Key Insights

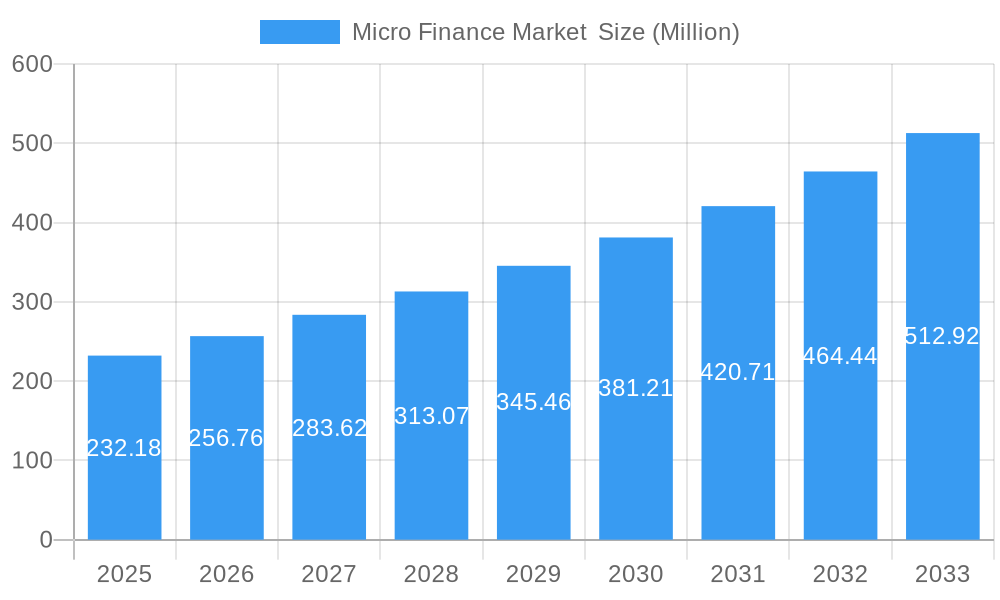

The global microfinance market, valued at $232.18 million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 10.58% from 2025 to 2033. This expansion is fueled by several key factors. Increasing financial inclusion initiatives in developing economies are broadening access to credit for underserved populations, particularly small and micro-enterprises (SMEs), solo entrepreneurs, and micro-entrepreneurs. The growing adoption of technology, including mobile banking and digital lending platforms, is streamlining loan disbursement and management processes, further accelerating market growth. Government support through subsidies and favorable regulatory frameworks also plays a significant role in fostering a conducive environment for microfinance institutions (MFIs) to operate and expand their reach. However, challenges such as high default rates in certain regions, stringent regulatory compliance requirements, and the need for effective risk management strategies pose potential restraints on market growth. The market is segmented by type of institution (banks, MFIs, NBFCs) and by end-user (small enterprises, solo entrepreneurs, micro-entrepreneurs), allowing for a nuanced understanding of market dynamics across diverse customer segments and operational models. Leading players like Accion International, Bandhan Bank, and Grameen Bank are actively shaping market competition and innovation. Geographical expansion, particularly in rapidly developing Asian and African markets, presents significant opportunities for future growth.

Micro Finance Market Market Size (In Million)

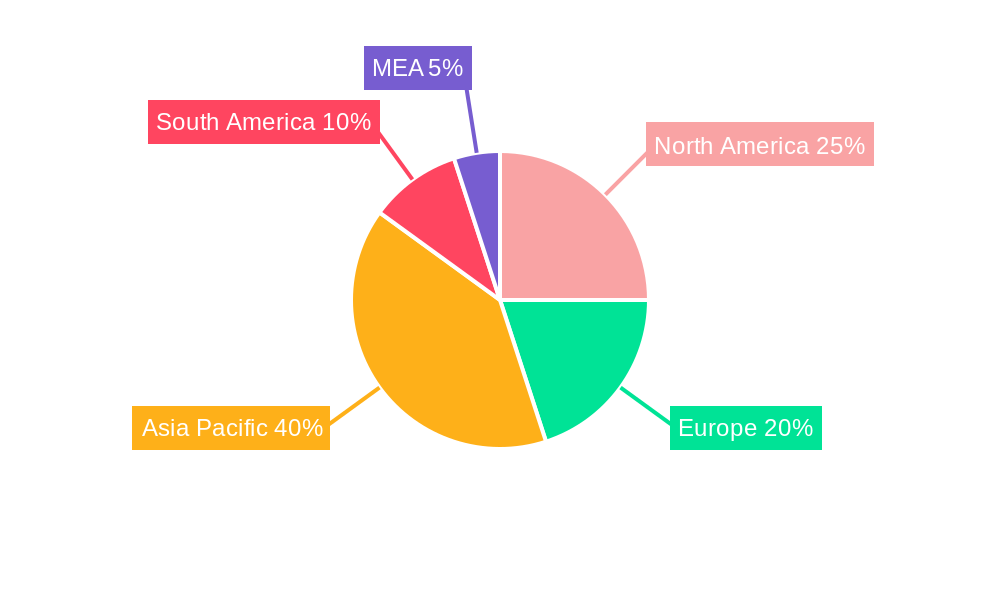

The market's geographical distribution shows a diverse landscape, with North America, Europe, and Asia-Pacific representing major regions. However, the fastest growth is expected in developing nations within Asia-Pacific and South America, reflecting the significant unmet financial needs of their populations. Future market trends suggest a continued focus on technological innovation, particularly in areas like fintech integration and big data analytics for improved risk assessment and credit scoring. Furthermore, the evolving regulatory landscape, including the implementation of responsible lending practices and consumer protection measures, will play a critical role in shaping the trajectory of the microfinance market in the coming years. The integration of sustainable financial practices and environmental, social, and governance (ESG) considerations is also becoming increasingly prominent, driving a shift towards more responsible and impactful microfinance operations.

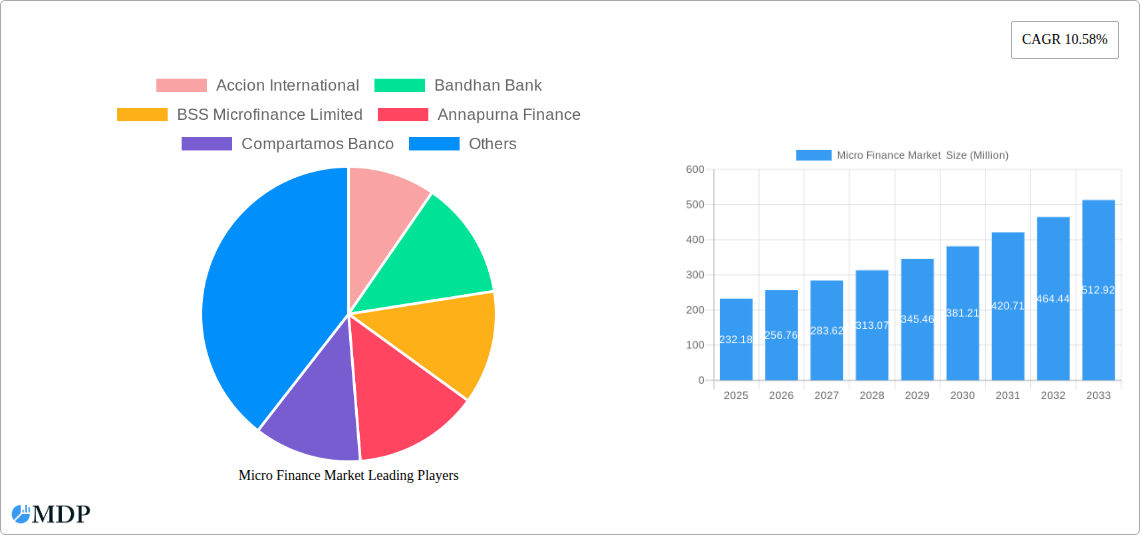

Micro Finance Market Company Market Share

Microfinance Market Report: 2019-2033 Forecast

Dive deep into the dynamic world of microfinance with this comprehensive market report, projecting a vibrant future from 2025 to 2033. This in-depth analysis provides actionable insights for investors, industry stakeholders, and businesses seeking to navigate this rapidly evolving sector. The report covers key trends, leading players like Accion International, Bandhan Bank, and Grameen Bank, and forecasts significant growth opportunities. Understand market dynamics, competitive landscapes, and emerging opportunities to make informed strategic decisions.

Micro Finance Market Market Dynamics & Concentration

The global microfinance market, valued at xx Million in 2024, is expected to reach xx Million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). Market concentration is moderate, with a few dominant players and numerous smaller institutions. Innovation is driven by technological advancements like fintech solutions and mobile banking, improving accessibility and efficiency. Regulatory frameworks vary across regions, impacting market growth and operational costs. Substitute financial products, such as informal lending networks, continue to compete, albeit with limitations. End-user trends show increasing demand from women entrepreneurs and small businesses in developing economies. M&A activity has been notable, with xx deals recorded between 2019 and 2024, indicating consolidation within the sector.

- Market Share: Top 5 players hold approximately xx% of the global market share in 2024.

- M&A Activity: An average of xx M&A deals per year were observed during the historical period (2019-2024).

- Innovation Drivers: Fintech integration, mobile money transfer services, and data analytics are key drivers.

- Regulatory Landscape: Varying regulations across different regions pose both challenges and opportunities.

Micro Finance Market Industry Trends & Analysis

The microfinance market demonstrates robust growth fueled by several key factors. The increasing number of micro, small, and medium enterprises (MSMEs) in developing economies creates significant demand for financial services. Technological advancements such as mobile banking and digital lending platforms enhance financial inclusion and operational efficiency, reducing transaction costs and expanding reach. Shifting consumer preferences toward convenient and accessible financial solutions further drive market expansion. However, competitive dynamics are intense, with both established players and new entrants vying for market share. The industry is also facing challenges related to regulatory compliance and risk management. The market penetration rate is currently estimated at xx% and is projected to increase to xx% by 2033.

Leading Markets & Segments in Micro Finance Market

The microfinance market exhibits regional disparities in growth and penetration. Asia-Pacific remains the leading market, driven by high population density, a large unbanked population, and supportive government policies. Within this region, India and Bangladesh are particularly significant. By type, MFIs hold the largest market share, followed by NBFCs and banks. The end-user segment dominated by solo entrepreneurs and micro-entrepreneurs, reflecting the market's core focus on serving the needs of low-income individuals and small businesses.

- Key Drivers in Asia-Pacific:

- Supportive government policies promoting financial inclusion.

- Rapid growth of MSMEs.

- Increasing mobile phone and internet penetration.

- Dominant Segment by Type: MFIs dominate due to their specialized focus and flexible lending practices.

- Dominant Segment by End-User: Solo entrepreneurs and micro-entrepreneurs represent the largest customer base.

Micro Finance Market Product Developments

Product innovation in the microfinance sector centers around technological advancements. Mobile lending applications, digital payment platforms, and customized financial products tailored to specific client needs are gaining traction. These innovations aim to enhance accessibility, affordability, and efficiency, thereby broadening financial inclusion and improving customer experience. Competitive advantages are often derived from superior technology, personalized customer service, and efficient risk management practices.

Key Drivers of Micro Finance Market Growth

Several factors contribute to the growth of the microfinance market:

- Technological advancements: Fintech solutions improve efficiency and accessibility.

- Favorable government policies: Initiatives supporting financial inclusion drive market expansion.

- Increasing demand from MSMEs: The rise of small businesses creates substantial demand for credit and financial services.

Challenges in the Micro Finance Market Market

The microfinance market faces several challenges:

- Regulatory hurdles: Complex regulatory landscapes in some regions create compliance burdens.

- High operating costs: Serving a dispersed clientele with limited resources can be expensive.

- Credit risk: Assessing and managing credit risk in a low-income population presents significant challenges.

Emerging Opportunities in Micro Finance Market

Several factors present significant long-term growth potential:

- Expansion into underserved markets: Reaching remote populations and previously unbanked individuals offers substantial untapped potential.

- Strategic partnerships: Collaborations between microfinance institutions and technology providers can enhance efficiency and scalability.

- Product diversification: Developing new products and services tailored to evolving client needs creates additional growth avenues.

Leading Players in the Micro Finance Market Sector

- Accion International

- Bandhan Bank

- BSS Microfinance Limited

- Annapurna Finance

- Compartamos Banco

- Grameen Bank

- CreditAccess Grameen Limited

- Kiva

- ASA International

- Asirvad Microfinance Limited

Key Milestones in Micro Finance Market Industry

- November 2023: In 2022-23, the Indian microfinance industry added 80,000 female clients, reaching a total of 6.64 crore low-income women across 729 districts. This highlights significant market expansion and outreach.

- September 2023: Almun Microfinance Foundation secured a EGP 120 million (USD 4.84 million) loan agreement with First Abu Dhabi Bank, Egypt, to expand its services to women-owned microenterprises. This demonstrates growing investment and the focus on women entrepreneurs.

Strategic Outlook for Micro Finance Market Market

The microfinance market presents a significant long-term growth trajectory, driven by financial inclusion initiatives, technological advancements, and the continuing expansion of the MSME sector. Strategic opportunities lie in leveraging technology to enhance efficiency, expanding into underserved regions, and developing innovative financial products to meet evolving client needs. Strategic partnerships and collaborations are key to navigating the challenges and capitalizing on the immense growth potential.

Micro Finance Market Segmentation

-

1. Type

- 1.1. Banks

- 1.2. Micro Finance Institute (MFI)

- 1.3. NBFC (Non-Banking Financial Institutions)

-

2. End-User

- 2.1. Small Enterprises

- 2.2. Solo Entrepreneurs

- 2.3. Micro Entrepreneurs

Micro Finance Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. South America

Micro Finance Market Regional Market Share

Geographic Coverage of Micro Finance Market

Micro Finance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.58% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Use of Advanced Technology in the Micro Finance Sector in Developing Countries; Funding Needs from Small and Medium-Sized Enterprises Boosts Market Growth

- 3.3. Market Restrains

- 3.3.1. Legislation and Regulatory Compliance Impedes Market Growth; Lack of Knowledge About Financial Services Within the Economy

- 3.4. Market Trends

- 3.4.1. Growing Importance of Digitalization for Traditional Microfinance Institutions

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Micro Finance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Banks

- 5.1.2. Micro Finance Institute (MFI)

- 5.1.3. NBFC (Non-Banking Financial Institutions)

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Small Enterprises

- 5.2.2. Solo Entrepreneurs

- 5.2.3. Micro Entrepreneurs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Micro Finance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Banks

- 6.1.2. Micro Finance Institute (MFI)

- 6.1.3. NBFC (Non-Banking Financial Institutions)

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Small Enterprises

- 6.2.2. Solo Entrepreneurs

- 6.2.3. Micro Entrepreneurs

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Micro Finance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Banks

- 7.1.2. Micro Finance Institute (MFI)

- 7.1.3. NBFC (Non-Banking Financial Institutions)

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Small Enterprises

- 7.2.2. Solo Entrepreneurs

- 7.2.3. Micro Entrepreneurs

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Micro Finance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Banks

- 8.1.2. Micro Finance Institute (MFI)

- 8.1.3. NBFC (Non-Banking Financial Institutions)

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Small Enterprises

- 8.2.2. Solo Entrepreneurs

- 8.2.3. Micro Entrepreneurs

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Micro Finance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Banks

- 9.1.2. Micro Finance Institute (MFI)

- 9.1.3. NBFC (Non-Banking Financial Institutions)

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Small Enterprises

- 9.2.2. Solo Entrepreneurs

- 9.2.3. Micro Entrepreneurs

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Micro Finance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Banks

- 10.1.2. Micro Finance Institute (MFI)

- 10.1.3. NBFC (Non-Banking Financial Institutions)

- 10.2. Market Analysis, Insights and Forecast - by End-User

- 10.2.1. Small Enterprises

- 10.2.2. Solo Entrepreneurs

- 10.2.3. Micro Entrepreneurs

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Accion International

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Bandhan Bank

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 BSS Microfinance Limited

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Annapurna Finance

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Compartamos Banco

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Grameen Bank

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 CreditAccess Grameen Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kiva

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 ASA International**List Not Exhaustive

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Asirvad Microfinance Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Accion International

List of Figures

- Figure 1: Global Micro Finance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Micro Finance Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Micro Finance Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Micro Finance Market Revenue (Million), by End-User 2025 & 2033

- Figure 5: North America Micro Finance Market Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Micro Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Micro Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Micro Finance Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Micro Finance Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Micro Finance Market Revenue (Million), by End-User 2025 & 2033

- Figure 11: Europe Micro Finance Market Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Micro Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Micro Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Micro Finance Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Pacific Micro Finance Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Micro Finance Market Revenue (Million), by End-User 2025 & 2033

- Figure 17: Asia Pacific Micro Finance Market Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific Micro Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Micro Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Micro Finance Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Middle East and Africa Micro Finance Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Middle East and Africa Micro Finance Market Revenue (Million), by End-User 2025 & 2033

- Figure 23: Middle East and Africa Micro Finance Market Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Middle East and Africa Micro Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East and Africa Micro Finance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Micro Finance Market Revenue (Million), by Type 2025 & 2033

- Figure 27: South America Micro Finance Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: South America Micro Finance Market Revenue (Million), by End-User 2025 & 2033

- Figure 29: South America Micro Finance Market Revenue Share (%), by End-User 2025 & 2033

- Figure 30: South America Micro Finance Market Revenue (Million), by Country 2025 & 2033

- Figure 31: South America Micro Finance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Micro Finance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Micro Finance Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Global Micro Finance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Micro Finance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Micro Finance Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Micro Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Micro Finance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Micro Finance Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 9: Global Micro Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Micro Finance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Micro Finance Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Micro Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Micro Finance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Micro Finance Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global Micro Finance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Micro Finance Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Micro Finance Market Revenue Million Forecast, by End-User 2020 & 2033

- Table 18: Global Micro Finance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Micro Finance Market ?

The projected CAGR is approximately 10.58%.

2. Which companies are prominent players in the Micro Finance Market ?

Key companies in the market include Accion International, Bandhan Bank, BSS Microfinance Limited, Annapurna Finance, Compartamos Banco, Grameen Bank, CreditAccess Grameen Limited, Kiva, ASA International**List Not Exhaustive, Asirvad Microfinance Limited.

3. What are the main segments of the Micro Finance Market ?

The market segments include Type, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 232.18 Million as of 2022.

5. What are some drivers contributing to market growth?

Use of Advanced Technology in the Micro Finance Sector in Developing Countries; Funding Needs from Small and Medium-Sized Enterprises Boosts Market Growth.

6. What are the notable trends driving market growth?

Growing Importance of Digitalization for Traditional Microfinance Institutions.

7. Are there any restraints impacting market growth?

Legislation and Regulatory Compliance Impedes Market Growth; Lack of Knowledge About Financial Services Within the Economy.

8. Can you provide examples of recent developments in the market?

November 2023 - In 2022-23, the microfinance industry in India increased its outreach by incorporating 80,000 more female clients, resulting in a total of 6.64 crore low-income women clients spread across 729 districts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Micro Finance Market ," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Micro Finance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Micro Finance Market ?

To stay informed about further developments, trends, and reports in the Micro Finance Market , consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence