Key Insights

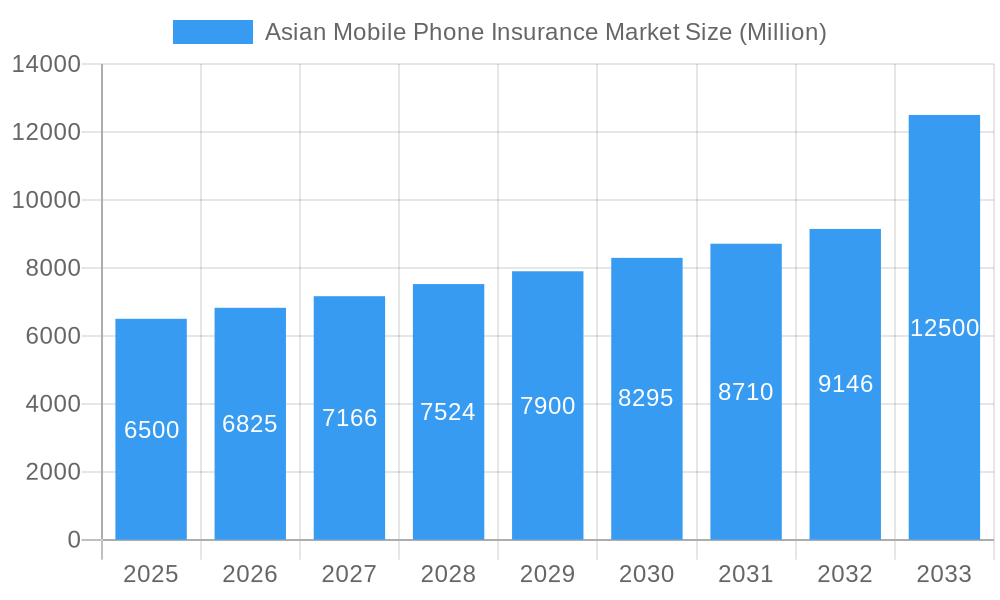

The Asian mobile phone insurance market is projected for substantial growth, anticipated to reach over USD 39.15 billion by 2033, with a CAGR of 11.5%. This expansion is driven by the increasing cost of premium smartphones and heightened consumer awareness of financial risks associated with device damage, loss, or theft. The proliferation of advanced mobile devices and their integral role in daily life underscore the value of comprehensive protection. Evolving consumer preferences, including a shift towards online purchasing and insurers' mobile-first strategies, are enhancing accessibility and adoption. Rising disposable incomes across the Asia Pacific region also contribute to market growth by enabling more consumers to afford both high-value devices and insurance.

Asian Mobile Phone Insurance Market Market Size (In Billion)

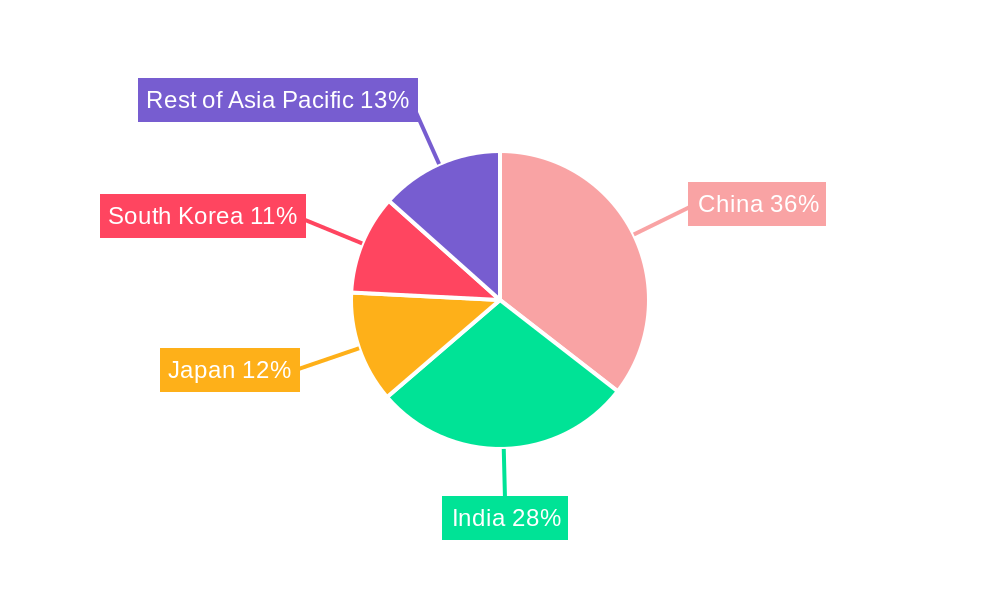

The market is effectively segmented to address diverse needs. Physical damage coverage remains prominent due to common accidental incidents, while electronic damage and data protection are gaining traction with advancements in smartphone capabilities and the increasing importance of personal data. Theft protection is also a significant segment, particularly in urban centers. Laptops, computers, and mobile devices are leading segments, with the insurance landscape expanding to include a broader range of connected gadgets. End-users are categorized into corporate clients protecting device fleets and individual consumers prioritizing personal asset security. Geographically, China and India are the largest and fastest-growing markets, attributed to their large populations and expanding middle class. Japan and South Korea are also key contributors due to high smartphone penetration. The remaining Asia Pacific region offers significant untapped potential. Leading players like Warranty Asia, Brightstar Corp, Aviva, Allianz Insurance, and Apple Care+ are actively shaping the market through innovative offerings and strategic alliances.

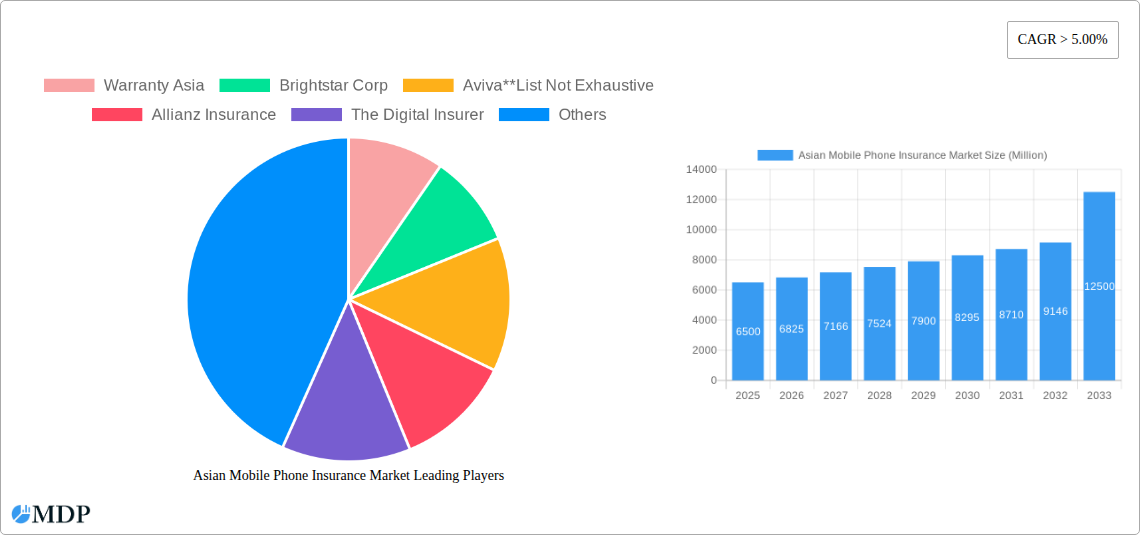

Asian Mobile Phone Insurance Market Company Market Share

Gain unparalleled insights into the Asian Mobile Phone Insurance Market with this comprehensive report. Spanning 2019-2033, with a focus on the 2025 base year and a forecast period of 2025-2033, this analysis is built on 2019-2024 historical data. Identify high-growth opportunities, understand market dynamics, and secure a competitive advantage. This report utilizes high-traffic keywords including "mobile phone insurance Asia," "smartphone protection plans," "gadget insurance APAC," "device insurance market China," and "Asia Pacific insurance trends," ensuring broad visibility for insurers, mobile device manufacturers, tech companies, and investors.

The Asian Mobile Phone Insurance Market is experiencing rapid expansion, fueled by increasing smartphone penetration, rising device values, and growing consumer demand for protection against accidental damage, theft, and other risks. This report offers a detailed market segmentation by Coverage Type (Physical Damage, Electronic Damage, Data Protection, Virus Protection, Theft Protection, Other Coverage Types), Device Type (Laptops, Computers, Cameras, Mobile Devices, Tablets, Other Devices), End-User (Corporate, Individual), and Geography (China, India, Japan, South Korea, Rest of Asia Pacific). Explore market dynamics, key players, emerging trends, and future projections to strategically position your business.

Asian Mobile Phone Insurance Market Market Dynamics & Concentration

The Asian Mobile Phone Insurance Market is characterized by a dynamic and moderately concentrated landscape. Innovation drivers are predominantly focused on developing more comprehensive and flexible coverage options, particularly for high-value mobile devices and emerging gadget categories. Regulatory frameworks are evolving, with a growing emphasis on consumer protection and transparency in policy terms. Product substitutes, such as extended warranties offered directly by manufacturers and DIY repair solutions, are present but often lack the all-encompassing protection provided by dedicated insurance policies. End-user trends indicate a strong preference for digital-first purchasing experiences and on-demand coverage options, especially among younger demographics. Mergers and acquisition (M&A) activities are anticipated to increase as established insurance players seek to expand their footprint in this lucrative market and InsurTech startups aim to disrupt the status quo. Key market players are investing heavily in technological advancements to streamline claims processing and enhance customer engagement. The market share distribution is expected to see shifts as new entrants leverage digital channels to capture a significant portion of the rapidly growing demand for mobile phone insurance. We anticipate approximately 3-5 significant M&A deals within the forecast period, aimed at consolidating market share and acquiring innovative technologies.

Asian Mobile Phone Insurance Market Industry Trends & Analysis

The Asian Mobile Phone Insurance Market is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 12.5% over the forecast period (2025–2033). This robust expansion is fueled by a confluence of factors, including the escalating proliferation of smartphones and other advanced electronic devices across the region. The increasing average selling price of premium mobile devices directly translates into higher insurance premiums, thus driving market revenue. Furthermore, a growing awareness among consumers regarding the financial implications of device damage, loss, or theft is fostering a greater demand for comprehensive insurance solutions. Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) in underwriting and claims processing, are enhancing efficiency and personalizing customer experiences. The rise of InsurTech companies is also a significant trend, introducing innovative business models and digital platforms that cater to evolving consumer preferences for seamless online transactions and personalized services. Competitive dynamics are intensifying, with both traditional insurers and new-age tech players vying for market share. This competition is leading to more attractive policy offerings and competitive pricing. Market penetration, currently estimated at around 20% for mobile device insurance in major Asian economies, presents significant untapped potential for further growth. The increasing affordability of mobile devices in developing Asian economies, coupled with rising disposable incomes, is expected to further accelerate market penetration and overall market size.

Leading Markets & Segments in Asian Mobile Phone Insurance Market

Dominant Geography: China and India

- China: China stands as a behemoth in the Asian Mobile Phone Insurance Market, driven by its immense population, high smartphone penetration, and a rapidly expanding middle class with significant disposable income. The sheer volume of device sales, coupled with a burgeoning demand for protection, makes it the leading market. Economic policies that encourage consumer spending on technology and robust e-commerce infrastructure facilitate the widespread adoption of mobile insurance products.

- India: India follows closely, characterized by its rapidly growing smartphone user base, increasing urbanization, and a growing awareness of the need for device protection. Government initiatives promoting digital literacy and financial inclusion indirectly support the growth of the insurance sector, including mobile insurance. The affordability of mobile devices in India makes insurance a crucial consideration for many consumers to safeguard their investments.

Dominant Coverage Type: Physical Damage and Theft Protection

- Physical Damage: This segment is the cornerstone of mobile phone insurance due to the high incidence of accidental drops, spills, and other physical mishaps. The increasing fragility of modern smartphones with large, glass displays makes this coverage indispensable for consumers.

- Theft Protection: With the high resale value of many mobile devices, theft remains a significant concern for individuals and corporations alike. This coverage offers peace of mind and financial security against such losses, making it a highly sought-after component of mobile insurance policies.

Dominant Device Type: Mobile Devices

- The primary focus of the Asian Mobile Phone Insurance Market is unequivocally Mobile Devices (smartphones and feature phones). Their ubiquity, personal nature, and reliance in daily life make them the most frequently insured electronic gadgets.

Dominant End-User: Individual

- While corporate insurance for mobile fleets is growing, the Individual segment constitutes the largest share of the market. This is driven by the widespread ownership of personal mobile devices by consumers across all demographics. The desire to protect personal investments and maintain seamless connectivity fuels individual demand.

Asian Mobile Phone Insurance Market Product Developments

Product innovations in the Asian Mobile Phone Insurance Market are increasingly focusing on enhancing customer value and simplifying the insurance journey. Developments include the integration of IoT sensors for proactive device health monitoring and predictive maintenance, offering tailored insurance plans based on actual device usage patterns. Insurers are also rolling out simplified claims processes, often leveraging AI-powered chatbots and image recognition technology for faster claim assessments. Competitive advantages are being built around offering bundled protection, including extended warranties, accidental damage coverage, and theft protection in a single, convenient package. This focus on user experience and holistic device protection is crucial for attracting and retaining customers in a competitive market.

Key Drivers of Asian Mobile Phone Insurance Market Growth

The Asian Mobile Phone Insurance Market is propelled by several key drivers. Firstly, the relentless growth in smartphone adoption, particularly in emerging economies, creates a constantly expanding customer base. Secondly, the increasing value of advanced mobile devices, with their sophisticated technology and premium pricing, amplifies the perceived need for financial protection. Thirdly, a growing consumer awareness, facilitated by digital marketing and educational campaigns, highlights the risks associated with device damage and loss. Regulatory support for consumer protection and fair insurance practices also plays a crucial role, fostering trust and encouraging market participation. The increasing availability of convenient digital purchase channels and streamlined claims processes further lubricates market growth.

Challenges in the Asian Mobile Phone Insurance Market Market

Despite its promising growth, the Asian Mobile Phone Insurance Market faces several challenges. Regulatory fragmentation across different Asian countries can complicate market entry and operational scaling for insurers. The risk of fraudulent claims remains a persistent concern, requiring robust verification processes and technological solutions. Intense competition among numerous players, including traditional insurers, mobile manufacturers, and new InsurTech startups, can lead to price wars and pressure on profit margins. Supply chain disruptions affecting device availability and repair parts can also impact the efficiency of claims fulfillment. Furthermore, educating a diverse consumer base about the benefits and nuances of mobile insurance requires sustained effort and targeted marketing strategies.

Emerging Opportunities in Asian Mobile Phone Insurance Market

Emerging opportunities in the Asian Mobile Phone Insurance Market lie in leveraging technological breakthroughs and strategic partnerships. The increasing adoption of 5G technology and the proliferation of smart devices present opportunities for developing specialized insurance products catering to these newer ecosystems. InsurTech advancements, such as blockchain for secure claims processing and AI for hyper-personalized policy offerings, will drive innovation and operational efficiency. Strategic partnerships between mobile manufacturers, network carriers, and insurance providers can create bundled offerings and streamline distribution channels. Expanding into underserved segments, such as rural populations and small and medium-sized enterprises (SMEs), offers significant untapped market potential.

Leading Players in the Asian Mobile Phone Insurance Market Sector

- Warranty Asia

- Brightstar Corp

- Aviva

- Allianz Insurance

- The Digital Insurer

- Samsung Premium Care

- Gadget Cover

- Safeware

- AppleCare+

- Syska Gadget Secure

Key Milestones in Asian Mobile Phone Insurance Market Industry

- March 2021: AppleCare+ enhances its accidental damage coverage to two incidents every 12 months (previously 24 months) and lowers deductibles for Theft or Loss plans across all service centers in the Asia Pacific region. This expansion broadens the appeal and utility of Apple's protection plans.

- March 2022: Samsung Electronics introduces a global self-repair program for popular Galaxy models (S20, S21, Tab S7+) in the Asia Pacific region, collaborating with iFixit to provide genuine parts, tools, and repair guides. This initiative represents a shift towards empowering consumers with repair options.

Strategic Outlook for Asian Mobile Phone Insurance Market Market

The strategic outlook for the Asian Mobile Phone Insurance Market remains exceptionally positive, fueled by sustained technological advancement and evolving consumer demands. Future growth will be accelerated by the deeper integration of InsurTech solutions, offering more personalized, transparent, and seamless insurance experiences. Strategic partnerships between device manufacturers, telecommunication providers, and insurance companies will unlock new distribution channels and bundled offerings, increasing accessibility. The expansion of coverage to include emerging device categories and the development of innovative protection plans for complex technological ecosystems will further diversify market offerings. Continued focus on enhancing customer engagement through digital platforms and efficient claims processing will be critical for sustained market leadership and capturing the vast untapped potential across the diverse Asian landscape.

Asian Mobile Phone Insurance Market Segmentation

-

1. Coverage Type

- 1.1. Physical Damage

- 1.2. Electronic Damage

- 1.3. Data Protection

- 1.4. Virus Protection

- 1.5. Theft Protectiom

- 1.6. Other Coverage Types

-

2. Device Type

- 2.1. Laptops

- 2.2. Computers

- 2.3. Cameras

- 2.4. Mobile Devices

- 2.5. Tablets

- 2.6. Other Devices

-

3. End-User

- 3.1. Corporate

- 3.2. Individual

-

4. Geography

- 4.1. China

- 4.2. India

- 4.3. Japan

- 4.4. South Korea

- 4.5. Rest of Asia Pacific

Asian Mobile Phone Insurance Market Segmentation By Geography

- 1. China

- 2. India

- 3. Japan

- 4. South Korea

- 5. Rest of Asia Pacific

Asian Mobile Phone Insurance Market Regional Market Share

Geographic Coverage of Asian Mobile Phone Insurance Market

Asian Mobile Phone Insurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 11.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Increasing Cost Acts as a Restraint to the Market

- 3.4. Market Trends

- 3.4.1. Increase in the Electronics Market in the Asia-Pacific region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 5.1.1. Physical Damage

- 5.1.2. Electronic Damage

- 5.1.3. Data Protection

- 5.1.4. Virus Protection

- 5.1.5. Theft Protectiom

- 5.1.6. Other Coverage Types

- 5.2. Market Analysis, Insights and Forecast - by Device Type

- 5.2.1. Laptops

- 5.2.2. Computers

- 5.2.3. Cameras

- 5.2.4. Mobile Devices

- 5.2.5. Tablets

- 5.2.6. Other Devices

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Corporate

- 5.3.2. Individual

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. China

- 5.4.2. India

- 5.4.3. Japan

- 5.4.4. South Korea

- 5.4.5. Rest of Asia Pacific

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. China

- 5.5.2. India

- 5.5.3. Japan

- 5.5.4. South Korea

- 5.5.5. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6. China Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Coverage Type

- 6.1.1. Physical Damage

- 6.1.2. Electronic Damage

- 6.1.3. Data Protection

- 6.1.4. Virus Protection

- 6.1.5. Theft Protectiom

- 6.1.6. Other Coverage Types

- 6.2. Market Analysis, Insights and Forecast - by Device Type

- 6.2.1. Laptops

- 6.2.2. Computers

- 6.2.3. Cameras

- 6.2.4. Mobile Devices

- 6.2.5. Tablets

- 6.2.6. Other Devices

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Corporate

- 6.3.2. Individual

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. China

- 6.4.2. India

- 6.4.3. Japan

- 6.4.4. South Korea

- 6.4.5. Rest of Asia Pacific

- 6.1. Market Analysis, Insights and Forecast - by Coverage Type

- 7. India Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Coverage Type

- 7.1.1. Physical Damage

- 7.1.2. Electronic Damage

- 7.1.3. Data Protection

- 7.1.4. Virus Protection

- 7.1.5. Theft Protectiom

- 7.1.6. Other Coverage Types

- 7.2. Market Analysis, Insights and Forecast - by Device Type

- 7.2.1. Laptops

- 7.2.2. Computers

- 7.2.3. Cameras

- 7.2.4. Mobile Devices

- 7.2.5. Tablets

- 7.2.6. Other Devices

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Corporate

- 7.3.2. Individual

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. China

- 7.4.2. India

- 7.4.3. Japan

- 7.4.4. South Korea

- 7.4.5. Rest of Asia Pacific

- 7.1. Market Analysis, Insights and Forecast - by Coverage Type

- 8. Japan Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Coverage Type

- 8.1.1. Physical Damage

- 8.1.2. Electronic Damage

- 8.1.3. Data Protection

- 8.1.4. Virus Protection

- 8.1.5. Theft Protectiom

- 8.1.6. Other Coverage Types

- 8.2. Market Analysis, Insights and Forecast - by Device Type

- 8.2.1. Laptops

- 8.2.2. Computers

- 8.2.3. Cameras

- 8.2.4. Mobile Devices

- 8.2.5. Tablets

- 8.2.6. Other Devices

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Corporate

- 8.3.2. Individual

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. China

- 8.4.2. India

- 8.4.3. Japan

- 8.4.4. South Korea

- 8.4.5. Rest of Asia Pacific

- 8.1. Market Analysis, Insights and Forecast - by Coverage Type

- 9. South Korea Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Coverage Type

- 9.1.1. Physical Damage

- 9.1.2. Electronic Damage

- 9.1.3. Data Protection

- 9.1.4. Virus Protection

- 9.1.5. Theft Protectiom

- 9.1.6. Other Coverage Types

- 9.2. Market Analysis, Insights and Forecast - by Device Type

- 9.2.1. Laptops

- 9.2.2. Computers

- 9.2.3. Cameras

- 9.2.4. Mobile Devices

- 9.2.5. Tablets

- 9.2.6. Other Devices

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Corporate

- 9.3.2. Individual

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. China

- 9.4.2. India

- 9.4.3. Japan

- 9.4.4. South Korea

- 9.4.5. Rest of Asia Pacific

- 9.1. Market Analysis, Insights and Forecast - by Coverage Type

- 10. Rest of Asia Pacific Asian Mobile Phone Insurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Coverage Type

- 10.1.1. Physical Damage

- 10.1.2. Electronic Damage

- 10.1.3. Data Protection

- 10.1.4. Virus Protection

- 10.1.5. Theft Protectiom

- 10.1.6. Other Coverage Types

- 10.2. Market Analysis, Insights and Forecast - by Device Type

- 10.2.1. Laptops

- 10.2.2. Computers

- 10.2.3. Cameras

- 10.2.4. Mobile Devices

- 10.2.5. Tablets

- 10.2.6. Other Devices

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Corporate

- 10.3.2. Individual

- 10.4. Market Analysis, Insights and Forecast - by Geography

- 10.4.1. China

- 10.4.2. India

- 10.4.3. Japan

- 10.4.4. South Korea

- 10.4.5. Rest of Asia Pacific

- 10.1. Market Analysis, Insights and Forecast - by Coverage Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Warranty Asia

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Brightstar Corp

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aviva**List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Allianz Insurance

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 The Digital Insurer

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Samsing Premium Care

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Gadget Cover

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Safeware

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Apple Care+

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Syska Gadget Secure

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Warranty Asia

List of Figures

- Figure 1: Asian Mobile Phone Insurance Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Asian Mobile Phone Insurance Market Share (%) by Company 2025

List of Tables

- Table 1: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 2: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 3: Asian Mobile Phone Insurance Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 4: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 5: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 7: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 8: Asian Mobile Phone Insurance Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 9: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 10: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 11: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 12: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 13: Asian Mobile Phone Insurance Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 14: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 15: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 17: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 18: Asian Mobile Phone Insurance Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 19: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 21: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 22: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 23: Asian Mobile Phone Insurance Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 24: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 25: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Country 2020 & 2033

- Table 26: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Coverage Type 2020 & 2033

- Table 27: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Device Type 2020 & 2033

- Table 28: Asian Mobile Phone Insurance Market Revenue billion Forecast, by End-User 2020 & 2033

- Table 29: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Geography 2020 & 2033

- Table 30: Asian Mobile Phone Insurance Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asian Mobile Phone Insurance Market?

The projected CAGR is approximately 11.5%.

2. Which companies are prominent players in the Asian Mobile Phone Insurance Market?

Key companies in the market include Warranty Asia, Brightstar Corp, Aviva**List Not Exhaustive, Allianz Insurance, The Digital Insurer, Samsing Premium Care, Gadget Cover, Safeware, Apple Care+, Syska Gadget Secure.

3. What are the main segments of the Asian Mobile Phone Insurance Market?

The market segments include Coverage Type, Device Type, End-User, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 39.15 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Life Insurance is Driving the Market; Increasing Digital Adoption in the Insurance Industry is Driving the Market.

6. What are the notable trends driving market growth?

Increase in the Electronics Market in the Asia-Pacific region.

7. Are there any restraints impacting market growth?

Increasing Cost Acts as a Restraint to the Market.

8. Can you provide examples of recent developments in the market?

On March 2022, Samsung Electronics has announced that Galaxy device owners will be able to take product repair into their own hands for Samsung's most popular models across the globe including Asia Pacific region, the Galaxy S20 and S21 family of products, and the Galaxy Tab S7+ beginning this summer. Samsung consumers would get access to genuine device parts, repair tools, and intuitive, visual, step-by-step repair guides. Samsung is collaborating with iFixit, the leading online repair community, on this program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asian Mobile Phone Insurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asian Mobile Phone Insurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asian Mobile Phone Insurance Market?

To stay informed about further developments, trends, and reports in the Asian Mobile Phone Insurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence