Key Insights

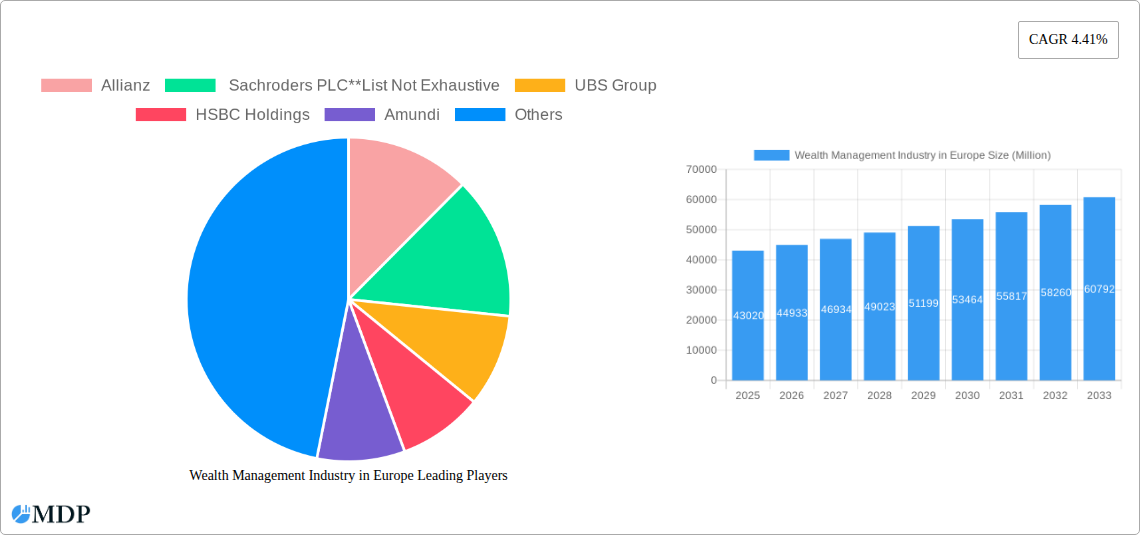

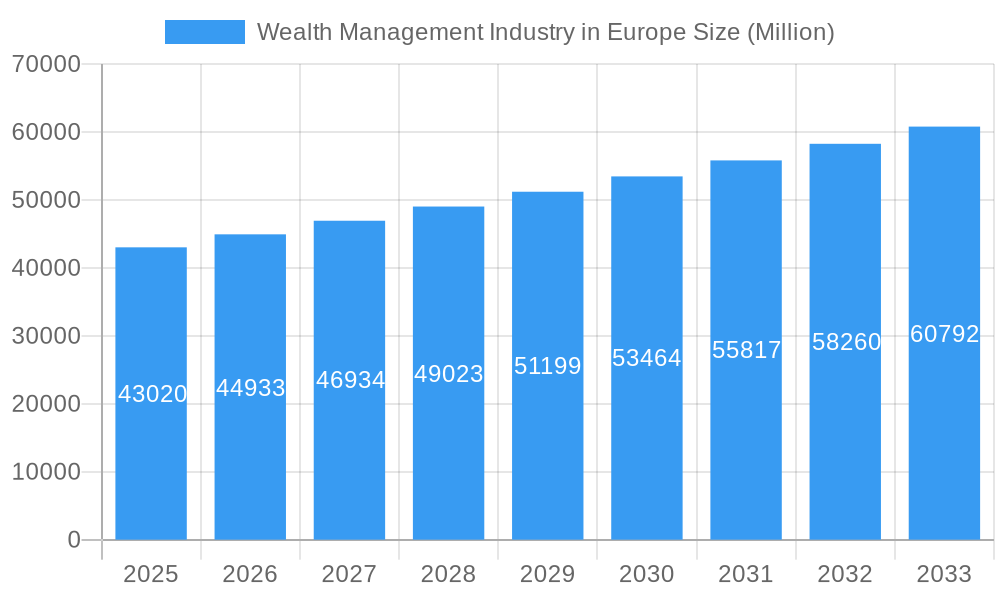

The European wealth management industry, valued at €43.02 billion in 2025, is projected to experience steady growth, with a compound annual growth rate (CAGR) of 4.41% from 2025 to 2033. This expansion is driven by several key factors. The increasing number of high-net-worth individuals (HNWIs) and mass-affluent individuals across Europe, particularly in major economies like Germany, France, and the UK, fuels demand for sophisticated wealth management services. Technological advancements, such as robo-advisors and digital platforms, are enhancing accessibility and efficiency, attracting a broader client base. Furthermore, evolving regulatory landscapes and a focus on sustainable and responsible investing are reshaping the industry, compelling firms to adapt and innovate. Competition remains intense among established players like Allianz, Schroders, UBS, HSBC, and Amundi, as well as smaller, specialized firms, leading to continuous product and service diversification.

Wealth Management Industry in Europe Market Size (In Billion)

However, the industry faces certain challenges. Fluctuations in global financial markets and economic uncertainties can significantly impact investment performance and client sentiment. Increasing regulatory scrutiny and compliance costs put pressure on profitability. Additionally, attracting and retaining skilled professionals in a competitive talent market poses a significant hurdle for growth. The industry's segmentation, with distinct service offerings for HNWIs, retail/individuals, and mass-affluent clients, requires specialized expertise and targeted marketing strategies. The geographic distribution of wealth within Europe also influences growth patterns, with established financial centers continuing to attract a significant share of market activity. The forecast period suggests a consistent, albeit moderate, expansion trajectory, reflecting the inherent stability and long-term growth potential within the European wealth management sector.

Wealth Management Industry in Europe Company Market Share

Wealth Management Industry in Europe: 2019-2033 Market Report

This comprehensive report provides an in-depth analysis of the European wealth management industry, covering market dynamics, trends, leading players, and future outlook from 2019 to 2033. Leveraging data from the historical period (2019-2024), base year (2025), and forecast period (2025-2033), this report is an essential resource for industry stakeholders, investors, and strategic decision-makers. Discover actionable insights into market share, M&A activity, technological disruptions, and emerging opportunities within this dynamic sector.

Wealth Management Industry in Europe Market Dynamics & Concentration

The European wealth management market, valued at €XX Million in 2024, exhibits a moderately concentrated landscape with significant variations across segments and geographies. Key drivers of market dynamics include evolving regulatory frameworks like MiFID II and PSD2, increasing demand for personalized wealth management solutions from HNWIs and mass affluent individuals, and a surge in fintech-driven innovation. Product substitutes, primarily robo-advisors and digital investment platforms, are steadily gaining market share, impacting traditional players. The industry has witnessed considerable M&A activity, with a total of XX deals recorded between 2019 and 2024, indicating consolidation and strategic expansion. This trend is expected to continue, driven by firms seeking to scale their operations and enhance their technological capabilities.

- Market Concentration: The top 5 players account for approximately XX% of the market share in 2024.

- M&A Activity: XX major mergers and acquisitions occurred between 2019 and 2024.

- Innovation Drivers: Fintech disruption, regulatory changes, and evolving client expectations.

- Regulatory Framework: MiFID II, PSD2, and other evolving regulations influence market structure and operational compliance.

Wealth Management Industry in Europe Industry Trends & Analysis

The European wealth management market is poised for significant growth, projected to reach €XX Million by 2033, with a CAGR of XX% during the forecast period (2025-2033). Key growth drivers include the increasing wealth of HNWIs and mass affluent individuals, heightened demand for sophisticated investment solutions, and the expansion of digital wealth management platforms. Technological disruptions, such as AI-powered robo-advisors and blockchain technology, are reshaping the competitive landscape. Consumer preferences are shifting towards personalized, digitally enabled wealth management services, demanding increased transparency and efficiency. Competitive dynamics are marked by increased consolidation, strategic partnerships, and a growing focus on delivering holistic wealth solutions. Market penetration of digital wealth management platforms is projected to reach XX% by 2033.

Leading Markets & Segments in Wealth Management Industry in Europe

The UK, Germany, and Switzerland remain the leading markets for wealth management in Europe, accounting for approximately XX% of the total market value in 2024. Within the client segments, HNWIs contribute the most significant proportion of the market, driven by their higher investment capacity and complex financial needs.

By Client Type:

- HNWIs: High net worth individuals (HNWIs) dominate the market, driven by substantial investable assets and demand for tailored services.

- Retail/Individuals: This segment shows steady growth, fueled by rising financial literacy and accessibility of online investment platforms.

- Mass Affluent: This rapidly expanding segment presents significant growth potential.

- Other Client Types: Includes institutional investors, family offices, and corporations.

By Wealth Management Firm:

- Private Bankers: Private banks remain major players, catering to HNWIs and ultra-high-net-worth individuals.

- Family Offices: Family offices manage substantial wealth for select families and represent a significant portion of the market.

- Other Wealth Management Firms: This includes independent financial advisors, robo-advisors, and other specialized wealth management firms.

Key Drivers:

- Economic growth: Strong economic conditions in leading European nations support the wealth management industry.

- Favorable regulatory environment: Supportive regulations attract investments and increase market participation.

- Technological advancements: Fintech innovations drive efficiency and customer engagement.

Wealth Management Industry in Europe Product Developments

Product innovation in the European wealth management industry focuses on enhancing client experience through digitalization, personalization, and integrated wealth solutions. Robo-advisors, AI-powered portfolio management tools, and sophisticated financial planning software are gaining traction. The trend toward holistic wealth management, encompassing investment, insurance, and estate planning, is strengthening. These developments aim to meet the evolving demands of tech-savvy clients seeking seamless, cost-effective, and personalized wealth management solutions.

Key Drivers of Wealth Management Industry in Europe Growth

Technological advancements, particularly in fintech, are transforming the industry, enhancing efficiency and client experience. Favorable economic conditions across key European markets are supporting wealth accumulation, and relaxed regulatory frameworks in some countries are encouraging increased market participation. Growing awareness of financial planning and investment among individuals further strengthens market growth.

Challenges in the Wealth Management Industry in Europe Market

Stringent regulatory compliance requirements pose a significant challenge, increasing operational costs and complexities for firms. Intense competition, both from established players and fintech disruptors, creates pressure on margins and necessitates ongoing innovation. Geopolitical uncertainties and economic volatility can impact investor sentiment and market stability, affecting investment decisions and wealth accumulation.

Emerging Opportunities in Wealth Management Industry in Europe

Strategic partnerships between traditional wealth management firms and fintech companies create opportunities for innovation and market expansion. Growing adoption of sustainable and responsible investing practices creates a niche market for specialized products and services. Expansion into underserved markets and client segments, such as younger generations, presents significant potential for growth.

Leading Players in the Wealth Management Industry in Europe Sector

Key Milestones in Wealth Management Industry in Europe Industry

- September 2022: UBS's planned acquisition of Wealthfront was terminated. This highlights the challenges and complexities involved in large-scale M&A within the wealth management sector.

- 2021: Legal & General launched the ONIX platform, a next-generation online quote-and-buy platform for group income protection, signifying a move towards digitalization within the industry. This improved accessibility for intermediaries and clients.

Strategic Outlook for Wealth Management Industry in Europe Market

The European wealth management industry is projected to experience robust growth, driven by technological advancements, favorable economic conditions, and changing consumer preferences. Strategic partnerships, expansion into new markets and client segments, and adaptation to evolving regulatory landscapes will be crucial for success in this dynamic sector. The focus will be on personalized, digital-first solutions tailored to individual needs, alongside the increasing importance of sustainability in investment strategies.

Wealth Management Industry in Europe Segmentation

-

1. Client Type

- 1.1. HNWIs

- 1.2. Retail/ Individuals

- 1.3. Mass Affluent

- 1.4. Other Client Types

-

2. Wealth Management Firm

- 2.1. Private Bankers

- 2.2. Family Offices

- 2.3. Other Wealth Management Firms

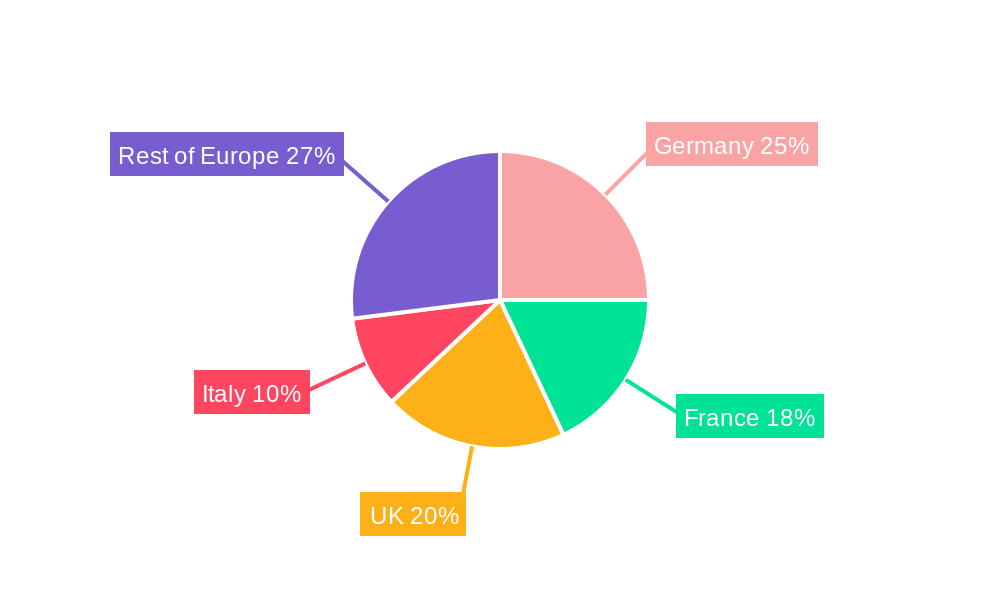

Wealth Management Industry in Europe Segmentation By Geography

- 1. Italy

- 2. Germany

- 3. France

- 4. United Kingdom

- 5. Rest of Europe

Wealth Management Industry in Europe Regional Market Share

Geographic Coverage of Wealth Management Industry in Europe

Wealth Management Industry in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.41% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Guaranteed Protection Drives The Market

- 3.3. Market Restrains

- 3.3.1. Long and Costly Legal Procedures

- 3.4. Market Trends

- 3.4.1. Growth In Millionaire Wealth Leading to the European Wealth Management Market Uptrend

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 5.1.1. HNWIs

- 5.1.2. Retail/ Individuals

- 5.1.3. Mass Affluent

- 5.1.4. Other Client Types

- 5.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 5.2.1. Private Bankers

- 5.2.2. Family Offices

- 5.2.3. Other Wealth Management Firms

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Italy

- 5.3.2. Germany

- 5.3.3. France

- 5.3.4. United Kingdom

- 5.3.5. Rest of Europe

- 5.1. Market Analysis, Insights and Forecast - by Client Type

- 6. Italy Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 6.1.1. HNWIs

- 6.1.2. Retail/ Individuals

- 6.1.3. Mass Affluent

- 6.1.4. Other Client Types

- 6.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 6.2.1. Private Bankers

- 6.2.2. Family Offices

- 6.2.3. Other Wealth Management Firms

- 6.1. Market Analysis, Insights and Forecast - by Client Type

- 7. Germany Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 7.1.1. HNWIs

- 7.1.2. Retail/ Individuals

- 7.1.3. Mass Affluent

- 7.1.4. Other Client Types

- 7.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 7.2.1. Private Bankers

- 7.2.2. Family Offices

- 7.2.3. Other Wealth Management Firms

- 7.1. Market Analysis, Insights and Forecast - by Client Type

- 8. France Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 8.1.1. HNWIs

- 8.1.2. Retail/ Individuals

- 8.1.3. Mass Affluent

- 8.1.4. Other Client Types

- 8.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 8.2.1. Private Bankers

- 8.2.2. Family Offices

- 8.2.3. Other Wealth Management Firms

- 8.1. Market Analysis, Insights and Forecast - by Client Type

- 9. United Kingdom Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 9.1.1. HNWIs

- 9.1.2. Retail/ Individuals

- 9.1.3. Mass Affluent

- 9.1.4. Other Client Types

- 9.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 9.2.1. Private Bankers

- 9.2.2. Family Offices

- 9.2.3. Other Wealth Management Firms

- 9.1. Market Analysis, Insights and Forecast - by Client Type

- 10. Rest of Europe Wealth Management Industry in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 10.1.1. HNWIs

- 10.1.2. Retail/ Individuals

- 10.1.3. Mass Affluent

- 10.1.4. Other Client Types

- 10.2. Market Analysis, Insights and Forecast - by Wealth Management Firm

- 10.2.1. Private Bankers

- 10.2.2. Family Offices

- 10.2.3. Other Wealth Management Firms

- 10.1. Market Analysis, Insights and Forecast - by Client Type

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Allianz

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sachroders PLC**List Not Exhaustive

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 UBS Group

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 HSBC Holdings

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Amundi

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AXA Group

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 BNP Paribas

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Aegon N V

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Credit Suisse

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Legal and General

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Allianz

List of Figures

- Figure 1: Wealth Management Industry in Europe Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Wealth Management Industry in Europe Share (%) by Company 2025

List of Tables

- Table 1: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 2: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 3: Wealth Management Industry in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 5: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 6: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 8: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 9: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 11: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 12: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 14: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 15: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Wealth Management Industry in Europe Revenue Million Forecast, by Client Type 2020 & 2033

- Table 17: Wealth Management Industry in Europe Revenue Million Forecast, by Wealth Management Firm 2020 & 2033

- Table 18: Wealth Management Industry in Europe Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Wealth Management Industry in Europe?

The projected CAGR is approximately 4.41%.

2. Which companies are prominent players in the Wealth Management Industry in Europe?

Key companies in the market include Allianz, Sachroders PLC**List Not Exhaustive, UBS Group, HSBC Holdings, Amundi, AXA Group, BNP Paribas, Aegon N V, Credit Suisse, Legal and General.

3. What are the main segments of the Wealth Management Industry in Europe?

The market segments include Client Type, Wealth Management Firm.

4. Can you provide details about the market size?

The market size is estimated to be USD 43.02 Million as of 2022.

5. What are some drivers contributing to market growth?

Guaranteed Protection Drives The Market.

6. What are the notable trends driving market growth?

Growth In Millionaire Wealth Leading to the European Wealth Management Market Uptrend.

7. Are there any restraints impacting market growth?

Long and Costly Legal Procedures.

8. Can you provide examples of recent developments in the market?

September 2022: UBS was set to acquire the Millennial and Gen Z-focused Wealthfront. UBS and wealth management platform Wealthfront have pulled out of a proposed acquisition deal.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Wealth Management Industry in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Wealth Management Industry in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Wealth Management Industry in Europe?

To stay informed about further developments, trends, and reports in the Wealth Management Industry in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence