer preferences towards experiential consumption and sustainable products are shaping investment strategies. Intense competition among private equity firms is driving innovation and pushing down fees. The Compound Annual Growth Rate (CAGR) for the industry is projected to be xx% during the forecast period (2025-2033). Market penetration is expected to increase by xx% by 2033, driven by increasing awareness and access to private equity investments. Competition is further intensified by the entrance of global players alongside regional players which fosters a dynamic environment.

Leading Markets & Segments in Middle East and Africa Private Equity Fund Industry

The UAE and South Africa currently dominate the MEA private equity market, accounting for approximately xx% of total investments. Key drivers of their dominance include:

- UAE: Strong regulatory framework, developed infrastructure, strategic geographic location, significant Sovereign Wealth Funds (SWFs) like Mubadala, and a well-established financial ecosystem.

- South Africa: Large and diversified economy, relatively developed financial markets, abundant natural resources, and a growing entrepreneurial class.

Other significant markets include Egypt, Kenya, and Nigeria. The technology, healthcare, and renewable energy sectors are attracting the most private equity investments due to high growth potential. The dominance of these regions and sectors is expected to continue throughout the forecast period, supported by ongoing economic development and government initiatives.

Middle East and Africa Private Equity Fund Industry Product Developments

Recent product innovations focus on specialized funds targeting specific sectors or geographies, impact investing strategies with a focus on ESG (Environmental, Social, and Governance) factors, and fund structures designed to attract a wider range of investors. These developments reflect evolving market demands and a need to cater to specific investment objectives. Technological advancements, particularly in data analytics and portfolio management, are significantly improving the efficiency and effectiveness of private equity investments.

Key Drivers of Middle East and Africa Private Equity Fund Industry Growth

Several factors are driving the growth of the MEA private equity market:

- Increased Foreign Direct Investment (FDI): Government initiatives to attract FDI are fueling growth.

- Economic Diversification: Shifting away from reliance on oil and gas, creating opportunities in diverse sectors.

- Technological Advancements: Fintech and digital infrastructure are enabling new investment avenues.

- Supportive Regulatory Environment: Easing regulations related to foreign investment in many countries.

Challenges in the Middle East and Africa Private Equity Fund Industry Market

The MEA private equity market faces several challenges:

- Regulatory Uncertainty: Inconsistent regulatory frameworks across different countries create complexities.

- Political and Economic Instability: Geopolitical risks in some regions can deter investment.

- Lack of Transparency: Limited access to information can hinder deal flow and valuations.

- Infrastructure Gaps: Inadequate infrastructure in some areas can limit investment opportunities.

Emerging Opportunities in Middle East and Africa Private Equity Fund Industry

Significant growth opportunities exist in sectors such as renewable energy, fintech, and healthcare. Strategic partnerships between local and international players can unlock considerable value. Expansion into untapped markets within the MEA region promises substantial returns. Technological breakthroughs in areas like AI and big data offer enhanced due diligence and portfolio management capabilities.

Leading Players in the Middle East and Africa Private Equity Fund Industry Sector

- Investcorp

- Mubadala

- Hyatt Group

- Olive Rock Partners

- Colliers International Middle East

- Ascension Capital Partners

- Saint Capital Fund

- BluePeak Private Capital

- Sigma Capital Holding

- Vantage Capital

Key Milestones in Middle East and Africa Private Equity Fund Industry Industry

- January 2022: Colliers International Middle East expands its footprint through Eltizam's acquisition of Falcon Investments LLC.

- January 2022: BluePeak Private Capital invests in Grit Real Estate Income Group Limited, boosting East African infrastructure.

Strategic Outlook for Middle East and Africa Private Equity Fund Industry Market

The MEA private equity market is poised for continued growth, driven by strong economic fundamentals, supportive government policies, and technological advancements. Strategic partnerships, focused sector investments, and the adoption of innovative technologies will play a key role in shaping the industry's future. The long-term outlook remains positive, with significant opportunities for investors and fund managers who can navigate the market's unique challenges and leverage its significant potential.

Middle East and Africa Private Equity Fund Industry Segmentation

-

1. Industry / Sector

- 1.1. Utilities

- 1.2. Oil & Gas

- 1.3. Financials

- 1.4. Technology

- 1.5. Healthcare

- 1.6. Consumer Goods & Services

- 1.7. Others

-

2. Investment Type

- 2.1. Venture Capital

- 2.2. Growth

- 2.3. Buyout

- 2.4. Others

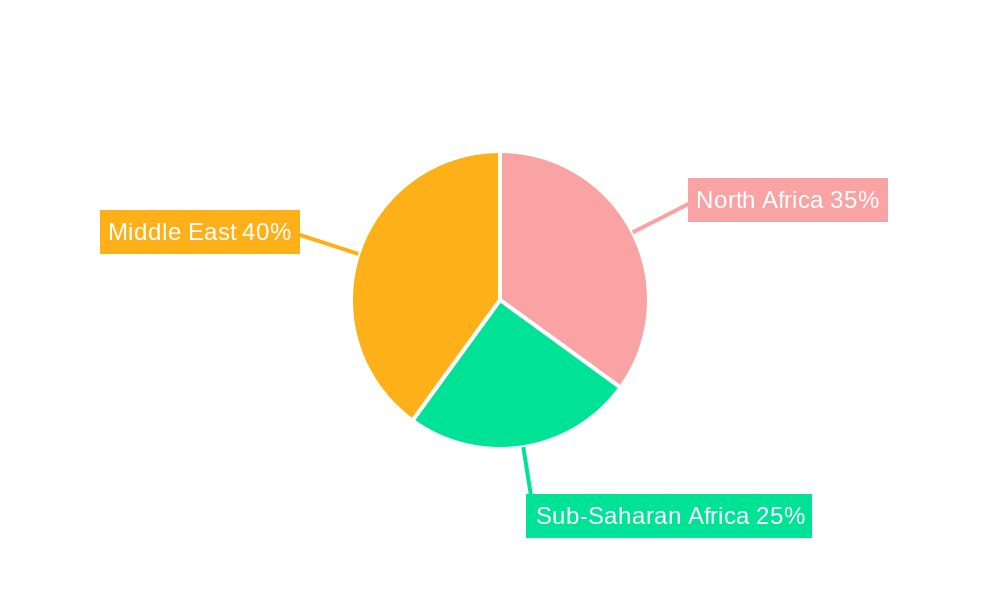

Middle East and Africa Private Equity Fund Industry Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Private Equity Fund Industry Regional Market Share

Geographic Coverage of Middle East and Africa Private Equity Fund Industry

Middle East and Africa Private Equity Fund Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Capital Deployment in Africa

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Private Equity Fund Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Industry / Sector

- 5.1.1. Utilities

- 5.1.2. Oil & Gas

- 5.1.3. Financials

- 5.1.4. Technology

- 5.1.5. Healthcare

- 5.1.6. Consumer Goods & Services

- 5.1.7. Others

- 5.2. Market Analysis, Insights and Forecast - by Investment Type

- 5.2.1. Venture Capital

- 5.2.2. Growth

- 5.2.3. Buyout

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Industry / Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Investcorp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Mubadala

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyaat Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Olive Rock Partners

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Colliers International Middle East

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ascension Capital Partners

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saint Capital Fund

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BluePeak Private Capital

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sigma Capital Holding

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vantage Capital**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Investcorp

List of Figures

- Figure 1: Middle East and Africa Private Equity Fund Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Private Equity Fund Industry Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Industry / Sector 2020 & 2033

- Table 2: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Investment Type 2020 & 2033

- Table 3: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Industry / Sector 2020 & 2033

- Table 5: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Investment Type 2020 & 2033

- Table 6: Middle East and Africa Private Equity Fund Industry Revenue million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Private Equity Fund Industry Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Private Equity Fund Industry?

The projected CAGR is approximately 6.41%.

2. Which companies are prominent players in the Middle East and Africa Private Equity Fund Industry?

Key companies in the market include Investcorp, Mubadala, Hyaat Group, Olive Rock Partners, Colliers International Middle East, Ascension Capital Partners, Saint Capital Fund, BluePeak Private Capital, Sigma Capital Holding, Vantage Capital**List Not Exhaustive.

3. What are the main segments of the Middle East and Africa Private Equity Fund Industry?

The market segments include Industry / Sector, Investment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 21063.4 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Capital Deployment in Africa.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

In Jan 2022, Colliers, a services and investment management firm, improved its footprint in the Middle East and North Africa (MENA) with Eltizam Asset Management Group's (Eltizam) acquisition of Falcon Investments LLC, an associate partner that has been doing business in the region as Colliers since 1995. Colliers benefits from the competence in core real estate transactions and advisory services offered by Eltizam and the asset management services.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Private Equity Fund Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Private Equity Fund Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Private Equity Fund Industry?

To stay informed about further developments, trends, and reports in the Middle East and Africa Private Equity Fund Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence